Global Lingerie Market size was valued at USD 46.87 Bn in 2023 and is expected to reach USD 79.30 Bn by 2030, at a CAGR of 7.8 %.Lingerie Market Overview

Lingerie is a form of intimate apparel encompassing a broad range of undergarments designed to improve comfort, aesthetics and self-confidence. It plays a substantial role in fashion, personal expression and sensuality. Lingerie has a rich history dating back centuries. Originally, it served a functional purpose, aiding to shape and support the body while modestly covering it. Over time, it has evolved into a fashion statement and a symbol of sensuality. Modern lingerie comes in several styles, materials, and designs, providing different preferences and occasions. Bras are a fundamental component of lingerie. They offer support and shape to the breasts. Various styles, such as push-ups, balconettes and sports bras, provide to different needs and preferences. Bralettes have gained popularity for their comfort and style, often designed without underwire. Panties, another essential lingerie item, come in various styles such as thongs, briefs, and boyshorts. They offer comfort and coverage, and like bras, they have been found in an array of fabrics, colors and designs. Corsets, although less common today, have a historical significance in lingerie. They cinch the waist and provide a curvier silhouette. Modern variations focus on comfort rather than extreme shaping. Teddies and Chemises are one-piece garments that combine the comfort of nightgowns with the sensuality of lingerie. Brands provide a wider range of sizes, offering various body types. This inclusivity movement has resulted in more diverse representations of beauty and body positivity. Lingerie has been both functional and seductive, making it preferable for everyday wear, special occasions, and moments of self-indulgence. High-quality lingerie is constructed with fine materials, intricate lace and meticulous craftsmanship.To know about the Research Methodology :- Request Free Sample Report

Lingerie Market Dynamics:

The Increasing Number of Working Women across the globe is a major driver of the market growth. As more women enter the workforce, they gain financial independence. With their own source of income, women have better control over their expenditure decisions such as purchases related to clothing and lingerie. Working women have more active and social lifestyles. They engage in various activities and events, both professionally and personally. This necessitates a diverse range of lingerie to meet several needs, from comfortable everyday wear to elegant, special occasion pieces. Many professional workplaces have specific dress codes that require appropriate undergarments. This contains the necessity for seamless bras, shapewear and lingerie that complements formal attire. The rising number of women in the workforce has led to an increased demand for specialized lingerie. The focus on health and fitness has grown in recent years. Working women, who are growingly health-conscious, essential sports bras and workout-friendly undergarments to help their active lifestyles. This trend has driven sales of athletic and sports-related lingerie. With more women in the business sector, there is a heightened sense of empowerment and self-confidence. This assurance translates into a want to invest in quality lingerie that looks good and makes them feel confident and comfortable. Lingerie is no longer seen solely as functional underwear but also as a fashion statement and a means of self-expression. Working women, who are often at the forefront of fashion trends, contribute to the lingerie market growth by seeking out stylish and trendy choices. The correlation between women's education and workforce participation is strong. As educational awareness and opportunities for women increase, so does their participation in the labor force, which, in turn, boosts the demand for quality lingerie. Lingerie brands target working women in their marketing campaigns, highlighting the importance of feeling confident and comfortable in their daily lives. These campaigns resonate with the increasing number of women in the workforce, enhancing sales. Growing Consumer Preferences for Fashionable Apparel Products driving the market growth. The rapid expansion of information technology and the process of globalization have transformed the way consumers interact with and consume products in the market. This transformation is evident in the lingerie industry, where consumers now have easy access to information on the latest trends and fashion aids from around the world. Consumers today are more informed and discerning than ever due to the wealth of information available through the internet and social media. The global fashion landscape is just a click away, allowing lingerie shoppers to stay updated with the latest trends, designs, and collections. This growing awareness has led to a rising preference for fashionable lingerie products. Women look for comfort and functionality in their undergarments and want them to be stylish and reflective of the latest fashion trends. This results in consumers being more likely to invest in lingerie that not only aids a functional purpose but also boosts their sense of style and self-expression. The influence of social media has been a game-changer in shaping consumer preferences for apparel, including lingerie. Platforms including Facebook, Instagram, Twitter and YouTube have emerged as powerful tools for fashion enthusiasts and customers. These social media channels are flooded with fashion-related content and influencers, bloggers and brands actively engage with their audiences. In the realm of lingerie, social media has created an environment where consumers are easily access, explore and engage with several lingerie brands and their offerings. Lingerie sales are boosted by the sheer volume of content by the interactive nature of social media. Brands leverage these platforms to encourage their products, establish direct connections with consumers, and offer expert advice. The dynamic and visually appealing nature of lingerie makes it particularly well-suited for presentation on social media, where images and videos play a significant role in influencing consumer choices. The Prevalence of the Unorganized Sector Restraining the Market Growth. The global lingerie market is extremely fragmented, with a substantial number of players. In terms of designs, quality pricing, and supply chain, the players are intensely competitive. The predominance of the unorganized sector is a key obstacle to their growth. Local suppliers have been shown to significantly restrict the sales of the leading players, owing to their quick availability, reduced prices, and simplicity of customization. A large portion of the population is price-sensitive, especially in emerging nations, making it challenging for established companies to build dominance over the unorganized sector. As manufacturers and SMEs break out of their conventional roles and sell directly to global customers, established fashion brands and retailers would confront increasing competition from new entrants across the globe. Expect more competition from previously unknown supply chain companies that create popular things to sell at low costs via cross-border e-commerce platforms.Lingerie Market Segment Analysis:

Based on Product, the market is segmented into Bra, Knickers and Panties, Loungewear, Shapewear and Others. The Bra dominated the Lingerie market in 2023 with the largest market share. Bra-wearing involves lifting the breasts upward. Wearing bras enhances posture and prevents a lot of spine problems, back pain, and overall attire. Fabric availability and continual technological advancements have enabled designers to create innovative goods while maintaining their market dominance. Leaser-cut seamless, model and complete t-shirt brasserie innovations are willingly available in a variety of sizes. Fabric availability and ongoing technological advancement have enabled designers to create fresh goods while maintaining their market dominance. Leaser cut seamless, model, and complete t-shirt brasserie are now readily available in a variety of precise sizes. When certain large-breasted women go braless, they generally experience back pain. By wearing bras, such ladies have to keep their breasts in form and prevent them from bobbing unnaturally. The support provided by these bras has been assisting in alleviating any discomfort that heavy-breasted women have. Many women are sports players. During sports or strenuous leisure activities, a woman wearing a bra is less likely to feel the same acute discomfort that women who do not wear bras do. A lady wearing a bra has been finding it easy to jog or engage in comparable activities. In the United Kingdom, leading women's lingerie and underwear brands among female users in 2021 such as Marks & Spencer, Victoria's Secret, Calvin Klein, and Primark. Globally, the lingerie market features prominent brands such as Victoria's Secret, H&M, Triumph, La Perla, and Aerie, offering diverse preferences and styles for women's intimate apparel. These brands provide a wide range of choices, reflecting fashion trends and comfort.Shapewear is expected to grow at a significant CAGR during the forecast period. The shapewear is gaining popularity in the lingerie market. Wearing shapewear improves posture, abdominal muscles, self-esteem and confidence. Shapewear offers prolapse of age benefits, loss of inches instantly, and weight loss efforts. Body shapers or shapewear are now available in a variety of sizes and forms, due to this, consumers are attracted to the product. The Knickers and Panties are also experiencing rapid growth throughout the forecast period. Manufacturers are focused on providing knickers and Panties composed of pleasant fabrics such as cotton and nylon, in a variety of designs including hipster, shorts, and full briefs. This, in turn, has boosted customer availability of alternatives, hence boosting segment growth. To give comfort and other benefits, companies are developing specific types of underwear such as jacquard and lace patterns, no VPL lace trim and high-waisted control. Based on the Distribution Channel, the online segment held the largest market share of the Lingerie market in 2023 and is expected to maintain its dominance at the end of the forecast period. To reach a larger audience, companies including Myntra, Jabong, Amazon, Nykaa, Shyaway, Elitify, Ajio, Journelle, Cosabella, Aerie, Adore Me, and Thirdlove are working with online retailers and developing their own e-portals. Companies with their internet portals/websites include Zivame.com, Clovia.com, Jockeyinternational.com, Victoriasecret.com, and hunkemoller.com. In 2017, two major lingerie companies, MAE and Arabelle, teamed with Amazon to sell their items. These are the primary drivers that drive this segment's growth in the global market over the forecast period.

The Offline segment is experiencing rapid growth during the forecast period. The Multi Brands Store held the largest market share in 2023 and is expected to grow rapidly during the forecast period. This segment is growing in popularity because of its advantages including the ability to scan things and test them before purchasing. The presence of a shop worker who assists consumers in selecting the proper product impacts the purchasing choice, encouraging segment growth. Shoppers Stop, H&M, Marks and Spencer, Carrefour, Reliance Trends, MAX, and FBB are the primary distributors of these several brands' lingerie. Clovia and Zivame have expanded their offline presence. Clovia operates 13 brand stores and 150 retail touchpoints, including Central and Brand Factory. Zivame is available at 800 multi-brand stores such as Shoppers Stop.

Lingerie Market Regional Insights:

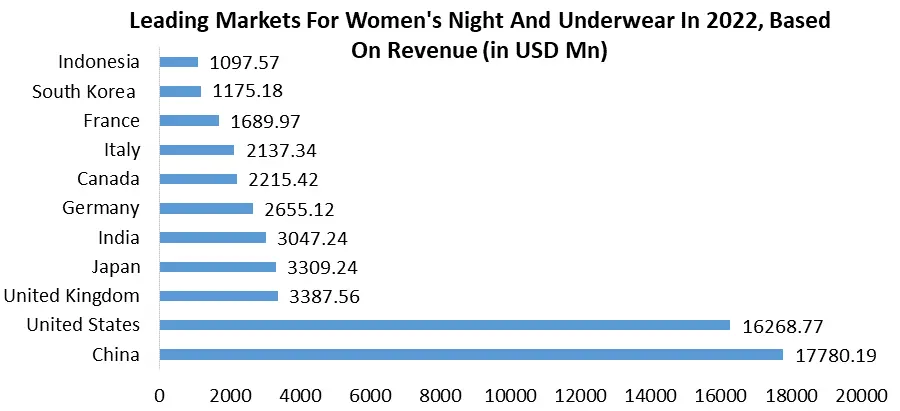

Asia-Pacific held the largest revenue share in 2023 and is expected to maintain its dominance during the forecast period. The significant amount of end-users in the region is a primary driver of the regional growth. Rapidly changing consumer preferences for fashionable, trendy clothing products, rising disposable income amongst consumers as well as the emergence of the e-commerce industry, drive demand in the Asia Pacific market. Increased awareness of best fits as usage, changes in working millennials' lives, a higher ability to invest in the best accessible items, and a fixation on maintaining a well-groomed structure boost regional Lingerie Market growth. Fashion businesses have always considered China as an exceptional development prospect. Over the last decade, China has accounted for 38 percent of global fashion industry growth across all categories. Since 2012, it has been accountable for an amazing 70 percent growth in the luxury market and estimations this dominance to continue throughout the forecast period. Along with that, the lingerie market in China benefits from low raw material costs, low labor costs, and huge manufacturing facilities. The growing acceptance of Western culture and lifestyle, increased demand from millennials, and an expanding number of working women are all supporting the domestic lingerie market. The key competitors in China's lingerie market are La Perla, Triumph, Cosmo Lady, Sunny Group, Hoplun Group, Topformbras International, and Chun Wing Holdings. An increase in internet purchasing and shifting fashion trends are driving the growth of the Chinese lingerie market. India continues to provide an intriguing opportunity, especially for price-competitive businesses. While GDP growth has been slower than expected, due in part to regulatory uncertainties, India is still likely to be the fastest-growing major region, for the lingerie market. Despite the market's problems, foreign brands are actively engaged with India. Online shopping accounted for roughly 14 percent of the clothing market in 2023, more than repetition its share just three years ago due to the increased internet and smartphone implementation. India had the highest absolute improvement in the number of internet users in the world over the last year. Social media use is rising at a rate of about 25 percent each year, with about 70 percent of users on Instagram. Europe is expected to grow substantially during the forecast period for the Lingerie market. The existence of key companies, as well as the strong demand for premium and elegant goods, drive the industry. Companies are highlighting design and quality for every shape and size. The European penchant for luxury lingerie brands as well as limited editions has led to the global market's tremendous increase. The regional market is being driven by rising product accessibility as well as the increasing penetration of online and offline channels for these items. In 2023, the leading markets for women's night and underwear, based on revenue in USD million, include the United States, China, Japan, Germany, and the United Kingdom. The lingerie market continues to be a flourishing industry, with strong demand for women's intimate apparel across several regions, driven by changing fashion trends and consumer preferences.

Lingerie Market Competitive Landscape

The Market's competitive analysis includes the Lingerie Market size, growth rate and key trends. The report provides information about the Key companies, such as their size, Lingerie market share, and geographic presence. The report provides such type of competitive landscape of all Lingerie Key Players to assist new market entrants. Some of the key players are Hanes brands Inc (US), Fruit of the Loom (US), Jockey International (US), Lise Charmel (US), Venies (US), Victoria’s Secret (US), Gap, Inc. (US), Bare Nessities (US), Calvin Klein (US), Triumph International (Germany), Nubian Skin (UK) and others. Many companies conducted research and development activities to increase their product portfolio. For instance, Wacoal Holdings Corporation launched a new lingerie brand in 2022 known as Salute by Wacoal Rose of Versailles. This brand is a collaboration between Wacoal and the popular Japanese manga series Rose of Versailles (Berubara Bara). The brand features a collection of bras and panties that are enthused by the characters and designs from the manga series.The Salute by Wacoal Rose of Versailles collection is designed to be elegant as well as comfortable. The bras are made with high-quality materials and feature intricate details including lace and embroidery.Lingerie Market Scope: Inquiry Before Buying

Lingerie Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 46.87 Bn. Forecast Period 2024 to 2030 CAGR: 7.8% Market Size in 2030: US $ 79.30 Bn. Segments Covered: by Product Bra Knickers and Panties Loungewear Shapewear Other by Material Cotton Satin/Synthetic Silk Woollen Polyester Velvet Others by Price Low Medium High by Distribution Channel Offline Supermarket/Hypermarket Specialty Stores Multi Brands Stores Online E-commerce Company-owned Website Lingerie Market, by region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Lingerie Key Players are:

1. Hanes brands Inc (US) 2. Fruit of the Loom (US) 3. Jockey International (US) 4. Lise Charmel (US) 5. Venies (US) 6. Victoria’s Secret (US) 7. Gap, Inc. (US) 8. Bare Nessities (US) 9. Calvin Klein (US) 10. Triumph International (Germany) 11. Nubian Skin (UK) 12. Calida (Switzerland) 13. Hunkemoller (Netherlands) 14. Wacoal Holdings (Japan) 15. Uniqlo Co., Ltd. (Japan) 16. Aimer Group (China) 17. Mani Form (China) 18. Embry Form (China) 19. Ordifen (China) 20. Oleno International Company Ltd. (China) 21. Cosmo-lady (China) 22. Essentie (HongKong) 23. Hoplun Group (Hong Kong) 24. Hop Lun Limited (Hong Kong) 25. MAS Holdings (Shri Lanka) Frequently Asked Questions: 1] What is the growth rate of the Global Lingerie Market? Ans. The Global Lingerie Market is growing at a significant rate of 7.8 % during the forecast period. 2] Which region is expected to dominate the Global Lingerie Market? Ans. Asia Pacific is expected to dominate the Lingerie Market during the forecast period. 3] What is the expected Global Lingerie Market size by 2030? Ans. The Lingerie Market size is expected to reach USD 79.30 Bn by 2030. 4] Which are the top players in the Global Lingerie Market? Ans. The major top players in the Global Lingerie Market are Hanes brands Inc (US), Fruit of the Loom (US), Jockey International (US), Lise Charmel (US), Venies (US), Victoria’s Secret (US), Gap, Inc. (US), Bare Nessities (US), Calvin Klein (US), Triumph International (Germany), Nubian Skin (UK) and others. 5] What are the factors driving the Global Lingerie Market growth? Ans. The increasing number of working women across the globe and rising consumer preferences for fashionable apparel products are expected to drive market growth during the forecast period.

1. Lingerie Market: Research Methodology 2. Lingerie Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Lingerie Market: Dynamics 3.1 Lingerie Market Trends by Region 3.1.1 North America Lingerie Market Trends 3.1.2 Europe Lingerie Market Trends 3.1.3 Asia Pacific Lingerie Market Trends 3.1.4 Middle East and Africa Lingerie Market Trends 3.1.5 South America Lingerie Market Trends 3.2 Lingerie Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Lingerie Market Drivers 3.2.1.2 North America Lingerie Market Restraints 3.2.1.3 North America Lingerie Market Opportunities 3.2.1.4 North America Lingerie Market Challenges 3.2.2 Europe 3.2.2.1 Europe Lingerie Market Drivers 3.2.2.2 Europe Lingerie Market Restraints 3.2.2.3 Europe Lingerie Market Opportunities 3.2.2.4 Europe Lingerie Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Lingerie Market Market Drivers 3.2.3.2 Asia Pacific Lingerie Market Restraints 3.2.3.3 Asia Pacific Lingerie Market Opportunities 3.2.3.4 Asia Pacific Lingerie Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Lingerie Market Drivers 3.2.4.2 Middle East and Africa Lingerie Market Restraints 3.2.4.3 Middle East and Africa Lingerie Market Opportunities 3.2.4.4 Middle East and Africa Lingerie Market Challenges 3.2.5 South America 3.2.5.1 South America Lingerie Market Drivers 3.2.5.2 South America Lingerie Market Restraints 3.2.5.3 South America Lingerie Market Opportunities 3.2.5.4 South America Lingerie Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives For the Lingerie Industry 3.8 The Global Pandemic impact on The Lingerie Industry Landscape 3.9 Price Trend Analysis 4. Global Lingerie Market: Global Market Size and Forecast by Segmentation (By Value) (2023-2030) 4.1 Global Lingerie Market Size and Forecast, by Product (2023-2030) 4.1.1 Bra 4.1.2 Nickers and Panties 4.1.3 Loungewear 4.1.4 Shapewear 4.1.5 Other 4.2 Global Lingerie Market Size and Forecast, by Material (2023-2030) 4.2.1 Cotton 4.2.2 Satin/Synthetic Silk 4.2.3 Woolen 4.2.4 Polyester 4.2.5 Velvet 4.2.6 Others 4.3 Global Lingerie Market Size and Forecast, by Price (2023-2030) 4.3.1 Low 4.3.2 Medium 4.3.3 High 4.4 Global Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.1.1.1 Offline 4.4.1.1.1.1 Supermarket/Hypermarket 4.4.1.1.1.2 Specialty Stores 4.4.1.1.1.3 Multi Brands Stores 4.4.1.1.2 Online 4.4.1.1.2.1 E-commerce 4.4.1.1.2.2 Company-owned Website 4.5 Global Lingerie Market Size and Forecast, by Region (2023-2030) 4.5.1 North America 4.5.2 Europe 4.5.3 Asia Pacific 4.5.4 Middle East and Africa 4.5.5 South America 5. North America Lingerie Market Size and Forecast by Segmentation (By Value) (2023-2030) 5.1 North America Lingerie Market Size and Forecast, by Product (2023-2030) 5.1.1 Bra 5.1.2 Nickers and Panties 5.1.3 Loungewear 5.1.4 Shapewear 5.1.5 Other 5.2 North America Lingerie Market Size and Forecast, by Material (2023-2030) 5.2.1 Cotton 5.2.2 Satin/Synthetic Silk 5.2.3 Woolen 5.2.4 Polyester 5.2.5 Velvet 5.2.6 Others 5.3 North America Lingerie Market Size and Forecast, by Price (2023-2030) 5.3.1 Low 5.3.2 Medium 5.3.3 High 5.4 North America Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.1.1.1 Offline 5.4.1.1.1.1 Supermarket/Hypermarket 5.4.1.1.1.2 Specialty Stores 5.4.1.1.1.3 Multi Brands Stores 5.4.1.1.2 Online 5.4.1.1.2.1 E-commerce 5.4.1.1.2.2 Company-owned Website 5.5 North America Lingerie Market Size and Forecast, by Country (2023-2030) 5.5.1 United States 5.5.1.1 United States Lingerie Market Size and Forecast, by Product (2023-2030) 5.5.1.1.1 Bra 5.5.1.1.2 Nickers and Panties 5.5.1.1.3 Loungewear 5.5.1.1.4 Shapewear 5.5.1.1.5 Other 5.5.1.2 United States Lingerie Market Size and Forecast, by Material (2023-2030) 5.5.1.2.1 Cotton 5.5.1.2.2 Satin/Synthetic Silk 5.5.1.2.3 Woolen 5.5.1.2.4 Polyester 5.5.1.2.5 Velvet 5.5.1.2.6 Others 5.5.1.3 United States Lingerie Market Size and Forecast, by Price (2023-2030) 5.5.1.3.1 Low 5.5.1.3.2 Medium 5.5.1.3.3 High 5.5.1.4 United States Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 5.5.1.4.1 Offline 5.5.1.4.1.1 Supermarket/Hypermarket 5.5.1.4.1.2 Specialty Stores 5.5.1.4.1.3 Multi Brands Stores 5.5.1.4.2 Online 5.5.1.4.2.1 E-commerce 5.5.1.4.2.2 Company-owned Website 5.5.2 Canada 5.5.2.1 Canada Lingerie Market Size and Forecast, by Product (2023-2030) 5.5.2.1.1 Bra 5.5.2.1.2 Nickers and Panties 5.5.2.1.3 Loungewear 5.5.2.1.4 Shapewear 5.5.2.1.5 Other 5.5.2.2 Canada Lingerie Market Size and Forecast, by Material (2023-2030) 5.5.2.2.1 Cotton 5.5.2.2.2 Satin/Synthetic Silk 5.5.2.2.3 Woolen 5.5.2.2.4 Polyester 5.5.2.2.5 Velvet 5.5.2.2.6 Others 5.5.2.3 Canada Lingerie Market Size and Forecast, by Price (2023-2030) 5.5.2.3.1 Low 5.5.2.3.2 Medium 5.5.2.3.3 High 5.5.2.4 Canada Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 5.5.2.4.1 Offline 5.5.2.4.1.1 Supermarket/Hypermarket 5.5.2.4.1.2 Specialty Stores 5.5.2.4.1.3 Multi Brands Stores 5.5.2.4.2 Online 5.5.2.4.2.1 E-commerce 5.5.2.4.2.2 Company-owned Website 5.5.3 Mexico 5.5.3.1 Mexico Lingerie Market Size and Forecast, by Product (2023-2030) 5.5.3.1.1 Bra 5.5.3.1.2 Nickers and Panties 5.5.3.1.3 Loungewear 5.5.3.1.4 Shapewear 5.5.3.1.5 Other 5.5.3.2 Mexico Lingerie Market Size and Forecast, by Material (2023-2030) 5.5.3.2.1 Cotton 5.5.3.2.2 Satin/Synthetic Silk 5.5.3.2.3 Woolen 5.5.3.2.4 Polyester 5.5.3.2.5 Velvet 5.5.3.2.6 Others 5.5.3.3 Mexico Lingerie Market Size and Forecast, by Price (2023-2030) 5.5.3.3.1 Low 5.5.3.3.2 Medium 5.5.3.3.3 High 5.5.3.4 Mexico Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 5.5.3.4.1 Offline 5.5.3.4.1.1 Supermarket/Hypermarket 5.5.3.4.1.2 Specialty Stores 5.5.3.4.1.3 Multi Brands Stores 5.5.3.4.2 Online 5.5.3.4.2.1 E-commerce 5.5.3.4.2.2 Company-owned Website 6. Europe Lingerie Market Size and Forecast by Segmentation (By Value) (2023-2030) 6.1 Europe Lingerie Market Size and Forecast, by Product (2023-2030) 6.2 Europe Lingerie Market Size and Forecast, by Material (2023-2030) 6.3 Europe Lingerie Market Size and Forecast, by Price (2023-2030) 6.4 Europe Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 6.5 Europe Lingerie Market Size and Forecast, by Country (2023-2030) 6.5.1 United Kingdom 6.5.1.1 United Kingdom Lingerie Market Size and Forecast, by Product (2023-2030) 6.5.1.2 United Kingdom Lingerie Market Size and Forecast, by Material (2023-2030) 6.5.1.3 United Kingdom Lingerie Market Size and Forecast, by Price (2023-2030) 6.5.1.4 United Kingdom Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.2 France 6.5.2.1 France Lingerie Market Size and Forecast, by Product (2023-2030) 6.5.2.2 France Lingerie Market Size and Forecast, by Material (2023-2030) 6.5.2.3 France Lingerie Market Size and Forecast, by Price (2023-2030) 6.5.2.4 France Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.3 Germany 6.5.3.1 Germany Lingerie Market Size and Forecast, by Product (2023-2030) 6.5.3.2 Germany Lingerie Market Size and Forecast, by Material (2023-2030) 6.5.3.3 Germany Lingerie Market Size and Forecast, by Price (2023-2030) 6.5.3.4 Germany Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.4 Italy 6.5.4.1 Italy Lingerie Market Size and Forecast, by Product (2023-2030) 6.5.4.2 Italy Lingerie Market Size and Forecast, by Material (2023-2030) 6.5.4.3 Italy Lingerie Market Size and Forecast, by Price (2023-2030) 6.5.4.4 Italy Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.5 Spain 6.5.5.1 Spain Lingerie Market Size and Forecast, by Product (2023-2030) 6.5.5.2 Spain Lingerie Market Size and Forecast, by Material (2023-2030) 6.5.5.3 Spain Lingerie Market Size and Forecast, by Price (2023-2030) 6.5.5.4 Spain Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.6 Sweden 6.5.6.1 Sweden Lingerie Market Size and Forecast, by Product (2023-2030) 6.5.6.2 Sweden Lingerie Market Size and Forecast, by Material (2023-2030) 6.5.6.3 Sweden Lingerie Market Size and Forecast, by Price (2023-2030) 6.5.6.4 Sweden Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.7 Austria 6.5.7.1 Austria Lingerie Market Size and Forecast, by Product (2023-2030) 6.5.7.2 Austria Lingerie Market Size and Forecast, by Material (2023-2030) 6.5.7.3 Austria Lingerie Market Size and Forecast, by Price (2023-2030) 6.5.7.4 Austria Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.8 Rest of Europe 6.5.8.1 Rest of Europe Lingerie Market Size and Forecast, by Product (2023-2030) 6.5.8.2 Rest of Europe Lingerie Market Size and Forecast, by Material (2023-2030). 6.5.8.3 Rest of Europe Lingerie Market Size and Forecast, by Price (2023-2030) 6.5.8.4 Rest of Europe Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 7. Asia Pacific Lingerie Market Size and Forecast by Segmentation (By Value) (2023-2030) 7.1 Asia Pacific Lingerie Market Size and Forecast, by Product (2023-2030) 7.2 Asia Pacific Lingerie Market Size and Forecast, by Material (2023-2030) 7.3 Asia Pacific Lingerie Market Size and Forecast, by Price (2023-2030) 7.4 Asia Pacific Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 7.5 Asia Pacific Lingerie Market Size and Forecast, by Country (2023-2030) 7.5.1 China 7.5.1.1 China Lingerie Market Size and Forecast, by Product (2023-2030) 7.5.1.2 China Lingerie Market Size and Forecast, by Material (2023-2030) 7.5.1.3 China Lingerie Market Size and Forecast, by Price (2023-2030) 7.5.1.4 China Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.2 South Korea 7.5.2.1 S Korea Lingerie Market Size and Forecast, by Product (2023-2030) 7.5.2.2 S Korea Lingerie Market Size and Forecast, by Material (2023-2030) 7.5.2.3 S Korea Lingerie Market Size and Forecast, by Price (2023-2030) 7.5.2.4 S Korea Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.3 Japan 7.5.3.1 Japan Lingerie Market Size and Forecast, by Product (2023-2030) 7.5.3.2 Japan Lingerie Market Size and Forecast, by Material (2023-2030) 7.5.3.3 Japan Lingerie Market Size and Forecast, by Price (2023-2030) 7.5.3.4 Japan Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.4 India 7.5.4.1 India Lingerie Market Size and Forecast, by Product (2023-2030) 7.5.4.2 India Lingerie Market Size and Forecast, by Material (2023-2030) 7.5.4.3 India Lingerie Market Size and Forecast, by Price (2023-2030) 7.5.4.4 India Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.5 Australia 7.5.5.1 Australia Lingerie Market Size and Forecast, by Product (2023-2030) 7.5.5.2 Australia Lingerie Market Size and Forecast, by Material (2023-2030) 7.5.5.3 Australia Lingerie Market Size and Forecast, by Price (2023-2030) 7.5.5.4 Australia Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.6 Indonesia 7.5.6.1 Indonesia Lingerie Market Size and Forecast, by Product (2023-2030) 7.5.6.2 Indonesia Lingerie Market Size and Forecast, by Material (2023-2030) 7.5.6.3 Indonesia Lingerie Market Size and Forecast, by Price (2023-2030) 7.5.6.4 Indonesia Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.7 Malaysia 7.5.7.1 Malaysia Lingerie Market Size and Forecast, by Product (2023-2030) 7.5.7.2 Malaysia Lingerie Market Size and Forecast, by Material (2023-2030) 7.5.7.3 Malaysia Lingerie Market Size and Forecast, by Price (2023-2030) 7.5.7.4 Malaysia Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.8 Vietnam 7.5.8.1 Vietnam Lingerie Market Size and Forecast, by Product (2023-2030) 7.5.8.2 Vietnam Lingerie Market Size and Forecast, by Material (2023-2030) 7.5.8.3 Vietnam Lingerie Market Size and Forecast, by Price (2023-2030) 7.5.8.4 Vietnam Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.9 Taiwan 7.5.9.1 Taiwan Lingerie Market Size and Forecast, by Product (2023-2030) 7.5.9.2 Taiwan Lingerie Market Size and Forecast, by Material (2023-2030) 7.5.9.3 Taiwan Lingerie Market Size and Forecast, by Price (2023-2030) 7.5.9.4 Taiwan Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.10 Bangladesh 7.5.10.1 Bangladesh Lingerie Market Size and Forecast, by Product (2023-2030) 7.5.10.2 Bangladesh Lingerie Market Size and Forecast, by Material (2023-2030) 7.5.10.3 Bangladesh Lingerie Market Size and Forecast, by Price (2023-2030) 7.5.10.4 Bangladesh Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.11 Pakistan 7.5.11.1 Pakistan Lingerie Market Size and Forecast, by Product (2023-2030) 7.5.11.2 Pakistan Lingerie Market Size and Forecast, by Material (2023-2030) 7.5.11.3 Pakistan Lingerie Market Size and Forecast, by Price (2023-2030) 7.5.11.4 Pakistan Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.12 Rest of Asia Pacific 7.5.12.1 Rest of Asia Pacific Lingerie Market Size and Forecast, by Product (2023-2030) 7.5.12.2 Rest of Asia PacificLingerie Market Size and Forecast, by Material (2023-2030) 7.5.12.3 Rest of Asia Pacific Lingerie Market Size and Forecast, by Price (2023-2030) 7.5.12.4 Rest of Asia Pacific Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 8. Middle East and Africa Lingerie Market Size and Forecast by Segmentation (By Value) (2023-2030) 8.1 Middle East and Africa Lingerie Market Size and Forecast, by Product (2023-2030) 8.2 Middle East and Africa Lingerie Market Size and Forecast, by Material (2023-2030) 8.3 Middle East and Africa Lingerie Market Size and Forecast, by Price (2023-2030) 8.4 Middle East and Africa Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 8.5 Middle East and Africa Lingerie Market Size and Forecast, by Country (2023-2030) 8.5.1 South Africa 8.5.1.1 South Africa Lingerie Market Size and Forecast, by Product (2023-2030) 8.5.1.2 South Africa Lingerie Market Size and Forecast, by Material (2023-2030) 8.5.1.3 South Africa Lingerie Market Size and Forecast, by Price (2023-2030) 8.5.1.4 South Africa Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 8.5.2 GCC 8.5.2.1 GCC Lingerie Market Size and Forecast, by Product (2023-2030) 8.5.2.2 GCC Lingerie Market Size and Forecast, by Material (2023-2030) 8.5.2.3 GCC Lingerie Market Size and Forecast, by Price (2023-2030) 8.5.2.4 GCC Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 8.5.3 Egypt 8.5.3.1 Egypt Lingerie Market Size and Forecast, by Product (2023-2030) 8.5.3.2 Egypt Lingerie Market Size and Forecast, by Material (2023-2030) 8.5.3.3 Egypt Lingerie Market Size and Forecast, by Price (2023-2030) 8.5.3.4 Egypt Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 8.5.4 Nigeria 8.5.4.1 Nigeria Lingerie Market Size and Forecast, by Product (2023-2030) 8.5.4.2 Nigeria Lingerie Market Size and Forecast, by Material (2023-2030) 8.5.4.3 Nigeria Lingerie Market Size and Forecast, by Price (2023-2030) 8.5.4.4 Nigeria Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 8.5.5 Rest of ME&A 8.5.5.1 Rest of ME&A Lingerie Market Size and Forecast, by Product (2023-2030) 8.5.5.2 Rest of ME&A Lingerie Market Size and Forecast, by Material (2023-2030) 8.5.5.3 Rest of ME&A Lingerie Market Size and Forecast, by Price (2023-2030) 8.5.5.4 Rest of ME&A Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 9. South America Lingerie Market Size and Forecast by Segmentation (By Value) (2023-2030) 9.1 South America Lingerie Market Size and Forecast, by Product (2023-2030) 9.2 South America Lingerie Market Size and Forecast, by Material (2023-2030) 9.3 South America Lingerie Market Size and Forecast, by Price (2023-2030) 9.4 South America Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 9.5 South America Lingerie Market Size and Forecast, by Country (2023-2030) 9.5.1 Brazil 9.5.1.1 Brazil Lingerie Market Size and Forecast, by Product (2023-2030) 9.5.1.2 Brazil Lingerie Market Size and Forecast, by Material (2023-2030) 9.5.1.3 Brazil Lingerie Market Size and Forecast, by Price (2023-2030) 9.5.1.4 Brazil Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 9.5.2 Argentina 9.5.2.1 Argentina Lingerie Market Size and Forecast, by Product (2023-2030) 9.5.2.2 Argentina Lingerie Market Size and Forecast, by Material (2023-2030) 9.5.2.3 Argentina Lingerie Market Size and Forecast, by Price (2023-2030) 9.5.2.4 Argentina Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 9.5.3 Rest Of South America 9.5.3.1 Rest Of South America Lingerie Market Size and Forecast, by Product (2023-2030) 9.5.3.2 Rest Of South America Lingerie Market Size and Forecast, by Material (2023-2030) 9.5.3.3 Rest Of South America Lingerie Market Size and Forecast, by Price (2023-2030) 9.5.3.4 Rest Of South America Lingerie Market Size and Forecast, by Distribution Channel (2023-2030) 10. Global Lingerie Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End User Segment 10.3.4 Revenue (2023) 10.3.5 Headquarter 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Lingerie Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Hanes brands Inc (US) 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Fruit of the Loom (US) 11.3 Jockey International (US) 11.4 Lise Charmel (US) 11.5 Venies (US) 11.6 Victoria’s Secret (US) 11.7 Gap, Inc. (US) 11.8 Bare Nessities (US) 11.9 Calvin Klein (US) 11.10 Triumph International (Germany) 11.11 Nubian Skin (UK) 11.12 Calida (Switzerland) 11.13 Hunkemoller (Netherlands) 11.14 Wacoal Holdings (Japan) 11.15 Uniqlo Co., Ltd. (Japan) 11.16 Aimer Group (China) 11.17 Mani Form (China) 11.18 Embry Form (China) 11.19 Ordifen (China) 11.20 Oleno International Company Ltd. (China) 11.21 Cosmo-lady (China) 11.22 Essentie (HongKong) 11.23 Hoplun Group (Hong Kong) 11.24 Hop Lun Limited (Hong Kong) 11.25 MAS Holdings (Shri Lanka) 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary