Flotation Reagents Market size was valued at USD 5.20 Billion in 2023 and the total Flotation Reagents Revenue is expected to grow at a CAGR of 6.3 % from 2024 to 2030, reaching nearly USD 7.98 Billion in 2030.Flotation Reagents Market Overview:

Flotation reagents are the chemicals used for the froth flotation process. Included pH regulators, slime dispersants, conditioning agents, collectors, resurfacing agents, wetting agents, and frothers. flotation reagents are based on the function of a particular reagent. Reagents are divided into collectors, frothers, regulators, and depressants. Collectors are a fairly large group of organic chemical compounds, which differ in chemical composition and function.To know about the Research Methodology:-Request Free Sample Report Flotation propelled the mining industry into a new age. And argued that flotation was the beginning of modem mining in the base metals industry. While earlier concentration methods, such as gravity followed by cyanidation, were effective in processing gold ore, flotation opened the minerals market. Metal production was increased to 24 metallic and 19 non-metallic minerals by the mid-twentieth century. Flotation is used in processing metallic ores (e.g. copper, lead, zinc, gold, silver) or non-metallic ores (e.g. day, phosphate, coal). The most widely used process in the world for extracting minerals, flotation also recovers several metals from a single ore body into two or more concentrated products. The development of flotation diverted a crisis in industry, as well as allowing increased mineral production. Flotation Reagents Market Dynamics: Driving Forces Behind Floatation Reagent Market Growth

Increasing mining activities, rising demand for metals and minerals, and the need for improved mineral processing efficiency drive the growth of the Floatation Reagent Market. Also, Flotation reagent formulation development, growing environmental concern, and stricter regulations regarding the use of toxins contributed to market growth. Extending the Scope of Mineral Exploration Activities, as new mineral resources are discovered and current ones are exhausted, the necessity for effective extraction techniques is increasing, which in turn is driving up the Flotation Reagents Market. Research and development in the oil and gas industry is driving the growth of the flotation reagents market. This is because increasing oil field research and development in the oil and gas industry requires foaming reagents such as blowing agents, and flocculants to separate liquids and solids. Challenges Facing the Flotation Reagents Market to Rising Oil Costs, Regulatory Compliance, and Innovation Demands One of the major challenges for the flotation reagents market is the rising cost of oil. Petroleum-based products, such as surfactants and collectors, are commonly used in the production of flotation reagents. Therefore, any increase in oil prices significantly impacts the production costs of these reagents, which can subsequently lead to higher market prices. In a competitive market, manufacturers find it difficult to pass on the increased costs to consumers, leading to reduced profit margins. This create financial constraints for the manufacturers, hindering their ability to invest in research and development for more efficient and cost-effective reagents. High prices also result in decreased demand for flotation reagents, especially from price-sensitive customers in emerging economies, who opt for alternative technologies or process modifications to reduce their overall costs. Additionally, governments worldwide are imposing stricter regulations on the mining industry, with a strong focus on environmental conservation and worker safety. The regulations often require mining companies to use specific types of reagents or restrict the use of certain harmful chemicals often found in flotation reagents. Complying with the regulations is costly for manufacturers, as it necessitates changes in production processes or the development of new, compliant reagents. Failure to comply results in hefty fines and damage to a company’s reputation, leading to potential loss of business opportunities. In addition to the financial and regulatory challenges, manufacturers also face the need to constantly innovate and improve their products to meet the evolving needs of the mining industry. As new technologies and processes emerge, manufacturers must invest in research and development to stay ahead of the competition and provide more efficient and sustainable solutions. It requires significant investments in resources, expertise, and time, which impacts the overall costs and profitability of the flotation reagents market.

Flotation Reagents Market Segment Analysis:

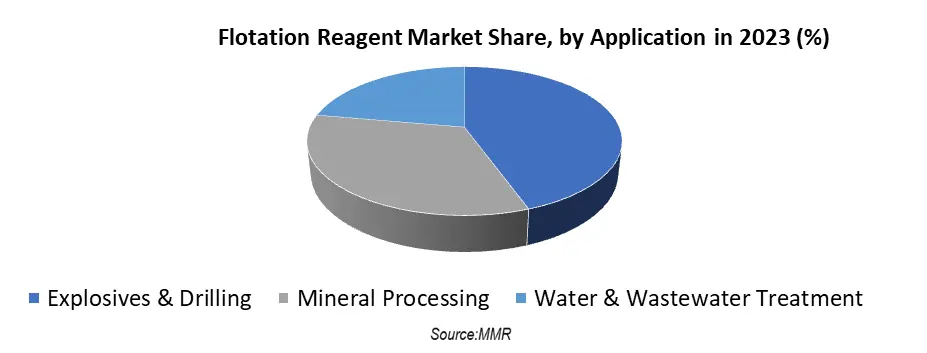

By Application, the Mineral processing Segment holds a 30 % market share in the Floatation Reagent Market. Flotation is the most flexible and adaptable mineral beneficiation technique. Mineral separation by flotation works on the physicochemical surface properties of valuable and unwanted gangue minerals. It is being continuously modified for low-grade complex sulfide ores like lead-zinc, lead zinc-copper, nickel-platinum-gold, tin, fluorite, phosphate, fine coal, and iron ore at a lower cost with better recovery. The processes are known as froth and column flotation. The froth flotation process produces froth of selective mineral agglomerates and separates them from other associated metallic components and gangue minerals. Stanford draws attention to Atlas Copco’s zero-compromise approach when it comes to operator safety and comfort, stressing that Atlas Copco places operators at the core of its tool design. The two-step SOFTSTART™ trigger gives operators full control enabling them to start a cut with surgical precision even under difficult conditions. In addition, these tools are HAPS™ (Hand and Arm Protection Systems) enabled which lessens the impact of vibrations, making it possible to extend working hours up to six-fold. Atlas Copco has developed a pneumatic dust collector to protect operators from the large amounts of silica dust produced during drilling and breaking. Powered by compressed air and utilizing vacuum technology, the dust collector efficiently removes dust directly at the source, maintaining levels below the permissible exposure limit. The semi-automatic filter cleaning mechanism requires minimal maintenance, the dust collector consumes no more than 12 liters of air per second and its recyclable collection bags will last for an 8-hour shift. The unit is suitable for indoor and outdoor use.

Flotation Reagents Market Regional Insight:

North- America holds the largest share of 33 % in 2023. The U.S. government imposed an antidumping duty on metal and mineral-related products that have been imported from China. This significantly affected the sales of Chinese metallic mineral products in the U.S. market. The Chinese government decided to impose a counter-duty on Imports from the U.S., which hurt U.S.-based products as China is a major market that carries a significant share. On Sep 12, 2022, the U.S. Department of Interior amended the mining law, allowing individuals to explore public lands for valuable minerals like gold, silver, and copper, stake a claim if profitable exploitation is possible, and acquire legal title to the area for a nominal fee, promoting settlement. The presence of major companies in the region and their strategic initiatives also play a significant role. On September 29, 2021, Nalco Water, a subsidiary of Scolab, announced the launch of Flotation 360, a comprehensive approach to flotation in mineral exploration. The innovative solution combines Nalco water’s advanced frother and collector chemistry with United States technical support and digital diagnostic equipment, enabling tracking of chemical, operational, and mechanical factors to optimize performance. Such ground-breaking innovations are expected the demand for Floatation Reagent Market. Asia-Pacific is the fastest-growing market owing to the huge demand for clean drinking water for the enormous population residing in the region. India is amongst the nations that are lacking clean drinking water and hence the demand for efficient water & wastewater management is rising. India's water demand is expected to exceed supply by two times, indicating severe water scarcity in the country. Annual per capita water availability is expected to reduce to 1,140m3 by 2030. As per the Composite Water Management Index - Niti Aayog, 6% of GDP was lost by 2030 owing to the water crisis under a business-as-usual scenario. China is amongst the largest iron ore mine producers in the world and its 2019 production is estimated to be 350 million metric tons. Therefore, growing mining activities are anticipated to propel the demand for the flotation reagent mining sector. Rising demand from various industries coupled with government support is expected to drive the market studied in the region through the forecast period.Flotation Reagents Market Competitive Landscape: 1. In February 2023, Huntsman International LLC sold its textile effects business to Archroma, which was also approved by CCI. 2. In March 2023, Solvay launched Polycare Heat Therapy for bio-based chemoprotection in hair care, the non-ecotoxic, double-derivatized cationic guar active ingredient advances the global trend of bio-based and silicone-free solutions in hair care and delivers excellent thermal protection in transparent formulations. 3. In May 2023, Akzo Nobel announced the launch of bisphenol-free internal coating for beverage cans.

Flotation Reagents Market Scope: Inquire before buying

Global Flotation Reagents Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.20 Bn. Forecast Period 2024 to 2030 CAGR: 6.3% Market Size in 2030: US $ 7.98 Bn. Segments Covered: by Type Flocculants Collectors Frothers Dispersants Others by Application Explosives & Drilling Mineral Processing Water & Wastewater Treatment Others Flotation Reagents Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Flotation Reagents Market Key Players:

1. Huntsman- The Woodlands, Texas, USA 2. BASF SE - Ludwigshafen, Germany 3. The DOW Chemical Company- USA 4. Akzonobel- Amsterdam, Netherlands 5. Clariant AG- Muttenz, Switzerland 6. Kemira OYJ- Helsinki, Finland 7. Cytec Solvay Group- Brussels, Belgium 8. Evonik Industries- Germany 9. Orica Limited - Australia 10. SNF Floerger SAS- France 11. Ecolab- USA, Australia 12. IXOM- Australia 13. Nalco Company- USA 14. Nasaco International Ltd.- Canada 15. Shandong Shuiheng Chemical Co., Ltd- China 16. Yixing Bluwat Chemicals Co., Ltd.- China Frequently Asked Questions: 1] What segments are covered in the Flotation Reagents Market report? Ans. The segments covered in the Flotation Reagents Market report are based on, Type and Application. 2] Which region is expected to hold the highest share in the Flotation Reagents Market? Ans. The North American region is expected to hold the highest share of the Flotation Reagents Market. 3] What is the market size of the Flotation Reagents Market by 2030? Ans. The market size of the Flotation Reagents Market by 2030 will be USD 7.98 Billion. 4] What is the forecast period for the Flotation Reagents Market? Ans. The Forecast period for the Flotation Reagents Market is 2024- 2030.

1. Flotation Reagents Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Flotation Reagents Market: Dynamics 2.1. Flotation Reagents Market Trends by Region 2.1.1. North America Flotation Reagents Market Trends 2.1.2. Europe Flotation Reagents Market Trends 2.1.3. Asia Pacific Flotation Reagents Market Trends 2.1.4. Middle East and Africa Flotation Reagents Market Trends 2.1.5. South America Flotation Reagents Market Trends 2.2. Flotation Reagents Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Flotation Reagents Market Drivers 2.2.1.2. North America Flotation Reagents Market Restraints 2.2.1.3. North America Flotation Reagents Market Opportunities 2.2.1.4. North America Flotation Reagents Market Challenges 2.2.2. Europe 2.2.2.1. Europe Flotation Reagents Market Drivers 2.2.2.2. Europe Flotation Reagents Market Restraints 2.2.2.3. Europe Flotation Reagents Market Opportunities 2.2.2.4. Europe Flotation Reagents Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Flotation Reagents Market Drivers 2.2.3.2. Asia Pacific Flotation Reagents Market Restraints 2.2.3.3. Asia Pacific Flotation Reagents Market Opportunities 2.2.3.4. Asia Pacific Flotation Reagents Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Flotation Reagents Market Drivers 2.2.4.2. Middle East and Africa Flotation Reagents Market Restraints 2.2.4.3. Middle East and Africa Flotation Reagents Market Opportunities 2.2.4.4. Middle East and Africa Flotation Reagents Market Challenges 2.2.5. South America 2.2.5.1. South America Flotation Reagents Market Drivers 2.2.5.2. South America Flotation Reagents Market Restraints 2.2.5.3. South America Flotation Reagents Market Opportunities 2.2.5.4. South America Flotation Reagents Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Flotation Reagents Industry 2.8. Analysis of Government Schemes and Initiatives For Flotation Reagents Industry 2.9. Flotation Reagents Market Trade Analysis 2.10. The Global Pandemic Impact on Flotation Reagents Market 3. Flotation Reagents Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Flotation Reagents Market Size and Forecast, by Type (2023-2030) 3.1.1. Flocculants 3.1.2. Collectors 3.1.3. Frothers 3.1.4. Dispersants 3.1.5. Others 3.2. Flotation Reagents Market Size and Forecast, by Application (2023-2030) 3.2.1. Explosives & Drilling 3.2.2. Mineral Processing 3.2.3. Water & Wastewater Treatment 3.2.4. Others 3.3. Flotation Reagents Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Flotation Reagents Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Flotation Reagents Market Size and Forecast, by Type (2023-2030) 4.1.1. Flocculants 4.1.2. Collectors 4.1.3. Frothers 4.1.4. Dispersants 4.1.5. Others 4.2. North America Flotation Reagents Market Size and Forecast, by Application (2023-2030) 4.2.1. Explosives & Drilling 4.2.2. Mineral Processing 4.2.3. Water & Wastewater Treatment 4.2.4. Others 4.3. North America Flotation Reagents Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Flotation Reagents Market Size and Forecast, by Type (2023-2030) 4.3.1.1.1. Flocculants 4.3.1.1.2. Collectors 4.3.1.1.3. Frothers 4.3.1.1.4. Dispersants 4.3.1.1.5. Others 4.3.1.2. United States Flotation Reagents Market Size and Forecast, by Application (2023-2030) 4.3.1.2.1. Explosives & Drilling 4.3.1.2.2. Mineral Processing 4.3.1.2.3. Water & Wastewater Treatment 4.3.1.2.4. Others 4.3.2. Canada 4.3.2.1. Canada Flotation Reagents Market Size and Forecast, by Type (2023-2030) 4.3.2.1.1. Flocculants 4.3.2.1.2. Collectors 4.3.2.1.3. Frothers 4.3.2.1.4. Dispersants 4.3.2.1.5. Others 4.3.2.2. Canada Flotation Reagents Market Size and Forecast, by Application (2023-2030) 4.3.2.2.1. Explosives & Drilling 4.3.2.2.2. Mineral Processing 4.3.2.2.3. Water & Wastewater Treatment 4.3.2.2.4. Others 4.3.3. Mexico 4.3.3.1. Mexico Flotation Reagents Market Size and Forecast, by Type (2023-2030) 4.3.3.1.1. Flocculants 4.3.3.1.2. Collectors 4.3.3.1.3. Frothers 4.3.3.1.4. Dispersants 4.3.3.1.5. Others 4.3.3.2. Mexico Flotation Reagents Market Size and Forecast, by Application (2023-2030) 4.3.3.2.1. Explosives & Drilling 4.3.3.2.2. Mineral Processing 4.3.3.2.3. Water & Wastewater Treatment 4.3.3.2.4. Others 5. Europe Flotation Reagents Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Flotation Reagents Market Size and Forecast, by Type (2023-2030) 5.2. Europe Flotation Reagents Market Size and Forecast, by Application (2023-2030) 5.3. Europe Flotation Reagents Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Flotation Reagents Market Size and Forecast, by Type (2023-2030) 5.3.1.2. United Kingdom Flotation Reagents Market Size and Forecast, by Application (2023-2030) 5.3.2. France 5.3.2.1. France Flotation Reagents Market Size and Forecast, by Type (2023-2030) 5.3.2.2. France Flotation Reagents Market Size and Forecast, by Application (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Flotation Reagents Market Size and Forecast, by Type (2023-2030) 5.3.3.2. Germany Flotation Reagents Market Size and Forecast, by Application (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Flotation Reagents Market Size and Forecast, by Type (2023-2030) 5.3.4.2. Italy Flotation Reagents Market Size and Forecast, by Application (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Flotation Reagents Market Size and Forecast, by Type (2023-2030) 5.3.5.2. Spain Flotation Reagents Market Size and Forecast, by Application (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Flotation Reagents Market Size and Forecast, by Type (2023-2030) 5.3.6.2. Sweden Flotation Reagents Market Size and Forecast, by Application (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Flotation Reagents Market Size and Forecast, by Type (2023-2030) 5.3.7.2. Austria Flotation Reagents Market Size and Forecast, by Application (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Flotation Reagents Market Size and Forecast, by Type (2023-2030) 5.3.8.2. Rest of Europe Flotation Reagents Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Flotation Reagents Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Flotation Reagents Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Flotation Reagents Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Flotation Reagents Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Flotation Reagents Market Size and Forecast, by Type (2023-2030) 6.3.1.2. China Flotation Reagents Market Size and Forecast, by Application (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Flotation Reagents Market Size and Forecast, by Type (2023-2030) 6.3.2.2. S Korea Flotation Reagents Market Size and Forecast, by Application (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Flotation Reagents Market Size and Forecast, by Type (2023-2030) 6.3.3.2. Japan Flotation Reagents Market Size and Forecast, by Application (2023-2030) 6.3.4. India 6.3.4.1. India Flotation Reagents Market Size and Forecast, by Type (2023-2030) 6.3.4.2. India Flotation Reagents Market Size and Forecast, by Application (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Flotation Reagents Market Size and Forecast, by Type (2023-2030) 6.3.5.2. Australia Flotation Reagents Market Size and Forecast, by Application (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Flotation Reagents Market Size and Forecast, by Type (2023-2030) 6.3.6.2. Indonesia Flotation Reagents Market Size and Forecast, by Application (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Flotation Reagents Market Size and Forecast, by Type (2023-2030) 6.3.7.2. Malaysia Flotation Reagents Market Size and Forecast, by Application (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Flotation Reagents Market Size and Forecast, by Type (2023-2030) 6.3.8.2. Vietnam Flotation Reagents Market Size and Forecast, by Application (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Flotation Reagents Market Size and Forecast, by Type (2023-2030) 6.3.9.2. Taiwan Flotation Reagents Market Size and Forecast, by Application (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Flotation Reagents Market Size and Forecast, by Type (2023-2030) 6.3.10.2. Rest of Asia Pacific Flotation Reagents Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Flotation Reagents Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Flotation Reagents Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Flotation Reagents Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Flotation Reagents Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Flotation Reagents Market Size and Forecast, by Type (2023-2030) 7.3.1.2. South Africa Flotation Reagents Market Size and Forecast, by Application (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Flotation Reagents Market Size and Forecast, by Type (2023-2030) 7.3.2.2. GCC Flotation Reagents Market Size and Forecast, by Application (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Flotation Reagents Market Size and Forecast, by Type (2023-2030) 7.3.3.2. Nigeria Flotation Reagents Market Size and Forecast, by Application (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Flotation Reagents Market Size and Forecast, by Type (2023-2030) 7.3.4.2. Rest of ME&A Flotation Reagents Market Size and Forecast, by Application (2023-2030) 8. South America Flotation Reagents Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Flotation Reagents Market Size and Forecast, by Type (2023-2030) 8.2. South America Flotation Reagents Market Size and Forecast, by Application (2023-2030) 8.3. South America Flotation Reagents Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Flotation Reagents Market Size and Forecast, by Type (2023-2030) 8.3.1.2. Brazil Flotation Reagents Market Size and Forecast, by Application (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Flotation Reagents Market Size and Forecast, by Type (2023-2030) 8.3.2.2. Argentina Flotation Reagents Market Size and Forecast, by Application (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Flotation Reagents Market Size and Forecast, by Type (2023-2030) 8.3.3.2. Rest Of South America Flotation Reagents Market Size and Forecast, by Application (2023-2030) 9. Global Flotation Reagents Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Flotation Reagents Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Microsoft Corporation - United States 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Intel Corporation - United States 10.3. Pelican Imaging - United States 10.4. PMD Technologies - Germany 10.5. Leica AG - Germany 10.6. Infineon Technologies AG - Germany 10.7. Soft Kinetic Systems S.A. - Belgium 10.8. Sharp Corporation - Japan 10.9. Sony Inc. - Japan 10.10. Toshiba Group - Japan 10.11. Panasonic Corporation - Japan 10.12. LG Electronics - South Korea 10.13. Canon - Japan 10.14. Samsung Electronics Limited - South Korea 11. Key Findings 12. Industry Recommendations 13. Flotation Reagents Market: Research Methodology 14. Terms and Glossary