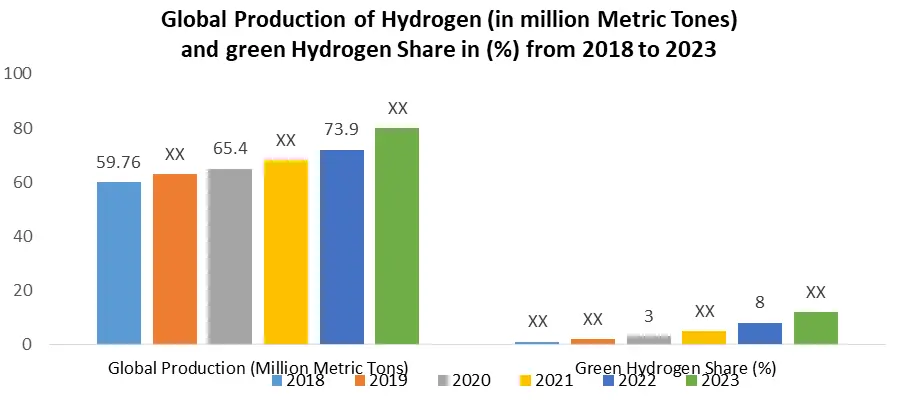

Global Hydrogen Generator Market size was valued at USD 131.5 Bn in 2023 and is expected to reach USD 156.4 Bn by 2030, at a CAGR of 8.1 %. A hydrogen generator is a device designed to produce hydrogen gas (H2) from various feedstocks. The process typically involves the electrolysis of water or the reforming of hydrocarbons, such as natural gas or methanol. Electrolysis utilizes an electric current to split water into hydrogen and oxygen, while reforming involves extracting hydrogen from hydrocarbon molecules. The generated hydrogen can be used as a clean fuel for various applications, including fuel cells, industrial processes, and transportation.To know about the Research Methodology:-Request Free Sample Report One major driver of the Hydrogen Generator Market is the global shift towards sustainable and clean energy solutions, particularly in the form of green hydrogen. Governments, industries, and investors are increasingly prioritizing the reduction of carbon emissions and embracing environmentally friendly practices. Green hydrogen, produced through the electrolysis of water using renewable energy sources like solar or wind, aligns with these sustainability goals. As the world seeks to transition away from fossil fuels and reduce its carbon footprint, the demand for hydrogen generators, especially those facilitating the production of green hydrogen, experiences substantial growth. This driver reflects the broader commitment to a cleaner energy future, positioning hydrogen generators as essential components in the global pursuit of renewable and low-carbon energy sources. Air Liquide, a major player in the Hydrogen Generator Market, is significantly advancing the landscape through ambitious endeavors in green hydrogen production. In a monumental move in September 2023, the company unveiled a substantial €433 million investment to construct the Normandy electrolyzer, boasting an impressive 200 MW capacity. This project, surpassing their previous largest electrolyzer by eightfold, underscores Air Liquide's dedication to decarbonizing heavy industries and enhancing mobility in Normandy. The sheer magnitude of Normandy is noteworthy, with an estimated annual production of 20,000 tons of green hydrogen. This volume can power 45,000 hydrogen vehicles or facilitate the decarbonisation of around 300 industrial sites, contributing to a substantial 20% reduction in CO2 emissions within the targeted region a significant stride towards a cleaner future. Beyond its size, Air Liquid’s impact extends to technological innovation with a focus on making green hydrogen more economically viable. Collaborating with Siemens Energy to manufacture PEM electrolysers at scale, Air Liquid aims to substantially lower costs, enabling broader adoption across diverse sectors. This emphasis on affordability addresses a crucial challenge in the Hydrogen Generator Market, where high production costs often impede widespread adoption. Air Liquid’s efforts in cost reduction could prove pivotal, fostering a more inclusive and dynamic hydrogen ecosystem. The Normandy project and Air Liquid’s technological advancements position them as a driving force in the growth of the Hydrogen Generator Market, promising a surge in hydrogen-powered solutions across industries and propelling us towards a cleaner and sustainable future.

Hydrogen Generator Market Driver

Green Hydrogen Revolution Sparks Unprecedented Growth in Hydrogen Generator Market The Hydrogen Generator Market is witnessing a significant surge propelled by global eco-friendly aspirations and net-zero goals. Governments, industries, and investors are increasingly embracing hydrogen as a clean energy solution to align with ambitious sustainability targets. The shift towards green hydrogen production, utilizing renewable sources like solar and wind, is a key driver. Hydrogen generators play a pivotal role in this transition by facilitating the on-site production of eco-friendly hydrogen. As the world strives for a decarbonized future, the Hydrogen Generator Market stands at the forefront, meeting the growing demand for sustainable energy solutions in line with the broader global push towards achieving net-zero emissions. Governments and businesses alike are racing to move away from fossil fuels and embrace cleaner alternatives. The Paris Agreement, ambitious net-zero objectives, and the surge in carbon pricing initiatives are generating a substantial surge in demand for green hydrogen, produced through renewable sources like solar or wind power. This environmentally conscious fuel, once confined to niche applications, is now infiltrating sectors such as transportation, heating, and heavy industry. Notably, hydrogen generators emerge as indispensable on-site solutions for producing this eco-friendly resource, establishing themselves as vital components in the transition to green energy. In Japan, a consortium led by Kawasaki Heavy Industries is constructing the world's largest green hydrogen production facility, boasting a planned capacity of 10,000 tons per year. This monumental project, slated for completion in 2024, exemplifies the expanding scale and ambition of global green hydrogen initiatives, further propelling the Hydrogen Generator Market. Decentralized Power Solutions Fuelling the Surge in Hydrogen Generator Market Decentralization is taking center stage in the Hydrogen Generator Market, as traditional centralized energy models face a transformative shift. The market is witnessing a growing preference for localized and distributed solutions. Portable hydrogen generators play a pivotal role in this paradigm, offering clean power-on-demand in remote locations, for backup systems, and off-grid applications. Individuals and communities are increasingly taking control of their energy needs, and hydrogen generators align perfectly with this decentralized energy trend. This shift not only enhances energy accessibility but also contributes to a more resilient and adaptive energy infrastructure. As decentralization assumes control, hydrogen generators emerge as vital components in shaping a sustainable and distributed energy future. The traditional centralized energy model is encountering a formidable challenge – the rise of distributed, localized solutions. From rooftop solar to micro grids, individuals are taking charge of their energy needs. Enter portable hydrogen generators! These compact units can efficiently generate clean power on demand, making them ideal for remote locations, backup systems, and powering off-grid communities. In India, Reliance Industries has announced a $75 billion investment in green hydrogen projects, including the development of portable generators for rural electrification. This ambitious venture underscores hydrogen's potential to provide clean energy access to underserved communities, further propelling the Hydrogen Generator Market. Hydrogen Generator Market Restraint High Initial Costs and Infrastructure Investment The upfront capital required for establishing hydrogen generation infrastructure poses a substantial barrier to entry. Hydrogen generators, particularly those employing advanced technologies like electrolysis, demand significant initial investment. Additionally, the development of a robust distribution network for hydrogen adds to the overall costs. High capital expenditure is often a deterrent for potential investors and businesses, limiting the widespread adoption of hydrogen generators. Limited Hydrogen Storage and Transportation Infrastructure Hydrogen has unique storage and transportation challenges due to its low energy density and the need for specialized infrastructure. Existing infrastructure primarily designed for conventional fuels may not be suitable for hydrogen, necessitating additional investment. The lack of an extensive and efficient hydrogen distribution network limits the accessibility and availability of hydrogen for end-users. Addressing these storage and transportation challenges is crucial for the Hydrogen Generator Market to reach its full potential. Hydrogen Generator Market Challenges Beyond these restraints, challenges such as regulatory uncertainties, safety concerns, and the need for international standardization further complicate the market landscape. Regulations governing hydrogen production, storage, and transportation vary across regions, impacting market uniformity. Safety concerns, especially related to hydrogen's flammability, require stringent protocols and education. Achieving international standardization is essential to fostering a cohesive and globally integrated Hydrogen Generator Market. Navigating these restraints and challenges will be pivotal for industry stakeholders to unlock the full potential of the Hydrogen Generator Market, promoting its sustainable growth and widespread adoption. Hydrogen Generator Market Trends Rising Embrace of Green Hydrogen Production A notable trend in the Hydrogen Generator Market is the increasing emphasis on green hydrogen production. Governments, industries, and investors are recognizing the environmental benefits of producing hydrogen using renewable energy sources, such as wind and solar power. Green hydrogen, generated through processes like electrolysis, is gaining traction due to its potential to significantly reduce carbon emissions. The push toward sustainability and achieving net-zero goals is propelling the adoption of green hydrogen technologies, creating new opportunities within the Hydrogen Generator Market. As industries strive to reduce their carbon footprint, the demand for generators facilitating green hydrogen production is set to rise. Advancements in Electrolysis Technologies Another key trend shaping the Hydrogen Generator Market is the continuous advancements in electrolysis technologies. Electrolyzes, particularly Proton Exchange Membrane (PEM) and Alkaline Electrolyzes, are witnessing technological enhancements, leading to increased efficiency, durability, and cost-effectiveness. These innovations are crucial in making hydrogen production more economically viable and scalable. As research and development efforts focus on improving electrolysis technologies, the Hydrogen Generator Market stands to benefit from enhanced performance and expanded applications. The evolution of electrolysis technologies is pivotal in meeting the growing demand for hydrogen across various sectors, including transportation, industry, and energy. Embracing these trends, industry stakeholders in the Hydrogen Generator Market are well-positioned to capitalize on the growing demand for clean and sustainable hydrogen solutions. The convergence of green hydrogen production and advancements in electrolysis technologies reflects a broader shift toward a more environmentally conscious and technologically sophisticated Hydrogen Generator Market.Hydrogen Generator Market Segment Analysis

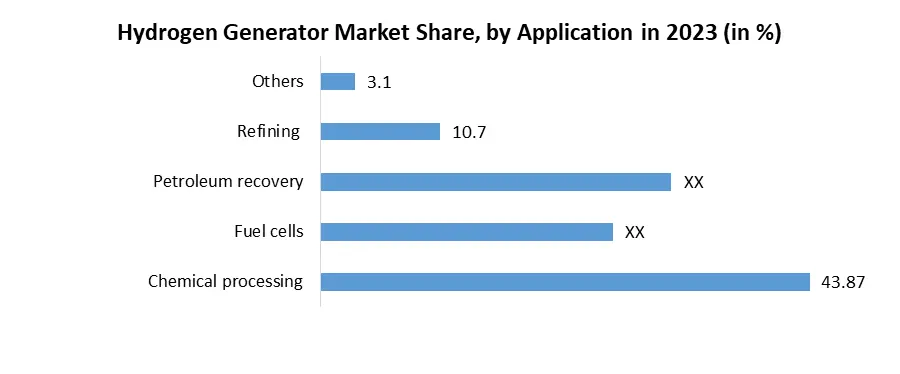

By Source, in the competitive realm of the Hydrogen Generator Market, Green Hydrogen emerges as the undisputed leader, wielding the scepter of environmental consciousness. Generated through renewable sources like solar or wind, Green Hydrogen dominates as the most environmentally friendly segment, aligning seamlessly with global net-zero goals and stringent carbon regulations. Government and corporate investments gravitate towards this champion, driven by its near-zero carbon emissions and sustainability credentials. Recent developments, such as the European Union's €3 billion pledge to enhance green hydrogen production and electrolyzer technology, underscore the growing momentum behind Green Hydrogen within the Hydrogen Generator Market. While contenders like Gray Hydrogen and Blue Hydrogen present alternatives, Green Hydrogen's reign appears secure, poised to strengthen as technology advances and costs decline, making it the prime force shaping the future of the Hydrogen Generator Market.By Application, In the Hydrogen Generator Market, the most dominant segment by process is currently Chemical Processing. This segment holds a prominent position due to the widespread applications of hydrogen in chemical manufacturing, where it serves as a crucial raw material. Chemical processing involves various industries, such as petrochemicals, ammonia production, and methanol production, contributing significantly to the demand for hydrogen generators. The versatility and indispensability of hydrogen in these processes make chemical processing the primary driver of the Hydrogen Generator Market. A recent development highlighting the importance of the chemical processing segment is the increased focus on green hydrogen production within chemical manufacturing. As governments and industries emphasize sustainability, there's a growing push to integrate hydrogen generators in chemical processes powered by renewable energy sources, aligning with global environmental goals. This development underscores the evolving landscape of the Hydrogen Generator Market, where chemical processing remains a key and evolving player.

Hydrogen Generator Market Regional Analysis

Asia Pacific: Green Hydrogen Prowess Unleashed Asia Pacific held the largest Hydrogen Generator Market Share in 2023 with economic powerhouses like China and Japan rising ahead in the race for green hydrogen supremacy. China, with its ambitious goal of achieving carbon neutrality, has unveiled plans to install an astounding 100 GW of electrolyzer capacity. This colossal initiative is poised to redefine the Hydrogen Generator Market on a global scale. Japan stands at the forefront of green hydrogen technology, exemplified by its recent unveiling of a USD 10 billion green hydrogen project, the largest of its kind globally, highlighting the nation's steadfast commitment to advancing clean fuel technologies. In Additional, In October 2023, India, a significant player in the Asia Pacific region, announced a groundbreaking USD 75 billion green hydrogen roadmap. This strategic plan includes the development of portable generators tailored for rural electrification, underscoring the region's dedication to decentralized clean energy solutions through hydrogen generators. Asia Pacific's dominance in the Hydrogen Generator Market is further solidified by these ambitious initiatives, positioning the region at the forefront of clean energy innovation and market leadership. Europe: Policy-Driven Innovation Hub in the Hydrogen Generator Market In the dynamic arena of the Hydrogen Generator Market, Europe emerges as a policy-driven innovation powerhouse, fueled by ambitious net-zero targets and robust supportive measures. At the forefront of this movement is Germany, acknowledged as the hydrogen champion within the EU, allocating a substantial USD 9 billion investment to propel advancements in green hydrogen technologies. This strategic initiative nurtures a flourishing market for hydrogen generators, positioning Europe as a driving force in the industry. Complementing this, France's dedicated USD 5 billion green hydrogen strategy, inclusive of electrolyzer and generator development, exemplifies the region's unwavering commitment to stimulating market growth. In Additional, In November 2023, a consortium led by Siemens Energy in Spain achieved a milestone by inaugurating the world's largest PEM electrolyzer, capable of producing 5 MW of green hydrogen daily. This groundbreaking technological advancement sets the stage for more efficient and cost-effective hydrogen generators, further solidifying Europe's predominant role in the Market. With distinct strategies Asia Pacific focusing on capacity expansion and Europe prioritizing technological innovation these influential regions are steering the course of the Hydrogen Generator Market. Their resolute commitment to green hydrogen signifies a transformative shift towards a cleaner energy future, underpinned by cutting-edge generators.

Hydrogen Generator Market Scope: Inquire before buying

Global Hydrogen Generator Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 131.5 Bn. Forecast Period 2024 to 2030 CAGR: 8.1% Market Size in 2030: US $ 156.4 Bn. Segments Covered: by Source Green Hydrogen Blue Hydrogen Gray Hydrogen by Application Chemical processing Fuel cells Petroleum recovery Refining Others by Process Steam Methane Reforming Coal Gasification Electrolysis Others by End User Industrial Commercial Residential Global Hydrogen Generator Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Hydrogen Generator Market Key players

North America: 1. Hydrogenics Corporation (Canada) 2. Air Products & Chemicals Inc. (United States) 3. Praxair Inc. (United States) 4. Airgas Inc. (United States) 5. Cummins (United States) 6. Fuel Cell Energy (United States) 7. Messer Group (Germany) 8. Air Liquide SA (France) 9. Plug Power (United States) 10. ParkarBalston (United States) 11. Praxair Inc. (United States) 12. Xebec (Canada) Europe: 1. droenergy (Italy) 2. Linde AG (Germany) 3. McPhy Energy (France) 4. ITM Power (United Kingdom) 5. NEL Hydrogen (Norway) 6. Enapter (Germany) 7. Engie (France) 8. Uniper (Germany) 9. Starfire Energy (Switzerland) 10. Claind (Italy) Asia-Pacific 1. .Iwatani (Japan) 2. Taiyo Nippon (Japan) 3. Showa Denko (Japan) Frequently Asked Questions: 1] What is the growth rate of the Global Market? Ans. The Global Market is growing at a significant rate of 8.1 % during the forecast period. 2] Which region is expected to dominate the Global Hydrogen Generator Market? Ans. North America held a significant share in the global Hydrogen Generator market, primarily due to advanced healthcare infrastructure, a higher prevalence of respiratory diseases, and a well-established market for medical devices. 3] What is the expected Global Hydrogen Generator Market size by 2030? Ans. The Hydrogen Generator Market size is expected to reach USD 156.4Bn by 2030. 4] Which are the top players in the Global Hydrogen Generator Market? Ans. The major top players in the Global Hydrogen Generator Market are Gilead Sciences Inc., TCR2 Therapeutics Inc, Bluebird Bio Inc, Sorrento Therapeutics, and Fate Therapeutics 5] What are the factors driving the Global Hydrogen Generator Market growth? Ans. The Global Hydrogen Generator Market is driven by the increasing demand for clean and sustainable energy solutions. Factors such as the global shift towards green hydrogen production, government initiatives promoting hydrogen as a clean fuel, and advancements in hydrogen generation technologies contribute to the market's significant growth. 6] Which country held the largest Global Market share in 2023? Ans. China held the largest Hydrogen Generator Market share in 2023.

1. Hydrogen Generator Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Hydrogen Generator Market: Dynamics 2.1. Hydrogen Generator Market Trends by Region 2.1.1. North America Hydrogen Generator Market Trends 2.1.2. Europe Hydrogen Generator Market Trends 2.1.3. Asia Pacific Hydrogen Generator Market Trends 2.1.4. Middle East and Africa Hydrogen Generator Market Trends 2.1.5. South America Hydrogen Generator Market Trends 2.2. Hydrogen Generator Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Hydrogen Generator Market Drivers 2.2.1.2. North America Hydrogen Generator Market Restraints 2.2.1.3. North America Hydrogen Generator Market Opportunities 2.2.1.4. North America Hydrogen Generator Market Challenges 2.2.2. Europe 2.2.2.1. Europe Hydrogen Generator Market Drivers 2.2.2.2. Europe Hydrogen Generator Market Restraints 2.2.2.3. Europe Hydrogen Generator Market Opportunities 2.2.2.4. Europe Hydrogen Generator Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Hydrogen Generator Market Drivers 2.2.3.2. Asia Pacific Hydrogen Generator Market Restraints 2.2.3.3. Asia Pacific Hydrogen Generator Market Opportunities 2.2.3.4. Asia Pacific Hydrogen Generator Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Hydrogen Generator Market Drivers 2.2.4.2. Middle East and Africa Hydrogen Generator Market Restraints 2.2.4.3. Middle East and Africa Hydrogen Generator Market Opportunities 2.2.4.4. Middle East and Africa Hydrogen Generator Market Challenges 2.2.5. South America 2.2.5.1. South America Hydrogen Generator Market Drivers 2.2.5.2. South America Hydrogen Generator Market Restraints 2.2.5.3. South America Hydrogen Generator Market Opportunities 2.2.5.4. South America Hydrogen Generator Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Hydrogen Generator Industry 2.8. Analysis of Government Schemes and Initiatives For Hydrogen Generator Industry 2.9. Hydrogen Generator Market Trade Analysis 2.10. The Global Pandemic Impact on Hydrogen Generator Market 3. Hydrogen Generator Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 3.1.1. Green Hydrogen 3.1.2. Blue Hydrogen 3.1.3. Gray Hydrogen 3.2. Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 3.2.1. Chemical processing 3.2.2. Fuel cells 3.2.3. Petroleum recovery 3.2.4. Refining 3.2.5. Others 3.3. Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 3.3.1. Steam Methane Reforming 3.3.2. Coal Gasification 3.3.3. Electrolysis 3.3.4. Others 3.4. Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 3.4.1. Industrial 3.4.2. Commercial 3.4.3. Residential 3.5. Hydrogen Generator Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Hydrogen Generator Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 4.1.1. Green Hydrogen 4.1.2. Blue Hydrogen 4.1.3. Gray Hydrogen 4.2. North America Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 4.2.1. Chemical processing 4.2.2. Fuel cells 4.2.3. Petroleum recovery 4.2.4. Refining 4.2.5. Others 4.3. North America Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 4.3.1. Steam Methane Reforming 4.3.2. Coal Gasification 4.3.3. Electrolysis 4.3.4. Others 4.4. North America Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 4.4.1. Industrial 4.4.2. Commercial 4.4.3. Residential 4.5. North America Hydrogen Generator Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 4.5.1.1.1. Green Hydrogen 4.5.1.1.2. Blue Hydrogen 4.5.1.1.3. Gray Hydrogen 4.5.1.2. United States Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 4.5.1.2.1. Chemical processing 4.5.1.2.2. Fuel cells 4.5.1.2.3. Petroleum recovery 4.5.1.2.4. Refining 4.5.1.2.5. Others 4.5.1.3. United States Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 4.5.1.3.1. Steam Methane Reforming 4.5.1.3.2. Coal Gasification 4.5.1.3.3. Electrolysis 4.5.1.3.4. Others 4.5.1.4. United States Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 4.5.1.4.1. Industrial 4.5.1.4.2. Commercial 4.5.1.4.3. Residential 4.5.2. Canada 4.5.2.1. Canada Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 4.5.2.1.1. Green Hydrogen 4.5.2.1.2. Blue Hydrogen 4.5.2.1.3. Gray Hydrogen 4.5.2.2. Canada Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 4.5.2.2.1. Chemical processing 4.5.2.2.2. Fuel cells 4.5.2.2.3. Petroleum recovery 4.5.2.2.4. Refining 4.5.2.2.5. Others 4.5.2.3. Canada Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 4.5.2.3.1. Steam Methane Reforming 4.5.2.3.2. Coal Gasification 4.5.2.3.3. Electrolysis 4.5.2.3.4. Others 4.5.2.4. Canada Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 4.5.2.4.1. Industrial 4.5.2.4.2. Commercial 4.5.2.4.3. Residential 4.5.3. Mexico 4.5.3.1. Mexico Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 4.5.3.1.1. Green Hydrogen 4.5.3.1.2. Blue Hydrogen 4.5.3.1.3. Gray Hydrogen 4.5.3.2. Mexico Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 4.5.3.2.1. Chemical processing 4.5.3.2.2. Fuel cells 4.5.3.2.3. Petroleum recovery 4.5.3.2.4. Refining 4.5.3.2.5. Others 4.5.3.3. Mexico Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 4.5.3.3.1. Steam Methane Reforming 4.5.3.3.2. Coal Gasification 4.5.3.3.3. Electrolysis 4.5.3.3.4. Others 4.5.3.4. Mexico Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 4.5.3.4.1. Industrial 4.5.3.4.2. Commercial 4.5.3.4.3. Residential 5. Europe Hydrogen Generator Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 5.2. Europe Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 5.3. Europe Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 5.4. Europe Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 5.5. Europe Hydrogen Generator Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 5.5.1.2. United Kingdom Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 5.5.1.3. United Kingdom Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 5.5.1.4. United Kingdom Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 5.5.2. France 5.5.2.1. France Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 5.5.2.2. France Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 5.5.2.3. France Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 5.5.2.4. France Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 5.5.3.2. Germany Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 5.5.3.3. Germany Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 5.5.3.4. Germany Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 5.5.4.2. Italy Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 5.5.4.3. Italy Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 5.5.4.4. Italy Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 5.5.5.2. Spain Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 5.5.5.3. Spain Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 5.5.5.4. Spain Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 5.5.6.2. Sweden Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 5.5.6.3. Sweden Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 5.5.6.4. Sweden Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 5.5.7.2. Austria Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 5.5.7.3. Austria Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 5.5.7.4. Austria Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 5.5.8.2. Rest of Europe Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 5.5.8.3. Rest of Europe Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 5.5.8.4. Rest of Europe Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Hydrogen Generator Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 6.2. Asia Pacific Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 6.4. Asia Pacific Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 6.5. Asia Pacific Hydrogen Generator Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 6.5.1.2. China Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 6.5.1.3. China Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 6.5.1.4. China Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 6.5.2.2. S Korea Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 6.5.2.3. S Korea Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 6.5.2.4. S Korea Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 6.5.3.2. Japan Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 6.5.3.3. Japan Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 6.5.3.4. Japan Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 6.5.4. India 6.5.4.1. India Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 6.5.4.2. India Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 6.5.4.3. India Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 6.5.4.4. India Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 6.5.5.2. Australia Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 6.5.5.3. Australia Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 6.5.5.4. Australia Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 6.5.6.2. Indonesia Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 6.5.6.3. Indonesia Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 6.5.6.4. Indonesia Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 6.5.7.2. Malaysia Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 6.5.7.3. Malaysia Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 6.5.7.4. Malaysia Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 6.5.8.2. Vietnam Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 6.5.8.3. Vietnam Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 6.5.8.4. Vietnam Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 6.5.9.2. Taiwan Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 6.5.9.3. Taiwan Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 6.5.9.4. Taiwan Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 6.5.10.2. Rest of Asia Pacific Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 6.5.10.3. Rest of Asia Pacific Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 6.5.10.4. Rest of Asia Pacific Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Hydrogen Generator Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 7.2. Middle East and Africa Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 7.4. Middle East and Africa Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 7.5. Middle East and Africa Hydrogen Generator Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 7.5.1.2. South Africa Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 7.5.1.3. South Africa Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 7.5.1.4. South Africa Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 7.5.2.2. GCC Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 7.5.2.3. GCC Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 7.5.2.4. GCC Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 7.5.3.2. Nigeria Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 7.5.3.3. Nigeria Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 7.5.3.4. Nigeria Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 7.5.4.2. Rest of ME&A Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 7.5.4.3. Rest of ME&A Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 7.5.4.4. Rest of ME&A Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 8. South America Hydrogen Generator Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 8.2. South America Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 8.3. South America Hydrogen Generator Market Size and Forecast, by Process(2023-2030) 8.4. South America Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 8.5. South America Hydrogen Generator Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 8.5.1.2. Brazil Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 8.5.1.3. Brazil Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 8.5.1.4. Brazil Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 8.5.2.2. Argentina Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 8.5.2.3. Argentina Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 8.5.2.4. Argentina Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Hydrogen Generator Market Size and Forecast, by Source (2023-2030) 8.5.3.2. Rest Of South America Hydrogen Generator Market Size and Forecast, by Application (2023-2030) 8.5.3.3. Rest Of South America Hydrogen Generator Market Size and Forecast, by Process (2023-2030) 8.5.3.4. Rest Of South America Hydrogen Generator Market Size and Forecast, by End User (2023-2030) 9. Global Hydrogen Generator Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Hydrogen Generator Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Hydrogenics Corporation (Canada) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Air Products & Chemicals Inc. (United States) 10.3. Praxair Inc. (United States) 10.4. Airgas Inc. (United States) 10.5. Cummins (United States) 10.6. Fuel Cell Energy (United States) 10.7. Messer Group (Germany) 10.8. Air Liquide SA (France) 10.9. Plug Power (United States) 10.10. ParkarBalston (United States) 10.11. Praxair Inc. (United States) 10.12. Xebec (Canada) 10.13. droenergy (Italy) 10.14. Linde AG (Germany) 10.15. McPhy Energy (France) 10.16. ITM Power (United Kingdom) 10.17. NEL Hydrogen (Norway) 10.18. Enapter (Germany) 10.19. Engie (France) 10.20. Uniper (Germany) 10.21. Starfire Energy (Switzerland) 10.22. Claind (Italy) 10.23. Iwatani (Japan) 10.24. Taiyo Nippon (Japan) 10.25. Showa Denko (Japan) 11. Key Findings 12. Industry Recommendations 13. Hydrogen Generator Market: Research Methodology 14. Terms and Glossary