The Jet Engines Market size was valued at USD 70.39 Billion in 2023 and the total Jet Engines revenue is expected to grow at a CAGR of 5.12 % from 2024 to 2030, reaching nearly USD 99.84 Billion by 2030. engine is an internal combustion reaction engine, discharging a fast-moving jet that generates thrust by propulsion and power is used by rockets and aircrafts. These jet engines are used to propel military aircraft, rockets, civil aircraft, and cargo aircraft and so on. Many types of jet engine present in the market such as turbofan, ramjet, turboprop, and turbojet.To know about the Research Methodology :- Request Free Sample Report Increasing air passenger traffic, growing airline fleets, and advancements in aviation technology driving the growth of Jet Engines Market. The market includes a range of engines, including turbofan, turboprop, turbojet, and turboshaft engines, catering to various aircraft types from commercial airliners to military jets. Recent advancements have seen a shift toward more fuel-efficient and environmentally friendly engines, spurred by stringent emission regulations and a growing focus on sustainability within the aviation industry. Companies like General Electric, Rolls-Royce Holdings, Pratt & Whitney, and CFM International are Jet Engines Market key players shaping the landscape. GE's GE9X engine, known for its efficiency and power, has gained prominence, especially in the wide-body aircraft segment. Rolls-Royce's UltraFan, an innovative geared turbofan engine, has been making waves due to its promise of higher fuel efficiency and reduced emissions. Pratt & Whitney's PW1000G geared turbofan engine series has gained traction in the narrow-body aircraft market owing to its fuel efficiency and quieter operations. Additionally, CFM International, a joint venture between GE Aviation and Safran Aircraft Engines, continues to dominate the single-aisle aircraft engine market with its LEAP engine series, recognized for its fuel efficiency and reliability. The market's growth is further propelled by the increasing demand for air travel in emerging economies, technological innovations focused on enhancing engine performance, and the rising emphasis on reducing carbon footprints through the development of more sustainable propulsion systems. Recent developments also include research into hybrid-electric and hydrogen-powered engines, signaling a transformative shift towards greener aviation solutions, albeit with challenges related to infrastructure and technological feasibility. Overall, the Jet Engines Market is undergoing a dynamic phase marked by innovation, sustainability initiatives, and intense competition among key players, poised to shape the future of aviation propulsion systems.

Jet Engines Market Dynamics:

Growing economies such as China and India's escalating investments in aviation infrastructure bolster the demand for Jet Engines Increasing Global air passenger traffic, forecasted to surge significantly, emerges as a formidable driver boosting the growth of Jet Engines Market. Boeing's staggering prediction of over 44,000 new commercial airplanes by 2039 heralds a soaring demand for engines that are not just powerful but more efficient. This surge necessitates technological innovations that redefine benchmarks, such as GE's monumental GE9X engine. Renowned as the largest and most powerful commercial aircraft engine, it exemplifies the market's trajectory by offering unparalleled fuel efficiency and performance, setting new standards for propulsion systems. Stringent emission regulations catalyze a transformative push within the Jet Engines industry. Manufacturers, such as Rolls-Royce with their UltraFan engine, respond by pioneering eco-friendly engines. These engines, while significantly reducing carbon footprints, ensure optimal performance in adherence to regulatory norms, marking a pivotal shift toward sustainable aviation practices. Simultaneously, the imperative for advanced military jets such as the F-35 Lightning II, powered by Pratt & Whitney's F135 engine, fuels the market's momentum. The demand for high-performance engines with enhanced capabilities surges, driving the development of cutting-edge propulsion systems. Jet Engines market benefits from burgeoning economies like China and India, strategically investing in aviation infrastructure and expanding airline fleets. This rapid growth amplifies the demand for engines from manufacturers like CFM International, particularly their LEAP engines, responding to the burgeoning needs of expanding fleets. Engines like Pratt & Whitney's PW1000G geared turbofan series emerge as game-changers, offering increased fuel efficiency and substantial cost savings for airlines over their operational lifespan, further catalyzing market growth. The Jet Engines market growth is substantiated by evolving preferences, such as the demand for quieter engines that align with noise regulations and elevate the passenger experience. The exploration of alternative fuels, notably hydrogen-powered engines, anticipates a shift toward greener solutions, aligning with the industry's increasing emphasis on sustainability. The growing popularity of long-haul flights underscores the necessity for engines with heightened reliability and fuel efficiency, typified by GE's GE9X engine, meticulously designed for long-range aircraft, exemplifying the market's trajectory. Collaborations among industry giants, such as CFM International and Pratt & Whitney, foster innovation and propel market growth through synergistic resource pooling and technological advancements in engine development. Technological Advancement Costs hinders the market growth Stringent emission standards are the major factor hindering the growth of Jet Engines Market, exemplified by the International Civil Aviation Organization's carbon emission reduction targets, pose a tough challenge. Engine manufacturers such as Rolls-Royce are compelled to pivot toward eco-friendly solutions, investing significantly in R&D. This pursuit for lower emissions and heightened efficiency drives innovations such as the UltraFan, yet it demands substantial resources and expertise, complicating the developmental landscape. Fuel cost fluctuations emerge as a persistent challenge impacting operational expenses for airlines and, in turn, engine manufacturers. The need for higher fuel efficiency, addressed by engines like GE's GE9X with improved economy, mitigates the volatile fuel price impacts. However, this necessity directs considerable focus and resources toward refining engine designs to ensure optimal performance in varying economic landscapes. The relentless advancement in engine technology mandates substantial investments in R&D and infrastructure. Engines like Pratt & Whitney's geared turbofan series signify this complexity, demanding sophisticated manufacturing processes and intricate engineering, escalating the technological and financial stakes for manufacturers. Intensified competition within a saturated Jet Engines Market, dominated by giants such as GE Aviation and Rolls-Royce, prompts incessant innovation and cost-efficiency strategies. Smaller players entering the arena face an uphill battle in carving out their niche, amplifying the challenge of market entry and sustainability. Evolving aviation regulations, particularly noise standards, necessitate significant modifications in engine designs, exemplified by Pratt & Whitney's PW1000G series. Such adaptations underscore the complexities in aligning with evolving standards while maintaining competitiveness. Additionally, the complex global supply chain vulnerability, witnessed during the COVID-19 pandemic, disrupts timely engine delivery and production, imposing challenges in logistics and operational continuity. The transition from conventional fuels to sustainable alternatives like hydrogen encounters hurdles in infrastructure and scalability, hindering swift adoption despite companies exploring hydrogen-powered engines. Geopolitical tensions and trade disputes further complicate the global supply chain, affecting sourcing and sales for manufacturers operating in volatile geopolitical landscapes, adding unpredictability to Jet Engines Market dynamics.Jet Engines Market Segment Analysis:

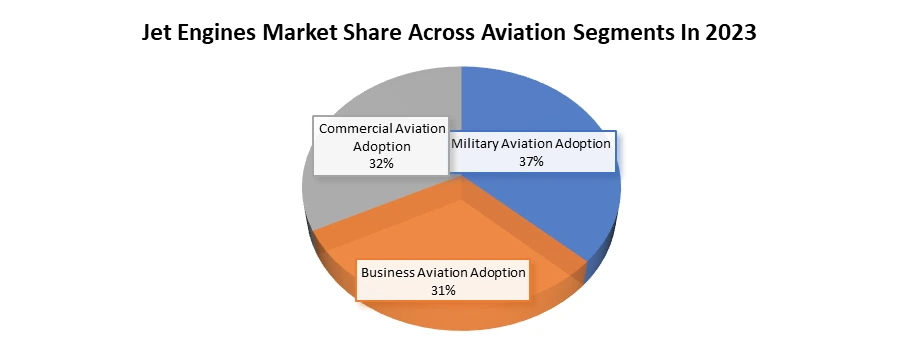

Based on Technology, Turboprop engines dominated the Jet Engines Market in 2023 and is expected to maintain its dominance over the forecast period. It finds extensive use in regional airliners and smaller aircraft due to their efficiency at lower speeds, ideal for short-haul flights and commuter routes. Turbofan engines, dominating the commercial aviation sector, power most large passenger aircraft, owing to their optimal balance between fuel efficiency and high thrust, making them suitable for long-haul flights. Turbojet engines, though less common in modern commercial aviation, excel in military aircraft for their high-speed capabilities and manoeuvrability. Pulsejet engines, characterized by their simplicity and low cost, have niche applications in unmanned aerial vehicles (UAVs) and model aircraft due to their limited efficiency but minimalistic design. The adoption of each technology is driven by specific performance needs, with turbofan engines reigning supreme in commercial aviation for their efficient and versatile performance across various flight ranges, while turboprops serve regional and short-haul needs efficiently.Based on Application, Military aviation dominated the Jet Engines Market with largest market share in 2023 and is expected to maintain its dominance over the forecast period. It relies on high-performance engines such as turbojet and more advanced technologies due to their emphasis on speed, manoeuvrability, and specialized functionalities, resulting in extensive adoption of such engines in fighter jets and military aircraft. Business aviation, fulfilling to private jets and smaller aircraft, often opts for turbofan engines that offer a balance between efficiency and power, making them a preferred choice for long-range flights with lower operational costs. Commercial aviation, the largest segment, favors turbofan engines owing to their versatility, fuel efficiency, and reliability, powering most large passenger aircraft for short-haul and long-haul flights. The adoption rates reflect this trend, with commercial aviation showcasing the highest adoption of jet engines due to its vast fleet size, followed by business aviation, while military aviation maintains a more specialized and focused adoption pattern, favoring specific engine types tailored for its unique operational requirements.

Jet Engines Market Regional Insights:

North America Dominance in the Jet Engines Market North America dominated the Jet Engines Market in 2023 and is expected to maintain its dominance during the forecast period. The United States, in particular, is a thriving hub for both military and commercial aviation. Its strong demand for new engines, upgrades, and maintenance services consistently fuels market growth. While Europe is a emerging region in Jet Engines Market with its leading nations like the UK, France, and Germany, holds a substantial presence in the aerospace sector. Renowned companies like Rolls-Royce, Safran, and MTU Aero Engines contribute significantly to the global jet engine market. Europe focuses extensively on pioneering engine technologies, sustainability, and efficiency, steering market growth in these progressive domains. In the Asia-Pacific region, rapid aviation growth is evident. Countries such as China, India, Japan, and South Korea are making substantial investments in aerospace infrastructure and expanding their aviation fleets. This surge is driven by escalating air travel demand and the emergence of low-cost carriers, amplifying the need for both commercial and military jet engines. the Middle East, particularly Gulf countries like the UAE and Qatar, serves as pivotal hubs for airlines. Their emphasis on becoming aviation and logistics centers fuels the demand for modern, fuel-efficient engines and associated maintenance services. In Latin America, though comparatively smaller, countries like Brazil and Mexico are witnessing steady growth in their aviation industries. The increase in passenger traffic and fleet expansions is propelling the demand for newer, more efficient jet engines. Africa is experiencing a gradual but steady growth trajectory in its aviation sector. Countries such as South Africa, Nigeria, and Kenya are investing in revamping their aviation infrastructure by acquiring modern aircraft and engines, contributing to the regional demand for jet engines. These regional markets are influenced by multifaceted factors such as economic growth, airline expansions, environmental regulations, geopolitical situations, and the ongoing evolution of technology. The global trend towards sustainable aviation and the development of hybrid or electric propulsion systems further shapes the jet engines market, with different regions responding to these transformative changes at varying paces and capacities.Jet Engines Market Scope: Inquire before buying

Global Jet Engines Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 70.39 Bn. Forecast Period 2024 to 2030 CAGR: 5.12% Market Size in 2030: US $ 99.84 Bn. Segments Covered: by Technology Turboprop engine Turbofan engine Turbojet engine Pulsejet engine Others by Platform Rotary wings Fixed wings by Application Military aviation Business aviation Commercial aviation Jet Engines Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Jet Engines Market Key Players:

Major Contributors in the Jet Engines Industry in North America: 1. Pratt & Whitney, East Hartford, Connecticut, USA 2. General Electric Aviation, Evendale, Ohio, USA 3. CFM International, West Chester, Ohio, USA 4. Honeywell Aerospace, Charlotte, North Carolina, USA 5. Engine Alliance, East Hartford, Connecticut, USA 6. Williams International, Walled Lake, Michigan, USA Leading players in the Europe Jet Engines Market: 1. Rolls Royce, London, United Kingdom 2. Safran Aircraft Engines, Paris, France 3. MTU Aero Engines, Munich, Germany 4. Avio Aero, Rivalta di Torino, Italy 5. GKN Aerospace Engine Systems, Trollhättan, Sweden 6. PowerJet, Paris, France 7. Klimov, St. Petersburg, Russia 8. Ivchenko-Progress, Zaporizhzhia, Ukraine 9. JSC UEC Saturn, Rybinsk, Russia 10. Austro Engine, Wiener Neustadt, Austria 11. Motor Sich, Zaporizhzhia, Ukraine 12. Dassault Aviation, Paris, France Key players driving the Asia-Pacific Jet Engines Market: 1. IHI Corporation, Tokyo, Japan 2. Aero Engine Corporation of China (AECC), Beijing, China 3. Turbofan Engine Company of China (TECC), Shanghai, China 4. Hindustan Aeronautics Limited (HAL), Bangalore, India 5. Kawasaki Heavy Industries Aerospace Company, Tokyo, Japan FAQs: 1] What Major Key players in the Global Jet Engines Market report? Ans. The important key players in the Global market are – Rolls Royce, Pratt & Whitney, Safran, Eurojet, Klimov, Boeing, Safran SA, CFM International, PowerJet, Honeywell Aerospace, General Electric Aviation, Engine Alliance, MTU Aero Engines AG, International Aero Engines, and Walter 2] Which region is expected to hold the highest share in the Global Jet Engines Market? Ans. North America region is expected to hold the highest share in the Jet Engines Market. 3] What is the market size of the Global Jet Engines Market by 2030? Ans. The market size of the Jet Engines Market by 2030 is expected to reach US$ 99.84 Billion. 4] What is the forecast period for the Global Jet Engines Market? Ans. The forecast period for the Jet Engines Market is 2024-2030. 5] What was the market size of the Global Jet Engines Market in 2023? Ans. The market size of the Jet Engines Market in 2023 was valued at US$ 70.39 Billion.

1. Jet Engines Market: Research Methodology 2. Jet Engines Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Jet Engines Market: Dynamics 3.1. Jet Engines Market Trends by Region 3.1.1. North America Jet Engines Market Trends 3.1.2. Europe Jet Engines Market Trends 3.1.3. Asia Pacific Jet Engines Market Trends 3.1.4. Middle East and Africa Jet Engines Market Trends 3.1.5. South America Jet Engines Market Trends 3.2. Jet Engines Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Jet Engines Market Drivers 3.2.1.2. North America Jet Engines Market Restraints 3.2.1.3. North America Jet Engines Market Opportunities 3.2.1.4. North America Jet Engines Market Challenges 3.2.2. Europe 3.2.2.1. Europe Jet Engines Market Drivers 3.2.2.2. Europe Jet Engines Market Restraints 3.2.2.3. Europe Jet Engines Market Opportunities 3.2.2.4. Europe Jet Engines Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Jet Engines Market Drivers 3.2.3.2. Asia Pacific Jet Engines Market Restraints 3.2.3.3. Asia Pacific Jet Engines Market Opportunities 3.2.3.4. Asia Pacific Jet Engines Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Jet Engines Market Drivers 3.2.4.2. Middle East and Africa Jet Engines Market Restraints 3.2.4.3. Middle East and Africa Jet Engines Market Opportunities 3.2.4.4. Middle East and Africa Jet Engines Market Challenges 3.2.5. South America 3.2.5.1. South America Jet Engines Market Drivers 3.2.5.2. South America Jet Engines Market Restraints 3.2.5.3. South America Jet Engines Market Opportunities 3.2.5.4. South America Jet Engines Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Jet Engines Market 3.8. Analysis of Government Schemes and Initiatives For Jet Engines Market 3.9. The Global Pandemic Impact on Jet Engines Market 4. Jet Engines Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2030-2030) 4.1. Jet Engines Market Size and Forecast, by Technology (2030-2030) 4.1.1. Turboprop engine 4.1.2. Turbofan engine 4.1.3. Turbojet engine 4.1.4. Pulsejet engine 4.1.5. Others 4.2. Jet Engines Market Size and Forecast, by Platform (2030-2030) 4.2.1. Rotary wings 4.2.2. Fixed wings 4.3. Jet Engines Market Size and Forecast, by Application (2030-2030) 4.3.1. Military aviation 4.3.2. Business aviation 4.3.3. Commercial aviation 4.4. Jet Engines Market Size and Forecast, by Region (2030-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Jet Engines Market Size and Forecast by Segmentation (by Value in USD Million) (2030-2030) 5.1. North America Jet Engines Market Size and Forecast, by Technology (2030-2030) 5.1.1. Turboprop engine 5.1.2. Turbofan engine 5.1.3. Turbojet engine 5.1.4. Pulsejet engine 5.1.5. Others 5.2. North America Jet Engines Market Size and Forecast, by Platform (2030-2030) 5.2.1. Rotary wings 5.2.2. Fixed wings 5.3. North America Jet Engines Market Size and Forecast, by Application (2030-2030) 5.3.1. Military aviation 5.3.2. Business aviation 5.3.3. Commercial aviation 5.4. North America Jet Engines Market Size and Forecast, by Country (2030-2030) 5.4.1. United States 5.4.1.1. United States Jet Engines Market Size and Forecast, by Technology (2030-2030) 5.4.1.1.1. Turboprop engine 5.4.1.1.2. Turbofan engine 5.4.1.1.3. Turbojet engine 5.4.1.1.4. Pulsejet engine 5.4.1.1.5. Others 5.4.1.2. United States Jet Engines Market Size and Forecast, by Platform (2030-2030) 5.4.1.2.1. Rotary wings 5.4.1.2.2. Fixed wings 5.4.1.3. United States Jet Engines Market Size and Forecast, by Application (2030-2030) 5.4.1.3.1. Military aviation 5.4.1.3.2. Business aviation 5.4.1.3.3. Commercial aviation 5.4.2. Canada 5.4.2.1. Canada Jet Engines Market Size and Forecast, by Technology (2030-2030) 5.4.2.1.1. Turboprop engine 5.4.2.1.2. Turbofan engine 5.4.2.1.3. Turbojet engine 5.4.2.1.4. Pulsejet engine 5.4.2.1.5. Others 5.4.2.2. Canada Jet Engines Market Size and Forecast, by Platform (2030-2030) 5.4.2.2.1. Rotary wings 5.4.2.2.2. Fixed wings 5.4.2.3. Canada Jet Engines Market Size and Forecast, by Application (2030-2030) 5.4.2.3.1. Military aviation 5.4.2.3.2. Business aviation 5.4.2.3.3. Commercial aviation 5.4.3. Mexico 5.4.3.1. Mexico Jet Engines Market Size and Forecast, by Technology (2030-2030) 5.4.3.1.1. Turboprop engine 5.4.3.1.2. Turbofan engine 5.4.3.1.3. Turbojet engine 5.4.3.1.4. Pulsejet engine 5.4.3.1.5. Others 5.4.3.2. Mexico Jet Engines Market Size and Forecast, by Platform (2030-2030) 5.4.3.2.1. Rotary wings 5.4.3.2.2. Fixed wings 5.4.3.3. Mexico Jet Engines Market Size and Forecast, by Application (2030-2030) 5.4.3.3.1. Military aviation 5.4.3.3.2. Business aviation 5.4.3.3.3. Commercial aviation 6. Europe Jet Engines Market Size and Forecast by Segmentation (by Value in USD Million) (2030-2030) 6.1. Europe Jet Engines Market Size and Forecast, by Technology (2030-2030) 6.2. Europe Jet Engines Market Size and Forecast, by Platform (2030-2030) 6.3. Europe Jet Engines Market Size and Forecast, by Application (2030-2030) 6.4. Europe Jet Engines Market Size and Forecast, by Country (2030-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Jet Engines Market Size and Forecast, by Technology (2030-2030) 6.4.1.2. United Kingdom Jet Engines Market Size and Forecast, by Platform (2030-2030) 6.4.1.3. United Kingdom Jet Engines Market Size and Forecast, by Application (2030-2030) 6.4.2. France 6.4.2.1. France Jet Engines Market Size and Forecast, by Technology (2030-2030) 6.4.2.2. France Jet Engines Market Size and Forecast, by Platform (2030-2030) 6.4.2.3. France Jet Engines Market Size and Forecast, by Application (2030-2030) 6.4.3. Germany 6.4.3.1. Germany Jet Engines Market Size and Forecast, by Technology (2030-2030) 6.4.3.2. Germany Jet Engines Market Size and Forecast, by Platform (2030-2030) 6.4.3.3. Germany Jet Engines Market Size and Forecast, by Application (2030-2030) 6.4.4. Italy 6.4.4.1. Italy Jet Engines Market Size and Forecast, by Technology (2030-2030) 6.4.4.2. Italy Jet Engines Market Size and Forecast, by Platform (2030-2030) 6.4.4.3. Italy Jet Engines Market Size and Forecast, by Application (2030-2030) 6.4.5. Spain 6.4.5.1. Spain Jet Engines Market Size and Forecast, by Technology (2030-2030) 6.4.5.2. Spain Jet Engines Market Size and Forecast, by Platform (2030-2030) 6.4.5.3. Spain Jet Engines Market Size and Forecast, by Application (2030-2030) 6.4.6. Sweden 6.4.6.1. Sweden Jet Engines Market Size and Forecast, by Technology (2030-2030) 6.4.6.2. Sweden Jet Engines Market Size and Forecast, by Platform (2030-2030) 6.4.6.3. Sweden Jet Engines Market Size and Forecast, by Application (2030-2030) 6.4.7. Austria 6.4.7.1. Austria Jet Engines Market Size and Forecast, by Technology (2030-2030) 6.4.7.2. Austria Jet Engines Market Size and Forecast, by Platform (2030-2030) 6.4.7.3. Austria Jet Engines Market Size and Forecast, by Application (2030-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Jet Engines Market Size and Forecast, by Technology (2030-2030) 6.4.8.2. Rest of Europe Jet Engines Market Size and Forecast, by Platform (2030-2030) 6.4.8.3. Rest of Europe Jet Engines Market Size and Forecast, by Application (2030-2030) 7. Asia Pacific Jet Engines Market Size and Forecast by Segmentation (by Value in USD Million) (2030-2030) 7.1. Asia Pacific Jet Engines Market Size and Forecast, by Technology (2030-2030) 7.2. Asia Pacific Jet Engines Market Size and Forecast, by Platform (2030-2030) 7.3. Asia Pacific Jet Engines Market Size and Forecast, by Application (2030-2030) 7.4. Asia Pacific Jet Engines Market Size and Forecast, by Country (2030-2030) 7.4.1. China 7.4.1.1. China Jet Engines Market Size and Forecast, by Technology (2030-2030) 7.4.1.2. China Jet Engines Market Size and Forecast, by Platform (2030-2030) 7.4.1.3. China Jet Engines Market Size and Forecast, by Application (2030-2030) 7.4.2. S Korea 7.4.2.1. S Korea Jet Engines Market Size and Forecast, by Technology (2030-2030) 7.4.2.2. S Korea Jet Engines Market Size and Forecast, by Platform (2030-2030) 7.4.2.3. S Korea Jet Engines Market Size and Forecast, by Application (2030-2030) 7.4.3. Japan 7.4.3.1. Japan Jet Engines Market Size and Forecast, by Technology (2030-2030) 7.4.3.2. Japan Jet Engines Market Size and Forecast, by Platform (2030-2030) 7.4.3.3. Japan Jet Engines Market Size and Forecast, by Application (2030-2030) 7.4.4. India 7.4.4.1. India Jet Engines Market Size and Forecast, by Technology (2030-2030) 7.4.4.2. India Jet Engines Market Size and Forecast, by Platform (2030-2030) 7.4.4.3. India Jet Engines Market Size and Forecast, by Application (2030-2030) 7.4.5. Australia 7.4.5.1. Australia Jet Engines Market Size and Forecast, by Technology (2030-2030) 7.4.5.2. Australia Jet Engines Market Size and Forecast, by Platform (2030-2030) 7.4.5.3. Australia Jet Engines Market Size and Forecast, by Application (2030-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Jet Engines Market Size and Forecast, by Technology (2030-2030) 7.4.6.2. Indonesia Jet Engines Market Size and Forecast, by Platform (2030-2030) 7.4.6.3. Indonesia Jet Engines Market Size and Forecast, by Application (2030-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Jet Engines Market Size and Forecast, by Technology (2030-2030) 7.4.7.2. Malaysia Jet Engines Market Size and Forecast, by Platform (2030-2030) 7.4.7.3. Malaysia Jet Engines Market Size and Forecast, by Application (2030-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Jet Engines Market Size and Forecast, by Technology (2030-2030) 7.4.8.2. Vietnam Jet Engines Market Size and Forecast, by Platform (2030-2030) 7.4.8.3. Vietnam Jet Engines Market Size and Forecast, by Application (2030-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Jet Engines Market Size and Forecast, by Technology (2030-2030) 7.4.9.2. Taiwan Jet Engines Market Size and Forecast, by Platform (2030-2030) 7.4.9.3. Taiwan Jet Engines Market Size and Forecast, by Application (2030-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Jet Engines Market Size and Forecast, by Technology (2030-2030) 7.4.10.2. Rest of Asia Pacific Jet Engines Market Size and Forecast, by Platform (2030-2030) 7.4.10.3. Rest of Asia Pacific Jet Engines Market Size and Forecast, by Application (2030-2030) 8. Middle East and Africa Jet Engines Market Size and Forecast by Segmentation (by Value in USD Million) (2030-2030 8.1. Middle East and Africa Jet Engines Market Size and Forecast, by Technology (2030-2030) 8.2. Middle East and Africa Jet Engines Market Size and Forecast, by Platform (2030-2030) 8.3. Middle East and Africa Jet Engines Market Size and Forecast, by Application (2030-2030) 8.4. Middle East and Africa Jet Engines Market Size and Forecast, by Country (2030-2030) 8.4.1. South Africa 8.4.1.1. South Africa Jet Engines Market Size and Forecast, by Technology (2030-2030) 8.4.1.2. South Africa Jet Engines Market Size and Forecast, by Platform (2030-2030) 8.4.1.3. South Africa Jet Engines Market Size and Forecast, by Application (2030-2030) 8.4.2. GCC 8.4.2.1. GCC Jet Engines Market Size and Forecast, by Technology (2030-2030) 8.4.2.2. GCC Jet Engines Market Size and Forecast, by Platform (2030-2030) 8.4.2.3. GCC Jet Engines Market Size and Forecast, by Application (2030-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Jet Engines Market Size and Forecast, by Technology (2030-2030) 8.4.3.2. Nigeria Jet Engines Market Size and Forecast, by Platform (2030-2030) 8.4.3.3. Nigeria Jet Engines Market Size and Forecast, by Application (2030-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Jet Engines Market Size and Forecast, by Technology (2030-2030) 8.4.4.2. Rest of ME&A Jet Engines Market Size and Forecast, by Platform (2030-2030) 8.4.4.3. Rest of ME&A Jet Engines Market Size and Forecast, by Application (2030-2030) 9. South America Jet Engines Market Size and Forecast by Segmentation (by Value in USD Million) (2030-2030 9.1. South America Jet Engines Market Size and Forecast, by Technology (2030-2030) 9.2. South America Jet Engines Market Size and Forecast, by Platform (2030-2030) 9.3. South America Jet Engines Market Size and Forecast, by Application (2030-2030) 9.4. South America Jet Engines Market Size and Forecast, by Country (2030-2030) 9.4.1. Brazil 9.4.1.1. Brazil Jet Engines Market Size and Forecast, by Technology (2030-2030) 9.4.1.2. Brazil Jet Engines Market Size and Forecast, by Platform (2030-2030) 9.4.1.3. Brazil Jet Engines Market Size and Forecast, by Application (2030-2030) 9.4.2. Argentina 9.4.2.1. Argentina Jet Engines Market Size and Forecast, by Technology (2030-2030) 9.4.2.2. Argentina Jet Engines Market Size and Forecast, by Platform (2030-2030) 9.4.2.3. Argentina Jet Engines Market Size and Forecast, by Application (2030-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Jet Engines Market Size and Forecast, by Technology (2030-2030) 9.4.3.2. Rest Of South America Jet Engines Market Size and Forecast, by Platform (2030-2030) 9.4.3.3. Rest Of South America Jet Engines Market Size and Forecast, by Application (2030-2030) 10. Global Jet Engines Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Product Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Jet Engines Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Pratt & Whitney, East Hartford, Connecticut, USA 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. General Electric Aviation, Evendale, Ohio, USA 11.3. CFM International, West Chester, Ohio, USA 11.4. Honeywell Aerospace, Charlotte, North Carolina, USA 11.5. Engine Alliance, East Hartford, Connecticut, USA 11.6. Williams International, Walled Lake, Michigan, USA 11.7. Rolls-Royce, London, United Kingdom 11.8. Safran Aircraft Engines, Paris, France 11.9. MTU Aero Engines, Munich, Germany 11.10. Avio Aero, Rivalta di Torino, Italy 11.11. GKN Aerospace Engine Systems, Trollhättan, Sweden 11.12. PowerJet, Paris, France 11.13. Klimov, St. Petersburg, Russia 11.14. Ivchenko-Progress, Zaporizhzhia, Ukraine 11.15. JSC UEC Saturn, Rybinsk, Russia 11.16. Austro Engine, Wiener Neustadt, Austria 11.17. Motor Sich, Zaporizhzhia, Ukraine 11.18. Dassault Aviation, Paris, France 11.19. IHI Corporation, Tokyo, Japan 11.20. Aero Engine Corporation of China (AECC), Beijing, China 11.21. Turbofan Engine Company of China (TECC), Shanghai, China 11.22. Hindustan Aeronautics Limited (HAL), Bangalore, India 11.23. Kawasaki Heavy Industries Aerospace Company, Tokyo, Japan 12. Key Findings 13. Industry Recommendations