The Electric Truck Market size was valued at USD 4.03 Billion in 2024 and the total Electric Truck revenue is expected to grow at a CAGR of 28.2% from 2025 to 2032, reaching nearly USD 29.46 Billion.Electric Truck Market Overview

Electric trucks are a revolutionary of the transportation industry designed to address environmental concerns and reduce carbon footprints. Unlike traditional diesel or gasoline-powered trucks, electric trucks are equipped with electric motors powered by batteries. These batteries store and provide energy for the vehicle's operation, eliminating the need for fossil fuels and significantly lowering emissions. Electric trucks contribute to a more sustainable future by reducing air pollution and dependence on non-renewable energy sources. They are particularly well-suited for urban deliveries, where noise and pollution reduction are critical. Major automotive manufacturers are increasingly investing in the development and production of electric trucks, aiming to revolutionize freight and logistics while adhering to global efforts to combat climate change. The Electric Truck Market is constantly evolving, with advancements in battery technology, charging infrastructure and government incentives driving its growth and establishing it in the transition to cleaner and more efficient transportation solutions.To know about the Research Methodology :- Request Free Sample Report Electric trucks, powered by electric motors and batteries, aim to replace traditional internal combustion engine vehicles in the freight and logistics sector. Offering environmental benefits and lower operating costs, electric trucks are gaining momentum globally. Key players in the automotive industry are investing heavily in the development and production of electric trucks, contributing to the Electric Truck Market. These vehicles are well-suited for urban delivery, where zero-emission zones are becoming more predominant. The electric truck industry is evolving rapidly, with ongoing advancements in battery technology and charging infrastructure, addressing range anxiety and enhancing the feasibility of widespread adoption. Governments worldwide are also incentivizing the transition to electric trucks, fostering a competitive landscape and encouraging innovation in this essential sector for a sustainable future.

Electric Truck Market Trend

Increasing focus on advanced telematics and connectivity solutions Recent advancements in the trucking industry have led to smarter vehicles and components, facilitated by smaller, more sophisticated electronics and widespread communications infrastructure. Telematics, the integration of telecommunications and informatics, provides real-time insights into various aspects of vehicles, including engine health, fuel consumption, and maintenance needs. Connectivity technologies enable the accumulation and remote transmission of critical vehicle information, such as engine health, driving patterns, and fuel usage. This trend is revolutionizing vehicle management, offering customers real-time data that enhances vehicle uptime, reduces costs, and improves overall efficiency. Telematics and connectivity bring benefits like remote diagnostics, predictive service insights, and over-the-air updates, leading to operational cost reductions, enhanced environmental sustainability, and improved safety in the Electric Truck Market. The integration of these technologies is pivotal for modern customers, contributing to optimized fleet performance and reliability. Telematics, a convergence of telecommunications and information technology, facilitates real-time data exchange, reception, and storage, playing a pivotal role in the Internet of Things (IoT). This trend is reshaping the electric truck landscape by integrating automotive technology with computer science, communication tech, data sciences, and GPS locational systems, which is expected to boost the Electric Truck Market growth. In electric trucks, telematics technology comprises sophisticated components such as telematics devices, IoT cloud servers, and an ECU network, contributing to instant data analysis and insights. The demand for safety features, connected car services, and efficient fleet management, the integration of advanced technologies like AI, machine learning, and IoT further enhances telematics capabilities. As electric trucks gain prominence, there is a surge in EV telematics solutions addressing the specific challenges of electric fleets, offering benefits such as real-time tracking, predictive maintenance, driver behavior analysis, safety enhancements, and connectivity for improved operational efficiency. The sustained growth of the telematics industry is crucial for the Electric Truck Market, fostering data-driven insights, efficient fleet management, and contributing to the broader trajectory of sustainable and connected transportation.Electric Truck Market Dynamics

Increasing emphasis on sustainability and environmental regulations to boost Market Growth Governments globally advocate for cleaner transportation to combat climate change, positioning electric trucks as vital in the green revolution. The Electric Truck Market benefits from policies promoting zero-emission vehicles. Electric trucks, in stark contrast to their diesel complements, provide a sustainable alternative by emitting significantly fewer greenhouse gases. According to the International Council on Clean Transportation, battery electric trucks demonstrate a significant 63% reduction in greenhouse gas emissions compared to traditional diesel trucks, aligning seamlessly with the world's commitment to mitigating climate change. This environmental imperative has driven rapid adoption of electric trucks, driven by countries implementing rigorous emissions regulations that compel manufacturers to innovate and invest in electric vehicle technology. Technological advancements enhance the economic viability of electric trucks for businesses, making them an increasingly attractive option. As the cost-effectiveness and efficiency of electric trucks improve, more businesses are recognizing the long-term benefits, including lower operating costs and enhanced sustainability. Increasing awareness among consumers and businesses regarding the advantages of electric trucks is a key factor contributing to the Electric Truck Market growth. The appeal lies not only in the environmental benefits but also in the potential for significant cost savings over the lifespan of electric trucks. As businesses seek to align with sustainable practices, the adoption of electric trucks becomes a strategic choice. Current Limitations of Charging Infrastructure to hamper Market Growth The Electric Truck Market faces a significant restraint in the form of current limitations in charging infrastructure. These limitations pose multifaceted challenges for the widespread adoption of electric trucks. The insufficient number of charging stations, a critical aspect for addressing range anxiety and ensuring seamless EV operation, remains a primary hurdle. The strain on power grid capacity due to the growing number of electric vehicles raises concerns about potential power outages, necessitating upgrades and smart charging solutions. The lack of standardized charging connectors and protocols further complicates the user experience, as varying standards create inconvenience for electric truck owners. The substantial costs associated with deploying comprehensive charging infrastructure, spanning installation, maintenance, and operation, serve as a deterrent for stakeholders, necessitating innovative funding models and public-private partnerships.Electric Truck Market Segment Analysis

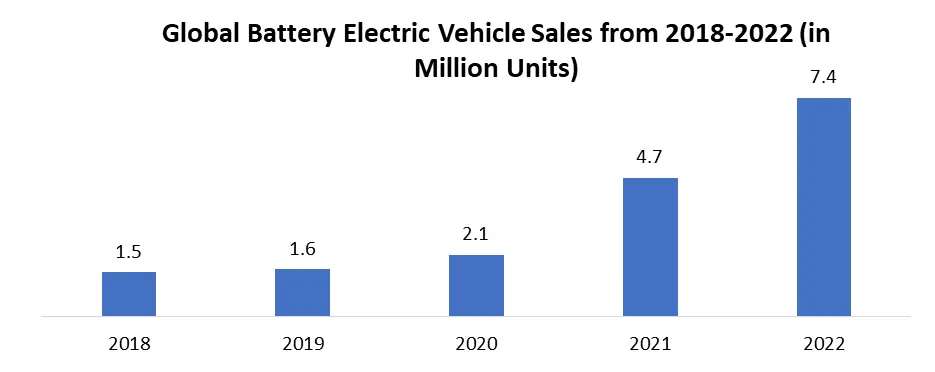

Based on the propulsion, the market is segmented into Battery Electric Trucks (BEVs), Hybrid Electric Trucks (HEVs) and Plug-in Hybrid Electric Trucks (PHEVs). Battery Electric Trucks (BEVs) dominated the Electric Truck Market in 2022 and are expected to continue their dominance over the forecast period. BEVs operate exclusively on electric power, producing zero tailpipe emissions. As the global focus on environmental sustainability and the reduction of greenhouse gas emissions intensifies, BEVs are considered a cleaner and more eco-friendly alternative to traditional internal combustion engine vehicles and even other electric truck types. Many regions and countries are implementing stringent emissions regulations to combat air pollution and address climate change and these regulations significantly boosts the Electric Truck Market growth. BEVs align well with these regulations as they contribute significantly to reducing overall emissions in the transportation sector. Ongoing advancements in battery technology have led to improvements in energy density, range, and charging infrastructure. BEVs benefit from these advancements, providing longer driving ranges and quicker charging times, making them more practical for a variety of applications, including last-mile delivery and urban transport.The development of a strong charging infrastructure is crucial for the adoption of electric vehicles. The proliferation of fast-charging stations bolsters Battery Electric Trucks (BEVs) in the Electric Truck Market, alleviating range anxiety and offering convenient charging solutions, contributing to the widespread adoption of electric trucks. Consumer and corporate preferences are shifting towards more sustainable transportation options. BEVs are seen as a symbol of innovation and commitment to reducing the carbon footprint. Many companies are integrating electric trucks into their fleets as part of broader sustainability initiatives. Various governments around the world offer incentives and subsidies for the purchase of electric vehicles, including electric trucks. These incentives significantly reduce the initial costs for businesses and encourage the adoption of BEVs. Global Battery Electric Vehicle (BEV) sales are experiencing strong growth, with a significant impact on the Electric Truck Market. As sustainability gains prominence, the surge in BEV sales reflects a broader shift toward cleaner transportation solutions, driving innovation and adoption in the electric truck sector across the globe.

Electric Truck Market Regional Insights

Asia Pacific dominated the largest Electric Truck Market share in 2022 and is expected to continue its dominance over the forecast period. The Asia-Pacific region stands out as a dominating force in the Electric Truck industry, boosted by a convergence of factors that position it at the forefront of the industry's growth. Rapid urbanization, escalating concerns about air quality, and a strategic focus on sustainable development have propelled countries in the Asia-Pacific region to embrace electric trucks as a transformative solution for commercial transportation. Countries such as China, India, and Japan are witnessing a surge in the adoption of electric trucks, driven by ambitious government initiatives, stringent emission regulations, and a strong commitment to reducing carbon footprints. The sheer size of the Asia-Pacific market, coupled with a burgeoning population and expanding urban landscapes, creates an ideal environment for electric trucks to address the pressing challenges of pollution and environmental degradation. The region's strong manufacturing capabilities, particularly in China, contribute to the availability and affordability of electric trucks, making them an attractive choice for fleet operators. Investments in charging infrastructure and advancements in battery technology further support the widespread acceptance of electric trucks across diverse applications, from last-mile delivery to long-haul logistics. With a combination of regulatory support, technological innovation, and market demand, the Asia-Pacific region emerges as a dominant force shaping the present and future landscape of the Electric Truck Market. North America is expected to have the highest CAGR for the Electric Truck Market during the forecast period. The electric truck industry in North America is experiencing significant growth and transformation, driven by a strong push towards sustainable and clean transportation. Major players such as Tesla, Rivian, and General Motors are at the forefront, developing innovative electric truck models. The region's commitment to reducing carbon emissions and increasing government support, along with advancements in charging infrastructure, contributes to the rapid adoption of electric trucks. With a focus on addressing environmental concerns and improving overall efficiency, the region is witnessing a dynamic shift towards electric trucks, marking a moment in the evolution of the transportation sector.Electric Truck Market Scope: Inquire before buying

Global Electric Truck Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 4.03 Bn. Forecast Period 2025 to 2032 CAGR: 28.2% Market Size in 2032: USD 29.46 Bn. Segments Covered: by Propulsion Battery Electric Trucks (BEVs) Hybrid Electric Trucks (HEVs) Plug-in Hybrid Electric Trucks (PHEVs) by Type Light-duty Electric Trucks Medium-duty Electric Trucks Heavy-duty Electric Trucks by Range Short Range (Up to 150 Miles) Medium Range (150-300 Miles) Long Range (300-500 Miles) Ultra-Long Range (500+ Miles) by Battery Type Lithium-Ion (Li-ion) Batteries Solid-State Batteries Lead-Acid Batteries Nickel-Metal Hydride (NiMH) Batteries by End Use Logistics and Transportation Companies E-commerce and Retail Municipalities and Public Services Construction and Infrastructure Development Manufacturing and Industrial Sector Others Electric Truck Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest)Electric Truck Market, Key Players

Global 1. Tesla, Inc. (Palo Alto, California, USA) 2. BYD Company Ltd. (Shenzhen, Guangdong, China) 3. Daimler AG (Mercedes-Benz) (Stuttgart, Germany) 4. AB Volvo Group (Gothenburg, Sweden) 5. Nikola Corporation (Phoenix, Arizona, USA) North America 1. Rivian Automotive, Inc. (Plymouth, Michigan, USA) 2. General Motors Company (Detroit, Michigan, USA) 3. Ford Motor Company (Dearborn, Michigan, USA) 4. Workhorse Group Inc. (Loveland, Ohio, USA) 5. Lordstown Motors Corp. (Lordstown, Ohio, USA) 6. XPeng Inc. (Guangzhou, Guangdong, China) 7. Chanje Energy Inc. (Los Angeles, California, USA) 8. Kenworth (PACCAR Inc.) (Bellevue, Washington, USA) 9. Peterbilt (PACCAR Inc.) (Denton, Texas, USA) 10. Ryder System, Inc. (Miami, Florida, USA) Europe 1. Scania AB (Volkswagen Truck & Bus) (Sweden) Asia Pacific 1. XPeng Inc. (Guangzhou, Guangdong, China) 2. SAIC Motor Corporation Limited (Shanghai, China) 3. China National Heavy Duty Truck Group Co., Ltd. (SINOTRUK) (Jinan, Shandong, China) 4. Hino Motors, Ltd. (Hino, Tokyo, Japan) Frequently Asked Questions: 1] What is the growth rate of the Global Electric Truck Market? Ans. The Global Electric Truck Market is growing at a significant rate of 28.2% during the forecast period. 2] Which region is expected to dominate the Global Electric Truck Market? Ans. Asia Pacific is expected to dominate the Electric Truck Market during the forecast period. 3] What is the expected Global Electric Truck Market size by 2032? Ans. The Electric Truck Market size is expected to reach USD 29.43 Billion by 2032. 4] Which are the top players in the Global Electric Truck Market? Ans. The major top players in the Global Electric Truck Market are Tesla, Inc. (Palo Alto, California, USA), BYD Company Ltd. (Shenzhen, Guangdong, China), Daimler AG (Mercedes-Benz) (Stuttgart, Germany), Volvo Group (Gothenburg, Sweden), Nikola Corporation (Phoenix, Arizona, USA) and Others. 5] What are the factors driving the Global Electric Truck Market growth? Ans. Increased emphasis on sustainability and environmental concerns drives the transition towards electric vehicles and urge in research and development efforts by major automotive manufacturers fosters innovation and the introduction of competitive electric truck models. is expected to drive market growth during the forecast period.

1. Electric Truck Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Electric Truck Market: Dynamics 2.1. Electric Truck Market Trends by Region 2.1.1. North America Electric Truck Market Trends 2.1.2. Europe Electric Truck Market Trends 2.1.3. Asia Pacific Electric Truck Market Trends 2.1.4. Middle East and Africa Electric Truck Market Trends 2.1.5. South America Electric Truck Market Trends 2.2. Electric Truck Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Electric Truck Market Drivers 2.2.1.2. North America Electric Truck Market Restraints 2.2.1.3. North America Electric Truck Market Opportunities 2.2.1.4. North America Electric Truck Market Challenges 2.2.2. Europe 2.2.2.1. Europe Electric Truck Market Drivers 2.2.2.2. Europe Electric Truck Market Restraints 2.2.2.3. Europe Electric Truck Market Opportunities 2.2.2.4. Europe Electric Truck Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Electric Truck Market Drivers 2.2.3.2. Asia Pacific Electric Truck Market Restraints 2.2.3.3. Asia Pacific Electric Truck Market Opportunities 2.2.3.4. Asia Pacific Electric Truck Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Electric Truck Market Drivers 2.2.4.2. Middle East and Africa Electric Truck Market Restraints 2.2.4.3. Middle East and Africa Electric Truck Market Opportunities 2.2.4.4. Middle East and Africa Electric Truck Market Challenges 2.2.5. South America 2.2.5.1. South America Electric Truck Market Drivers 2.2.5.2. South America Electric Truck Market Restraints 2.2.5.3. South America Electric Truck Market Opportunities 2.2.5.4. South America Electric Truck Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Electric Truck Industry 2.8. Analysis of Government Schemes and Initiatives For Electric Truck Industry 2.9. Electric Truck Market Trade Analysis 2.10. The Global Pandemic Impact on Electric Truck Market 3. Electric Truck Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 3.1. Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 3.1.1. Battery Electric Trucks (BEVs) 3.1.2. Hybrid Electric Trucks (HEVs) 3.1.3. Plug-in Hybrid Electric Trucks (PHEVs) 3.2. Electric Truck Market Size and Forecast, by Type (2024-2032) 3.2.1. Light-duty Electric Trucks 3.2.2. Medium-duty Electric Trucks 3.2.3. Heavy-duty Electric Trucks 3.3. Electric Truck Market Size and Forecast, by Range (2024-2032) 3.3.1. Short Range (Up to 150 Miles) 3.3.2. Medium Range (150-300 Miles) 3.3.3. Long Range (300-500 Miles) 3.3.4. Ultra-Long Range (500+ Miles) 3.4. Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 3.4.1. Lithium-Ion (Li-ion) Batteries 3.4.2. Solid-State Batteries 3.4.3. Lead-Acid Batteries 3.4.4. Nickel-Metal Hydride (NiMH) Batteries 3.5. Electric Truck Market Size and Forecast, by End Use (2024-2032) 3.5.1. Logistics and Transportation Companies 3.5.2. E-commerce and Retail 3.5.3. Municipalities and Public Services 3.5.4. Construction and Infrastructure Development 3.5.5. Manufacturing and Industrial Sector 3.5.6. Others 3.6. Electric Truck Market Size and Forecast, by Region (2024-2032) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America Electric Truck Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 4.1. North America Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 4.1.1. Battery Electric Trucks (BEVs) 4.1.2. Hybrid Electric Trucks (HEVs) 4.1.3. Plug-in Hybrid Electric Trucks (PHEVs) 4.2. North America Electric Truck Market Size and Forecast, by Type (2024-2032) 4.2.1. Light-duty Electric Trucks 4.2.2. Medium-duty Electric Trucks 4.2.3. Heavy-duty Electric Trucks 4.3. North America Electric Truck Market Size and Forecast, by Range (2024-2032) 4.3.1. Short Range (Up to 150 Miles) 4.3.2. Medium Range (150-300 Miles) 4.3.3. Long Range (300-500 Miles) 4.3.4. Ultra-Long Range (500+ Miles) 4.4. North America Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 4.4.1. Lithium-Ion (Li-ion) Batteries 4.4.2. Solid-State Batteries 4.4.3. Lead-Acid Batteries 4.4.4. Nickel-Metal Hydride (NiMH) Batteries 4.5. North America Electric Truck Market Size and Forecast, by End Use (2024-2032) 4.5.1. Logistics and Transportation Companies 4.5.2. E-commerce and Retail 4.5.3. Municipalities and Public Services 4.5.4. Construction and Infrastructure Development 4.5.5. Manufacturing and Industrial Sector 4.5.6. Others 4.6. North America Electric Truck Market Size and Forecast, by Country (2024-2032) 4.6.1. United States 4.6.1.1. United States Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 4.6.1.1.1. Battery Electric Trucks (BEVs) 4.6.1.1.2. Hybrid Electric Trucks (HEVs) 4.6.1.1.3. Plug-in Hybrid Electric Trucks (PHEVs) 4.6.1.2. United States Electric Truck Market Size and Forecast, by Type (2024-2032) 4.6.1.2.1. Light-duty Electric Trucks 4.6.1.2.2. Medium-duty Electric Trucks 4.6.1.2.3. Heavy-duty Electric Trucks 4.6.1.3. United States Electric Truck Market Size and Forecast, by Range (2024-2032) 4.6.1.3.1. Short Range (Up to 150 Miles) 4.6.1.3.2. Medium Range (150-300 Miles) 4.6.1.3.3. Long Range (300-500 Miles) 4.6.1.3.4. Ultra-Long Range (500+ Miles) 4.6.1.4. United States Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 4.6.1.4.1. Lithium-Ion (Li-ion) Batteries 4.6.1.4.2. Solid-State Batteries 4.6.1.4.3. Lead-Acid Batteries 4.6.1.4.4. Nickel-Metal Hydride (NiMH) Batteries 4.6.1.5. United States Electric Truck Market Size and Forecast, by End Use (2024-2032) 4.6.1.5.1. Logistics and Transportation Companies 4.6.1.5.2. E-commerce and Retail 4.6.1.5.3. Municipalities and Public Services 4.6.1.5.4. Construction and Infrastructure Development 4.6.1.5.5. Manufacturing and Industrial Sector 4.6.1.5.6. Others 4.6.2. Canada 4.6.2.1. Canada Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 4.6.2.1.1. Battery Electric Trucks (BEVs) 4.6.2.1.2. Hybrid Electric Trucks (HEVs) 4.6.2.1.3. Plug-in Hybrid Electric Trucks (PHEVs) 4.6.2.2. Canada Electric Truck Market Size and Forecast, by Type (2024-2032) 4.6.2.2.1. Light-duty Electric Trucks 4.6.2.2.2. Medium-duty Electric Trucks 4.6.2.2.3. Heavy-duty Electric Trucks 4.6.2.3. Canada Electric Truck Market Size and Forecast, by Range (2024-2032) 4.6.2.3.1. Short Range (Up to 150 Miles) 4.6.2.3.2. Medium Range (150-300 Miles) 4.6.2.3.3. Long Range (300-500 Miles) 4.6.2.3.4. Ultra-Long Range (500+ Miles) 4.6.2.4. Canada Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 4.6.2.4.1. Lithium-Ion (Li-ion) Batteries 4.6.2.4.2. Solid-State Batteries 4.6.2.4.3. Lead-Acid Batteries 4.6.2.4.4. Nickel-Metal Hydride (NiMH) Batteries 4.6.2.5. Canada Electric Truck Market Size and Forecast, by End Use (2024-2032) 4.6.2.5.1. Logistics and Transportation Companies 4.6.2.5.2. E-commerce and Retail 4.6.2.5.3. Municipalities and Public Services 4.6.2.5.4. Construction and Infrastructure Development 4.6.2.5.5. Manufacturing and Industrial Sector 4.6.2.5.6. Others 4.6.3. Mexico 4.6.3.1. Mexico Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 4.6.3.1.1. Battery Electric Trucks (BEVs) 4.6.3.1.2. Hybrid Electric Trucks (HEVs) 4.6.3.1.3. Plug-in Hybrid Electric Trucks (PHEVs) 4.6.3.2. Mexico Electric Truck Market Size and Forecast, by Type (2024-2032) 4.6.3.2.1. Light-duty Electric Trucks 4.6.3.2.2. Medium-duty Electric Trucks 4.6.3.2.3. Heavy-duty Electric Trucks 4.6.3.3. Mexico Electric Truck Market Size and Forecast, by Range (2024-2032) 4.6.3.3.1. Short Range (Up to 150 Miles) 4.6.3.3.2. Medium Range (150-300 Miles) 4.6.3.3.3. Long Range (300-500 Miles) 4.6.3.3.4. Ultra-Long Range (500+ Miles) 4.6.3.4. Mexico Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 4.6.3.4.1. Lithium-Ion (Li-ion) Batteries 4.6.3.4.2. Solid-State Batteries 4.6.3.4.3. Lead-Acid Batteries 4.6.3.4.4. Nickel-Metal Hydride (NiMH) Batteries 4.6.3.5. Mexico Electric Truck Market Size and Forecast, by End Use (2024-2032) 4.6.3.5.1. Logistics and Transportation Companies 4.6.3.5.2. E-commerce and Retail 4.6.3.5.3. Municipalities and Public Services 4.6.3.5.4. Construction and Infrastructure Development 4.6.3.5.5. Manufacturing and Industrial Sector 4.6.3.5.6. Others 5. Europe Electric Truck Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. Europe Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 5.2. Europe Electric Truck Market Size and Forecast, by Type (2024-2032) 5.3. Europe Electric Truck Market Size and Forecast, by Range (2024-2032) 5.4. Europe Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 5.5. Europe Electric Truck Market Size and Forecast, by End Use (2024-2032) 5.6. Europe Electric Truck Market Size and Forecast, by Country (2024-2032) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 5.6.1.2. United Kingdom Electric Truck Market Size and Forecast, by Type (2024-2032) 5.6.1.3. United Kingdom Electric Truck Market Size and Forecast, by Range (2024-2032) 5.6.1.4. United Kingdom Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 5.6.1.5. United Kingdom Electric Truck Market Size and Forecast, by End Use (2024-2032) 5.6.2. France 5.6.2.1. France Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 5.6.2.2. France Electric Truck Market Size and Forecast, by Type (2024-2032) 5.6.2.3. France Electric Truck Market Size and Forecast, by Range (2024-2032) 5.6.2.4. France Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 5.6.2.5. France Electric Truck Market Size and Forecast, by End Use (2024-2032) 5.6.3. Germany 5.6.3.1. Germany Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 5.6.3.2. Germany Electric Truck Market Size and Forecast, by Type (2024-2032) 5.6.3.3. Germany Electric Truck Market Size and Forecast, by Range (2024-2032) 5.6.3.4. Germany Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 5.6.3.5. Germany Electric Truck Market Size and Forecast, by End Use (2024-2032) 5.6.4. Italy 5.6.4.1. Italy Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 5.6.4.2. Italy Electric Truck Market Size and Forecast, by Type (2024-2032) 5.6.4.3. Italy Electric Truck Market Size and Forecast, by Range (2024-2032) 5.6.4.4. Italy Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 5.6.4.5. Italy Electric Truck Market Size and Forecast, by End Use (2024-2032) 5.6.5. Spain 5.6.5.1. Spain Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 5.6.5.2. Spain Electric Truck Market Size and Forecast, by Type (2024-2032) 5.6.5.3. Spain Electric Truck Market Size and Forecast, by Range (2024-2032) 5.6.5.4. Spain Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 5.6.5.5. Spain Electric Truck Market Size and Forecast, by End Use (2024-2032) 5.6.6. Sweden 5.6.6.1. Sweden Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 5.6.6.2. Sweden Electric Truck Market Size and Forecast, by Type (2024-2032) 5.6.6.3. Sweden Electric Truck Market Size and Forecast, by Range (2024-2032) 5.6.6.4. Sweden Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 5.6.6.5. Sweden Electric Truck Market Size and Forecast, by End Use (2024-2032) 5.6.7. Austria 5.6.7.1. Austria Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 5.6.7.2. Austria Electric Truck Market Size and Forecast, by Type (2024-2032) 5.6.7.3. Austria Electric Truck Market Size and Forecast, by Range (2024-2032) 5.6.7.4. Austria Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 5.6.7.5. Austria Electric Truck Market Size and Forecast, by End Use (2024-2032) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 5.6.8.2. Rest of Europe Electric Truck Market Size and Forecast, by Type (2024-2032) 5.6.8.3. Rest of Europe Electric Truck Market Size and Forecast, by Range (2024-2032) 5.6.8.4. Rest of Europe Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 5.6.8.5. Rest of Europe Electric Truck Market Size and Forecast, by End Use (2024-2032) 6. Asia Pacific Electric Truck Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Asia Pacific Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 6.2. Asia Pacific Electric Truck Market Size and Forecast, by Type (2024-2032) 6.3. Asia Pacific Electric Truck Market Size and Forecast, by Range (2024-2032) 6.4. Asia Pacific Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 6.5. Asia Pacific Electric Truck Market Size and Forecast, by End Use (2024-2032) 6.6. Asia Pacific Electric Truck Market Size and Forecast, by Country (2024-2032) 6.6.1. China 6.6.1.1. China Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 6.6.1.2. China Electric Truck Market Size and Forecast, by Type (2024-2032) 6.6.1.3. China Electric Truck Market Size and Forecast, by Range (2024-2032) 6.6.1.4. China Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 6.6.1.5. China Electric Truck Market Size and Forecast, by End Use (2024-2032) 6.6.2. S Korea 6.6.2.1. S Korea Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 6.6.2.2. S Korea Electric Truck Market Size and Forecast, by Type (2024-2032) 6.6.2.3. S Korea Electric Truck Market Size and Forecast, by Range (2024-2032) 6.6.2.4. S Korea Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 6.6.2.5. S Korea Electric Truck Market Size and Forecast, by End Use (2024-2032) 6.6.3. Japan 6.6.3.1. Japan Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 6.6.3.2. Japan Electric Truck Market Size and Forecast, by Type (2024-2032) 6.6.3.3. Japan Electric Truck Market Size and Forecast, by Range (2024-2032) 6.6.3.4. Japan Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 6.6.3.5. Japan Electric Truck Market Size and Forecast, by End Use (2024-2032) 6.6.4. India 6.6.4.1. India Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 6.6.4.2. India Electric Truck Market Size and Forecast, by Type (2024-2032) 6.6.4.3. India Electric Truck Market Size and Forecast, by Range (2024-2032) 6.6.4.4. India Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 6.6.4.5. India Electric Truck Market Size and Forecast, by End Use (2024-2032) 6.6.5. Australia 6.6.5.1. Australia Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 6.6.5.2. Australia Electric Truck Market Size and Forecast, by Type (2024-2032) 6.6.5.3. Australia Electric Truck Market Size and Forecast, by Range (2024-2032) 6.6.5.4. Australia Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 6.6.5.5. Australia Electric Truck Market Size and Forecast, by End Use (2024-2032) 6.6.6. Indonesia 6.6.6.1. Indonesia Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 6.6.6.2. Indonesia Electric Truck Market Size and Forecast, by Type (2024-2032) 6.6.6.3. Indonesia Electric Truck Market Size and Forecast, by Range (2024-2032) 6.6.6.4. Indonesia Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 6.6.6.5. Indonesia Electric Truck Market Size and Forecast, by End Use (2024-2032) 6.6.7. Malaysia 6.6.7.1. Malaysia Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 6.6.7.2. Malaysia Electric Truck Market Size and Forecast, by Type (2024-2032) 6.6.7.3. Malaysia Electric Truck Market Size and Forecast, by Range (2024-2032) 6.6.7.4. Malaysia Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 6.6.7.5. Malaysia Electric Truck Market Size and Forecast, by End Use (2024-2032) 6.6.8. Vietnam 6.6.8.1. Vietnam Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 6.6.8.2. Vietnam Electric Truck Market Size and Forecast, by Type (2024-2032) 6.6.8.3. Vietnam Electric Truck Market Size and Forecast, by Range (2024-2032) 6.6.8.4. Vietnam Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 6.6.8.5. Vietnam Electric Truck Market Size and Forecast, by End Use (2024-2032) 6.6.9. Taiwan 6.6.9.1. Taiwan Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 6.6.9.2. Taiwan Electric Truck Market Size and Forecast, by Type (2024-2032) 6.6.9.3. Taiwan Electric Truck Market Size and Forecast, by Range (2024-2032) 6.6.9.4. Taiwan Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 6.6.9.5. Taiwan Electric Truck Market Size and Forecast, by End Use (2024-2032) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 6.6.10.2. Rest of Asia Pacific Electric Truck Market Size and Forecast, by Type (2024-2032) 6.6.10.3. Rest of Asia Pacific Electric Truck Market Size and Forecast, by Range (2024-2032) 6.6.10.4. Rest of Asia Pacific Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 6.6.10.5. Rest of Asia Pacific Electric Truck Market Size and Forecast, by End Use (2024-2032) 7. Middle East and Africa Electric Truck Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Middle East and Africa Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 7.2. Middle East and Africa Electric Truck Market Size and Forecast, by Type (2024-2032) 7.3. Middle East and Africa Electric Truck Market Size and Forecast, by Range (2024-2032) 7.4. Middle East and Africa Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 7.5. Middle East and Africa Electric Truck Market Size and Forecast, by End Use (2024-2032) 7.6. Middle East and Africa Electric Truck Market Size and Forecast, by Country (2024-2032) 7.6.1. South Africa 7.6.1.1. South Africa Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 7.6.1.2. South Africa Electric Truck Market Size and Forecast, by Type (2024-2032) 7.6.1.3. South Africa Electric Truck Market Size and Forecast, by Range (2024-2032) 7.6.1.4. South Africa Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 7.6.1.5. South Africa Electric Truck Market Size and Forecast, by End Use (2024-2032) 7.6.2. GCC 7.6.2.1. GCC Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 7.6.2.2. GCC Electric Truck Market Size and Forecast, by Type (2024-2032) 7.6.2.3. GCC Electric Truck Market Size and Forecast, by Range (2024-2032) 7.6.2.4. GCC Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 7.6.2.5. GCC Electric Truck Market Size and Forecast, by End Use (2024-2032) 7.6.3. Nigeria 7.6.3.1. Nigeria Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 7.6.3.2. Nigeria Electric Truck Market Size and Forecast, by Type (2024-2032) 7.6.3.3. Nigeria Electric Truck Market Size and Forecast, by Range (2024-2032) 7.6.3.4. Nigeria Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 7.6.3.5. Nigeria Electric Truck Market Size and Forecast, by End Use (2024-2032) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 7.6.4.2. Rest of ME&A Electric Truck Market Size and Forecast, by Type (2024-2032) 7.6.4.3. Rest of ME&A Electric Truck Market Size and Forecast, by Range (2024-2032) 7.6.4.4. Rest of ME&A Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 7.6.4.5. Rest of ME&A Electric Truck Market Size and Forecast, by End Use (2024-2032) 8. South America Electric Truck Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. South America Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 8.2. South America Electric Truck Market Size and Forecast, by Type (2024-2032) 8.3. South America Electric Truck Market Size and Forecast, by Range(2024-2032) 8.4. South America Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 8.5. South America Electric Truck Market Size and Forecast, by End Use (2024-2032) 8.6. South America Electric Truck Market Size and Forecast, by Country (2024-2032) 8.6.1. Brazil 8.6.1.1. Brazil Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 8.6.1.2. Brazil Electric Truck Market Size and Forecast, by Type (2024-2032) 8.6.1.3. Brazil Electric Truck Market Size and Forecast, by Range (2024-2032) 8.6.1.4. Brazil Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 8.6.1.5. Brazil Electric Truck Market Size and Forecast, by End Use (2024-2032) 8.6.2. Argentina 8.6.2.1. Argentina Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 8.6.2.2. Argentina Electric Truck Market Size and Forecast, by Type (2024-2032) 8.6.2.3. Argentina Electric Truck Market Size and Forecast, by Range (2024-2032) 8.6.2.4. Argentina Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 8.6.2.5. Argentina Electric Truck Market Size and Forecast, by End Use (2024-2032) 8.6.3. Rest Of South America 8.6.3.1. Rest Of South America Electric Truck Market Size and Forecast, by Propulsion (2024-2032) 8.6.3.2. Rest Of South America Electric Truck Market Size and Forecast, by Type (2024-2032) 8.6.3.3. Rest Of South America Electric Truck Market Size and Forecast, by Range (2024-2032) 8.6.3.4. Rest Of South America Electric Truck Market Size and Forecast, by Battery Type (2024-2032) 8.6.3.5. Rest Of South America Electric Truck Market Size and Forecast, by End Use (2024-2032) 9. Global Electric Truck Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Electric Truck Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Tesla, Inc. (Palo Alto, California, USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. BYD Company Ltd. (Shenzhen, Guangdong, China) 10.3. Daimler AG (Mercedes-Benz) (Stuttgart, Germany) 10.4. Volvo Group (Gothenburg, Sweden) 10.5. Nikola Corporation (Phoenix, Arizona, USA) 10.6. Rivian Automotive, Inc. (Plymouth, Michigan, USA) 10.7. General Motors Company (Detroit, Michigan, USA) 10.8. Ford Motor Company (Dearborn, Michigan, USA) 10.9. Workhorse Group Inc. (Loveland, Ohio, USA) 10.10. Lordstown Motors Corp. (Lordstown, Ohio, USA) 10.11. XPeng Inc. (Guangzhou, Guangdong, China) 10.12. Chanje Energy Inc. (Los Angeles, California, USA) 10.13. Kenworth (PACCAR Inc.) (Bellevue, Washington, USA) 10.14. Peterbilt (PACCAR Inc.) (Denton, Texas, USA) 10.15. 1Ryder System, Inc. (Miami, Florida, USA) 10.16. Scania AB (Volkswagen Truck & Bus) (Sweden) 10.17. XPeng Inc. (Guangzhou, Guangdong, China) 10.18. SAIC Motor Corporation Limited (Shanghai, China) 10.19. China National Heavy Duty Truck Group Co., Ltd. (SINOTRUK) (Jinan, Shandong, China) 10.20. Hino Motors, Ltd. (Hino, Tokyo, Japan) 11. Key Findings 12. Industry Recommendations 13. Electric Truck Market: Research Methodology 14. Terms and Glossary