The Healthcare Asset Management Market size was valued at USD 5.64 Billion in 2023 and the total Healthcare Asset Management revenue is expected to grow at a CAGR of 4.52 % from 2024 to 2030, reaching nearly USD 7.69 Billion by 2030. Healthcare Asset Management is a systematic approach of tracking, managing, and optimizing medical assets and inventory within healthcare facilities to meet the growing demand for healthcare services efficiently. The Healthcare Asset Management Market is experiencing robust growth driven by the rising demand for efficient asset tracking solutions in healthcare facilities. Factors driving market growth include the need for real-time location tracking of medical equipment, the adoption of RFID and RTLS technologies, and the implementation of inventory management systems.To know about the Research Methodology:-Request Free Sample Report The COVID-19 pandemic has further accelerated the adoption of asset management solutions to manage the influx of medical equipment and ensure their availability where needed most. The Healthcare Asset Management Market faces the challenge of managing a diverse range of medical assets amidst an aging population, higher prevalence of chronic diseases, and increasing pollution levels. The complexity of medical assets encompasses various categories, including diagnostic and supporting equipment such as ECG, X-ray, and ultrasound machines, laboratory and surgical instruments like surgical tools and pacemakers, and consumables like medicines, surgical disposables, and cleaning supplies. These assets require efficient management to ensure timely availability, proper maintenance, and compliance with regulatory standards. Key players like IBM, GE Healthcare, and Siemens Healthineers are investing in advanced asset management platforms incorporating AI and ML algorithms for predictive maintenance and optimizing asset lifecycle management. Partnerships and collaborations among healthcare providers, technology vendors, and regulatory bodies are driving innovation in the development of comprehensive asset management solutions tailored to the unique needs of healthcare organizations. These solutions not only enhance operational efficiency but also improve patient outcomes by ensuring timely access to critical medical resources. With the integration of IoT devices and cloud-based platforms, the healthcare asset management market is poised for significant growth, offering opportunities for stakeholders to capitalize on the increasing demand for smart healthcare infrastructure and digital transformation initiatives worldwide.

Healthcare Asset Management Market Dynamics:

Growing adoption of sophisticated technology in the medical field is driving market growth The rising demand for efficient resource utilization within healthcare facilities driving the growth of Healthcare Asset Management Market. Institutions like Johns Hopkins Hospital have implemented real-time location systems (RTLS) to track essential equipment, reducing search time significantly and saving substantial costs annually. Stringent regulatory compliance requirements also contribute to the market's growth, with asset management solutions aiding healthcare organizations in maintaining accurate records of medical assets to meet standards such as the FDA's Unique Device Identification (UDI) system. Advancements in RFID and RTLS technologies further enhance operational efficiency by enabling real-time tracking of medical assets, as evidenced by the Cleveland Clinic's successful deployment of RFID tags to reduce rental costs and improve asset utilization rates. The increasing adoption of IoT devices enables seamless integration with asset management systems, facilitating automated tracking and management of medical assets. Philips Healthcare's IoT-enabled asset tracking solutions exemplify this trend, allowing healthcare providers to monitor the location and status of medical devices remotely. As patient safety remains a top priority, asset management solutions play a crucial role in preventing equipment failures and minimizing errors. Mayo Clinic's implementation of predictive maintenance systems underscores the importance of such solutions in enhancing patient care quality by reducing equipment downtime. Moreover, with healthcare facilities expanding rapidly, Kaiser Permanente's utilization of asset management software to centralize inventory management across its network of hospitals highlights the need for efficient management of medical assets across multiple locations. Poor Workflow Design with Lack of Integration hindering the market growth Data Inaccuracy hampers the growth of Healthcare Asset Management Market, as Healthcare institutions deal with lots of data regarding patients, drugs and treatment methods. Inaccurate data collected from manual methods can give hospitals a wrong overview of their capital requirements and take a toll on their performance. A solid Asset management solution that shows actionable data so hospitals can better assess their requirements and performance is the key. While healthcare facilities merge with growth, their supply chains often remain siloed. This results in inconsistent workflows that eventually impact the bottomline and challenge the growth of Healthcare Asset Management Market4. It is important to integrate supply chains and centralize purchases from all departments with good Asset management solution. Disconnected supply chains from different departments bleed into unnecessarily duplicated workflows. This simply takes up more time and resources. Automating and integrating siloed tasks with Asset management technology can free up human resources and streamline the entire workflows of a hospital. Overnight shipping costs of emergency items due to frequent Asset stockouts can have a detrimental impact on a hospital’s revenue. With a better Asset management solution, you can pull down instances of stockouts and eliminate these costs. Drug shortages are inescapable in the healthcare industry, forcing hospitals to purchase more expensive alternatives or disrupting their entire supply chain. A technology that gives early notifications or alerts on long run drug shortages can help healthcare institutions effectively monitor and manage foreseen and some unforeseen drug shortages.Healthcare Asset Management Market Segment Analysis:

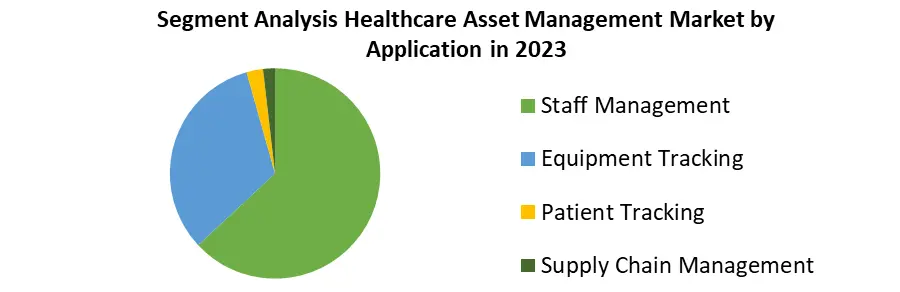

Based on Application, Staff Management solutions streamline workforce allocation and optimize operational efficiency, addressing staffing shortages and enhancing patient care. Equipment Tracking systems ensure the availability and maintenance of crucial medical equipment, reducing downtime and improving resource utilization. Patient Tracking technologies enhance safety and care coordination by monitoring patient movements and interactions, ultimately improving patient outcomes and satisfaction. Supply Chain Management solutions optimize inventory management and procurement processes, ensuring timely access to critical supplies while minimizing waste and costs. While each application serves unique needs, they collectively contribute to a more efficient, safer, and cost-effective healthcare ecosystem, driving adoption across diverse healthcare settings worldwide.

Healthcare Asset Management Market Regional Insights:

North America Dominated the Healthcare Asset Management Market North America stands out as a significant hub for the adoption and utilization of hospital asset management solutions within the healthcare sector. The region's robust healthcare infrastructure has played a pivotal role in fostering the demand for such solutions, owing to the feasibility of their immediate implementation. A crucial contributing factor to this trend is the region's status as an early adopter of IT infrastructure, with an impressive internet penetration rate of 89.4% of the population, as reported by Internet World Stats. This high level of connectivity facilitates the seamless deployment and integration of asset management solutions across healthcare facilities. North America commands a substantial portion, exceeding 40%, of the global pharmaceutical industry. This dominance underscores the region's pivotal role in shaping trends and driving innovations within the healthcare sector. Consequently, the increasing recognition of the manifold benefits associated with the deployment of asset management systems in healthcare settings is expected to further propel the demand for such solutions in the foreseeable future. The symbiotic relationship between the burgeoning pharmaceutical industry and the healthcare asset management market is evident. The growth trajectory of the former significantly influences the dynamics of the latter, with the demand for asset management solutions being intricately linked to the evolving needs and requirements of pharmaceutical stakeholders. As such, the expansion of the pharmaceutical industry in North America emerges as a primary driver driving the growth of the healthcare asset management market in the region.Healthcare Asset Management Market Scope: Inquire before buying

Global Healthcare Asset Management Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.64 Bn. Forecast Period 2024 to 2030 CAGR: 4.52% Market Size in 2030: US $ 7.69 Bn. Segments Covered: by Type RFID (Radiofrequency Identification Devices) RTLS (Real-Time Location Systems) by Application Staff Management Equipment Tracking Patient Tracking Supply Chain Management by End Use Industry Hospital/Clinic Laboratory Pharmaceutical Healthcare Asset Management Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Healthcare Asset Management Market Key Players:

Major Contributors in the Healthcare Asset Management Industry: 1. IBM Corporation 2. AeroScout 3. Ekahau 4. Awarepoint Corporation 5. Siemens Healthcare 6. GE Healthcare 7. AiRISTA Flow 8. Elpas 9. CenTrak 10. ThingMagic 11. Sonitor 12. Stanley Healthcare 13. Versus Technology 14. Symantec 15. CA Technologies 16. Philips 17. DXC Technology 18. CloudPassage 19. FireEye 20. Zebra Technologies FAQs: 1] Which region is expected to hold the highest share in the Global Healthcare Asset Management Market? Ans. North America region is expected to hold the highest share in the Healthcare Asset Management Market. 2] What is the market size of the Global Healthcare Asset Management Market by 2030? Ans. The market size of the Healthcare Asset Management Market by 2030 is expected to reach US$ 7.69 Billion. 3] What is the forecast period for the Global Healthcare Asset Management Market? Ans. The forecast period for the Healthcare Asset Management Market is 2024-2030. 4] What was the market size of the Global Healthcare Asset Management Market in 2023? Ans. The market size of the Healthcare Asset Management Market in 2023 was valued at US$ 5.64 Billion.

1. Healthcare Asset Management Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Healthcare Asset Management Market: Dynamics 2.1. Healthcare Asset Management Market Trends by Region 2.1.1. North America Healthcare Asset Management Market Trends 2.1.2. Europe Healthcare Asset Management Market Trends 2.1.3. Asia Pacific Healthcare Asset Management Market Trends 2.1.4. Middle East and Africa Healthcare Asset Management Market Trends 2.1.5. South America Healthcare Asset Management Market Trends 2.2. Healthcare Asset Management Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Healthcare Asset Management Market Drivers 2.2.1.2. North America Healthcare Asset Management Market Restraints 2.2.1.3. North America Healthcare Asset Management Market Opportunities 2.2.1.4. North America Healthcare Asset Management Market Challenges 2.2.2. Europe 2.2.2.1. Europe Healthcare Asset Management Market Drivers 2.2.2.2. Europe Healthcare Asset Management Market Restraints 2.2.2.3. Europe Healthcare Asset Management Market Opportunities 2.2.2.4. Europe Healthcare Asset Management Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Healthcare Asset Management Market Drivers 2.2.3.2. Asia Pacific Healthcare Asset Management Market Restraints 2.2.3.3. Asia Pacific Healthcare Asset Management Market Opportunities 2.2.3.4. Asia Pacific Healthcare Asset Management Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Healthcare Asset Management Market Drivers 2.2.4.2. Middle East and Africa Healthcare Asset Management Market Restraints 2.2.4.3. Middle East and Africa Healthcare Asset Management Market Opportunities 2.2.4.4. Middle East and Africa Healthcare Asset Management Market Challenges 2.2.5. South America 2.2.5.1. South America Healthcare Asset Management Market Drivers 2.2.5.2. South America Healthcare Asset Management Market Restraints 2.2.5.3. South America Healthcare Asset Management Market Opportunities 2.2.5.4. South America Healthcare Asset Management Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Healthcare Asset Management Industry 2.8. Analysis of Government Schemes and Initiatives For Healthcare Asset Management Industry 2.9. Healthcare Asset Management Market Trade Analysis 2.10. The Global Pandemic Impact on Healthcare Asset Management Market 3. Healthcare Asset Management Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 3.1.1. RFID (Radiofrequency Identification Devices) 3.1.2. RTLS (Real-Time Location Systems) 3.2. Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 3.2.1. Staff Management 3.2.2. Equipment Tracking 3.2.3. Patient Tracking 3.2.4. Supply Chain Management 3.3. Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 3.3.1. Hospital/Clinic 3.3.2. Laboratory 3.3.3. Pharmaceutical 3.4. Healthcare Asset Management Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Healthcare Asset Management Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 4.1.1. RFID (Radiofrequency Identification Devices) 4.1.2. RTLS (Real-Time Location Systems) 4.2. North America Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 4.2.1. Staff Management 4.2.2. Equipment Tracking 4.2.3. Patient Tracking 4.2.4. Supply Chain Management 4.3. North America Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 4.3.1. Hospital/Clinic 4.3.2. Laboratory 4.3.3. Pharmaceutical 4.4. North America Healthcare Asset Management Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. RFID (Radiofrequency Identification Devices) 4.4.1.1.2. RTLS (Real-Time Location Systems) 4.4.1.2. United States Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Staff Management 4.4.1.2.2. Equipment Tracking 4.4.1.2.3. Patient Tracking 4.4.1.2.4. Supply Chain Management 4.4.1.3. United States Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 4.4.1.3.1. Hospital/Clinic 4.4.1.3.2. Laboratory 4.4.1.3.3. Pharmaceutical 4.4.2. Canada 4.4.2.1. Canada Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. RFID (Radiofrequency Identification Devices) 4.4.2.1.2. RTLS (Real-Time Location Systems) 4.4.2.2. Canada Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Staff Management 4.4.2.2.2. Equipment Tracking 4.4.2.2.3. Patient Tracking 4.4.2.2.4. Supply Chain Management 4.4.2.3. Canada Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 4.4.2.3.1. Hospital/Clinic 4.4.2.3.2. Laboratory 4.4.2.3.3. Pharmaceutical 4.4.3. Mexico 4.4.3.1. Mexico Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. RFID (Radiofrequency Identification Devices) 4.4.3.1.2. RTLS (Real-Time Location Systems) 4.4.3.2. Mexico Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Staff Management 4.4.3.2.2. Equipment Tracking 4.4.3.2.3. Patient Tracking 4.4.3.2.4. Supply Chain Management 4.4.3.3. Mexico Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 4.4.3.3.1. Hospital/Clinic 4.4.3.3.2. Laboratory 4.4.3.3.3. Pharmaceutical 5. Europe Healthcare Asset Management Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 5.2. Europe Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 5.3. Europe Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 5.4. Europe Healthcare Asset Management Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 5.4.2. France 5.4.2.1. France Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 6. Asia Pacific Healthcare Asset Management Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 6.4. Asia Pacific Healthcare Asset Management Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 6.4.4. India 6.4.4.1. India Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 7. Middle East and Africa Healthcare Asset Management Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 7.4. Middle East and Africa Healthcare Asset Management Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 8. South America Healthcare Asset Management Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 8.2. South America Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 8.3. South America Healthcare Asset Management Market Size and Forecast, by End Use Industry(2023-2030) 8.4. South America Healthcare Asset Management Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Healthcare Asset Management Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Healthcare Asset Management Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Healthcare Asset Management Market Size and Forecast, by End Use Industry (2023-2030) 9. Global Healthcare Asset Management Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Healthcare Asset Management Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. IBM Corporation 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. AeroScout 10.3. Ekahau 10.4. Awarepoint Corporation 10.5. Siemens Healthcare 10.6. GE Healthcare 10.7. AiRISTA Flow 10.8. Elpas 10.9. CenTrak 10.10. ThingMagic 10.11. Sonitor 10.12. Stanley Healthcare 10.13. Versus Technology 10.14. Symantec 10.15. CA Technologies 10.16. Philips 10.17. DXC Technology 10.18. CloudPassage 10.19. FireEye 10.20. Zebra Technologies 11. Key Findings 12. Industry Recommendations 13. Healthcare Asset Management Market: Research Methodology 14. Terms and Glossary