Medical Device Connectivity Market was valued at USD 2.63 Billion in 2023, and it is expected to reach USD 11.66 Billion by 2030, exhibiting a CAGR of 23.71 % during the forecast period (2024-2030). Medical device connectivity helps to reduce healthcare costs. Medical device connectivity permits the remote monitoring of chronic diseases like diabetes and high blood pressure. The report explores the Medical Device Connectivity Market’s segments (Connectivity and Content, and End Users). Data has been provided by market participants, and End User (North America, Asia Pacific, Europe, Middle East & Africa, and South America). The MMR market report provides a thorough analysis of the rapid advances that are currently taking place across all healthcare systems sectors. Facts and figures, illustrations, and presentations are used to provide key data analysis for the historical period from 2018 to 2023. The report investigates the Medical Device Connectivity Market’s drivers, limitations, prospects, and barriers. This MMR report includes investor recommendations based on a thorough examination of the Medical Device Connectivity Market’s contemporary competitive scenario.To know about the Research Methodology :- Request Free Sample Report

Medical Device Connectivity Market Dynamics

Over the next seven years, the health care and life sciences industries are converting from reactive and largely episodic models to provident digitally enabled models, which can deliver better value for patients. An intro of the disruptive technologies is changing ways of working across the healthcare sector. A series of technological and educational revolutions are getting into technology and people to be improved connectivity, which is leading to the development of a network of connected, smart devices and objects. Big data, AI, mobile usages, 3D printing, advanced detectors, and other technologies are expected to produce new opportunities for key players, which are operating in the global medical device connectivity market. An integration of connected medical devices into established care pathways is demanding and needs significant cooperation from multiple stakeholders to work successfully. Cross-industry collaborations are playing a vital part in bridging gaps in experience and creating solutions, which deliver clinical, functional, and monetary value. Cost-effective and purposefully designed, technology- enabled health care results are expected to upgrade the well- being of millions of people. The adoption of connected medical devices is expanding for home healthcare because of the introduction of technologies like mobile health. The connected medical device is transferring cautions to croakers or concerned people in case of a healthcare crisis. The Medical device connectivity system also reduces the number of nursing hours and offers enhanced functional effectiveness of the healthcare staff. It can give optimal patient care in lower time and serve a lesser number of cases. On the other hand, some of the enterprises regarding with security issues and high original costs are expected to limit the global medical device connectivity market growth. The report has profiled seventeen key players in the demand from different regions. still, the report has considered all market leaders, followers and new entrants with investors while analyzing the market and estimation the size of the same. expanding R&D conditioning in each region are different and focus is given on the indigenous impact on the cost, accessibility of advanced technology is anatomized and report has come up with recommendations for a future hot spot in APAC region.Medical Device Connectivity Market, by Technology in 2023 (%)

MMR provides an analysis of the key trends in each sub-segment of the Blood Irradiator Device The hybrid technologies, segment is expected to contribute xx% share in the global medical device connectivity market. The growth in the market by technology segment is attributed to the high demand for network bandwidth governance and network visibility within health setups, demand for scalability, and adoption of connected smart devices. An increase in demand for hybrid technologies in hospitals and home care settings is expected to boost market growth. The hospitals segment is expected to contribute xx% share in the global market. The growth in the request is attributed to the large case volume, copping power of hospitals to buy innovative medical device connectivity results, and adding focus on offering high- quality patient care and safety. Hospitals and small practices are looking for medical device data to be more interoperable, complete, standardized, and accurate to perfect clinical issues and patient safety. Hospitals frequently employment hundreds of customizations to make EHRs user-friendly and have multiple connecting systems, which helps to increase the complexity of participating information.

Medical Device Connectivity Market Regional Insights

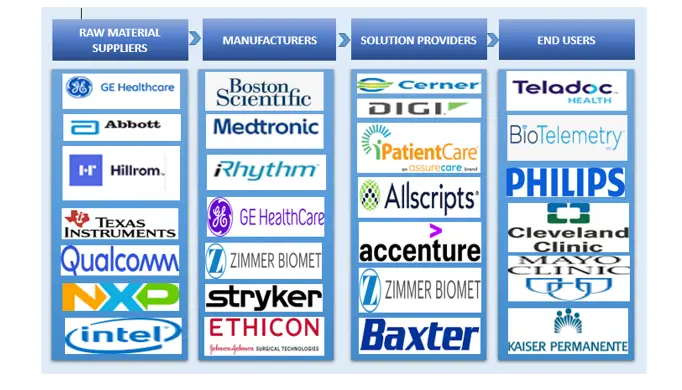

The North American End User holds an xx% market share in global Market. Aggregate demand for sophisticated and well-organized medical devices is driving the growth of the US market. Increasing medical costs, medical needs of the aging population, and the number of cases of surgery are also some of the drivers behind market growth. The pharmaceutical market is expected to grow rapidly, but political instability is now affecting the global economy as a whole. For example, Trump's trade war with China and the turmoil in the UK's Brevity process have created market uncertainty in the market. Business fundamentals are expected to be strong and very bullish during the forecast period. The objective of the report is to present a comprehensive analysis of the global Market to the stakeholders in the devices. The past and current status of the Surgery with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the Surgery with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the Surgery to the decision-makers. The reports also help in understanding the Market dynamic, structure by analysing the market segments and projecting the Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, Surgery portfolio, growth strategies, and End-Industrial presence in the Market make the report investor’s guide.Medical Device Connectivity Industry Ecosystem

Medical Device Connectivity Market Scope: Inquire before buying

Global Medical Device Connectivity Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.63 Bn. Forecast Period 2024 to 2030 CAGR: 23.71% Market Size in 2030: US $ 11.66 Bn. Segments Covered: by Component Medical Device Connectivity Solutions Medical Device Integration Interface Devices Connectivity Hubs Telemetry Systems

Medical Device Connectivity ServicesSupport and Maintenance Implementation and Integration Training Consulting

by Technology Wired Technologies Wireless Technologies Hybrid Technologies by End User Hospitals Home Healthcare Centers Diagnostic and Imaging Centers Ambulatory Care Centers Medical Device Connectivity Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Medical Device Connectivity Market, Key Players are

1. Infosys 2. Lantronix 3. S3 Connected Health 4. Iatric Systems, Inc. 5. Silex Technology, Inc. 6. True Process 7. Medicollector Llc 8. Cerner Corporation 9. Capsule Technologies, Inc. 10. GE Healthcare 11. Koninklijke Philips 12. Medtronic Plc 13. Ihealth Labs Inc. 14. Cisco Systems 15. Bridge-Tech Medical, Inc. 16. Digi International Inc. 17. Te Connectivity 18. Spectrum Medical Ltd. 19. Hill-Rom Holdings Inc. 20. Masimo Corporation Frequently Asked Questions: 1] What segments are covered in the Global Medical Device Connectivity Market report? Ans. The segments covered in the Medical Device Connectivity Market report are based on Component, Technology and End User. 2] Which End User is expected to hold the highest share in the Global Medical Device Connectivity Market? Ans. The Asia Pacific End User is expected to hold the highest share in the Medical Device Connectivity Market. 3] What is the market size of the Global Medical Device Connectivity Market by 2030? Ans. The market size of the Medical Device Connectivity Market by 2030 is expected to reach USD 11.66 Bn. 4] What is the forecast period for the Global Medical Device Connectivity Market? Ans. The forecast period for the Medical Device Connectivity Market is 2024-2030 5] What was the market size of the Global Medical Device Connectivity Market in 2023? Ans. The market size of the Medical Device Connectivity Market in 2023 was valued at USD 2.63 Bn.

1. Global Medical Device Connectivity Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Medical Device Connectivity Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Products specific analysis 2.5. Key Players Benchmarking 2.5.1. Company Name 2.5.2. Company Location 2.5.3. Product Segment 2.5.4. End-user Segment 2.5.5. Revenue (2023) 2.5.6. Key Development 2.5.7. Market Share 2.6. Industry Ecosystem Analysis 2.7. Market Structure 2.7.1. Market Leaders 2.7.2. Market Followers 2.7.3. Emerging Players 2.8. Consolidation of the Market 2.8.1. Strategic Initiatives and Developments 2.8.2. Mergers and Acquisitions 2.8.3. Collaborations and Partnerships 2.8.4. Product Launches and Innovations 3. Global Medical Device Connectivity Market: Dynamics 3.1. Medical Device Connectivity Market Trends 3.2. Medical Device Connectivity Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.3.1. Threat of New Entrants 3.3.2. Threat of Substitutes 3.3.3. Bargaining Power of Suppliers 3.3.4. Bargaining Power of Buyers 3.3.5. Intensity of Competitive Rivalry 3.4. PESTLE Analysis 3.5. Technology Analysis 3.5.1. IOMT (Internet of Medical Things) 3.5.1.1. Edge Computing 3.6. Regulatory Landscape 3.6.1. Regulations by Region 3.6.2. Regulatory Bodies, Government Agencies, and Other Organizations 3.6.2.1. US 3.6.2.2. Canada 3.6.2.3. Japan 3.6.2.4. China 3.6.2.5. India 3.7. Trade Analysis 3.7.1. Trade Analysis for Medical Device Connectivity Solutions 3.8. Pricing Analysis 3.8.1. Average Selling Price Trend by Key Players 3.9. Patent Analysis 3.9.1. Patent Publication Trends 3.9.2. Jurisdiction Analysis of top applicants(Countries) for Medical device connectivity patents (2011-2023) 3.9.3. Medical Device Connectivity Market: Top Applicants 3.9.4. Medical Device Connectivity Market: List Of Patents/Patent Application 3.9.5. Jurisdiction Analysis 4. Global Medical Device Connectivity Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Global Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 4.1.1. Medical Device Connectivity Solutions 4.1.1.1. Medical Device Integration 4.1.1.2. Interface Devices 4.1.1.3. Connectivity Hubs 4.1.1.4. Telemetry Systems 4.1.2. Medical Device Connectivity Services 4.1.2.1. Support and Maintenance 4.1.2.2. Implementation and Integration 4.1.2.3. Training 4.1.2.4. Consulting 4.2. Global Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 4.2.1. Wired Technologies 4.2.2. Wireless Technologies 4.2.3. Hybrid Technologies 4.3. Global Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 4.3.1. Hospitals 4.3.2. Home Healthcare Centers 4.3.3. Diagnostic and Imaging Centers 4.3.4. Ambulatory Care Centers 4.4. Global Medical Device Connectivity Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Medical Device Connectivity Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 5.1.1. Medical Device Connectivity Solutions 5.1.1.1. Medical Device Integration 5.1.1.2. Interface Devices 5.1.1.3. Connectivity Hubs 5.1.1.4. Telemetry Systems 5.1.2. Medical Device Connectivity Services 5.1.2.1. Support and Maintenance 5.1.2.2. Implementation and Integration 5.1.2.3. Training 5.1.2.4. Consulting 5.2. North America Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 5.2.1. Wired Technologies 5.2.2. Wireless Technologies 5.2.3. Hybrid Technologies 5.3. North America Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 5.3.1. Hospitals 5.3.2. Home Healthcare Centers 5.3.3. Diagnostic and Imaging Centers 5.3.4. Ambulatory Care Centers 5.4. North America Medical Device Connectivity Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 5.4.1.1.1. Medical Device Connectivity Solutions 5.4.1.1.1.1. Medical Device Integration 5.4.1.1.1.2. Interface Devices 5.4.1.1.1.3. Connectivity Hubs 5.4.1.1.1.4. Telemetry Systems 5.4.1.1.2. Medical Device Connectivity Services 5.4.1.1.2.1. Support and Maintenance 5.4.1.1.2.2. Implementation and Integration 5.4.1.1.2.3. Training 5.4.1.1.2.4. Consulting 5.4.1.2. United States Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 5.4.1.2.1. Wired Technologies 5.4.1.2.2. Wireless Technologies 5.4.1.2.3. Hybrid Technologies 5.4.1.3. United States Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 5.4.1.3.1. Hospitals 5.4.1.3.2. Home Healthcare Centers 5.4.1.3.3. Diagnostic and Imaging Centers 5.4.1.3.4. Ambulatory Care Centers 5.4.2. Canada 5.4.2.1. Canada Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 5.4.2.1.1. Medical Device Connectivity Solutions 5.4.2.1.1.1. Medical Device Integration 5.4.2.1.1.2. Interface Devices 5.4.2.1.1.3. Connectivity Hubs 5.4.2.1.1.4. Telemetry Systems 5.4.2.1.2. Medical Device Connectivity Services 5.4.2.1.2.1. Support and Maintenance 5.4.2.1.2.2. Implementation and Integration 5.4.2.1.2.3. Training 5.4.2.1.2.4. Consulting 5.4.2.2. Canada Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 5.4.2.2.1. Wired Technologies 5.4.2.2.2. Wireless Technologies 5.4.2.2.3. Hybrid Technologies 5.4.2.3. Canada Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 5.4.2.3.1. Hospitals 5.4.2.3.2. Home Healthcare Centers 5.4.2.3.3. Diagnostic and Imaging Centers 5.4.2.3.4. Ambulatory Care Centers 5.4.3. Mexico 5.4.3.1. Mexico Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 5.4.3.1.1. Medical Device Connectivity Solutions 5.4.3.1.1.1. Medical Device Integration 5.4.3.1.1.2. Interface Devices 5.4.3.1.1.3. Connectivity Hubs 5.4.3.1.1.4. Telemetry Systems 5.4.3.1.2. Medical Device Connectivity Services 5.4.3.1.2.1. Support and Maintenance 5.4.3.1.2.2. Implementation and Integration 5.4.3.1.2.3. Training 5.4.3.1.2.4. Consulting 5.4.3.2. Mexico Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 5.4.3.2.1. Wired Technologies 5.4.3.2.2. Wireless Technologies 5.4.3.2.3. Hybrid Technologies 5.4.3.3. Mexico Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 5.4.3.3.1. Hospitals 5.4.3.3.2. Home Healthcare Centers 5.4.3.3.3. Diagnostic and Imaging Centers 5.4.3.3.4. Ambulatory Care Centers 6. Europe Medical Device Connectivity Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 6.2. Europe Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 6.3. Europe Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 6.4. Europe Medical Device Connectivity Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 6.4.1.2. United Kingdom Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 6.4.1.3. United Kingdom Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 6.4.2. France 6.4.2.1. France Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 6.4.2.2. France Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 6.4.2.3. France Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 6.4.3.2. Germany Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 6.4.3.3. Germany Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 6.4.4.2. Italy Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 6.4.4.3. Italy Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 6.4.5.2. Spain Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 6.4.5.3. Spain Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 6.4.6.2. Sweden Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 6.4.6.3. Sweden Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 6.4.7. Russia 6.4.7.1. Russia Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 6.4.7.2. Russia Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 6.4.7.3. Russia Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 6.4.8.2. Rest of Europe Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 6.4.8.3. Rest of Europe Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 7. Asia Pacific Medical Device Connectivity Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 7.2. Asia Pacific Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 7.3. Asia Pacific Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 7.4. Asia Pacific Medical Device Connectivity Market Size and Forecast, by Industry (2023-2030) 7.5. Asia Pacific Medical Device Connectivity Market Size and Forecast, by Country (2023-2030) 7.5.1. China 7.5.1.1. China Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 7.5.1.2. China Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 7.5.1.3. China Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 7.5.2. S Korea 7.5.2.1. S Korea Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 7.5.2.2. S Korea Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 7.5.2.3. S Korea Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 7.5.3. Japan 7.5.3.1. Japan Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 7.5.3.2. Japan Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 7.5.3.3. Japan Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 7.5.4. India 7.5.4.1. India Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 7.5.4.2. India Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 7.5.4.3. India Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 7.5.5. Australia 7.5.5.1. Australia Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 7.5.5.2. Australia Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 7.5.5.3. Australia Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 7.5.6. ASEAN 7.5.6.1. ASEAN Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 7.5.6.2. ASEAN Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 7.5.6.3. ASEAN Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 7.5.7. Rest of Asia Pacific 7.5.7.1. Rest of Asia Pacific Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 7.5.7.2. Rest of Asia Pacific Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 7.5.7.3. Rest of Asia Pacific Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 8. Middle East and Africa Medical Device Connectivity Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 8.2. Middle East and Africa Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 8.3. Middle East and Africa Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 8.4. Middle East and Africa Medical Device Connectivity Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 8.4.1.2. South Africa Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 8.4.1.3. South Africa Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 8.4.2.2. GCC Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 8.4.2.3. GCC Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest of MEandA 8.4.3.1. Rest of MEandA Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 8.4.3.2. Rest of MEandA Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 8.4.3.3. Rest of MEandA Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 9. South America Medical Device Connectivity Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 9.1. South America Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 9.2. South America Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 9.3. South America Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 9.4. South America Medical Device Connectivity Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 9.4.1.2. Brazil Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 9.4.1.3. Brazil Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 9.4.2.2. Argentina Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 9.4.2.3. Argentina Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Medical Device Connectivity Market Size and Forecast, by Connectivity (2023-2030) 9.4.3.2. Rest of South America Medical Device Connectivity Market Size and Forecast, by Technology (2023-2030) 9.4.3.3. Rest of South America Medical Device Connectivity Market Size and Forecast, by End User (2023-2030) 10. Company Profile: Key Players 10.1. Infosys 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Lantronix 10.3. S3 Connected Health 10.4. Iatric Systems, Inc. 10.5. Silex Technology, Inc. 10.6. True Process 10.7. Medicollector Llc 10.8. Cerner Corporation 10.9. Capsule Technologies, Inc. 10.10. GE Healthcare 10.11. Koninklijke Philips 10.12. Medtronic Plc 10.13. Ihealth Labs Inc. 10.14. Cisco Systems 10.15. Bridge-Tech Medical, Inc. 10.16. Digi International Inc. 10.17. Te Connectivity 10.18. Spectrum Medical Ltd. 10.19. Hill-Rom Holdings Inc. 10.20. Masimo Corporation 11. Key Findings & Analyst Recommendations 12. Medical Device Connectivity Market: Research Methodology 12.1. Top-Down Approach 12.2. Bottom-up Approach 12.3. Market Breakdown and Data Triangulation