The global fleet management market reached USD 32.25 billion in 2024 and is expected to hit USD 94.61 billion by 2032 at a 14.4% CAGR. This report analyzes market trends, telematics adoption, EV fleet growth, competitive landscape, and opportunities across industries and regions.Fleet Management Market Overview

Fleet management is the process of optimizing and overseeing vehicle fleets through acquisition, maintenance, routing, fuel control, and driver management to ensure safety, efficiency, and regulatory compliance. The fleet management market has been growing rapidly as enterprises prioritize automation, sustainability, and digital transformation, making it one of the fastest-growing segments in mobility and logistics technology. Telematics penetration is accelerating, with 70 million connected units installed in 2023, enabling real-time insights that reduce operational costs by 15–20% and increase fleet uptime by up to 25%. The U.S. alone operates 12 million commercial vehicles, highlighting the vast addressable base for fleet management solutions and analytics-driven decision systems. Growth is supported by EV adoption, battery monitoring, and charging optimization as operators align with sustainability targets such as the EU’s 55% CO₂ reduction mandate by 2030. MaaS integration and shared mobility models are creating new service opportunities, while predictive maintenance, real-time tracking, driver behavior monitoring, and cloud-based fleet orchestration continue to strengthen the fleet management market trends outlined in the latest fleet management industry analysis.To know about the Research Methodology :- Request Free Sample Report Fleet management Market Trend: Increasing demand for operational efficiency and cost optimization Fleet operations typically account for 20–35% of a company’s total operating expenses, including fuel, maintenance, idling costs, route inefficiencies, and downtime. As competition intensifies and delivery timelines shrink, organizations require smarter, data-driven systems to improve fleet productivity and reduce avoidable costs. Digital platforms and telematics-enabled systems help companies streamline routing, optimize dispatching, reduce unauthorized vehicle usage, and eliminate inefficient driving patterns, reinforcing the growing reliance on smart technologies within the fleet management market and enhancing the value of modern fleet management solutions. The effective optimization tools can improve fuel efficiency by 10–15%, extend vehicle lifespan by 15–20%, and reduce maintenance-related downtime by up to 25%. Integration of real-time monitoring, driver behavior analytics, and vehicle diagnostics enables predictive maintenance, which alone can lower repair expenses by up to 30%. Increased adoption of electric vehicles within fleets is further reinforcing the shift toward advanced fleet management solutions, as operators now require systems for battery monitoring, charging coordination, and range planning. Compliance with safety standards, emissions regulations, and government-mandated tracking norms is driving companies to adopt smart monitoring platforms, accelerating digital transformation across the fleet management market and boosting demand for advanced fleet management solutions. Organizations with large commercial vehicle fleets, such as e-commerce, last-mile delivery, freight transport, field service management, and rental mobility, are experiencing rapid scaling, making automation essential to prevent operational leakage. The rapid integration of telematics, IoT, and AI-driven analytics to drive the Fleet Management Market Growth The need for real-time fleet tracking, intelligent routing, maintenance automation, driver safety solutions, and compliance reporting drives the Fleet Management Market growth. Modern sensors and IoT modules enable continuous data collection from engines, tires, brakes, fuel systems, and battery packs, creating a digital footprint for every vehicle. AI analyzes this data to identify mechanical issues before failures occur, helping fleets save 15–20% on annual maintenance costs. Machine learning models are increasingly used to predict fuel consumption patterns, accident risks, and idle-time inefficiencies, allowing companies to make proactive adjustments. Another rising trend is the integration of ADAS and semi-autonomous features, which are becoming standard in commercial fleets, enhancing safety and reducing insurance costs. The growing adoption of electric fleets accelerates the shift toward intelligent management platforms capable of monitoring battery health, charging cycles, energy consumption, and route feasibility. Cloud ecosystems and SaaS-based platforms also support scalable deployments, enabling even small and medium enterprises to access advanced analytics. IoT connections are projected to rise sharply from 2024 to 2032, driven by connected vehicles, telematics devices, and AI-enabled sensors. This rapid surge in IoT adoption accelerates fleet automation, predictive maintenance, real-time monitoring, and overall fleet management market growth.

Cybersecurity Risks and Data Privacy Vulnerabilities to Restraint the Fleet Management Market Modern fleets generate enormous volumes of sensitive data driver identities, vehicle speeds, route histories, cargo details, maintenance patterns, and real-time GPS locations. This information, if compromised, could expose fleets to cargo theft, financial fraud, operational sabotage, or targeted attacks, making data security a critical concern in the fleet management market and a major barrier to wider adoption of advanced fleet management solutions. Cybercriminals target telematics APIs, unsecured Wi-Fi modules, outdated firmware, or cloud endpoints to gain unauthorized access. Incidents such as GPS spoofing, signal jamming, and data manipulation highlight vulnerabilities in existing systems. Many fleet operators operate across borders, complicating compliance due to varying regulations like GDPR (EU), CCPA (California), and China’s cybersecurity law, each imposing strict controls on how data is collected, stored, and transmitted. Compliance violations can result in fines running into millions of dollars, discouraging companies from rapid digital adoption. Smaller operators lack the technical infrastructure or cybersecurity expertise needed to secure telematics systems, making them reluctant to adopt advanced fleet platforms despite the operational benefits, which hampers the Fleet Management Market growth.

Fleet Management Market Segment Analysis

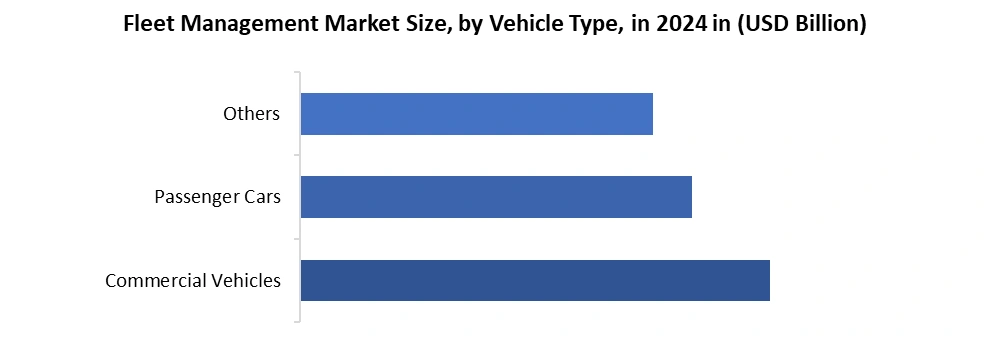

By Component, the Fleet Management Market is segmented into the Solutions (Operations Management, Vehicle Maintenance and Diagnostics, Performance Management, Fleet Analytics & Reporting, and Others) and Services. In the component landscape of the fleet management solutions market, the Solutions clearly dominate, accounting largest global revenue share in 2024, due to continuous adoption of telematics, automation tools, and analytics-driven platforms. Within Solutions, Operations Management represents, as enterprises prioritize route optimization, trip scheduling, dispatch automation, and regulatory compliance tracking. This is followed by Vehicle Maintenance & Diagnostics, driven by the need for predictive maintenance and reduced downtime for commercial fleets. Increasing demand for real-time monitoring, driver behavior analysis, IoT integration, and cloud-first deployments is strengthening the shift toward digital operations across industries such as logistics, e-commerce, rental mobility, utilities, mining, and construction fleets. As fleet operators modernize through cloud-based fleet management, SaaS fleet management platform offerings are expanding rapidly, enabling scalable, subscription-based analytics solutions for organizations of all sizes. By Vehicle Type, the market is categorized into Commercial Vehicles, Passenger Cars and Others. Commercial Vehicles hold the dominant share in the market in 2024, and this share continues to rise with the rapid expansion of logistics, long-haul transport, last-mile delivery, leasing, and construction operations worldwide. The dominance of commercial fleets is linked to the need for continuous monitoring, fuel cost control, maintenance optimization, and compliance management across multi-vehicle, multi-route operations. Rising adoption of fleet management for logistics, enhanced fleet route optimization software, and expanding demand for real-time fleet tracking strengthen the commercial fleet ecosystem. Additionally, the shift toward electric vehicle fleet management among corporate delivery fleets and public transport operators is accelerating the requirement for advanced telematics, battery health monitoring, and EV charging optimization.

Fleet Management Market Regional Insights

North America dominated the Fleet Management Market in 2024 and is expected to continue its dominance over the forecast period. The region benefits from strong regulatory support for safety, emissions, and driver compliance, pushing rapid fleet management system adoption across logistics, delivery, construction, oil & gas, utilities, and public sector fleets. The U.S. alone operates over 12 million commercial vehicles, creating the largest addressable base for real-time monitoring, predictive maintenance, and vehicle tracking and fleet management platforms. Investments in IoT, AI-driven analytics, cloud ecosystems, and 5G connectivity continue to elevate the adoption of fleet management solutions, enabling optimized routing, automated compliance checks, and fuel savings of 10–20%. North America also leads the global fleet management market in EV transition, supported by federal incentives and corporate sustainability initiatives, driving demand for battery diagnostics, charging coordination, and EV fleet optimization systems. The region’s strong presence of technology leaders, ranging from telematics providers and SaaS developers to OEM-integrated platforms, accelerates innovation in the fleet management software market, particularly in areas such as driver behavior monitoring, ADAS integration, and autonomous fleet pilots. Growing pressure from insurance companies to adopt real-time tracking and risk-reduction tools supports the expansion of the fleet telematics market, while e-commerce growth fuels demand for last-mile delivery optimization across LCV fleets.Fleet Management Market Competitive Landscape

The fleet management market is highly competitive, driven by rapid digitalization, telematics integration, and the adoption of AI-powered analytics. Global leaders, including Geotab, Verizon Connect, Trimble, Samsara, and Teletrac Navman compete on advanced fleet management solutions, scalability, and real-time data accuracy. Emerging players focus on cost-effective cloud deployments, expanding the global fleet management market among SMEs and logistics startups. Vendors differentiate through fleet telematics, predictive maintenance capabilities, driver behavior monitoring, and compliance automation as regulations tighten worldwide. With rising EV adoption and demand for sustainable transport, companies offering integrated EV fleet management and charging optimization tools are gaining share. Strong partnerships with OEMs, telecom operators, and SaaS providers define the evolving fleet management market growth. • On September 26, 2023, Bridgestone launched the availability of its Azuga Fleet Management Software on AWS Marketplace, marking its first product offering on the platform since joining the AWS Partner Network. The move enables fleets to digitally buy and deploy Azuga’s GPS tracking and dashcam-based safety solutions directly through AWS. The launch supports Bridgestone’s strategy to enhance connected-fleet services, streamline deployment, reduce downtime, and expand digital mobility solutions under the Bridgestone E8 Commitment. • On November 16, 2023, TomTom signed a multi-year contract with Bridgestone Mobility Solutions to strengthen Webfleet, its fleet-management platform. The partnership integrates TomTom’s advanced navigation, maps, live traffic intelligence, and EV-routing capabilities into Webfleet, enabling fleets to optimize vehicle operations and accelerate electrification. By combining TomTom’s location data with Bridgestone’s fleet-management tools, the collaboration enhances routing efficiency, driving behavior, and electric-vehicle range management for global commercial fleets.Global Fleet Management Market Scope: Inquire before buying

Global Fleet Management Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 32.25 Bn. Forecast Period 2025 to 2032 CAGR: 14.4% Market Size in 2032: USD 94.61 Bn. Segments Covered: by Component Solutions Operations Management Vehicle Maintenance and Diagnostics Performance Management Fleet Analytics & Reporting Others Services by Deployment Model Cloud On-premises Hybrid by Vehicle Type Commercial Vehicles Passenger Cars Others by Fleet Size Small Fleets Mid-sized Fleets Large Fleets Enterprise Fleets by End Use Industry Transportation & Logistics Retail & E-commerce Manufacturing Construction & Mining Energy & Utilities Oil, Gas & Chemicals Others Fleet Management Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Fleet Management Key Players

1. Geotab Inc. 2. Verizon Connect 3. Samsara Inc. 4. Omnitracs LLC 5. Trimble Inc. 6. Teletrac Navman 7. Fleet Complete 8. Azuga 9. MiX Telematics 10. Bridgestone Mobility Solutions 11. Powerfleet Inc. 12. Microlise Group 13. ZF Transics 14. ORBCOMM Inc. 15. Inseego Corp. 16. Gurtam 17. TomTom Telematics 18. FleetCheck 19. Holman Fleet Management 20. AssetWorks LLC 21. Mike Albert Fleet Solutions 22. Emkay Inc. 23. Chinaway 24. Wheels Inc. 25. Fleetmatics 26. Astrata Group 27. CalAmp 28. Donlen Corporation 29. LeasePlan Corporation 30. ARI Fleet ManagementFrequently Asked Questions:

1] What is the growth rate of the Global Fleet Management Market? Ans. The Global Fleet Management Market is growing at a significant rate of 14.4% during the forecast period. 2] Which region is expected to dominate the Global Fleet Management Market? Ans. North America is expected to dominate the Fleet Management Market during the forecast period. 3] What was the Global Fleet Management Market size in 2024? Ans. The Fleet Management Market size is expected to reach USD 32.25 billion in 2024. 4] What is the expected Global Fleet Management Market size by 2032? Ans. The Fleet Management Market size is expected to reach USD 94.61billion by 2032. 5] Which are the top players in the Global Fleet Management Market? Ans. The major players in the Global Fleet Management Market are Geotab Inc., Verizon Connect, Samsara Inc., Omnitracs LLC, Trimble Inc. and Others. 6] What are the factors driving the Global Fleet Management Market growth? Ans. Key factors driving the global fleet management market growth include rising demand for operational efficiency, telematics adoption, IoT connectivity, AI-driven analytics, regulatory compliance needs, EV fleet expansion, real-time tracking, predictive maintenance, and cost reduction across commercial and logistics fleets.

1. Fleet Management Market: Research Methodology 2. Fleet Management Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Fleet Management Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Headquarter 3.3.3. Type Segment 3.3.4. End User Segment 3.3.5. Revenue (2024) 3.3.6. Profit Margin (%) 3.4. Mergers and Acquisitions Details 4. Fleet Management Market: Dynamics 4.1. Fleet Management Market Trends 4.2. Fleet Management Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Analysis of Government Schemes and Initiatives for the Fleet Management Market 5. Fleet Management Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 5.1. Fleet Management Market Size and Forecast, by Component (2024-2032) 5.1.1. Solutions 5.1.1.1. Operations Management 5.1.1.2. Vehicle Maintenance and Diagnostics 5.1.1.3. Performance Management 5.1.1.4. Fleet Analytics & Reporting 5.1.1.5. Others 5.1.2. Services 5.2. Fleet Management Market Size and Forecast, by Deployment Model (2024-2032) 5.2.1. Cloud 5.2.2. On-premises 5.2.3. Hybrid 5.3. Fleet Management Market Size and Forecast, by Vehicle Type (2024-2032) 5.3.1. Commercial Vehicles 5.3.2. Passenger Cars 5.3.3. Others 5.4. Fleet Management Market Size and Forecast, by Fleet Size (2024-2032) 5.4.1. Small Fleets 5.4.2. Mid-sized Fleets 5.4.3. Large Fleets 5.4.4. Enterprise Fleets 5.5. Fleet Management Market Size and Forecast, by End-Use Industry(2024-2032) 5.5.1. Transportation & Logistics 5.5.2. Retail & E-commerce 5.5.3. Manufacturing 5.5.4. Construction & Mining 5.5.5. Energy & Utilities 5.5.6. Oil, Gas & Chemicals 5.5.7. Others 5.6. Fleet Management Market Size and Forecast, by Region (2024-2032) 5.6.1. North America 5.6.2. Europe 5.6.3. Asia Pacific 5.6.4. Middle East and Africa 5.6.5. South America 6. North America Fleet Management Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 6.1. North America Fleet Management Market Size and Forecast, by Component (2024-2032) 6.1.1. Solutions 6.1.1.1. Operations Management 6.1.1.2. Vehicle Maintenance and Diagnostics 6.1.1.3. Performance Management 6.1.1.4. Fleet Analytics & Reporting 6.1.1.5. Others 6.1.2. Services 6.2. North America Fleet Management Market Size and Forecast, by Deployment Model (2024-2032) 6.2.1. Cloud 6.2.2. On-premises 6.2.3. Hybrid 6.3. North America Fleet Management Market Size and Forecast, by Vehicle Type (2024-2032) 6.3.1. Commercial Vehicles 6.3.2. Passenger Cars 6.3.3. Others 6.4. North America Fleet Management Market Size and Forecast, by Fleet Size (2024-2032) 6.4.1. Small Fleets 6.4.2. Mid-sized Fleets 6.4.3. Large Fleets 6.4.4. Enterprise Fleets 6.5. North America Fleet Management Market Size and Forecast, by End-Use Industry (2024-2032) 6.5.1. Transportation & Logistics 6.5.2. Retail & E-commerce 6.5.3. Manufacturing 6.5.4. Construction & Mining 6.5.5. Energy & Utilities 6.5.6. Oil, Gas & Chemicals 6.5.7. Others 6.6. North America Fleet Management Market Size and Forecast, by Country (2024-2032) 6.6.1. United States 6.6.2. Canada 6.6.3. Mexico 7. Europe Fleet Management Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 7.1. Europe Fleet Management Market Size and Forecast, by Component (2024-2032) 7.2. Europe Fleet Management Market Size and Forecast, by Deployment Model (2024-2032) 7.3. Europe Fleet Management Market Size and Forecast, by Vehicle Type (2024-2032) 7.4. Europe Fleet Management Market Size and Forecast, by Fleet Size (2024-2032) 7.5. Europe Fleet Management Market Size and Forecast, by End-Use Industry (2024-2032) 7.6. Europe Fleet Management Market Size and Forecast, by Country (2024-2032) 7.6.1. United Kingdom 7.6.2. France 7.6.3. Germany 7.6.4. Italy 7.6.5. Spain 7.6.6. Russia 7.6.7. Rest of Europe 8. Asia Pacific Fleet Management Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 8.1. Asia Pacific Fleet Management Market Size and Forecast, by Component (2024-2032) 8.2. Asia Pacific Fleet Management Market Size and Forecast, by Deployment Model (2024-2032) 8.3. Asia Pacific Fleet Management Market Size and Forecast, by Vehicle Type (2024-2032) 8.4. Asia Pacific Fleet Management Market Size and Forecast, by Fleet Size (2024-2032) 8.5. Asia Pacific Fleet Management Market Size and Forecast, by End-Use Industry (2024-2032) 8.6. Asia Pacific Fleet Management Market Size and Forecast, by Country (2024-2032) 8.6.1. China 8.6.2. S Korea 8.6.3. Japan 8.6.4. India 8.6.5. Australia 8.6.6. Rest of Asia Pacific 9. Middle East and Africa Fleet Management Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 9.1. Middle East and Africa Fleet Management Market Size and Forecast, by Component (2024-2032) 9.2. Middle East and Africa Fleet Management Market Size and Forecast, by Deployment Model (2024-2032) 9.3. Middle East and Africa Fleet Management Market Size and Forecast, by Vehicle Type (2024-2032) 9.4. Middle East and Africa Fleet Management Market Size and Forecast, by Fleet Size (2024-2032) 9.5. Middle East and Africa Fleet Management Market Size and Forecast, by End-Use Industry (2024-2032) 9.6. Middle East and Africa Fleet Management Market Size and Forecast, by Country (2024-2032) 9.6.1. South Africa 9.6.2. GCC 9.6.3. Nigeria 9.6.4. Rest of ME&A 10. South America Fleet Management Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 10.1. South America Fleet Management Market Size and Forecast, by Component (2024-2032) 10.2. South America Fleet Management Market Size and Forecast, by Deployment Model (2024-2032) 10.3. South America Fleet Management Market Size and Forecast, by Vehicle Type (2024-2032) 10.4. South America Fleet Management Market Size and Forecast, by Fleet Size (2024-2032) 10.5. South America Fleet Management Market Size and Forecast, by End-Use Industry (2024-2032) 10.6. South America Fleet Management Market Size and Forecast, by Country (2024-2032) 10.6.1. Brazil 10.6.2. Argentina 10.6.3. Colombia 10.6.4. Chile 10.6.5. Rest Of South America 11. Company Profile: Key Players 11.1. Geotab Inc. 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Verizon Connect 11.3. Samsara Inc. 11.4. Omnitracs LLC 11.5. Trimble Inc. 11.6. Teletrac Navman 11.7. Fleet Complete 11.8. Azuga 11.9. MiX Telematics 11.10. Bridgestone Mobility Solutions 11.11. Powerfleet Inc. 11.12. Microlise Group 11.13. ZF Transics 11.14. ORBCOMM Inc. 11.15. Inseego Corp. 11.16. Gurtam 11.17. TomTom Telematics 11.18. FleetCheck 11.19. Holman Fleet Management 11.20. AssetWorks LLC 11.21. Mike Albert Fleet Solutions 11.22. Emkay Inc. 11.23. Chinaway 11.24. Wheels Inc. 11.25. Fleetmatics 11.26. Astrata Group 11.27. CalAmp 11.28. Donlen Corporation 11.29. LeasePlan Corporation 11.30. ARI Fleet Management 12. Key Findings 13. Analyst Recommendations