Electronic Warfare Industry Market size was valued at USD 19.3 Billion in 2023 and the Electronic Warfare Industry Market revenue is expected to reach USD 25.81 Billion by 2030, at a CAGR of 4.6 % over the forecast period.Electronic Warfare Industry Market Overview

Any activity involving the use of the electromagnetic spectrum (EM spectrum) or directed energy to control the spectrum, attack an adversary, or obstruct hostile attacks is known as electronic warfare (EW). The goal of electronic warfare is to deny the enemy an advantage over the EM spectrum while ensuring unrestricted access for friendly forces. Manned and unmanned systems can use EW to target radar, communication, and other assets from the air, sea, land, and/or space (military and civilian).To know about the Research Methodology:- Request Free Sample Report Electronic Warfare Industries are not limited to a specific geographical region. The market has a global presence, with consumers across different continents showing interest in these supplements. This Electronic Warfare Industry Market Report offers a specific and detailed market overview with statistical as well as pre-sized trendy data. This Electronic Warfare Industry Market report showcases the Electronic Warfare Industry market situation with Dynamics, Market Segments, Regional Analysis, and Top competitor's Market Position.

Electronic Warfare Industry Market Dynamics

Surging regional and transnational imbalance leading to rising adoption of EW: The frequency of bilateral military confrontations between countries is increasing at a rapid rate, necessitating a greater requirement for countries' defense forces to beef up their security measures. To meet the demands of battle, new weaponry, and fighting systems are being developed in the Electronic Warfare Industry Market. Electronic warfare technology has been included in all defense systems utilized during combat missions because of the development of digital battlefields. As a result of these systems, governments' procurement priorities have shifted to keep up with emerging wartime needs. For example, since 2014, political instability and terrorism in Iraq and Syria in the Middle East have resulted in military confrontations, with numerous terrorist organizations increasingly employing high-tech weapon systems. To protect their borders from these weapons, countries in this region are expanding their defense spending to incorporate modern electronic warfare systems in the electronic warfare industry market. The United Arab Emirates (UAE), Saudi Arabia, and Qatar are among the countries in the area that have increased their investment in radar and air defense systems. Saudi Arabia, for example, intends to purchase Russian S-400 air defense systems in the future. Several incursions into India by China and Pakistan occurred in 2018-2019, culminating in a confrontation between the two countries. Turkish government officials announced the purchase of Russian S-400 air defense systems in October 2019. Rising tensions in the South China Sea between China and its neighbors, including Indonesia, Vietnam, Taiwan, Malaysia, and the Philippines, have prompted these countries to raise their defense budgets. Because of the tensions between Russia and NATO (North Atlantic Treaty Organization), nations like Poland, Romania, and Ukraine have increased their spending on air defense systems. Also, Russia intends to upgrade and improve its military and electronic warfare capabilities. Thus, the electronic warfare industry market is driven by ambitions to modernize defensive capabilities. Increasing adoption of advanced electronic and associated equipment The significant driver propelling the growth of the global electronic warfare industry market is the increasing adoption of advanced electronic and associated equipment, as well as weapon systems. The widespread use of these technologies has created a demand for electronic warfare systems that can detect and counter potential threats effectively. As a result, defense organizations and military forces are investing in electronic warfare capabilities to ensure enhanced situational awareness and protection against evolving electromagnetic threats. High cost of adoption: Electronic warfare is becoming more important in tactical and strategic roles in modern conflict, necessitating the development of innovative, effective, and economical electronic warfare systems in the electronic warfare industry market. Electromagnetic radiations are used in these systems to ensure secure data transmission. Electronic warfare systems can perform a variety of tasks, including electronic attacks, electronic defense, and electronic support. These systems must fulfill a variety of critical duties in a variety of threat scenarios. They must use SIGINT techniques to identify all emitters in a target area, ascertain their physical locations or mobility ranges, describe their signals, and determine the enemy's conflict strategy in the electronic warfare industry market. Because of the complexity of electronic warfare systems, achieving the performance levels needed for next-generation electronic warfare systems becomes a hard undertaking. To function in high-magnitude signal settings, these systems require complicated architectures. Modifying and programming electronic warfare systems is one of the most difficult tasks encountered by manufacturers. To function in a congested EM environment, advanced EW technologies are necessary, and a cost-effective open system approach may help in achieving difficult design goals. Because of the high cost of R&D, the electronic warfare industry market is expected to be cost-dependent, which poses a challenge for manufacturers. Potential impact of defense budget cuts A significant restraint challenging the growth of the global electronic warfare industry market is the potential impact of defense budget cuts in key regions such as the United States and Europe. Reductions in defense spending can limit the resources available for the development and procurement of advanced electronic warfare systems. Additionally, economic concerns in developing regions is expected to hinder their ability to allocate significant funds toward upgrading their military capabilities. These factors is expected to pose challenges to market growth and the adoption of advanced electronic warfare technologies. Increasing integration of cyber electronic warfare capabilities As modern conflicts extend into the digital domain, the synergy between cyber and electronic warfare has become critical for military operations and national security. This convergence offers several compelling opportunities. Firstly, it enables more comprehensive and adaptive responses to threats. By combining cyber and electronic warfare capabilities, military forces can disrupt enemy communications, deceive their sensor networks, and simultaneously launch cyberattacks, creating a multifaceted assault that overwhelms adversaries. Also, digitalization of critical infrastructure continues, and the need to protect it from cyber threats becomes paramount. This opens a significant electronic warfare industry market designed to safeguard essential sectors such as power grids, telecommunications, and transportation networks. Moreover, the integration of these capabilities fosters cross-disciplinary collaboration between electronic warfare and cyber security experts. This knowledge exchange drives innovation, leading to the development of cutting-edge technologies and tactics that can counter emerging threats effectively in the electronic warfare industry market. Cyber and electronic warfare also accelerates the adoption of artificial intelligence and machine learning in these fields. These technologies improve real-time data analysis, enabling for quicker and more precise decision-making in complex electronic and cyber environments. Thus, the integration of cyber and electronic warfare capabilities not only enhances military capabilities but also unlocks a wealth of opportunities within the electronic warfare industry market.

Electronic Warfare Industry Market Segment Analysis:

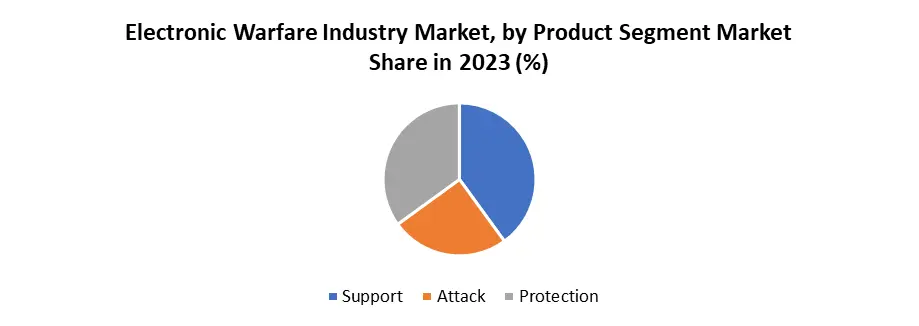

Based on Capability, the electronic warfare industry market is segmented as, protection, attack, and support. In 2022, the electronic support segment dominated the market. During the forecast period, the electronic support segment is expected to grow at the fastest rate. Intelligence, surveillance, and reconnaissance (ISR) has increased militaries' situational awareness and, as a result, their decision-making process. During the forecast period, the defense sector's growing focus on situational awareness capabilities is likely to promote the growth of the electronic warfare support industry. Based on Product, the electronic warfare industry market is segmented as, equipment, and operational support. The equipment segment is expected to account for the majority of market share during the forecast period, owing to the increasing procurement of electronic warfare equipment for the up-gradation of various platforms such as naval vessels, land vehicles, and aircraft thanks to benefits such as advance electronic protection, electronic attack, and electronic support applications. By platform, the market can be segmented into airborne, and ground-based. The airborne segment dominated the electronic warfare industry market, driven by the increasing deployment of electronic warfare systems on airborne platforms such as fighter jets, unmanned aerial vehicles (UAVs), and surveillance aircraft. Airborne systems offer several advantages, including wide-area coverage, increased mobility, and rapid response capabilities, making them an essential tool for modern warfare. The dominance of the airborne segment is expected to continue due to the growing importance of airborne electronic warfare in future military operations. The land sub-segment is experiencing steady growth, driven by the increasing demand for land electronic warfare capabilities. As adversaries develop sophisticated electronic systems, there is a growing need for advanced land electronic warfare systems capable of countering these threats. The integration of advanced technologies, including artificial intelligence, machine learning, and adaptive algorithms, has led to the development of more capable and efficient ground-based electronic warfare systems, contributing to their steady growth in the market.

Electronic Warfare Industry Market Regional Analysis

North America dominated the electronic warfare industry market, driven by the presence of established defense industries, technological advancements, and high defense spending. The region is home to major players in the market, including leading defense contractors and manufacturers. The United States, in particular, plays a crucial role in shaping the electronic warfare industry market dynamics due to its robust defense capabilities and significant investments in electronic warfare systems. The country's military modernization programs and focus on maintaining technological superiority contribute to the dominance of North America in the market. The APAC region is witnessing rapid growth in the electronic warfare industry market. Factors such as increasing defense budgets, geopolitical tensions, and territorial disputes drive the demand for advanced electronic warfare systems. Countries like China, India, and Japan are investing heavily in upgrading their military capabilities, including electronic warfare, to ensure regional security and maintain a competitive edge. The growing military modernization efforts in APAC, coupled with advancements in electronic technologies and the rising adoption of unmanned systems, contribute to the region's status as the fastest-growing electronic warfare industry market. Trending EW areas of research and development: 1. Radiation detection and sorting in a dense signal environment. 2. Stand-off jamming for wide-area penetration of enemy radar with minimum risk to the attacking force. 3. Extension of EW spectrum coverage to the millimeter and optical wavelengths. 4. Decoys 5. Airborne early warning and illumination warning. 6. Obscuration aids 7. Radar and infra-red cross-section reduction. 8. High-speed signal processing. 9. Microwave phased arrays 10. Artificial Intelligence 11. Simulation 12. EW Integration Global Electronic Warfare Market Recent Developments 1. In April 2023, Leonardo announced the launch of its new electronic warfare suite, the EWS-50. 2. In March 2023, L3Harris Technologies announced a $1.5 billion contract from the U.S. Air Force to provide electronic warfare systems for the F-35 fighter jet. 3. In February 2023, Raytheon Technologies announced the launch of its new electronic warfare system, the Next Generation Jammer-Low Band (NGJ-LB). 4. In January 2023, Harris Corporation announced the acquisition of Verint Systems, a leading provider of advanced intelligence and surveillance technologies. 5. In July 2022, Cobham Advanced Electronic Solutions announced the acquisition of D-TA Systems, a leading provider of electronic warfare and spectrum dominance solutions.Electronic Warfare Industry Market Scope:Inquire before buying

Global Electronic Warfare Industry Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $19.3 Bn. Forecast Period 2024 to 2030 CAGR: 4.6% Market Size in 2030: US $25.81 Bn. Segments Covered: by Capability Support Attack Protection by Product Equipment Jammers Self-Protection EW Suite Directed Energy Weapons Anti-radiation Missiles Antennas Direction Finders Others Operational Support Software Simulation by Platform Land Naval Airborne Space Electronic Warfare Industry Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Electronic Warfare Industry Key Players Includes

1. BAE Systems Plc (UK) 2. Lockheed Martin Corporation (US) 3. Raytheon Company (US) 4. Northrop Grumman Corporation (US) 5. Thales Group (France) 6. Saab AB (Sweden) 7. L3Harris Technologies, Inc. (US) 8. Leonardo S.p.A. (Italy) 9. Harris Corporation (US) 10. Elbit Systems Ltd. (Israel) 11. Israel Aerospace Industries Ltd. (Israel) 12. Rheinmetall AG (Germany) 13. Cobham plc (UK) 14. FLIR Systems, Inc. (US) 15. Teledyne Technologies Incorporated (US) 16. Kratos Defense & Security Solutions, Inc. (US) 17. Mercury Systems, Inc. (US) 18. Airbus Defense and Space (France) 19. General Dynamics Corporation (US) 20. Electronic Warfare Associates, Inc. (US) Frequently Asked Questions in the Electronic Warfare Industry Market: 1 What is the forecast period considered for the Electronic Warfare Industry market report? Ans: The forecast period for the global electronic warfare industry market is 2023-2030. 2. Which key factors are expected to hinder the growth of the Electronic Warfare Industry market? Ans: The rising deployment of electronic warfare technology in unmanned system is the key factor expected to hinder market growth during the forecast period. 3. What is the compound annual growth rate (CAGR) of the Electronic Warfare Industry market? Ans: The global electronic warfare industry market is expected to grow at a CAGR of 4.6% during the forecast period (2023-2030). 4. What are the key factors driving the growth of the Electronic Warfare Industry market? Ans: The surging regional and transnational imbalance leading to the rising adoption of EW is the key factor expected to drive the growth of the market during the forecast period. 5. Which are the worldwide major key players covered in the Electronic Warfare Industry market report? Ans: BAE Systems Plc, Northrop Grumman Corporation, Raytheon Technologies Corporation, Lockheed Martin Corporation, Thales Group, L3 Harris Technologies Inc., Israel Aerospace Industries, SAAB AB, Rockwell Collins, Alliant Techsystems Inc., Boeing, Cobham Plc., Leonardo SPA, Teledyne Technologies, Elbit Systems, Exelis Inc., and Others.

1. Electronic Warfare Industry Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Electronic Warfare Industry Market: Dynamics 2.1. Electronic Warfare Industry Market Trends by Region 2.1.1. North America Electronic Warfare Industry Market Trends 2.1.2. Europe Electronic Warfare Industry Market Trends 2.1.3. Asia Pacific Electronic Warfare Industry Market Trends 2.1.4. Middle East and Africa Electronic Warfare Industry Market Trends 2.1.5. South America Electronic Warfare Industry Market Trends 2.2. Electronic Warfare Industry Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Electronic Warfare Industry Market Drivers 2.2.1.2. North America Electronic Warfare Industry Market Restraints 2.2.1.3. North America Electronic Warfare Industry Market Opportunities 2.2.1.4. North America Electronic Warfare Industry Market Challenges 2.2.2. Europe 2.2.2.1. Europe Electronic Warfare Industry Market Drivers 2.2.2.2. Europe Electronic Warfare Industry Market Restraints 2.2.2.3. Europe Electronic Warfare Industry Market Opportunities 2.2.2.4. Europe Electronic Warfare Industry Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Electronic Warfare Industry Market Drivers 2.2.3.2. Asia Pacific Electronic Warfare Industry Market Restraints 2.2.3.3. Asia Pacific Electronic Warfare Industry Market Opportunities 2.2.3.4. Asia Pacific Electronic Warfare Industry Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Electronic Warfare Industry Market Drivers 2.2.4.2. Middle East and Africa Electronic Warfare Industry Market Restraints 2.2.4.3. Middle East and Africa Electronic Warfare Industry Market Opportunities 2.2.4.4. Middle East and Africa Electronic Warfare Industry Market Challenges 2.2.5. South America 2.2.5.1. South America Electronic Warfare Industry Market Drivers 2.2.5.2. South America Electronic Warfare Industry Market Restraints 2.2.5.3. South America Electronic Warfare Industry Market Opportunities 2.2.5.4. South America Electronic Warfare Industry Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Electronic Warfare Industry Industry 2.8. Analysis of Government Schemes and Initiatives For Electronic Warfare Industry Industry 2.9. Electronic Warfare Industry Market Trade Analysis 2.10. The Global Pandemic Impact on Electronic Warfare Industry Market 3. Electronic Warfare Industry Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 3.1.1. Support 3.1.2. Attack 3.1.3. Protection 3.2. Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 3.2.1. Equipment 3.2.2. Operational Support 3.3. Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 3.3.1. Land 3.3.2. Naval 3.3.3. Airborne 3.3.4. Space 3.4. Electronic Warfare Industry Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Electronic Warfare Industry Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 4.1.1. Support 4.1.2. Attack 4.1.3. Protection 4.2. North America Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 4.2.1. Equipment 4.2.2. Operational Support 4.3. North America Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 4.3.1. Land 4.3.2. Naval 4.3.3. Airborne 4.3.4. Space 4.4. North America Electronic Warfare Industry Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 4.4.1.1.1. Support 4.4.1.1.2. Attack 4.4.1.1.3. Protection 4.4.1.2. United States Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 4.4.1.2.1. Equipment 4.4.1.2.2. Operational Support 4.4.1.3. United States Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 4.4.1.3.1. Land 4.4.1.3.2. Naval 4.4.1.3.3. Airborne 4.4.1.3.4. Space 4.4.2. Canada 4.4.2.1. Canada Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 4.4.2.1.1. Support 4.4.2.1.2. Attack 4.4.2.1.3. Protection 4.4.2.2. Canada Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 4.4.2.2.1. Equipment 4.4.2.2.2. Operational Support 4.4.2.3. Canada Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 4.4.2.3.1. Land 4.4.2.3.2. Naval 4.4.2.3.3. Airborne 4.4.2.3.4. Space 4.4.3. Mexico 4.4.3.1. Mexico Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 4.4.3.1.1. Support 4.4.3.1.2. Attack 4.4.3.1.3. Protection 4.4.3.2. Mexico Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 4.4.3.2.1. Equipment 4.4.3.2.2. Operational Support 4.4.3.3. Mexico Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 4.4.3.3.1. Land 4.4.3.3.2. Naval 4.4.3.3.3. Airborne 4.4.3.3.4. Space 5. Europe Electronic Warfare Industry Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 5.2. Europe Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 5.3. Europe Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 5.4. Europe Electronic Warfare Industry Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 5.4.1.2. United Kingdom Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 5.4.1.3. United Kingdom Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 5.4.2. France 5.4.2.1. France Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 5.4.2.2. France Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 5.4.2.3. France Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 5.4.3.2. Germany Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 5.4.3.3. Germany Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 5.4.4.2. Italy Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 5.4.4.3. Italy Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 5.4.5.2. Spain Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 5.4.5.3. Spain Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 5.4.6.2. Sweden Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 5.4.6.3. Sweden Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 5.4.7.2. Austria Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 5.4.7.3. Austria Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 5.4.8.2. Rest of Europe Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 5.4.8.3. Rest of Europe Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 6. Asia Pacific Electronic Warfare Industry Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 6.2. Asia Pacific Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 6.3. Asia Pacific Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 6.4. Asia Pacific Electronic Warfare Industry Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 6.4.1.2. China Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 6.4.1.3. China Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 6.4.2.2. S Korea Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 6.4.2.3. S Korea Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 6.4.3.2. Japan Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 6.4.3.3. Japan Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 6.4.4. India 6.4.4.1. India Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 6.4.4.2. India Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 6.4.4.3. India Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 6.4.5.2. Australia Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 6.4.5.3. Australia Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 6.4.6.2. Indonesia Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 6.4.6.3. Indonesia Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 6.4.7.2. Malaysia Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 6.4.7.3. Malaysia Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 6.4.8.2. Vietnam Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 6.4.8.3. Vietnam Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 6.4.9.2. Taiwan Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 6.4.9.3. Taiwan Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 6.4.10.2. Rest of Asia Pacific Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 6.4.10.3. Rest of Asia Pacific Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 7. Middle East and Africa Electronic Warfare Industry Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 7.2. Middle East and Africa Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 7.3. Middle East and Africa Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 7.4. Middle East and Africa Electronic Warfare Industry Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 7.4.1.2. South Africa Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 7.4.1.3. South Africa Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 7.4.2.2. GCC Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 7.4.2.3. GCC Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 7.4.3.2. Nigeria Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 7.4.3.3. Nigeria Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 7.4.4.2. Rest of ME&A Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 7.4.4.3. Rest of ME&A Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 8. South America Electronic Warfare Industry Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 8.2. South America Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 8.3. South America Electronic Warfare Industry Market Size and Forecast, by Platform(2023-2030) 8.4. South America Electronic Warfare Industry Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 8.4.1.2. Brazil Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 8.4.1.3. Brazil Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 8.4.2.2. Argentina Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 8.4.2.3. Argentina Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Electronic Warfare Industry Market Size and Forecast, by Capabilities (2023-2030) 8.4.3.2. Rest Of South America Electronic Warfare Industry Market Size and Forecast, by Product (2023-2030) 8.4.3.3. Rest Of South America Electronic Warfare Industry Market Size and Forecast, by Platform (2023-2030) 9. Global Electronic Warfare Industry Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Electronic Warfare Industry Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. BAE Systems (UK) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Lockheed Martin Corporation (US) 10.3. Raytheon Company (US) 10.4. Northrop Grumman Corporation (US) 10.5. Thales Group (France) 10.6. Saab AB (Sweden) 10.7. L3Harris Technologies, Inc. (US) 10.8. Leonardo S.p.A. (Italy) 10.9. Harris Corporation (US) 10.10. Elbit Systems Ltd. (Israel) 10.11. Israel Aerospace Industries Ltd. (Israel) 10.12. Rheinmetall AG (Germany) 10.13. Cobham plc (UK) 10.14. FLIR Systems, Inc. (US) 10.15. Teledyne Technologies Incorporated (US) 10.16. Kratos Defense & Security Solutions, Inc. (US) 10.17. Mercury Systems, Inc. (US) 10.18. Airbus Defense and Space (France) 10.19. General Dynamics Corporation (US) 10.20. Electronic Warfare Associates, Inc. (US) 11. Key Findings 12. Industry Recommendations 13. Electronic Warfare Industry Market: Research Methodology 14. Terms and Glossary