Global Light Commercial Vehicle Market size was valued at USD 580 Billion in 2023 and the Light Commercial Vehicle Market revenue is expected to reach USD 990 Billion by 2030, at a CAGR of 6.7 % over the forecast period.Light Commercial Vehicle Market Overview

LCVs encompass various types of vehicles like vans, pickup trucks, and light-duty trucks, commonly used for transporting goods or for small-scale commercial activities. Light commercial vehicles or LCVs have a weight ranging between 3.5 to 7 tons. All mini trucks, pickup trucks, and minivans within the weight mentioned above range fall under the LCV category. Light Commercial Vehicle is not limited to a specific geographical region. The Light Commercial Vehicle Market has a global presence, with consumers across different continents interested in these supplements. This Light Commercial Vehicle Market Report offers a specific and detailed market overview with statistical as well as pre-sized trendy data. This Light Commercial Vehicle Market report showcases the market situation with Dynamics, Light Commercial Vehicle Market Segment, Regional Analysis, and Top Competitor's Market Position.To know about the Research Methodology :- Request Free Sample Report

Light Commercial Vehicle Market Dynamics

Electrification and the use of cutting-edge technologies help the industry to accelerate the Light Commercial Vehicle Market’s growth. Environmental problems are brought on by the increased air pollution that conventional automobiles’ fuel emissions create on a global scale. This has prompted manufacturing firms to switch to renewable energy sources. To promote zero-emission public transportation and maintain a clean, breathing environment for citizens, public transportation agencies in various locations are electrifying their vehicles. To reduce the growing pollution levels, governments have implemented strict laws. They have also launched several initiatives to encourage the electrification of automobiles. The logistics industry is concentrating on electric cars as well by creating the necessary infrastructure. The OEMs are also aiming to lower battery prices to promote the usage of electric vehicles globally. Many significant players are moving toward electric automobiles to meet rising demand. Moreover, due to their numerous benefits, including long battery lives, expanded range, energy economy, and improvements in electrical systems, electric cars are also becoming more and more popular on the international market. The Light commercial vehicle industry is boosted by the use of ADAS, which includes lane departure warning systems, driver monitoring systems, and blind spot detection systems. These benefits of electric vehicles and technological improvements are driving the Light Commercial Vehicle Market demand for light commercial vehicles in the electric version. The growth of the automobile industry has fueled the expansion of the Light Commercial Vehicle Market Due to technical improvements and the introduction of automobiles with efficient fuel consumption technologies, the automotive sector has experienced tremendous development in recent years. The development and introduction of cutting-edge commercial vehicles by several organizations to various regions throughout the world have aided in the expansion of the worldwide Light Commercial Vehicle Market. Key manufacturers have also been updating their current lineup of light commercial vehicles, which is anticipated to provide profitable chances for the industry. Therefore, over the projected period, the advancements & technical advancements in the automotive sector support the growth of the worldwide Light Commercial Vehicle Market.

Light Commercial Vehicle Market Segment Analysis

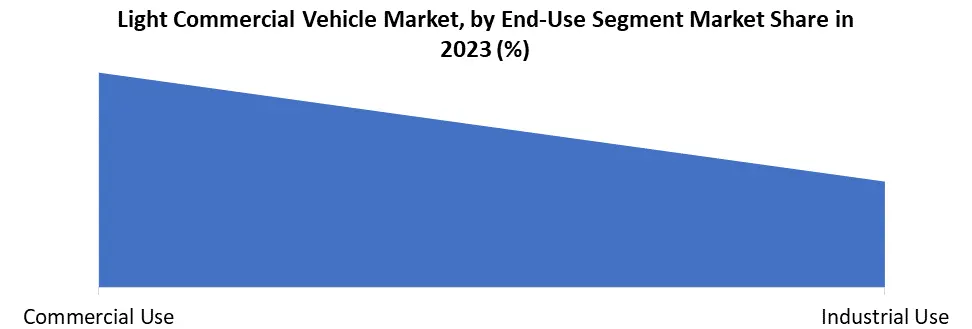

The Light Commercial Vehicle Market is segmented into vehicle type and propulsion type. Based on vehicle type, the market for light trucks segment is dominating during the forecast period. Almost all industries employ light vehicles. It is used by the industrial sector to move completed items and raw materials between their storage facilities and consumer outlets. The primary end-use markets for light vehicles are the public, private, and industrial sectors. The development of sensor technologies, artificial intelligence, maps, and advanced processing capabilities is expected to lead to a major increase in the market for light commercial trucks. Additionally, a factor in the market expansion for light commercial trucks is the growing prevalence of smaller engines in these vehicles. Furthermore, the primary market factors that will have a beneficial effect on the market’s growth rate are the expansion of infrastructure and an increase in industrialization. The market growth rate will be further accelerated by a number of reasons, including an increase in disposable income, the introduction of automobiles with efficient fuel consumption technologies, and expanding urbanization. By propulsion type, the I.C. engine segment is anticipated to dominate the Light Commercial Vehicle Market during the forecast period. The segment is hopeful for a number of reasons owning to accessible energy, which is still crucial, especially in emerging nations like India. The only dependable source of energy up to this point has been the combustion of fossil fuels. The I.C. engine is the main component of vast transportation networks and infrastructure, thus replacing it would be extremely expensive. EVs require a very complex charging infrastructure that is quite expensive, which many nations now lack. Due to strict laws surrounding fuel efficiency requirements, the EV industry is anticipated to have promising development as demand increases. Additionally, manufacturers are consistently focused on lowering the price of the battery to enhance EV sales, driving the expansion of the global market. Commercial EVs offer a longer driving range and create no noise or air pollution in comparison to traditional internal combustion engines. They are also more suited for autonomous driving; hence the EV category is anticipated to have the greatest CAGR throughout the projected period.

Light Commercial Vehicle Market Regional Analysis

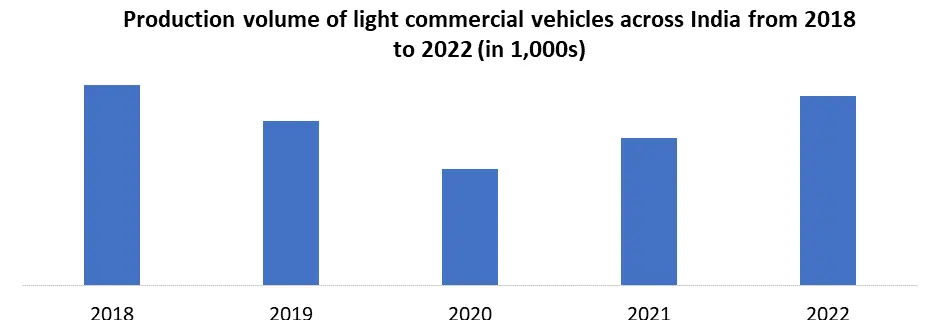

In North America, the Light Commercial Vehicle Market is buoyed by the robust economies of the United States and Canada. The United States, being the largest market in the region, benefits from a thriving e-commerce sector, burgeoning construction activities, and the demand from small and medium-sized businesses for efficient transportation solutions. Canada, on the other hand, experiences significant growth driven by similar factors, along with government investments in infrastructure projects. Both countries exhibit a strong demand for LCVs, reflecting the region's economic vitality and logistical needs. The Asia Pacific region, particularly countries like China and India, represents a burgeoning Light Commercial Vehicle Market propelled by rapid urbanization, population growth, and the expansion of e-commerce. In China, the sheer scale of its population and the flourishing e-commerce industry contribute to a high demand for LCVs, especially in tier 2 and tier 3 cities. Similarly, India's LCV market experiences steady growth fueled by urbanization, infrastructure development, and the need for efficient last-mile delivery services. Additionally, government initiatives like 'Make in India' and investments in road infrastructure further stimulate the demand for Light Commercial Vehicles across the region.In Europe, the Light Commercial Vehicle Market is shaped by a combination of factors including economic activity, urbanization, and environmental regulations. Countries like Germany, the United Kingdom, France, and Italy are key players in the European LCV market. Germany, with its strong manufacturing sector and emphasis on sustainability, leads the market by catering to logistics and last-mile delivery needs. The UK experiences growth propelled by e-commerce expansion and government incentives for low-emission vehicles. Meanwhile, France and Italy witness demand driven by urbanization, services sector expansion, and efforts to reduce carbon emissions. Across Europe, the market is dynamic, with a focus on efficiency, sustainability, and meeting the evolving transportation needs of businesses and consumers alike.

Light Commercial Vehicle Market Recent Development:

March 2023: The new Traffic van from Renault is now available for pre-order, with deliveries starting at the end of 2023. The van’s entirely rebuilt interior and cabin are anticipated to provide the highest level of functionality and mobile connectivity. For long-haul travel reasons, the vehicle also has updated ADAS features. March 2023: The new AVTR family of vehicles, made by a modular truck platform, was introduced by Ashok Leyland Ltd. Customers may modify their trucks using this platform to meet their needs. In August 2023, Hyundai Motor Company, a South Korea-based automotive manufacturing company acquired General Motors Company's Talegaon plant for an undisclosed amount. With this acquisition, the South Korean auto giant hopes to double the number of vehicles it can produce annually in the nation to 1 million and the factory will start producing goods in 2025. General Motors Company is a US-based automobile manufacturing company including light commercial vehicles.Light Commercial Vehicle Market Scope: Inquiry Before Buying

Light Commercial Vehicle Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 580 Bn. Forecast Period 2024 to 2030 CAGR: 6.7% Market Size in 2030: US $ 990 Bn. Segments Covered: by Vehicle Type Pickup Trucks Light Trucks Others by Propulsion Type Internal Combustion Engine (ICE) Electric & Hybrid by End-Use Commercial Use Industrial Use Light Commercial Vehicle Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Russia and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, and the Rest of APAC) Middle East and Africa (South Africa, GCC, and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Light Commercial Vehicle Key Players Include

1. Ford Motor Company - United States 2. General Motors Company - United States 3. Volkswagen AG - Germany 4. Groupe PSA - France 5. Renault Group - France 6. Fiat Chrysler Automobiles (FCA) - Italy/United States 7. Mercedes-Benz Vans - Germany 8. Toyota Motor Corporation - Japan 9. Nissan Motor Corporation - Japan 10. Hyundai Motor Company - South Korea 11. Isuzu Motors Limited - Japan 12. Mitsubishi Motors Corporation - Japan 13. Tata Motors Limited - India 14. Mahindra & Mahindra Limited - India 15. Suzuki Motor Corporation - Japan 16. Iveco - Italy 17. Dongfeng Motor Corporation - China 18. JAC Motors - China 19. Great Wall Motors Company Limited - China 20. GAZ Group – Russia 21. Ashok Leyland 22. Ford Motor Company 23. Honda Motor CompanyFrequently Asked Questions

1. What is the estimated value of the global Light Commercial Vehicle Market? Ans: The global market for Light Commercial Vehicle was estimated to be valued at USD 580 Bn in 2023. 2. What is the expected growth rate of the global Light Commercial Vehicle Market during the forecast period?? Ans: The Global market is growing at a CAGR of 6.7 % during the forecasting period 2024-2030. 3. What are the key industry segments covered in the report? Ans: The global Light Commercial Vehicle Market is segmented based on Vehicle Type, Propulsion Type, End-Use, and Region. 4. based on region, how is the global Light Commercial Vehicle Market segmented? Ans: Based on region, the global market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. 5. Who are the key players competing in the global Light Commercial Vehicle Market? Ans: The key players operating in the global market are Ashok Leyland, Ford Motor Company, Gaz Group, General Motors, Honda Motor Company, Hyundai Motor Company, Isuzu Motors, Renault Group, Tata Motors and Toyota Motors.

1. Light Commercial Vehicle Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Light Commercial Vehicle Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2023) 2.3.5. Company Locations 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Light Commercial Vehicle Market: Dynamics 3.1. Light Commercial Vehicle Market Trends 3.2. Light Commercial Vehicle Market Dynamics by Region 3.2.1. Light Commercial Vehicle Market Drivers 3.2.2. Light Commercial Vehicle Market Restraints 3.2.3. Light Commercial Vehicle Market Opportunities 3.2.4. Light Commercial Vehicle Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. Light Commercial Vehicle Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 4.1.1. Pickup Trucks 4.1.2. Light Trucks 4.1.3. Others 4.2. Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 4.2.1. Internal Combustion Engine (ICE) 4.2.2. Electric & Hybrid 4.3. Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 4.3.1. Commercial Use 4.3.2. Industrial Use 4.4. Light Commercial Vehicle Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Light Commercial Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 5.1.1. Pickup Trucks 5.1.2. Light Trucks 5.1.3. Others 5.2. North America Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 5.2.1. Internal Combustion Engine (ICE) 5.2.2. Electric & Hybrid 5.3. North America Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 5.3.1. Commercial Use 5.3.2. Industrial Use 5.4. North America Light Commercial Vehicle Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Light Commercial Vehicle Market Size and Forecast, By Vehicle Type(2023-2030) 5.4.1.1.1. Pickup Trucks 5.4.1.1.2. Light Trucks 5.4.1.1.3. Others 5.4.1.2. United States Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 5.4.1.2.1. Internal Combustion Engine (ICE) 5.4.1.2.2. Electric & Hybrid 5.4.1.3. United States Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 5.4.1.3.1. Commercial Use 5.4.1.3.2. Industrial Use 5.4.2. Canada 5.4.2.1. Canada Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 5.4.2.1.1. Pickup Trucks 5.4.2.1.2. Light Trucks 5.4.2.1.3. Others 5.4.2.2. Canada Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 5.4.2.2.1. Internal Combustion Engine (ICE) 5.4.2.2.2. Electric & Hybrid 5.4.2.3. Canada Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 5.4.2.3.1. Commercial Use 5.4.2.3.2. Industrial Use 5.4.3. Mexico 5.4.3.1. Mexico Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 5.4.3.1.1. Pickup Trucks 5.4.3.1.2. Light Trucks 5.4.3.1.3. Others 5.4.3.2. Mexico Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 5.4.3.2.1. Internal Combustion Engine (ICE) 5.4.3.2.2. Electric & Hybrid 5.4.3.3. Mexico Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 5.4.3.3.1. Commercial Use 5.4.3.3.2. Industrial Use 6. Europe Light Commercial Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 6.2. Europe Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 6.3. Europe Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 6.4. Europe Light Commercial Vehicle Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 6.4.1.2. United Kingdom Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 6.4.1.3. United Kingdom Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 6.4.2. France 6.4.2.1. France Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 6.4.2.2. France Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 6.4.2.3. France Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 6.4.3.2. Germany Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 6.4.3.3. Germany Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 6.4.4.2. Italy Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 6.4.4.3. Italy Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 6.4.5.2. Spain Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 6.4.5.3. Spain Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 6.4.6.2. Sweden Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 6.4.6.3. Sweden Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 6.4.7. Russia 6.4.7.1. Russia Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 6.4.7.2. Russia Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 6.4.7.3. Russia Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 6.4.8.2. Rest of Europe Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 6.4.8.3. Rest of Europe Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 7. Asia Pacific Light Commercial Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 7.2. Asia Pacific Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 7.3. Asia Pacific Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 7.4. Asia Pacific Light Commercial Vehicle Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 7.4.1.2. China Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 7.4.1.3. China Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 7.4.2.2. S Korea Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 7.4.2.3. S Korea Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 7.4.3.2. Japan Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 7.4.3.3. Japan Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 7.4.4. India 7.4.4.1. India Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 7.4.4.2. India Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 7.4.4.3. India Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 7.4.5.2. Australia Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 7.4.5.3. Australia Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 7.4.6. ASEAN 7.4.6.1. ASEAN Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 7.4.6.2. ASEAN Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 7.4.6.3. ASEAN Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 7.4.7. Rest of Asia Pacific 7.4.7.1. Rest of Asia Pacific Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 7.4.7.2. Rest of Asia Pacific Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 7.4.7.3. Rest of Asia Pacific Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 8. Middle East and Africa Light Commercial Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 8.2. Middle East and Africa Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 8.3. Middle East and Africa Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 8.4. Middle East and Africa Light Commercial Vehicle Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 8.4.1.2. South Africa Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 8.4.1.3. South Africa Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 8.4.2.2. GCC Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 8.4.2.3. GCC Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 8.4.3. Rest of ME&A 8.4.3.1. Rest of ME&A Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 8.4.3.2. Rest of ME&A Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 8.4.3.3. Rest of ME&A Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 9. South America Light Commercial Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. South America Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 9.2. South America Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 9.3. South America Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 9.4. South America Light Commercial Vehicle Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 9.4.1.2. Brazil Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 9.4.1.3. Brazil Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 9.4.2.2. Argentina Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 9.4.2.3. Argentina Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Light Commercial Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 9.4.3.2. Rest Of South America Light Commercial Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 9.4.3.3. Rest Of South America Light Commercial Vehicle Market Size and Forecast, By End-Use (2023-2030) 10. Company Profile: Key Players 10.1. Ford Motor Company - United States 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. General Motors Company - United States 10.3. Volkswagen AG - Germany 10.4. Groupe PSA - France 10.5. Renault Group - France 10.6. Fiat Chrysler Automobiles (FCA) - Italy/United States 10.7. Mercedes-Benz Vans - Germany 10.8. Toyota Motor Corporation - Japan 10.9. Nissan Motor Corporation - Japan 10.10. Hyundai Motor Company - South Korea 10.11. Isuzu Motors Limited - Japan 10.12. Mitsubishi Motors Corporation - Japan 10.13. Tata Motors Limited - India 10.14. Mahindra & Mahindra Limited - India 10.15. Suzuki Motor Corporation - Japan 10.16. Iveco - Italy 10.17. Dongfeng Motor Corporation - China 10.18. JAC Motors - China 10.19. Great Wall Motors Company Limited - China 10.20. GAZ Group – Russia 10.21. Ashok Leyland 10.22. Ford Motor Company 10.23. Honda Motor Company 11. Key Findings 12. Analyst Recommendations 13. Light Commercial Vehicle Market: Research Methodology