Global Erythritol Market size was valued at USD 0.25 Billion in 2024, and the total Erythritol Market size is expected to grow at a CAGR of 7.8% from 2025 to 2032, reaching nearly USD 0.46 Billion by 2032.Global Erythritol Market Overview:

Erythritol is an organic compound that is often used as a food additive or as sugar alcohol. Erythritol is 65-70% as sweet as table sugar i.e. sucrose but its involvement in daily food intake doesn’t affect blood sugar and it doesn’t cause any teeth decay in its consumers because it is a non-caloric organic compound. Global Erythritol occurs naturally in some fruits but from an industrial standpoint, it is made from a yeast called Moniliella pollinis. The fact that this organic compound is made from yeast; as a result Erythritol market is indirectly affected by the yeast ingredients market. It is made commercially available in different varieties i.e. granular and powder to different industries like pharmaceuticals (as a flavoring agent to change the taste of medicines) and food & beverage. The Food and Drug Administration of the United States approved the use of Erythritol in Food & Beverages as a safe to consume product because of its non–caloric nature. The global erythritol market report provides extensive analysis. The market report presents an analytical idea of the global erythritol market by type, applications, major players, and key regions and countries, market share, and growth opportunities. The report also has a comprehensive analysis of the competitive scenario of the global erythritol market.To know about the Research Methodology :- Request Free Sample Report

Global Erythritol Market Dynamics:

Growing Consumer Interest in Sugar-Free and Low-Calorie Foods: The expansion of the Erythritol market is being driven largely by rising customer demand for low-calorie and sugar-free goods. As consumers become more conscious of health problems, including obesity, diabetes, and heart disease, they are looking for healthier food options. Because erythritol may add sweetness without raising blood sugar levels, it has emerged as a popular natural sweetener with no calories. Beverages, snacks, baked items, and confections all make extensive use of it. Further driving demand is the growing acceptance of keto, clean-label, and diabetic-friendly products. In response to changing consumer health preferences, manufacturers are expanding their product lines to include erythritol. Higher Manufacturing Costs than Those of Other Sweeteners: The expansion of the erythritol market is significantly hampered by its higher manufacturing costs compared to other sweeteners. Erythritol is primarily produced through fermentation processes, which require expensive raw materials, extended processing times, and sophisticated machinery. It is less competitive than artificial sweeteners like aspartame and sucralose or conventional sweeteners like sucrose due to these features, which also contribute to its comparatively high cost. Especially in markets where prices are sensitive, this cost difference may restrict its uptake. Erythritol's impact on overall production costs may also deter small and medium-sized food manufacturers from adopting it, which could hinder broader market penetration despite rising health demand. Growth of Keto and Clean-Label Products: The erythritol market has a significant opportunity due to the rising demand for clean-label and keto products. Due to its natural origin and zero-calorie content, erythritol stands out as a favored sweetener among customers seeking natural, low-carb, and sugar-free options to support weight control and metabolic health. It provides a familiar ingredient free of artificial additives, which aligns with clean-label requirements. Keto-friendly snacks, drinks, and desserts frequently contain erythritol. Erythritol is used, for instance, by companies like Lily's Sweets and Perfect Keto in their protein and chocolate bars to satisfy consumer demand for decadent yet health-conscious goods free of added sugars. Volatility of Raw Materials and the Supply Chain: A significant challenge in the erythritol market is the fluctuation of both the supply chain and raw materials. Erythritol is primarily produced through fermentation using inputs such as glucose from wheat or corn, which can fluctuate in price due to trade regulations, crop yields, and climate change. Geopolitical conflicts, port delays, and disruptions in global logistics further impact consistent raw material availability and prompt product delivery. For manufacturers, these difficulties result in lower profit margins and higher production costs. For instance, firms such as Cargill and Jungbunzlauer may have increased input costs during times of disruption in the corn supply, which could impact market price and supply stability.Global Erythritol Market Segment Analysis:

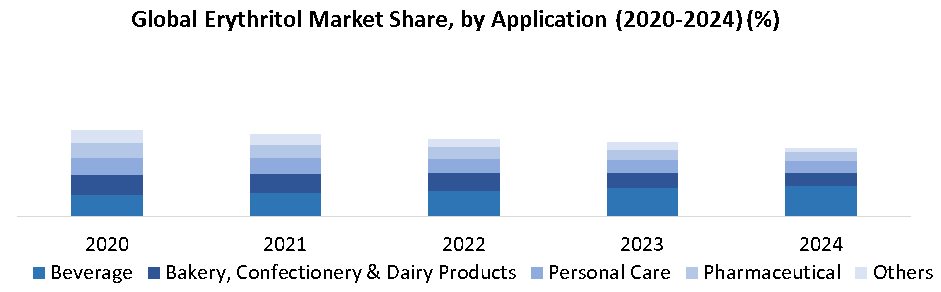

Based on the Form, the Powder segment dominates the Erythritol market. Due to its fine texture, quick solubility, and versatility in food, beverages, and medications, erythritol powder is gaining increasing popularity worldwide. Due to its consistency in sweetness and ease of blending, powdered erythritol is particularly popular in sugar-free beverages, tabletop sweeteners, and low-calorie baked goods. As evidence of its dominance, powdered erythritol held a market share of more than 56% in 2024. Companies such as NOW Foods and Lakanto, for instance, include powdered erythritol in their sweetener blends and keto baking mixes. The powdered form is anticipated to grow steadily due to the rise of products suitable for diabetics and keto diets, as well as the increasing consumer preference for healthier choices. Based on the Application, the beverage category dominated the erythritol market. The growing demand for sugar-free, low-calorie, and diabetic-friendly beverages is driving the growth of the erythritol market in the beverage segment. Due to its natural origin, low-calorie content, and pure sweet flavor, erythritol is ideal for use in energy drinks, flavored waters, soft drinks, and ready-to-drink teas. Beverages accounted for a significant proportion of erythritol consumption in the food and beverage industry in 2024, and this percentage is expected to increase further due to consumer preferences for healthier options. For instance, erythritol is a component of the sweetening blend used in PepsiCo's "Bubly Bounce" and Coca-Cola's Vitaminwater Zero.

Global Erythritol Market Regional Insights:

North America dominated the Erythritol Market in 2024. Growing customer preference for sugar-free and low-calorie options is contributing to the steady expansion of the erythritol market in North America. Erythritol is now the preferred sweetener in various food and beverage applications due to growing health consciousness, particularly in relation to diabetes, obesity, and metabolic health. Erythritol is a popular choice among health-conscious individuals due to consumers' increasing demand for natural, clean-label, and keto-friendly sweeteners. Strong demand from food companies, beverage producers, and the personal care sector further supports the market. In response to changing dietary preferences, leading brands in North America continue to be a major center for innovation in natural sweeteners, adding erythritol into energy drinks, sugar-free gums, and health goods. The European market for erythritol experienced significant demand in 2024, driven by the region's growing interest in clean-label, low-sugar products. Encouraged by the European Food Safety Authority's reaffirmation of erythritol's safety, producers are increasingly using erythritol in products such as sugar-free drinks, nutritional bars, and confections. Brands are using erythritol-stevia blends to enhance sweetness profiles, while domestic manufacturers are investing in fermentation modifications to increase purity. Early adoption is being supported by key markets such as Germany, the UK, and France. Erythritol uptake is supported by Germany's concentration on health-conscious consumers and sugar tariffs, while Italy's artisanal food industry uses it in healthier traditional desserts. All factors considered, Europe is at the forefront of innovation in erythritol use and sustainability. Due to growing health consciousness and rising disposable incomes in countries like China, India, Japan, and Southeast Asia, the Asia Pacific erythritol market experienced significant growth in 2024. As consumers continue to gravitate toward sugar-free and clean-label goods, demand for beverages, baked goods, confections, and dietary supplements is increasing. Regional businesses are expanding their fermentation capacity in an effort to lower costs and improve product quality. Erythritol has become a popular sweetener due to its compatibility with keto and diabetic diets, regulatory acceptance, and its tendency in food reformulation. The Asia Pacific region, in addition to North America and Europe, is currently a major growth hub essential to the global expansion of the erythritol market.Global Erythritol Market: Recent Developments

In November 2024, Ingredion announced two significant investments in India to strengthen its position in high-value pharmaceutical applications. A controlling stake in Mannitab Pharma Specialities was acquired by Ingredion in the fourth quarter of 2022, following its purchase of Amishi Drugs & Chemicals in the third quarter. These expenditures enhanced Ingredion's specialty pharmaceutical portfolio, which now includes mannitol, super disintegrants, lubricants, and erythritol, to serve the rapidly expanding Indian pharmaceutical industry better. In January 2024, Holiferm Limited and Sasol Chemicals expanded their partnership to manufacture and sell sustainable surfactants, including mannosyl erythritol lipids (MELs) and rhamnolipids. Their agreement in March 2022 to create sophorolipids using Holiferm's fermentation technology, which aims to lower carbon footprints in surfactant synthesis, served as the foundation for this collaboration. The companies aimed to commercialize these biosurfactants in various industries, including cleaning and personal care products. In November 2022, Tate & Lyle PLC introduced ERYTESSETM Erythritol to its range of sweeteners. With this addition, Tate & Lyle's position as a world leader in ingredient solutions that promote healthier food and beverages is strengthened, and the firm is better equipped to help customers meet consumer demand for lower-calorie, lower-sugar, and healthier products. In November 2022, Zhejiang Huakang Pharmaceutical Co., Ltd. (Huakang Pharma) announced that it was considering relocating a portion of its erythritol manufacturing capacity due to market conditions and that key clients were evaluating its erythritol products. The business also highlighted its emphasis on product creation, technology, and overcoming obstacles in the sector. In the face of technological and legal obstacles in the functional sugar alcohol sector, Huakang Pharma persisted in investigating novel products and technologies, including crystalline fructose and allulose.Erythritol Market Scope: Inquiry Before Buying

Erythritol Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 0.25 Bn. Forecast Period 2025 to 2032 CAGR: 6.5 % Market Size in 2032: USD 0.46 Bn. Segments Covered: by Form Powder Granular by Application Beverage Bakery, Confectionery & Dairy Products Personal Care Pharmaceutical Others Global Erythritol Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest)Global Erythritol Market Key Players

1. Jungbunzlauer Suisse AG 2. Ingredion Inc. 3. Cargill Incorporated 4. Archer Daniels Midland (ADM) 5. Shandong Sanyuan Biotechnology Co., Ltd. 6. Dongxiao Biotechnology 7. Mitsubishi Chemical Corporation 8. Mitushi Bio Pharma 9. Shandong Fuyang Bio-Tech. Co. Ltd. 10. Futaste Pharmaceutical Co., Ltd. 11. Zibo Zhongshi Green Biotech Co., Ltd. 12. AdvanceIn Organics LLP 13. Jebsen & Jessen Life Science GmbH 14. Sinofi Ingredients 15. AVANSCHEM 16. AMS NOSHCRAFT PVT. LTD. 17. Rajvi Enterprise (Erythritol) 18. Radiant International (Erythritol) 19. Kailash Chemicals (Erythritol) 20. RAS Greeen Sweetners 21. Other Key PlayersFAQs:

1. What are the growth drivers for the Erythritol Market? Ans. The growing consumer health consciousness and the increasing demand for low-calorie and sugar-free food items are driving the erythritol market. 2. What are the major opportunities for growth in the Erythritol Market? Ans. The rise of plant-based and natural food ingredient trends, along with the growing popularity of low-carb and ketogenic diets, presents significant opportunities for the erythritol industry. 3. Which region is expected to lead the Global Erythritol Market during the forecast period? Ans. North America is expected to lead the Erythritol Market during the forecast period. 4. What is the projected market size and growth rate of the Erythritol Market? Ans. The Erythritol Market size was valued at USD 0.25 Billion in 2024, and the total market revenue is expected to grow at a CAGR of 7.8% from 2025 to 2032, reaching nearly USD 0.46 Billion in 2032. 5. What segments are covered in the Erythritol Market report? Ans. The Erythritol Market report covers segments in three key areas: Form, Application, and Region.

1. Erythritol Market: Executive Summary 1.1 Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032), 1.1.2. Market Size (Value and Volume) - By Segments, Regions, and Country 2. Erythritol Market: Competitive Landscape 2.1 MMR Competition Matrix 2.2 Competitive Positioning of Key Players 2.3 Key Players Benchmarking 2.3.1 Company Name 2.3.2 Business Portfolio 2.3.3 End-User Segment 2.3.4 Revenue (2024) 2.3.5 Profit Margin (%) 2.3.6 Approach in Process 2.3.7 Dominant Revenue Location 2.3.8 Market Share (%) (2024) 2.3.9 Geographical Presence 2.4 Market Structure 2.4.1 Market Leaders 2.4.2 Market Followers 2.4.3 Emerging Players 2.5 Mergers and Acquisitions Details 3 Erythritol Market: Market Dynamics 3.1 Erythritol Market Trends 3.2 Erythritol Market Dynamics 3.2.1 Drivers 3.2.2 Restraints 3.2.3 Opportunities 3.2.4 Challenges 3.3 PORTER’s Five Forces Analysis 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.7 Key Opinion Leader Analysis for the Industry 3.8 Analysis of Government Schemes and Initiatives for the Industry 4 Erythritol Market: Supply Chain Analysis 4.1 Raw Material Sourcing 4.2 Fermentation Process 4.3 Purification & Crystallization 4.4 Manufacturing & Packaging 4.5 Distribution & Logistics 4.6 End Use Industries 4.7 Supply Chain Challenges 5 Erythritol Market: Import and Export Analysis 5.1 Importing Countries of Erythritol 5.2 Exporting Countries of Erythritol 5.3 US Tariff Potential Impact on Major Exporting and Importing Countries of Erythritol 6 Erythritol Market: Global Market Size and Forecast By Segmentation (by Value in USD Billion and Volume in Tonnes) (2024-2032) 6.1 Erythritol Market Size and Forecast, By Form (2024-2032) 6.1.1 Powder 6.1.2 Granular 6.2 Erythritol Market Size and Forecast, By Application (2024-2032) 6.2.1 Beverage 6.2.2 Bakery, Confectionery & Dairy Products 6.2.3 Personal Care 6.2.4 Pharmaceutical 6.2.5 Others 6.3 Erythritol Market Size and Forecast, By Region (2024-2032) 6.3.1 North America 6.3.2 Europe 6.3.3 Asia Pacific 6.3.4 South America 6.3.5 MEA 7 North America Erythritol Market Size and Forecast By Segmentation (by Value in USD Billion and Volume in Tonnes) (2024-2032) 7.1 North America Erythritol Market Size and Forecast, By Form (2024-2032) 7.1.1 Powder 7.1.2 Granular 7.2 North America Erythritol Market Size and Forecast, By Application (2024-2032) 7.2.1 Beverage 7.2.2 Bakery, Confectionery & Dairy Products 7.2.3 Personal Care 7.2.4 Pharmaceutical 7.2.5 Others 7.3 North America Erythritol Market Size and Forecast, By Country (2024-2032) 7.3.1 United States 7.3.1.1 United States Erythritol Market Size and Forecast, By Form (2024-2032) 7.3.1.1.1 Powder 7.3.1.1.2 Granular 7.3.1.2 United States Erythritol Market Size and Forecast, By Application (2024-2032) 7.3.1.2.1 Beverage 7.3.1.2.2 Bakery, Confectionery & Dairy Products 7.3.1.2.3 Personal Care 7.3.1.2.4 Pharmaceutical 7.3.1.2.5 Others 7.3.2 Canada 7.3.3 Mexico 8 Europe Erythritol Market Size and Forecast By Segmentation (by Value in USD Billion and Volume in Tonnes) (2024-2032) 8.1 Europe Erythritol Market Size and Forecast, By Form (2024-2032) 8.2 Europe Erythritol Market Size and Forecast, By Application (2024-2032) 8.3 Europe Erythritol Market Size and Forecast, By Country (2024-2032) 8.3.1 United Kingdom 8.3.2 France 8.3.3 Germany 8.3.4 Italy 8.3.5 Spain 8.3.6 Sweden 8.3.7 Austria 8.3.8 Rest of Europe 9 Asia Pacific Erythritol Market Size and Forecast By Segmentation (by Value in USD Billion and Volume in Tonnes) (2024-2032) 9.1 Asia Pacific Erythritol Market Size and Forecast, By Form (2024-2032) 9.2 Asia Pacific Erythritol Market Size and Forecast, By Application (2024-2032) 9.3 Asia Pacific Erythritol Market Size and Forecast, By Country (2024-2032) 9.3.1 China 9.3.2 S Korea 9.3.3 Japan 9.3.4 India 9.3.5 Australia 9.3.6 Malaysia 9.3.7 Vietnam 9.3.8 Thailand 9.3.9 Indonesia 9.3.10 Philippines 9.3.11 Rest of Asia Pacific 10 South America Erythritol Market Size and Forecast By Segmentation (by Value in USD Billion and Volume in Tonnes) (2024-2032) 10.1 South America Erythritol Market Size and Forecast, By Form (2024-2032) 10.2 South America Erythritol Market Size and Forecast, By Application (2024-2032) 10.3 South America Erythritol Market Size and Forecast, By Country (2024-2032) 10.3.1 Brazil 10.3.2 Argentina 10.3.3 Colombia 10.3.4 Chile 10.3.5 Peru 10.3.6 Rest of South America 11 Middle East and Africa Erythritol Market Size and Forecast By Segmentation (by Value in USD Billion and Volume in Tonnes) (2024-2032) 11.1 Middle East and Africa Erythritol Market Size and Forecast, By Form (2024-2032) 11.2 Middle East and Africa Erythritol Market Size and Forecast, By Application (2024-2032) 11.3 Middle East and Africa Erythritol Market Size and Forecast, By Country (2024-2032) 11.3.1 South Africa 11.3.2 GCC 11.3.3 Nigeria 11.3.4 Egypt 11.3.5 Turkey 11.3.6 Rest Of MEA 12 Company Profile: Key Players 12.1 Jungbunzlauer Suisse AG 12.1.1 Company Overview 12.1.2 Business Portfolio 12.1.3 Financial Overview 12.1.4 SWOT Analysis 12.1.5 Strategic Analysis 12.1.6 Recent Developments 12.2 Ingredion Inc. 12.3 Cargill Incorporated 12.4 Archer Daniels Midland (ADM) 12.5 Shandong Sanyuan Biotechnology Co., Ltd. 12.6 Dongxiao Biotechnology 12.7 Mitsubishi Chemical Corporation 12.8 Mitushi Bio Pharma 12.9 Shandong Fuyang Bio-Tech. Co. Ltd. 12.10 Futaste Pharmaceutical Co., Ltd. 12.11 Zibo Zhongshi Green Biotech Co., Ltd. 12.12 AdvanceIn Organics LLP 12.13 Jebsen & Jessen Life Science GmbH 12.14 Sinofi Ingredients 12.15 AVANSCHEM 12.16 AMS NOSHCRAFT PVT. LTD. 12.17 Rajvi Enterprise (Erythritol) 12.18 Radiant International (Erythritol) 12.19 Kailash Chemicals (Erythritol) 12.20 RAS Greeen Sweetners 12.21 Other Key Players 13 Key Findings 14 Analyst Recommendations 15 Erythritol Market – Research Methodology