The Industrial Metrology Market size was valued at USD 12.17 Billion in 2024 and the total Industrial Metrology revenue is expected to grow at a CAGR of 6.2% from 2025 to 2032, reaching nearly USD 19.70 Billion.Global Industrial Metrology Market Overview:

The design and maintenance of controlled production processes in modern industry are primarily based on measurements. Metrology, the science of measurement, is essential not only in industry but in every aspect of personnel in all fields of measurement, thus metrology is essential for the development of science and technology in all countries. The need for precise dimensional analysis and validation of geometric accuracy is a primary driver of Industrial Metrology Market growth. Industries are increasingly depending on metrology equipment to ensure product quality and compliance with stringent standards. Advancements in metrology technologies, such as non-contact measurement methods and 3D scanning, are enhancing measurement accuracy and efficiency, further accelerating Industrial Metrology Market growth.To know about the Research Methodology :- Request Free Sample Report

Industrial Metrology Market Trend:

The future of industrial metrology promises a dynamic transformation characterized by digitalization, automation, and advanced technologies. As Industry 4.0 continues to evolve, metrology integrates with digital systems, leveraging IoT and cloud computing for real-time data analysis, thereby enhancing process control and enabling remote monitoring. Advanced 3D scanning and printing technologies revolutionize product design and quality control, facilitating rapid prototyping and customization. Artificial intelligence and machine learning play important roles in data analysis, predictive maintenance, and process optimization, reducing downtime and boosting efficiency. Miniaturization of metrology tools enables on-site measurements and greater flexibility, while augmented reality and virtual reality applications provide intuitive visualizations and enhance training. Sustainable practices and blockchain technology for data traceability become essential, and emerging quantum technologies enable ultra-precise measurements, setting the stage for innovation in various industries. Harmonization of metrology standards at the global level is for facilitating international trade and ensuring compatibility across diverse sectors. Together, these trends represent a promising future for industrial metrology, promoting efficiency, innovation, and quality assurance. Industrial Metrology: The Future Industrial metrology is a beneficial process that helps meet the demand for manufacturing high-quality products that comply with internationally recognized standards. The industrial metrology infrastructure enforces and confirms the accuracy and traceability criteria necessary to validate the reliability of the measurements. However, the high cost of precision equipment has hampered the maintenance of inventory consistency in various industries, necessitating manufacturers to outsource measurement needs. Thus, there is scope for cost-effective production of high-precision equipment. Industrial Metrology Impact on Economy. Industrial metrology significantly impacts the economy by enhancing product quality, reducing costs through efficient processes, and fostering innovation. It ensures compliance with international standards, facilitating global trade and market expansion. Precise measurements also enable predictive maintenance, reducing downtime and increasing productivity. Research and development benefit from metrology, leading to breakthrough innovations. Compliance with regulatory requirements is essential in industries such as aerospace and healthcare. Metrology creates export opportunities and stimulates job growth through skill development. Industrial metrology makes industries more competitive and contributes to economic growth and stability.

Industrial Metrology Market Dynamics:

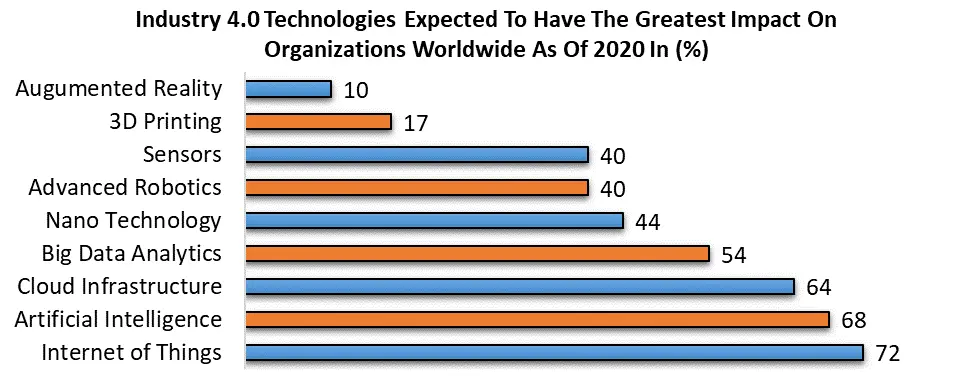

Increasing Demand for Quality Control and Inspection Boosts the Industrial Metrology Growth The industrial metrology market is growing due to the increasing demand for quality control and inspection. In today's viciously competitive business environment, prioritizing top-tier product quality is essential. Key sectors such as automotive, aerospace, manufacturing, and electronics depend extensively on industrial metrology to guarantee that their products consistently meet and uphold stringent quality standards. This proactive approach ensures product quality but also minimizes defects and costly rework, saving both time and resources. Additionally, it helps industries comply with regulatory standards and enhances customer satisfaction. The continuous advancement of technology enhances industrial metrology solutions, providing faster, more precise, and non-destructive measurement methods. This heightened sophistication intensifies the demand for these systems, solidifying their indispensable role in modern manufacturing, quality assurance, and process optimization. Increasing Automotive Industry Drives Market Growth The automotive industry is an important and enduring market for industrial metrology due to its stringent precision and quality control requirements. Automotive manufacturing relies heavily on metrology tools like coordinate measuring machines (CMMs) and laser scanners to ensure that components meet exact specifications and tolerances. With the increasing complexity of vehicle designs, metrology solutions are indispensable for measuring intricate surfaces and contours with sub-millimeter precision, allowing manufacturers to create aerodynamic and lightweight components while maintaining structural integrity. Moreover, the automotive sector's adherence to strict safety standards, including those for airbags, collision avoidance systems, and crash tests, underscores the role of metrology in guaranteeing compliance.Integration of industrial metrology processes limits the Market growth Integration of industrial metrology processes is expected to limit market growth due to high initial costs, resistance to change, technical barriers, and data management challenges. Smaller companies may find these barriers prohibitive, while compatibility issues and regulatory compliance complexities slow adoption. Additionally, the uncertainty surrounding return on investment prevents potential users. However, successful integration offers improved accuracy, efficiency, and quality control, ultimately driving market growth by enhancing product and process quality. Overcoming these limitations requires careful planning, proper training, and a focus on long-term ROI, allowing companies to compete and thrive in their industries. Industry 4.0 and Smart Manufacturing Creates Lucrative Growth Opportunities for Market Growth Industry 4.0 and Smart Manufacturing represent a transformative shift in the industrial landscape. These approaches leverage advanced technologies like IoT sensors, artificial intelligence, and big data analytics to create highly interconnected and intelligent manufacturing systems. In Industry 4.0, factories become "smart" by collecting and analyzing real-time data from machines and processes, enabling predictive maintenance, process optimization, and better decision-making. Smart Manufacturing goes beyond this, emphasizing the integration of data, communication, and collaboration across the entire value chain, from suppliers to customers. These approaches improve efficiency, reduce downtime, enhance quality control, and enable more flexible and customized production. Industrial metrology plays a pivotal role in this context by providing precise measurement data that underpins the quality and reliability of smart manufacturing processes, ensuring that products meet exact specifications in this era of data-driven production. For example, Industry 4.0 relies heavily on the Internet of Things (IoT), artificial intelligence (AI), cloud infrastructure, and big data/analytics, forming the big four technologies. IoT is on the top of the list, with nearly 72 percent of the respondents acknowledging this would be one of the most impactful industry 4.0 technologies within their organization.

Industrial Metrology Market Segment Analysis:

Based on Offering, the services segment holds the maximum share in 2024 and boost at a high CAGR in the year 2032. The industrial metrology market requires high investments to install and the lack of experts responsible for segmentation growth. As a result, major manufacturing companies are outsourcing industry metrology to reduce costs. The software segment is expected to register a significant share of the global market, due to the high cost incurred in setting up a metrology facility and the lack of metrology experts. The growing adoption of cloud-based services among manufacturing industries is also boosting the software segment. Based on Equipment, The market is categorized by equipment type CMM equipment dominate the Market in the year 2024. CMM equipment stands out as the most widely adopted choice among end-users and is expected to dominate the global market share. CMM machines come in both contact and non-contact models, featuring touch probes and spherical objects for precise measurements.These machines play a pivotal role in the manufacturing industry accurately measuring and recording the physical-geometrical characteristics of objects. The increasing demand for precision dimensional analysis and validation of geometric accuracy across various sectors, including manufacturing, aerospace, and automotive, is propelling the growth of this segment. In essence, CMM equipment serves as an indispensable tool in meeting the exacting standards of these industries, fueling its market prominence.

Industrial Metrology Market Regional Insight

North American region holds a significant share of the global Industrial Metrology Market in the year 2024. The industrial metrology market's propulsion is attributed to advanced manufacturing sectors, encompassing aerospace, automotive, and electronics. The United States and Canada highest growth in this region, emphasizing stringent quality control and precision measurement within manufacturing operations. However, The Asia Pacific region emerged as the fastest-growing hub for industrial metrology. This surge in demand is largely attributed to the thriving manufacturing landscapes in nations like China, Japan, South Korea, and India. The relentless growth of these sectors has heightened the need for precise measurement and quality assurance processes, elevating the significance of industrial metrology. Consequently, the Asia Pacific region has become a focal point for the industry, with expanding opportunities and an ever-increasing demand for metrology solutions in these flourishing manufacturing economies. The region has seen increased investments in metrology equipment to enhance product quality and manufacturing efficiency.Industrial Metrology Ecosystem

Competitive Landscape:

The global Industrial Metrology market is highly competitive. The report provides a comprehensive analysis of the key players in the Global Industrial Metrology Market. The Major players in the market are focusing on mergers and acquisitions to innovate the products and maintain sustainability. Also, the key players rising focus on partnerships and investment to expand the product portfolio. As the industrial metrology market evolves, players are increasingly focusing on non-contact measurement methods, Industry 4.0 integration, and expanding into emerging markets. To boom in a competitive area, commitment to innovation, adherence to regulations, and adaptability to changing markets are crucial. Extensive R&D investments keep leaders ahead in technology. Pricing strategies, marketing efforts, and customer support help in their competitiveness. Moreover, strategic partnerships and acquisitions contribute to their growth and diversification.Industrial Metrology Market Scope: Inquire before buying

Industrial Metrology Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 12.17 Bn. Forecast Period 2025 to 2032 CAGR: 6.2% Market Size in 2032: USD 19.70 Bn. Segments Covered: by Offering Hardware Software Services by Equipment Type Coordinate Measuring Machine Optical Digitizer and Scanner Measuring Instrument X-Ray and Computed Tomography Automated Optical Inspection 2D Equipment by Application Reverse Engineering Quality Control & Inspection Mapping and Modelling Other Applications by End-User Aerospace and Defense Automotive Manufacturing Semiconductor Other End User Industries Industrial Metrology Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Industrial Metrology Market Key Players

1. Hexagon AB (Sweden) 2. Renishaw PLC (UK) 3. FARO Technologies (US) 4. Carl Zeiss AG (Germany) 5. Nikon (Japan) 6. Jenoptik (Germany) 7. KLA Corporation (US) 8. Mitutoyo Corporation (Japan) 9. Automated Precision Inc 10. Baker Hughes (US) 11. CyberOptics (US) 12. Cairnhill Metrology (Singapore) 13. ATT Metrology Services (US) 14. SGS Group (Switzerland) 15. TriMet (US) 16. Applied Materials Inc. (US) Frequently Asked Questions: 1] What segments are covered in the Global Industrial Metrology Market report? Ans. The segments covered in the Industrial Metrology Market report are based on Offering, Equipment Type, Application, End User, and Regions. 2] Which region is expected to hold the highest share in the Global Industrial Metrology Market? Ans. The North American region is expected to hold the highest share of the Industrial Metrology Market. 3] What was the Global Industrial Metrology Market size in 2024? Ans: The Global Industrial Metrology Market size was USD 12.17 Billion in 2024. 4] What is the forecast period for the Global Industrial Metrology Market? Ans. The forecast period for the Industrial Metrology Market is 2025-2032. 5] What is the market size of the Global Industrial Metrology Market in 2032? Ans. The market size of the Industrial Metrology Market in 2032 is valued at USD 19.70 Bn.

1. Industrial Metrology Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Industrial Metrology Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Product Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Payment Methods Market Analysis by Organized Players vs. Unorganized Players 2.3.6. Organized Players 2.3.7. Unorganized Players 2.4. Leading Industrial Metrology Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Industrial Metrology Market: Dynamics 3.1. Industrial Metrology Market Trends 3.2. Industrial Metrology Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For the Industrial Metrology Industry 3.8. Analysis of Government Schemes and Initiatives For the Industrial Metrology Industry 3.9. Industrial Metrology Ecosystem Analysis 4. Industrial Metrology Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 4.1.1. Hardware 4.1.2. Software 4.1.3. Services 4.2. Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 4.2.1. Coordinate Measuring Machine 4.2.2. Optical Digitizer and Scanner 4.2.3. Measuring Instrument 4.2.4. X-Ray and Computed Tomography 4.2.5. Automated Optical Inspection 4.2.6. 2D Equipment 4.3. Industrial Metrology Market Size and Forecast, by Application (2024-2032) 4.3.1. Reverse Engineering 4.3.2. Quality Control & Inspection 4.3.3. Mapping and Modelling 4.3.4. Others 4.4. Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 4.4.1. Aerospace and Defense 4.4.2. Automotive 4.4.3. Manufacturing 4.4.4. Semiconductor 4.4.5. Others 4.5. Industrial Metrology Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Industrial Metrology Market Size and Forecast by Segmentation (by Value in USD Billion ) (2024-2032) 5.1. North America Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 5.1.1. Hardware 5.1.2. Software 5.1.3. Services 5.2. North America Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 5.2.1. Coordinate Measuring Machine 5.2.2. Optical Digitizer and Scanner 5.2.3. Measuring Instrument 5.2.4. X-Ray and Computed Tomography 5.2.5. Automated Optical Inspection 5.2.6. 2D Equipment 5.3. North America Industrial Metrology Market Size and Forecast, by Application (2024-2032) 5.3.1. Reverse Engineering 5.3.2. Quality Control & Inspection 5.3.3. Mapping and Modelling 5.3.4. Others 5.4. North America Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 5.4.1. Aerospace and Defense 5.4.2. Automotive 5.4.3. Manufacturing 5.4.4. Semiconductor 5.4.5. Others 5.5. North America Industrial Metrology Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 5.5.1.1.1. Hardware 5.5.1.1.2. Software 5.5.1.1.3. Services 5.5.1.2. United States Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 5.5.1.2.1. Coordinate Measuring Machine 5.5.1.2.2. Optical Digitizer and Scanner 5.5.1.2.3. Measuring Instrument 5.5.1.2.4. X-Ray and Computed Tomography 5.5.1.2.5. Automated Optical Inspection 5.5.1.2.6. 2D Equipment 5.5.1.3. United States Industrial Metrology Market Size and Forecast, by Application (2024-2032) 5.5.1.3.1. Reverse Engineering 5.5.1.3.2. Quality Control & Inspection 5.5.1.3.3. Mapping and Modelling 5.5.1.3.4. Others 5.5.1.4. United States Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 5.5.1.4.1. Aerospace and Defense 5.5.1.4.2. Automotive 5.5.1.4.3. Manufacturing 5.5.1.4.4. Semiconductor 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 5.5.2.1.1. Hardware 5.5.2.1.2. Software 5.5.2.1.3. Services 5.5.2.2. Canada Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 5.5.2.2.1. Coordinate Measuring Machine 5.5.2.2.2. Optical Digitizer and Scanner 5.5.2.2.3. Measuring Instrument 5.5.2.2.4. X-Ray and Computed Tomography 5.5.2.2.5. Automated Optical Inspection 5.5.2.2.6. 2D Equipment 5.5.2.3. Canada Industrial Metrology Market Size and Forecast, by Application (2024-2032) 5.5.2.3.1. Reverse Engineering 5.5.2.3.2. Quality Control & Inspection 5.5.2.3.3. Mapping and Modelling 5.5.2.3.4. Others 5.5.2.4. Canada Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 5.5.2.4.1. Aerospace and Defense 5.5.2.4.2. Automotive 5.5.2.4.3. Manufacturing 5.5.2.4.4. Semiconductor 5.5.2.4.5. Others 5.5.3. Mexico 5.5.3.1. Mexico Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 5.5.3.1.1. Hardware 5.5.3.1.2. Software 5.5.3.1.3. Services 5.5.3.2. Mexico Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 5.5.3.2.1. Coordinate Measuring Machine 5.5.3.2.2. Optical Digitizer and Scanner 5.5.3.2.3. Measuring Instrument 5.5.3.2.4. X-Ray and Computed Tomography 5.5.3.2.5. Automated Optical Inspection 5.5.3.2.6. 2D Equipment 5.5.3.3. Mexico Industrial Metrology Market Size and Forecast, by Application (2024-2032) 5.5.3.3.1. Reverse Engineering 5.5.3.3.2. Quality Control & Inspection 5.5.3.3.3. Mapping and Modelling 5.5.3.3.4. Others 5.5.3.4. Mexico Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 5.5.3.4.1. Aerospace and Defense 5.5.3.4.2. Automotive 5.5.3.4.3. Manufacturing 5.5.3.4.4. Semiconductor 5.5.3.4.5. Others 6. Europe Industrial Metrology Market Size and Forecast by Segmentation (by Value in USD Billion ) (2024-2032) 6.1. Europe Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 6.2. Europe Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 6.3. Europe Industrial Metrology Market Size and Forecast, by Application (2024-2032) 6.4. Europe Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 6.5. Europe Industrial Metrology Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 6.5.1.2. United Kingdom Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 6.5.1.3. United Kingdom Industrial Metrology Market Size and Forecast, by Application (2024-2032) 6.5.1.4. United Kingdom Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 6.5.2. France 6.5.2.1. France Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 6.5.2.2. France Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 6.5.2.3. France Industrial Metrology Market Size and Forecast, by Application (2024-2032) 6.5.2.4. France Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 6.5.3.2. Germany Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 6.5.3.3. Germany Industrial Metrology Market Size and Forecast, by Application (2024-2032) 6.5.3.4. Germany Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 6.5.4.2. Italy Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 6.5.4.3. Italy Industrial Metrology Market Size and Forecast, by Application (2024-2032) 6.5.4.4. Italy Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 6.5.5.2. Spain Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 6.5.5.3. Spain Industrial Metrology Market Size and Forecast, by Application (2024-2032) 6.5.5.4. Spain Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 6.5.6.2. Sweden Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 6.5.6.3. Sweden Industrial Metrology Market Size and Forecast, by Application (2024-2032) 6.5.6.4. Sweden Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 6.5.7.2. Austria Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 6.5.7.3. Austria Industrial Metrology Market Size and Forecast, by Application (2024-2032) 6.5.7.4. Austria Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 6.5.8.2. Rest of Europe Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 6.5.8.3. Rest of Europe Industrial Metrology Market Size and Forecast, by Application (2024-2032) 6.5.8.4. Rest of Europe Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 7. Asia Pacific Industrial Metrology Market Size and Forecast by Segmentation (by Value in USD Billion ) (2024-2032) 7.1. Asia Pacific Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 7.2. Asia Pacific Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 7.3. Asia Pacific Industrial Metrology Market Size and Forecast, by Application (2024-2032) 7.4. Asia Pacific Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 7.5. Asia Pacific Industrial Metrology Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 7.5.1.2. China Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 7.5.1.3. China Industrial Metrology Market Size and Forecast, by Application (2024-2032) 7.5.1.4. China Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 7.5.2.2. S Korea Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 7.5.2.3. S Korea Industrial Metrology Market Size and Forecast, by Application (2024-2032) 7.5.2.4. S Korea Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 7.5.3.2. Japan Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 7.5.3.3. Japan Industrial Metrology Market Size and Forecast, by Application (2024-2032) 7.5.3.4. Japan Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 7.5.4. India 7.5.4.1. India Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 7.5.4.2. India Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 7.5.4.3. India Industrial Metrology Market Size and Forecast, by Application (2024-2032) 7.5.4.4. India Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 7.5.5.2. Australia Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 7.5.5.3. Australia Industrial Metrology Market Size and Forecast, by Application (2024-2032) 7.5.5.4. Australia Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 7.5.6. ASEAN 7.5.6.1. ASEAN Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 7.5.6.2. ASEAN Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 7.5.6.3. ASEAN Industrial Metrology Market Size and Forecast, by Application (2024-2032) 7.5.6.4. ASEAN Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 7.5.7. Rest of Asia Pacific 7.5.7.1. Rest of Asia Pacific Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 7.5.7.2. Rest of Asia Pacific Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 7.5.7.3. Rest of Asia Pacific Industrial Metrology Market Size and Forecast, by Application (2024-2032) 7.5.7.4. Rest of Asia Pacific Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 8. Middle East and Africa Industrial Metrology Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 8.2. Middle East and Africa Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 8.3. Middle East and Africa Industrial Metrology Market Size and Forecast, by Application (2024-2032) 8.4. Middle East & Africa Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 8.5. Middle East and Africa Industrial Metrology Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 8.5.1.2. South Africa Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 8.5.1.3. South Africa Industrial Metrology Market Size and Forecast, by Application (2024-2032) 8.5.1.4. South Africa Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 8.5.2.2. GCC Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 8.5.2.3. GCC Industrial Metrology Market Size and Forecast, by Application (2024-2032) 8.5.2.4. GCC Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 8.5.3.2. Nigeria Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 8.5.3.3. Nigeria Industrial Metrology Market Size and Forecast, by Application (2024-2032) 8.5.3.4. Nigeria Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 8.5.4.2. Rest of ME&A Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 8.5.4.3. Rest of ME&A Industrial Metrology Market Size and Forecast, by Application (2024-2032) 8.5.4.4. Rest of ME&A Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 9. South America Industrial Metrology Market Size and Forecast by Segmentation (by Value in USD Billion ) (2024-2032 9.1. South America Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 9.2. South America Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 9.3. South America Industrial Metrology Market Size and Forecast, by Application (2024-2032) 9.4. South America Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 9.5. South America Industrial Metrology Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 9.5.1.2. Brazil Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 9.5.1.3. Brazil Industrial Metrology Market Size and Forecast, by Application (2024-2032) 9.5.1.4. Brazil Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 9.5.2.2. Argentina Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 9.5.2.3. Argentina Industrial Metrology Market Size and Forecast, by Application (2024-2032) 9.5.2.4. Argentina Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Industrial Metrology Market Size and Forecast, by Offering (2024-2032) 9.5.3.2. Rest Of South America Industrial Metrology Market Size and Forecast, by Equipment Type (2024-2032) 9.5.3.3. Rest Of South America Industrial Metrology Market Size and Forecast, by Application (2024-2032) 9.5.3.4. Rest of South America Industrial Metrology Market Size and Forecast, by End-User (2024-2032) 10. Company Profile: Key Players 10.1. Hexagon AB 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Details on Partnership 10.1.7. Regulatory Accreditations and Certifications Received 10.1.8. Awards Received 10.1.9. Recent Developments 10.2. Renishaw PLC 10.3. FARO Technologies 10.4. Carl Zeiss AG 10.5. Nikon 10.6. Jenoptik 10.7. KLA Corporation 10.8. Mitutoyo Corporation 10.9. Automated Precision Inc 10.10. Baker Hughes 10.11. CyberOptics 10.12. Cairnhill Metrology 10.13. ATT Metrology Services 10.14. SGS Group 10.15. TriMet 10.16. Applied Materials Inc. 11. Key Findings 12. Analyst Recommendations 13. Industrial Metrology Market: Research Methodology