The Intelligent Document Processing Market size was valued 1.51 Bn in 2023 and is expected to reach USD 14.03 Bn by 2030, at a CAGR of 37.5 % during the forecast period.Intelligent Document Processing Market Overview

Intelligent Document Processing (IDP) encompasses a versatile technology facilitating the structured extraction of various types of content. This empowers businesses to automate the handling of diverse office data, including emails, customer onboarding, insurance claims processing, sales conversions, and pipelines, among others. Through the incorporation of intelligent document processing, large enterprises streamline numerous processes involving the analysis of unstructured data, which is expected to boost the Intelligent Document Processing Market growth. For instance, in the realm of human resources, Intelligent Document Processing is leveraged to organize candidate information and resumes, allowing personnel to redirect their efforts toward strategic organizational planning. Adopting AI-driven document processing enables Intelligent Document Processing companies to delegate the initial reading and categorization of documents to a mechanized system, freeing up employees to concentrate on other critical endeavors, such as optimizing data extraction methods for enhanced productivity.To know about the Research Methodology :- Request Free Sample Report

Intelligent Document Processing Market Dynamics

Data Explosion to boost the Intelligent Document Processing Market growth In the current era of technological advancement, businesses grapple with a deluge of data daily. Data specialists observe a staggering 65% increase in data volume within their organizations each month. This influx comprises data sourced from various channels such as scanned documents, PDFs, emails, and images. Traditional manual approaches to data entry and processing are inadequate to cope with this exponential growth. Intelligent Document Processing streamlines tasks, freeing employees from repetitive chores. This enhances productivity, allowing the workforce to focus on strategic and value-added activities, which significantly boosts the Intelligent Document Processing Market growth. By reducing labor dependency, organizations achieve significant cost efficiencies. IDP facilitates the extraction and processing of data in real or near-real-time. This capability empowers prompt decision-making and faster response times for both customers and partners, thereby enhancing overall operational efficiency. In the contemporary business landscape, firms are in a constant state of evolution, seeking avenues to optimize their operations. Embracing technology-driven solutions for automating and improving document processing and workflow management is pivotal in this journey. IDP emerges as a fitting solution for organizations aiming to streamline their processes through digital transformation initiatives. Accelerated processing speeds and reduced turnaround times translate into enriched customer experiences. Intelligent Document Processing Companies swiftly address customer inquiries, expedite approval processes, and ensure a seamless customer journey, thereby bolstering satisfaction levels. Benefits of intelligent document processing: Intelligent document processing has been demonstrated to improve business processes and increase team efficiency. Here are a few of the key advantages to automating your document processing: Increase the accuracy of processing with intelligent document processing. The rate of error for human data processors is much higher than it is for IDP. Lower the cost of processing documents by automating some of your workflows. On average, manual document processing costs 6 to 8 dollars per document. The per-document cost of automated document processing is considerably lower than that. Increase employee productivity by offering them the opportunity to do more impactful work. Without the need to process mindlessly time-consuming documents, employees are free to direct their attention elsewhere. Complex Implementation Processes to limit the Intelligent Document Processing Market growth Implementing IDP solutions is complex and time-consuming. Integration with existing systems and processes, data migration, and employee training are all challenges that organizations may face during implementation. The upfront costs associated with implementing Intelligent Document Processing solutions, including software licensing fees, hardware requirements, and consultancy services, is significant. This high initial investment deter some organizations, particularly smaller ones, from adopting IDP technologies. Processing sensitive documents and data raises concerns about data privacy and security. Organizations ensure compliance with data protection regulations such as GDPR or HIPAA, which involve additional costs and efforts to implement robust security measures and ensure regulatory compliance, which is expected to fuel the Intelligent Document Processing Market growth. Integrating IDP solutions with existing enterprise systems, such as Enterprise Resource Planning (ERP) or Customer Relationship Management (CRM) systems, is challenging. Compatibility issues, data synchronization problems, and the need for customizations may arise during the integration process. While IDP technologies have made significant advancements in accuracy and reliability, they still encounter difficulties in accurately extracting and processing data from complex documents or unstructured formats. Errors in data extraction lead to inaccuracies in decision-making and operational inefficiencies. Resistance from employees who are accustomed to manual document processing methods pose a barrier to the adoption of IDP technologies. Resistance to change may stem from fear of job displacement, lack of familiarity with new technologies, or skepticism about the benefits of automation.Intelligent Document Processing Market Segment Analysis

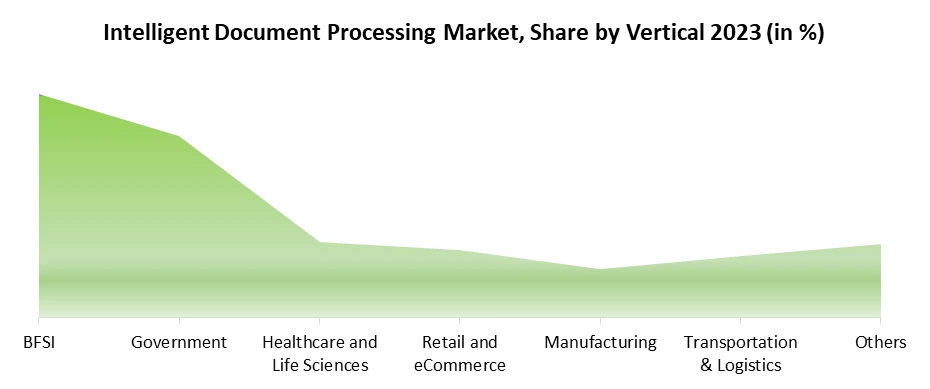

Based on Component, the market is segmented into Solutions and Services. Service segmented held the largest Intelligent Document Processing Market share in 2023 and is expected to dominate the market over the forecast period. In the Intelligent Document Processing (IDP) Market, the service segment refers to the range of professional services provided by vendors and service providers to support the implementation, customization, integration, and ongoing support of IDP solutions for their clients. These services are essential for ensuring the successful adoption and utilization of Intelligent Document Processing technologies within organizations. This involves providing strategic guidance and advisory support to organizations seeking to implement IDP solutions. Consultants help clients assess their document processing needs, evaluate available IDP technologies, develop implementation roadmaps, and define business objectives and success criteria, which is expected to boost the Intelligent Document Processing Market growth. Some organizations opt for managed services, where the service provider takes on the responsibility of managing and operating the IDP solution on behalf of the client. Managed services may include monitoring, maintenance, system administration, and performance optimization to offload operational burdens and ensure continuous availability and performance of the IDP solution. Based on Organization Size, the market is segmented into SMEs, and Large Enterprises. Large Enterprises segment dominated the market in 2023 and is expected to hold the largest Intelligent Document Processing Market share over the forecast period. Large enterprises operate on a sizable scale, with multiple departments, branches, and business units generating a vast amount of documents on a daily basis. These documents may include invoices, contracts, purchase orders, customer correspondence, legal documents, and more. Managing and processing such a large volume of documents manually is time-consuming, error-prone, and resource-intensive. Large enterprises deal with a diverse range of document types, formats, and languages, making document processing a complex and challenging task. Many documents is unstructured or semi-structured, requiring advanced data extraction and recognition capabilities to accurately capture and interpret relevant information. Additionally, large enterprises often have stringent compliance requirements and regulatory obligations, further adding to the complexity of document processing.Based on Vertical, the market is segmented into BFSI, Government, Healthcare and Life Sciences, Retail and eCommerce, Manufacturing, Transportation & Logistics, and Others. BFSI segment dominated the market in 2023 and is expected to hold the largest Intelligent Document Processing Market share over the forecast period. This segment includes a wide range of organizations including banks, credit unions, insurance companies, investment firms, and other financial institutions. In the context of IDP, the BFSI sector has unique document processing needs and challenges that IDP solutions aim to address. The BFSI sector deals with a vast array of documents including loan applications, insurance claims, financial statements, invoices, contracts, customer correspondence, regulatory filings, and more. These documents are critical for various business processes such as account opening, loan origination, claims processing, compliance reporting, and customer service. The BFSI industry is highly regulated, with stringent compliance requirements imposed by regulatory bodies such as the Securities and Exchange Commission (SEC), Federal Reserve, Financial Industry Regulatory Authority (FINRA), and various other regulatory authorities worldwide, which is expected to boost the Intelligent Document Processing Market growth. Compliance with regulations such as Know Your Customer (KYC), Anti-Money Laundering (AML), Sarbanes-Oxley (SOX), GDPR, and others is paramount for BFSI organizations. Intelligent Document Processing solutions help automate compliance-related document processing tasks, ensuring accuracy, consistency, and auditability.

Intelligent Document Processing Market Regional Insight

Technological Advancement to boost North America Intelligent Document Processing Market growth North America is a key region in the global IDP market, driven by the widespread adoption of automation technologies, the presence of leading technology companies, and the high demand for efficient document processing solutions across various industries. The region comprises the United States, Canada, and Mexico, with the United States being the largest Intelligent Document Processing Market for IDP solutions. North America is at the forefront of technological innovation, with a strong emphasis on leveraging artificial intelligence (AI), machine learning (ML), natural language processing (NLP), and robotic process automation (RPA) to improve business processes. These technological advancements drive the adoption of IDP solutions, enabling organizations to automate document-centric workflows, enhance operational efficiency, and reduce manual errors. The exponential growth of digital data in North America, fueled by factors such as the proliferation of digital transactions, increasing internet penetration, and the adoption of cloud computing, has led to a surge in the volume and complexity of documents that organizations need to process. IDP solutions address the challenges associated with handling large volumes of unstructured data, enabling organizations to extract valuable insights and drive informed decision-making. Organizations in North America are under pressure to optimize costs, streamline operations, and improve productivity. IDP solutions offer cost-effective alternatives to manual document processing methods, allowing organizations to achieve significant cost savings, streamline workflows, and reallocate resources to strategic initiatives, which boosts the Intelligent Document Processing Market growth.Intelligent Document Processing Market Scope: Inquire before buying

Intelligent Document Processing Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.51 Bn. Forecast Period 2024 to 2030 CAGR: 37.5% Market Size in 2030: US $ 14.03 Bn. Segments Covered: by Component Solutions Services by Organization Size SMEs Large Enterprises by Technology Natural Language Processing (NLP) Optical Character Recognition (OCR) Machine Learning (ML) Artificial Intelligence (AI) Robotic Process Automation (RPA) Deep Learning (DL) by Vertical BFSI Government Healthcare and Life Sciences Retail and eCommerce Manufacturing Transportation & Logistics Others Intelligent Document Processing Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Intelligent Document Processing KeyPlayers Includes:

Global 1. Google LLC - Mountain View, California, USA 2. Amazon Web Services - Seattle, Washington, USA 3. Pegasystems Inc. - Cambridge, Massachusetts, USA North America: 4. IBM Corporation - Armonk, New York, USA 5. Adobe Inc. - San Jose, California, USA 6. UiPath Inc. - New York City, New York, USA 7. ABBYY - Milpitas, California, USA 8. Kofax Inc. - Irvine, California, USA 9. Flexton Inc. - Mexico City, Mexico 10. Microsoft Corporation - Redmond, Washington, USA Europe: 11. Blue Prism Group plc - Warrington, England, UK 12. Celaton Ltd. - Maidenhead, England, UK 13. Ephesoft Inc. - Maidenhead, England, UK 14. Hypatos GmbH - Berlin, Germany 15. Parascript LLC - Longmont, Colorado, USA (European operations based in the UK) 16. SAP - Walldorf, German Asia Pacific: 17. AntWorks - Singapore 18. Datamatics Global Services Limited - Mumbai, India 19. Nanonets - Bengaluru, India 20. TCS - Mumbai, India Frequently asked Questions: 1: What is Intelligent Document Processing (IDP) and what types of content can it handle? Ans: IDP is a versatile technology enabling the structured extraction of various types of content, such as emails, customer onboarding data, insurance claims, sales conversions, and more. 2: How does IDP benefit large enterprises? Ans: IDP streamlines processes involving unstructured data analysis, such as candidate information organization in human resources, allowing employees to focus on strategic planning. 3: How does the service segment contribute to the IDP market? Ans: The service segment offers professional services such as consulting, implementation, training, support, and managed services to assist organizations in deploying and optimizing IDP solutions. 4: What industries dominate the IDP market, and why? Ans: Industries such as Banking, Financial Services, and Insurance (BFSI) lead the IDP market due to their extensive document processing requirements, regulatory compliance obligations, and focus on enhancing customer experiences. 5: What drives the growth of the IDP market in North America? Ans: Factors such as technological advancements, increasing data volume and complexity, cost reduction and efficiency goals, and a focus on delivering superior customer experiences contribute to the growth of the IDP market in North America.

1. Intelligent Document Processing Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Intelligent Document Processing Market: Dynamics 2.1. Intelligent Document Processing Market Trends by Region 2.1.1. North America Intelligent Document Processing Market Trends 2.1.2. Europe Intelligent Document Processing Market Trends 2.1.3. Asia Pacific Intelligent Document Processing Market Trends 2.1.4. Middle East and Africa Intelligent Document Processing Market Trends 2.1.5. South America Intelligent Document Processing Market Trends 2.2. Intelligent Document Processing Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Intelligent Document Processing Market Drivers 2.2.1.2. North America Intelligent Document Processing Market Restraints 2.2.1.3. North America Intelligent Document Processing Market Opportunities 2.2.1.4. North America Intelligent Document Processing Market Challenges 2.2.2. Europe 2.2.2.1. Europe Intelligent Document Processing Market Drivers 2.2.2.2. Europe Intelligent Document Processing Market Restraints 2.2.2.3. Europe Intelligent Document Processing Market Opportunities 2.2.2.4. Europe Intelligent Document Processing Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Intelligent Document Processing Market Drivers 2.2.3.2. Asia Pacific Intelligent Document Processing Market Restraints 2.2.3.3. Asia Pacific Intelligent Document Processing Market Opportunities 2.2.3.4. Asia Pacific Intelligent Document Processing Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Intelligent Document Processing Market Drivers 2.2.4.2. Middle East and Africa Intelligent Document Processing Market Restraints 2.2.4.3. Middle East and Africa Intelligent Document Processing Market Opportunities 2.2.4.4. Middle East and Africa Intelligent Document Processing Market Challenges 2.2.5. South America 2.2.5.1. South America Intelligent Document Processing Market Drivers 2.2.5.2. South America Intelligent Document Processing Market Restraints 2.2.5.3. South America Intelligent Document Processing Market Opportunities 2.2.5.4. South America Intelligent Document Processing Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Intelligent Document Processing Industry 2.8. Analysis of Government Schemes and Initiatives For Intelligent Document Processing Industry 2.9. Intelligent Document Processing Market Trade Analysis 2.10. The Global Pandemic Impact on Intelligent Document Processing Market 3. Intelligent Document Processing Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 3.1.1. Solutions 3.1.2. Services 3.2. Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 3.2.1. SMEs 3.2.2. Large Enterprises 3.3. Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 3.3.1. Natural Language Processing (NLP) 3.3.2. Optical Character Recognition (OCR) 3.3.3. Machine Learning (ML) 3.3.4. Artificial Intelligence (AI) 3.3.5. Robotic Process Automation (RPA) 3.3.6. Deep Learning (DL) 3.4. Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 3.4.1. BFSI 3.4.2. Government 3.4.3. Healthcare and Life Sciences 3.4.4. Retail and eCommerce 3.4.5. Manufacturing 3.4.6. Transportation & Logistics 3.4.7. Others 3.5. Intelligent Document Processing Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Intelligent Document Processing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 4.1.1. Solutions 4.1.2. Services 4.2. North America Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 4.2.1. SMEs 4.2.2. Large Enterprises 4.3. North America Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 4.3.1. Natural Language Processing (NLP) 4.3.2. Optical Character Recognition (OCR) 4.3.3. Machine Learning (ML) 4.3.4. Artificial Intelligence (AI) 4.3.5. Robotic Process Automation (RPA) 4.3.6. Deep Learning (DL) 4.4. North America Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 4.4.1. BFSI 4.4.2. Government 4.4.3. Healthcare and Life Sciences 4.4.4. Retail and eCommerce 4.4.5. Manufacturing 4.4.6. Transportation & Logistics 4.4.7. Others 4.5. North America Intelligent Document Processing Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 4.5.1.1.1. Solutions 4.5.1.1.2. Services 4.5.1.2. United States Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 4.5.1.2.1. SMEs 4.5.1.2.2. Large Enterprises 4.5.1.3. United States Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 4.5.1.3.1. Natural Language Processing (NLP) 4.5.1.3.2. Optical Character Recognition (OCR) 4.5.1.3.3. Machine Learning (ML) 4.5.1.3.4. Artificial Intelligence (AI) 4.5.1.3.5. Robotic Process Automation (RPA) 4.5.1.3.6. Deep Learning (DL) 4.5.1.4. United States Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 4.5.1.4.1. BFSI 4.5.1.4.2. Government 4.5.1.4.3. Healthcare and Life Sciences 4.5.1.4.4. Retail and eCommerce 4.5.1.4.5. Manufacturing 4.5.1.4.6. Transportation & Logistics 4.5.1.4.7. Others 4.5.2. Canada 4.5.2.1. Canada Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 4.5.2.1.1. Solutions 4.5.2.1.2. Services 4.5.2.2. Canada Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 4.5.2.2.1. SMEs 4.5.2.2.2. Large Enterprises 4.5.2.3. Canada Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 4.5.2.3.1. Natural Language Processing (NLP) 4.5.2.3.2. Optical Character Recognition (OCR) 4.5.2.3.3. Machine Learning (ML) 4.5.2.3.4. Artificial Intelligence (AI) 4.5.2.3.5. Robotic Process Automation (RPA) 4.5.2.3.6. Deep Learning (DL) 4.5.2.4. Canada Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 4.5.2.4.1. BFSI 4.5.2.4.2. Government 4.5.2.4.3. Healthcare and Life Sciences 4.5.2.4.4. Retail and eCommerce 4.5.2.4.5. Manufacturing 4.5.2.4.6. Transportation & Logistics 4.5.2.4.7. Others 4.5.3. Mexico 4.5.3.1. Mexico Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 4.5.3.1.1. Solutions 4.5.3.1.2. Services 4.5.3.2. Mexico Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 4.5.3.2.1. SMEs 4.5.3.2.2. Large Enterprises 4.5.3.3. Mexico Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 4.5.3.3.1. Natural Language Processing (NLP) 4.5.3.3.2. Optical Character Recognition (OCR) 4.5.3.3.3. Machine Learning (ML) 4.5.3.3.4. Artificial Intelligence (AI) 4.5.3.3.5. Robotic Process Automation (RPA) 4.5.3.3.6. Deep Learning (DL) 4.5.3.4. Mexico Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 4.5.3.4.1. BFSI 4.5.3.4.2. Government 4.5.3.4.3. Healthcare and Life Sciences 4.5.3.4.4. Retail and eCommerce 4.5.3.4.5. Manufacturing 4.5.3.4.6. Transportation & Logistics 4.5.3.4.7. Others 5. Europe Intelligent Document Processing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 5.2. Europe Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 5.3. Europe Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 5.4. Europe Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 5.5. Europe Intelligent Document Processing Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 5.5.1.2. United Kingdom Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 5.5.1.3. United Kingdom Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 5.5.1.4. United Kingdom Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 5.5.2. France 5.5.2.1. France Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 5.5.2.2. France Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 5.5.2.3. France Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 5.5.2.4. France Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 5.5.3.2. Germany Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 5.5.3.3. Germany Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 5.5.3.4. Germany Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 5.5.4.2. Italy Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 5.5.4.3. Italy Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 5.5.4.4. Italy Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 5.5.5.2. Spain Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 5.5.5.3. Spain Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 5.5.5.4. Spain Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 5.5.6.2. Sweden Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 5.5.6.3. Sweden Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 5.5.6.4. Sweden Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 5.5.7.2. Austria Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 5.5.7.3. Austria Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 5.5.7.4. Austria Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 5.5.8.2. Rest of Europe Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 5.5.8.3. Rest of Europe Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 5.5.8.4. Rest of Europe Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 6. Asia Pacific Intelligent Document Processing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 6.2. Asia Pacific Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 6.3. Asia Pacific Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 6.4. Asia Pacific Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 6.5. Asia Pacific Intelligent Document Processing Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 6.5.1.2. China Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 6.5.1.3. China Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 6.5.1.4. China Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 6.5.2.2. S Korea Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 6.5.2.3. S Korea Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 6.5.2.4. S Korea Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 6.5.3.2. Japan Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 6.5.3.3. Japan Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 6.5.3.4. Japan Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 6.5.4. India 6.5.4.1. India Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 6.5.4.2. India Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 6.5.4.3. India Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 6.5.4.4. India Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 6.5.5.2. Australia Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 6.5.5.3. Australia Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 6.5.5.4. Australia Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 6.5.6.2. Indonesia Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 6.5.6.3. Indonesia Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 6.5.6.4. Indonesia Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 6.5.7.2. Malaysia Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 6.5.7.3. Malaysia Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 6.5.7.4. Malaysia Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 6.5.8.2. Vietnam Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 6.5.8.3. Vietnam Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 6.5.8.4. Vietnam Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 6.5.9.2. Taiwan Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 6.5.9.3. Taiwan Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 6.5.9.4. Taiwan Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 6.5.10.2. Rest of Asia Pacific Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 6.5.10.3. Rest of Asia Pacific Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 6.5.10.4. Rest of Asia Pacific Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 7. Middle East and Africa Intelligent Document Processing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 7.2. Middle East and Africa Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 7.3. Middle East and Africa Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 7.4. Middle East and Africa Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 7.5. Middle East and Africa Intelligent Document Processing Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 7.5.1.2. South Africa Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 7.5.1.3. South Africa Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 7.5.1.4. South Africa Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 7.5.2.2. GCC Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 7.5.2.3. GCC Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 7.5.2.4. GCC Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 7.5.3.2. Nigeria Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 7.5.3.3. Nigeria Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 7.5.3.4. Nigeria Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 7.5.4.2. Rest of ME&A Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 7.5.4.3. Rest of ME&A Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 7.5.4.4. Rest of ME&A Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 8. South America Intelligent Document Processing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 8.2. South America Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 8.3. South America Intelligent Document Processing Market Size and Forecast, by Technology(2023-2030) 8.4. South America Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 8.5. South America Intelligent Document Processing Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 8.5.1.2. Brazil Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 8.5.1.3. Brazil Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 8.5.1.4. Brazil Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 8.5.2.2. Argentina Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 8.5.2.3. Argentina Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 8.5.2.4. Argentina Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Intelligent Document Processing Market Size and Forecast, by Componet (2023-2030) 8.5.3.2. Rest Of South America Intelligent Document Processing Market Size and Forecast, by Organization Size (2023-2030) 8.5.3.3. Rest Of South America Intelligent Document Processing Market Size and Forecast, by Technology (2023-2030) 8.5.3.4. Rest Of South America Intelligent Document Processing Market Size and Forecast, by Vertical (2023-2030) 9. Global Intelligent Document Processing Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Intelligent Document Processing Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Google LLC - Mountain View, California, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Amazon Web Services Inc. - Seattle, Washington, USA 10.3. Pegasystems Inc. - Cambridge, Massachusetts, USA 10.4. IBM Corporation - Armonk, New York, USA 10.5. Adobe Inc. - San Jose, California, USA 10.6. UiPath Inc. - New York City, New York, USA 10.7. ABBYY - Milpitas, California, USA 10.8. Kofax Inc. - Irvine, California, USA 10.9. Flexton Inc. - Mexico City, Mexico 10.10. Microsoft Corporation - Redmond, Washington, USA 10.11. Blue Prism Group plc - Warrington, England, UK 10.12. Celaton Ltd. - Maidenhead, England, UK 10.13. Ephesoft Inc. - Maidenhead, England, UK 10.14. Hypatos GmbH - Berlin, Germany 10.15. Parascript LLC - Longmont, Colorado, USA (European operations based in the UK) 10.16. AntWorks - Singapore 10.17. Datamatics Global Services Limited - Mumbai, India 10.18. Nanonets - Bengaluru, India 10.19. TCS - Mumbai, India 11. Key Findings 12. Industry Recommendations 13. Intelligent Document Processing Market: Research Methodology 14. Terms and Glossary