CNG and LPG Vehicle Market size was valued at USD 5.23 Billion in 2023 and the CNG and LPG Vehicle Market revenue is expected to reach USD 7.20 Billion by 2030, at a CAGR of 3.71 % over the forecast period.CNG and LPG Vehicle Market Overview

The CNG (Compressed Natural Gas) and LPG (Liquefied Petroleum Gas) vehicle market refers to the segment of the automotive industry that involves vehicles that utilize either compressed natural gas or liquefied petroleum gas as fuel instead of traditional gasoline or diesel. CNG is stored under high pressure in tanks onboard the vehicle. CNG vehicles are popular due to their lower emissions compared to gasoline or diesel vehicles and the relatively lower cost of natural gas compared to petroleum fuels. LPG vehicles, also known as propane vehicles, are equipped to run on liquefied petroleum gas, typically propane or butane. LPG is stored in a liquid state in tanks onboard the vehicle, and it is converted into vapor before being sent to the engine. LPG vehicles are chosen by some consumers due to their lower emissions and cost advantages compared to traditional gasoline vehicles.To know about the Research Methodology :- Request Free Sample Report The CNG and LPG vehicle market encompasses various stakeholders, including automobile manufacturers producing dedicated CNG or LPG vehicles, conversion companies offering retrofitting services to convert conventional gasoline vehicles to CNG or LPG, fuelling station operators providing CNG and LPG refueling infrastructure, regulatory bodies setting emission standards and incentives, and consumers opting for alternative fuel vehicles for environmental or economic reasons. CNG and LPG Vehicles is not limited to a specific geographical region. The market has a global presence, with consumers across different continents showing interest in these supplements. This CNG and LPG Vehicle Market Report offers a specific and detailed market overview with statistical as well as pre-sized trendy data. This CNG and LPG Vehicle Market report showcases the CNG and LPG Vehicle market situation with Dynamics, Market Segment, Regional Analysis, and Top Competitor's Market Position.

CNG and LPG Vehicle Market Dynamics

Growing Environmental Awareness and Concerns Over Air Quality Have Led to Increased Interest in Alternative Fuel Vehicles like CNG and LPG Vehicles. These vehicles produce lower emissions of harmful pollutants such as carbon dioxide (CO2), nitrogen oxides (NOx), and particulate matter compared to conventional gasoline and diesel vehicles, making them attractive options for individuals and businesses looking to reduce their carbon footprint and comply with stringent emission regulations. Government policies and regulations play a crucial role in shaping the CNG and LPG Vehicle Market. Many governments around the world offer incentives such as tax credits, subsidies, and rebates to promote the adoption of alternative fuel vehicles and build infrastructure for CNG and LPG refueling stations. Additionally, regulatory mandates such as emission standards and targets drive automakers to develop and offer CNG and LPG vehicle options in their product portfolios. Advancements in technology have improved the efficiency, performance, and affordability of CNG and LPG vehicles. Innovations in engine design, fuel storage systems, and conversion technologies have made CNG and LPG vehicles more practical and accessible for consumers. These advancements have also contributed to increased driving range and reduced refueling times, addressing some of the concerns that previously hindered the widespread adoption of alternative fuel vehicles. Economic considerations such as fluctuating oil prices and the availability of natural gas resources influence consumer and fleet operator decisions regarding vehicle fuel choices. CNG and LPG vehicles offer cost savings potential over the long term, as natural gas prices tend to be more stable and lower than gasoline and diesel prices in many regions. Additionally, reduced maintenance costs and potential tax incentives further enhance the economic attractiveness of CNG and LPG vehicles, driving demand in the CNG and LPG Vehicle Market. Overall, these drivers collectively contribute to the growth and expansion of the CNG and LPG Vehicle Market worldwide. Advanced maintenance cost and primary investment cost compared to petroleum vehicles CNG and LPG Vehicles tend to be priced higher than regular petrol vehicles in the CNG and LPG Vehicle Market. This is due to the extra components added to these vehicles. As some parts of these vehicles get damaged faster compared to petrol vehicles due to lack of lubrication in most of these vehicles, these vehicles need much more regular maintenance over the years and thus cost more in the long term. Also, the parts need to be replaced from time to time compared to petrol vehicles which usually have a longer life for such parts. Thus, only people who drive a lot every month prefer using CNG and LPG vehicles. For instance, fleet providers may use CNG as they can drive a lot daily for their services. CNG and LPG Vehicles are cost-effective only when the vehicles are extensively driven. Rising concerns of countries around the world for lower emission fuel vehicles. The rising concerns for reducing emissions by countries all around the world may lead to an increase in the growth of low-emission fuel vehicles like CNG and LPG Vehicles in the CNG and LPG Vehicle Market. European countries have declared the ambition to reduce emissions in the coming decades and may be a major market for these vehicles in the coming years. Asian countries have already been supporting the growth of alternative fuel vehicles like CNG and LPG for a reduction in emissions and cost due to the import of petrol. As the present vehicles can be easily changed to CNG or LPG fuel systems and at an affordable price, we can expect explosive growth in the CNG and LPG Vehicle Market and aftermarket in the coming years. Improper Drainage causes cylinder damage CNG and LPG systems have various challenges that need to be addressed. With increasing technology, many such challenges have been mitigated. However, some key challenges still need to be addressed. One such problem is improper drainage which causes unnecessary cylinder damage. NPFA 52 requires the shield systems to be able to drain solids and liquids away from the cylinder. This means that holes are drilled at certain intervals. However, it has been discovered that many suppliers of kit services provide no allowance for drainage that is provided in the company-fitted systems.

CNG and LPG Vehicle Market Segment Analysis

Compressed Natural Gas (CNG) is estimated to hold the highest share of 94.7% in 2024 in the market owing to its cost-effectiveness and environmental friendliness relative to gasoline and diesel in the CNG and LPG Vehicle Market. CNG vehicles offer significant savings at the pump as natural gas is currently priced nearly 40-50% lower than an equivalent amount of gasoline. With fluctuating crude oil prices pushing petrol and diesel costs higher, consumers are increasingly attracted to CNG for its stable and affordable fuelling option. This factor has significantly boosted the adoption of new CNG vehicles as well as conversions of existing gasoline models. The passenger vehicle segment is estimated to hold the highest share of 83% in 2024 in the CNG and LPG Vehicle Market. Changing consumer preferences toward family transportation underlines this segment's prominence. Rapid urbanization and improving economic conditions have boosted the sedan and Sports Utility Vehicles demand for commutes, school runs, and weekend getaways.CNG and LPG Vehicle Market Regional Analysis

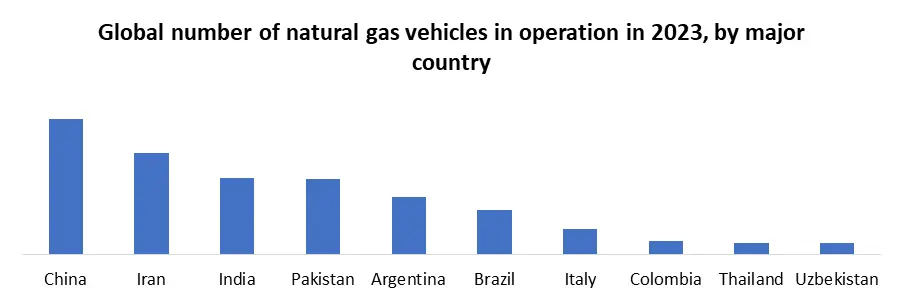

The global CNG and LPG Vehicle Market is analyzed and market size insights and trends are provided by countries, vehicle type, and fuel type as referenced above. The countries covered in the global CNG and LPG vehicles market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E., Saudi Arabia, Egypt, South Africa, Israel, and Rest of Middle East and Africa. Asia Pacific dominates the global CNG and LPG Vehicle Market, with India anticipated to boast the highest number of CNG vehicles globally. This dominance is attributed to elevated petrol and diesel prices, strict automotive emissions standards, widespread adoption of CNG in buses, taxis, and auto-rickshaws, a substantial presence of CNG/LPG retrofitting kits, prevalent conversion of old petrol and diesel vehicles to CNG/LPG, and a limited penetration of electric vehicles. CNG and LPG Vehicle Market growth is further propelled by rising demand for passenger cars, substantial investments from major original equipment manufacturers, and concurrent infrastructural advancements. Europe is the fastest growing region in the global CNG and LPG Vehicle Market, due to the exploding population and high demand for clean fuel, and the European LNG fuelling network is still expanding as of now approx. 690 LNG and 4160 CNG fuelling stations in Europe. The region section of the report also provides individual market-impacting factors and changes in regulation in the CNG and LPG Vehicle Market domestically that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and Porter’s five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.CNG and LPG Vehicle Market Competitive Analysis In May 2023, the European Council officially approved updated regulations mandating that only new 100% electric and hydrogen fuel cell vehicles can be sold in the European CNG and LPG Vehicle Market from 2035, both for individual and commercial use. The sale of petrol, diesel, E85, LPG, CNG, and various hybrids, including rechargeable ones, will be banned. This decision will notably impact a sector employing 12.5 million people in Europe, including around 400,000 direct jobs in France. In March 2023, HAM Group inaugurated a new liquefied natural gas (LNG) and compressed natural gas (CNG) service station in Benavente, Zamora, located at Caada Berciana 9A. The strategic location near the A-6 (Northwest route), one of Spain's major radial highways, and the N-630, one of the country's longest national highways, enhances accessibility and convenience for customers. In March 2022, Anhui Ankai Automobile Co. from China successfully shipped 800 CNG buses to Mexico as part of the Xinhua Silk Route Initiative, strengthening collaboration between China and Mexico. These buses are designated for public transportation services in the city of Monterrey. In November 2022, Toyota Kirloskar Motor Pvt. Ltd., an India-based joint venture of Toyota Motor Corp., introduced the Compressed Natural Gas (CNG) variant of their high-end hatchback, the Toyota Glanza, to the Indian CNG and LPG Vehicle Market.

Scope of the Global CNG and LPG Vehicle Market: Inquire before buying

Global CNG and LPG Vehicle Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.23 Bn. Forecast Period 2024 to 2030 CAGR: 3.71% Market Size in 2030: US $ 7.20 Bn. Segments Covered: by Vehicle Type Passenger Light Commercial Medium Commercial by Fuel Type CNG LPG CNG and LPG Vehicle Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading CNG and LPG Vehicle Key Players Include

1. Hyundai Motor Group 2. Landi Renzo 3. Impco 4. General Motors 5. Ford Motor Company 6. Suzuki Motor Corporation 7. Venchurs 8. Westport 9. Fiat S.P.A 10. Volkswagen 11. Honda Motor Co 12. Tomasetoo Achile 13. Nissan 14. Tata 15. Groupe Renault 16. Navistar Inc. 17. AB Volvo 18. KION GROUP AG 19. AC S.A. 20. Landi Renzo S.p.a. Frequently Asked Questions in the CNG and LPG Vehicles Market: 1. What are the main advantages of CNG and LPG vehicles over traditional gasoline vehicles? Ans: Both CNG and LPG vehicles offer lower operating costs due to the generally lower price of natural gas compared to gasoline. Additionally, they produce fewer emissions, making them environmentally friendly options. 2. What advancements in technology are driving the growth of the CNG and LPG vehicle market? Ans: Technological advancements in engine design, fuel storage systems, and conversion technologies are improving the efficiency, performance, and affordability of CNG and LPG vehicles.. 3. Which region contributes notably towards the global CNG and LPG Vehicle Market? Ans: North America contributes notably towards the global CNG and LPG Vehicle Market. 4. What will be the expected CAGR of the CNG and LPG Vehicle Market during the forecast period (2023-2032)? Ans: The global CNG and LPG Vehicle market is expected to grow at a CAGR of 3.71% during the forecast period. 5. What impact do fluctuating oil prices have on the CNG and LPG vehicle market? Ans: Fluctuating oil prices can influence consumer decisions regarding vehicle fuel choices, with CNG and LPG vehicles offering cost savings potential over the long term due to the generally more stable and lower price of natural gas compared to gasoline.

1. CNG and LPG Vehicle Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. CNG and LPG Vehicle Market: Dynamics 2.1. CNG and LPG Vehicle Market Trends by Region 2.1.1. North America CNG and LPG Vehicle Market Trends 2.1.2. Europe CNG and LPG Vehicle Market Trends 2.1.3. Asia Pacific CNG and LPG Vehicle Market Trends 2.1.4. Middle East and Africa CNG and LPG Vehicle Market Trends 2.1.5. South America CNG and LPG Vehicle Market Trends 2.2. CNG and LPG Vehicle Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America CNG and LPG Vehicle Market Drivers 2.2.1.2. North America CNG and LPG Vehicle Market Restraints 2.2.1.3. North America CNG and LPG Vehicle Market Opportunities 2.2.1.4. North America CNG and LPG Vehicle Market Challenges 2.2.2. Europe 2.2.2.1. Europe CNG and LPG Vehicle Market Drivers 2.2.2.2. Europe CNG and LPG Vehicle Market Restraints 2.2.2.3. Europe CNG and LPG Vehicle Market Opportunities 2.2.2.4. Europe CNG and LPG Vehicle Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific CNG and LPG Vehicle Market Drivers 2.2.3.2. Asia Pacific CNG and LPG Vehicle Market Restraints 2.2.3.3. Asia Pacific CNG and LPG Vehicle Market Opportunities 2.2.3.4. Asia Pacific CNG and LPG Vehicle Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa CNG and LPG Vehicle Market Drivers 2.2.4.2. Middle East and Africa CNG and LPG Vehicle Market Restraints 2.2.4.3. Middle East and Africa CNG and LPG Vehicle Market Opportunities 2.2.4.4. Middle East and Africa CNG and LPG Vehicle Market Challenges 2.2.5. South America 2.2.5.1. South America CNG and LPG Vehicle Market Drivers 2.2.5.2. South America CNG and LPG Vehicle Market Restraints 2.2.5.3. South America CNG and LPG Vehicle Market Opportunities 2.2.5.4. South America CNG and LPG Vehicle Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For CNG and LPG Vehicle Industry 2.8. Analysis of Government Schemes and Initiatives For CNG and LPG Vehicle Industry 2.9. CNG and LPG Vehicle Market Trade Analysis 2.10. The Global Pandemic Impact on CNG and LPG Vehicle Market 3. CNG and LPG Vehicle Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 3.1.1. Passenger 3.1.2. Light Commercial 3.1.3. Medium Commercial 3.2. CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 3.2.1. CNG 3.2.2. LPG 3.3. CNG and LPG Vehicle Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America CNG and LPG Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 4.1.1. Passenger 4.1.2. Light Commercial 4.1.3. Medium Commercial 4.2. North America CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 4.2.1. CNG 4.2.2. LPG 4.3. North America CNG and LPG Vehicle Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 4.3.1.1.1. Passenger 4.3.1.1.2. Light Commercial 4.3.1.1.3. Medium Commercial 4.3.1.2. United States CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 4.3.1.2.1. CNG 4.3.1.2.2. LPG 4.3.2. Canada 4.3.2.1. Canada CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 4.3.2.1.1. Passenger 4.3.2.1.2. Light Commercial 4.3.2.1.3. Medium Commercial 4.3.2.2. Canada CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 4.3.2.2.1. CNG 4.3.2.2.2. LPG 4.3.3. Mexico 4.3.3.1. Mexico CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 4.3.3.1.1. Passenger 4.3.3.1.2. Light Commercial 4.3.3.1.3. Medium Commercial 4.3.3.2. Mexico CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 4.3.3.2.1. CNG 4.3.3.2.2. LPG 5. Europe CNG and LPG Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.2. Europe CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 5.3. Europe CNG and LPG Vehicle Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.3.1.2. United Kingdom CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 5.3.2. France 5.3.2.1. France CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.3.2.2. France CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 5.3.3. Germany 5.3.3.1. Germany CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.3.3.2. Germany CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 5.3.4. Italy 5.3.4.1. Italy CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.3.4.2. Italy CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 5.3.5. Spain 5.3.5.1. Spain CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.3.5.2. Spain CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.3.6.2. Sweden CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 5.3.7. Austria 5.3.7.1. Austria CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.3.7.2. Austria CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.3.8.2. Rest of Europe CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 6. Asia Pacific CNG and LPG Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.2. Asia Pacific CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 6.3. Asia Pacific CNG and LPG Vehicle Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.3.1.2. China CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.3.2.2. S Korea CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 6.3.3. Japan 6.3.3.1. Japan CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.3.3.2. Japan CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 6.3.4. India 6.3.4.1. India CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.3.4.2. India CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 6.3.5. Australia 6.3.5.1. Australia CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.3.5.2. Australia CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.3.6.2. Indonesia CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.3.7.2. Malaysia CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.3.8.2. Vietnam CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.3.9.2. Taiwan CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.3.10.2. Rest of Asia Pacific CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 7. Middle East and Africa CNG and LPG Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 7.2. Middle East and Africa CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 7.3. Middle East and Africa CNG and LPG Vehicle Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 7.3.1.2. South Africa CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 7.3.2. GCC 7.3.2.1. GCC CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 7.3.2.2. GCC CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 7.3.3.2. Nigeria CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 7.3.4.2. Rest of ME&A CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 8. South America CNG and LPG Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 8.2. South America CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 8.3. South America CNG and LPG Vehicle Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 8.3.1.2. Brazil CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 8.3.2.2. Argentina CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America CNG and LPG Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 8.3.3.2. Rest Of South America CNG and LPG Vehicle Market Size and Forecast, by Fuel Type (2023-2030) 9. Global CNG and LPG Vehicle Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading CNG and LPG Vehicle Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Hyundai Motor Group 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Landi Renzo 10.3. Impco 10.4. General Motors 10.5. Ford Motor Company 10.6. Suzuki Motor Corporation 10.7. Venchurs 10.8. Westport 10.9. Fiat S.P.A 10.10. Volkswagen 10.11. Honda Motor Co 10.12. Tomasetoo Achile 10.13. Nissan 10.14. Tata 10.15. Groupe Renault 10.16. Navistar Inc. 10.17. AB Volvo 10.18. KION GROUP AG 10.19. AC S.A. 10.20. Landi Renzo S.p.a. 11. Key Findings 12. Industry Recommendations 13. CNG and LPG Vehicle Market: Research Methodology 14. Terms and Glossary