Global Electric Scooter and Motorcycle Market size was valued at USD 5.96 Bn in 2023 and is expected to reach USD 8.00 Bn by 2030, at a CAGR of 4.3%.Electric Scooter and Motorcycle Market Overview

Electric scooters and motorcycles represent innovative and sustainable modes of urban transportation. Electric scooters are typically lightweight, compact, and designed for short-distance commuting within urban environments. They feature electric motors powered by rechargeable batteries, offering quiet operation and zero emissions. Electric scooters are popular among commuters for their convenience, affordability, and eco-friendliness. In the Electric Scooter and Motorcycle Market, electric motorcycles, larger and more powerful, cater to longer commutes and highway travel, while electric scooters are compact for urban mobility. They offer higher speeds, longer ranges, and enhanced performance compared to scooters. Electric motorcycles cater to riders seeking a more traditional riding experience while still benefiting from the efficiency and environmental advantages of electric propulsion. Both electric scooters and motorcycles contribute to reducing traffic congestion, air pollution, and dependence on fossil fuels, making them increasingly popular choices for sustainable urban mobility.To know about the Research Methodology :- Request Free Sample Report The electric scooter and motorcycle industry grows due to increasing environmental concerns, technological advancements, and supportive government policies. As people become more conscious of air pollution and climate change, there's a growing demand for eco-friendly transportation options. Electric scooters and motorcycles, with their zero-emission operation, have emerged as attractive alternatives to traditional gasoline-powered vehicles. Advances in battery technology have significantly improved the performance and affordability of electric two-wheelers, making them increasingly viable for urban commuting. The government initiatives such as subsidies and infrastructure development programs are encouraging consumers to embrace electric mobility. The rise of shared mobility services, including electric scooters and motorcycle-sharing programs, is boosting Electric Scooter and Motorcycle Market growth by offering convenient and cost-effective transportation solutions. The ongoing technological innovations in connectivity features, safety systems, and lightweight materials are enhancing the appeal and functionality of electric two-wheelers, attracting a broader consumer base.

Dynamics

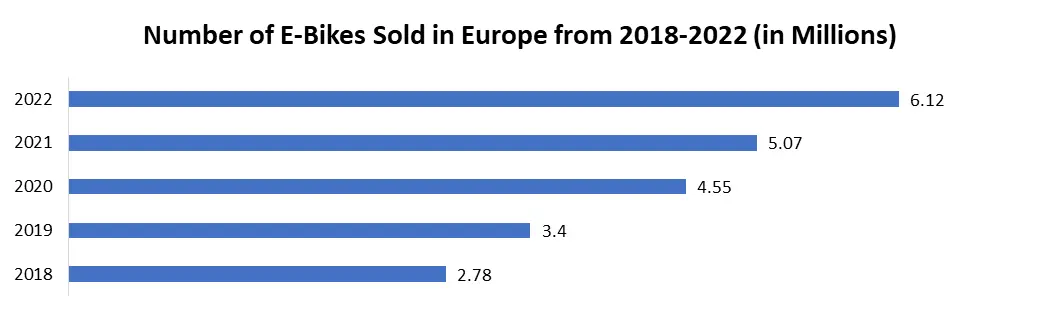

Increasing Emphasis on Sustainable Urban Mobility Solutions to Boost Market Growth With cities grappling with issues of congestion, pollution and the need for more efficient transport alternatives, electric bikes and scooters have garnered significant attention for their potential to offer tidy, hassle-free, and economical remedies to conventional transportation challenges. Electric scooters and bikes present a transformative force in urban mobility, combining the convenience of traditional bicycles with electric drive technology. They have become integral components of sustainable transportation strategies, offering abundant benefits to individuals, communities, and the environment. These vehicles are environmentally friendly, producing zero emissions during operation, which contributes to cleaner air and reduced greenhouse gas emissions and drives the Electric Scooter and Motorcycle Market growth. Electric scooters and bikes are cost-effective options for commuters, as they need minimal maintenance and have lower operational costs compared to traditional vehicles. The affordability and accessibility of electric two-wheelers make them attractive alternatives for short trips and last-mile connectivity, helping to alleviate traffic congestion and reduce travel times in urban areas. Utilizing electric scooters and bikes promotes physical activity, improving cardiovascular health and overall fitness while reducing dependence on sedentary modes of transport. The rise of electric bikes and scooters has been fueled by advancements in battery technology, design innovation, and growing environmental consciousness. Manufacturers have leveraged lightweight materials and efficient lithium-ion batteries to enhance the performance, range, and affordability of electric two-wheelers, making them increasingly practical for everyday commuting. Collaborations between technology providers, manufacturers, and urban planners have facilitated the integration of electric bikes and scooters into transportation ecosystems, expanding access to sustainable mobility solutions. The partnerships between e-bike manufacturers and ride-sharing platforms have democratized access to electric two-wheelers, making them a convenient option for personal and shared mobility needs. Beyond individual benefits, the environmental advantages of electric bikes and scooters are profound. By reducing emissions and noise pollution, e-bikes contribute to cleaner and quieter urban environments, fostering healthier and more livable cities, which boosts Electric Scooter and Motorcycle Market growth. The promotion of cycling infrastructure and the adoption of e-bike sharing systems reinforce the transformative impact of electric two-wheelers on urban mobility. As cities embrace sustainable transportation solutions, electric scooters and bikes are achieving greener, more efficient, and more inclusive urban transportation systems.

Electric Scooter and Motorcycle Market Trend

Integration of Advanced Connectivity and Smart Features The electric scooter and motorcycle market is seeing a surge in the adoption of advanced connectivity and smart features, which are changing how people move around in cities. Electric Scooter and Motorcycle companies such as TVS are investing heavily in technologies to improve safety, efficiency, and connectivity for riders. Innovations such as high-tech displays and smart connectivity are transforming electric two-wheelers, making them safer and more efficient. These advancements include features including live tracking, crash alerts, and anti-theft systems, providing riders with peace of mind and enhancing their safety on the road. The features like service reminders and proactive diagnostics help maintain the performance of these vehicles, making ownership hassle-free. The integration of infotainment features, navigation assistance, and sustainability metrics is taking electric scooters and motorcycles to the next level. For instance, TVS iQube provides a dedicated app with services such as real-time tracking and emergency alerts, allowing riders to stay connected and informed. Beyond individual vehicles, there's a trend towards broader ecosystem solutions, with collaborations between manufacturers, tech companies, and urban planners. These partnerships aim to use connectivity to improve traffic flow, reduce congestion, and enhance the overall urban mobility experience. As the demand for sustainable transportation grows, the integration of advanced connectivity and smart features continues to shape the electric scooter and motorcycle market, revolutionizing urban commuting across the globe.The limited Infrastructure for Charging and Battery Swapping to hamper Market Growth Limited infrastructure for charging and battery swapping poses a significant restraint in the electric scooter and motorcycle market, impeding the widespread adoption of these eco-friendly transportation options. The absence of a strong network of charging stations results in range anxiety among riders, particularly on longer trips, as they fear running out of battery power before reaching their destination. This anxiety dissuades potential buyers, particularly those relying on their vehicles for daily commuting or extended travel, from investing in electric two-wheelers. The time-consuming nature of charging or battery swapping compared to refueling traditional vehicles at gas stations adds inconvenience for riders. Despite advancements in battery technology, lengthy charging times and limited availability of charging stations deter consumers, who perceive electric vehicles as less convenient than gasoline-powered counterparts. Moreover, the lack of charging infrastructure in densely populated urban areas or regions with restricted access to electricity exacerbates the challenge, constraining the market potential for electric scooters and motorcycles in these areas and hindering their adoption as viable alternatives to traditional vehicles.

Electric Scooter and Motorcycle Market Segment Analysis

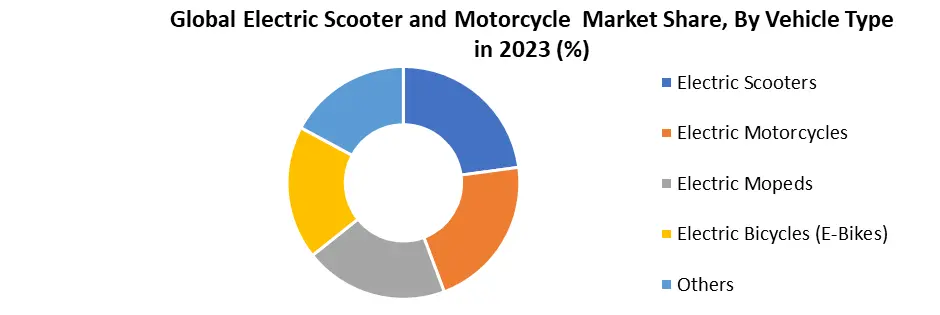

Based on Vehicle Type, the market is segmented into Electric Scooters, Electric Motorcycles, Electric Mopeds, Electric Bicycles (E-Bikes) and Others. Electric Scooters dominated the Electric Scooter and Motorcycle Market in 2023 and are expected to continue their dominance over the forecast period. Electric scooters have risen to prominence as the leading vehicle type in the market, driven by a multitude of factors spanning practicality, affordability, environmental consciousness, and widespread urban adoption. Urban commuters, grappling with escalating congestion and pollution in cities worldwide, are increasingly seeking sustainable and efficient transportation solutions. Electric scooters provide a convenient remedy for short-distance travel, enabling commuters to navigate crowded streets swiftly and reach their destinations with ease. Their compact dimensions and agile maneuverability make them adept at weaving through traffic, allowing users to circumvent gridlocked roads and significantly reduce travel times. Electric scooters offer accessibility to a broad spectrum of consumers due to their affordability and user-friendly design. Unlike electric motorcycles, which necessitate a motorcycle license and specialized training, electric scooters operate with minimal instruction, making them appealing to newcomers and experienced riders alike. This accessibility factor has broadened its appeal, attracting a diverse customer base encompassing students, professionals, and tourists exploring urban locales that fuel the Electric Scooter and Motorcycle Market growth. The electric scooters boast significant environmental benefits compared to their gasoline-powered counterparts. Emitting zero tailpipe emissions, they curb air pollution and combat climate change. As environmental concerns mount and the imperative for cleaner transportation options intensifies, electric scooters emerge as a compelling choice for eco-conscious consumers keen on reducing their carbon footprint and fostering a greener future.

Electric Scooter and Motorcycle Market Regional Insights

Asia Pacific held the Electric Scooter and Motorcycle Market share in 2023 and is expected to continue its dominance over the forecast period. The rapid growth of urban populations in this region, coupled with rising concerns over pollution and traffic congestion, has sparked a strong demand for sustainable transportation options. Many cities in Asia Pacific are grappling with severe air quality issues and crowded streets, making it crucial to find alternatives to traditional gas-powered vehicles. Electric scooters and motorcycles offer a cleaner and more efficient way to get around, which aligns well with the region's focus on environmental sustainability and reducing carbon emissions. Their compact size and agility make them particularly well-suited for navigating the crowded streets of Asia-Pacific's densely populated urban areas, making them even more appealing to consumers. The region has strong manufacturing capabilities and a reputation for technological innovation. Countries such as China, India, and Taiwan have become major centers for the production of electric vehicles, benefiting from well-established supply chains, skilled labor forces, and strong government support for the electric mobility sector. These countries have also seen substantial investments in research and development, leading to advancements in battery technology, motor efficiency, and overall vehicle performance. The presence of numerous startups and established automotive companies in the region fosters healthy competition and drives ongoing innovation in electric two-wheeler technology. This combination of favorable market conditions, supportive government policies, and a thriving ecosystem for innovation positions the region as a leader in the Electric Scooter and Motorcycle Market, shaping the future of urban mobility.Electric Scooter and Motorcycle Market Scope:Inquire before buying

Global Electric Scooter and Motorcycle Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.96 Bn. Forecast Period 2024 to 2030 CAGR: 4.3% Market Size in 2030: US $ 8 Bn. Segments Covered: by Vehicle Type Electric Scooters Electric Motorcycles Electric Mopeds Electric Bicycles (E-Bikes) Others by Battery Type Lithium-ion (Li-ion) batteries Lead-acid batteries Nickel-metal hydride (NiMH) batteries Others by Range Less Than 75 Miles 75 Miles to 100 Miles More Than 100 Miles Electric Scooter and Motorcycle Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&AElectric Scooter and Motorcycle Key Players

Global 1. Niu Technologies (Beijing, China) 2. Gogoro (Taipei, Taiwan) 3. Segway-Ninebot (Beijing, China) 4. Xiaomi (Beijing, China) 5. Zero Motorcycles (Scotts Valley, California, USA) North America 1. Harley-Davidson, Inc. (Milwaukee, Wisconsin, USA) 2. GenZe (Fremont, California, USA) 3. Vectrix Corporation (New Bedford, Massachusetts, USA) Europe 1. Energica Motor Company (Modena, Italy) 2. Vespa (Pontedera, Italy) Asia Pacific 1. Xiaomi (Beijing, China) 2. Hero Electric (New Delhi, India) 3. Evoke Motorcycles (Beijing, China) 4. Super Soco (Jiangsu, China) 5. Yadea Group Holdings Ltd. (Wuxi, China) 6. Revolt Motors (Gurugram, India) 7. Emflux Motors (Bengaluru, India) 8. Okinawa Autotech Pvt. Ltd (Gurugram, India) 9. Ampere Vehicles Pvt. Ltd. (Coimbatore, India) 10. Ather Energy (Bengaluru, India) 11. Mahindra Electric Mobility Ltd. (Bengaluru, India) 12. TVS Motor Company (Chennai, India) Frequently Asked Questions: 1] What is the growth rate of the Global Electric Scooter and Motorcycle Market? Ans. The Global Electric Scooter and Motorcycle Market is growing at a significant rate of 4.3% during the forecast period. 2] Which region is expected to dominate the Global Electric Scooter and Motorcycle Market? Ans. Asia Pacific is expected to dominate the Electric Scooter and Motorcycle Market during the forecast period. 3] What is the expected Global Electric Scooter and Motorcycle Market size by 2030? Ans. The Electric Scooter and Motorcycle Market size is expected to reach USD 8.00 Billion by 2030. 4] Which are the top players in the Global Electric Scooter and Motorcycle Market? Ans. The major top players in the Global Electric Scooter and Motorcycle Market are Niu Technologies (China) (Beijing, China), Gogoro (Taiwan) (Taipei, Taiwan, Segway-Ninebot (China) (Beijing, China), Xiaomi (China) (Beijing, China), Zero Motorcycles (USA) (Scotts Valley, California, USA), Harley-Davidson, Inc. (USA) (Milwaukee, Wisconsin, USA) and Others. 5] What are the factors driving the Global Electric Scooter and Motorcycle Market growth? Ans. The advancements in battery technology and government incentives and regulations are expected to drive market growth during the forecast period.

1. Electric Scooter and Motorcycle Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Electric Scooter and Motorcycle Market: Dynamics 2.1. Electric Scooter and Motorcycle Market Trends by Region 2.1.1. North America Electric Scooter and Motorcycle Market Trends 2.1.2. Europe Electric Scooter and Motorcycle Market Trends 2.1.3. Asia Pacific Electric Scooter and Motorcycle Market Trends 2.1.4. Middle East and Africa Electric Scooter and Motorcycle Market Trends 2.1.5. South America Electric Scooter and Motorcycle Market Trends 2.2. Electric Scooter and Motorcycle Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Electric Scooter and Motorcycle Market Drivers 2.2.1.2. North America Electric Scooter and Motorcycle Market Restraints 2.2.1.3. North America Electric Scooter and Motorcycle Market Opportunities 2.2.1.4. North America Electric Scooter and Motorcycle Market Challenges 2.2.2. Europe 2.2.2.1. Europe Electric Scooter and Motorcycle Market Drivers 2.2.2.2. Europe Electric Scooter and Motorcycle Market Restraints 2.2.2.3. Europe Electric Scooter and Motorcycle Market Opportunities 2.2.2.4. Europe Electric Scooter and Motorcycle Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Electric Scooter and Motorcycle Market Drivers 2.2.3.2. Asia Pacific Electric Scooter and Motorcycle Market Restraints 2.2.3.3. Asia Pacific Electric Scooter and Motorcycle Market Opportunities 2.2.3.4. Asia Pacific Electric Scooter and Motorcycle Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Electric Scooter and Motorcycle Market Drivers 2.2.4.2. Middle East and Africa Electric Scooter and Motorcycle Market Restraints 2.2.4.3. Middle East and Africa Electric Scooter and Motorcycle Market Opportunities 2.2.4.4. Middle East and Africa Electric Scooter and Motorcycle Market Challenges 2.2.5. South America 2.2.5.1. South America Electric Scooter and Motorcycle Market Drivers 2.2.5.2. South America Electric Scooter and Motorcycle Market Restraints 2.2.5.3. South America Electric Scooter and Motorcycle Market Opportunities 2.2.5.4. South America Electric Scooter and Motorcycle Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Electric Scooter and Motorcycle Industry 2.8. Analysis of Government Schemes and Initiatives For Electric Scooter and Motorcycle Industry 2.9. Electric Scooter and Motorcycle Market Trade Analysis 2.10. The Global Pandemic Impact on Electric Scooter and Motorcycle Market 3. Electric Scooter and Motorcycle Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 3.1.1. Electric Scooters 3.1.2. Electric Motorcycles 3.1.3. Electric Mopeds 3.1.4. Electric Bicycles (E-Bikes) 3.1.5. Others 3.2. Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 3.2.1. Lithium-ion (Li-ion) batteries 3.2.2. Lead-acid batteries 3.2.3. Nickel-metal hydride (NiMH) batteries 3.2.4. Others 3.3. Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 3.3.1. Less Than 75 Miles 3.3.2. 75 Miles to 100 Miles 3.3.3. More Than 100 Miles 3.4. Electric Scooter and Motorcycle Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Electric Scooter and Motorcycle Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 4.1.1. Electric Scooters 4.1.2. Electric Motorcycles 4.1.3. Electric Mopeds 4.1.4. Electric Bicycles (E-Bikes) 4.1.5. Others 4.2. North America Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 4.2.1. Lithium-ion (Li-ion) batteries 4.2.2. Lead-acid batteries 4.2.3. Nickel-metal hydride (NiMH) batteries 4.2.4. Others 4.3. North America Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 4.3.1. Less Than 75 Miles 4.3.2. 75 Miles to 100 Miles 4.3.3. More Than 100 Miles 4.4. North America Electric Scooter and Motorcycle Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 4.4.1.1.1. Electric Scooters 4.4.1.1.2. Electric Motorcycles 4.4.1.1.3. Electric Mopeds 4.4.1.1.4. Electric Bicycles (E-Bikes) 4.4.1.1.5. Others 4.4.1.2. United States Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 4.4.1.2.1. Lithium-ion (Li-ion) batteries 4.4.1.2.2. Lead-acid batteries 4.4.1.2.3. Nickel-metal hydride (NiMH) batteries 4.4.1.2.4. Others 4.4.1.3. United States Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 4.4.1.3.1. Less Than 75 Miles 4.4.1.3.2. 75 Miles to 100 Miles 4.4.1.3.3. More Than 100 Miles 4.4.2. Canada 4.4.2.1. Canada Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 4.4.2.1.1. Electric Scooters 4.4.2.1.2. Electric Motorcycles 4.4.2.1.3. Electric Mopeds 4.4.2.1.4. Electric Bicycles (E-Bikes) 4.4.2.1.5. Others 4.4.2.2. Canada Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 4.4.2.2.1. Lithium-ion (Li-ion) batteries 4.4.2.2.2. Lead-acid batteries 4.4.2.2.3. Nickel-metal hydride (NiMH) batteries 4.4.2.2.4. Others 4.4.2.3. Canada Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 4.4.2.3.1. Less Than 75 Miles 4.4.2.3.2. 75 Miles to 100 Miles 4.4.2.3.3. More Than 100 Miles 4.4.3. Mexico 4.4.3.1. Mexico Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 4.4.3.1.1. Electric Scooters 4.4.3.1.2. Electric Motorcycles 4.4.3.1.3. Electric Mopeds 4.4.3.1.4. Electric Bicycles (E-Bikes) 4.4.3.1.5. Others 4.4.3.2. Mexico Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 4.4.3.2.1. Lithium-ion (Li-ion) batteries 4.4.3.2.2. Lead-acid batteries 4.4.3.2.3. Nickel-metal hydride (NiMH) batteries 4.4.3.2.4. Others 4.4.3.3. Mexico Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 4.4.3.3.1. Less Than 75 Miles 4.4.3.3.2. 75 Miles to 100 Miles 4.4.3.3.3. More Than 100 Miles 5. Europe Electric Scooter and Motorcycle Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 5.2. Europe Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 5.3. Europe Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 5.4. Europe Electric Scooter and Motorcycle Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.1.2. United Kingdom Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 5.4.1.3. United Kingdom Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 5.4.2. France 5.4.2.1. France Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.2.2. France Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 5.4.2.3. France Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.3.2. Germany Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 5.4.3.3. Germany Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.4.2. Italy Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 5.4.4.3. Italy Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.5.2. Spain Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 5.4.5.3. Spain Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.6.2. Sweden Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 5.4.6.3. Sweden Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.7.2. Austria Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 5.4.7.3. Austria Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.8.2. Rest of Europe Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 5.4.8.3. Rest of Europe Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 6. Asia Pacific Electric Scooter and Motorcycle Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 6.2. Asia Pacific Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 6.3. Asia Pacific Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 6.4. Asia Pacific Electric Scooter and Motorcycle Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.1.2. China Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 6.4.1.3. China Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.2.2. S Korea Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 6.4.2.3. S Korea Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.3.2. Japan Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 6.4.3.3. Japan Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 6.4.4. India 6.4.4.1. India Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.4.2. India Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 6.4.4.3. India Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.5.2. Australia Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 6.4.5.3. Australia Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.6.2. Indonesia Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 6.4.6.3. Indonesia Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.7.2. Malaysia Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 6.4.7.3. Malaysia Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.8.2. Vietnam Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 6.4.8.3. Vietnam Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.9.2. Taiwan Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 6.4.9.3. Taiwan Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 7. Middle East and Africa Electric Scooter and Motorcycle Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 7.2. Middle East and Africa Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 7.3. Middle East and Africa Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 7.4. Middle East and Africa Electric Scooter and Motorcycle Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.1.2. South Africa Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 7.4.1.3. South Africa Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.2.2. GCC Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 7.4.2.3. GCC Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.3.2. Nigeria Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 7.4.3.3. Nigeria Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.4.2. Rest of ME&A Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 7.4.4.3. Rest of ME&A Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 8. South America Electric Scooter and Motorcycle Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 8.2. South America Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 8.3. South America Electric Scooter and Motorcycle Market Size and Forecast, by Range(2023-2030) 8.4. South America Electric Scooter and Motorcycle Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 8.4.1.2. Brazil Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 8.4.1.3. Brazil Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 8.4.2.2. Argentina Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 8.4.2.3. Argentina Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Electric Scooter and Motorcycle Market Size and Forecast, by Vehicle Type (2023-2030) 8.4.3.2. Rest Of South America Electric Scooter and Motorcycle Market Size and Forecast, by Battery Type (2023-2030) 8.4.3.3. Rest Of South America Electric Scooter and Motorcycle Market Size and Forecast, by Range (2023-2030) 9. Global Electric Scooter and Motorcycle Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Electric Scooter and Motorcycle Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Niu Technologies (Beijing, China) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Gogoro (Taipei, Taiwan) 10.3. Segway-Ninebot (Beijing, China) 10.4. Xiaomi (Beijing, China) 10.5. Zero Motorcycles (Scotts Valley, California, USA) 10.6. Harley-Davidson, Inc. (Milwaukee, Wisconsin, USA) 10.7. GenZe (Fremont, California, USA) 10.8. Vectrix Corporation (New Bedford, Massachusetts, USA) 10.9. Energica Motor Company (Modena, Italy) 10.10. Vespa (Pontedera, Italy) 10.11. Xiaomi (Beijing, China) 10.12. Hero Electric (New Delhi, India) 10.13. Evoke Motorcycles (Beijing, China) 10.14. Super Soco (Jiangsu, China) 10.15. Yadea Group Holdings Ltd. (Wuxi, China) 10.16. Revolt Motors (Gurugram, India) 10.17. Emflux Motors (Bengaluru, India) 10.18. Okinawa Autotech Pvt. Ltd (Gurugram, India) 10.19. Ampere Vehicles Pvt. Ltd. (Coimbatore, India) 10.20. Ather Energy (Bengaluru, India) 10.21. Mahindra Electric Mobility Ltd. (Bengaluru, India) 10.22. TVS Motor Company (Chennai, India) 11. Key Findings 12. Industry Recommendations 13. Electric Scooter and Motorcycle Market: Research Methodology 14. Terms and Glossary