Global Main Automation Contractor (MAC) Market is expected to reach USD 1.60 Bn at a CAGR of 5.65% during the forecast period 2029Global Main Automation Contractor (MAC) Market Introduction

Project management, expertise, goods, systems, and services are provided by a Main Automation Contractor (MAC). It also manages the engineering suppliers' interfaces to maintain a consistent supply and is in charge of data transfer between parties. To reduce process requirements and lead to practical, optimal solutions, initial concept design and Front-End Engineering & Design (FEED) studies can be done. In today's automation environment, all major corporations place a premium on SCADA products. The likelihood of improving overall project coordination is improved when the main automation contractor is used since it improves on handling vendor obligations in an efficient manner.To know about the Research Methodology :- Request Free Sample Report

Global Main Automation Contractor (MAC) Market Dynamics

The growing trend for automation, as well as the widespread adoption of automation in industries, has resulted in the early involvement of MAC in projects, which reduces risk and the need for later modifications; this benefit is driving the growth of the main automation contractor market in industries. Growing need for automation in power plants, industries, and oil and gas, as well as automation contractors, integrating automation into operations to aid project execution and risk reduction. Large automation solution providers have shifted their focus to services in recent years, whereas suppliers formerly concentrated on product development and sales. Constant sophisticated demands are placed on automation systems in today's competitive and rapidly evolving technology and business environment. Today's businesses are looking for the best solution that will allow them to manage their worldwide operations in real-time while lowering their capital and lifecycle costs. There is always a strong requirement for safety and reliability in the oil and gas industry's procedures. The sector's supply chain has produced a substantial demand for automation, specialized expertise, and a large network of partners. In order to respond to the changing worldwide demand, complete automation solutions primarily assist oil and gas producers in integrating information, as well as controlling and providing safety solutions. For example, Honeywell Process Solutions (HPS) was named the major automation contractor for the Kuwait Integrated Petroleum Industries Company's new Petrochemicals and Refinery Integration Al Zour Project in November 2019. (PRIZe). Honeywell is expected to supply front-end engineering design and advanced process control technologies to the KIPIC, which is expected to aid the KIPIC in accelerating production start-up and meeting production targets more quickly and efficiently. Furthermore, the current coronavirus outbreak has encouraged automation to play an increasingly important part in the manufacturing process. In a situation where industries are working with a reduced workforce due to layoffs and job losses, automation is allowing firms to maintain production levels while reducing the danger of workers being exposed to the COVID-19 epidemic.Segment Analysis:

The Upstream Segment is expected to Grow Significantly The oil and gas industry's upstream sector includes many drilling activities that must adhere to severe government rules and necessitate meticulous planning in order to save operational expenses. The industry frequently works with large volumes of geographic data to make many judgments. Several process automation technologies and analytical engines are used in the sector to fully harness the power of geographical data. Furthermore, there has been a lot of exploration work in the UK, which has resulted in important finds like Glendronach, which is projected to be the fifth-largest conventional natural gas reserve finding on the UK Continental Shelf. Following the success of the Glendronach, businesses such as Total are planning more exploratory efforts in the area, which are projected to be the key source of demand for upstream oil and gas automation systems. Furthermore, under the National Outer Continental Shelf Oil and Gas Leasing Program (National OCS Program) for 2019-2024, the US Department of the Interior plans to allow offshore exploratory drilling in about 90% of the Outer Continental Shelf (OCS) acreage, the sector is expected to open up new opportunities for the market.

Regional Insights:

Because of the drop in oil prices, countries in the region such as the United States are interested in increasing their oil output. One of the most important energy advancements in the last decade was the shale boom. According to the EIA, due to rising production efficiencies and an expanding resource base, US oil output is predicted to rise Y-o-Y. Despite reduced oil prices, the US crude oil output is predicted to grow by 20% by 2030. Furthermore, the sector's oil production is expected to grow. For example, ExxonMobil, one of the country's largest oil producers, recently announced intentions to raise production in the Permian Basin of West Texas to more than 1 million barrels per day of oil-equivalent by 2024, an increase of about 80% above current capacity. Similarly, Chevron's net oil-equivalent production is estimated to climb to 600,000 BPD by 2020 and 900,000 BPD by 2023. As oilfield activity grows, demand for complete automation solutions is likely to rise, propelling the market forward throughout the forecast period.Global Main Automation Contractor (MAC) Market Report Scope: Inquire before buying

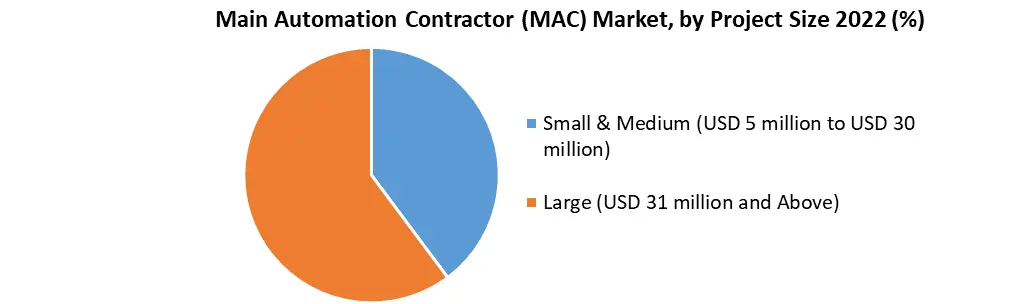

Main Automation Contractor (MAC) Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 1.09 Bn. Forecast Period 2023 to 2029 CAGR: 5.65% Market Size in 2029: US $ 1.60 Bn. Segments Covered: by Sector Upstream (Offshore and Onshore) Midstream Downstream by Project Size Small & Medium (USD 5 million to USD 30 million) Large (USD 31 million and Above) Global Main Automation Contractor (MAC) Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest) South America (Brazil, Argetina and Rest of South America)Global Main Automation Contractor (MAC) Market Key Players

1. ABB Ltd. 2. Yokogawa Electric Corporation 3. Rockwell Automation, Inc. 4. Siemens 5. Emerson Electric Co. 6. Schneider Electric 7. Control Global 8. Silvertech Middle East 9. Honeywell International Inc 10. Tengizchevroil 11. Autopro Automation Consultants Ltd 12. Cognex Corporation 13. Brooks Automation 14. Plexus Corp Frequently Asked Questions: 1. What is the growth rate of Global Main Automation Contractor (MAC) Market? Ans: The Global Main Automation Contractor (MAC) Market is growing at a CAGR of 5.65 % during forecasting period 2023-2029. 2. What is scope of the Global Main Automation Contractor (MAC) Market report? Ans: Global Main Automation Contractor (MAC) Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 3. What was the Global Main Automation Contractor (MAC) Market size in 2022? Ans: The Global Main Automation Contractor (MAC) market was valued at US$ 1.09 Bn. In 2022. 4. What is the study period of this Market? Ans: The Global Main Automation Contractor (MAC) Market is studied from 2022 to 2029.

1.Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Main Automation Contractor (MAC) Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2022 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Main Automation Contractor (MAC) Market 3.4. Geographical Snapshot of the Main Automation Contractor (MAC) Market, By Manufacturer share 4. Global Main Automation Contractor (MAC) Market Overview, 2022-2029 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Main Automation Contractor (MAC) Market 5. Supply Side and Demand Side Indicators 6. Global Main Automation Contractor (MAC) Market Analysis and Forecast, 2022-2029 6.1. Global Main Automation Contractor (MAC) Market Size & Y-o-Y Growth Analysis. 7. Global Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 7.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 7.1.1. Upstream (Offshore and Onshore) 7.1.2. Midstream 7.1.3. Downstream 7.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 7.2.1. Small & Medium (USD 5 million to USD 30 million) 7.2.2. Large (USD 31 million and Above) 8. Global Main Automation Contractor (MAC) Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2022-2029 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 9.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 9.1.1. Upstream (Offshore and Onshore) 9.1.2. Midstream 9.1.3. Downstream 9.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 9.2.1. Small & Medium (USD 5 million to USD 30 million) 9.2.2. Large (USD 31 million and Above) 10. North America Main Automation Contractor (MAC) Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 11.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 11.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 12. Canada Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 12.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 12.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 13. Mexico Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 13.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 13.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 14. Europe Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 14.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 14.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 15. Europe Main Automation Contractor (MAC) Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 16.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 16.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 17. France Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 17.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 17.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 18. Germany Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 18.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 18.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 19. Italy Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 19.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 19.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 20. Spain Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 20.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 20.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 21. Sweden Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 21.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 21.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 22. CIS Countries Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 22.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 22.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 23. Rest of Europe Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 23.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 23.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 24. Asia Pacific Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 24.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 24.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 25. Asia Pacific Main Automation Contractor (MAC) Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 26.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 26.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 27. India Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 27.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 27.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 28. Japan Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 28.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 28.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 29. South Korea Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 29.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 29.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 30. Australia Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 30.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 30.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 31. ASEAN Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 31.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 31.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 32. Rest of Asia Pacific Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 32.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 32.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 33. Middle East Africa Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 33.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 33.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 34. Middle East Africa Main Automation Contractor (MAC) Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2022-2029 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 35.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 35.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 36. GCC Countries Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 36.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 36.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 37. Egypt Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 37.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 37.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 38. Nigeria Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 38.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 38.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 39. Rest of ME&A Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 39.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 39.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 40. South America Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 40.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 40.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 41. South America Main Automation Contractor (MAC) Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2022-2029 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 42.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 42.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 43. Argentina Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 43.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 43.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 44. Rest of South America Main Automation Contractor (MAC) Market Analysis and Forecasts, 2022-2029 44.1. Market Size (Value) Estimates & Forecast By Sector, 2022-2029 44.2. Market Size (Value) Estimates & Forecast By Project Size, 2022-2029 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global Main Automation Contractor (MAC) Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Applications and R&D Investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 45.3. Company Profile: Key Players 45.3.1. ABB Ltd. 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.3.2. Yokogawa Electric Corporation 45.3.3. Rockwell Automation, Inc. 45.3.4. Siemens 45.3.5. Emerson Electric Co. 45.3.6. Schneider Electric 45.3.7. Control Global 45.3.8. Silvertech Middle East 45.3.9. Honeywell International Inc 45.3.10. Tengizchevroil 45.3.11. Autopro Automation Consultants Ltd 45.3.12. Cognex Corporation 45.3.13. Brooks Automation 45.3.14. Plexus Corp 45.3.15. Other Key Players 46. Primary Key Insights