High Availability Server Market was valued at US$ 51.88 Bn. in 2022. The Global High Availability Server Market size is estimated to grow at a CAGR of 21.5% over the forecast period.High Availability Server Market Definition:

The High Availability Server is an advanced system equipped with idle power, a fully operational network, RAID disk towers, and backups, which guarantees maximum time and complete reliability without a single point of failure. It is built on a complex hardware and software structure; all system components work independently of each other. Any failure of one component will not affect the entire system.To know about the Research Methodology:-Request Free Sample Report The global high availability server market is influenced by the investment proposed in data center building projects by Google, AWS, Alibaba Cloud, and Microsoft. Server vendors lower the prices of their products to target small and medium enterprises (SMEs) directly. Vendors focus on designing and producing energy-efficient processors to meet the growing demand for energy-saving servers. The growing demand for cloud service solutions in a variety of end-user industries, such as BFSI, IT & Telecom, will have an impact on the need for a high-end available market server. In addition, the need to analyze big data and cloud-enabled applications will influence the growing capacity of cloud service providers, thereby accelerating the growth of high availability servers in all emerging economies.

High Availability Server Market Dynamics:

IoT, AI, VR, etc., are various factors that are expected to increase during the forecast period while contributing to their market growth. The rapid digitalization of the world is accelerating the growth of the available high-end server market. High-availability servers provide an advanced data centre solution and are much needed by all businesses due to increased data production. The server operates without fail as it is equipped with inactive power, high-reliability backups, and high-quality RAID disk towers. Increased adoption of Internet-based (IoT) solutions for devices or devices worldwide is one of the major factors driving the growth of the most widely available server market. The increase in the deployment of multiple applications across a wide range of industries, such as moderately dedicated servers, awesome private cloud, dedicated servers for the highest performance, and increased demand for extensive data analysis among businesses, accelerates the market growth. Increased availability of high-availability servers due to its advantageous features, such as the lower risk of system failure and increased demand for cloud-based services, also impact the market. In addition, the increase in digital input in the workplace, increased investment, and increased industrial use has a positive impact on the high-availability server market. In addition, technological advances and the expansion of data centres increase profitable opportunities for market players in the forecast period 2023 to 2029. On the other hand, higher initial investment costs and repair costs are expected to hamper the global high availability server market growth. Lack of awareness about the server is expected to challenge the most accessible server market in the forecast period 2023-2029. For instance, in July 2022 - Cisco Systems and Acacia Communications announced they had entered into a security agreement when Cisco agreed to buy Acacia. An existing Cisco provider, Acacia designs and manufactures high-speed optical interconnect technology that allows web-scale companies, data centre operators and service providers to meet the highly growing consumer data needs. Another example is VMware Inc., where the company has announced its intention to acquire Avi Networks, a leader in cloud-based application delivery services. Avi Networks will also allow VMware to automatically deliver public cloud information to the entire data centre, which is highly scalable and internally protected with the ability to use apps with a single click when discovery closes. These all are the positive signs which reflect the growth of the global high availability server market in the coming forecast period of 2023-2029.

High Availability Server Market Segment Analysis:

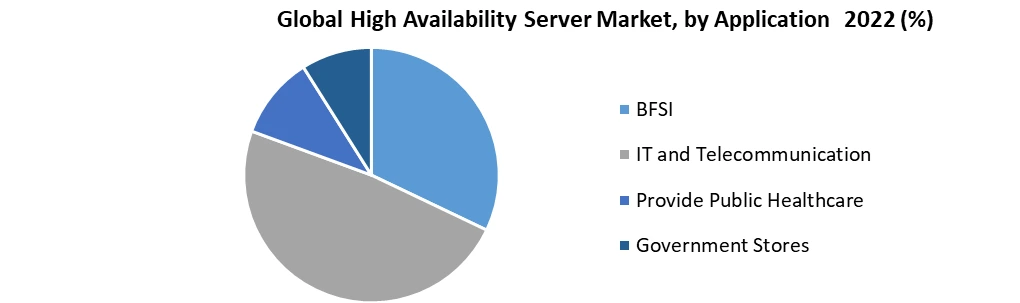

High Availability Server Market by Application, High Availability Servers are used in the IT & Telecommunication industry to provide high availability of servers. It has helped telecom providers focus on building trust, launching new technologies faster, and supporting mobile users who want to stay connected. A discovery-II level can be used in the telecommunications industry for its high-time capabilities and reduces the complexity of network infrastructure by providing robustness and error tolerance. Today, banks and the financial services industry desperately need high-quality available servers. They rely heavily on IT infrastructure for efficient operation and customer support. The availability rate can be improved to a higher level through the well-planned distribution of HA servers so that these organizations provide day-to-day service to their customers even in the event of system failures or disasters. Medical and healthcare organizations use the highest available servers to monitor and manage their IT infrastructure. This assists the organization in ensuring the proper functioning of health services without expiration. The acquisition server plays a vital role as it provides reliable, consistent access to client/server applications or file storage systems across all LAN (local networks) such as Intranet, Internet, and Extranets. They also help provide business continuity solutions for critical purpose data by eliminating a single point of failure that can lead to random disruption, thus improving productivity and reducing costs at the same time. Many organizations and businesses around the world use high-quality government servers to ensure that their data is secure. They can store a lot of sensitive information that do not get exposed infront of cybercriminals. These servers are used for other purposes, such as online shopping, communication, etc., where security becomes an important goal. Therefore, these types of servers help them achieve both goals; ensuring safety while allowing for efficient operation of the business at all times without any downtime or disruption to customers/clients using the various services.

High Availability Server Market Regional Insights:

North America is expected to dominate the global high availability market as growth is due to key players such as Dell Inc, Cisco System Inc., IBM Corp., and AWS Inc., among others. These players are trying to strengthen their market position throughout the US and Canada, thus contributing a large portion of the assignment. In addition, the early adoption of advanced technologies in the region encourages growth in the overall market. The influx of available high-end servers is increasing across all end-of-life industries, creating opportunities for market growth in North America. A growing number of integration and acquisition among some of the leading players are strengthening their market position across the region. The Asia-Pacific region is also significant in the global high availability server market due to its emerging population and the adoption of advanced technology, especially in the countries like China, India, Japan, Israel etc. Europe's thriving acceptance of the IT sector is a significant factor in mapping the region to a global market for the high availability of the server. South America is also gaining momentum in this market due to the region's investment in the internet and technology sector. Middle East Africa is already in the first phase of the high global availability of the server market but is expected to have a significant CAGR in the forecast period. The objective of the report is to present a comprehensive analysis of the Global High Availability Server Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global High Availability Server Market dynamic, structure by analyzing the market segments and projecting the Global High Availability Server Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the Global High Availability Server Market make the report investor’s guide.High Availability Server Market Scope: Inquire before buying

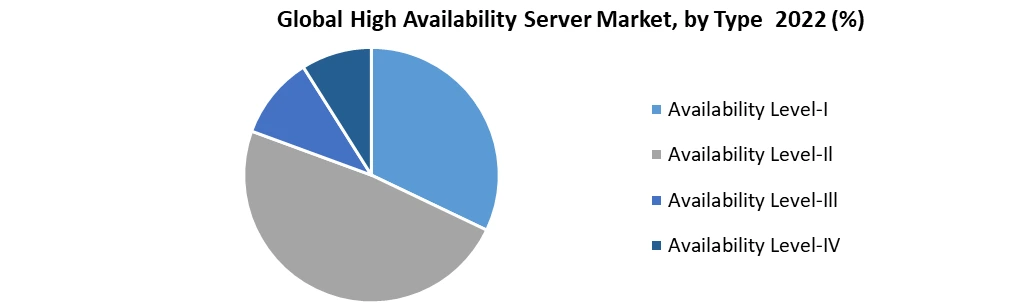

Global High Availability Server Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 51.88 Bn. Forecast Period 2023 to 2029 CAGR: 21.5% Market Size in 2029: US $ 202.78 Bn. Segments Covered: by Type Availability Level-I Availability Level-Il Availability Level-Ill Availability Level-IV by Application BFSI IT and Telecommunication Provide Public Healthcare Government Stores High Availability Server Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)High Availability Server Market, Key Players are

1. HP Development Company, L.P. (US) 2. IBM Corporation (US) 3. Dell (US) 4. Stratus Technologies (US) 5. Oracle (US) 6. Fujitsu (Japan) 7. NEC Corporation (Japan) 8. Unisys (US) 9. CenterServ International (Canada) 10. Cisco (US) 11. Jabil Inc. (US) 12. Atos SE (France) 13. Huawei Technologies Co., Ltd. (China) 14. Inspur (China) 15. MiTAC Holdings Corp. (Taiwan) 16. Quanta Computer lnc. (Taiwan) 17. Dawning Information Industry (China) 18. Super Micro Computer, Inc. (US) 19. Wistron Corporation (Taiwan) 20. OSNEXUS Corporation (US) Frequently Asked Questions: 1] What segments are covered in the Global High Availability Server Market report? Ans. The segments covered in the Global High Availability Server Market report are based on Type, Application and Region. 2] Which region is expected to hold the highest share in the Global High Availability Server Market? Ans. The North America region is expected to hold the highest share in the Global High Availability Server Market. 3] What is the market size of the Global High Availability Server Market by 2029? Ans. The market size of the Global High Availability Server Market by 2029 is expected to reach US$ 202.78 Bn. 4] What is the forecast period for the Global High Availability Server Market? Ans. The forecast period for the Global High Availability Server Market is 2023-2029. 5] What was the market size of the Global High Availability Server Market in 2022? Ans. The market size of the Global High Availability Server Market in 2022 was valued at US$ 51.88 Bn.

1. Global High Availability Server Market Size: Research Methodology 2. Global High Availability Server Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global High Availability Server Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global High Availability Server Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global High Availability Server Market Size Segmentation 4.1. Global High Availability Server Market Size, by Type (2022-2029) • Availability Level-I • Availability Level-Il • Availability Level-Ill • Availability Level-IV 4.2. Global High Availability Server Market Size, by Application (2022-2029) • BFSI • IT and Telecommunication • Healthcare • Government Stores 5. North America Global High Availability Server Market (2022-2029) 5.1. North America Global High Availability Server Market Size, by Type (2022-2029) 5.1.1. Availability Level-I 5.1.2. Availability Level-Il 5.1.3. Availability Level-Ill 5.1.4. Availability Level-IV 5.2. North America Global High Availability Server Market Size, by Application (2022-2029) 5.2.1. BFSI 5.2.2. IT and Telecommunication 5.2.3. Healthcare 5.2.4. Government Stores 5.3. North America Global High Availability Server Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Global High Availability Server Market (2022-2029) 6.1. European Global High Availability Server Market Size, by Type (2022-2029) 6.2. European Global High Availability Server Market Size, by Application (2022-2029) 6.3. European Global High Availability Server Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Global High Availability Server Market (2022-2029) 7.1. Asia Pacific Global High Availability Server Market Size, by Type (2022-2029) 7.2. Asia Pacific Global High Availability Server Market Size, by Application (2022-2029) 7.3. Asia Pacific Global High Availability Server Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. The Middle East and Africa Global High Availability Server Market (2022-2029) 8.1. The Middle East and Africa Global High Availability Server Market Size, by Type (2022-2029) 8.2. The Middle East and Africa Global High Availability Server Market Size, by Application (2022-2029) 8.3. The Middle East and Africa Global High Availability Server Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Global High Availability Server Market (2022-2029) 9.1. South America Global High Availability Server Market Size, by Type (2022-2029) 9.2. South America Global High Availability Server Market, by Application (2022-2029) 9.3. South America Global High Availability Server Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Dell (US) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Development 10.2. HP Development Company, L.P. (US) 10.3. IBM Corporation (US) 10.4. Stratus Technologies (US) 10.5. Oracle (US) 10.6. Fujitsu (Japan) 10.7. NEC Corporation (Japan) 10.8. Unisys (US) 10.9. CenterServ International (Canada) 10.10. Cisco (US) 10.11. Jabil Inc. (US) 10.12. Atos SE (France) 10.13. Huawei Technologies Co., Ltd. (China) 10.14. Inspur (China) 10.15. MiTAC Holdings Corp. (Taiwan) 10.16. Quanta Computer lnc. (Taiwan) 10.17. Dawning Information Industry (China) 10.18. Super Micro Computer, Inc. (US) 10.19. Wistron Corporation (Taiwan) 10.20. OSNEXUS Corporation (US)