Integration Platform as a Service Market size was valued at US$ 4.82 Bn. in 2022 and the total revenue is expected to grow at 30.32% through 2023 to 2029, reaching nearly US$ 30.79 Bn. by 2029.Integration Platform as a Service Market Overview:

An iPaaS is a cloud-based integration strategy that connects apps, data, and processes more quickly to meet the needs of users. Additionally, iPaaS technology makes it simple to integrate on-premises applications with cloud-to-cloud, cloud-to-ground, and ground-to-ground connections. IPaaS technology is widely utilised by large companies to maximise the value of their IT investments, future-proof their integration solutions, and manage integration requirements as they change. The expansion of the Integration Platform as a Service Market is being driven by factors such as increased iPaaS efficiency and productivity, cost efficiency, scalability, and higher business agility, and many others.To know about the Research Methodology:- Request Free Sample Report

Integration Platform as a Service Market Dynamics:

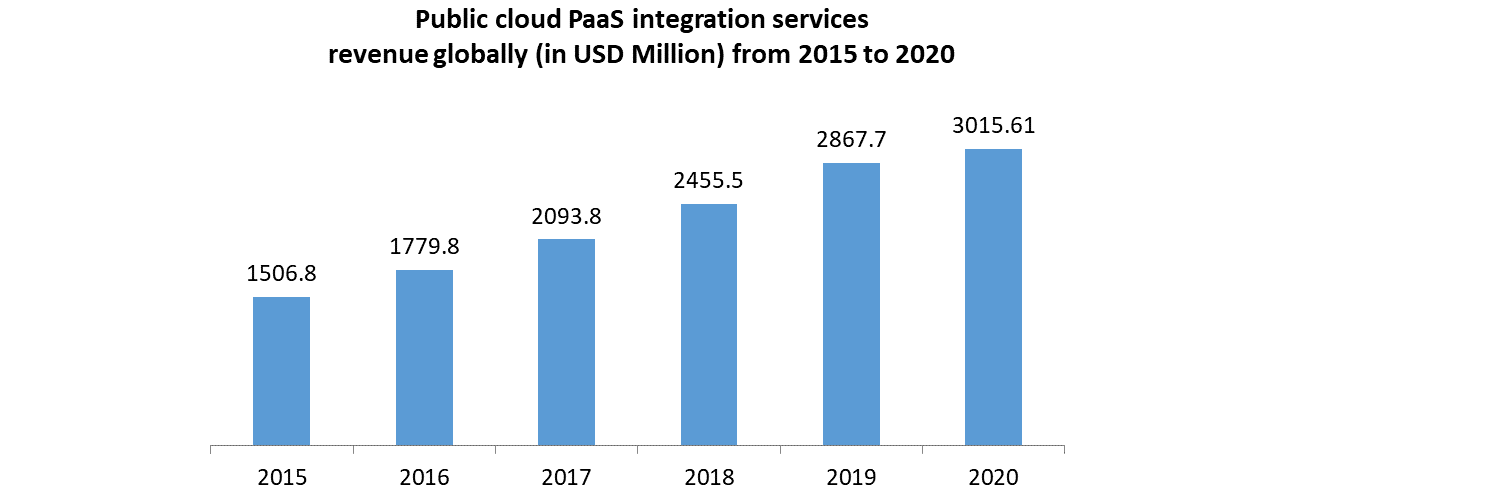

Over the forecast period, increasing usage of cloud solutions across various sectors is estimated to drive the growth of the global integration platform as a service market. Reduced capital expenditures, flexibility in data and information storage, improved IT maintenance, customized user interface, greater user experience, and integration with many commercial apps are just a few of the advantages of cloud solutions. Due to their aversion to relying on a single cloud vendor, various enterprises are expected to embrace hybrid and multi-cloud systems in the coming decades. By 2022, 98 % of enterprises aim to use several hybrid clouds, according to IBM Corp. By increasing mobility to operate between both public and private clouds, hybrid cloud gives the benefits of both. Additionally, it allows businesses to protect sensitive data by storing it in the private cloud while also storing public data in the public cloud. As the number of specialised services grows, so will the requirements for unique applications and functionalities. Another significant factor estimated to drive the global integration platform as a service market is the growing requirement for efficient procedures and better enterprise application management to increase profit margins across different markets throughout the world. Scalability, interference control, multi-platform integration, ubiquitous access, and hyper connection are among the unique solutions offered by the cloud-based platform service, which are intended to help the target market grow. The growing demand for high-response intelligent systems across various industry verticals to form future strategy plans, mitigate risk and fraud, personalize, and improve overall performance in business processes is expected to fuel the global integration platform as a service market's growth over the forecast period. CRM solutions are increasingly being used by businesses to connect their customer service systems. However, there is still a disconnect between these CRM systems and ERP and BI/Analytics systems. However, The high cost of implementing iPaaS is a major factor that is likely to limit the global market growth. Additionally, intricacy in the interchange between various applications is another factor that is estimated to limit the intended market's growth to some level.

Integration Platform as a Service Market Segment Analysis:

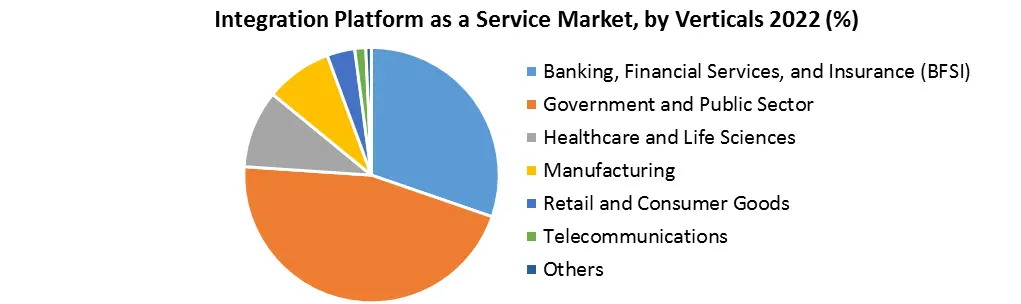

Based on the Organization Size, the global Integration Platform as a Service market is sub-segmented Large Enterprises and into Small and Medium-sized Enterprises (SMEs). The Small and Medium-sized Enterprises (SMEs) segment held the largest market share of 62.3% in 2022. For SMEs, cost-effectiveness is critical because they operate on a shoestring budget, leaving them with few options for marketing and exposure. The fierce competition in the industry has prompted SMEs to invest in IPaaS solutions in order to reach their intended audience. For SMEs, implementing cloud storage would result in greater income, desired outcomes, and improved operational efficiency. SMEs, on the other hand, confront difficulties in capital management, acquiring trained labour, and scalability. Based on the Verticals, the global Integration Platform as a Service market is sub-segmented into Banking, Financial Services, and Insurance (BFSI), Government and Public Sector, Healthcare and Life Sciences, Manufacturing, Retail, and Consumer Goods, Telecommunications and Others. The Banking, Financial Services, and Insurance (BFSI) segment held the largest market share of xx% in 2022. BFSI has been disrupting the market with new applications and innovations to the point where people are managing their finances with a variety of apps. It can automate data entry routines, allow SaaS and on-premises systems to share data, and automate workflows between systems for increased efficiency and productivity. The Retail and Consumer Goods held the 2nd largest market share of xx% in 2022. The rapid growth of e-commerce, which deals in both b2b and b2c platforms, has required firms to perform a variety of tasks, including online selling, placing orders, and inventory management. IPaaS solutions can give a seamless e-commerce integration solution, combining back-end operations, ERP systems, and websites. Additionally, these integration technologies allow for the free flow of data between front-end and back-end systems while lowering IT costs.

Integration Platform as a Service Market Regional Insights:

North America held the largest market share of 45.3% in 2022. Due to the existence of several industry participants, as well as the region's growing adoption of cloud-based services. Demand for IPaaS solutions is likely to be driven by a number of causes, including an increased requirement for enhanced integration services and a transfer of workloads to the cloud. Smart homes are also likely to be one of the main drivers of IoT connectivity development in the coming decades, according to maximize research. By 2022, the business estimates that IoT/machine-to-machine connectivity will account for roughly half of the total 28.5 billion device connections (M2M). Asia Pacific is expected to grow at the highest CAGR of 11.1% in the global Integration Platform as a Service market during the forecast period. Australia, Singapore, Hong Kong, and South Korea were among the first countries to recognize the benefits of cloud leadership, transforming their businesses into digital enterprises. On the other side, businesses in Sri Lanka, Cambodia, and Myanmar are free of existing systems and may incorporate them into cloud-first models. As a result of the growing use of cloud platforms in the industrial sector, the Asia Pacific market is booming. The objective of the report is to present a comprehensive analysis of the global Integration Platform as a Service Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also helps in understanding the global Integration Platform as a Service Market dynamic, structure by analyzing the market segments and project the global market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Integration Platform as a Service Market make the report investor’s guide.Integration Platform as a Service Market Scope: Inquire before buying

Integration Platform as a Service Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 4.82 Bn. Forecast Period 2023 to 2029 CAGR: 30.32 % Market Size in 2029: US $ 30.79 Bn. Segments Covered: by Service Type API Management B2B Integration Data Integration Cloud Integration Application Integration Other Services by Deployment Mode Public Cloud Private Cloud by Organization Size Large Enterprises SMEs by Verticals Banking, Financial Services, and Insurance (BFSI) Government and Public Sector Healthcare and Life Sciences Manufacturing Retail and Consumer Goods Telecommunications Others Integration Platform as a Service Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players

1. Adaptris 2. SAP SE 3. Scribe Software Corporation 4. Oracle Corporation 5. Fujitsu 6. IBM 7. Mulesoft Inc 8. Microsoft Corporation 9. Boomi Inc 10.Celigo inc 11.Informatica Inc. 12.Jitterbit Inc. 13.Workato Inc. 14.SnapLogic Inc. 15.Software AG 16.Tibco 17.Celigo 18.Zapier 19.FlowgearFrequently Asked Questions:

1] What segments are covered in Global Integration Platform as a Service Market report? Ans. The segments covered in global market report are based on Service Type, Deployment Mode, Organization Size and Verticals. 2] Which region is expected to hold the highest share in the global Integration Platform as a Service Market? Ans. North America is expected to hold the highest share in the global market. 3] What is the market size of global Integration Platform as a Service Market by 2029? Ans. The market size of global Integration Platform as a Service Market is expected to reach US $ 30.79 Bn. by 2029. 4] Who are the top key players in the global Integration Platform as a Service Market? Ans. Adaptris, SAP SE, Scribe Software Corporation, Oracle Corporation, Fujitsu and IBM are the top key players in the global Integration Platform as a Service Market. 5] What was the market size of global Integration Platform as a Service Market in 2022? Ans. The market size of global Integration Platform as a Service Market in 2022 was US $ 4.82 Bn.

1. Global Integration Platform as a Service Market: Research Methodology 2. Global Integration Platform as a Service Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Integration Platform as a Service Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Global Integration Platform as a Service Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Global Integration Platform as a Service Market Segmentation 4.1 Global Integration Platform as a Service Market, by Service Type (2022-2029) • Public Cloud • Private Cloud • Hybrid Cloud 4.2 Global Integration Platform as a Service Market, by Deployment Mode (2022-2029) • Small and Medium-sized Enterprises (SMEs) • Large Enterprises 4.3 Global Integration Platform as a Service Market, by Organization Size (2022-2029) • Customer Relationship Management (CRM) • Human Resource Management (HRM) • Financial Management • Sales Management • Enterprise Resource Planning (ERP) • Supply Chain Management 4.4 Global Integration Platform as a Service Market, by Verticals (2022-2029) • Manufacturing • Healthcare • IT & Telecom • Retail • Government • BFSI • Oil & Gas 5. North America Integration Platform as a Service Market(2022-2029) 5.1 Global Integration Platform as a Service Market, by Service Type (2022-2029) • Public Cloud • Private Cloud • Hybrid Cloud 5.2 Global Integration Platform as a Service Market, by Deployment Mode (2022-2029) • Small and Medium-sized Enterprises (SMEs) • Large Enterprises 5.3 Global Integration Platform as a Service Market, by Organization Size (2022-2029) • Customer Relationship Management (CRM) • Human Resource Management (HRM) • Financial Management • Sales Management • Enterprise Resource Planning (ERP) • Supply Chain Management 5.4 Global Integration Platform as a Service Market, by Verticals (2022-2029) • Manufacturing • Healthcare • IT & Telecom • Retail • Government • BFSI • Oil & Gas 5.4 North America Integration Platform as a Service Market, by Country (2022-2029) • United States • Canada • Mexico 6. Asia Pacific Integration Platform as a Service Market (2022-2029) 6.1. Asia Pacific Integration Platform as a Service Market, by Service Type (2022-2029) 6.2. Asia Pacific Integration Platform as a Service Market, by Deployment Mode (2022-2029) 6.3. Global Integration Platform as a Service Market, by Organization Size (2022-2029) 6.4. Asia Pacific Integration Platform as a Service Market, by Verticals (2022-2029) 6.4. Asia Pacific Integration Platform as a Service Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. Middle East and Africa Integration Platform as a Service Market (2022-2029) 7.1 Middle East and Africa Integration Platform as a Service Market, by Service Type (2022-2029) 7.2. Middle East and Africa Integration Platform as a Service Market, by Deployment Mode (2022-2029) 7.3. Middle East and Africa Integration Platform as a Service Market, by Organization Size (2022-2029) 7.4. Middle East and Africa Integration Platform as a Service Market, by Verticals (2022-2029) 7.5. Middle East and Africa Integration Platform as a Service Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America Integration Platform as a Service Market (2022-2029) 8.1. Latin America Integration Platform as a Service Market, by Service Type (2022-2029) 8.2. Latin America Integration Platform as a Service Market, by Deployment Mode (2022-2029) 8.3. Latin America Integration Platform as a Service Market, by Organization Size (2022-2029) 8.4. Latin America Integration Platform as a Service Market, by Verticals (2022-2029) 8.5 Latin America Integration Platform as a Service Market, by Country (2022-2029) • Brazil • Argentina • Rest Of Latin America 9. European Integration Platform as a Service Market (2022-2029) 9.1. European Integration Platform as a Service Market, by Service Type (2022-2029) 9.2. European Integration Platform as a Service Market, by Deployment Mode (2022-2029) 9.3. European Integration Platform as a Service Market, by Organization Size (2022-2029) 9.4. Latin America Integration Platform as a Service Market, by Verticals (2022-2029) 9.5. European Integration Platform as a Service Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 10. Company Profile: Key players 10.1. Adaptris 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. SAP SE 10.3. Scribe Software Corporation 10.4. Oracle Corporation 10.5. Fujitsu 10.6. IBM 10.7. Mulesoft Inc 10.8. Microsoft Corporation 10.9. Boomi Inc 10.10. Celigo inc 10.11. Informatica Inc. 10.12. Jitterbit Inc. 10.13. Workato Inc. 10.14. SnapLogic Inc. 10.15. Software AG 10.16. Tibco 10.17. Celigo 10.18. Zapier 10.19. Flowgear