Hybrid Heavy Duty Vehicle Market size was valued at US$ 48.21 Bn. in 2020. Trucks are expected to dominate the post COVID era for Hybrid Heavy Duty Vehicle Market.Hybrid Heavy Duty Vehicle Market Overview:

Hybrid heavy-duty vehicles are hybrid electric vehicles built for off-road and on-road heavy-duty uses. To create vehicle driving momentum, hybrid heavy duty vehicles use combustion engines in conjunction with hybrid electric powertrain technology. Because hybrid heavy duty vehicles are designed for lengthy journeys and heavy freight hauling, the electric motor handles the work while the on board range extender internal combustion engines keep the battery charged. Larger tyres and a flexible suspension system are standard on hybrid heavy duty trucks, resulting in a better ground clearance ratio and allowing these high-traction vehicles to drive over uneven and bumpy roads. Hybrid heavy duty vehicle market is expected to register CAGR of approximately 5.88% during the forecast period.To know about the Research Methodology:- Request Free Sample Report

Hybrid Heavy Duty Vehicle Market Dynamics:

As public knowledge of pollution grows, regulatory organizations are enacting more strict emission regulations. OEMs are being forced to produce hybrid and electric vehicles as emission regulations become more stringent. Gasoline and diesel automobiles release more greenhouse gases than hybrid vehicles. Governments in the United States and Europe are focusing on decreasing emission standards to reduce greenhouse gas emissions, as well as improving car fuel economy. The Corporate Average Fuel Economy (CAFE) criteria for automobiles, for example, were established by the US Department of Transportation. Although electrification of MHDV powertrains has long been recognized as a potential avenue to lower fuel costs and emissions for the nation's freight movement, the establishment of a viable market for electrified commercial vehicles has trailed well behind that of light trucks. The United Parcel Service used electric delivery trucks in the 1930s. Battery performance has increased and battery costs have decreased significantly in the previous ten years, making MHDV electrification more appealing. Due to low volume purchases and specialized pack requirements, these low prices have yet to be realized in the MHDV sector, according to industry input. Electric commercial vehicles are being reevaluated, and they are finding use on the road in freight, package delivery, and buses. Buses are the most common type of electric commercial vehicle worldwide, with significant numbers in China and Europe. According to the American Public Transit Association, there were 9,821 electrified buses in US transit systems in 2019, with 538 of them being battery electric vehicles (BEVs—battery alone). This market has been boosted by a variety of incentives and laws. In 2018, the National Academies published a report on the state of battery electric buses in the United States, which included a survey of 21 transportation agencies that have previously deployed electric buses. They discovered that half of the agencies had implemented electric vehicles (EVs) as a result of board direction, environmental regulations, and sustainability programmes, and that 39% had purchased the buses using federal or state grant opportunities like the Federal Transit Administration Transit Investments for Greenhouse Gas and Energy Reduction programme. The agencies adopted a number of charging tactics, including the construction of charging equipment at both the depot and on the road. While just 33% of the agencies made no changes to their operations, 60% had to change their schedules, 40% had to adapt layover periods to allow charging, 20% adopted block scheduling, and 13% changed the number of buses servicing a route.Key restraints:

One of the key difficulties for the expansion of hybrid vehicles will be the increasing demand for battery electric vehicles (BEVs) and fuel cell electric vehicles (FCEVs). In the passenger car category, there are a variety of models and types of BEVs, including hatchbacks, sedans, and SUVs. BYD (China), Tesla (USA), and Volkswagen (Germany) are among the automakers putting increasing emphasis on the development of BEVs. FCEVs have a long driving range, quick recharging, quiet operation, and no emissions of greenhouse gases or air pollutants. The demand for FCEVs is increasing as a result of these advantages. Furthermore, governments are taking steps to promote and encourage the use of fuel cells in transportation, which could increase demand for fuel cells in the automotive and transportation sectors.Capital Cost Challenges:

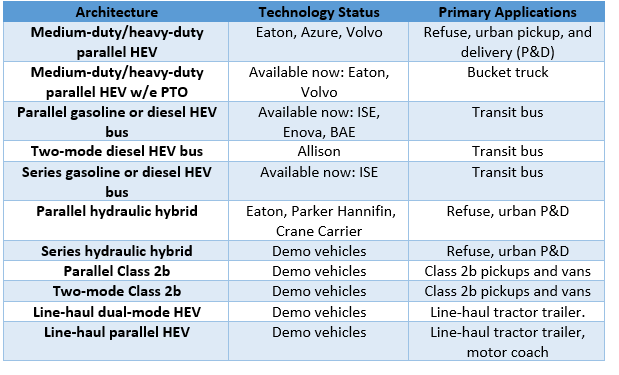

The 'California Hybrid, Efficient, and Advanced Truck Research Center,' which confirms the cost-effectiveness of electrification, predicts that electrified delivery trucks will be ready for widespread commercial deployment by around 2020, with a 3- to 5-year return-on-investment. A full electric vehicle, or battery electric vehicle (BEV), on the other hand, necessitates the creation and optimization of a complete electric powertrain, which includes the battery, power electronics, electric machine, sensors, and control system, all of which takes time and money. Full electric vehicles have a restricted range of applications at the moment: Without significant infrastructure improvements or battery technological breakthroughs, applications that rely on long range and minimum downtime are not currently appropriate for complete battery-based operation.Hybrid Vehicle Architectures in USA:

Hybrid Heavy Duty Vehicle Market Segment Analysis:

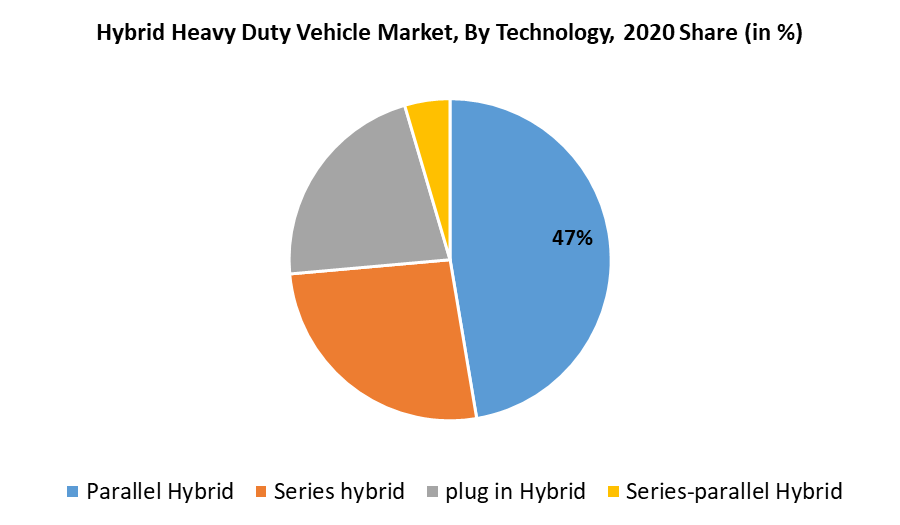

Parallel Hybrid Segment is driving the Hybrid Heavy Duty Vehicle Market: The hybrid Heavy duty vehicle market is divided into parallel and series hybrids based on the kind of electric powertrain. During the projected period, the parallel hybrid segment is expected to have the greatest market share by volume. Because of the rising use of regenerative braking technology, this market is expected to develop. When the brakes are used, regenerative braking technology returns energy to replenish the battery. As a result, the need for external electric infrastructure is reduced. In hybrid automobiles, the regenerative braking system is the most frequent technology. Parallel hybrid demand will be boosted by the usage of regenerative braking and the lower cost of micro and mild hybrids compared to PHEVs.

Hybrid Heavy Duty Vehicle Market Regional Insights:

North America is dominating the hybrid heavy duty vehicle market owing to stringent regulations across USA and Canada for emission control. Moreover, federal government has regulated the use of diesel operated cars across the region which is driving the demand for system integration and electrification of heavy duty vehicles. The hybrid vehicle market in APAC is expected to grow at the highest rate, with Japan accounting for the largest market share in 2018. Increased sales of hybrid automobiles in Japan, China, and South Korea are responsible for the region's rise. In addition, significant companies in the hybrid car market, including as Toyota, Honda, Nissan, Kia, BYD, and Hyundai, are based in the Asia Pacific region. Toyota has the largest market share for hybrid vehicles in the world. Furthermore, Asian governments assist growth by offering subsidies. The market will also benefit from Japan and China's widespread embrace of hybrid vehicle technology. The objective of the report is to present a comprehensive analysis of the Hybrid Heavy Duty Vehicle market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Hybrid Heavy Duty Vehicle market dynamics, structure by analyzing the market segments and project the Hybrid Heavy Duty Vehicle market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Hybrid Heavy Duty Vehicle market make the report investor’s guide.Hybrid Heavy Duty Vehicle Market Scope: Inquire before buying

Hybrid Heavy Duty Vehicle Market Report Coverage Details Base Year: 2020 Forecast Period: 2021-2027 Historical Data: 2016 to 2020 Market Size in 2020: US $ 48.21 Bn. Forecast Period 2021 to 2027 CAGR: 5.88% Market Size in 2027: US $ 71.92 Bn. Segments Covered: by Technology • Parallel hybrid • Series hybrid • Series-parallel hybrid • Plug-in hybrid by Hybrid Type • Full hybrid • Micro hybrid • Mild hybrid by Vehicle Type • Buses • Trucks by Power Train Type • Series • Parallel by Propulsion Type • NGV • HEV • PHEV Hybrid Heavy Duty Vehicle Market, by Region

• North America • Europe • Asia Pacific • Middle East and Africa • South AmericaHybrid Heavy Duty Vehicle Market Key Players

• AB Volvo • Daimler AG • Nissan Motor Corporation • Azure Dynamics Corp. • Hino Motors, Ltd. • General Motors • Nikola Motor Company • Fiat Chrysler Automobiles • Volkswagen AG • Renault Trucks • DAF • BYD Motors Inc. • Danfoss • Dongfeng Motor Corporation • Ford Motor Company • Toyota Motor Corporation. • Liebherr Group • MANFAQ:

1] What segments are covered in the Hybrid Heavy Duty Vehicle Market report? Ans. The segments covered in the Hybrid Heavy Duty Vehicle Market report are based on Technology, Hybrid Type, vehicle type, power train type and propulsion type. 2] Which region is expected to hold the highest share in the Hybrid Heavy Duty Vehicle Market? Ans. North American Region is expected to hold the highest share in the Hybrid Heavy Duty Vehicle Market. 3] What is the market size of the Hybrid Heavy Duty Vehicle Market in 2020? Ans. The market size of the Hybrid Heavy Duty Vehicle Market in 2020 was valued at US $ 48.21 Bn. 4] Who are the top key players in the Hybrid Heavy Duty Vehicle Market? Ans. AB Volvo, Daimler AG, Nissan Motor Corporation, Azure Dynamics Corp., Hino Motors, Ltd., General Motors, Nikola Motor Company, Fiat Chrysler Automobiles, Volkswagen AG, Renault Trucks, DAF, BYD Motors Inc., Danfoss, Dongfeng Motor Corporation, Ford Motor Company, Toyota Motor Corporation., Liebherr Group, MAN 5] What will be the market size of the Hybrid Heavy Duty Vehicle Market in 2027? Ans. The market size of the Hybrid Heavy Duty Vehicle Market is expected to be US$ 71.92 Bn. By 2027

1. Global Hybrid Heavy Duty Vehicle Market: Research Methodology 2. Global Hybrid Heavy Duty Vehicle Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Hybrid Heavy Duty Vehicle Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Hybrid Heavy Duty Vehicle Market: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12. COVID-19 Impact 4. Global Hybrid Heavy Duty Vehicle Market Segmentation 4.1. Global Hybrid Heavy Duty Vehicle Market, by Technology (2020-2027) • Parallel hybrid • Series hybrid • Series-parallel hybrid • Plug-in hybrid 4.2. Global Hybrid Heavy Duty Vehicle Market, by Hybrid Type (2020-2027) • Full hybrid • Micro hybrid • Mild hybrid 4.3. Global Hybrid Heavy Duty Vehicle Market, by Vehicle Type (2020-2027) • Buses • Trucks 4.4. Global Hybrid Heavy Duty Vehicle Market, by Power Train Type (2020-2027) • Series • Parallel 4.5. Global Hybrid Heavy Duty Vehicle Market, by Propulsion Type (2020-2027) • NGV • HEV • PHEV 5. North America Hybrid Heavy Duty Vehicle Market(2020-2027) 5.1. Global Hybrid Heavy Duty Vehicle Market, by Technology (2020-2027) • Parallel hybrid • Series hybrid • Series-parallel hybrid • Plug-in hybrid 5.2. Global Hybrid Heavy Duty Vehicle Market, by Hybrid Type (2020-2027) • Full hybrid • Micro hybrid • Mild hybrid 5.3. Global Hybrid Heavy Duty Vehicle Market, by Vehicle Type (2020-2027) • Buses • Trucks 5.4. Global Hybrid Heavy Duty Vehicle Market, by Power Train Type (2020-2027) • Series • Parallel 5.5. Global Hybrid Heavy Duty Vehicle Market, by Propulsion Type (2020-2027) • NGV • HEV • PHEV 5.6. North America Hybrid Heavy Duty Vehicle Market, by Country (2020-2027) • United States • Canada • Mexico 6. European Hybrid Heavy Duty Vehicle Market (2020-2027) 6.1. European Hybrid Heavy Duty Vehicle Market, by Technology (2020-2027) 6.2. European Hybrid Heavy Duty Vehicle Market, by Hybrid Type (2020-2027) 6.3. European Hybrid Heavy Duty Vehicle Market, by Vehicle Type (2020-2027) 6.4. European Hybrid Heavy Duty Vehicle Market, by Power Train Type (2020-2027) 6.5. European Hybrid Heavy Duty Vehicle Market, by Propulsion Type (2020-2027) 6.6. European Hybrid Heavy Duty Vehicle Market, by Country (2020-2027) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Hybrid Heavy Duty Vehicle Market (2020-2027) 7.1. Asia Pacific Hybrid Heavy Duty Vehicle Market, by Technology (2020-2027) 7.2. Asia Pacific Hybrid Heavy Duty Vehicle Market, by Hybrid Type (2020-2027) 7.3. Asia Pacific Hybrid Heavy Duty Vehicle Market, by Vehicle Type (2020-2027) 7.4. Asia Pacific Hybrid Heavy Duty Vehicle Market, by Power Train Type (2020-2027) 7.5. Asia Pacific Hybrid Heavy Duty Vehicle Market, by Propulsion Type (2020-2027) 7.6. Asia Pacific Hybrid Heavy Duty Vehicle Market, by Country (2020-2027) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Hybrid Heavy Duty Vehicle Market (2020-2027) 8.1. Middle East and Africa Hybrid Heavy Duty Vehicle Market, by Technology (2020-2027) 8.2. Middle East and Africa Hybrid Heavy Duty Vehicle Market, by Hybrid Type (2020-2027) 8.3. Middle East and Africa Hybrid Heavy Duty Vehicle Market, by Vehicle Type (2020-2027) 8.4. Middle East and Africa Hybrid Heavy Duty Vehicle Market, by Power Train Type (2020-2027) 8.5. Middle East and Africa Hybrid Heavy Duty Vehicle Market, by Propulsion Type (2020-2027) 8.6. Middle East and Africa Hybrid Heavy Duty Vehicle Market, by Country (2020-2027) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. Latin America Hybrid Heavy Duty Vehicle Market (2020-2027) 9.1. Latin America Hybrid Heavy Duty Vehicle Market, by Technology (2020-2027) 9.2. Latin America Hybrid Heavy Duty Vehicle Market, by Hybrid Type (2020-2027) 9.3. Latin America Hybrid Heavy Duty Vehicle Market, by Vehicle Type (2020-2027) 9.4. Latin America Hybrid Heavy Duty Vehicle Market, by Power Train Type (2020-2027) 9.5. Latin America Hybrid Heavy Duty Vehicle Market, by Propulsion Type (2020-2027) 9.6. Latin America Hybrid Heavy Duty Vehicle Market, by Country (2020-2027) • Brazil • Argentina • Rest Of Latin America 10. Company Profile: Key players 10.1. AB Volvo 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Daimler AG 10.3. Nissan Motor Corporation 10.4. Azure Dynamics Corp. 10.5. Hino Motors, Ltd. 10.6. General Motors 10.7. Nikola Motor Company 10.8. Fiat Chrysler Automobiles 10.9. Volkswagen AG 10.10. Renault Trucks 10.11. DAF 10.12. BYD Motors Inc. 10.13. Danfoss 10.14. Dongfeng Motor Corporation 10.15. Ford Motor Company 10.16. Toyota Motor Corporation. 10.17. Liebherr Group 10.18. MAN