Golf Equipment Market was valued at USD 8.82 Billion in 2023, and it is expected to reach USD 11.68 Billion by 2030, exhibiting a CAGR of 4.09% during the forecast period (2024-2030).Golf Equipment Market Overview:

Golf has a long tradition of integrity and honor, which depends heavily on the standards set in the golf industry. The industry is currently experiencing high demand and increased participation with strong long-term opportunities across the globe. The growing popularity of TopGolf, which now has 70 locations across six countries has been one of the main drivers of the golf equipment market growth. Junior golfers and others brand-new to the game are buying up new equipment. Golf is a recreational activity that requires time and money. The golf industry has been principally driven by the age cohort of 30 and above, mainly who have the time and money to engage in the sport. The golf game has benefited from a significant increase in rounds of play and new golfers, and courses around the world have served as safe and enjoyable sanctuaries. Currently, there are a lot of golf brands producing golf clubs available in the market. The most popular Original Equipment Manufacturers (OEMs) are Callaway, Titleist, PING, Mizuno, Cleveland, Tour Edge, and others. Many companies need to provide an available product at an acceptable price, delivered promptly to sustain jumps in demand. Key players operating in the market have to be able to respond quickly to fluctuations in sales volume and the need for certain product changes. A level of product customization would require a whole new information infrastructure for the golf industry. The Golf equipment market is highly competitive because of the presence of many established market players in retail, e-commerce, sports stores, and wholesale, and many new start-ups joining frequently. It also faces negative competition with counterfeit sporting equipment and accessories with cheaper low-quality variants. Competition among manufacturers to gain market share exists in the areas such as new technologies, product performance, price and service, design, and strategic alliances.To know about the Research Methodology :- Request Free Sample Report

Golf Statistics:

In 2023, there were over 66 million golfers worldwide playing over 900 million rounds at over 31,000 golf facilities on nearly 38,000 golf courses. In 2023, on a geographic basis, the Americas accounted for over 40% of the golf equipment market, followed by the many countries that comprise the Asia Pacific accounting for approximately 45%, and EMEA for over 10% of the equipment market. While rounds of play had been relatively stable for years, the game experienced an approximate 8% global increase in rounds in both 2022 and 2020. The state of the economy influences the amount of money people spend on golf. Golf equipment like clubs, shoes, balls, and accessories are recreational in nature and is therefore a discretionary purchase for consumers. Consumers are usually more willing to make discretionary purchases of golf products when economic conditions are favorable.Research Methodology

The Maximize Market Research helps organizations across different industry verticals to solve their business problems. Strategic market sizing and data searching techniques include secondary research, and primary research (interviews with industry experts). The MMR provides syndicated and customized market research reports on different verticals like pharmaceutical and healthcare, oil and gas and power, chemicals, automotive, technology, FMCG, and food & beverages. Secondary research is conducted to identify the segment specifications, and qualitative and quantitative data along with the factors responsible for the growth of the market. The secondary source referred for the research are press releases, company annual reports, government websites, and research papers related to the market. The global golf equipment market report covers a detailed analysis of major market prospects and elements that influence the firm's value. Market analysis is used in forecasting to focus on the various market sectors that are required to track the fastest-growing company. The report provides a general overview of the market as well as a detailed analysis of future supply and demand conditions, current market trends, and the potential for rapid expansion. The study delivers market insights to help to understand better predict future demand. The golf equipment market overview contains detailed information on the market's size, main players, and market dynamics like drivers, restraints, opportunities, challenges, and key trends.Golf Equipment Market Dynamics

Surging Interest among Buyers boosts the Sales of Golf Equipment With more amateurs turning professional, senior golfers have high hopes for the future and popularity of the game. Youngsters have started taking to the game in droves over the last decade. The interest is on the rise, particularly when youngsters see a future in it. New participants are increasingly younger. The number of female golfers grew 8% in 2023, which was the largest uptick in five years. A surge in interest in golf is mainly driven by older, already passionate golfers. The average number of rounds, which had played by golfers grew to 20.2 in 2023. More people are joining golf courses. Key manufacturers operating in the market are focusing on long-term trends, which are going to be quite attractive. Many companies have invested in talent and elevated the in-store service model to become trusted advisers for golf enthusiasts of all levels. An increase in government initiatives in the promotion of sports participation and purchasing power coupled with the development of new products is expected to drive golf equipment adoption. High-income levels across developed countries and a focus on enhancing living standards are expected to bolster golf equipment market growth.Regulation:

The United States Golf Association is the governing body for golf in the United States and Mexico. The Royal and Ancient Golf Club of St. Andrews is the governing body for golf in all jurisdictions outside of the United States and Mexico. Government bodies in various countries draft and implement national laws, regulations, policies, and standards related to sports. The USGA and the R&A together are the "Governing Bodies" for golf, and they collectively write, interpret and maintain the Rules of Golf. The Rules of Golf set the standards and establish limitations for the design and performance of all balls and clubs. Many new regulations on golf balls and golf clubs have been introduced. The Rules of Golf have regulated the size, weight, spherical symmetry, initial velocity, and overall distance performance of golf balls. Golf’s most regulated categories are golf balls and golf clubs. Manufacturers are seeking to have their new golf ball and golf club products conform with the Rules of Golf published by the United States Golf Association (the "USGA") and The Royal and Ancient Golf Club of St. Andrews (the "R&A" and, with the USGA, the "Governing Bodies"), because these rules are usually followed by golfers, both professional and amateur, within their respective jurisdictions. The report covers a detailed analysis of the regulations.

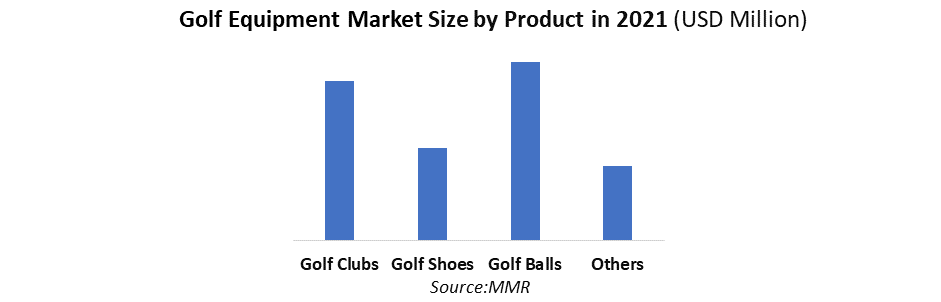

Golf Equipment Market Segment Analysis

Golf balls are the main contributing product in the golf equipment industry. Golf ball manufacturers rely on distinct processes to create two types of balls: one for general use, and the second is designated for use by pro golfers. Accounting for 70% of all golf balls, the two-piece balls include a rubber core and a plastic outer shell. In contrast, the three-piece balls have a liquid or gel core, which is surrounded by rubber and encased in plastic. Suppliers have to be fully stocked and prepared well in advance of major tournaments like the Masters because professionals use the more complex three-piece ball. The three-piece balls are more difficult to make, with the manufacturing process. It is entailing more than 80 distinct steps and over 30 rounds of inspections. Key manufacturers are continually investing in design innovation and process technology to deliver the highest performance and quality golf balls in the game. They strive to strengthen their sell-in and sell-through route to market capabilities by focusing on enhancing the sales team's skills, supporting trade partners in those channels where dedicated golfers shop, and educating golfers on Titleist golf ball performance and quality excellence. They also offer custom imprinting for country clubs, tournaments, corporate logos, and personalization. The golf ball business is highly competitive. There are a number of well-established and well-financed competitors, including Callaway, TaylorMade, SRI Sports Limited (Dunlop and Srixon brands), and Bridgestone (Bridgestone and Precept brands). The golf ball and golf club industries have been characterized by widespread imitation of the popular ball and club designs.

Golf Equipment Market Regional Insights

North America region is home to the golf Industry Currently, there are 23.8 million golfers in the United States who generate almost $70 billion in revenue every year. Manufacturers have adjusted their production processes accordingly and turning their efforts towards longer production cycles and a focus on custom fitting for golf. US Golf Equipment Sales Surge Continues in 2023 by 43%. The substantial majority of golf equipment sales include the United States, Japan, Korea, the United Kingdom, Canada, Germany, Sweden, France, Greater China, Australia, New Zealand, Thailand, Singapore, Malaysia, and Switzerland. The current U.S. presidential administration may support and introduce certain new tax, trade, and tariff proposals, modifications to international trade policy, and other changes, which may affect U.S. trade relations with other countries. The United States, United Kingdom, Japan, Germany, Canada, South Korea, Sweden, France, and Italy are some of the major countries in the golf industry, with more than 50% of golf courses in these countries. Most of these courses belong to private clubs, golf-centric real estate courses, and golf resorts. With over 30,000 golf courses worldwide, over 70% of which are open to the public, most are accessible. The global golf equipment market is highly impacted by product innovations carried out by the key players, along with high investment in marketing and promotional activities, to reach higher customer bases. With the substantial growth of the golf tourism industry, the golf equipment market is expected to have a positive outlook during the forecast period. In developing economies, certain investments are necessary to continue to grow in the domestic market environment. The competitive environment is intensifying because of sluggish growth among the population and golfer population in Japan and new entries in the Internet environment. The threat or power of potential entrants in the golf equipment industry is less. Competitive barriers to companies trying to enter the market include economic, technological, and regulatory obstacles; even though they are not as rigid as in other industries. Golf Equipment production has increased significantly because of advances in analytics, automation, and the Internet of Things, along with innovations in areas such as materials science, which are already showing great promise in reducing resource consumption. Various research and development programs have been initiated by sports equipment manufacturers to improve the quality of golf equipment. The Bargaining power of buyers in the sports equipment industry is high. In the current competitive environment, customer satisfaction has become a crucial factor in shaping companies' business strategies. Companies have to build and maintain long-lasting and effective relationships with consumers to remain competitive in the market.Report Scope:

The objective of the report is to present a comprehensive analysis of the global Golf Equipment Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Golf Equipment Market dynamic, and structure by analyzing the market segments and projecting the Golf Equipment Market size. Clear representation of competitive analysis of key players by segment type and regional presence in the Golf Equipment Market makes the report investor's guide.Golf Equipment Market Scope: Inquire before buying

Golf Equipment Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 8.82 Bn. Forecast Period 2024 to 2030 CAGR: 4.09% Market Size in 2030: US $ 11.68 Bn. Segments Covered: by Product 1. Golf Clubs 2. Golf Shoes 3. Golf Balls 4. Others by Distribution Channel 1. Offline 2. Online by End Use 1. Amateur 2. Professional Golf Equipment Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Golf Equipment Market, Key Players are

1. Acushnet Holding Corp. (US) 2. TaylorMade Golf Company, Inc. (US) 3. Dixon Golf, Inc. (US) 4. Roger Cleveland Golf Company, Inc. (US) 5. True Temper (US) 6. Mizuno USA (US) 7. Wilson (US) 8. Miura Golf Inc (US) 9. Nike, Inc (US) 10. callway golf company (US) 11. Cobragolf.com (US) 12. Yamaha Golf (US) 13. Bettinardi Golf (US) 14. Cure Putters (US) 15. Bridgestone Golf (US) 16. Birton Golf, Inc. (US) 17. Dunlop Sports (US) 18. Golf Galaxy (US) 19. Volvik (US) 20. Robin Golf Inc. (US) 21. Penfold Golf (UK) 22. Srixon Sports Europe Ltd. (UK) 23. Piranha Golf (Australia) 24. Amer Sports (Finland) 25. Nexen Corporation (South Korea) Frequently Asked Questions: 1] What segments are covered in the Global Golf Equipment Market report? Ans. The segments covered in the Golf Equipment Market report are based on Product and Distribution channels. 2] Which region is expected to hold the highest share in the Global Golf Equipment Market? Ans. The North America region is expected to hold the highest share in the Golf Equipment Market. 3] What is the market size of the Global Golf Equipment Market by 2030? Ans. The market size of the Golf Equipment Market by 2030 is expected to reach USD 11.68 Bn. 4] What is the forecast period for the Global Golf Equipment Market? Ans. The forecast period for the Golf Equipment Market is 2024-2030. 5] What was the market size of the Global Golf Equipment Market in 2023? Ans. The market size of the Golf Equipment Market in 2023 was valued at USD 8.82 Bn.

1. Global Golf Equipment Market: Research Methodology 2. Global Golf Equipment Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Golf Equipment Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Golf Equipment Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Golf Equipment Market Segmentation 4.1 Global Golf Equipment Market, by Product (2023-2030) • Golf Clubs • Golf Shoes • Golf Balls • Others 4.2 Global Golf Equipment Market, by Distribution Channel (2023-2030) • Offline • Online 4.3 Global Golf Equipment Market, by End Use (2023-2030) • Amateur • Professional 5. North America Golf Equipment Market(2023-2030) 5.1 North America Golf Equipment Market, by Product (2023-2030) • Golf Clubs • Golf Shoes • Golf Balls • Others 5.2 North America Golf Equipment Market, by Distribution Channel (2023-2030) • Offline • Online 5.3 North America Golf Equipment Market, by End Use (2023-2030) • Amateur • Professional 5.4 North America Golf Equipment Market, by Country (2023-2030) • United States • Canada • Mexico 6. Europe Golf Equipment Market (2023-2030) 6.1. European Golf Equipment Market, by Product (2023-2030) 6.2. European Golf Equipment Market, by Distribution Channel (2023-2030) 6.3. European Golf Equipment Market, by End Use (2023-2030) 6.4. European Golf Equipment Market, by Country (2023-2030) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Golf Equipment Market (2023-2030) 7.1. Asia Pacific Golf Equipment Market, by Product (2023-2030) 7.2. Asia Pacific Golf Equipment Market, by Distribution Channel (2023-2030) 7.3. Asia Pacific Golf Equipment Market, by End Use (2023-2030) 7.4. Asia Pacific Golf Equipment Market, by Country (2023-2030) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Golf Equipment Market (2023-2030) 8.1 Middle East and Africa Golf Equipment Market, by Product (2023-2030) 8.2. Middle East and Africa Golf Equipment Market, by Distribution Channel (2023-2030) 8.3. Middle East and Africa Golf Equipment Market, by End Use (2023-2030) 8.4. Middle East and Africa Golf Equipment Market, by Country (2023-2030) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Golf Equipment Market (2023-2030) 9.1. South America Golf Equipment Market, by Product (2023-2030) 9.2. South America Golf Equipment Market, by Distribution Channel (2023-2030) 9.3. South America Golf Equipment Market, by End Use (2023-2030) 9.4 South America Golf Equipment Market, by Country (2023-2030) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Acushnet Holding Corp. (US) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 TaylorMade Golf Company, Inc. (US) 10.3 Dixon Golf, Inc. (US) 10.4 Roger Cleveland Golf Company, Inc. (US) 10.5 True Temper (US) 10.6 Mizuno USA (US) 10.7 Wilson (US) 10.8 Miura Golf Inc (US) 10.9 Nike, Inc (US) 10.10 callway golf company (US) 10.11 Cobragolf.com (US) 10.12 Yamaha Golf (US) 10.13 Bettinardi Golf (US) 10.14 Cure Putters (US) 10.15 Bridgestone Golf (US) 10.16 Birton Golf, Inc. (US) 10.17 Dunlop Sports (US) 10.18 Golf Galaxy (US) 10.19 Volvik (US) 10.20 Robin Golf Inc. (US) 10.21 Penfold Golf (UK) 10.22 Srixon Sports Europe Ltd. (UK) 10.23 Piranha Golf (Australia) 10.24 Amer Sports (Finland) 10.25 Nexen Corporation (South Korea)