Forward Collision Warning System for Automotive Market size was valued at US$ 39.94 Bn. in 2022. LiDAR is expected to dominate the post COVID era for Forward Collision Warning System for Automotive Market.Forward Collision Warning System for Automotive Market Overview:

The Intelligent Forward Collision Warning system detects the distances between the two cars ahead, as well as their relative speeds, using a radar sensor mounted in the front of the vehicle. The device can then assess the scenario in front of the car. When the system detects that the vehicle has to slow down owing to a sudden change in the cars ahead of it, it alerts the driver by blinking the vehicle ahead detection indicator and producing an auditory alert. The Intelligent Forward Collision Warning system measures the distance to a second car ahead in the same lane using a radar sensor situated behind the lower grille below the front bumper. The system can travel at speeds of up to 4.8 km/h. Forward Collision Warning System for Automotive market is expected to register CAGR of approximately 12.17% during the forecast period.To know about the Research Methodology :- Request Free Sample Report

Forward Collision Warning System for Automotive Market Dynamics:

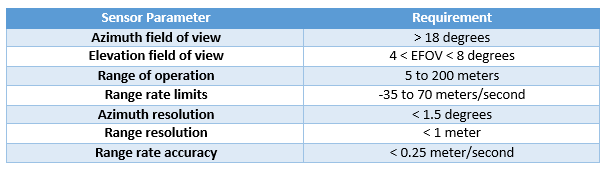

According to the World Health Organization (WHO), traffic accidents kill 1.25 million people and damage millions more. The vehicle's safety is crucial in preventing or reducing the impact of a collision. Vehicles that meet these requirements are less likely to be involved in an accident and cause serious injury to the occupants. Frontal and side impact prevention, electronic stability control, pedestrian protection, seat belts, and ISOFIX child restraint anchorage points are among the minimal basic safety regulations for vehicle manufacturers and industries. Furthermore, there is a growing trend to include safety as a regular component, which opens up significant market expansion potential. For example, the Insurance Institute for Highway Safety (IIHS) of the National Highway Traffic Safety Administration (NHTSA) recently announced that 99% of auto manufacturers in the United States have agreed to make automatic emergency braking (AEB) systems a standard feature on all new vehicles by 2022. Automated driving technologies have advanced significantly in recent years (ADS). Some of today's automobiles have adapted to automated operations. Furthermore, prototype automobiles capable of self-driving are being tested on public roads in Europe, Japan, and the United States. Congestion is lessened, safety is increased, and automobile occupants experience less stress as a result of the automated system. As a result of the presence of such characteristics, demand for automated vehicles is increasing, supplementing the expansion of the collision warning system market. Customers' growing knowledge is driving up demand for vehicles with self-driving and sophisticated safety systems. Government laws and regulations are also helping the market's sales. From 2020, the United States and Europe have made the installation of automobile emergency braking (AEB) and forward collision avoidance/warning systems mandatory in passenger cars and all commercial vehicles up to a specific level. The traditional pattern of modern safety systems being found only in luxury automobiles is rapidly giving way to safety systems being found in all automotive classes. For example, the United Kingdom's government approved an automatic lane-keeping system (ALKS) in April 2021, designed for use on highways in slow traffic and other applications, in an effort to boost the usage of ADAS systems. Collision avoidance systems require sensors such as electromagnetic sensors, optical sensors, and acoustic sensors to continuously sense and monitor the surrounding environment, which adds to the overall cost of the collision warning system. The use of ultrasonic sensors in parking aid automobile safety systems, for example. Furthermore, electromagnetic sensors are the most expensive of all the sensors. As a result, the high cost of implementation limits the proliferation of forward collision warning systems. Because it is unable to adjust for driving conditions, your forward collision warning system may suffer on wet or snowy roads. Wet or slick roads might lengthen your stopping distance, leading your forward collision warning system to warn you too late to prevent a collision. Due to poor road conditions, the anticipated stopping distance of the front collision warning system (in blue) is significantly shorter than the actual stopping distance (in red). US NHTSA Parameters for ACAS:

Forward Collision Warning System for Automotive Market Segment Analysis:

Full Hybrid Segment is driving the Forward Collision Warning System for Automotive Market: Electricity is the future of public transportation. However, due to a number of restrictions, including the lack of suitable charging infrastructure, large-scale, reliable, and cost-effective implementation of electric buses will be a gradual process rather than an overnight switch. As a result, fleet renewals in the future will need to include different technologies in addition to electric buses. Diesel, gas, and hybrid buses, as well as their alternative fuel variations, are all viable options, although not all of them are equally advantageous. Due to the scarcity of biofuels, the options are restricted, and most people must choose between diesel, CNG, mild hybrids, or full hybrids. Connectivity and geofencing can improve the latest generation of complete hybrids, making them more electric than ever before. They often spend 25 to 50% of their operating time and 10 to 30% of their driving distance in quiet electric mode. Full hybrids also provide a tailored approach, as their electric behavior may be focused on reducing emissions and noise in urban areas and at bus stops, where it matters the most. As a result, complete hybrids can be more electric than average values suggest in these emission-sensitive places. Furthermore, complete hybrids are a proven technology that has advanced significantly in recent years, combining the advantages of electricity with the operational convenience and productivity of diesel buses. Simply said, they do not require charging infrastructure and are thus quick and easy to adopt because they employ recovered kinetic energy to drive in electric mode. You could even say that the purpose of full hybrid technology is to take advantage of all of the electrification's benefits without any restrictions attached.The objective of the report is to present a comprehensive analysis of the Forward Collision Warning System for Automotive market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Forward Collision Warning System for Automotive market dynamics, structure by analyzing the market segments and project the Forward Collision Warning System for Automotive market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Forward Collision Warning System for Automotive market make the report investor’s guide.

Forward Collision Warning System for Automotive Market Scope: Inquiry Before Buying

Forward Collision Warning System for Automotive Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 39.94 Bn. Forecast Period 2023 to 2029 CAGR: 12.17% Market Size in 2029: US $ 89.25 Bn. Segments Covered: by Technology • LIDAR • Radar • Camera • Ultrasonic • Others by Type •Adaptive Cruise Control (ACC) • Autonomous Emergency Braking (AEB) • Lane Departure Warning System (LDWS) • Parking assistance • Others (blind spot detection & night vision) by Sales Channel • OEM • Aftermarket by Application • Aerospace & Defense • Marine • Rail • Automotive Forward Collision Warning System for Automotive Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Forward Collision Warning System for Automotive Market Key Players

•DENSO CORPORATION • Continental AG • Delphi Automotive LLP • Honeywell International Inc. • Gentex Corporation • ZF Friedrichshafen • Velodyne LiDAR Inc. • Robert Bosch GmbH • Wabtec Corporation • Alstom • Becker Mining • Siemens • GENERAL ELECTRIC • Autoliv Inc • Saab AB • Rockwell Collins, Inc. • Mobileye • Gentex Corporation • BorgWarner Inc. • Velodyne Lidar, Inc. Frequently Asked Questions: 1. Which region has the largest share in Global Forward Collision Warning System for Automotive Market? Ans: North America region held the highest share in 2022. 2. What is the growth rate of Global Forward Collision Warning System for Automotive Market? Ans: The Global Forward Collision Warning System for Automotive Market is growing at a CAGR of 12.17% during forecasting period 2023-2029. 3. What is scope of the Global Forward Collision Warning System for Automotive Market report? Ans: Global Forward Collision Warning System for Automotive Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Forward Collision Warning System for Automotive Market? Ans: The important key players in the Global Forward Collision Warning System for Automotive Market are DENSO CORPORATION, Continental AG, Gentex Corporation, ZF Friedrichshafen, Velodyne LiDAR Inc., Robert Bosch GmbH, Wabtec Corporation, Alstom, Becker Mining, Siemens, GENERAL ELECTRIC, Autoliv Inc, Saab AB, Rockwell Collins, Mobileye, Gentex Corporation, BorgWarner, Velodyne Lidar 5. What is the study period of this Market? Ans: The Global Forward Collision Warning System for Automotive Market is studied from 2022 to 2029.

1. Global Forward Collision Warning System for Automotive Market: Research Methodology 2. Global Forward Collision Warning System for Automotive Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Forward Collision Warning System for Automotive Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Forward Collision Warning System for Automotive Market: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12. COVID-19 Impact 4. Global Forward Collision Warning System for Automotive Market Segmentation 4.1. Global Forward Collision Warning System for Automotive Market, by Technology (2022-2029) • LIDAR • Radar • Camera • Ultrasonic • Others 4.2. Global Forward Collision Warning System for Automotive Market, by Type (2022-2029) • Adaptive Cruise Control (ACC) • Autonomous Emergency Braking (AEB) • Lane Departure Warning System (LDWS) • Parking assistance • Others (blind spot detection & night vision) 4.3. Global Forward Collision Warning System for Automotive Market, by Application (2022-2029) • Aerospace & Defense • Marine • Rail • Automotive 4.4. Global Forward Collision Warning System for Automotive Market, by Sales Channel (2022-2029) • OEM • Aftermarket 5. North America Forward Collision Warning System for Automotive Market(2022-2029) 5.1. Global Forward Collision Warning System for Automotive Market, by Technology (2022-2029) • LIDAR • Radar • Camera • Ultrasonic • Others 5.2. Global Forward Collision Warning System for Automotive Market, by Type (2022-2029) • Adaptive Cruise Control (ACC) • Autonomous Emergency Braking (AEB) • Lane Departure Warning System (LDWS) • Parking assistance • Others (blind spot detection & night vision) 5.3. Global Forward Collision Warning System for Automotive Market, by Application (2022-2029) • Aerospace & Defense • Marine • Rail • Automotive 5.4. Global Forward Collision Warning System for Automotive Market, by Sales Channel (2022-2029) • OEM • Aftermarket 5.5. North America Forward Collision Warning System for Automotive Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Forward Collision Warning System for Automotive Market (2022-2029) 6.1. European Forward Collision Warning System for Automotive Market, by Technology (2022-2029) 6.2. European Forward Collision Warning System for Automotive Market, by Type (2022-2029) 6.3. European Forward Collision Warning System for Automotive Market, by Application (2022-2029) 6.4. European Forward Collision Warning System for Automotive Market, by Sales Channel (2022-2029) 6.5. European Forward Collision Warning System for Automotive Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Forward Collision Warning System for Automotive Market (2022-2029) 7.1. Asia Pacific Forward Collision Warning System for Automotive Market, by Technology (2022-2029) 7.2. Asia Pacific Forward Collision Warning System for Automotive Market, by Type (2022-2029) 7.3. Asia Pacific Forward Collision Warning System for Automotive Market, by Application (2022-2029) 7.4. Asia Pacific Forward Collision Warning System for Automotive Market, by Sales Channel (2022-2029) 7.5. Asia Pacific Forward Collision Warning System for Automotive Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Forward Collision Warning System for Automotive Market (2022-2029) 8.1. Middle East and Africa Forward Collision Warning System for Automotive Market, by Technology (2022-2029) 8.2. Middle East and Africa Forward Collision Warning System for Automotive Market, by Type (2022-2029) 8.3. Middle East and Africa Forward Collision Warning System for Automotive Market, by Application (2022-2029) 8.4. Middle East and Africa Forward Collision Warning System for Automotive Market, by Sales Channel (2022-2029) 8.5. Middle East and Africa Forward Collision Warning System for Automotive Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. Latin America Forward Collision Warning System for Automotive Market (2022-2029) 9.1. Latin America Forward Collision Warning System for Automotive Market, by Technology (2022-2029) 9.2. Latin America Forward Collision Warning System for Automotive Market, by Type (2022-2029) 9.3. Latin America Forward Collision Warning System for Automotive Market, by Application (2022-2029) 9.4. Latin America Forward Collision Warning System for Automotive Market, by Sales Channel (2022-2029) 9.5. Latin America Forward Collision Warning System for Automotive Market, by Country (2022-2029) • Brazil • Argentina • Rest Of Latin America 10. Company Profile: Key players 10.1. DENSO Corporation 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Continental AG 10.3. Delphi Automotive LLP 10.4. Honeywell International Inc. 10.5. Gentex Corporation 10.6. ZF Friedrichshafen 10.7. Velodyne LiDAR Inc. 10.8. Robert Bosch GmbH 10.9. Wabtec Corporation 10.10. Alstom 10.11. Becker Mining 10.12. Siemens 10.13. GENERAL ELECTRIC 10.14. Autoliv Inc 10.15. Saab AB 10.16. Rockwell Collins, Inc. 10.17. Mobileye 10.18. Gentex Corporation 10.19. BorgWarner Inc. 10.20. Velodyne Lidar, Inc.