The Global Fire Protection Systems Market size was valued at USD 70.17 Billion in 2023 and the total Fire Protection Systems Market revenue is expected to grow at a CAGR of 6.59% from 2024 to 2030, reaching nearly USD 109.70 Billion. The Global Fire Protection Systems Market is currently witnessing a robust and evolving landscape, driven by several key factors that emphasize the significance of fire safety in various industries. The market is characterized by rising demand for advanced fire protection solutions due to increased awareness of the devastating consequences of fire incidents, stricter government regulations, and the growing adoption of smart building technologies. These factors have fueled the expansion of the fire protection systems market, encompassing fire detection, suppression, and control systems. Increasing urbanization, infrastructure development, and investments in commercial and residential construction projects worldwide have further accelerated market growth. The market is benefiting from advancements in fire protection technologies, including the integration of IoT and AI-based systems for real-time monitoring and rapid response. This technology-driven approach aids in the early detection and mitigation of fire hazards, which is critical to preventing disasters and protecting lives and assets. The global emphasis on environmental sustainability and the use of eco-friendly fire suppression agents is influencing market dynamics, as companies strive to align with eco-conscious consumers and meet stringent environmental regulations. Recent developments by key market players are indicative of the industry's dynamism. Leading companies like Honeywell International, Johnson Controls, Siemens AG, and Tyco Fire Products are consistently innovating to strengthen their market presence. For instance, Honeywell launched the "Xtralis VESDA-E VEA" series, an advanced aspirating smoke detection solution, which enhances early warning capabilities. Siemens introduced "Cerberus FIT," a cost-effective and versatile fire protection system suitable for diverse applications. Such innovations underscore fierce competition and the focus on providing more efficient, reliable, and tailored fire protection solutions. The market is also witnessing increased partnerships and collaborations among industry players to expand their global reach and offer comprehensive fire safety solutions. Mergers and acquisitions are shaping the competitive landscape, with larger companies acquiring specialized firms to broaden their product portfolios and improve their market position. These trends indicate that the Global Fire Protection Systems Market is on a growth trajectory, offering immense opportunities for both established players and new entrants to contribute to the global fire safety landscape, ensuring safer environments for people and assets while fostering sustainability and technological advancement.To know about the Research Methodology :- Request Free Sample Report

Fire Protection Systems Market Scope and Research Methodology:

The Fire Protection Systems Market encompasses a wide scope and utilizes a robust research methodology to gather insights and analyze the various facets of the industry. Gathering data from diverse sources, including market reports, industry publications, government sources, company financial reports, and market surveys. Carefully examining the collected data to identify market trends, growth drivers, challenges, and opportunities. Evaluating the competitive landscape by assessing the market shares, strategies, and developments of key industry players. Utilizing statistical models and historical data to forecast future market trends, growth projections, and market size. Conducting interviews, surveys, and discussions with industry experts, stakeholders, and consumers to gain valuable insights into market dynamics. Reviewing existing literature, industry reports, and academic studies to gather additional information and context. Cross-referencing and validating research findings to ensure the accuracy and reliability of the collected data and analysis. This combination of comprehensive elements provides a holistic understanding of the Fire Protection Systems Market, enabling businesses and stakeholders to make well-informed decisions and investments in thisFire Protection Systems Market Dynamics:

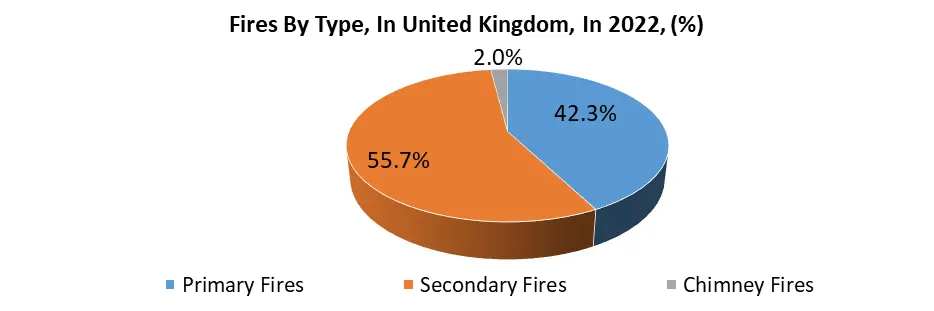

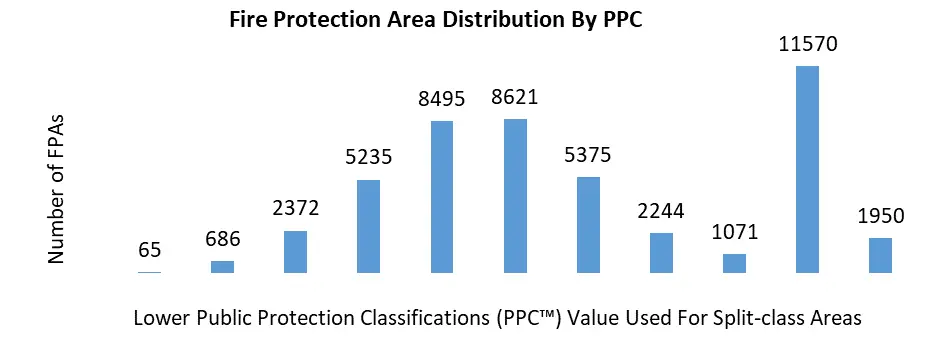

Urbanization and High-Rise Construction Fuel Fire Safety Market: Government regulations for the installation of fire protection systems in commercial and residential buildings are a key driver. For example, in 2019, New York City passed Local Law 194, which requires the installation of sprinkler systems in all residential buildings with three or more units, boosting demand for fire protection systems. Increasing urbanization and infrastructure development globally are driving demand for fire protection systems. The growth of smart cities and the construction of high-rise buildings necessitate advanced fire protection systems to ensure safety. Innovations in fire detection and suppression technologies, like advanced smoke detectors, automated fire suppression systems, and AI-based analytics, are spurring market growth. For instance, the use of aspirating smoke detection (ASD) systems, like Xtralis VESDA, offers early warning capabilities. Growing environmental concerns are promoting the use of eco-friendly fire suppression agents. The adoption of clean agents like 3M™ Novec™ 1230 Fire Protection Fluid in data centers and critical facilities is an example of this trend. The growth of industries such as oil and gas, manufacturing, and energy necessitates fire protection systems. For instance, the expansion of oil refineries in the Middle East is driving the demand for advanced fire suppression systems. Heightened awareness of fire safety in the wake of high-profile fire incidents is encouraging businesses and individuals to invest in fire protection. The Notre Dame Cathedral fire in Paris in 2019 raised awareness about the importance of fire protection. Insurance companies incentivize the installation of fire protection systems by offering reduced premiums. This encourages property owners to invest in fire safety measures, as seen in the adoption of fire sprinklers in commercial buildings to reduce insurance costs. The expansion of multinational corporations and businesses into new regions and markets creates a need for standardized fire protection systems. These companies require consistent fire safety measures across their global facilities, fostering market growth. Ongoing R&D efforts by key market players to develop more efficient and cost-effective fire protection solutions are driving market growth. For example, Siemens' Cerberus FIT is the product of such R&D efforts. Strategic collaborations and acquisitions among industry players enhance product offerings and market reach. Johnson Controls' acquisition of Tyco Fire Products is a notable example of how partnerships influence the market's competitive landscape. Weak Enforcement of Safety Regulations Hampers Market Growth: The significant upfront investment required for the installation of advanced fire protection systems deters cost-sensitive customers. For example, retrofitting a building with a comprehensive fire sprinkler system is expensive and discourages some property owners from adopting these safety measures. In many developing regions, weak enforcement of building codes and fire safety regulations hampers market growth. The tragic Grenfell Tower fire in London in 2017 highlighted the consequences of lax enforcement of fire safety standards. Fire protection systems require regular maintenance to ensure their effectiveness. Complex maintenance procedures and costs pose a challenge for businesses, such as hotels and hospitals, which must maintain fire safety around the clock. The installation and maintenance of advanced fire protection systems require specialized technical skills. The shortage of qualified technicians and engineers hinders system deployment. This challenge is particularly prevalent in remote or rural areas. Integration challenges may arise when older buildings need to incorporate advanced fire protection technology. Retrofitting outdated infrastructure is complicated and costly, as seen in the case of historical landmarks, like the Louvre Museum in Paris, which face challenges in modernizing fire safety without compromising their architectural integrity. Frequent false alarms strain resources, as emergency responders and building staff may become complacent or fail to respond promptly. False alarms result from outdated or poorly maintained fire detection systems, impacting public safety and resources. While eco-friendly fire suppression agents are gaining traction, some face environmental scrutiny. For example, the phase-out of Halon fire extinguishing agents due to their ozone-depleting properties led to the need for alternative solutions that are not always as effective. The market's fragmentation with numerous players and products leads to confusion among consumers. The abundance of options makes it challenging for decision-makers to choose the most suitable fire protection systems for their specific needs, resulting in market uncertainty. Economic downturns and fluctuations in construction and industrial activities impact investments in fire protection. During economic crises, companies may postpone or scale back fire safety investments, affecting market growth. Evolving fire safety regulations and standards pose challenges for manufacturers and end-users in maintaining compliance. Frequent changes may require continuous updates and adjustments to fire protection systems, leading to added costs and complexity for businesses.Historic Building Renovations Create Opportunities for Fire Safety Upgrades: The growing adoption of smart building technologies presents an opportunity for fire protection system manufacturers to integrate advanced sensors, IoT, and AI for real-time monitoring and response. For instance, the integration of fire detection with building automation systems in modern skyscrapers like The Shard in London enhances safety and efficiency. The expansion of renewable energy projects, such as solar and wind farms, requires specialized fire protection systems. Companies offer solutions like early detection and fire suppression in remote renewable energy facilities, ensuring their protection and compliance with environmental standards. With the increasing reliance on data centers, there is a significant opportunity for advanced fire suppression and detection systems. Companies like Amazon Web Services invest in cutting-edge fire protection to safeguard data centers from potential threats, driving demand for innovative solutions. Hospitals and healthcare facilities demand robust fire protection due to the sensitive nature of their operations. The implementation of advanced fire suppression systems, like water mist systems, ensures patient and staff safety, as seen in hospitals adopting these technologies worldwide. The aviation sector requires specialized fire protection systems for aircraft hangars and maintenance facilities. Developments like foam-based fire suppression systems used in military aircraft hangars create opportunities for industry players to cater to this unique market. The emphasis on green building certifications, such as LEED (Leadership in Energy and Environmental Design), provides opportunities for manufacturers of eco-friendly fire suppression agents. Green buildings often require sustainable fire protection solutions to meet environmental standards. As developing regions invest in infrastructure development, including airports, railways, and commercial complexes, there is a growing demand for fire protection systems. The e-commerce boom drives the need for fire protection in large distribution centers. Companies like Alibaba invest in state-of-the-art fire detection and suppression systems to protect their vast warehouses, creating opportunities for suppliers of these technologies. Many older buildings require fire safety upgrades to comply with modern standards. The renovation and retrofitting of historic structures, like the Palace of Westminster in the UK, offers opportunities for companies specializing in preserving architectural integrity while enhancing fire protection. The growth of energy storage facilities, such as lithium-ion battery farms, requires specialized fire protection solutions to mitigate the risk of thermal runaway events. Innovations in fire detection and suppression for energy storage systems create opportunities in this emerging sector. These growth opportunities highlight the diverse applications and evolving needs within the Global Fire Protection Systems Market, demonstrating the potential for innovation, specialization, and market expansion.

Fire Protection Systems Market Segment Analysis:

Based on Type, The Global Fire Protection Systems Market is effectively segmented based on the type of systems, distinguishing between Active Fire Protection Systems and Passive Fire Protection Systems. Active Fire Protection Systems, which include fire detection and suppression systems, are extensively adopted in critical applications like data centers and industrial facilities due to their real-time response capabilities. They are particularly relevant in environments where early fire detection and rapid suppression are essential to safeguard lives and assets. Passive fire protection systems, which encompass fire-resistant materials, structural components, and compartmentalization, are widely applied in the building and construction sectors, including residential, commercial, and public infrastructure projects. The adoption of passive fire protection systems is driven by regulatory compliance, building codes, and a growing awareness of fire safety in the construction industry. These two segments complement each other, with Active systems addressing immediate threats and Passive systems providing structural integrity, making the Global Fire Protection Systems Market highly adaptable to diverse applications and adoption scenarios.

Fire Protection Systems Market Regional Insights:

The Global Fire Protection Systems Market exhibits distinct regional insights based on manufacturing hubs, major consumption areas, and trade dynamics. Large manufacturing regions, such as Asia-Pacific, particularly China, have emerged as the epicenter of fire protection system production. The robust manufacturing infrastructure, skilled labor force, and the presence of key market players have propelled this region into a global manufacturing powerhouse. North America, with the United States at its core, stands out as a major consuming region. The stringent enforcement of safety regulations and a heightened awareness of fire protection measures drive significant demand for advanced fire protection systems in sectors ranging from commercial to industrial. This demand is further catalyzed by the region's inclination toward smart building technologies. On the import-export front, Europe plays a pivotal role. With well-established trade networks and partnerships, European countries import and export a substantial volume of fire protection equipment and technologies. This region acts as a critical trading junction, facilitating the flow of fire protection systems to various parts of the world. Additionally, the Middle East and Africa, with their rapid urbanization and increasing infrastructure development, are showing an upward trajectory in both consumption and production of fire protection systems, making them significant players in the global market. These regional dynamics emphasize the interplay of manufacturing, consumption, and trade in the Global Fire Protection Systems Market, where different regions contribute uniquely to the industry's growth and development.

Detector type Operational criteria Application Optical detectors Smoke development, no / low heat development, no visible flames for early detection of smoldering fires with large and bright smoke particles Thermal detectors strong heat radiation, heat development Detection of open fires in small monitoring areas Optical-thermal multi-sensor detectors Incipient fire with slow progression, CO gas development Surveillance areas with high requirements for personal protection Ionization smoke detector particularly sensitive, even to the smallest smoke particles often prohibited in Germany due to radioactive radiation (replacement by optical-thermal detectors) Flame detector high emission (IR, UV), e.g. with flammable liquids and gases Surveillance areas with increased fire hazard Special detectors I – linear heat detectors Places where point detectors cannot be used Use in difficult environmental conditions (e.g. dirt, heat, cold, humidity) Competitive Landscape

Key Players of the Fire Protection Systems Market profiled in the report are Consilium AB, DESAUTEL SAS, Eaton, Encore Fire Protection, Fike Corporation, Fire Suppression Ltd, Gentex Corporation, Gunnebo AB, Halma plc, Hochiki Corporation, Honeywell International Inc, Johnson Controls International Plc, Minimax Viking GmbH, NAFFCO FZCO, Napco Security Technologies, Inc. This provides huge opportunities to serve many End-users and customers and expand the Fire Protection Systems Market. In July 2023 - SparxTM Smart Sprinkler System Prototype: Sparx Holdings Group completed the SparxTM Smart Sprinkler System prototype, aiming to revolutionize fire suppression. It enhances the efficiency of conventional sprinkler systems, improving response times, and making them effective in complex fire scenarios. In July 2023 - QTEC Fire Suppression Solutions: Integrated Fire Technology expanded its product offering with QTEC fire suppression solutions, gaining exclusive distribution rights in South Africa. QTEC's low-pressure foam spray system is adaptable to various applications, including mining, and industrial facilities. In June 2023 - Fike Fire Monitors: Fike Corp. introduced autonomous water cannons, the Fike Fire Monitors, capable of quickly extinguishing fires in hard-to-reach areas. These water-based cannons utilize advanced technology, including flame detectors and high-definition cameras, for effective fire suppression. In October 2022 - Johnson Controls and Rescue Air Systems: Johnson Controls acquired Rescue Air Systems, specializing in firefighter air replenishment systems (FARS). FARS allows firefighters to refill breathing air bottles within buildings during emergencies, expanding Johnson Controls' fire suppression product line. In August 2022 - Honeywell's Fire-Lite Detection: Honeywell introduced Fire-Lite Detection, offering contemporary fire prevention systems for small to medium-sized buildings in Australia. This announcement aligns with the robust growth of Australia's construction sector, driving demand for modern fire protection systems.Fire Protection Systems Market Scope: Inquiry Before Buying

Fire Protection Systems Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 70.17 Bn. Forecast Period 2024 to 2030 CAGR: 6.59% Market Size in 2030: US $ 109.70 Bn. Segments Covered: by Service Managed Services Installation and Design Services Maintenance Services Other by Type Active Fire Protection System Passive Fire Protection System by Product Fire Detection Fire Response Fire Suppression Fire Analysis by End-User Commercial Industrial Governmental Institutional Others Fire Protection Systems Market, by region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Fire Protection Systems Market Key Players:

1. Consilium AB 2. DESAUTEL SAS 3. Eaton 4. Encore Fire Protection 5. Fike Corporation, 6. Fire Suppression Ltd 7. Gentex Corporation 8. Gunnebo AB 9. Halma plc 10. Hochiki Corporation 11. Honeywell International Inc 12. Johnson Controls International Plc 13. Minimax Viking GmbH 14. NAFFCO FZCO 15. Napco Security Technologies, Inc. 16. Robert Bosch GmbH 17. Schneider Electric, 18. SCHRACK SECONET AG, 19. Securiton AG 20. Siemens AG 21. Solas Fire Safety Equipment (P) Ltd. 22. Swastik Synergy Engineering Private Limited 23. Victaulic Co., 24. Viking Automatic Sprinkler Company 25. Yamato Protec Corporation FAQs: 1. What are the growth drivers for the Fire Protection Systems Market? Ans. Urbanization and High-Rise Construction Fuel Fire Safety Market and is expected to be the major driver for the Fire Protection Systems Market. 2. What are the major restraints for the Fire Protection Systems Market growth? Ans. Weak Enforcement of Safety Regulations Hampers Market Growth is expected to be the major Opportunity in the Fire Protection Systems Market. 3. Which country is expected to lead the global Fire Protection Systems Market during the forecast period? Ans. Asia Pacific is expected to lead the Fire Protection Systems Market during the forecast period. 4. What is the projected market size and growth rate of the Fire Protection Systems Market? Ans. The Global Fire Protection Systems Market size was valued at USD 70.17 Billion in 2023 and the total Fire Protection Systems Market revenue is expected to grow at a CAGR of 6.59% from 2024 to 2030, reaching nearly USD 109.70 Billion. 5. What segments are covered in the Fire Protection Systems Market report? Ans. The segments covered in the Fire Protection Systems Market report are by Service, Type, Product, End-User, and Region.

1. Fire Protection Systems Market: Research Methodology 2. Fire Protection Systems Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Fire Protection Systems Market: Dynamics 3.1 Fire Protection Systems Market Trends by Region 3.1.1 Global Fire Protection Systems Market Trends 3.1.2 North America Fire Protection Systems Market Trends 3.1.3 Europe Fire Protection Systems Market Trends 3.1.4 Asia Pacific Fire Protection Systems Market Trends 3.1.5 Middle East and Africa Fire Protection Systems Market Trends 3.1.6 South America Fire Protection Systems Market Trends 3.2 Fire Protection Systems Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Fire Protection Systems Market Drivers 3.2.1.2 North America Fire Protection Systems Market Restraints 3.2.1.3 North America Fire Protection Systems Market Opportunities 3.2.1.4 North America Fire Protection Systems Market Challenges 3.2.2 Europe 3.2.2.1 Europe Fire Protection Systems Market Drivers 3.2.2.2 Europe Fire Protection Systems Market Restraints 3.2.2.3 Europe Fire Protection Systems Market Opportunities 3.2.2.4 Europe Fire Protection Systems Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Fire Protection Systems Market Drivers 3.2.3.2 Asia Pacific Fire Protection Systems Market Restraints 3.2.3.3 Asia Pacific Fire Protection Systems Market Opportunities 3.2.3.4 Asia Pacific Fire Protection Systems Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Fire Protection Systems Market Drivers 3.2.4.2 Middle East and Africa Fire Protection Systems Market Restraints 3.2.4.3 Middle East and Africa Fire Protection Systems Market Opportunities 3.2.4.4 Middle East and Africa Fire Protection Systems Market Challenges 3.2.5 South America 3.2.5.1 South America Fire Protection Systems Market Drivers 3.2.5.2 South America Fire Protection Systems Market Restraints 3.2.5.3 South America Fire Protection Systems Market Opportunities 3.2.5.4 South America Fire Protection Systems Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power of Suppliers 3.3.2 Bargaining Power of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 Global 3.6.2 North America 3.6.3 Europe 3.6.4 Asia Pacific 3.6.5 Middle East and Africa 3.6.6 South America 3.7 Analysis of Government Schemes and Initiatives for the Fire Protection Systems Industry 3.8 The Global Pandemic and Redefining of The Fire Protection Systems Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 3.11 Global Fire Protection Systems Trade Analysis (2017-2023) 3.11.1 Global Import of Fire Protection Systems 3.11.2 Global Export of Fire Protection Systems 4. Global Fire Protection Systems Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 4.1 Global Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 4.1.1 Managed Services 4.1.2 Installation and Design Services 4.1.3 Maintenance Services 4.1.4 Others 4.2 Global Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 4.2.1 Active Fire Protection System 4.2.2 Passive Fire Protection System 4.3 Global Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 4.3.1 Fire Detection 4.3.2 Fire Response 4.3.3 Fire Suppression 4.3.4 Fire Analysis 4.4 Global Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 4.4.1 Commercial 4.4.2 Industrial 4.4.3 Governmental 4.4.4 Institutional 4.4.5 Others 4.5 Global Fire Protection Systems Market Size and Forecast, By Region (2023-2030) 4.5.1 North America 4.5.2 Europe 4.5.3 Asia Pacific 4.5.4 Middle East and Africa 4.5.5 South America 5. North America Fire Protection Systems Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 5.1 North America Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 5.1.1 Managed Services 5.1.2 Installation and Design Services 5.1.3 Maintenance Services 5.1.4 Others 5.2 North America Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 5.2.1 Active Fire Protection System 5.2.2 Passive Fire Protection System 5.3 North America Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 5.3.1 Fire Detection 5.3.2 Fire Response 5.3.3 Fire Suppression 5.3.4 Fire Analysis 5.4 North America Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 5.4.1 Commercial 5.4.2 Industrial 5.4.3 Governmental 5.4.4 Institutional 5.4.5 Others 5.5 North America Fire Protection Systems Market Size and Forecast, By Country (2023-2030) 5.5.1 United States 5.5.1.1 United States Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 5.5.1.1.1 Managed Services 5.5.1.1.2 Installation and Design Services 5.5.1.1.3 Maintenance Services 5.5.1.1.4 Others 5.5.1.2 United States Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 5.5.1.2.1 Active Fire Protection System 5.5.1.2.2 Passive Fire Protection System 5.5.1.3 United States Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 5.5.1.3.1 Fire Detection 5.5.1.3.2 Fire Response 5.5.1.3.3 Fire Suppression 5.5.1.3.4 Fire Analysis 5.5.1.4 United States Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 5.5.1.4.1 Commercial 5.5.1.4.2 Industrial 5.5.1.4.3 Governmental 5.5.1.4.4 Institutional 5.5.1.4.5 Others 5.5.2 Canada 5.5.2.1 Canada Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 5.5.2.1.1 Managed Services 5.5.2.1.2 Installation and Design Services 5.5.2.1.3 Maintenance Services 5.5.2.1.4 Others 5.5.2.2 Canada Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 5.5.2.2.1 Active Fire Protection System 5.5.2.2.2 Passive Fire Protection System 5.5.2.3 Canada Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 5.5.2.3.1 Fire Detection 5.5.2.3.2 Fire Response 5.5.2.3.3 Fire Suppression 5.5.2.3.4 Fire Analysis 5.5.2.4 Canada Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 5.5.2.4.1 Commercial 5.5.2.4.2 Industrial 5.5.2.4.3 Governmental 5.5.2.4.4 Institutional 5.5.2.4.5 Others 5.5.3 Mexico 5.5.3.1 Mexico Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 5.5.3.1.1 Managed Services 5.5.3.1.2 Installation and Design Services 5.5.3.1.3 Maintenance Services 5.5.3.1.4 Others 5.5.3.2 Mexico Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 5.5.3.2.1 Active Fire Protection System 5.5.3.2.2 Passive Fire Protection System 5.5.3.3 Mexico Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 5.5.3.3.1 Fire Detection 5.5.3.3.2 Fire Response 5.5.3.3.3 Fire Suppression 5.5.3.3.4 Fire Analysis 5.5.3.4 Mexico Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 5.5.3.4.1 Commercial 5.5.3.4.2 Industrial 5.5.3.4.3 Governmental 5.5.3.4.4 Institutional 5.5.3.4.5 Others 6. Europe Fire Protection Systems Market Size and Forecast By Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 6.1 Europe Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 6.2 Europe Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 6.3 Europe Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 6.4 Europe Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 6.5 Europe Fire Protection Systems Market Size and Forecast, By Country (2023-2030) 6.5.1 United Kingdom 6.5.1.1 United Kingdom Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 6.5.1.2 United Kingdom Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 6.5.1.3 United Kingdom Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 6.5.1.4 United Kingdom Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 6.5.2 France 6.5.2.1 France Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 6.5.2.2 France Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 6.5.2.3 France Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 6.5.2.4 France Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 6.5.3 Germany 6.5.3.1 Germany Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 6.5.3.2 Germany Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 6.5.3.3 Germany Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 6.5.3.4 Germany Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 6.5.4 Italy 6.5.4.1 Italy Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 6.5.4.2 Italy Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 6.5.4.3 Italy Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 6.5.4.4 Italy Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 6.5.5 Spain 6.5.5.1 Spain Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 6.5.5.2 Spain Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 6.5.5.3 Spain Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 6.5.5.4 Spain Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 6.5.6 Sweden 6.5.6.1 Sweden Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 6.5.6.2 Sweden Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 6.5.6.3 Sweden Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 6.5.6.4 Sweden Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 6.5.7 Austria 6.5.7.1 Austria Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 6.5.7.2 Austria Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 6.5.7.3 Austria Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 6.5.7.4 Austria Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 6.5.8 Rest of Europe 6.5.8.1 Rest of Europe Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 6.5.8.2 Rest of Europe Fire Protection Systems Market Size and Forecast, By Type (2023-2030). 6.5.8.3 Rest of Europe Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 6.5.8.4 Rest of Europe Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 7. Asia Pacific Fire Protection Systems Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 7.1 Asia Pacific Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 7.2 Asia Pacific Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 7.3 Asia Pacific Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 7.4 Asia Pacific Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 7.5 Asia Pacific Fire Protection Systems Market Size and Forecast, By Country (2023-2030) 7.5.1 China 7.5.1.1 China Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 7.5.1.2 China Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 7.5.1.3 China Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 7.5.1.4 China Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 7.5.2 South Korea 7.5.2.1 S Korea Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 7.5.2.2 S Korea Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 7.5.2.3 S Korea Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 7.5.2.4 S Korea Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 7.5.3 Japan 7.5.3.1 Japan Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 7.5.3.2 Japan Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 7.5.3.3 Japan Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 7.5.3.4 Japan Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 7.5.4 India 7.5.4.1 India Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 7.5.4.2 India Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 7.5.4.3 India Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 7.5.4.4 India Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 7.5.5 Australia 7.5.5.1 Australia Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 7.5.5.2 Australia Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 7.5.5.3 Australia Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 7.5.5.4 Australia Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 7.5.6 Indonesia 7.5.6.1 Indonesia Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 7.5.6.2 Indonesia Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 7.5.6.3 Indonesia Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 7.5.6.4 Indonesia Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 7.5.7 Malaysia 7.5.7.1 Malaysia Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 7.5.7.2 Malaysia Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 7.5.7.3 Malaysia Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 7.5.7.4 Malaysia Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 7.5.8 Vietnam 7.5.8.1 Vietnam Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 7.5.8.2 Vietnam Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 7.5.8.3 Vietnam Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 7.5.8.4 Vietnam Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 7.5.9 Taiwan 7.5.9.1 Taiwan Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 7.5.9.2 Taiwan Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 7.5.9.3 Taiwan Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 7.5.9.4 Taiwan Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 7.5.10 Bangladesh 7.5.10.1 Bangladesh Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 7.5.10.2 Bangladesh Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 7.5.10.3 Bangladesh Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 7.5.10.4 Bangladesh Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 7.5.11 Pakistan 7.5.11.1 Pakistan Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 7.5.11.2 Pakistan Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 7.5.11.3 Pakistan Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 7.5.11.4 Pakistan Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 7.5.12 Rest of Asia Pacific 7.5.12.1 Rest of Asia Pacific Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 7.5.12.2 Rest of Asia Pacific Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 7.5.12.3 Rest of Asia Pacific Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 7.5.12.4 Rest of Asia Pacific Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 8. Middle East and Africa Fire Protection Systems Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 8.1 Middle East and Africa Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 8.2 Middle East and Africa Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 8.3 Middle East and Africa Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 8.4 Middle East and Africa Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 8.5 Middle East and Africa Fire Protection Systems Market Size and Forecast, By Country (2023-2030) 8.5.1 South Africa 8.5.1.1 South Africa Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 8.5.1.2 South Africa Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 8.5.1.3 South Africa Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 8.5.1.4 South Africa Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 8.5.2 GCC 8.5.2.1 GCC Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 8.5.2.2 GCC Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 8.5.2.3 GCC Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 8.5.2.4 GCC Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 8.5.3 Egypt 8.5.3.1 Egypt Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 8.5.3.2 Egypt Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 8.5.3.3 Egypt Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 8.5.3.4 Egypt Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 8.5.4 Nigeria 8.5.4.1 Nigeria Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 8.5.4.2 Nigeria Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 8.5.4.3 Nigeria Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 8.5.4.4 Nigeria Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 8.5.5 Rest of ME&A 8.5.5.1 Rest of ME&A Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 8.5.5.2 Rest of ME&A Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 8.5.5.3 Rest of ME&A Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 8.5.5.4 Rest of ME&A Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 9. South America Fire Protection Systems Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 9.1 South America Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 9.2 South America Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 9.3 South America Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 9.4 South America Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 9.5 South America Fire Protection Systems Market Size and Forecast, By Country (2023-2030) 9.5.1 Brazil 9.5.1.1 Brazil Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 9.5.1.2 Brazil Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 9.5.1.3 Brazil Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 9.5.1.4 Brazil Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 9.5.2 Argentina 9.5.2.1 Argentina Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 9.5.2.2 Argentina Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 9.5.2.3 Argentina Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 9.5.2.4 Argentina Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 9.5.3 Rest Of South America 9.5.3.1 Rest Of South America Fire Protection Systems Market Size and Forecast, By Service (2023-2030) 9.5.3.2 Rest Of South America Fire Protection Systems Market Size and Forecast, By Type (2023-2030) 9.5.3.3 Rest Of South America Fire Protection Systems Market Size and Forecast, By Product (2023-2030) 9.5.3.4 Rest Of South America Fire Protection Systems Market Size and Forecast, By End User (2023-2030) 10. Global Fire Protection Systems Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.3.6 SKU Details 10.3.7 Production Capacity 10.3.8 Production for 2023 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Fire Protection Systems Global Companies, By market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Consilium AB 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 DESAUTEL SAS 11.3 Eaton 11.4 Encore Fire Protection 11.5 Fike Corporation, 11.6 Fire Suppression Ltd 11.7 Gentex Corporation 11.8 Gunnebo AB 11.9 Halma plc 11.10 Hochiki Corporation 11.11 Honeywell International Inc 11.12 Johnson Controls International Plc 11.13 Minimax Viking GmbH 11.14 NAFFCO FZCO 11.15 Napco Security Technologies, Inc. 11.16 Robert Bosch GmbH 11.17 Schneider Electric, 11.18 SCHRACK SECONET AG, 11.19 Securiton AG 11.20 Siemens AG 11.21 Solas Fire Safety Equipment (P) Ltd. 11.22 Swastik Synergy Engineering Private Limited 11.23 Victaulic Co., 11.24 Viking Automatic Sprinkler Company 11.25 Yamato Protec Corporation 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary