By 2030, the Helium Market is expected to reach US $27.06 billion, thanks to growth in the cryogenics segment. The report analyzes market dynamics by region and end-user industries.Helium Market Overview:

The global Helium market was valued at US $15.48 Bn. in 2023, and it is expected to reach US $27.06 Bn. by 2030 with a CAGR of 8.3% during the forecast period. Helium is a critical component of many significant technologies that impact our lives daily, but the capacity of current and anticipated helium supply sources to meet future demand is highly questionable. Many circumstances have combined to produce a problematic scenario, beginning with the United States government's decision in 1996 to sell virtually all of its helium stockpile, which was held in a depleted natural gas field in Amarillo, Texas. For much of the last decade, this resulted in an increase in supply and artificially low pricing. Because this was the only site in the world to store helium until recently, all of the helium sold out of this reserve has already been spent. Many big energy projects have been canceled or delayed as a result of declining oil and gas prices induced by the introduction of shale drilling, in addition to the depletion of the US government's helium reserve. Helium was previously generated as a byproduct in a few major conventional oil and gas projects that occurred to contain a lot of helium. Most helium-related projects have been cancelled in recent years, as spending on oil and gas production from shale, which cannot capture or create considerable amounts of helium, has taken its place. There are no substantial projects in the works in North America to replace the helium supply lost as a result of US government stockpile sales. Recent shortages have made existing helium demand less elastic, and new sources of helium demand that are rapidly emerging could accelerate demand growth.To know about the Research Methodology :- Request Free Sample Report

Helium Market Dynamics:

Growing consumption of helium in the electronics and semiconductor industry

Helium is also necessary for the use of the Internet. Liquid helium is used to cool the magnets used in the production process of semiconductors, which are found in almost all modern gadgets. Meanwhile, the fiber optic cables that deliver Internet access and cable TV to people's homes must be manufactured in an all-helium atmosphere to avoid trapped bubbles. Silicon is processed into working chips at a fabrication facility with high-tech equipment and ultra-clean conditions. Modern fabs cost billions of dollars, and each of the several pieces of equipment costs millions of dollars, so it's critical that the processing runs smoothly to make the most of that investment. Helium is used in a variety of ways in these operations. Helium is used in the semiconductor manufacturing process for a variety of reasons. It is also an "inert" gas, which means it does not react with other substances. As a result, it's suitable as a setting for the chemical reactions that occur during the procedure. Because many of these are based on gases or liquids, having an inert atmosphere surrounding the silicon eliminates any undesirable reactions. Helium also has a high thermal conductivity, which means it effectively carries heat away. This helps in maintaining the silicon's temperature during these procedures. As the size of the circuitry on silicon shrinks, this is becoming increasingly significant. Without the process control that helium gives, this downsizing would be difficult to achieve. Thus, the unique features of helium which, cannot be replaced with any other element are expected to drive the market growth over the forecast period.Growing consumption of liquid helium in the medical industry

Liquid helium is used to cool the superconducting magnet that generates the magnetic field in magnetic resonance imaging devices. MRIs are used by doctors to diagnose malignancies, tumors, strokes, heart problems, and brain illnesses, as well as by researchers for chemical, biology, and medical investigations. Newer machines use "dramatically less helium," but the National Research Council estimates that inventing a magnet that doesn't require liquid helium will take at least five years and may not happen at all.Health risks associated with helium

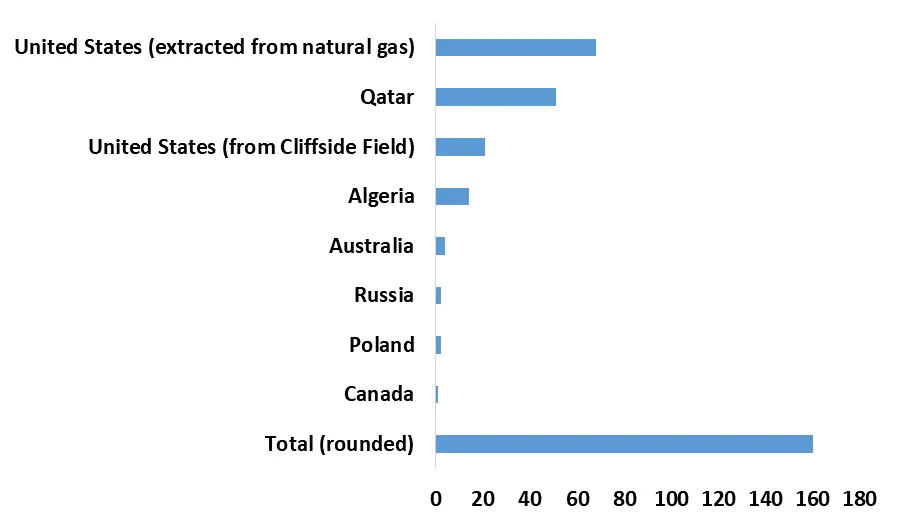

Helium is a non-toxic, inert gas. Excessive concentrations can cause nausea, dizziness, vomiting, unconsciousness, and death when inhaled. Errors in judgment, confusion, or loss of consciousness can all lead to death if self-rescue is not possible. When oxygen levels are low, unconsciousness and death can happen quickly and without warning. As a result, this is the factor expected to hamper the market growth during the forecast period.The production level of the countries producing Helium in million cubic meters in 2023:

Global Helium Market Segment Analysis:

Based on Phase, the global helium market is segmented as Liquid Phase, and Gas Phase. In 2023, the liquid phase segment was dominant and held xx% of the overall market shares in terms of revenue because of the COVID-19 emergence which, led increased in the number of patients that got affected by the pandemic globally. Liquid helium's major consumer is the medical industry as it is used to cool the super magnets that are used in MRI machines.Based on Application, the global helium market is segmented as, Breathing Mixes, Cryogenics, Lead Detection, Pressurizing and Purging, Welding, Controlled Atmosphere, and Others. In 2023, the cryogenics segment was dominant and held 28% of the overall market share in terms of revenue as helium is used as a super coolant for cryogenic applications such as magnetic resonance imaging (MRI), nuclear magnetic resonance (NMR) spectroscopy, particle accelerators, large hadron collider, superconducting quantum interference device (SQUID), electron spin resonance spectroscopy (ESR), superconducting magnetic energy storage (SMEs). Based on End-use Industry, the global helium market is segmented as Aerospace & Aircraft, Electronics & Semiconductors, Nuclear Power, Healthcare, Welding and Metal Fabrication, and Others. In 2023, the healthcare segment was dominant and held more than 34% of the overall market share in terms of revenue. Helium has many applications in the medical field. Liquid helium can reach a temperature of -269° C, making it the ideal choice for cooling MRI magnets. Also, helium is consumed to monitor breathing. It is an important content in the cure of emphysema, asthma, and other breathing disorders. Typically, the gas is used to treat lung illnesses. The mixture of helium and oxygen is used to cure chronic and acute respiratory illnesses because it enters the lungs faster than any other gas. There is no alternative available for helium in cryogenic applications.

Helium Market Regional Insights:

North America region dominated the market: In 2023, North America accounted for the greatest portion of the market, with the United States alone accounting for 30% of global consumption. In terms of scale, the US electronics market is the largest in the world. Also, thanks to the application of modern technology, an increase in the number of R&D centers, and rising consumer demand, it is likely to be the leading market over the forecast period. Helium reserves are primarily found in the United States, Russia, Qatar, Algeria, and Iran, although fresh finds in Western Canada show substantial potential. North American Helium is at the vanguard of developing large helium production in Saskatchewan, which will be needed in North America and possibly the rest of the globe. The focus on generating high-end products has resulted in a large growth in the number of manufacturing plants and development centers in the United States. Over the forecast period, this is expected to increase helium demand. Also, the United States possesses the world's largest aerospace industry. The total active general aviation fleet is expected to decline by 0.9 percent from 212,335 aircraft in 2019 to 210,380 aircraft by 2040, according to the Federal Aviation Administration (FAA), thanks to unfavorable pilot demographics, the availability of much lower-cost alternatives for recreational use, and the overall increasing cost of aircraft ownership. However, between 2019 and 2040, the more expensive and complex turbine-powered fleet (including rotorcraft) is expected to grow by 14,640 aircraft, or 1.82% per year, while the turbojet fleet is expected to grow by 2.32% per year. The objective of the report is to present a comprehensive analysis of the global market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the global market dynamics, structure by analyzing the market segments and project the global market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global market makes the report investor's guide.Global Helium Market Scope: Inquire before buying

Global Helium Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 15.48 Bn. Forecast Period 2024 to 2030 CAGR: 8.3% Market Size in 2030: US $ 27.06 Bn. Segments Covered: by Phase Liquid Gas by Application Breathing Mixes Cryogenics Leak Detection Pressurizing and Purging Welding Controlled Atmospheres Other by End-user Industry Aerospace & Aircraft Electronics & Semiconductors Nuclear Power Healthcare Welding & Metal Fabrication Other Helium Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Helium Market, Key Players are

1.Air Products and Chemicals, Inc. 2. Air Liquide 3. Linde AG 4. Praxair, Inc. 5. Taiyo Nippon Sanso Corporation 6. Iwatani Corporation 7. Gulf Cryo 8. Messer Group 9. Qatar Gas Operating Company Limited 10. Global Gases 11. Matheson Tri-Gas Inc 12. ONEOK Inc. 13. Exxon Mobil Corporation 14. Polish Oil and Gas Company 15. Weil Group 16. OthersFrequently Asked Questions:

1. What is the forecast period considered for the Helium market report? Ans. The considered forecast period for the helium market is 2024-2030 2. Which key factors are hindering the growth of the Helium market? Ans. The health risk associated with helium and the costly extraction process is the key factor expected to hinder the growth of the market during the forecast period. 3. What is the compound annual growth rate (CAGR) of the Helium market for the next 8 years? Ans. The global Helium market is expected to grow at a CAGR of 8.3% during the forecast period (2024-2030). 4. What are the key factors driving the growth of the Helium market? Ans. The growing use of helium in the booming electronics, semiconductors, and medical industry are the key factors expected to drive the growth of the market during the forecast period. 5. Which are the worldwide major key players covered in the Helium market report? Ans. Air Products and Chemicals, Inc., Air Liquide, Linde AG, Praxair, Inc., Taiyo Nippon Sanso Corporation, Iwatani Corporation, Gulf Cryo, Messer Group, Qatar Gas Operating Company Limited, Global Gases, Matheson Tri-Gas Inc, ONEOK Inc., Exxon Mobil Corporation, Polish Oil and Gas Company, Weil Group, and Others.

1. Helium Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Helium Market: Dynamics 2.1. Helium Market Trends by Region 2.1.1. North America Helium Market Trends 2.1.2. Europe Helium Market Trends 2.1.3. Asia Pacific Helium Market Trends 2.1.4. Middle East and Africa Helium Market Trends 2.1.5. South America Helium Market Trends 2.2. Helium Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Helium Market Drivers 2.2.1.2. North America Helium Market Restraints 2.2.1.3. North America Helium Market Opportunities 2.2.1.4. North America Helium Market Challenges 2.2.2. Europe 2.2.2.1. Europe Helium Market Drivers 2.2.2.2. Europe Helium Market Restraints 2.2.2.3. Europe Helium Market Opportunities 2.2.2.4. Europe Helium Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Helium Market Drivers 2.2.3.2. Asia Pacific Helium Market Restraints 2.2.3.3. Asia Pacific Helium Market Opportunities 2.2.3.4. Asia Pacific Helium Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Helium Market Drivers 2.2.4.2. Middle East and Africa Helium Market Restraints 2.2.4.3. Middle East and Africa Helium Market Opportunities 2.2.4.4. Middle East and Africa Helium Market Challenges 2.2.5. South America 2.2.5.1. South America Helium Market Drivers 2.2.5.2. South America Helium Market Restraints 2.2.5.3. South America Helium Market Opportunities 2.2.5.4. South America Helium Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Helium Industry 2.8. Analysis of Government Schemes and Initiatives For Helium Industry 2.9. Helium Market price trend Analysis (2021-22) 2.10. Helium Market Trade Analysis 2.10.1. Global Import Analysis 2.10.1.1. Top Importer of Helium 2.10.2. Global Export Analysis 2.10.2.1. Top Exporter of Helium 2.11. Helium Production Analysis 2.12. The Global Pandemic Impact on Helium Market 3. Helium Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) 2023-2030 3.1. Helium Market Size and Forecast, by Phase (2023-2030) 3.1.1. Liquid 3.1.2. Gas 3.2. Helium Market Size and Forecast, by Application (2023-2030) 3.2.1. Breathing Mixes 3.2.2. Cryogenics 3.2.3. Leak Detection 3.2.4. Pressurizing and Purging 3.2.5. Welding 3.2.6. Controlled Atmospheres 3.2.7. Other 3.3. Helium Market Size and Forecast, by End-user Industry (2023-2030) 3.3.1. Aerospace & Aircraft 3.3.2. Electronics & Semiconductors 3.3.3. Nuclear Power 3.3.4. Healthcare 3.3.5. Welding & Metal Fabrication 3.3.6. Other 3.4. Helium Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Helium Market Size and Forecast by Segmentation (by Value and Volume) 2023-2030 4.1. North America Helium Market Size and Forecast, by Phase (2023-2030) 4.1.1. Liquid 4.1.2. Gas 4.2. North America Helium Market Size and Forecast, by Application (2023-2030) 4.2.1. Breathing Mixes 4.2.2. Cryogenics 4.2.3. Leak Detection 4.2.4. Pressurizing and Purging 4.2.5. Welding 4.2.6. Controlled Atmospheres 4.2.7. Other 4.3. North America Helium Market Size and Forecast, by End-user Industry (2023-2030) 4.3.1. Aerospace & Aircraft 4.3.2. Electronics & Semiconductors 4.3.3. Nuclear Power 4.3.4. Healthcare 4.3.5. Welding & Metal Fabrication 4.3.6. Other 4.4. North America Helium Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Helium Market Size and Forecast, by Phase (2023-2030) 4.4.1.1.1. Liquid 4.4.1.1.2. Gas 4.4.1.2. United States Helium Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Breathing Mixes 4.4.1.2.2. Cryogenics 4.4.1.2.3. Leak Detection 4.4.1.2.4. Pressurizing and Purging 4.4.1.2.5. Welding 4.4.1.2.6. Controlled Atmospheres 4.4.1.2.7. Other 4.4.1.3. United States Helium Market Size and Forecast, by End-user Industry (2023-2030) 4.4.1.3.1. Aerospace & Aircraft 4.4.1.3.2. Electronics & Semiconductors 4.4.1.3.3. Nuclear Power 4.4.1.3.4. Healthcare 4.4.1.3.5. Welding & Metal Fabrication 4.4.1.3.6. Other 4.4.2. Canada 4.4.2.1. Canada Helium Market Size and Forecast, by Phase (2023-2030) 4.4.2.1.1. Liquid 4.4.2.1.2. Gas 4.4.2.2. Canada Helium Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Breathing Mixes 4.4.2.2.2. Cryogenics 4.4.2.2.3. Leak Detection 4.4.2.2.4. Pressurizing and Purging 4.4.2.2.5. Welding 4.4.2.2.6. Controlled Atmospheres 4.4.2.2.7. Other 4.4.2.3. Canada Helium Market Size and Forecast, by End-user Industry (2023-2030) 4.4.2.3.1. Aerospace & Aircraft 4.4.2.3.2. Electronics & Semiconductors 4.4.2.3.3. Nuclear Power 4.4.2.3.4. Healthcare 4.4.2.3.5. Welding & Metal Fabrication 4.4.2.3.6. Other 4.4.3. Mexico 4.4.3.1. Mexico Helium Market Size and Forecast, by Phase (2023-2030) 4.4.3.1.1. Liquid 4.4.3.1.2. Gas 4.4.3.2. Mexico Helium Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Breathing Mixes 4.4.3.2.2. Cryogenics 4.4.3.2.3. Leak Detection 4.4.3.2.4. Pressurizing and Purging 4.4.3.2.5. Welding 4.4.3.2.6. Controlled Atmospheres 4.4.3.2.7. Other 4.4.3.3. Mexico Helium Market Size and Forecast, by End-user Industry (2023-2030) 4.4.3.3.1. Aerospace & Aircraft 4.4.3.3.2. Electronics & Semiconductors 4.4.3.3.3. Nuclear Power 4.4.3.3.4. Healthcare 4.4.3.3.5. Welding & Metal Fabrication 4.4.3.3.6. Other 5. Europe Helium Market Size and Forecast by Segmentation (by Value and Volume) 2023-2030 5.1. Europe Helium Market Size and Forecast, by Phase (2023-2030) 5.2. Europe Helium Market Size and Forecast, by Application (2023-2030) 5.3. Europe Helium Market Size and Forecast, by End-user Industry (2023-2030) 5.4. Europe Helium Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Helium Market Size and Forecast, by Phase (2023-2030) 5.4.1.2. United Kingdom Helium Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Helium Market Size and Forecast, by End-user Industry(2023-2030) 5.4.2. France 5.4.2.1. France Helium Market Size and Forecast, by Phase (2023-2030) 5.4.2.2. France Helium Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Helium Market Size and Forecast, by End-user Industry(2023-2030) 5.4.3. Germany 5.4.3.1. Germany Helium Market Size and Forecast, by Phase (2023-2030) 5.4.3.2. Germany Helium Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Helium Market Size and Forecast, by End-user Industry (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Helium Market Size and Forecast, by Phase (2023-2030) 5.4.4.2. Italy Helium Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Helium Market Size and Forecast, by End-user Industry(2023-2030) 5.4.5. Spain 5.4.5.1. Spain Helium Market Size and Forecast, by Phase (2023-2030) 5.4.5.2. Spain Helium Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Helium Market Size and Forecast, by End-user Industry (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Helium Market Size and Forecast, by Phase (2023-2030) 5.4.6.2. Sweden Helium Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Helium Market Size and Forecast, by End-user Industry (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Helium Market Size and Forecast, by Phase (2023-2030) 5.4.7.2. Austria Helium Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Helium Market Size and Forecast, by End-user Industry (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Helium Market Size and Forecast, by Phase (2023-2030) 5.4.8.2. Rest of Europe Helium Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Helium Market Size and Forecast, by End-user Industry (2023-2030) 6. Asia Pacific Helium Market Size and Forecast by Segmentation (by Value and Volume) 2023-2030 6.1. Asia Pacific Helium Market Size and Forecast, by Phase (2023-2030) 6.2. Asia Pacific Helium Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Helium Market Size and Forecast, by End-user Industry (2023-2030) 6.4. Asia Pacific Helium Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Helium Market Size and Forecast, by Phase (2023-2030) 6.4.1.2. China Helium Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Helium Market Size and Forecast, by End-user Industry (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Helium Market Size and Forecast, by Phase (2023-2030) 6.4.2.2. S Korea Helium Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Helium Market Size and Forecast, by End-user Industry (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Helium Market Size and Forecast, by Phase (2023-2030) 6.4.3.2. Japan Helium Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Helium Market Size and Forecast, by End-user Industry (2023-2030) 6.4.4. India 6.4.4.1. India Helium Market Size and Forecast, by Phase (2023-2030) 6.4.4.2. India Helium Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Helium Market Size and Forecast, by End-user Industry (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Helium Market Size and Forecast, by Phase (2023-2030) 6.4.5.2. Australia Helium Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Helium Market Size and Forecast, by End-user Industry (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Helium Market Size and Forecast, by Phase (2023-2030) 6.4.6.2. Indonesia Helium Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Helium Market Size and Forecast, by End-user Industry (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Helium Market Size and Forecast, by Phase (2023-2030) 6.4.7.2. Malaysia Helium Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Helium Market Size and Forecast, by End-user Industry (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Helium Market Size and Forecast, by Phase (2023-2030) 6.4.8.2. Vietnam Helium Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Helium Market Size and Forecast, by End-user Industry(2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Helium Market Size and Forecast, by Phase (2023-2030) 6.4.9.2. Taiwan Helium Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Helium Market Size and Forecast, by End-user Industry (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Helium Market Size and Forecast, by Phase (2023-2030) 6.4.10.2. Rest of Asia Pacific Helium Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Helium Market Size and Forecast, by End-user Industry (2023-2030) 7. Middle East and Africa Helium Market Size and Forecast by Segmentation (by Value and Volume) 2023-2030 7.1. Middle East and Africa Helium Market Size and Forecast, by Phase (2023-2030) 7.2. Middle East and Africa Helium Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Helium Market Size and Forecast, by End-user Industry (2023-2030) 7.4. Middle East and Africa Helium Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Helium Market Size and Forecast, by Phase (2023-2030) 7.4.1.2. South Africa Helium Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Helium Market Size and Forecast, by End-user Industry (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Helium Market Size and Forecast, by Phase (2023-2030) 7.4.2.2. GCC Helium Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Helium Market Size and Forecast, by End-user Industry (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Helium Market Size and Forecast, by Phase (2023-2030) 7.4.3.2. Nigeria Helium Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Helium Market Size and Forecast, by End-user Industry (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Helium Market Size and Forecast, by Phase (2023-2030) 7.4.4.2. Rest of ME&A Helium Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Helium Market Size and Forecast, by End-user Industry (2023-2030) 8. South America Helium Market Size and Forecast by Segmentation (by Value and Volume) 2023-2030 8.1. South America Helium Market Size and Forecast, by Phase (2023-2030) 8.2. South America Helium Market Size and Forecast, by Application (2023-2030) 8.3. South America Helium Market Size and Forecast, by End-user Industry(2023-2030) 8.4. South America Helium Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Helium Market Size and Forecast, by Phase (2023-2030) 8.4.1.2. Brazil Helium Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Helium Market Size and Forecast, by End-user Industry (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Helium Market Size and Forecast, by Phase (2023-2030) 8.4.2.2. Argentina Helium Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Helium Market Size and Forecast, by End-user Industry (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Helium Market Size and Forecast, by Phase (2023-2030) 8.4.3.2. Rest Of South America Helium Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Helium Market Size and Forecast, by End-user Industry (2023-2030) 9. Global Helium Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Production of 2023 9.3.6. Company Locations 9.4. Leading Helium Market Companies, by market capitalization 9.5. Analysis of Organized and Unorganized Key Players in Helium Industry 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Air Products and Chemicals, Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Air Liquide 10.3. Linde AG 10.4. Praxair, Inc. 10.5. Taiyo Nippon Sanso Corporation 10.6. Iwatani Corporation 10.7. Gulf Cryo 10.8. Messer Group 10.9. Qatar Gas Operating Company Limited 10.10. Global Gases 10.11. Matheson Tri-Gas Inc 10.12. ONEOK Inc. 10.13. Exxon Mobil Corporation 10.14. Polish Oil and Gas Company 10.15. Weil Group 10.16. Others 11. Key Findings 12. Industry Recommendations 13. Helium Market: Research Methodology 14. Terms and Glossary