Global Geomembrane Market size was valued at USD 2.75 Bn in 2023 and is expected to reach USD 4.62 Bn by 2030, at a CAGR of 7.7%.Geomembrane Market Overview

Geomembranes, composed of impermeable geosynthetic materials, form thin continuous sheets of polymers. They act as an impervious barrier, preventing the seepage of hazardous substances, and safeguarding surrounding environments. Geomembranes, integral to containment barriers in potable water and irrigation storage, play a pivotal role in fluid control across industries. Their widespread utilization spans multiple sectors including mining, sewage treatment, and construction due to their versatility and adaptability. Found in mining, marine, civil engineering, water treatment, and transportation, geomembranes are indispensable. They serve critical functions in preventing leakage, managing fluid movement, and ensuring effective containment, underscoring their diverse applications and significance in preserving environmental integrity within the geomembrane market. The industry's growth is driven not just by regulatory pressures but also by technological advancements and evolving market trends. Continuous innovations in geomembrane materials and manufacturing processes improve their durability, flexibility, and efficiency, providing diverse applications across industries. The rising trend of sustainable construction practices boosts the demand for geomembranes, aligning with eco-friendly initiatives and green infrastructure development. One significant growth driver for the Geomembrane Market is the increasing emphasis on environmental protection and stringent regulations. As environmental concerns amplify globally, the demand for geomembranes surges due to their pivotal role in preventing the seepage of harmful chemicals and contaminants, thereby safeguarding ecosystems and water resources. This escalating need for environmental conservation drives the adoption of geomembranes across various sectors, including mining, waste management, and water conservation projects. The Geomembrane Market witnesses an increase in demand due to the expanding scope of applications. Geomembranes find increasing use in civil engineering projects, transportation infrastructure, and agriculture, diversifying their market reach. The trend leans toward the adoption of high-performance geomembranes, driven by their ability to withstand harsh environmental conditions, ensuring long-term reliability and stability in various applications. The growth of the geomembrane industry stems from the amalgamation of regulatory push towards environmental conservation, technological advancements enhancing product efficiency, and the widening spectrum of applications. As sustainability becomes paramount and industries prioritize eco-friendly solutions, the geomembrane market is poised for continuous expansion and innovation to meet evolving demands while addressing pressing environmental concerns.To know about the Research Methodology:-Request Free Sample Report

Geomembrane Market Trend

Increasing adoption of sustainable and environmentally friendly materials. Growing global awareness about environmental issues including pollution and waste generation, has led to increased scrutiny of construction and infrastructure projects. Geomembranes, being a critical part of containment systems, are under pressure to align with sustainability goals and environmental regulations. Stringent regulations and policies across regions mandate environmentally friendly practices in construction and infrastructure projects. Many governing bodies need the use of sustainable materials to minimize environmental impact and promote eco-friendly construction practices. Many companies and organizations have committed to sustainability and corporate social responsibility. As part of their initiatives, they seek eco-friendly alternatives in construction materials, including geomembranes, to reduce their ecological footprint. There's a growing consumer and Geomembrane demand for sustainable solutions. Clients, investors and end-users increasingly prefer projects that prioritize environmental responsibility. This demand drives the adoption of sustainable geomembranes, leading to their increased availability and affordability which boost Geomembrane Market growth. Advancements in material science and manufacturing techniques have made it more feasible to produce geomembranes using recycled or biodegradable materials without compromising performance. This has encouraged the development and adoption of sustainable geomembranes in the market. Sustainable geomembranes offer longevity, durability and reliability, addressing concerns about the environmental impact of a product's lifecycle. They provide effective containment while minimizing environmental risks during and after their use.Geomembrane Market Dynamics

Driver: Increasing focus on infrastructure development projects boost Market Growth Geomembranes offer a wide range of applications beyond traditional infrastructure projects. They are employed in environmental remediation efforts, such as landfill closures, hazardous waste containment, and remediation of contaminated sites. They play an essential role in agriculture, aquaculture, and mining activities by providing effective containment solutions. Manufacturers have developed diverse types of geomembranes to provide specific project requirements. Customization options in terms of thickness, material composition, and design are pivotal in tailoring geomembranes for specific applications. This adaptability optimizes their effectiveness across diverse uses within the Geomembrane Market, ensuring tailored solutions that meet varying industry requirements Ongoing advancements in geomembrane technology have resulted in the development of high-performance materials. These innovations include enhanced materials with superior resistance to ultraviolet radiation, improved flexibility, and increased tensile strength, ensuring better durability and performance over time. With a growing global focus on sustainability, geomembranes contribute significantly to meeting sustainability goals. They facilitate responsible waste management, prevent groundwater contamination, and enable efficient water conservation, aligning with global sustainability initiatives. The increasing demand for geomembranes has fuelled innovation in manufacturing techniques and materials. Companies are investing in research and development to create eco-friendly, recyclable and cost-effective geomembranes, driving Geomembrane Market growth and technological advancements. Restraint: Initial high cost of installation and procurement hamper Market Growth Geomembranes, while offering long-term benefits, require a substantial initial investment. This includes the cost of high-quality materials, specialized equipment, and skilled labor for proper installation. The significant upfront investment deters potential users, particularly those with budget constraints or those seeking immediate returns on investment. In certain projects, especially smaller-scale or short-term ventures, the initial cost of geomembranes outweighs the immediate benefits, impacting their viability. This leads to a preference for alternative, cheaper solutions despite potential long-term risks. The high initial cost of geomembranes limits their adoption, particularly in regions or industries with limited financial resources. This restricts Geomembrane Market penetration and adoption rates, hindering the widespread use of geomembranes across various applications. Besides the cost, the complexity of installation and the need for specialized skills and equipment contribute to the overall expense. This complexity discourages potential users who lack the necessary expertise or resources for proper installation.Geomembrane Market Segment Analysis

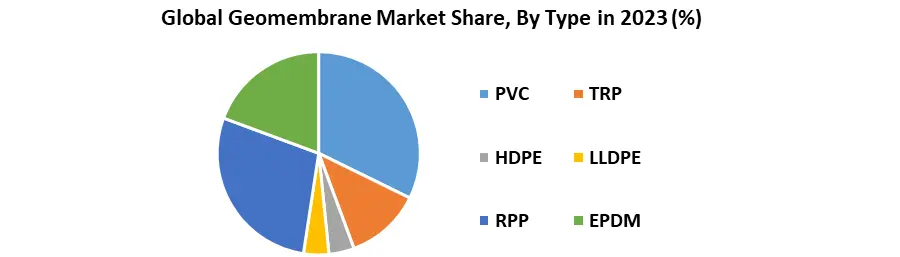

Based on Type, the market is segmented into PVC ,TRP ,HDPE , LLDPE , RPP and EPDM. HDPE dominated the Geomembrane Market in 2023. High-Density Polyethylene (HDPE) geomembranes reign supreme in the market due to a myriad of compelling attributes. One of its primary strengths lies in its exceptional chemical resistance, making it highly suitable for containing several hazardous substances without deteriorating or compromising the containment structure. This characteristic renders it invaluable across a broad spectrum of industries, from mining to waste management and agriculture, where secure containment is imperative. HDPE geomembranes provide exceptional durability and resilience, capable of withstanding harsh environmental conditions and extreme temperatures while maintaining structural integrity. Their strength against punctures and tears ensures long-term reliability, critical for applications such as landfills, reservoirs, and hazardous material containment. This durability extends through their capability to conform to different terrains and surface irregularities, enhancing their adaptability during installation and ensuring a secure containment system. The price of High-density Polyethylene (HDPE) in the Geomembrane Market varies based on thickness, size, and quantity, averaging between $0.25 to $2.50 per square foot. Factors such as quality, manufacturer, and specific project requirements significantly influence the pricing of HDPE geomembranes.The material's UV resistance is another significant advantage, ensuring prolonged outdoor use without deterioration or degradation from sun exposure. This feature is crucial for long-term applications in environmental engineering projects and landfills. The cost-effectiveness of HDPE geomembranes, combined with their ease of manufacturing, makes them a practical choice for various projects. Their accessibility and relatively lower installation costs compared to other materials contribute significantly to their dominance in the market. Considering their versatility, durability, chemical resistance and adaptability across diverse environments and industries, HDPE geomembranes are not only the preferred choice but also the cornerstone of reliable and secure containment solutions. Their exceptional properties continue to solidify their dominance in the Geomembrane Market globally.

Geomembrane Market Regional Insights

North America held the largest Geomembrane Market share in 2023 and is expected to maintain its dominance over the forecast period. The region's stringent environmental regulations and heightened awareness regarding containment and pollution control foster a high demand for geomembranes in various applications. The rapid infrastructure development initiatives, including transportation, mining, and waste management projects, drive the need for effective containment solutions, wherein geomembranes play a crucial role. The maturity of industries like mining, water treatment, and construction fuels the adoption of geomembranes for various containment needs. North America's advanced technological capabilities and significant investments in research and development contribute to the innovation and production of high-quality geomembranes, fostering trust and preference among consumers and industries. The emphasis on sustainability and environmental protection in the Geomembrane Market region promotes the adoption of geomembranes. Their significance lies in preventing soil contamination and ensuring secure containment of hazardous materials, aligning with the market's commitment to ecological preservation and safety measures. In North America, Atarfil stands as a pivotal manufacturer of Geomembranes, offering top-tier solutions for the safe containment of hazardous materials. Their Geosynthetics, crafted from specially manufactured processed polyolefins, ensure unparalleled efficiency and quality in containment applications. AGRU America, a leading manufacturer in the region, specializes in structured and embossed geomembranes. Utilizing a patented flat die-cast extrusion Manufacturing Process, AGRU produces consistent, smooth, and textured geomembranes. These liners, crafted from high-density polyethylene (HDPE) and linear low-density polyethylene (LLDPE), offer unmatched reliability in containment, stability, and chemical resistance. Across North America, these Geomembrane solutions from Atarfil and AGRU serve a wide spectrum of applications. From encapsulating and securely storing potentially hazardous waste to safeguarding pipelines, ponds, and various water treatment structures, geomembranes play an indispensable role in ensuring safe and effective containment across the Geomembrane Market continent.Geomembranes Market Scope: Inquire before buying

Global Geomembranes Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.75 Bn. Forecast Period 2024 to 2030 CAGR: 7.7% Market Size in 2030: US $ 4.62 Bn. Segments Covered: By Type PVC TRP HDPE LLDPE RPP EPDM By Manufacturing Process Extrusion Calendering Blow Molding Others By Application Agriculture and Nurseries Water industry Marine (Pontoon construction) Mining industry Others Global Geomembranes Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Geomembrane Key Player

1. Solmax International (Varennes, Quebec, Canada) 2. GSE Environmental ( Houston, Texas, USA) 3. Agru America ( Fernley, Nevada, USA) 4. Officine Maccaferri ( Bologna, Italy) 5. Plastika Kritis ( Megara, Greece) North America 1. Nilex Inc. (Edmonton, Alberta, Canada) 2. Carthage Mills (Madison, Tennessee, USA) 3. Colorado Lining International (Parker, Colorado, USA) 4. CETCO (Minerals Technologies Inc.) (Hoffman Estates, Illinois, USA) 5. Layfield Group Ltd. (Richmond, British Columbia, Canada) 6. Raven Industries Inc. (Sioux Falls, South Dakota, USA) 7. Brawler Industries (Houston, Texas, USA) Europe 1. Atarfil (Atarfe, Granada, Spain) 2. Officine Maccaferri (Bologna, Italy) 3. Plastika Kritis (Megara, Greece) 4. NAUE GmbH & Co. KG (Espelkamp, Germany) 5. HUESKER Group (Gescher, Germany) 6. EPI Environmental (Montréal, Quebec, Canada) 7. Sotrafa (El Ejido, Almería, Spain) Asia Pacific 1. Geofabrics Australasia (Albury, New South Wales, Australia) 2. Global Synthetics Pty Ltd. (Salisbury, South Australia, Australia)Frequently Asked Questions:

1] What is the growth rate of the Global Geomembrane Market? Ans. The Global Geomembrane Market is growing at a significant rate of 7.7% during the forecast period. 2] Which region is expected to dominate the Global Geomembrane Market? Ans. North America is expected to dominate the Geomembrane Market during the forecast period. 3] What is the expected Global Geomembrane Market size by 2030? Ans. The Geomembrane Market size is expected to reach USD 4.62 Billion by 2030 4] Which are the top players in the Global Geomembrane Market? Ans. The major top players in the Global Geomembrane Market are Solmax International (Varennes, Quebec, Canada), GSE Environmental ( Houston, Texas, USA), Agru America ( Fernley, Nevada, USA),Officine Maccaferri ( Bologna, Italy), Plastika Kritis ( Megara, Greece) and Others. 5] What are the factors driving the Global Geomembrane Market growth? Ans. Infrastructure development and technological advancements are expected to drive market growth during the forecast period.

1. Geomembrane Market: Research Methodology 2. Geomembrane Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Geomembrane Market: Dynamics 3.1. Geomembrane Market Trends by Region 3.1.1. North America Geomembrane Market Trends 3.1.2. Europe Geomembrane Market Trends 3.1.3. Asia Pacific Geomembrane Market Trends 3.1.4. Middle East and Africa Geomembrane Market Trends 3.1.5. South America Geomembrane Market Trends 3.2. Geomembrane Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Geomembrane Market Drivers 3.2.1.2. North America Geomembrane Market Restraints 3.2.1.3. North America Geomembrane Market Opportunities 3.2.1.4. North America Geomembrane Market Challenges 3.2.2. Europe 3.2.2.1. Europe Geomembrane Market Drivers 3.2.2.2. Europe Geomembrane Market Restraints 3.2.2.3. Europe Geomembrane Market Opportunities 3.2.2.4. Europe Geomembrane Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Geomembrane Market Drivers 3.2.3.2. Asia Pacific Geomembrane Market Restraints 3.2.3.3. Asia Pacific Geomembrane Market Opportunities 3.2.3.4. Asia Pacific Geomembrane Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Geomembrane Market Drivers 3.2.4.2. Middle East and Africa Geomembrane Market Restraints 3.2.4.3. Middle East and Africa Geomembrane Market Opportunities 3.2.4.4. Middle East and Africa Geomembrane Market Challenges 3.2.5. South America 3.2.5.1. South America Geomembrane Market Drivers 3.2.5.2. South America Geomembrane Market Restraints 3.2.5.3. South America Geomembrane Market Opportunities 3.2.5.4. South America Geomembrane Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Geomembrane Market 3.8. Analysis of Government Schemes and Initiatives For Geomembrane Market 3.9. The Global Pandemic Impact on Geomembrane Market 4. Geomembrane Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2023-2030) 4.1. Geomembrane Market Size and Forecast, by Type (2023-2030) 4.1.1. PVC 4.1.2. TRP 4.1.3. HDPE 4.1.4. LLDPE 4.1.5. RPP 4.1.6. EPDM 4.2. Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 4.2.1. Extrusion 4.2.2. Calendering 4.2.3. Blow Molding 4.2.4. Others 4.3. Geomembrane Market Size and Forecast, by Application (2023-2030) 4.3.1. Agriculture and Nurseries 4.3.2. Water industry 4.3.3. Marine (Pontoon construction) 4.3.4. Mining industry 4.3.5. Others 4.4. Geomembrane Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Geomembrane Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2023-2030) 5.1. North America Geomembrane Market Size and Forecast, by Type (2023-2030) 5.1.1. PVC 5.1.2. TRP 5.1.3. HDPE 5.1.4. LLDPE 5.1.5. RPP 5.1.6. EPDM 5.2. North America Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 5.2.1. Extrusion 5.2.2. Calendering 5.2.3. Blow Molding 5.2.4. Others 5.3. North America Geomembrane Market Size and Forecast, by Application (2023-2030) 5.3.1. Agriculture and Nurseries 5.3.2. Water industry 5.3.3. Marine (Pontoon construction) 5.3.4. Mining industry 5.3.5. Others 5.4. North America Geomembrane Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Geomembrane Market Size and Forecast, by Type (2023-2030) 5.4.1.1.1. PVC 5.4.1.1.2. TRP 5.4.1.1.3. HDPE 5.4.1.1.4. LLDPE 5.4.1.1.5. RPP 5.4.1.1.6. EPDM 5.4.1.2. United States Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 5.4.1.2.1. Extrusion 5.4.1.2.2. Calendering 5.4.1.2.3. Blow Molding 5.4.1.2.4. Others 5.4.1.3. United States Geomembrane Market Size and Forecast, by Application (2023-2030) 5.4.1.3.1. Agriculture and Nurseries 5.4.1.3.2. Water industry 5.4.1.3.3. Marine (Pontoon construction) 5.4.1.3.4. Mining industry 5.4.1.3.5. Others 5.4.2. Canada 5.4.2.1. Canada Geomembrane Market Size and Forecast, by Type (2023-2030) 5.4.2.1.1. PVC 5.4.2.1.2. TRP 5.4.2.1.3. HDPE 5.4.2.1.4. LLDPE 5.4.2.1.5. RPP 5.4.2.1.6. EPDM 5.4.2.2. Canada Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 5.4.2.2.1. Extrusion 5.4.2.2.2. Calendering 5.4.2.2.3. Blow Molding 5.4.2.2.4. Others 5.4.2.3. Canada Geomembrane Market Size and Forecast, by Application (2023-2030) 5.4.2.3.1. Agriculture and Nurseries 5.4.2.3.2. Water industry 5.4.2.3.3. Marine (Pontoon construction) 5.4.2.3.4. Mining industry 5.4.2.3.5. Others 5.4.3. Mexico 5.4.3.1. Mexico Geomembrane Market Size and Forecast, by Type (2023-2030) 5.4.3.1.1. PVC 5.4.3.1.2. TRP 5.4.3.1.3. HDPE 5.4.3.1.4. LLDPE 5.4.3.1.5. RPP 5.4.3.1.6. EPDM 5.4.3.2. Mexico Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 5.4.3.2.1. Extrusion 5.4.3.2.2. Calendering 5.4.3.2.3. Blow Molding 5.4.3.2.4. Others 5.4.3.3. Mexico Geomembrane Market Size and Forecast, by Application (2023-2030) 5.4.3.3.1. Agriculture and Nurseries 5.4.3.3.2. Water industry 5.4.3.3.3. Marine (Pontoon construction) 5.4.3.3.4. Mining industry 5.4.3.3.5. Others 6. Europe Geomembrane Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2023-2030) 6.1. Europe Geomembrane Market Size and Forecast, by Type (2023-2030) 6.2. Europe Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 6.3. Europe Geomembrane Market Size and Forecast, by Application (2023-2030) 6.4. Europe Geomembrane Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Geomembrane Market Size and Forecast, by Type (2023-2030) 6.4.1.2. United Kingdom Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 6.4.1.3. United Kingdom Geomembrane Market Size and Forecast, by Application (2023-2030) 6.4.2. France 6.4.2.1. France Geomembrane Market Size and Forecast, by Type (2023-2030) 6.4.2.2. France Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 6.4.2.3. France Geomembrane Market Size and Forecast, by Application (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Geomembrane Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Germany Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 6.4.3.3. Germany Geomembrane Market Size and Forecast, by Application (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Geomembrane Market Size and Forecast, by Type (2023-2030) 6.4.4.2. Italy Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 6.4.4.3. Italy Geomembrane Market Size and Forecast, by Application (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Geomembrane Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Spain Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 6.4.5.3. Spain Geomembrane Market Size and Forecast, by Application (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Geomembrane Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Sweden Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 6.4.6.3. Sweden Geomembrane Market Size and Forecast, by Application (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Geomembrane Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Austria Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 6.4.7.3. Austria Geomembrane Market Size and Forecast, by Application (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Geomembrane Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Rest of Europe Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 6.4.8.3. Rest of Europe Geomembrane Market Size and Forecast, by Application (2023-2030) 7. Asia Pacific Geomembrane Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2023-2030) 7.1. Asia Pacific Geomembrane Market Size and Forecast, by Type (2023-2030) 7.2. Asia Pacific Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 7.3. Asia Pacific Geomembrane Market Size and Forecast, by Application (2023-2030) 7.4. Asia Pacific Geomembrane Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Geomembrane Market Size and Forecast, by Type (2023-2030) 7.4.1.2. China Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 7.4.1.3. China Geomembrane Market Size and Forecast, by Application (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Geomembrane Market Size and Forecast, by Type (2023-2030) 7.4.2.2. S Korea Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 7.4.2.3. S Korea Geomembrane Market Size and Forecast, by Application (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Geomembrane Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Japan Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 7.4.3.3. Japan Geomembrane Market Size and Forecast, by Application (2023-2030) 7.4.4. India 7.4.4.1. India Geomembrane Market Size and Forecast, by Type (2023-2030) 7.4.4.2. India Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 7.4.4.3. India Geomembrane Market Size and Forecast, by Application (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Geomembrane Market Size and Forecast, by Type (2023-2030) 7.4.5.2. Australia Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 7.4.5.3. Australia Geomembrane Market Size and Forecast, by Application (2023-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Geomembrane Market Size and Forecast, by Type (2023-2030) 7.4.6.2. Indonesia Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 7.4.6.3. Indonesia Geomembrane Market Size and Forecast, by Application (2023-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Geomembrane Market Size and Forecast, by Type (2023-2030) 7.4.7.2. Malaysia Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 7.4.7.3. Malaysia Geomembrane Market Size and Forecast, by Application (2023-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Geomembrane Market Size and Forecast, by Type (2023-2030) 7.4.8.2. Vietnam Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 7.4.8.3. Vietnam Geomembrane Market Size and Forecast, by Application (2023-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Geomembrane Market Size and Forecast, by Type (2023-2030) 7.4.9.2. Taiwan Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 7.4.9.3. Taiwan Geomembrane Market Size and Forecast, by Application (2023-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Geomembrane Market Size and Forecast, by Type (2023-2030) 7.4.10.2. Rest of Asia Pacific Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 7.4.10.3. Rest of Asia Pacific Geomembrane Market Size and Forecast, by Application (2023-2030) 8. Middle East and Africa Geomembrane Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2023-2030 8.1. Middle East and Africa Geomembrane Market Size and Forecast, by Type (2023-2030) 8.2. Middle East and Africa Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 8.3. Middle East and Africa Geomembrane Market Size and Forecast, by Application (2023-2030) 8.4. Middle East and Africa Geomembrane Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Geomembrane Market Size and Forecast, by Type (2023-2030) 8.4.1.2. South Africa Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 8.4.1.3. South Africa Geomembrane Market Size and Forecast, by Application (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Geomembrane Market Size and Forecast, by Type (2023-2030) 8.4.2.2. GCC Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 8.4.2.3. GCC Geomembrane Market Size and Forecast, by Application (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Geomembrane Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Nigeria Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 8.4.3.3. Nigeria Geomembrane Market Size and Forecast, by Application (2023-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Geomembrane Market Size and Forecast, by Type (2023-2030) 8.4.4.2. Rest of ME&A Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 8.4.4.3. Rest of ME&A Geomembrane Market Size and Forecast, by Application (2023-2030) 9. South America Geomembrane Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2023-2030 9.1. South America Geomembrane Market Size and Forecast, by Type (2023-2030) 9.2. South America Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 9.3. South America Geomembrane Market Size and Forecast, by Application (2023-2030) 9.4. South America Geomembrane Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Geomembrane Market Size and Forecast, by Type (2023-2030) 9.4.1.2. Brazil Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 9.4.1.3. Brazil Geomembrane Market Size and Forecast, by Application (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Geomembrane Market Size and Forecast, by Type (2023-2030) 9.4.2.2. Argentina Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 9.4.2.3. Argentina Geomembrane Market Size and Forecast, by Application (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Geomembrane Market Size and Forecast, by Type (2023-2030) 9.4.3.2. Rest Of South America Geomembrane Market Size and Forecast, by Manufacturing Process (2023-2030) 9.4.3.3. Rest Of South America Geomembrane Market Size and Forecast, by Application (2023-2030) 10. Global Geomembrane Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Geomembrane Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Solmax International (Varennes, Quebec, Canada) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Recent Developments 11.2. GSE Environmental ( Houston, Texas, USA) 11.3. Agru America ( Fernley, Nevada, USA) 11.4. Officine Maccaferri ( Bologna, Italy) 11.5. Plastika Kritis ( Megara, Greece) 11.6. Nilex Inc. (Edmonton, Alberta, Canada) 11.7. Carthage Mills (Madison, Tennessee, USA) 11.8. Colorado Lining International (Parker, Colorado, USA) 11.9. CETCO (Minerals Technologies Inc.) (Hoffman Estates, Illinois, USA) 11.10. Layfield Group Ltd. (Richmond, British Columbia, Canada) 11.11. Raven Industries Inc. (Sioux Falls, South Dakota, USA) 11.12. Brawler Industries (Houston, Texas, USA) 11.13. Atarfil (Atarfe, Granada, Spain) 11.14. Officine Maccaferri (Bologna, Italy) 11.15. Plastika Kritis (Megara, Greece) 11.16. NAUE GmbH & Co. KG (Espelkamp, Germany) 11.17. HUESKER Group (Gescher, Germany) 11.18. EPI Environmental (Montréal, Quebec, Canada) 11.19. Sotrafa (El Ejido, Almería, Spain) 11.20. Geofabrics Australasia (Albury, New South Wales, Australia) 11.21. Global Synthetics Pty Ltd. (Salisbury, South Australia, Australia) 12. Key Findings 13. Industry Recommendations