The Global Microalgae based Products Market size was valued at USD 13.25 Billion in 2023 and the total Microalgae based Products revenue is expected to grow at a CAGR of 8.2% from 2024 to 2030, reaching nearly USD 23.01 Billion by 2030.Microalgae based Products Market Overview

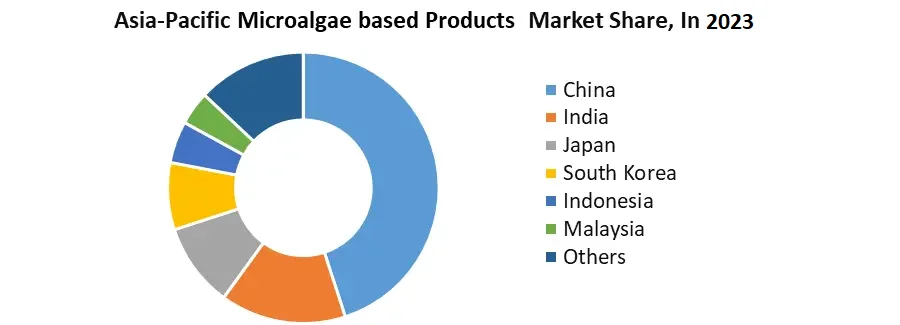

Microalgae based Products, comprising autotrophic microorganisms thriving in marine, freshwater, and terrestrial environments, exhibit a capacity for organic substance production through photosynthesis. Their inherent metabolic flexibility, adaptability to diverse cultivation conditions, and swift growth rate have spurred a surge in research exploring their potential as a source of biologically significant products. There's an increasing focus on integrated technologies tailored for Microalgae based Products cultivation, geared toward isolating various bioactive compounds from biomass, thereby enhancing the profitability of algae production and boosting the Microalgae based Products market. The Asia-Pacific is the fastest-growing region, which boasts approximately 110 commercial Microalgae based Products producers, showcasing annual production capacities ranging from 3 to 500 metric tons. Predominantly situated in Asia, these cultivation facilities focus on various Microalgae based Products types like Chlorella, Spirulina, Dunaliella, Nannochloris, and others. The market primarily caters to health-conscious consumers, integrating algae into diverse products ranging from health supplements to cosmetics, beverages, and even dietary items like noodles and breakfast cereals. With an increasing interest in cruelty-free and vegan lifestyles, manufacturers in the consumer packaged goods (CPG) sector are increasingly turning to algae as a viable alternative. Algae protein, in particular, is gaining traction in the nutrition industry, not only for its health benefits but also for its contribution to sustainability by reducing carbon footprints. Algae-based products are rapidly diversifying, serving various demographics from athletes to the elderly. They are available in different forms—powders, tablets, soft gel capsules—packed with valuable nutrients like protein, minerals, amino acids, and fatty acids, appealing not only to human consumers but also finding applications in animal feed. This growing market underscores the potential of algae as a versatile and sustainable ingredient in numerous industries.To know about the Research Methodology :- Request Free Sample Report

Microalgae based Products Market Dynamics

Increasing Demand For Sustainable And Renewable Products The growing demand for sustainable and renewable products is a significant driver of the Microalgae based Products market. Microalgae based Products are an efficient group of microorganisms that offer a promising solution for producing a variety of sustainable products, including biofuels, food, feed, and nutraceuticals. The sustainable production of biodiesel from Microalgae based Products’s triacylglycerides (TAGs) is of growing interest due to their favorable growth traits. Nitrogen supply methods in Microalgae based Products biorefineries significantly impact energy yields, sustainability, and commercial viability. While strategies like urban wastewater reuse enhance energy balance, substantial biofuel production demands nitrogen recycling from non-Tag Microalgae based Products portions. To achieve this, understanding tradeoffs in utilizing non-tag Microalgae based Products for energy production and developing nitrogen separation technologies is crucial. Microalgae based Products, a promising biofuel source thanks to its versatile growth, high photosynthetic efficiency, and energy-dense compounds, offer potential for sustainable fuel production. To reduce external nitrogen needs, strategies involve utilizing nitrogen-rich wastewater and recycling nitrogen from non-tag Microalgae based Products proteins, comprising a significant portion of Microalgae based Products mass and energy, which demands careful consideration within economics, sustainability, and energy perspectives in the biorefinery framework driving the Microalgae based Products market.Microalgae based Products in Innovative Food Products: Exploring Health Benefits and Market Potential The rapidly increasing demand for Microalgae based Products in food products is expected to be the major factor supporting the global Microalgae based Products market. Microalgae based Products have emerged as a promising solution to address the growing demand for sustainable and nutritious food sources, particularly in meeting the escalating protein needs of the global population. Their utilization offers distinct advantages over traditional raw materials, notably from an environmental perspective. Moreover, Microalgae based Products possess the unique ability to produce bioactive compounds that hold substantial potential for enhancing human health. The growing global population, estimated to reach 9.8 billion by 2050, necessitates a double increase in food production and underscores a demand for protein. Presently, over a billion individuals suffer from insufficient protein intake, projecting an inadequacy in conventional protein sources. Plant-based proteins dominate global consumption for food and feed, although animal-based proteins still prevail in the EU driving the Microalgae based Products market.

Microalgae based Products Incorporation in Different Food Products

Microalgae based Products As Promising Future Food Sources The expanding global population poses a challenge to meet rising food demand while facing increasing environmental concerns. Microalgae based Products are emerging as promising future food sources. Their inherent strengths in carbon sequestration and high photosynthetic efficiency position them as crucial players in the evolving food supply system and the global drive toward carbon neutrality. Microalgae based Products in their whole dried biomass form offers a simple yet nutritionally rich product suitable for food applications, boasting high-quality protein, essential fatty acids, carbohydrates, and vitamins. These extracts, rich in various high-value molecules such as omega-3 PUFAs, proteins, carbohydrates, and pigments, have well-established physiological activities with documented health benefits. Consequently, the incorporation of these compounds into food products holds substantial promise for enhancing health, contributing to their widespread popularity in the Microalgae based Products market.

Product Microalgae based Products Incorporation Addition Benefit Yogurt Chlorella Sp. 0.25% w/w extract powder and 2.5-10.0% extract liquid Techno-Functional Properties and Nutritional Properties Biscuits A. Plantensis 0.3,0.6 and 0.9% phycocyanin extract: 0.3% w/w to wheat flour Nutritional Properties Bread Dunaliella sp Whole biomass, biomass after b-carotene extraction, and, biomass after b-cartene and glycerol extraction:10% w/w Nutritional Properties (Protein Content) Pasta D.Salina 1,2, and 3% w/w in flour Techno-Functional Properties and Nutritional Properties Microalgae based Products Market Segment Analysis:

By Species Type, the Spirulina segment dominated the global Microalgae based Products market with the highest market share of 38% in 2023. The segment is further expected to grow at a CAGR of 8.5% and maintain its dominance during the forecast period. Thanks to its unique properties such as a rich source of protein, vitamins, minerals, and antioxidants are widely adopted as natural and organic food products, such as anti-inflammatory, sports nutrition products, animal feed, and dietary supplements, is driving a substantial increase in the demand for spirulina, thereby driving the segment growth. Their ability to provide enriching vitamins, protein, copper, essential amino acids, carotenoids, and iron, drives the segment's growth.

With customization options and a promising future benefitting human health, the spirulina segment is expected to continue to increase the Microalgae based Products market growth during the forecast period. China is the leading producer and consumer of Spirulina it is expected to offer lucrative growth during the forecast period, while the high-end consumer population resides in Australia, Japan, and South Korea.

The Chlorella segment is expected to grow at a significant CAGR and offer lucrative growth opportunities for the Microalgae based Products market players during the forecast period. Chlorella, characterized by its unique blend of properties, including natural or supplemented grades holds immense promise in various industries. These are gaining traction due to their use in dietary supplements and food ingredients for their high protein content thereby driving the segment growth. Their ability to provide antiaging, antioxidant, anti-hair loss, and anti-dandruff properties leads to an increase in the chlorella segment.

As consumers are more concerned about healthy lifestyles chlorella is used in drinks such as green smoothies, plant-based mass gainers, and protein shakes leading the food and beverage industry. Their fat, carbohydrates, and sodium are the top nutrients found in Microalgae based Products making them particularly attractive for end products. The increasing awareness of its versatile applications and the ongoing research to enhance its properties are expected to be the major factors driving the segment's growth.

Methods For Microalgae based Products Cultivation, By Category

Cultivation method Energy Source Carbon Source Features Phototrophic Light Inorganic The Cell density of the culture is low; Water Evaporation Heterotrophic Organic matter Organic The high price of the nutrient medium components and the possibility of Microbial contamination Mixotrophic Light, Organic Matter Organic and inorganic The high price of the nutrient medium component; the Possibility of microbial Microalgae Based Products Market Regional Insights:

The North American region led the global Microalgae based Products market with the highest market share of 32% in 2023. The region is further expected to grow at a CAGR of 8.6% during the forecast period and maintain its dominance by 2030. The increasing demand for natural food colors, the growing popularity of nutraceuticals and dietary supplements, and technological investment are expected to be the major factors driving regional growth. The United States is expected to be the key region for the Microalgae based Products Market. Consumers are increasingly aware of the health benefits of Microalgae based Products and willing to pay a premium drives the United States Microalgae based Products Market. The country’s continuous investments in technology advancements are a major factor supporting regional growth. The US government provides substantial funding for Microalgae based Products research and development through various agencies, including the Department of Energy (DOE), the Department of Agriculture (USDA), and the National Science Foundation (NSF) boosts the US Microalgae based Products market. The collaboration between government agencies and research institutes plays a vital role in accelerating the Microalgae based Products US market. According to the MMR analysis, the country is expected to witness robust growth from 2024 to 2030. This substantial investment in research institutes creates lucrative opportunities for Microalgae based Products. Canada, further expected to be a significant player in North America’s chemical products, also contributes to the regional growth of the Microalgae based Products market. The Canadian Microalgae based Products market includes sustainable energy, water treatment, chemicals, and ingredients for the food industry, which diversifies the Microalgae based Products market into different sectors. This sector thrives on continuous product innovations and draws upon cutting-edge research groups conducted in Canadian universities, encouraging partnerships among industry and policymakers. This research often translates into driving the Microalgae based Products market growth. The Asia-Pacific is one of the fastest leading markets in the world, with countries like China, India, and Japan emerging as a vital player in the Microalgae based Products market. Algae extraction, consumption, and end-product formulation are expected to be the major factors driving the demand for the APAC Microalgae based Products market. Food and beverage applications are witnessing substantial growth as consumers' interest in sustainable and clean eating is increased. Moreover, the region's economic growth is leading to a vegan and cruelty-free world which, in turn, boosts market growth. China, South Korea, and Japan in particular, is becoming a hub for Microalgae based Products production due to its large population base and low manufacturing costs, thereby supporting market growth.

Microalgae based Products Market Competitive Landscapes:

The Global Microalgae based Products market is expected to be highly competitive active presence of numerous market players. Major companies are striving to introduce sustainable, renewable, and beneficial products to meet the increasing demand, consequently fostering overall market growth. In addition, the Microalgae based Products industry's growth is significantly influenced by research institutions and government backing for product approvals and technological advancements. Key players are adopting various business strategies, including technical partnerships and mergers and acquisitions (M&A) to remain competitive in the Microalgae based Products market. For instance, 1. Algalita, a US-based Microalgae based Products company, acquired Aurora Algae, a leading producer of algal oil in 2023. This acquisition aimed to strengthen Algalita’s position in the Microalgae based Products oil market and expand its product ranges in the nutraceutical and cosmetics industries. 2. Bioprocess Algae, a German Microalgae based Products producer, merged with Sapphire Energy 2023, a US-based Microalgae based Products Company, to form a new company called Sapphire Biofuels, which enhanced both companies' development for commercial algal biofuels. 3. AquaSpark, a US-based venture capital firm, acquired Blue Green Algae, a leading producer of algal biomass. This acquisition aimed to expand AquaSpark’s portfolio of sustainable food and feed companies. 4. Cyanotech has been a leading producer of Hawaiian Spirulina has acquired NutraAlgae, a French company specializing in Microalgae based Products-based animal nutrition. This acquisition has aimed to strengthen its position in the animal feed market. The global Microalgae based Products market is highly competitive, and there are various emerging startups such as EAlgae (USA), Pond Technologies (USA), Algalita (USA), Solazyme (USA), Heliae (USA), Algaeist(Canada), Aquaflow(Canada), Biostadt(Austria), Euglena(Germany), Microbiogen (Ireland), Greenlight Biosciences (Scotland), BioFuel Systems(UK), and Seambiotic (Ireland) as it is a lucrative market major companies are investing in Microalgae based Products market.Microalgae based Products Market Scope: Inquiry Before Buying

Microalgae based Products Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 13.25 Bn. Forecast Period 2024 to 2030 CAGR: 8.2% Market Size in 2030: US $ 23.01 Bn. Segments Covered: by Species Type Spirulina Chlorella Dunaliella Salina Others by Category Inorganic Organic by Application Food and Beverages Animal feed Cosmetics Others Microalgae based Products Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Microalgae based Products Market Key Players:

1. Fuqing King Dnarmsa Spirulina Co., Ltd. (China) 2. Earthrise Nutritionals, LLC, (U.S.) 3. E.I.D. - PARRY LIMITED (INDIA) 4. Cyanotech Corporation (U.S.) 5. C.B.N. Bio-engineering Co.Ltd (China) 6. YUNNAN GREEN A BIOLOGICAL PROJECT CO., LTD. (Yunnan Spirin 7. Biotechnology Co. Ltd (China) 8. Jiangshan COMP SPIRULINA CO., LTD. (China) 9. Inner Mongolia Rejuve Biotech Co., Ltd. (China) 10. Zhejiang Binmei BiotechnologyCo., Ltd. (China) 11. Bluetec Naturals CO., LTD. (China) 12. Taiwan Chlorella Manufacturing Company(TCMC) (Taiwan) 13. Sun Chlorella Corporation (Japan) 14. Roquette Klötze GmbH & Co. KG (Germany) 15. Gong Bih Enterprise Co., Ltd.(Taiwan) 16. Yaeyama Shokusan Co., Ltd. (Euglena Co Ltd) (Japan) 17. VedanBiotechnology Corporation (Taiwan) 18. AlgoSource (France) 19. Tianjin Norland Biotech CO., LTD (China) 20. Phycom BV (Netherlands) 21. AllMicroalgae based Products Natural Products S.A. (Portugal) 22. Aliga Microalgae based Products (Denmark) 23. Taiwan Wilson Enterprise Inc. (Taiwan) 24. Daesang Corporation (Korea) 25. Algalimento SL (Spain) 26. Seagrass Tech Private Limited (India) 27. Plankton Australia Pty Limited (Australia) 28. Hangzhou Ouqi Food Co., Ltd. (China) 29. Shaanxi Rebecca Bio-Tech Co., Ltd (China) FAQs: 1. What are the growth drivers for the Microalgae based Products market? Ans. The rising demand for advanced implantable materials, with a particular focus on replacing conventional metal implants is expected to be the major driver for the Microalgae based Products market. 2. What is the major restraint on the Microalgae based Products market growth? Ans. High Cost of Production and Stringent Regulatory Approvals are expected to be the major restraining factors for the Microalgae based Products market growth. 3. Which region is expected to lead the global Microalgae based Products market during the forecast period? Ans. North America is expected to lead the global Microalgae based Products market during the forecast period. 4. What is the projected market size & and growth rate of the Microalgae based Products Market? Ans. The Microalgae based Products Market size was valued at USD 13.25 Billion in 2023 and the total Microalgae based Products revenue is expected to grow at a CAGR of 8.2% from 2024 to 2030, reaching nearly USD 23.01 Billion. 5. What segments are covered in the Microalgae based Products Market report? Ans. The segments covered in the Microalgae based Products market report are Category, Type, Application, and Region.

1. Microalgae based Products Market: Research Methodology 2. Microalgae based Products Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Microalgae based Products Market: Dynamics 3.1 Microalgae based Products Market Trends by Region 3.1.1 North America Microalgae based Products Market Trends 3.1.2 Europe Microalgae based Products Market Trends 3.1.3 Asia Pacific Microalgae based Products Market Trends 3.1.4 Middle East and Africa Microalgae based Products Market Trends 3.1.5 South America Microalgae based Products Market Trends 3.2 Microalgae based Products Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Microalgae based Products Market Drivers 3.2.1.2 North America Microalgae based Products Market Restraints 3.2.1.3 North America Microalgae based Products Market Opportunities 3.2.1.4 North America Microalgae based Products Market Challenges 3.2.2 Europe 3.2.2.1 Europe Microalgae based Products Market Drivers 3.2.2.2 Europe Microalgae based Products Market Restraints 3.2.2.3 Europe Microalgae based Products Market Opportunities 3.2.2.4 Europe Microalgae based Products Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Microalgae based Products Market Market Drivers 3.2.3.2 Asia Pacific Microalgae based Products Market Restraints 3.2.3.3 Asia Pacific Microalgae based Products Market Opportunities 3.2.3.4 Asia Pacific Microalgae based Products Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Microalgae based Products Market Drivers 3.2.4.2 Middle East and Africa Microalgae based Products Market Restraints 3.2.4.3 Middle East and Africa Microalgae based Products Market Opportunities 3.2.4.4 Middle East and Africa Microalgae based Products Market Challenges 3.2.5 South America 3.2.5.1 South America Microalgae based Products Market Drivers 3.2.5.2 South America Microalgae based Products Market Restraints 3.2.5.3 South America Microalgae based Products Market Opportunities 3.2.5.4 South America Microalgae based Products Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives For the Microalgae based Products Industry 3.8 The Global Pandemic and Redefining of The Microalgae based Products Industry Landscape 4. Global Microalgae based Products Market: Global Market Size and Forecast by Segmentation (Value in USD Billion) (2023-2030) 4.1 Global Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 4.1.1 Spirulina 4.1.2 Chlorella 4.1.3 Dunaliella Salina 4.1.4 Others 4.2 Global Microalgae based Products Market Size and Forecast, by Category (2023-2030) 4.2.1 Inorganic 4.2.2 Organic 4.3 Global Microalgae based Products Market Size and Forecast, by Application (2023-2030) 4.3.1 Food and Beverages 4.3.2 Animal feed 4.3.3 Cosmetics 4.3.4 Other 4.4 Global Microalgae based Products Market Size and Forecast, by Region (2023-2030) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Microalgae based Products Market Size and Forecast by Segmentation (Value in USD Billion) (2023-2030) 5.1 North America Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 5.1.1 Spirulina 5.1.2 Chlorella 5.1.3 Dunaliella Salina 5.1.4 Others 5.2 North America Microalgae based Products Market Size and Forecast, by Category (2023-2030) 5.2.1 Inorganic 5.2.2 Organic 5.3 North America Microalgae based Products Market Size and Forecast, by Application (2023-2030) 5.3.1 Food and Beverages 5.3.2 Animal feed 5.3.3 Cosmetics 5.3.4 Other 5.4 North America Microalgae based Products Market Size and Forecast, by Country (2023-2030) 5.4.1 United States 5.4.1.1 United States Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 5.4.1.1.1 Spirulina 5.4.1.1.2 Chlorella 5.4.1.1.3 Dunaliella Salina 5.4.1.1.4 Others 5.4.1.2 United States Microalgae based Products Market Size and Forecast, by Category (2023-2030) 5.4.1.2.1 Inorganic 5.4.1.2.2 Organic 5.4.1.3 United States Microalgae based Products Market Size and Forecast, by Application (2023-2030) 5.4.1.3.1 Food and Beverages 5.4.1.3.2 Animal feed 5.4.1.3.3 Cosmetics 5.4.1.3.4 Other 5.4.2 Canada 5.4.2.1 Canada Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 5.4.2.1.1 Spirulina 5.4.2.1.2 Chlorella 5.4.2.1.3 Dunaliella Salina 5.4.2.1.4 Others 5.4.2.2 Canada Microalgae based Products Market Size and Forecast, by Category (2023-2030) 5.4.2.2.1 Inorganic 5.4.2.2.2 Organic 5.4.2.3 Canada Microalgae based Products Market Size and Forecast, by Application (2023-2030) 5.4.2.3.1 Food and Beverages 5.4.2.3.2 Animal feed 5.4.2.3.3 Cosmetics 5.4.2.3.4 Other 5.4.3 Mexico 5.4.3.1 Mexico Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 5.4.3.1.1 Spirulina 5.4.3.1.2 Chlorella 5.4.3.1.3 Dunaliella Salina 5.4.3.1.4 Others 5.4.3.2 Mexico Microalgae based Products Market Size and Forecast, by Category (2023-2030) 5.4.3.2.1 Inorganic 5.4.3.2.2 Organic 5.4.3.3 Mexico Microalgae based Products Market Size and Forecast, by Application (2023-2030) 5.4.3.3.1 Food and Beverages 5.4.3.3.2 Animal feed 5.4.3.3.3 Cosmetics 5.4.3.3.4 Other 6. Europe Microalgae based Products Market Size and Forecast by Segmentation (Value in USD Billion) (2023-2030) 6.1 Europe Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 6.2 Europe Microalgae based Products Market Size and Forecast, by Category (2023-2030) 6.3 Europe Microalgae based Products Market Size and Forecast, by Application (2023-2030) 6.4 Europe Microalgae based Products Market Size and Forecast, by Country (2023-2030) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 6.4.1.2 United Kingdom Microalgae based Products Market Size and Forecast, by Category (2023-2030) 6.4.1.3 United Kingdom Microalgae based Products Market Size and Forecast, by Application (2023-2030) 6.4.2 France 6.4.2.1 France Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 6.4.2.2 France Microalgae based Products Market Size and Forecast, by Category (2023-2030) 6.4.2.3 France Microalgae based Products Market Size and Forecast, by Application (2023-2030) 6.4.3 Germany 6.4.3.1 Germany Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 6.4.3.2 Germany Microalgae based Products Market Size and Forecast, by Category (2023-2030) 6.4.3.3 Germany Microalgae based Products Market Size and Forecast, by Application (2023-2030) 6.4.4 Italy 6.4.4.1 Italy Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 6.4.4.2 Italy Microalgae based Products Market Size and Forecast, by Category (2023-2030) 6.4.4.3 Italy Microalgae based Products Market Size and Forecast, by Application (2023-2030) 6.4.5 Spain 6.4.5.1 Spain Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 6.4.5.2 Spain Microalgae based Products Market Size and Forecast, by Category (2023-2030) 6.4.5.3 Spain Microalgae based Products Market Size and Forecast, by Application (2023-2030) 6.4.6 Sweden 6.4.6.1 Sweden Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 6.4.6.2 Sweden Microalgae based Products Market Size and Forecast, by Category (2023-2030) 6.4.6.3 Sweden Microalgae based Products Market Size and Forecast, by Application (2023-2030) 6.4.7 Austria 6.4.7.1 Austria Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 6.4.7.2 Austria Microalgae based Products Market Size and Forecast, by Category (2023-2030) 6.4.7.3 Austria Microalgae based Products Market Size and Forecast, by Application (2023-2030) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 6.4.8.2 Rest of Europe Microalgae based Products Market Size and Forecast, by Category (2023-2030). 6.4.8.3 Rest of Europe Microalgae based Products Market Size and Forecast, by Application (2023-2030) 7. Asia Pacific Microalgae based Products Market Size and Forecast by Segmentation (Value in USD Billion) (2023-2030) 7.1 Asia Pacific Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 7.2 Asia Pacific Microalgae based Products Market Size and Forecast, by Category (2023-2030) 7.3 Asia Pacific Microalgae based Products Market Size and Forecast, by Application (2023-2030) 7.4 Asia Pacific Microalgae based Products Market Size and Forecast, by Country (2023-2030) 7.4.1 China 7.4.1.1 China Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 7.4.1.2 China Microalgae based Products Market Size and Forecast, by Category (2023-2030) 7.4.1.3 China Microalgae based Products Market Size and Forecast, by Application (2023-2030) 7.4.2 South Korea 7.4.2.1 S Korea Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 7.4.2.2 S Korea Microalgae based Products Market Size and Forecast, by Category (2023-2030) 7.4.2.3 S Korea Microalgae based Products Market Size and Forecast, by Application (2023-2030) 7.4.3 Japan 7.4.3.1 Japan Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 7.4.3.2 Japan Microalgae based Products Market Size and Forecast, by Category (2023-2030) 7.4.3.3 Japan Microalgae based Products Market Size and Forecast, by Application (2023-2030) 7.4.4 India 7.4.4.1 India Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 7.4.4.2 India Microalgae based Products Market Size and Forecast, by Category (2023-2030) 7.4.4.3 India Microalgae based Products Market Size and Forecast, by Application (2023-2030) 7.4.5 Australia 7.4.5.1 Australia Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 7.4.5.2 Australia Microalgae based Products Market Size and Forecast, by Category (2023-2030) 7.4.5.3 Australia Microalgae based Products Market Size and Forecast, by Application (2023-2030) 7.4.6 Indonesia 7.4.6.1 Indonesia Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 7.4.6.2 Indonesia Microalgae based Products Market Size and Forecast, by Category (2023-2030) 7.4.6.3 Indonesia Microalgae based Products Market Size and Forecast, by Application (2023-2030) 7.4.7 Malaysia 7.4.7.1 Malaysia Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 7.4.7.2 Malaysia Microalgae based Products Market Size and Forecast, by Category (2023-2030) 7.4.7.3 Malaysia Microalgae based Products Market Size and Forecast, by Application (2023-2030) 7.4.8 Vietnam 7.4.8.1 Vietnam Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 7.4.8.2 Vietnam Microalgae based Products Market Size and Forecast, by Category (2023-2030) 7.4.8.3 Vietnam Microalgae based Products Market Size and Forecast, by Application (2023-2030) 7.4.9 Taiwan 7.4.9.1 Taiwan Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 7.4.9.2 Taiwan Microalgae based Products Market Size and Forecast, by Category (2023-2030) 7.4.9.3 Taiwan Microalgae based Products Market Size and Forecast, by Application (2023-2030) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 7.4.10.2 Bangladesh Microalgae based Products Market Size and Forecast, by Category (2023-2030) 7.4.10.3 Bangladesh Microalgae based Products Market Size and Forecast, by Application (2023-2030) 7.4.11 Pakistan 7.4.11.1 Pakistan Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 7.4.11.2 Pakistan Microalgae based Products Market Size and Forecast, by Category (2023-2030) 7.4.11.3 Pakistan Microalgae based Products Market Size and Forecast, by Application (2023-2030) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 7.4.12.2 Rest of Asia PacificMicroalgae based Products Market Size and Forecast, by Category (2023-2030) 7.4.12.3 Rest of Asia Pacific Microalgae based Products Market Size and Forecast, by Application (2023-2030) 8. Middle East and Africa Microalgae based Products Market Size and Forecast by Segmentation (Value in USD Billion) (2023-2030) 8.1 Middle East and Africa Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 8.2 Middle East and Africa Microalgae based Products Market Size and Forecast, by Category (2023-2030) 8.3 Middle East and Africa Microalgae based Products Market Size and Forecast, by Application (2023-2030) 8.4 Middle East and Africa Microalgae based Products Market Size and Forecast, by Country (2023-2030) 8.4.1 South Africa 8.4.1.1 South Africa Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 8.4.1.2 South Africa Microalgae based Products Market Size and Forecast, by Category (2023-2030) 8.4.1.3 South Africa Microalgae based Products Market Size and Forecast, by Application (2023-2030) 8.4.2 GCC 8.4.2.1 GCC Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 8.4.2.2 GCC Microalgae based Products Market Size and Forecast, by Category (2023-2030) 8.4.2.3 GCC Microalgae based Products Market Size and Forecast, by Application (2023-2030) 8.4.3 Egypt 8.4.3.1 Egypt Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 8.4.3.2 Egypt Microalgae based Products Market Size and Forecast, by Category (2023-2030) 8.4.3.3 Egypt Microalgae based Products Market Size and Forecast, by Application (2023-2030) 8.4.4 Nigeria 8.4.4.1 Nigeria Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 8.4.4.2 Nigeria Microalgae based Products Market Size and Forecast, by Category (2023-2030) 8.4.4.3 Nigeria Microalgae based Products Market Size and Forecast, by Application (2023-2030) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 8.4.5.2 Rest of ME&A Microalgae based Products Market Size and Forecast, by Category (2023-2030) 8.4.5.3 Rest of ME&A Microalgae based Products Market Size and Forecast, by Application (2023-2030) 9. South America Microalgae based Products Market Size and Forecast by Segmentation (Value in USD Billion) (2023-2030) 9.1 South America Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 9.2 South America Microalgae based Products Market Size and Forecast, by Category (2023-2030) 9.3 South America Microalgae based Products Market Size and Forecast, by Application (2023-2030) 9.4 South America Microalgae based Products Market Size and Forecast, by Country (2023-2030) 9.4.1 Brazil 9.4.1.1 Brazil Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 9.4.1.2 Brazil Microalgae based Products Market Size and Forecast, by Category (2023-2030) 9.4.1.3 Brazil Microalgae based Products Market Size and Forecast, by Application (2023-2030) 9.4.2 Argentina 9.4.2.1 Argentina Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 9.4.2.2 Argentina Microalgae based Products Market Size and Forecast, by Category (2023-2030) 9.4.2.3 Argentina Microalgae based Products Market Size and Forecast, by Application (2023-2030) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Microalgae based Products Market Size and Forecast, by Species Type (2023-2030) 9.4.3.2 Rest Of South America Microalgae based Products Market Size and Forecast, by Category (2023-2030) 9.4.3.3 Rest Of South America Microalgae based Products Market Size and Forecast, by Application (2023-2030) 10. Global Microalgae based Products Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.4 Leading Microalgae based Products Global Companies, by market capitalization 10.5 Market Structure 10.5.1 Market Leaders 10.5.2 Market Followers 10.5.3 Emerging Players 10.6 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Fuqing King Dnarmsa Spirulina Co., Ltd. (China) 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Earthrise Nutritionals, LLC, (U.S.) 11.3 E.I.D. - PARRY LIMITED (INDIA) 11.4 Cyanotech Corporation (U.S.) 11.5 C.B.N. Bio-engineering Co.Ltd (China) 11.6 YUNNAN GREEN A BIOLOGICAL PROJECT CO., LTD. (Yunnan Spirin 11.7 Biotechnology Co. Ltd) (China) 11.8 Jiangshan COMP SPIRULINA CO., LTD. (China) 11.9 Inner Mongolia Rejuve Biotech Co., Ltd. (China) 11.10 Zhejiang Binmei BiotechnologyCo., Ltd. (China) 11.11 Bluetec Naturals CO., LTD. (China) 11.12 Taiwan Chlorella Manufacturing Company(TCMC) (Taiwan) 11.13 Sun Chlorella corporation (Japan) 11.14 Roquette Klötze GmbH & Co. KG (Germany) 11.15 Gong Bih Enterprise Co., Ltd.(Taiwan) 11.16 Yaeyama Shokusan Co., Ltd. (Euglena Co Ltd) (Japan) 11.17 VedanBiotechnology Corporation (Taiwan) 11.18 AlgoSource (France) 11.19 Tianjin Norland Biotech CO., LTD (China) 11.20 Phycom BV (Netherlands) 11.21 AllMicroalgae based Products Natural Products S.A. (Portugal) 11.22 Aliga Microalgae based Products (Denmark) 11.23 Taiwan Wilson Enterprise Inc. (Taiwan) 12. Key Findings 13. Industry Recommendations