The High Density Polyethylene Market size was valued at US 72.3 Bn in 2023 and market revenue is growing at a CAGR of 4.2 % from 2023 to 2030, reaching nearly USD 96.43 Bn by 2030.High Density Polyethylene Market Overview:

The High Density Polyethylene Market is Important within the plastics industry, displaying strong growth and global demand. HDPE, a versatile thermoplastic polymer, stands out for its exceptional strength-to-density ratio, resistance to chemicals, and recyclability, positioning it as a preferred material across various applications. Central to the market's growth is the escalating need for packaging materials, particularly in sectors like food and beverage, pharmaceuticals, and consumer goods. HDPE's outstanding barrier properties against moisture and chemicals, alongside its durability, make it an ideal choice for diverse packaging solutions. Also, the construction industry significantly contributes to the High Density Polyethylene Market utilizing the material in pipes, geomembranes, and other infrastructure applications due to its corrosion resistance and lightweight nature. Environmental concerns and regulations promoting sustainability have further catalyzed HDPE adoption, given its recyclability and potential for reducing carbon footprint. The material's versatility and eco-friendly characteristics make it increasingly attractive to businesses and consumers. High Density Polyethylene Market is expected to sustainable growth, driven by increasing end-user industries and ongoing innovation in material technologies. Continued research and development efforts aimed at enhancing HDPE's properties and exploring new applications are expected to further boost its market presence.To know about the Research Methodology :- Request Free Sample Report

High Density Polyethylene Market Dynamics:

Driver Growing Demand in the Packaging Industry Boost the High Density Polyethylene Market Growth The High Density Polyethylene) market is experiencing significant growth due to the rising demand in the packaging industry. HDPE's versatile properties make it an excellent choice for packaging applications in various sectors, including food and beverages, pharmaceuticals, personal care, and household products. Its lightweight nature, durability, chemical resistance, and ability to be molded into different shapes make HDPE a highly attractive material for packaging solutions. In the food and beverage industry, HDPE is widely used for bottling milk, juices, water, and other liquid products. This is because HDPE's excellent barrier properties effectively protect the contents from contamination and extend their shelf life. This factor significantly drives the growth of the High Density Polyethylene Market.HDPE containers are preferred for their recyclability and sustainability, aligning with the growing consumer demand for eco-friendly packaging options. In the pharmaceutical sector, HDPE packaging is favored for its ability to safeguard medicines from moisture, light, and air, ensuring the integrity and safety of the products. Similarly, in the personal care industry, HDPE bottles and containers are chosen for their resistance to chemicals and their ability to maintain the quality of the products. The rising market for packaging materials indicates an increasing demand for High Density Polyethylene (HDPE) as it is a preferred choice due to its versatile properties, driving growth in the HDPE market.Restrain Fluctuating Raw Material limits the High Density Polyethylene Market Growth Fluctuating raw material prices present a significant challenge for the High Density Polyethylene (HDPE) market. HDPE is primarily derived from petroleum feedstocks, making it susceptible to changes in crude oil prices. The petrochemical industry is heavily influenced by fluctuations in oil and gas prices, which is influenced by factors such as geopolitical tensions, supply-demand imbalances, and macroeconomic trends. When crude oil prices rise, the cost of raw materials for High Density Polyethylene production increases, impacting the overall cost structure for manufacturers, which is expected to restrain the High Density Polyethylene Market growth. This lead to higher production costs and reduced profit margins unless these increases are passed on to customers through price adjustments. Conversely, when oil prices decline, HDPE manufacturers experience margin pressure due to downward pressure on selling prices amid competitive market conditions. The volatility in raw material prices also complicates procurement and inventory management for High-Density Polyethylene manufacturers, as they must navigate price uncertainties and hedge against potential risks. The sudden and significant price fluctuations disrupt long-term planning and investment decisions within the industry, impacting capital allocation and strategic initiatives. Opportunity Growing Demand for Recycled HDPE creates lucrative growth opportunities for the High Density Polyethylene Market. The High Density Polyethylene Market is experiencing a surge in demand for recycled High Density Polyethylene (HDPE), which is attributed to various factors such as environmental concerns, regulatory pressures, and changing consumer preferences toward sustainability. This growing demand presents lucrative growth opportunities for the High Density Polyethylene Market. The key drivers behind the demand for recycled HDPE is the increasing awareness of environmental issues, particularly plastic pollution and resource depletion. Governments and regulatory bodies across the world are taking measures to reduce plastic waste and promote recycling initiatives. There is a significant push towards the utilization of recycled materials in industries such as packaging, construction, automotive, and consumer goods. Recycled HDPE offers several advantages over virgin HDPE. It helps in reducing the environmental impact associated with plastic production by diverting post-consumer and post-industrial waste from landfills or incineration. This contributes to resource conservation and reduces greenhouse gas emissions. Recycled HDPE requires less energy and fewer resources to produce compared to virgin HDPE, making it a more sustainable choice. Recycled HDPE maintains similar performance characteristics to virgin HDPE, including durability, chemical resistance, and versatility. This makes it suitable for a wide range of applications, from packaging materials such as bottles, containers, and bags to non-packaging applications such as pipes, geomembranes, and automotive components. The demand for recycled HDPE is further driven by consumer preferences for eco-friendly products and packaging. With a growing awareness of environmental issues, consumers actively seek products that are made from recycled materials and are themselves recyclable. This shift in consumer behavior is prompting companies across industries to adopt sustainable packaging solutions, thereby creating a significant market opportunity for recycled HDPE. In response to these trends, HDPE manufacturers and recyclers are making investments in advanced technologies and processes to enhance the production and quality of recycled HDPE. This proactive approach ensures that they meet the increasing demand for sustainable materials and capitalize on the lucrative growth opportunities in the High Density Polyethylene Market.

High Density Polyethylene Market: Segment Analysis

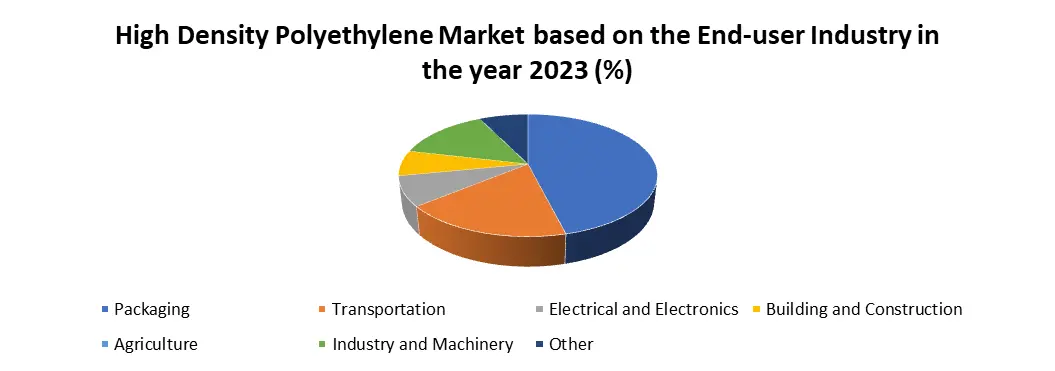

Based on End-user Industry, the Packaging industry dominated the End user Industry segment of the High-Density Polyethylene Market in the year 2023. HDPE's versatile properties, including durability, chemical resistance, and flexibility, make it an ideal choice for packaging applications across various sectors. In the food and beverage industry, HDPE is extensively used for packaging liquids such as milk, juices, and water, as well as for food containers and caps. Its excellent barrier properties help maintain product freshness and prevent contamination. The increasing consumer demand for sustainable packaging solutions aligns with HDPE's recyclability and eco-friendly nature, further driving its adoption in the packaging industry. Therefore, the packaging industry's reliance on HDPE for a wide range of products underscores its dominance within the High Density Polyethylene Market end-user segment.

High Density Polyethylene Market: Regional Analysis

Asia Pacific Region Dominated the High Density Polyethylene Market in the year 2023. The rapid industrialization and urbanization across countries such as China and India have driven by the demand for HDPE in various sectors such as packaging, construction, automotive, and agriculture. These industries rely heavily on HDPE for its excellent properties like high strength, chemical resistance, and lightweight nature. The availability of raw materials such as ethylene and propylene, which are essential for HDPE production, in abundance in the region further bolsters its position in the market. The favorable government policies, supportive regulatory frameworks, and investments in infrastructure development have stimulated the growth of the High Density Polyethylene market in the Asia Pacific. The region's burgeoning population and rising disposable income levels have led to increased consumption of packaged goods and a surge in construction activities, thereby driving the demand for HDPE products. Also, the presence of major market players and continuous technological advancements in HDPE production processes contribute to the region's dominance in the global HDPE market landscape. These factors collectively establish the Asia Pacific region as a powerhouse in the high-density polyethylene market. High Density Polyethylene Market: Competitive Landscape The High Density Polyethylene Market is highly competitive the various players are dominating the market such as ExxonMobil – (USA), Dow Chemical Company – USA, Chevron Phillips Chemical Company, and others. The companies are majorly focusing on the development and innovation of new products for example, In the High Density Polyethylene market, ExxonMobil's launch of ExxonMobil HMA706 in July 2022 signifies a competitive move towards enhanced product offerings. HMA706's features, including high dimensional stability, good impact strength, approval for food contact, fast cycling capabilities, and high gloss, position it favorably for applications in food packaging and consumer goods. Formosa Plastics Corporation's investment announcement in June 2022 adds to the competitive landscape. Their plan to establish a new production facility in Texas, with an annual capacity of 100,000 tons of alpha-olefins by October 2025, signals an expansion strategy geared towards meeting growing market demands for HDPE and related products. This highlights a trend toward product innovation and capacity growth among key players in the HDPE market. With ExxonMobil's introduction of HMA706 and Formosa Plastics Corporation's investment, competition intensifies, driving advancements in product quality, efficiency, and market presence. Companies in the HDPE sector is positioning themselves strategically to capitalize on evolving consumer preferences and industry requirements, aiming to maintain or gain market share in a dynamic and competitive environment.High-Density Polyethylene Market Scope: Inquire before buying

Global High-Density Polyethylene Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 72.3 Bn. Forecast Period 2024 to 2030 CAGR: 4.2% Market Size in 2030: US $ 96.43 Bn. Segments Covered: by Application Pipes and Tubes Rigid Articles Sheets and Films Other by End User Industry Packaging Transportation Electrical and Electronics Building and Construction Agriculture Industry and Machinery Other High Density Polyethylene Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)High Density Polyethylene Market Key Players

Europe 1. LyondellBasell Industries – Netherlands 2. INEOS – UK 3. Total SA - France Asia Pacific 1. Reliance Industries Limited - India 2. Formosa Plastics Corporation – Taiwan 3. Borealis AG – Austria 4. Sinopec - China 5. Thai Plastic and Chemicals Public Company Limited - Thailand 6. PTT Global Chemical – Thailand 7. Lotte Chemical Corporation - South Korea 8. Mitsui Chemicals - Japan North America 1. Exxon Mobil Corp – (USA) 2. Dow Chemical Company – USA 3. Chevron Phillips Chemical Company – USA 4. NOVA Chemicals Corporation – Canada 5. Westlake Chemical Corporation - USA Middle East and Africa 1. SABIC - Saudi Arabia 2. Qatar Petrochemical Company (QAPCO) - Qatar South America 1. Braskem – Brazil 2. Sasol - South Africa Frequently Asked Question: 1] What segments are covered in the Global High Density Polyethylene Market report? Ans. The segments covered in the High Density Polyethylene Market report are based on, Application and End User industry, and Regions. 2] Which region is expected to hold the highest share of the Global High Density Polyethylene Market? Ans. The Asia Pacific region is expected to hold the highest share of the High Density Polyethylene Market. 3] What is the market size of the Global High Density Polyethylene Market by 2030? Ans. The market size of the High Density Polyethylene Market by 2030 is expected to reach US$ 96.43 Bn. 4] What was the market size of the Global High Density Polyethylene Market in 2023? Ans. The market size of the High Density Polyethylene Market in 2023 was valued at US$ 72.3 Bn. 5] Key players in the High Density Polyethylene Market. Ans. LyondellBasell Industries – Netherlands, ExxonMobil – USA, SABIC - Saudi Arabia, Dow Chemical Company – USA, and INEOS - UK

1. High-Density Polyethylene Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. High-Density Polyethylene Market: Dynamics 2.1. High-Density Polyethylene Market Trends by Region 2.1.1. North America High-Density Polyethylene Market Trends 2.1.2. Europe High-Density Polyethylene Market Trends 2.1.3. Asia Pacific High-Density Polyethylene Market Trends 2.1.4. Middle East and Africa High-Density Polyethylene Market Trends 2.1.5. South America High-Density Polyethylene Market Trends 2.2. High-Density Polyethylene Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America High-Density Polyethylene Market Drivers 2.2.1.2. North America High-Density Polyethylene Market Restraints 2.2.1.3. North America High-Density Polyethylene Market Opportunities 2.2.1.4. North America High-Density Polyethylene Market Challenges 2.2.2. Europe 2.2.2.1. Europe High-Density Polyethylene Market Drivers 2.2.2.2. Europe High-Density Polyethylene Market Restraints 2.2.2.3. Europe High-Density Polyethylene Market Opportunities 2.2.2.4. Europe High-Density Polyethylene Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific High-Density Polyethylene Market Drivers 2.2.3.2. Asia Pacific High-Density Polyethylene Market Restraints 2.2.3.3. Asia Pacific High-Density Polyethylene Market Opportunities 2.2.3.4. Asia Pacific High-Density Polyethylene Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa High-Density Polyethylene Market Drivers 2.2.4.2. Middle East and Africa High-Density Polyethylene Market Restraints 2.2.4.3. Middle East and Africa High-Density Polyethylene Market Opportunities 2.2.4.4. Middle East and Africa High-Density Polyethylene Market Challenges 2.2.5. South America 2.2.5.1. South America High-Density Polyethylene Market Drivers 2.2.5.2. South America High-Density Polyethylene Market Restraints 2.2.5.3. South America High-Density Polyethylene Market Opportunities 2.2.5.4. South America High-Density Polyethylene Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For High-Density Polyethylene Industry 2.8. Analysis of Government Schemes and Initiatives For High-Density Polyethylene Industry 2.9. High-Density Polyethylene Market Trade Analysis 2.10. The Global Pandemic Impact on High-Density Polyethylene Market 3. High-Density Polyethylene Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 3.1.1. Pipes and Tubes 3.1.2. Rigid Articles 3.1.3. Sheets and Films 3.1.4. Other 3.2. High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 3.2.1. Packaging 3.2.2. Transportation 3.2.3. Electrical and Electronics 3.2.4. Building and Construction 3.2.5. Agriculture 3.2.6. Industry and Machinery 3.2.7. Other 3.3. High-Density Polyethylene Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America High-Density Polyethylene Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 4.1.1. Pipes and Tubes 4.1.2. Rigid Articles 4.1.3. Sheets and Films 4.1.4. Other 4.2. North America High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 4.2.1. Packaging 4.2.2. Transportation 4.2.3. Electrical and Electronics 4.2.4. Building and Construction 4.2.5. Agriculture 4.2.6. Industry and Machinery 4.2.7. Other 4.3. North America High-Density Polyethylene Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 4.3.1.1.1. Pipes and Tubes 4.3.1.1.2. Rigid Articles 4.3.1.1.3. Sheets and Films 4.3.1.1.4. Other 4.3.1.2. United States High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 4.3.1.2.1. Packaging 4.3.1.2.2. Transportation 4.3.1.2.3. Electrical and Electronics 4.3.1.2.4. Building and Construction 4.3.1.2.5. Agriculture 4.3.1.2.6. Industry and Machinery 4.3.1.2.7. Other 4.3.2. Canada 4.3.2.1. Canada High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 4.3.2.1.1. Pipes and Tubes 4.3.2.1.2. Rigid Articles 4.3.2.1.3. Sheets and Films 4.3.2.1.4. Other 4.3.2.2. Canada High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 4.3.2.2.1. Packaging 4.3.2.2.2. Transportation 4.3.2.2.3. Electrical and Electronics 4.3.2.2.4. Building and Construction 4.3.2.2.5. Agriculture 4.3.2.2.6. Industry and Machinery 4.3.2.2.7. Other 4.3.3. Mexico 4.3.3.1. Mexico High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 4.3.3.1.1. Pipes and Tubes 4.3.3.1.2. Rigid Articles 4.3.3.1.3. Sheets and Films 4.3.3.1.4. Other 4.3.3.2. Mexico High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 4.3.3.2.1. Packaging 4.3.3.2.2. Transportation 4.3.3.2.3. Electrical and Electronics 4.3.3.2.4. Building and Construction 4.3.3.2.5. Agriculture 4.3.3.2.6. Industry and Machinery 4.3.3.2.7. Other 5. Europe High-Density Polyethylene Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 5.2. Europe High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 5.3. Europe High-Density Polyethylene Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 5.3.1.2. United Kingdom High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 5.3.2. France 5.3.2.1. France High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 5.3.2.2. France High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 5.3.3. Germany 5.3.3.1. Germany High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 5.3.3.2. Germany High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 5.3.4. Italy 5.3.4.1. Italy High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 5.3.4.2. Italy High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 5.3.5. Spain 5.3.5.1. Spain High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 5.3.5.2. Spain High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 5.3.6.2. Sweden High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 5.3.7. Austria 5.3.7.1. Austria High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 5.3.7.2. Austria High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 5.3.8.2. Rest of Europe High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 6. Asia Pacific High-Density Polyethylene Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 6.2. Asia Pacific High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 6.3. Asia Pacific High-Density Polyethylene Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 6.3.1.2. China High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 6.3.2.2. S Korea High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 6.3.3. Japan 6.3.3.1. Japan High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 6.3.3.2. Japan High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 6.3.4. India 6.3.4.1. India High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 6.3.4.2. India High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 6.3.5. Australia 6.3.5.1. Australia High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 6.3.5.2. Australia High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 6.3.6.2. Indonesia High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 6.3.7.2. Malaysia High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 6.3.8.2. Vietnam High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 6.3.9.2. Taiwan High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 6.3.10.2. Rest of Asia Pacific High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 7. Middle East and Africa High-Density Polyethylene Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 7.2. Middle East and Africa High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 7.3. Middle East and Africa High-Density Polyethylene Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 7.3.1.2. South Africa High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 7.3.2. GCC 7.3.2.1. GCC High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 7.3.2.2. GCC High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 7.3.3.2. Nigeria High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 7.3.4.2. Rest of ME&A High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 8. South America High-Density Polyethylene Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 8.2. South America High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 8.3. South America High-Density Polyethylene Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 8.3.1.2. Brazil High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 8.3.2.2. Argentina High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America High-Density Polyethylene Market Size and Forecast, by Application (2023-2030) 8.3.3.2. Rest Of South America High-Density Polyethylene Market Size and Forecast, by End User Industry (2023-2030) 9. Global High-Density Polyethylene Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading High-Density Polyethylene Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. LyondellBasell Industries – Netherlands 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. INEOS – UK 10.3. Total SA - France 10.4. Reliance Industries Limited - India 10.5. Formosa Plastics Corporation – Taiwan 10.6. Borealis AG – Austria 10.7. Sinopec - China 10.8. Thai Plastic and Chemicals Public Company Limited - Thailand 10.9. PTT Global Chemical – Thailand 10.10. Lotte Chemical Corporation - South Korea 10.11. Mitsui Chemicals - Japan 10.12. ExxonMobil – (USA) 10.13. Dow Chemical Company – USA 10.14. Chevron Phillips Chemical Company – USA 10.15. NOVA Chemicals Corporation – Canada 10.16. Westlake Chemical Corporation - USA 10.17. SABIC - Saudi Arabia 10.18. Qatar Petrochemical Company (QAPCO) - Qatar 10.19. Braskem – Brazil 10.20. Sasol - South Africa 11. Key Findings 12. Industry Recommendations 13. High-Density Polyethylene Market: Research Methodology 14. Terms and Glossary