Electric Vehicle Supply Equipment Market size was valued at US$ 4.04 Bn. in 2022 and the total revenue is expected to grow at 26.3% of CAGR through 2023 to 2029, reaching nearly US$ 20.72 Bn.Electric Vehicle Supply Equipment Market Overview:

The Electric vehicle supply equipment is also called as EVSEs and it is used to supply electric energy to recharge electric vehicles in various residential and commercial locations. The growth of public and private sector initiatives to encourage the use of electric vehicles is beneficial to electric vehicle supply equipment market growth. The increase in demand for electric car supply equipment is being driven by the government’s regulations which have started to provide financial incentives, such as subsidies and tax breaks, to encourage people to purchase electric vehicles. The companies are offering lower tariffs for the electricity used by EVSE, which is propelling the market in countries such as the United States and China, which are the greatest manufacturers of electric energy. Additionally, there have been more government activities in recent years, including as attracting investment for the construction of charging infrastructure globally. the Additionally, the need for electric vehicle supply equipment is rising as private companies like The Coca-Cola Company and General Motors Company place a greater emphasis on creating charging stations for the automobiles of their employees. Additionally, in order to meet the need for electric vehicle supply equipment, energy providers like Pacific Gas and Electric Company (PG&E) and San Diego Gas & Electric Company are collaborating with EVSE players to meet the demand for charging infrastructure.To know about the Research Methodology :- Request Free Sample Report

Electric Vehicle Supply Equipment Market Dynamics:

Government support for EV ecosystem Electric vehicle charging infrastructure is critical to the mass adoption of electric vehicles, which results in growing support from governments around the world. Governments from various countries have also recognized the need to go electric in order to reduce pollution from automobiles, and several initiatives have been launched to provide EV charging stations around the world. For example, the Automotive Research Association of India (ARAI) planned to install more than 200 electric vehicle charging stations across the country. Furthermore, tata power (tata group India), an Indian electric utility company, supports the Indian government's national electric mobility mission. Tata Power established the first set of electric vehicles charging stations in Mumbai for the indies' growing EV economy and provides customers with easy access to energy-efficient options. Furthermore, developed countries such as the United States, the United Kingdom, and China have taken steps to improve charging networks across their respective states for electric vehicles in 2019 in order to promote better corporate governance and a smooth transition in the automotive industry. Furthermore, iot has begun an iterative process known as faster adoption and manufacturing of hybrid and electric vehicles II (FAME). According to this, incentives will be provided to promote local electric vehicle manufacturing and the electric vehicle supply equipment market. Zero emission EV Driving EVSEs market Electric vehicle adoption is expected to grow as low-emission vehicle development receives more attention, which will also increase equipment adoption. The absence of import taxes, purchase taxes, road taxes, and zero or minimal registration fees are expected to boost market growth. Governments also offer advantageous incentives and programs to promote the use of supply equipment for electric vehicles. For example, the Scottish government spent almost USD 30 million between 2011 and 2019 to expand the number of electric vehicles charging stations across the country. Additionally, consumers are switching to electric vehicles as a result of increased gas prices. These elements could fuel the market expansion for electric vehicle supply equipment. Major auto manufacturers are adopting electrification, as evidenced by the increased number and variety of electric vehicle supply equipment models offered, as well as commitments to brand electric vehicle supply equipment and sales targets. For example, Volvo anticipates BEVs will make up half of its sales in 2025 (the other half hybrid vehicles) and will move to exclusively sell EVs by 2030. Honda is aiming for two-thirds of its sales to be electric vehicle supply equipment globally and all sales in Europe by 2025. At COP26 six manufacturers, including GM, Ford, Mercedes-Benz, BYD, Volvo, and JLR, publicly committed to achieving an entirely zero-emissions light-duty vehicle fleet by 2040.14 Ford said that its entire European passenger vehicle line would be ZEV capable, BEV, or PHEV by mid-2026, and expects 50 percent of its global vehicle volume to be fully electric by 2030 with an interim goal of producing two million vehicles per year in 2026.15 Similarly, GM set a goal to have one million units of electric vehicle capacity in North America by mid-decade. High installation costs hampering the market As more people buy plug-in electric vehicles (PEVs), there is an increasing demand for a network of electric vehicle supply equipment (EVSE) to power those vehicles. PEV drivers primarily charge their vehicles with residential EVSE, but non-residential EVSE is required in the workplace, public, and fleet settings. This report contains information on the costs of purchasing, installing, and owning non-residential EVSE. A single port EVSE unit costs between $300 and $1,500 for Level 1, $400 and $6,500 for Level 2, and $10,000 and $40,000 for DC fast charging. Installation costs vary high from site to site, with an approximate cost range of $0-$3,000 for Level 1, $600- $12,700 for Level 2, and $4,000-$51,000 for DC fast charging The cost of installing a charging infrastructure is relatively high for electric automobiles. The market for electric car charging infrastructure is being constrained by high costs and a lack of infrastructure. The management of the charging network and charging terminals requires both a fixed site and a person. This cost becomes the restraining factor, making funding for charging stations unusable. Additionally, a number of governments have placed restrictions and per-unit fees on users of electric vehicles, which has complicated business operations for those who own EV charging stations. This aspect can restrain the Global Electric Vehicle Supply Equipment Market growth.Electric Vehicle Supply Equipment Market Segment Analysis:

By Type, based on type Level 2 type held the largest market shear of xx% in 2021. Level 2 chargers are the most common; they charge faster but are more expensive than Level 1. Level 2 chargers can be found in workplaces, public areas, and private residences. Residential Level 2 chargers, while sold separately from the vehicle, are frequently purchased at the same time and usually require professional installation. Level 2 chargers charge faster due to their ability to handle voltages in excess of 200 volts and the amount of current supported by Level 2 chargers ranges from 12 to 80 amps (compared to Level 1 which are limited to 10–12 amps). They are the most common type found at public charging stations due to their faster-charging speed when compared to Level 1. Level 2 chargers can be installed in homes without requiring extensive modification; they handle voltages exceeding 200 volts, which households already receive for certain appliances such as central air conditioning or washing machines. A Level 2 charger will charge a typical EV at a rate of 12-60 miles per hour, depending on the amount of power supplied by the charger and the amount of power accepted by the EV. The cost of purchasing and installing a Level 2 charger varies greatly depending on several factors, including the EVSE itself, design and engineering, permitting, and construction. Because they are stand-alone units and part of non-networked charging stations, residential Level 2 chargers are typically less expensive to purchase and install. As per MMR survey in India, installation of level 2 electric vehicle charger isBy product type, based on product the EV charging kiosk segment dominated the market in 2022. thanks to the deployment of self-service charging options like enhanced intelligence interactive EV kiosks. Additionally, technical developments like the adoption of Near Field Communication (NFC) and Radio-Frequency Identification (RFID) in EVSE have improved the efficiency of digital payments for EV users of the infrastructure. Additionally, it has been challenging for owners of electric vehicle charging stations to assign customer support agents during periods of heavy traffic due to the lack of an additional workforce in industrialized countries like the U.S., the U.K., and Germany. This is a key driver of the EV charging kiosk market.

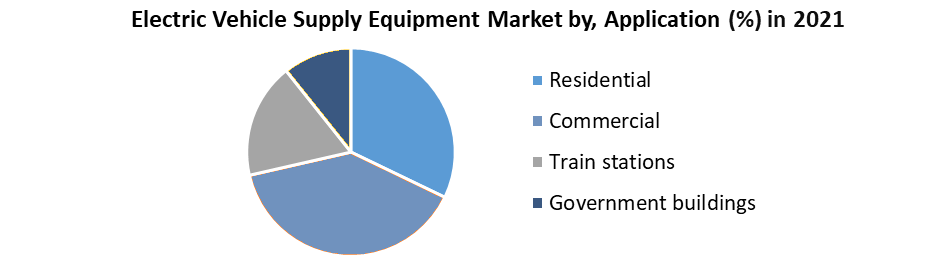

Type of Charger Cost Bharat AC – 001 RS 65,000 Bharat DC – 001 Rs 2,47,000 Type 2 AC Rs 2,47,000 CHAdeMO Rs 13,50,000 CCS Rs 14,00,000 By application, the market has been divided into commercial and residential segments based on the applications, with the commercial segment dominating the market in 2022. The segment is being driven by beneficent government programs like the Trans-Canada Highway Project, Norway to Italy Electric Highway, and the West Coast Electric Highway (WCEH). In order to meet the need for charging stations, electric car supply equipment manufacturers are also placing a strong emphasis on the construction of electric vehicle charging stations in hotels, malls, and resorts. Another element driving the segment's growth is an increasing focus on the implementation of electric vehicle charging stations by hospitality organizations like Hyatt Corporation and Marriot International, Inc. Over the forecast period, the residential category is expected to grow significantly. This can be due to the many tax breaks and incentives that different governments have provided for the purchase of electric vehicles, which are typically charged at homes. Additionally, a few of manufacturers offer residential chargers to go with their electric vehicles. Furthermore, due to advantages like ease and cost-effectiveness, overnight charging at residences or residential apartments is the favored method of charging.

Regional Insights:

North America accounted for the largest share of the market in 2022 and is expected xx% CAGR throughout the forecast period. The EV charger market in the United States is closely connected with EV ownership. Many EV owners buy a charger to keep at home. The United States has one public charger for every 18.5 EVs, but to keep up with expected EV sales growth, the country will need to invest significantly in public chargers. According to reports, more than 80% of EV charging in the United States is done at home. This may change as EV sales increase, EV prices fall, and more EV buyers lack a personal garage or off-street parking. Furthermore, as EV range expands, EV users may be more likely to use an EV as their primary vehicle, as well as on trips outside of their immediate area. As EV sales rise, so do the number of publicly available chargers. Available ports at Level 2 and Level 3 EV charging stations have increased rapidly since 2019, according to data from the US Department of Energy's Alternative Fuels Data Center. Between 2019 and 2021, the number of Level 2 and DC fast charger ports more than doubled. On average, 50 stations have 2.43 ports; many only have one, but some have dozens, and a few have hundreds. With the growing number of EVs in the US, and thus the demand for EV chargers, new and existing companies in a variety of industries have developed EVSE products and services. In the EVSE market, four types of companies compete, industrial manufacturers, EV charger startups, EV manufacturers, and energy companies (both utilities and gas companies). EVSE companies play a variety of roles, including designing EV chargers, manufacturing EV chargers, installing EV chargers, managing an EV charging station, and creating/managing an EV charging station software network. As a natural extension of their existing expertise, many existing companies participate in one of these spaces. For example, ABB, Eaton, and Schneider Electric, already manufacture electrical equipment and have been able to leverage that experience to design and manufacture EV chargers. Similarly, energy companies such as Shell and BP have a network of gas stations strategically placed along major traffic routes, making them ideal locations for EV charging stations. EV manufacturers such as Tesla and Volkswagen have also invested in The objective of the report is to present a comprehensive analysis of the Electric Vehicle Supply Equipment Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants.Electric Vehicle Supply Equipment Market Scope: Inquiry Before Buying

Electric Vehicle Supply Equipment Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018to 2022 Market Size in 2022: US $ 4.04 Bn. Forecast Period 2023 to 2029 CAGR: 26.3% Market Size in 2029: US $ 20.72 Bn. Segments Covered: by Type Level 1,2,3 by Product Type Portable Charger EV Charging Kiosk Onboard Charging Station Others by Application Residential Commercial Train stations Government buildings by Region North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America) Electric Vehicle Supply Equipment Manufacturers are:

1. Liberty Plugins (US) 2. Clipper Creek (US) 3. Coritech (US) 4. EVgo Services LLC (US) 5. Blink Charging Co. (US) 6. BTC Power (US) 7. Chargepoint (US) 8. Tesla Motors (US) 9. Andromeda Interfaces Inc (US) 10.Bosch Automotive Service Solutions Inc (US) 11.BYD Motors (US) 12.Eaton Corporation plc (US) 13.General Electric Company (US) 14.Leviton Manufacturing Co. Inc. (US) 15.Delta Electronics, Inc (US) 16.Webasto Group (Germany) 17.Siemens AG (Germany) 18.FullCharger (France) 19.Schneider Electric SE (France) 20.ABB Ltd. (Switzerland) 21.Circontrol (Spain) 22.Efacec Electric Mobility S.A. (Portugal) Frequently Asked Questions: 1. What is the forecast period considered for the Electric Vehicle Supply Equipment Market report? Ans. The forecast period for the Electric Vehicle Supply Equipment Market is 2023-2029. 2. Which key factors are hindering the growth of the Electric Vehicle Supply Equipment Market? Ans. High of installation hampering the market growth. 3. What is the compound annual growth rate (CAGR) of the Electric Vehicle Supply Equipment Market for the forecast period? Ans. 26.3% of CAGR is the annual growth rate of the electric vehicle supply equipment market for the forecast period. 4. What are the key factors driving the growth of the Electric Vehicle Supply Equipment Market? Ans. Government regulation driving the market growth. 5. Which are the worldwide major key players covered for the Electric Vehicle Supply Equipment Market report? Ans. ABB, Addenergie, Aerovironment/Webasto Allego, Andromeda, Beam are some of the major key players covered in report.

1. Global Electric Vehicle Supply Equipment Market: Research Methodology 2. Global Electric Vehicle Supply Equipment Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Electric Vehicle Supply Equipment Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Electric Vehicle Supply Equipment Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Electric Vehicle Supply Equipment Market Segmentation 4.1 Global Electric Vehicle Supply Equipment Market, by Type (2022-2029) • Level 1 • Level 2 • Level 3 4.2 Global Electric Vehicle Supply Equipment Market, by Product Type (2022-2029) • Residential • Commercial • Train stations • Government buildings • Other 4.3 Global Electric Vehicle Supply Equipment Market, by Application (2022-2029) • Portable Charger • EV Charging Kiosk • Onboard Charging Station • Others 5. North America Electric Vehicle Supply Equipment Market (2022-2029) 5.1 North America Electric Vehicle Supply Equipment Market, by Type (2022-2029) • Level 1 • Level 2 • Level 3 5.2 North America Electric Vehicle Supply Equipment Market, by Product Type (2022-2029) • Residential • Commercial • Train stations • Government buildings • Other 5.3 North America Electric Vehicle Supply Equipment Market, by Application (2022-2029) • Portable Charger • EV Charging Kiosk • Onboard Charging Station 5.4 North America Electric Vehicle Supply Equipment Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Electric Vehicle Supply Equipment Market (2022-2029) 6.1. European Electric Vehicle Supply Equipment Market, by Type (2022-2029) 6.2. European Electric Vehicle Supply Equipment Market, by Product Type (2022-2029) 6.3. European Electric Vehicle Supply Equipment Market, by Application (2022-2029) 6.4. European Electric Vehicle Supply Equipment Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Electric Vehicle Supply Equipment Market (2022-2029) 7.1. Asia Pacific Electric Vehicle Supply Equipment Market, by Type (2022-2029) 7.2. Asia Pacific Electric Vehicle Supply Equipment Market, by Product Type (2022-2029) 7.3. Asia Pacific Electric Vehicle Supply Equipment Market, by Application (2022-2029) 7.4. Asia Pacific Electric Vehicle Supply Equipment Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Electric Vehicle Supply Equipment Market (2022-2029) 8.1 Middle East and Africa Electric Vehicle Supply Equipment Market, by Type (2022-2029) 8.2. Middle East and Africa Electric Vehicle Supply Equipment Market, by Product Type (2022-2029) 8.3. Middle East and Africa Electric Vehicle Supply Equipment Market, by Application (2022-2029) 8.4. Middle East and Africa Electric Vehicle Supply Equipment Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Electric Vehicle Supply Equipment Market (2022-2029) 9.1. South America Electric Vehicle Supply Equipment Market, by Type (2022-2029) 9.2. South America Electric Vehicle Supply Equipment Market, by Product Type (2022-2029) 9.3. South America Electric Vehicle Supply Equipment Market, by Application (2022-2029) 9.4 South America Electric Vehicle Supply Equipment Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Liberty Plugins (US) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Clipper Creek (US) 10.3. Coritech (US) 10.4. EVgo Services LLC (US) 10.5. Blink Charging Co. (US) 10.6. BTC Power (US) 10.7. Chargepoint (US) 10.8. Tesla Motors (US) 10.9. Andromeda Interfaces Inc (US) 10.10. Bosch Automotive Service Solutions Inc (US) 10.11. BYD Motors (US) 10.12. Eaton Corporation plc (US) 10.13. General Electric Company (US) 10.14. Leviton Manufacturing Co. Inc. (US) 10.15. Delta Electronics, Inc (US) 10.16. Webasto Group (Germany) 10.17. Siemens AG (Germany) 10.18. FullCharger (France) 10.19. Schneider Electric SE (France) 10.20. ABB Ltd. (Switzerland) 10.21. Circontrol (Spain) 10.22. Efacec Electric Mobility S.A. (Portugal)