Fishing Waders Market is expected to reach USD 4.49 billion by 2029, with a CAGR of 6% between 2023 and 2029. A fishing wader is a waterproof outdoor garment worn by a fisherman that covers the human body from the chest to the foot and is intended to keep a fisherman warm when he is chest-deep in the water during the colder months. The research also contains a detailed cost, segment, trend, region, and commercial development forecast for the major global key players for the forecast period.To know about the Research Methodology :- Request Free Sample Report In the report, 2022 is considered a base year however 2022’s numbers are on the real output of the companies in the market. Special attention is given to 2022 and the effect of lockdown on the demand and supply, and also the impact of lockdown for the next two years on the market. Some companies have done well in lockdown also and a specific strategic analysis of those companies is done in the report.

Fishing Waders Market Dynamics

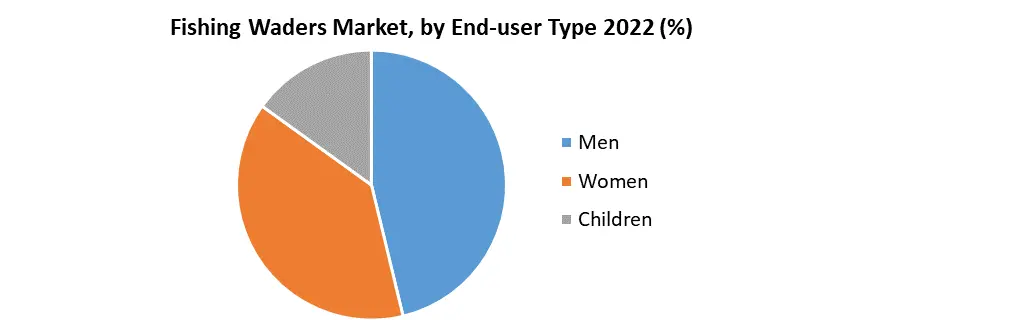

During the forecast period, the fishing waders market is expected to benefit from rising demand for eco-friendly and enhanced materials. Several companies are investing in R&D to produce high-quality goods and get environmentally friendly raw materials, which is projected to propel the fishing waders market in the future years. Temperature, climate, season, and activity type all have a role in the need for various types of fish waders. Because of the material's remarkable insulation, neoprene fish waders are commonly used for goose and duck hunting. During the winter, demand for neoprene fish waders is higher than in other seasons. During the forecast period, this is likely to boost sales of fish waders. Consumer demand has grown simpler to meet through distribution platforms such as e-Commerce. Consumers may now pick from a variety of different styles of fishing waders via e-Commerce platforms or company-owned websites. During the forecast period, this is also expected to open up new opportunities for the global fishing waders market. Market Trends for Fishing Waders According to the Food and Agriculture Organization (FAO), around 12% of women were employed in the fishing sector or engaged in fishing. This figure has been steadily rising, with a increase in the previous two decades, and continues to rise year after year. Women have an important and crucial role in small-scale fishing as well. The demand for women's fishing waders and related items is now increasing, and women are finding a variety of alternatives through online channels and multi-brand retail shops. This is expected to drive the fishing waders market forward in the forecasted period.Segmentation Analysis

Neoprene fishing waders are the most popular, accounting for 34% of the market in 2022. Manufacturers' relatively high R&D investment in product innovation for new designs and quality materials that enable lightweight and durable waders is likely to drive market growth throughout the forecast period. Neoprene waders are made of a rubber substance that contains microscopic nitrogen bubbles. This gives physical hardness as well as insulating characteristics, offering intrinsic warmth, particularly in cold weather.

Regional Insight

North America secured the highest share of more than 36.0 % in 2022 because of increasing product demand in the United States and Canada. Additionally, the growing spending power of this region's customers is supporting market expansion. Considering North America offers appealing potential for the consumer goods industry, the market is expected to increase significantly during the forecast period. From 2022 to 2029, Asia Pacific is expected to grow at the fastest CAGR of 7.3 %. This is due to the increased popularity of fishing waders in this area. Increased disposable income in countries such as China and India is also expected to fuel the market over the forecast period. The emergence of the digital economy, demography and productivity reductions have all had an influence on market growth in this region. By 2029, China is expected to emerge as an opportunistic centre for the selling of fishing waders. The Chinese market is expected to grow at a CAGR of 5.8 %. Demand is expected to rise as a result of the burgeoning recreational fishing sector. Progressive government programmes to encourage recreational fishing have multiplied in recent years. The Fisheries Bureau of the Ministry of Agriculture suggested in its recreational fisheries objectives in 2000 that it should be authorised where circumstances are most conducive. As a result, production increased by 22.6% between 2006 and 2010. Likewise, efforts are being made to promote recreational fishing as a potentially sustainable alternative. Report Objectives: Landscape analysis of the Fishing Waders Market competitive benchmarking Past and current status of the industry with the forecasted market size and trends Evaluation of potential key players that include market leaders, followers, and new entrants Technology trends The potential impact of micro-economic factors on the market External and Internal factors affecting the market have been analyzed The report also helps in understanding the Fishing Waders Market dynamics, and structure by analysing the market segments to project the Fishing Waders Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Fishing Waders Market make the report investor’s guide.Fishing Waders Market Scope: Inquiry Before Buying

Global Fishing Waders Market Base Year 2022 Forecast Period 2023-2029 Historical Data CAGR Market Size in 2022 Market Size in 2029 2018 to 2022 6 % US$ 2.98 Bn US$ 4.49 Bn Segments Covered by Material Nylon Polyester Neoprene Rubber by End-user Men Women Children by Distribution Channel Online ( e-Commerce Websites, Company-owned Websites) Offline Regions Covered North America United States Canada Mexico Europe UK France Germany Italy Spain Sweden Austria Rest of Europe Asia Pacific China S Korea Japan India Australia Indonesia Malaysia Vietnam Taiwan Bangladesh Pakistan Rest of APAC Middle East and Africa South Africa GCC Egypt Nigeria Rest of ME&A South America Brazil Argentina Rest of South America Fishing Waders Market Key Players are:

1. Cabela's LLC 2. Columbia Sportswear Company 3. Caddis Waders 4. Pure Fishing, Inc. 5. Gator Waders, LLC. 6. Redington 7. Pacific Eagle Enterprise Co., Ltd 8. Simms Fishing Products 9. Patagonia, Inc. 10.The Orvis Company Inc. 11.Decathlon 12.RIVERWORKS NZ 13.Dryline Ltd 14.Allen 15.DRYFT Frequently Asked Questions 1. What is the projected market size & growth rate of the Fishing Waders Market? Ans- The Fishing Waders Market was valued at USD 2.98 billion in 2022 and is projected to reach USD 4.49 billion by 2029, growing at a CAGR of 6 % during the forecast period. 2. What is the key driving factor for the growth of the Fishing Waders Market? Ans- During the forecast period, the fishing waders market is expected to benefit from rising demand for eco-friendly and enhanced materials. 3. Which Region accounted for the largest Fishing Waders Market share? Ans- North America secured the highest share of more than 36.0 %in 2022 because of increasing product demand in the United States and Canada. 4. What makes the Asia Pacific a Lucrative Market for Fishing Waders Market? Ans- This is due to the increased popularity of fishing waders in this area. Increased disposable income in countries such as China and India is also expected to fuel the market over the forecast period. 5. What are the top players operating in the Fishing Waders Market? Ans- Cabela's LLC, Columbia Sportswear Company, Caddis Waders, Pure Fishing, Inc., and Gator Waders, LLC.

1. Global Fishing Waders Market: Research Methodology 2. Global Fishing Waders Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to the Global Fishing Waders Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Global Fishing Waders Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Global Fishing Waders Market Segmentation 4.1 Global Fishing Waders Market, by Material (2022-2029) • Nylon • Polyester • Neoprene • Rubber 4.2 Global Fishing Waders Market, by End-user (2022-2029) • Men • Women • Children 4.3 Global Fishing Waders Market, by Distribution Channel (2022-2029) • Online ( e-Commerce Websites, Company-owned Websites) • Offline North America Fishing Waders Market (2022-2029) 5.1 North American Fishing Waders Market, by Material (2022-2029) • Nylon • Polyester • Neoprene • Rubber 5.2 North America Fishing Waders Market, by End-user (2022-2029) • Men • Women • Children 5.3 North America Fishing Waders Market, by Distribution Channel (2022-2029) • Online ( e-Commerce Websites, Company-owned Websites) • Offline 5.4. North America Fishing Waders Market, by Country (2022-2029) • United States • Canada • Mexico 5. European Fishing Waders Market (2022-2029) 6.1. European Fishing Waders Market, by Material (2022-2029) 6.2. European Fishing Waders Market, by End-user (2022-2029) 6.3 European Fishing Waders Market, by Distribution Channel (2022-2029) 6.4. European Fishing Waders Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 6. Asia Pacific Fishing Waders Market (2022-2029) 7.1. Asia Pacific Fishing Waders Market, by Material (2022-2029) 7.2. Asia Pacific Fishing Waders Market, by End-user (2022-2029) 7.3 Asia Pacific Fishing Waders Market, by Distribution Channel (2022-2029) 7.4. Asia Pacific Fishing Waders Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. The Middle East and Africa Fishing Waders Market (2022-2029) 8.1. Middle East and Africa Fishing Waders Market, by Material (2022-2029) 8.2. Middle East and Africa Fishing Waders Market, by End-user (2022-2029) 8.3 Middle East and Africa Fishing Waders Market, by Distribution Channel (2022-2029) 8.4. Middle East and Africa Fishing Waders Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America Fishing Waders Market (2022-2029) 9.1. Latin America Fishing Waders Market, by Material (2022-2029) 9.2. Latin America Fishing Waders Market, by End-user (2022-2029) 9.3 Latin America Fishing Waders Market, by Distribution Channel (2022-2029) 9.4. Latin America Fishing Waders Market, by Country (2022-2029) • Brazil • Argentina • Rest Of Latin America 9. Company Profile: Key players 10.1. Pure Fishing, Inc. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Cabela's LLC 10.3. Columbia Sportswear Company 10.4. Caddis Waders 10.5. Pure Fishing, Inc. 10.6. Gator Waders, LLC. 10.7. Redington 10.8. Pacific Eagle Enterprise Co., Ltd 10.9. Simms Fishing Products 10.10. Patagonia, Inc. 10.11. The Orvis Company Inc. 10.12. Decathlon 10.13. RIVERWORKS NZ 10.14. Dryline Ltd 10.15. Allen 10.16. DRYFT