The Global Food Service Packaging Market size was valued at USD 91.18 Bn. in 2023 the Food Service Packaging Market revenue is growing by 5.23% from 2024 to 2030, reaching nearly USD 130.28 Bn.Food Service Packaging Market Overview:

Foodservice packaging includes products used for the service or packaging of prepared foods and drinks in eat-in or takeaway food service establishments and increasingly for home delivery. The global Foodservice Packaging Market is poised for substantial growth, with several key factors expected to drive its growth. The increasing consumption of pre-packaged food products. The busy lifestyles of the working population have helped to a growing preference for on-the-go food consumption, further boosting the market's prospects. The surge in food service providers, encompassing retail food outlets, pizza chains, takeaway restaurants, and online food suppliers, is generating substantial demand for a range of packaging solutions, including food packaging containers, paper boxes, and canes. The availability of these packaging options in diverse shapes, sizes, and varieties, coupled with their rising adoption, is set to fuel the market's growth. Advancements in packaging technology, particularly in terms of design, recyclability, durability, and usability, are the factors expected to contribute to the growth of the Food Packaging Industry.To know about the Research Methodology:-Request Free Sample Report Circular Economic Contribution of Food Service Packaging Foodservice packaging predominantly consists of recyclable materials, including paper, cardboard, and plastics. In the UK, there are well-established recycling channels for paper and cardboard, encompassing kerbside collection, retail take-back programs, bank facilities, and collections in various settings such as workplaces and on-the-go locations. It's important to note that the paper used for manufacturing these packaging materials in the UK is sourced from sustainable and renewable resources, reflecting a commitment to environmental responsibility. Plastics play a significant role in foodservice packaging, with commonly used types including polyethylene terephthalate (PET), recycled polyethylene terephthalate (RPET), polypropylene (PP), polystyrene (PS), expanded polystyrene (EPS), and high-density polyethylene (HDPE). The UK has made substantial progress in recycling these plastics, with some local authorities accepting polystyrene for recycling. Also, ongoing advancements in technical and chemical recycling processes are contributing to the sustainable management of all plastic materials. Members of the Foodservice Packaging Association (FPA) wholeheartedly support initiatives aimed at enhancing the collection and recycling of food service packaging. They also recognize the economic value of recovering and reusing these materials, underlining their commitment to environmental sustainability and resource efficiency.

Food Service Packaging Market Dynamics:

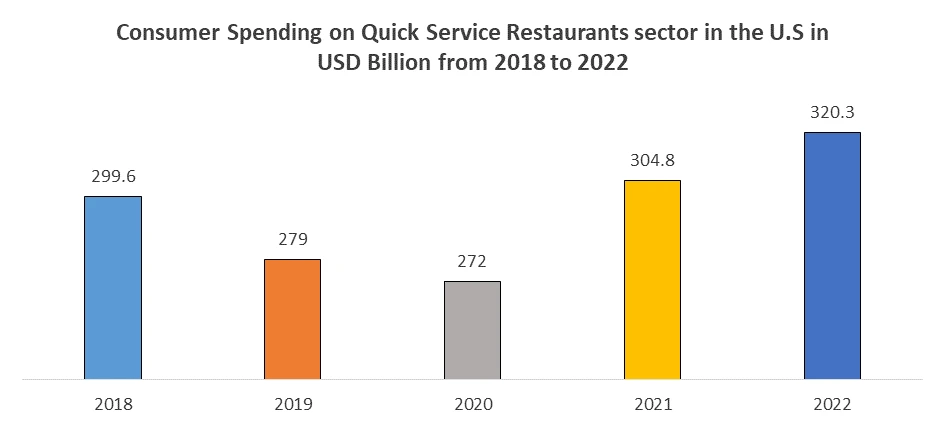

Increasing Demand for Custom Food Packaging Market Growth The growing emphasis on custom food packaging serves as an essential factor in driving the expansion of the food service packaging market. In a fast-paced world, consumers seek food options that align with their unique preferences and needs. Customized packaging allows for a convenient and personalized dining experience, enabling individuals to enjoy their meals seamlessly, whether on the move, at work, or during social engagements. The integral role of food delivery services, especially those facilitated through digital platforms, custom food packaging offers restaurants and eateries the means to ensure that delivered meals arrive in impeccable condition. Custom food packaging preserves the freshness and visual appeal of food, effectively reducing food wastage. It empowers consumers to store leftovers, extending the lifespan of their meals while minimizing the environmental footprint. The growing demand for Biodegradable food container packaging is met through custom food packaging solutions, aligning with consumer concerns regarding the environmental impact of packaging materials. This eco-conscious approach resonates with environmentally aware customers. These factors significantly boost the Food Service Packaging Industry. Growing Food Service Industry Drives Market Growth The food service industry's continued growth, there is a notable proliferation of dining establishments, including restaurants, fast-food chains, cafes, food trucks, and providing businesses. Each of these enterprises requires an array of packaging options to provide to the diverse needs of their customers, driving the demand for an extensive range of packaging materials. The ubiquity of food delivery services in today's market has reshaped the landscape of the food service industry. Takeout and home delivery are now integral components of food service, necessitating reliable and practical packaging solutions to ensure that food remains fresh and appealing during transit. This shift underscores the importance of food service packaging. Food service packaging designed to facilitate quick and hassle-free access to meals aligns seamlessly with these lifestyle demands, driving the adoption of packaging solutions that cater to on-the-go living. The growing food service industry serves as a dynamic force behind the growth of the food service packaging market. This symbiotic relationship reflects the ever-evolving needs and preferences of both consumers and businesses within the industry, driving the continuous innovation and diversification of packaging solutions to meet the demands of a constantly changing and expanding marketplace. Strict Regulations Limit the Food Service Packaging Market Growth Strict regulations impede the growth of the food service packaging market in various ways. Strict regulations related Food packaging materials hampers the market growth. Compliance costs, stemming from investments in research, development, and compliance processes, escalate production expenses and, consequently, consumer prices. Material restrictions limit packaging material options, curbing innovation and market competitiveness. Recycling and disposal mandates are challenging to meet, with non-compliance incurring penalties. Adherence to health and safety standards involves rigorous testing and quality standards, entailing cost and time investments. Environmental regulations emphasizing biodegradability, compostability, and recyclability demand alterations in packaging design, affecting cost and profitability. Labeling and transparency requirements add complexity and expenses to packaging. Regulatory variations across global markets pose challenges for multinational companies, limiting market expansion. Strict regulations serve as entry barriers, deterring smaller businesses. Balancing compliance with market growth and innovation remains a perpetual challenge for the food service packaging industry. Some of the key regulations related to food packaging services in the U.S.: 1.Sustainable Packaging for the State of California Act of 2018 (SB 1335): This act aims to ensure that food service packaging fits into the state's recycling and composting systems, and encourages packaging design improvements to protect the environment. 2.Food Packaging Regulation in the US: The FDA regulates the safety of ingredients added directly to food and substances that come into contact with food, such as those added to packaging materials, cookware, or containers that store food. Most food packaging regulatory systems include general safety requirements that are intended to preserve the physical, chemical, and sanitary integrity of the contents of food packages. 3.Fair Packaging and Labeling Act (FPLA): This act requires that all "consumer commodities" be labeled to disclose net contents, identity of commodity, and name and place of business of the product's manufacturer, packer, or distributor. The Act authorizes additional regulations where necessary to prevent consumer deception with respect to descriptions of ingredients, slack fill of packages, and use of "cents-off" or lower price labeling, or characterization of package sizes. 4.Federal Packaging Regulations in the US: Although the United States has no all-encompassing federal legislation regulating the packaging industry, the federal government has asserted its authority to regulate food, drug, and cosmetic packaging to preserve consumer safety and confidence. The FDA regulates the packaging and labeling of food, and any packaging that comes into direct contact with food is classified as a "food contact substance." It is the responsibility of The Office of Food Additive Safety and The Center for Food Safety and Applied Nutrition (CFSAN) to ensure the safety of these food contact substances. Rising E-Commerce Creates Lucrative Growth Opportunity for Market Growth The rise of e-commerce and the booming food delivery industry has created a highly lucrative growth opportunity for the food service packaging market. The convenience and popularity of online food delivery services have significantly boosted the demand for food service packaging. These services rely on ensuring the security and integrity of delivered food is paramount. Packaging innovations, such as tamper-evident seals and secure closures, provide peace of mind to both customers and restaurants.in packaging that maintains food quality during transit, presenting a substantial market opportunity. Integration with technology, such as QR codes for menu information, order tracking, and interactive packaging, enhances the customer experience and offers opportunities for marketing and data collection. The e-commerce and food delivery boom has opened up a wealth of opportunities for the food service packaging market. The industry's success hinges on its ability to meet the unique and evolving demands of this dynamic and rapidly expanding sector. The rapid rising QSR sector significantly helps to boost the market growth.

Food Service Packaging Market Segment Analysis:

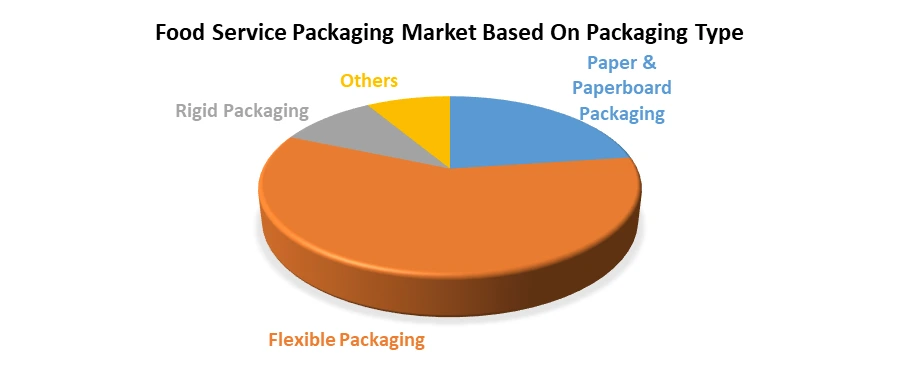

Based on Packaging Type, The Flexible Packaging sub-segment dominates the Food Service Packaging Market in the year 2023. The Flexible Packaging sub-segment dominates the Food Service Packaging Market due to its cost-effectiveness, lightweight nature, customization options, and extended shelf life. This packaging type offers a sustainable and eco-friendly solution, meeting the industry's increasing demand for environmental responsibility. Additionally, its convenience, versatility, and suitability for a wide range of food products make it a preferred choice. Flexible packaging's easy branding and printing opportunities help products stand out, while its sealed design reduces the risk of food contamination. Furthermore, the industry's continuous innovation in materials and technologies ensures that flexible packaging remains the go-to option for food service businesses seeking efficiency, cost savings, and consumer satisfaction.

Regional Insight:

The Asia-Pacific region dominates the Food Service Packaging market for several reasons. The region's rapidly growing population and urbanization have led to increased demand for convenient food options, driving the need for food service packaging. Rising disposable incomes in many Asian countries have resulted in greater dining out and takeaway food culture, further boosting the demand for such packaging. Additionally, the diverse cuisines and culinary traditions in the region have led to a wide variety of food service establishments, each requiring specific packaging solutions. The region's manufacturing capabilities and cost advantages have made it a global hub for food service packaging production.Lastly, the Asia-Pacific region has witnessed government initiatives to promote eco-friendly and sustainable packaging, aligning with global trends, which has spurred innovation and growth in this market segment. These factors collectively contribute to the dominant position of the Asia-Pacific region in the Food Service Packaging Market. Food packaging industry in india is rapidly growing this factor is responsible for the market growth.

Competitive Landscape:

The Competitive Landscape of the Food Service Packaging market covers the number of key companies, company size, strengths, weaknesses, barriers, and threats. It also focuses on the power of the company’s competitive rivals, potential, new market entrants, customers, suppliers, and substitute products that drive the profitability of the companies in the Food Service Packaging industry. The global Food Service Packaging markets include several market players at the country, regional, and global levels. Some of the Food Service Packaging companies are Pactiv Evergreen Inc.,Genpak Corporation, Huhtamaki Oyj, Berry Global Inc., Novolex Packaging and Amcor Many companies have conducted research and development activities to fulfill consumer demand and increase their portfolio. The company focuses on strategic partnerships mergers and acquisitions to expand the global reach and maintain the brand name. For Instance, Amcor plc, a Switzerland-based global packaging giant, operates in diverse sectors, including food, beverage, healthcare, and personal care. They offer flexible packaging, rigid packaging, and specialty cartons. Amcor is highly active in strategic moves: Partnership: On March 9, 2022, Amcor entered a partnership with the Alliance to End Plastic Waste, signaling its commitment to tackling plastic waste issues on a global scale. Acquisitions: On May 8, 2023, Amcor acquired Moda Systems, a company specializing in innovative modular vacuum packaging solutions for meat, poultry, and dairy industries. In June 2019, Amcor completed the acquisition of Bemis, establishing itself as the global packaging leader. Investments: On November 8, 2022, Amcor invested in PulPac fiber technology, accelerating the global deployment of innovative paper packaging solutions. These moves reflect Amcor's commitment to innovation, sustainability, and global market expansion.Food Service Packaging Market Scope: Inquire before buying

Food Service Packaging Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 91.18 Bn. Forecast Period 2024 to 2030 CAGR: 5.23% Market Size in 2030: US $ 130.28 Bn. Segments Covered: by Material Plastic Metal Others by Packaging Type Paper & Paperboard Packaging Flexible Packaging Rigid Packaging Others by Application Bakery & Confectionary Dairy Products Fruits & Vegetables Meat & Seafood Sauces & Dressings Others Food Service Packaging Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest) South America (Brazil, Argentina Rest of South America)Food Service Packaging Market Key Player are:

1. Pactiv Evergreen Inc. 2. Dart Container Corporation 3. Amhil North America 4. Genpak LLC 5. Huhtamaki Oyj 6. Berry Global Inc. 7. Novolex Holdings LLC 8. Sabert Corporation 9. Silgan Plastic Food Container 10. B&R Plastics Inc. 11. Graphic Packaging International Inc 12. Amcor PLC 13. Sonoco Products Company 14. Ball Corporation 15. Westrock Company Frequently Asked Questions: 1] What segments are covered in the Global Food Service Packaging Market report? Ans. The segments covered in the Food Service Packaging Market report are based on Material, Packaging Type, Application, and Regions. 2] Which region is expected to hold the highest share in the Global Food Service Packaging Market? Ans. The Asia Pacific region is expected to hold the highest share of the Food Service Packaging Market. 3] What was the market size of the Global Food Service Packaging Market by 2023? Ans. The market size of the Food Service Packaging Market by 2023 is expected to reach US$ 91.18 Bn. 4] What is the forecast period for the Global Food Service Packaging Market? Ans. The forecast period for the Food Service Packaging Market is 2024-2030. 5] What is the market size of the Global Food Service Packaging Market in 2030? Ans. The market size of the Food Service Packaging Market in 2030 is valued at US$ 130.28 Bn.

1. Food Service Packaging Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Food Service Packaging Market: Dynamics 2.1. Food Service Packaging Market Trends by Region 2.1.1. North America Food Service Packaging Market Trends 2.1.2. Europe Food Service Packaging Market Trends 2.1.3. Asia Pacific Food Service Packaging Market Trends 2.1.4. Middle East and Africa Food Service Packaging Market Trends 2.1.5. South America Food Service Packaging Market Trends 2.1.6. Preference Analysis 2.2. Food Service Packaging Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Food Service Packaging Market Drivers 2.2.1.2. North America Food Service Packaging Market Restraints 2.2.1.3. North America Food Service Packaging Market Opportunities 2.2.1.4. North America Food Service Packaging Market Challenges 2.2.2. Europe 2.2.2.1. Europe Food Service Packaging Market Drivers 2.2.2.2. Europe Food Service Packaging Market Restraints 2.2.2.3. Europe Food Service Packaging Market Opportunities 2.2.2.4. Europe Food Service Packaging Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Food Service Packaging Market Drivers 2.2.3.2. Asia Pacific Food Service Packaging Market Restraints 2.2.3.3. Asia Pacific Food Service Packaging Market Opportunities 2.2.3.4. Asia Pacific Food Service Packaging Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Food Service Packaging Market Drivers 2.2.4.2. Middle East and Africa Food Service Packaging Market Restraints 2.2.4.3. Middle East and Africa Food Service Packaging Market Opportunities 2.2.4.4. Middle East and Africa Food Service Packaging Market Challenges 2.2.5. South America 2.2.5.1. South America Food Service Packaging Market Drivers 2.2.5.2. South America Food Service Packaging Market Restraints 2.2.5.3. South America Food Service Packaging Market Opportunities 2.2.5.4. South America Food Service Packaging Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. Global 2.7.2. North America 2.7.3. Europe 2.7.4. Asia Pacific 2.7.5. Middle East and Africa 2.7.6. South America 2.8. Key Opinion Leader Analysis For Food Service Packaging Industry 2.9. Analysis of Government Schemes and Initiatives For Food Service Packaging Industry 2.10. The Global Pandemic Impact on Food Service Packaging Market 2.11. Food Service Packaging Price Trend Analysis (2021-22) 2.12. Global Food Service Packaging Market Trade Analysis (2017-2023) 3. Food Service Packaging Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2023-2030) 3.1. Food Service Packaging Market Size and Forecast, by Material (2023-2030) 3.1.1. Plastic 3.1.2. Metal 3.1.3. Other 3.2. Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 3.2.1. Paper & Paperboard Packaging 3.2.2. Flexible Packaging 3.2.3. Rigid Packaging 3.2.4. Other 3.3. Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 3.3.1. Bakery & Confectionary 3.3.2. Dairy Products 3.3.3. Fruits & Vegetables 3.3.4. Meat & Seafood 3.3.5. Sauces & Dressings 3.3.6. Others 3.4. Food Service Packaging Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Food Service Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Food Service Packaging Market Size and Forecast, by Material (2023-2030) 4.1.1. Plastic 4.1.2. Metal 4.1.3. Other 4.2. North America Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 4.2.1. Paper & Paperboard Packaging 4.2.2. Flexible Packaging 4.2.3. Rigid Packaging 4.2.4. Other 4.3. North America Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 4.3.1. Bakery & Confectionary 4.3.2. Dairy Products 4.3.3. Fruits & Vegetables 4.3.4. Meat & Seafood 4.3.5. Sauces & Dressings 4.3.6. Others 4.4. North America Food Service Packaging Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Food Service Packaging Market Size and Forecast, by Material (2023-2030) 4.4.1.1.1. Plastic 4.4.1.1.2. Metal 4.4.1.1.3. Other 4.4.1.2. United States Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 4.4.1.2.1. Paper & Paperboard Packaging 4.4.1.2.2. Flexible Packaging 4.4.1.2.3. Rigid Packaging 4.4.1.2.4. Other 4.4.1.3. United States Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 4.4.1.3.1. Bakery & Confectionary 4.4.1.3.2. Dairy Products 4.4.1.3.3. Fruits & Vegetables 4.4.1.3.4. Meat & Seafood 4.4.1.3.5. Sauces & Dressings 4.4.1.3.6. Others 4.4.2. Canada 4.4.2.1. Canada Food Service Packaging Market Size and Forecast, by Material (2023-2030) 4.4.2.1.1. Plastic 4.4.2.1.2. Metal 4.4.2.1.3. Other 4.4.2.2. Canada Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 4.4.2.2.1. Paper & Paperboard Packaging 4.4.2.2.2. Flexible Packaging 4.4.2.2.3. Rigid Packaging 4.4.2.2.4. Other 4.4.2.3. Canada Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 4.4.2.3.1. Bakery & Confectionary 4.4.2.3.2. Dairy Products 4.4.2.3.3. Fruits & Vegetables 4.4.2.3.4. Meat & Seafood 4.4.2.3.5. Sauces & Dressings 4.4.2.3.6. Others 4.4.3. Mexico 4.4.3.1. Mexico Food Service Packaging Market Size and Forecast, by Material (2023-2030) 4.4.3.1.1. Plastic 4.4.3.1.2. Metal 4.4.3.1.3. Other 4.4.3.2. Mexico Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 4.4.3.2.1. Paper & Paperboard Packaging 4.4.3.2.2. Flexible Packaging 4.4.3.2.3. Rigid Packaging 4.4.3.2.4. Other 4.4.3.3. Mexico Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 4.4.3.3.1. Bakery & Confectionary 4.4.3.3.2. Dairy Products 4.4.3.3.3. Fruits & Vegetables 4.4.3.3.4. Meat & Seafood 4.4.3.3.5. Sauces & Dressings 4.4.3.3.6. Others 5. Europe Food Service Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe Food Service Packaging Market Size and Forecast, by Material (2023-2030) 5.2. Europe Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 5.3. Europe Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 5.4. Europe Food Service Packaging Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Food Service Packaging Market Size and Forecast, by Material (2023-2030) 5.4.1.2. United Kingdom Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 5.4.1.3. United Kingdom Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 5.4.2. France 5.4.2.1. France Food Service Packaging Market Size and Forecast, by Material (2023-2030) 5.4.2.2. France Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 5.4.2.3. France Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 5.4.3. Germany 5.4.3.1. Germany Food Service Packaging Market Size and Forecast, by Material (2023-2030) 5.4.3.2. Germany Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 5.4.3.3. Germany Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 5.4.4. Italy 5.4.4.1. Italy Food Service Packaging Market Size and Forecast, by Material (2023-2030) 5.4.4.2. Italy Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 5.4.4.3. Italy Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 5.4.5. Spain 5.4.5.1. Spain Food Service Packaging Market Size and Forecast, by Material (2023-2030) 5.4.5.2. Spain Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 5.4.5.3. Spain Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Food Service Packaging Market Size and Forecast, by Material (2023-2030) 5.4.6.2. Sweden Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 5.4.6.3. Sweden Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 5.4.7. Austria 5.4.7.1. Austria Food Service Packaging Market Size and Forecast, by Material (2023-2030) 5.4.7.2. Austria Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 5.4.7.3. Austria Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Food Service Packaging Market Size and Forecast, by Material (2023-2030) 5.4.8.2. Rest of Europe Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 5.4.8.3. Rest of Europe Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6. Asia Pacific Food Service Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Food Service Packaging Market Size and Forecast, by Material (2023-2030) 6.2. Asia Pacific Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.3. Asia Pacific Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.4. Asia Pacific Food Service Packaging Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Food Service Packaging Market Size and Forecast, by Material (2023-2030) 6.4.1.2. China Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.4.1.3. China Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Food Service Packaging Market Size and Forecast, by Material (2023-2030) 6.4.2.2. S Korea Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.4.2.3. S Korea Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.4.3. Japan 6.4.3.1. Japan Food Service Packaging Market Size and Forecast, by Material (2023-2030) 6.4.3.2. Japan Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.4.3.3. Japan Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.4.4. India 6.4.4.1. India Food Service Packaging Market Size and Forecast, by Material (2023-2030) 6.4.4.2. India Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.4.4.3. India Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.4.5. Australia 6.4.5.1. Australia Food Service Packaging Market Size and Forecast, by Material (2023-2030) 6.4.5.2. Australia Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.4.5.3. Australia Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Food Service Packaging Market Size and Forecast, by Material (2023-2030) 6.4.6.2. Indonesia Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.4.6.3. Indonesia Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Food Service Packaging Market Size and Forecast, by Material (2023-2030) 6.4.7.2. Malaysia Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.4.7.3. Malaysia Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Food Service Packaging Market Size and Forecast, by Material (2023-2030) 6.4.8.2. Vietnam Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.4.8.3. Vietnam Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.4.8.4. Vietnam Food Service Packaging Market Size and Forecast, by Industry Vertical(2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Food Service Packaging Market Size and Forecast, by Material (2023-2030) 6.4.9.2. Taiwan Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.4.9.3. Taiwan Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Food Service Packaging Market Size and Forecast, by Material (2023-2030) 6.4.10.2. Rest of Asia Pacific Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 6.4.10.3. Rest of Asia Pacific Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 7. Middle East and Africa Food Service Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 7.1. Middle East and Africa Food Service Packaging Market Size and Forecast, by Material (2023-2030) 7.2. Middle East and Africa Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 7.3. Middle East and Africa Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 7.4. Middle East and Africa Food Service Packaging Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Food Service Packaging Market Size and Forecast, by Material (2023-2030) 7.4.1.2. South Africa Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 7.4.1.3. South Africa Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 7.4.2. GCC 7.4.2.1. GCC Food Service Packaging Market Size and Forecast, by Material (2023-2030) 7.4.2.2. GCC Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 7.4.2.3. GCC Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Food Service Packaging Market Size and Forecast, by Material (2023-2030) 7.4.3.2. Nigeria Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 7.4.3.3. Nigeria Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Food Service Packaging Market Size and Forecast, by Material (2023-2030) 7.4.4.2. Rest of ME&A Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 7.4.4.3. Rest of ME&A Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 8. South America Food Service Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 8.1. South America Food Service Packaging Market Size and Forecast, by Material (2023-2030) 8.2. South America Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 8.3. South America Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 8.4. South America Food Service Packaging Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Food Service Packaging Market Size and Forecast, by Material (2023-2030) 8.4.1.2. Brazil Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 8.4.1.3. Brazil Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Food Service Packaging Market Size and Forecast, by Material (2023-2030) 8.4.2.2. Argentina Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 8.4.2.3. Argentina Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Food Service Packaging Market Size and Forecast, by Material (2023-2030) 8.4.3.2. Rest Of South America Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 8.4.3.3. Rest Of South America Food Service Packaging Market Size and Forecast, by Packaging Type(2023-2030) 9. Global Food Service Packaging Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Material Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Food Service Packaging Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Pactiv Evergreen Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Dart Container Corporation 10.3. Amhil North America 10.4. Genpak LLC 10.5. Huhtamaki Oyj 10.6. Berry Global Inc. 10.7. Novolex Holdings LLC 10.8. Sabert Corporation 10.9. Silgan Plastic Food Container 10.10. B&R Plastics Inc. 10.11. Graphic Packaging International Inc 10.12. Amcor PLC 10.13. Sonoco Products Company 10.14. Ball Corporation 10.15. Westrock Company 11. Key Findings 12. Industry Recommendations 13. Food Service Packaging Market: Research Methodology 14. Terms and Glossary