In Wheel Motor Market size was valued at USD 1598.90 Mn. in 2023 and the total In-Wheel Motor revenue is expected to grow by 40.5% from 2024 to 2030, reaching nearly USD 17280.4 Mn.In Wheel Motor Market Overview:

The in-wheel motor is a type of EV (electric vehicle) propulsion system. Traditional EVs have a design that replaces the gasoline engine with an electric motor. The In-wheel motor EV, on the other hand, places motors immediately around each of the driving wheels to directly power the wheels. In addition to high accelerator responsiveness, which is a benefit of EVs, the in-wheel motor makes the car's behavior more in tune with the steering by separately managing the left and right wheels. When accelerating or turning, the automobile travels instinctively in the direction the driver wishes. One of the primary benefits of in-wheel motors is that they allow for more packaging space on the vehicle platform. From retrofits to new vehicle designs, the ability to add batteries, range extenders, or simply maintain luggage and passenger capacity gives all types of in-wheel motors a significant competitive edge over more traditional electrical machines. This benefit must be maintained by not having to shift the friction brake to a point on the vehicle's sprung mass, therefore both motors and brakes must be accommodated inside the wheels of a vehicle.Report Scope:

The report provides in-depth data on the strategies of the industry's leading corporations, as well as a thorough examination of the various market segments and geographies. The Global In Wheel Motor Market Share report examines the global market as well as growth trends, competitive landscape analysis, and regional development status. Policies and development plans are examined, as are manufacturing processes and cost structures. Figures for import/export consumption, supply and demand, cost, price, revenue, and gross margins are also included in this report. The report majority focused on the market's drivers, constraints, opportunities, and challenges and also supports the adjustment and resolution of problems with the global In Wheel Motor Market environment. External and internal market factors that are expected to have a positive or negative influence on the market have been analyzed, presenting decision-makers with a clear picture of the business's future. The research also supports understanding the trends and structure of the In Wheel Motor Market by researching market segments and estimating the In Wheel Motor Market size.To know about the Research Methodology:-Request Free Sample Report

Research Methodology:

The In Wheel Motor Market report highly depends on both primary and secondary data sources. The research process involves the investigation of various factors affecting the industry, such as government policy, market environment, competitive landscape, historical data, current market trends, technological innovation, upcoming technologies, and the technical progress in related industries, as well as market risks, opportunities, market barriers, and challenges. All conceivable elements influencing the markets included in this research study have been considered, examined in depth, validated through primary research, and evaluated to provide the final quantitative and qualitative data. The market size for top-level markets and sub-segments is normalized, and the impact of inflation, economic downturns, policy changes and other variables is factored into the market forecast. Extensive primary research was conducted to acquire information and verify and confirm the crucial numbers arrived at after comprehensive market engineering and calculations for market statistics; market size estimations; market forecasts; market breakdown; and data triangulation. The bottom-up technique is widely utilized in the whole market engineering process, along with multiple data triangulation methodologies, to perform market estimation and forecasting for the overall market segments and sub-segments covered in this research.In Wheel Motor Market Dynamics:

The rising demand for Electric vehicles across the globe is a key driver for market growth. A well-functioning and effective transportation sector is essential for economic and social growth since it brings people together and allows for the commerce and interchange of commodities and ideas. Concerns about the finite availability of fossil-based fuels are driving a surge of interest in alternate road transportation propulsion technologies. Furthermore, legislative constraints to minimize urban pollution, CO2 emissions, and city noise have made plug-in electric vehicles an appealing option to internal combustion engines. The market for electric automobiles is growing exponentially. Despite the conventional automobile market being plagued by the COVID-19 outbreak, which resulted in negative growth, global EV sales increased by 38% in 2020 compared to 2019. Factors such as rising demand for low-emission vehicles and government policies encouraging long-range, zero-emission vehicles through subsidies and tax breaks have driven manufacturers to offer electric vehicles globally. As electric vehicle sales grow, so does the need for electric vehicle parts and components and driving the growth of the market. Continuous changes in OEM Vehicle Strategy for boosting the Electrical Vehicles sales driving the market growth. Several big OEMs have made strategic commitments to EVs in the last year. New models have been launched, manufacturing objectives have been boosted, and sales targets have been advanced and doubled. COVID-19 affected certain OEMs' capacity to achieve these objectives in the short term, as they preserve cash and redirect expenditures elsewhere in the company. However, the organizations anticipate that these goals would remain the top priority for OEMs in the long term. The impact of the investment and objectives will reflect a seismic market change in terms of model availability and affordability over the next decade. Rise in unsprung strain in the wheel restraining the market growth. To improve ride comfort, automakers aim to keep the vehicle's unsprung mass to a minimum. The utilization of in-wheel motor technology in an automobile increases unsprung weight, which can reduce ride comfort. The weight of the suspension, brakes, bearings, wheels or tracks, and a few additional components immediately related to the wheel are all included in the unsprung weight or mass. The weight of components such as wheel axles, wheel bearings, wheel hubs, tires, and a fraction of the weight of driveshafts, springs, shock absorbers, and suspension links is also included in the unsprung weight. If the vehicle's brakes are mounted on the wheel, which is directly susceptible to unsprung weight, the wheel's stress would increase. As a result, the increase in unsprung weight may restrict the use of in-wheel motor technology in automobiles. An increase in the number of failures is a major challenge for market growth. Rising failure rates are one of the primary concerns that might hamper the growth of in-wheel motors. Due to motor failures in its electric buses, Hyundai Motor decided to cease the usage of in-wheel motors. On several occasions, Hyundai's in-wheel motor has encountered rotor wear and dissimilarity. According to the manufacturer, the moderator gear in the in-wheel motor was broken, resulting in metal powder generated by wear or dissimilarity. It was often noticed in certain automobiles, forcing them to come to a halt while traveling. Hyundai Motor subsequently recalled its 253 "Elec-city" electric buses manufactured and marketed between November 2018 and February 2020. From March 2021, the organization discontinue the usage of in-wheel motors and transition the power system of electric buses from an in-wheel motor to a standard electric motor.In Wheel Motor Market Segment Analysis:

By Propulsion, the hybrid electric vehicle (HEV) segment held the largest market share of about xx% in 2023 and is expected to grow significantly during the forecast period. To increase the efficiency of traditional vehicle designs, hybrid and plug-in electric vehicles utilize electricity as their primary fuel. This new generation of vehicles, known as electric drive vehicles, may be classified into three types: hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and all-electric vehicles (EVs). They have a huge potential to reduce petroleum usage when combined, and major players are manufacturing this vehicle type. This segment's growth is expected to increase during the forecast period because of the large manufacturing of this vehicle type.HEVs are driven by an internal combustion engine or another propulsion source that uses conventional or alternative fuel, as well as an electric motor that draws energy from a battery. Because of the increased power offered by the electric motor, the engine may be smaller, resulting in higher fuel efficiency without compromising performance. HEVs combine the advantages of low emissions and great fuel efficiency with the power and range of conventional vehicles. Electric Vehicles with Plug-In Hybrid Technology (PHEVs) run on conventional fuels as well as electrical energy stored in a battery. When compared to traditional automobiles, using power from the grid to charge the battery portion of the time costs less and reduces petroleum use. Depending on the electrical source, PHEVs can potentially lower emissions. By Motor Type, The Axial Flux Motor segment held the largest market share of the market and is expected to grow at a CAGR of xx% during the forecast period. Due to its high torque density, efficiency, and power factor, the Permanent Magnet (PM) motor has found several applications in industries and has become a hotspot in power electronics drives. Recently, the topologies of PM machines have mostly been characterized as radial flux PM machines and axial flux PM machines. The axial flux machine offers various benefits over the radial flux machine, including higher torque density, better heat removal, and a more compact design, and these advantages are amplified when the aspect ratio is small. Because of space restrictions in various driving systems, the axial flux machine is regarded as one of the finest candidates.

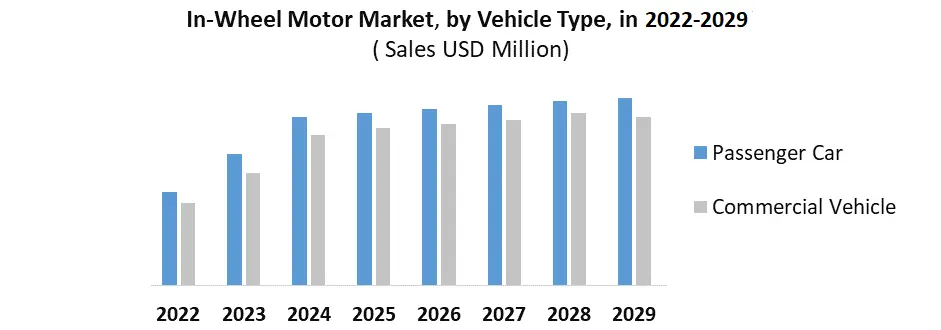

The axial flux motor has a higher power density and efficiency than the Radial Flux Motor. It is small and may be installed in or near each tire of the vehicle. It is mostly utilized in high-torque, low-speed applications. Axial flux motors are small, light, and efficient. They are utilized to boost output torque and efficiency and can be used as straight drives in electric vehicles. When compared to a radial flux motor, the production and assembly processes are straightforward. As a result, the segment would continue to dominate the market during the forecast period. By Vehicle Type, the Passenger Car segment dominated the In Wheel Motor Market in 2023 with the largest market share of about xx% and is expected to maintain its dominance at the end of the forecast period. The rising use of in-wheel motors in passenger vehicles may be associated with factors such as increased efficiency, high torque, higher power, and improved vehicle control in both new and existing vehicles. Most EV manufacturers are concentrating on increasing total driving range, reducing weight, and optimizing vehicle design. Using in-wheel motors, EV manufacturers can assure optimal space use as well as enhanced power efficiency. Tier 1 organizations, in addition to EV manufacturers, are interested in increasing the performance of electric vehicles in terms of weight, driving range, space, and overall handling. As a result, the passenger vehicle segment would continue to dominate during the forecast period.

In Wheel Motor Market Regional Insights:

The Asia-Pacific regional market held the largest market share of about xx% and dominated the market in 2023 and is expected to maintain its dominance at the end of the forecast period. The rapid surge in electric vehicle sales in countries such as China and Japan, Rapid Urbanization, and rising demand for environmentally friendly transportation solutions in emerging economies like India and China are driving the growth of the In Wheel Motor Market since in-wheel motors are utilized in electric vehicles. The increase in the urban population in cities, along with rising per capita income, is providing a stimulant for the use of electric vehicles and driving the growth of the In Wheel Motor Market throughout the forecast period. Key competitors such as Protean Electric and Elaphe are already continuing to expand their position in China, due to the large EV market in the country. The emerging economies are trying to improve their automotive sectors through a variety of methods, including direct and indirect government influence through creative policies and trade liberalization programs. Government initiatives towards investment liberalization gave considerable benefits to the targeted nations as private players stepped in with contemporary technology and FDI started pouring in mostly via the hands of Japanese car manufacturers. Thailand is a major Asian automobile manufacturing country. Japanese FDI is the primary driver of the sector. The Chinese automobile sector is rapidly increasing and prepared to have a significant impact on the global trading market very soon, with a particularly strong position in the component sector. India, on the other hand, is strengthening its position as a result of robust internal and overseas demand. The Indonesian automobile sector is mostly an assembly business controlled by large Japanese automakers, but it is growing its exports. The European market is expected to grow rapidly during the forecast period, because of the largest EV sales in recent years. In addition, stringent emission rules and regulations, as well as huge expenditures by significant vehicle OEMs to meet the region's demands for fuel-efficient and lightweight automobiles drive the regional growth. Additionally, due to the high volume of traffic in cities, there are an increasing number of extra requirements for maintaining air quality and noise pollution. To protect human health from dangerous pollutants, several European cities established environmental zones that only allow vehicles that satisfy specified emission criteria to enter. Germany, the United Kingdom, and other European countries primarily regulate the market. Europe also has major in-wheel motor manufacturers, which boosts the market growth.In Wheel Motor Market Scope: Inquire before buying

In Wheel Motor Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1598.90 Mn. Forecast Period 2024 to 2030 CAGR: 40.5% Market Size in 2030: US $ 17280.4 Mn. Segments Covered: by Propulsion BEV FCEV HEV PHEV by Vehicle Type Passenger Car Commercial Vehicle by Motor Type Axial Flux Motor Radial Flux Motor by Cooling Type Air-cooled Liquid-cooled by Power Output Type Up to 60 KW 60–90 KW Above 90 KW by Vehicle Class Mid-priced Luxury by Motor Weight Less than 20 Kg 20-30 Kg Above 30 Kg In Wheel Motor Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Manufacturers in the Global In Wheel Motor Market are:

1. General Motors (US) 2. Tesla (US) 3. The Orbis Ring Drive Wheel (US) 4. ORBIS Wheels, Inc. (US) 5. BYD Motors LLC (US) 6. DANA TM4 INC. (Canada) 7. YASA Limited (UK) 8. PMW Dynamics (UK) 9. Protean Electric (UK) 10.ECOmove GmbH (Germany) 11.Bayerische Motoren Werke AG (Germany) 12.Volkswagen AG (Germany) 13.Schaeffler AG (Germany) 14.Ziehl-Abegg SE (Germany) 15.ELAPHE LTD. (Slovenia) 16.GEM motors d.o.o. (Slovenia) 17.NSK Ltd. (Japan) 18.NTN Corporation (Japan) 19.Toyota Motor Corporation (Japan) 20.TAJIMA MOTOR CORPORATION (Japan) 21.Nissan Motor Corporation (Japan) 22.Honda Motor Co., Ltd. (Japan) 23.HYUNDAI MOTOR GROUP (South Korea) FAQs: 1. Which is the potential market for the In Wheel Motor in terms of the region? Ans. APAC region is the potential market for In-Wheel motors in terms of the region. 2. What are the challenges for new market entrants? Ans. An increase in the number of failures is a major challenge for market growth. 3. What is expected to drive the growth of the In Wheel Motor Market in the forecast period? Ans. The rising demand for Electric vehicles across the globe is a key driver of market growth 4. What is the projected market size & growth rate of the In Wheel Motor Market? Ans. In Wheel Motor Market size was valued at USD 1598.90 Mn. in 2023 and the total In-Wheel Motor revenue is expected to grow by 40.5% from 2024 to 2030, reaching nearly USD 17280.4 Mn. 5. What segments are covered in the In Wheel Motor Market report? Ans. The segments covered are Propulsion, Vehicle Type, Motor Type, Cooling Type, Power Output Type, Vehicle Class, Motor Weight, and Region.

1. Global In Wheel Motor Market: Research Methodology 2. Global In Wheel Motor Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global In Wheel Motor Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global In Wheel Motor Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global In Wheel Motor Market Segmentation 4.1 Global In Wheel Motor Market, by Propulsion (2023-2030) • BEV • FCEV • HEV • PHEV 4.2 Global In Wheel Motor Market, by Vehicle Type (2023-2030) • Passenger Car • Commercial Vehicle 4.3 Global In Wheel Motor Market, by Motor Type (2023-2030) • Axial Flux Motor • Radial Flux Motor 4.4 Global In Wheel Motor Market, by Cooling Type (2023-2030) • Air-cooled • Liquid-cooled 4.5 Global In Wheel Motor Market, by Power Output Type (2023-2030) • Up to 60 KW • 60–90 KW • Above 90 KW 4.6 Global In Wheel Motor Market, by Vehicle Class (2023-2030) • Mid-priced • Luxury 4.7 Global In Wheel Motor Market, by Motor Weight (2023-2030) • Less than 20 Kg • 20-30 Kg • Above 30 Kg 5. North America In Wheel Motor Market(2023-2030) 5.1 North America In Wheel Motor Market, by Propulsion (2023-2030) • BEV • FCEV • HEV • PHEV 5.2 North America In Wheel Motor Market, by Vehicle Type (2023-2030) • Passenger Car • Commercial Vehicle 5.3 North America In Wheel Motor Market, by Motor Type (2023-2030) • Axial Flux Motor • Radial Flux Motor 5.4 North America In Wheel Motor Market, by Cooling Type (2023-2030) • Air-cooled • Liquid-cooled 5.5 North America In Wheel Motor Market, by Power Output Type (2023-2030) • Up to 60 KW • 60–90 KW • Above 90 KW 5.6 North America In Wheel Motor Market, by Vehicle Class (2023-2030) • Mid-priced • Luxury 5.7 North America In Wheel Motor Market, by Motor Weight (2023-2030) • Less than 20 Kg • 20-30 Kg • Above 30 Kg 5.8 North America In Wheel Motor Market, by Country (2023-2030) • United States • Canada • Mexico 6 Europe In Wheel Motor Market (2023-2030) 6.1. European In Wheel Motor Market, by Propulsion (2023-2030) 6.2. European In Wheel Motor Market, by Vehicle Type (2023-2030) 6.3. European In Wheel Motor Market, by Motor Type (2023-2030) 6.4. European In Wheel Motor Market, by Cooling Type (2023-2030) 6.5. European In Wheel Motor Market, by Power Output Type (2023-2030) 6.6. European In Wheel Motor Market, by Vehicle Class (2023-2030) 6.7. European In Wheel Motor Market, by Motor Weight (2023-2030) 6.8. European In Wheel Motor Market, by Country (2023-2030) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7 Asia Pacific In Wheel Motor Market (2023-2030) 7.1. Asia Pacific In Wheel Motor Market, by Propulsion (2023-2030) 7.2. Asia Pacific In Wheel Motor Market, by Vehicle Type (2023-2030) 7.3. Asia Pacific In Wheel Motor Market, by Motor Type (2023-2030) 7.4. Asia Pacific In Wheel Motor Market, by Cooling Type (2023-2030) 7.5. Asia Pacific In Wheel Motor Market, by Power Output Type (2023-2030) 7.6. Asia Pacific In Wheel Motor Market, by Vehicle Class (2023-2030) 7.7. Asia Pacific In Wheel Motor Market, by Motor Weight (2023-2030) 7.8. Asia Pacific In Wheel Motor Market, by Country (2023-2030) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8 Middle East and Africa In Wheel Motor Market (2023-2030) 8.1 Middle East and Africa In Wheel Motor Market, by Propulsion (2023-2030) 8.2. Middle East and Africa In Wheel Motor Market, by Vehicle Type (2023-2030) 8.3. Middle East and Africa In Wheel Motor Market, by Motor Type (2023-2030) 8.4. Middle East and Africa In Wheel Motor Market, by Cooling Type (2023-2030) 8.5. Middle East and Africa In Wheel Motor Market, by Power Output Type (2023-2030) 8.6. Middle East and Africa In Wheel Motor Market, by Vehicle Class (2023-2030) 8.7. Middle East and Africa In Wheel Motor Market, by Motor Weight (2023-2030) 8.8. Middle East and Africa In Wheel Motor Market, by Country (2023-2030) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9 South America In Wheel Motor Market (2023-2030) 9.1. South America In Wheel Motor Market, by Propulsion (2023-2030) 9.2. South America In Wheel Motor Market, by Vehicle Type (2023-2030) 9.3. South America In Wheel Motor Market, by Motor Type (2023-2030) 9.4. South America In Wheel Motor Market, by Cooling Type (2023-2030) 9.5. South America In Wheel Motor Market, by Power Output Type (2023-2030) 9.6. South America In Wheel Motor Market, by Vehicle Class (2023-2030) 9.7. South America In Wheel Motor Market, by Motor Weight (2023-2030) 9.8. South America In Wheel Motor Market, by Country (2023-2030) • Brazil • Argentina • Rest Of South America 10 Company Profile: Key players 10.1 General Motors (US) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Tesla (US) 10.3. The Orbis Ring Drive Wheel (US) 10.4. ORBIS Wheels, Inc. (US) 10.5. BYD Motors LLC (US) 10.6. DANA TM4 INC. (Canada) 10.7. YASA Limited (UK) 10.8. PMW Dynamics (UK) 10.9. Protean Electric (UK) 10.10. ECOmove GmbH (Germany) 10.11. Bayerische Motoren Werke AG (Germany) 10.12. Volkswagen AG (Germany) 10.13. Schaeffler AG (Germany) 10.14. Ziehl-Abegg SE (Germany) 10.15. ELAPHE LTD. (Slovenia) 10.16. GEM motors d.o.o. (Slovenia) 10.17. NSK Ltd. (Japan) 10.18. NTN Corporation (Japan) 10.19. Toyota Motor Corporation (Japan) 10.20. TAJIMA MOTOR CORPORATION (Japan) 10.21. Nissan Motor Corporation (Japan) 10.22. Honda Motor Co., Ltd. (Japan) 10.23. HYUNDAI MOTOR GROUP (South Korea)