The Furfural Market size was valued at USD 630.2Mn in 2023. The Furfural Market revenue is growing at a CAGR of 6.8 % from 2023 to 2029, reaching nearly USD 998.30 Bn by 2030.Furfural Market

Furfural, a significant organic compound, is derived from agricultural and forestry waste that contains high levels of carbohydrates, particularly Pentosans. Furfural serves as a solvent and intermediate in various industries, including foundries, pharmaceuticals, paints and coatings, agriculture, chemicals, refineries, automotive, construction, and others. The demand for furfural in refractory materials such as bricks, fiberglass, and ceramic composites is expected to rise. According to the MMR Study Report, the foundry industry in India is projected to witness substantial growth, aiming for a production volume of 16-20 million metric tons by 2022 and further increasing to 30 million metric tons by 2025. This growth, coupled with the chemical and foundry sectors, acts as a catalyst for the furfural market. As of April 2022, China, the global leader in chemical production, manufactured approximately 229,000 metric tons of chemical pesticides. China maintains its dominance in the chemical industry, accounting for 43% of global chemical sales. Following closely behind are the EU27 chemical industry at 14.7% and the United States at 10.9%, solidifying China's prominent position in the global chemical landscape. The rising demand for furfural from the chemical and foundry industry further boosts the growth of the furfural market.To know about the Research Methodology :- Request Free Sample Report

Furfural Market Dynamics

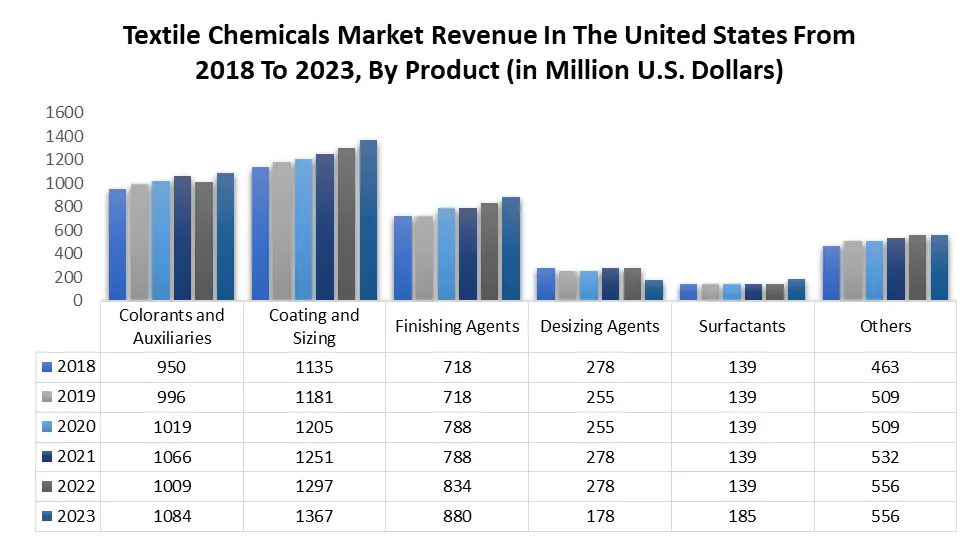

Driver Increasing Demand for Furfuryl Alcohol Boosts Market Growth The furfural market has seen a significant increase in growth due to the rising need for furfuryl alcohol, a byproduct of furfural. Furfural, which is derived from agricultural residues such as corncobs, sugarcane bagasse, and rice husks, is used as a raw material in the production of furfuryl alcohol. Furfuryl alcohol is used in various industries, including foundry, resin, and solvents, due to its versatile properties. The rising demand for furfury alcohol is primarily driven by its application in the foundry industry. Foundry sand binders made from furfuryl alcohol-based resins are widely utilized, providing superior strength and durability to castings. This has resulted in increased adoption by foundry operators who seek high-performance solutions. Also, the growing focus on eco-friendly and sustainable practices has led to the increased use of furfuryl alcohol in bio-based resins. As industries strive to reduce their environmental impact, there has been a substantial rise in demand for bio-based materials, further boosting the furfural market. The growth of end-user industries such as construction, automotive, and electronics has contributed to the growing demand for furfuryl alcohol. Its effectiveness as a solvent in coatings and as a corrosion inhibitor has extended its application scope, nurturing furfural market growth.Restrain High Price Volatility Limits Market Growth The furfural market faces obstacles due to its high price volatility. The uncertainty in raw material costs, especially those derived from agricultural by-products, creates a sense of unpredictability for manufacturers, impacting their production planning and profitability. This fluctuation in prices leads to budget constraints for industries utilizing furfural, which in turn limits their purchasing power and utilization of the product. This volatility also hinders the ability to make strategic decisions regarding long-term investments, and technological advancements within the industry. Therefore, disruptions in the supply chain occur, further destabilizing the sourcing of raw materials. The competitiveness of companies operating in the furfural market is at risk when effective management of price fluctuations is lacking. Also, changes in consumer and buyer behavior in response to price variations significantly influence the overall demand for furfural-based products. This Factor IS Significantly responsible for the slowdown of the furfural market Growth. Opportunity Increased Demand from The Textile Industry Creates Lucrative Growth Opportunities for The Furfural Market. The furfural market is experiencing lucrative growth opportunities due to increased demand from the textile industry. Furfural, derived from agricultural by-products, is gaining traction as a sustainable and eco-friendly alternative in textile processing. It serves as a versatile solvent and scouring agent, enhancing the efficiency of dyeing and finishing processes. The textile industry's growing importance on environmentally friendly practices aligns with furfural's characteristics, contributing to its rising adoption. Furfural's ability to replace conventional, more chemically intensive solvents in textile applications reduces the environmental impact of the overall production process. Textile manufacturers are increasingly recognizing the benefits of incorporating furfural into their operations, driven by both regulatory pressures and consumer demand for sustainable products. This shift aligns with global initiatives towards greener manufacturing practices in the textile sector. In the United States, textile chemicals are rapidly growing including dyes, finishes, and treatments. This factor significantly helps to boost the furfural market growth.

Furfural Market Segment Analysis

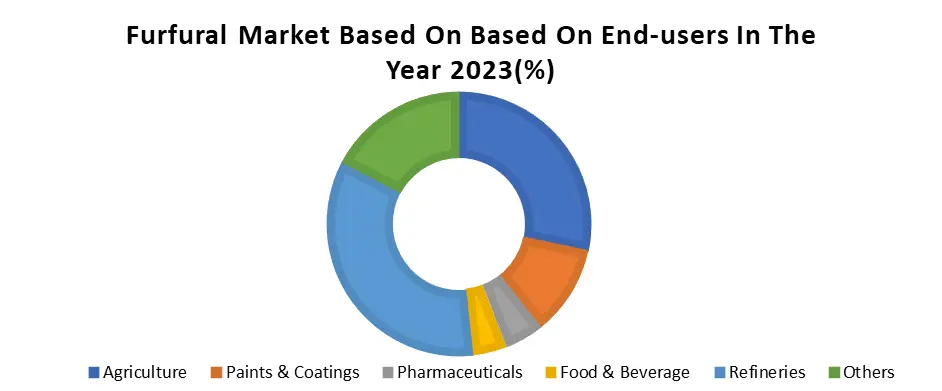

Based on the raw material, The Sugarcane Bagasse segment dominated the raw material segment of the Furfural market in the year 2023. Sugarcane is a renewable resource. The sugar cane industry produces a significant by-product called sugarcane bagasse, which consists of approximately 50% cellulose, 25% hemicellulose, and 25% lignin. This abundant material is an excellent substrate for microbial processes, enabling the production of valuable products such as furfural. By utilizing sugarcane bagasse for furfural extraction, the circular economy principles are embraced as agricultural waste is repurposed. This environmentally friendly approach effectively addresses environmental concerns and establishes sugarcane bagasse as a preferred choice for raw materials. As industries increasingly prioritize sustainable sourcing and production methods, the dominance of sugarcane bagasse in the Furfural Market highlights the significance of environmentally friendly and economically viable feedstocks.Based on end-users, The refinery segment dominated the end-user segment Furfural Market in the year 2023. Furfural is extensively used as a solvent in various industries including petroleum refining, specialty adhesives, and lubricants. Its conversion into 2-methyl tetrahydrofuran and 2-methyl furan, which are utilized as additives in gasoline, strengthens its significance. The increasing demand for lubricants in both industrial and automotive sectors driving the demand for furfural. Amplifying petroleum refining. Furfural is important in the production of refining substances, aiding in the elimination of impurities from hydrocarbons. Its exceptional properties, such as high reactivity and selectivity, make it an indispensable ingredient in the manufacturing of refining agents. With the continuous rise in global demand for refined petroleum products, the refinery sector heavily relies on furfural, this factor significantly boosts the Furfural Market Growth.

Furfural Market Regional Analysis

Asia Pacific dominated the global furfural market, in the year 2023. This growth is attributed to strong growth, particularly in China, a major furfural producer. The region's economic growth, including in China, India, and Japan, has escalating demand across diverse sectors such as agriculture, food & and beverages, pharmaceuticals, and refineries. The Asia Pacific market is driven by increased furfural consumption in agriculture, aligning with India's substantial agricultural dependence. With more than 58.0% of India's population relying on agriculture, the demand surge is boosted by population growth and rising rural and urban incomes. Also, a strong presence of established chemical and fertilizer manufacturers accelerates the furfural market growth. Asia-Pacific is a fast-growing market for foundry products because more people are moving to cities, industries are growing, and more money is being invested in emerging economies such as Japan, China, and India. This factor also helps to drive the Furfural Market.Furfural Industry Ecosystem:

Global Furfural Market Scope : Inquire before buying

Global Furfural Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 630.2 Mn. Forecast Period 2024 to 2030 CAGR: 6.8% Market Size in 2030: US $ 998.30 Mn. Segments Covered: by Process Quaker Batch Process Chinese Batch Process Rosenlew Continuous Process Others by Raw Material Corn cob Sugarcane Bagasse Sunflower Hull Rice Husk Others by Application Furfuryl Alcohol Solvent Intermediate Others by End-User Agriculture Paints & Coatings Pharmaceuticals Food & Beverage Refineries Others Furfural Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Furfural Market Key Players

The furfural Companies are enhancing their market positions through significant expansions, mergers and acquisitions, and strategic deals. The focus is primarily on expanding production capabilities and forming strategic partnerships to solidify their presence and meet the growing global demand for furfural. Asia Pacific 1. KRBL Limited (India) 2. China XLX Fertiliser Ltd. (China) 3. Puyang Refining Company Limited (China) 4. Thapar Agro Mills Ltd. (India) 5. Shandong Crownchem Industries Co., Ltd. (China) 6. Tanin Auto Electronix Pvt. Ltd. (India) 7. Shandong Yuyuan Group Co., Ltd. (China) 8. KRBL Limited (India) 9. Shandong Lianmeng Chemical Group Co., Ltd. (China) 10. Shandong Baisheng Biotechnology Co., Ltd. (China) 11. Kanoria Chemicals & Industries Ltd. (India) 12. Shandong Crownchem Industries Co., Ltd. (China) 13. Sugar Australia Pty Ltd. (Australia) North America 1.Lynx Enterprises (USA) Europe 1.Valmet Corporation (Finland) 2.Tanin Sevnica (Slovenia) 3.Metadynea Trading SA (Switzerland) Frequently Asked Questions: 1] What segments are covered in the Global Furfural Market report? Ans. The segments covered in the Furfural Market report are based on Type, Treatment, Drug Class, Diagnosis, Route of Administration, End-Users and Regions. 2] Which region is expected to hold the highest share in the Global Furfural Market? Ans. The Asia Pacific region is expected to hold the largest share of the Furfural Market. 3] What is the market size of the Global Furfural Market by 2030? Ans. The market size of the Furfural Market by 2030 is expected to reach US$ 998.30 Mn. 4] What is the forecast period for the Global Furfural Market? Ans. The forecast period for the Furfural Market is 2024-2030. 5] What was the market size of the Global Furfural Market in 2023? Ans. The market size of the Furfural Market in 2023 was valued at US$ 630.2 Bn.

1. Furfural Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Furfural Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Products specific analysis 2.5. Key Players Benchmarking 2.5.1. Company Name 2.5.2. Headquarter 2.5.3. Business Segment 2.5.4. End-user Segment 2.5.5. Y-O-Y% 2.5.6. Revenue (2023) 2.6. Market Structure 2.6.1. Market Leaders 2.6.2. Market Followers 2.6.3. Emerging Players 2.7. Consolidation of the Market 2.7.1. Strategic Initiatives and Developments 2.7.2. Mergers and Acquisitions 2.7.3. Collaborations and Partnerships 2.7.4. Product Launches and Innovations 3. Patent Analysis: 3.1.1. Top 10 Patent Holders 3.1.2. Top 10 Companies with Highest Number of Patents 3.1.3. Patent Registration Analysis 3.1.4. Number of Patents Granted Still 2024 4. Global Furfural Market: Dynamics 4.1. Furfural Market Trends 4.2. Furfural Market Dynamics 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 5. Value and Supply Chain Analysis 6. Pricing Analysis 6.1. Average price of Furfural, by Region 6.2. Average price of Furfural, by Function 7. Regulatory Landscape 7.1. Regulation by Region 7.2. Tariff and Taxes 7.3. Regulatory Bodies, Government agencies, and other organizations by Region 8. Trade Data Analysis: 8.1. Import/ Export of Furfural 8.1.1. Import Data on Furfural 8.1.2. Export Data on Furfural 9. Global Furfural Market Size and Forecast by Segments (by Value USD Billion) 9.1. Global Furfural Market Size and Forecast, by Process (2023-2030) 9.1.1. Quaker Batch Process 9.1.2. Chinese Batch Process 9.1.3. Rosenlew Continuous Process 9.1.4. Others 9.2. Global Furfural Market Size and Forecast, by Raw Material (2023-2030) 9.2.1. Corn cob 9.2.2. Sugarcane Bagasse 9.2.3. Sunflower Hull 9.2.4. Rice Husk 9.2.5. Others 9.3. Global Furfural Market Size and Forecast, by Application (2023-2030) 9.3.1. Furfuryl Alcohol 9.3.2. Solvent 9.3.3. Intermediate 9.3.4. Others 9.4. Global Furfural Market Size and Forecast, by End User (2023-2030) 9.4.1. Agriculture 9.4.2. Paints & Coatings 9.4.3. Pharmaceuticals 9.4.4. Food & Beverage 9.4.5. Refineries 9.4.6. Others 9.5. Global Furfural Market Size and Forecast, by Region (2023-2030) 9.5.1. North America 9.5.2. Europe 9.5.3. Asia Pacific 9.5.4. Middle East and Africa 9.5.5. South America 10. North America Global Furfural Market Size and Forecast (by Value USD Billion) 10.1. North America Global Furfural Market Size and Forecast, by Process (2023-2030) 10.1.1. Quaker Batch Process 10.1.2. Chinese Batch Process 10.1.3. Rosenlew Continuous Process 10.1.4. Others 10.2. North America Global Furfural Market Size and Forecast, by Raw Material (2023-2030) 10.2.1. Corn cob 10.2.2. Sugarcane Bagasse 10.2.3. Sunflower Hull 10.2.4. Rice Husk 10.2.5. Others 10.3. North America Global Furfural Market Size and Forecast, by Application (2023-2030) 10.3.1. Furfuryl Alcohol 10.3.2. Solvent 10.3.3. Intermediate 10.3.4. Others 10.4. North America Global Furfural Market Size and Forecast, by End User (2023-2030) 10.4.1. Agriculture 10.4.2. Paints & Coatings 10.4.3. Pharmaceuticals 10.4.4. Food & Beverage 10.4.5. Refineries 10.4.6. Others 10.5. North America Global Furfural Market Size and Forecast, by Country (2023-2030) 10.5.1. United States 10.5.1.1. United States Global Furfural Market Size and Forecast, by Process (2023-2030) 10.5.1.1.1. Quaker Batch Process 10.5.1.1.2. Chinese Batch Process 10.5.1.1.3. Rosenlew Continuous Process 10.5.1.1.4. Others 10.5.1.2. United States Global Furfural Market Size and Forecast, by Raw Material (2023-2030) 10.5.1.2.1. Corn cob 10.5.1.2.2. Sugarcane Bagasse 10.5.1.2.3. Sunflower Hull 10.5.1.2.4. Rice Husk 10.5.1.2.5. Others 10.5.1.3. United States Global Furfural Market Size and Forecast, by Application (2023-2030) 10.5.1.3.1. Furfuryl Alcohol 10.5.1.3.2. Solvent 10.5.1.3.3. Intermediate 10.5.1.3.4. Others 10.5.1.4. United States Global Furfural Market Size and Forecast, by End User (2023-2030) 10.5.1.4.1. Agriculture 10.5.1.4.2. Paints & Coatings 10.5.1.4.3. Pharmaceuticals 10.5.1.4.4. Food & Beverage 10.5.1.4.5. Refineries 10.5.1.4.6. Others 10.5.2. Canada 10.5.2.1. Canada Global Furfural Market Size and Forecast, by Process (2023-2030) 10.5.2.1.1. Quaker Batch Process 10.5.2.1.2. Chinese Batch Process 10.5.2.1.3. Rosenlew Continuous Process 10.5.2.1.4. Others 10.5.2.2. Canada Global Furfural Market Size and Forecast, by Raw Material (2023-2030) 10.5.2.2.1. Corn cob 10.5.2.2.2. Sugarcane Bagasse 10.5.2.2.3. Sunflower Hull 10.5.2.2.4. Rice Husk 10.5.2.2.5. Others 10.5.2.3. Canada Global Furfural Market Size and Forecast, by Application (2023-2030) 10.5.2.3.1. Furfuryl Alcohol 10.5.2.3.2. Solvent 10.5.2.3.3. Intermediate 10.5.2.3.4. Others 10.5.2.4. Canada Global Furfural Market Size and Forecast, by End User (2023-2030) 10.5.2.4.1. Agriculture 10.5.2.4.2. Paints & Coatings 10.5.2.4.3. Pharmaceuticals 10.5.2.4.4. Food & Beverage 10.5.2.4.5. Refineries 10.5.2.4.6. Others 10.5.3. Mexico 10.5.3.1. Mexico Global Furfural Market Size and Forecast, by Process (2023-2030) 10.5.3.1.1. Quaker Batch Process 10.5.3.1.2. Chinese Batch Process 10.5.3.1.3. Rosenlew Continuous Process 10.5.3.1.4. Others 10.5.3.2. Mexico Canada Global Furfural Market Size and Forecast, by Raw Material (2023-2030) 10.5.3.2.1. Corn cob 10.5.3.2.2. Sugarcane Bagasse 10.5.3.2.3. Sunflower Hull 10.5.3.2.4. Rice Husk 10.5.3.2.5. Others 10.5.3.3. Mexico Canada Global Furfural Market Size and Forecast, by Application (2023-2030) 10.5.3.3.1. Furfuryl Alcohol 10.5.3.3.2. Solvent 10.5.3.3.3. Intermediate 10.5.3.3.4. Others 10.5.3.4. Mexico Global Furfural Market Size and Forecast, by End User (2023-2030) 10.5.3.4.1. Agriculture 10.5.3.4.2. Paints & Coatings 10.5.3.4.3. Pharmaceuticals 10.5.3.4.4. Food & Beverage 10.5.3.4.5. Refineries 10.5.3.4.6. Others 11. Europe Furfural Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 11.1. Europe Furfural Market Size and Forecast, by Process (2023-2030) 11.2. Europe Furfural Market Size and Forecast, by Raw Material (2023-2030) 11.3. Europe Furfural Market Size and Forecast, by Application (2023-2030) 11.4. Europe Furfural Market Size and Forecast, by End User (2023-2030) 11.5. Europe Furfural Market Size and Forecast, by Country (2023-2030) 11.5.1. United Kingdom 11.5.1.1. Europe Furfural Market Size and Forecast, by Process (2023-2030) 11.5.1.2. Europe Furfural Market Size and Forecast, by Raw Material (2023-2030) 11.5.1.3. Europe Furfural Market Size and Forecast, by Application (2023-2030) 11.5.1.4. Europe Furfural Market Size and Forecast, by End User (2023-2030) 11.5.1.5. Europe Furfural Market Size and Forecast, by Country (2023-2030) 11.5.2. France 11.5.2.1. France Furfural Market Size and Forecast, by Process (2023-2030) 11.5.2.2. France Furfural Market Size and Forecast, by Raw Material (2023-2030) 11.5.2.3. France Furfural Market Size and Forecast, by Application (2023-2030) 11.5.2.4. France Furfural Market Size and Forecast, by End User (2023-2030) 11.5.2.5. France Furfural Market Size and Forecast, by Country (2023-2030) 11.5.3. Germany 11.5.3.1. Germany Furfural Market Size and Forecast, by Process (2023-2030) 11.5.3.2. Germany Furfural Market Size and Forecast, by Raw Material (2023-2030) 11.5.3.3. Germany Furfural Market Size and Forecast, by Application (2023-2030) 11.5.3.4. Germany Furfural Market Size and Forecast, by End User (2023-2030) 11.5.3.5. Germany Furfural Market Size and Forecast, by Country (2023-2030) 11.5.4. Italy 11.5.4.1. Italy Furfural Market Size and Forecast, by Process (2023-2030) 11.5.4.2. Italy Furfural Market Size and Forecast, by Raw Material (2023-2030) 11.5.4.3. Italy Furfural Market Size and Forecast, by Application (2023-2030) 11.5.4.4. Italy Furfural Market Size and Forecast, by End User (2023-2030) 11.5.4.5. Italy Furfural Market Size and Forecast, by Country (2023-2030) 11.5.5. Spain 11.5.5.1. Spain Furfural Market Size and Forecast, by Process (2023-2030) 11.5.5.2. Spain Furfural Market Size and Forecast, by Raw Material (2023-2030) 11.5.5.3. Spain Furfural Market Size and Forecast, by Application (2023-2030) 11.5.5.4. Spain Furfural Market Size and Forecast, by End User (2023-2030) 11.5.5.5. Spain Furfural Market Size and Forecast, by Country (2023-2030) 11.5.6. Sweden 11.5.6.1. Sweden Furfural Market Size and Forecast, by Process (2023-2030) 11.5.6.2. Sweden Furfural Market Size and Forecast, by Raw Material (2023-2030) 11.5.6.3. Sweden Furfural Market Size and Forecast, by Application (2023-2030) 11.5.6.4. Sweden Furfural Market Size and Forecast, by End User (2023-2030) 11.5.6.5. Sweden Furfural Market Size and Forecast, by Country (2023-2030) 11.5.7. Austria 11.5.7.1. Austria Furfural Market Size and Forecast, by Process (2023-2030) 11.5.7.2. Austria Furfural Market Size and Forecast, by Raw Material (2023-2030) 11.5.7.3. Austria Furfural Market Size and Forecast, by Application (2023-2030) 11.5.7.4. Austria Furfural Market Size and Forecast, by End User (2023-2030) 11.5.7.5. Austria Furfural Market Size and Forecast, by Country (2023-2030) 11.5.8. Rest of Europe 11.5.8.1. Rest of Europe Furfural Market Size and Forecast, by Process (2023-2030) 11.5.8.2. Rest of Europe Furfural Market Size and Forecast, by Raw Material (2023-2030) 11.5.8.3. Rest of Europe Furfural Market Size and Forecast, by Application (2023-2030) 11.5.8.4. Rest of Europe Furfural Market Size and Forecast, by End User (2023-2030) 11.5.8.5. Rest of Europe Furfural Market Size and Forecast, by Country (2023-2030) 12. Asia Pacific Furfural Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 12.1. Asia Pacific Furfural Market Size and Forecast, by Process (2023-2030) 12.2. Asia Pacific Furfural Market Size and Forecast, by Raw Material (2023-2030) 12.3. Asia Pacific Furfural Market Size and Forecast, by Application (2023-2030) 12.4. Asia Pacific Furfural Market Size and Forecast, by End User (2023-2030) 12.5. Asia Pacific Furfural Market Size and Forecast, by Country (2023-2030) 12.5.1. China 12.5.1.1. China Furfural Market Size and Forecast, by Process (2023-2030) 12.5.1.2. China Furfural Market Size and Forecast, by Raw Material (2023-2030) 12.5.1.3. China Furfural Market Size and Forecast, by Application (2023-2030) 12.5.1.4. China Furfural Market Size and Forecast, by End User (2023-2030) 12.5.1.5. China Furfural Market Size and Forecast, by Country (2023-2030) 12.5.2. S Korea 12.5.2.1. S Korea Furfural Market Size and Forecast, by Process (2023-2030) 12.5.2.2. S Korea Furfural Market Size and Forecast, by Raw Material (2023-2030) 12.5.2.3. S Korea Furfural Market Size and Forecast, by Application (2023-2030) 12.5.2.4. S Korea Furfural Market Size and Forecast, by End User (2023-2030) 12.5.2.5. S Korea Furfural Market Size and Forecast, by Country (2023-2030) 12.5.3. Japan 12.5.3.1. Japan Furfural Market Size and Forecast, by Process (2023-2030) 12.5.3.2. Japan Furfural Market Size and Forecast, by Raw Material (2023-2030) 12.5.3.3. Japan Furfural Market Size and Forecast, by Application (2023-2030) 12.5.3.4. Japan Furfural Market Size and Forecast, by End User (2023-2030) 12.5.3.5. Japan Furfural Market Size and Forecast, by Country (2023-2030) 12.5.4. India 12.5.4.1. India Furfural Market Size and Forecast, by Process (2023-2030) 12.5.4.2. India Furfural Market Size and Forecast, by Raw Material (2023-2030) 12.5.4.3. India Furfural Market Size and Forecast, by Application (2023-2030) 12.5.4.4. India Furfural Market Size and Forecast, by End User (2023-2030) 12.5.4.5. India Furfural Market Size and Forecast, by Country (2023-2030) 12.5.5. Australia 12.5.5.1. Australia Furfural Market Size and Forecast, by Process (2023-2030) 12.5.5.2. Australia Furfural Market Size and Forecast, by Raw Material (2023-2030) 12.5.5.3. Australia Furfural Market Size and Forecast, by Application (2023-2030) 12.5.5.4. Australia Furfural Market Size and Forecast, by End User (2023-2030) 12.5.5.5. Australia Furfural Market Size and Forecast, by Country (2023-2030) 12.5.6. Indonesia 12.5.6.1. Indonesia Furfural Market Size and Forecast, by Process (2023-2030) 12.5.6.2. Indonesia Furfural Market Size and Forecast, by Raw Material (2023-2030) 12.5.6.3. Indonesia Furfural Market Size and Forecast, by Application (2023-2030) 12.5.6.4. Indonesia Furfural Market Size and Forecast, by End User (2023-2030) 12.5.6.5. Indonesia Furfural Market Size and Forecast, by Country (2023-2030) 12.5.7. Malaysia 12.5.7.1. Malaysia Furfural Market Size and Forecast, by Process (2023-2030) 12.5.7.2. Malaysia Furfural Market Size and Forecast, by Raw Material (2023-2030) 12.5.7.3. Malaysia Furfural Market Size and Forecast, by Application (2023-2030) 12.5.7.4. Malaysia Furfural Market Size and Forecast, by End User (2023-2030) 12.5.7.5. Malaysia Furfural Market Size and Forecast, by Country (2023-2030) 12.5.8. Vietnam 12.5.8.1. Vietnam Furfural Market Size and Forecast, by Process (2023-2030) 12.5.8.2. Vietnam Furfural Market Size and Forecast, by Raw Material (2023-2030) 12.5.8.3. Vietnam Furfural Market Size and Forecast, by Application (2023-2030) 12.5.8.4. Vietnam Furfural Market Size and Forecast, by End User (2023-2030) 12.5.8.5. Vietnam Furfural Market Size and Forecast, by Country (2023-2030) 12.5.9. Taiwan 12.5.9.1. Taiwan Furfural Market Size and Forecast, by Process (2023-2030) 12.5.9.2. Taiwan Furfural Market Size and Forecast, by Raw Material (2023-2030) 12.5.9.3. Taiwan Furfural Market Size and Forecast, by Application (2023-2030) 12.5.9.4. Taiwan Furfural Market Size and Forecast, by End User (2023-2030) 12.5.9.5. Taiwan Furfural Market Size and Forecast, by Country (2023-2030) 12.5.10. Rest of Asia Pacific 12.5.10.1. Rest of Asia Pacific Furfural Market Size and Forecast, by Process (2023-2030) 12.5.10.2. Rest of Asia Pacific Furfural Market Size and Forecast, by Raw Material (2023-2030) 12.5.10.3. Rest of Asia Pacific Furfural Market Size and Forecast, by Application (2023-2030) 12.5.10.4. Rest of Asia Pacific Furfural Market Size and Forecast, by End User (2023-2030) 12.5.10.5. Rest of Asia Pacific Furfural Market Size and Forecast, by Country (2023-2030) 13. South America Furfural Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 13.1. South America Furfural Market Size and Forecast, by Process (2023-2030) 13.2. South America Furfural Market Size and Forecast, by Raw Material (2023-2030) 13.3. South America Furfural Market Size and Forecast, by Application (2023-2030) 13.4. South America Furfural Market Size and Forecast, by End User (2023-2030) 13.5. South America Furfural Market Size and Forecast, by Country (2023-2030) 13.5.1. Brazil 13.5.1.1. Brazil Furfural Market Size and Forecast, by Process (2023-2030) 13.5.1.2. Brazil Furfural Market Size and Forecast, by Raw Material (2023-2030) 13.5.1.3. Brazil Furfural Market Size and Forecast, by Application (2023-2030) 13.5.1.4. Brazil Furfural Market Size and Forecast, by End User (2023-2030) 13.5.1.5. Brazil Furfural Market Size and Forecast, by Country (2023-2030) 13.5.2. Argentina 13.5.2.1. Argentina Furfural Market Size and Forecast, by Process (2023-2030) 13.5.2.2. Argentina Furfural Market Size and Forecast, by Raw Material (2023-2030) 13.5.2.3. Argentina Furfural Market Size and Forecast, by Application (2023-2030) 13.5.2.4. Argentina Furfural Market Size and Forecast, by End User (2023-2030) 13.5.2.5. Argentina Furfural Market Size and Forecast, by Country (2023-2030) 13.5.3. Rest Of South America 13.5.3.1. Rest Of South America Furfural Market Size and Forecast, by Process (2023-2030) 13.5.3.2. Rest Of South America Furfural Market Size and Forecast, by Raw Material (2023-2030) 13.5.3.3. Rest Of South America Furfural Market Size and Forecast, by Application (2023-2030) 13.5.3.4. Rest Of South America Furfural Market Size and Forecast, by End User (2023-2030) 13.5.3.5. Rest Of South America Furfural Market Size and Forecast, by Country (2023-2030) 14. Company Profile: Key players 14.1. Tanin Auto Electronix Pvt. Ltd. (India) 14.1.1. Financial Overview 14.1.2. Business Portfolio 14.1.3. SWOT Analysis 14.1.4. Business Strategy 14.1.5. Recent Developments 14.2. KRBL Limited (India) 14.3. China XLX Fertiliser Ltd. (China) 14.4. Puyang Refining Company Limited (China) 14.5. Thapar Agro Mills Ltd. (India) 14.6. Shandong Crownchem Industries Co., Ltd. (China) 14.7. Tanin Auto Electronix Pvt. Ltd. (India) 14.8. Shandong Yuyuan Group Co., Ltd. (China) 14.9. KRBL Limited (India) 14.10. Shandong Lianmeng Chemical Group Co., Ltd. (China) 14.11. Shandong Baisheng Biotechnology Co., Ltd. (China) 14.12. Kanoria Chemicals & Industries Ltd. (India) 14.13. Shandong Crownchem Industries Co., Ltd. (China) 14.14. Sugar Australia Pty Ltd. (Australia) 14.15. Others 15. Key Findings 16. Industry Recommendations 16.1. Future Outlook and key Opportunities of Key Players in Market 17. Global Furfural Market: Research Methodology