Dry Shampoo Market size was valued at US$ 5.35 Bn. in 2023. Dry Shampoo will encourage a great deal of transformation in the Haircare and Personal Care Industry.Dry Shampoo Market Overview:

Dry shampoo, available in powder or aerosol form, offers a waterless hair cleansing solution, absorbing oil, sweat, and product residue to leave hair feeling clean and volumized. Its convenience suits busy lifestyles. Factors driving this growth include heightened hair health consciousness, time-saving preferences, diverse formulations like tinted options, increased marketing, and the trend toward natural-looking hairstyles. With rising disposable incomes, especially in developing economies, Dry Shampoo Market demand for convenient hair care solutions. The growing dry shampoo market is propelled by diverse factors, significantly influenced by evolving consumer behaviors and preferences. Consumers, increasingly mindful of the detrimental effects of excessive washing on hair health, seek gentler alternatives. Dry shampoo emerges as a gentle yet effective solution, cleansing and rejuvenating hair without compromising its natural oils, thereby fostering healthier hair maintenance. Unilever stands tall in the realm of consumer goods, recognized for its prized Batiste brand. Batiste's acclaim springs from its accessibility, vast product assortment, and notably effective formulations. The brand prides itself on addressing diverse consumer hair care needs, offering a rich array of dry shampoos spanning regular, tinted, and scent-specific options, catering to individual preferences. Dry Shampoo Market has innovative hair care product that enables individuals to prolong their hairstyles, minimizing the need for frequent washing and heat styling, which potentially damage hair strands. In a recent strategic maneuver in October 2023, Unilever made waves by introducing a fresh line of Batiste dry shampoos, harnessing the power of naturally sourced components and vegan-friendly formulas. This moves cements Unilever's leading position and adaptability within the industry, showcasing its dedication to sustainable advancements and consumer-driven innovation. This unveiling strategically aligns with Unilever's astute response to the evolving consumer trend leaning towards eco-conscious and ethical beauty products. The incorporation of these environmentally considerate formulations harmonizes seamlessly with the shifting market dynamics, symbolizing Unilever's steadfast commitment to innovation and meeting the heightened expectations of today's consumers.To know about the Research Methodology :- Request Free Sample Report

Dry Shampoo Market Dynamics:

Revolutionizing Haircare: The Global Surge of Dry Shampoo in a Time-Pressed World In the bustling landscape of modern life, time reigns as a prized commodity. Enter dry shampoo, heralded as the "bouncy blowout" of the hair care market. This revolutionary solution champions convenience, offering a swift and efficient alternative to traditional hair washing and styling rituals. The growing demand stems from a global surge in time-pressed consumers navigating the whirlwind of professional commitments, familial responsibilities, and social engagements. Embraced by a diverse audience, from executives managing hectic schedules to multitasking parents and the convenience-driven millennial and Gen Z cohorts, dry shampoo emerges as the go-to quick fix for maintaining a polished appearance without sacrificing precious time. Illustrating this trend's impact is L'Oréal's strategic campaign tailored for the Indian Dry Shampoo Market has innovative hair care product that enables individuals to prolong their hairstyles, minimizing the need for frequent washing and heat styling, which potentially damage hair strands. By spotlighting dry shampoo's convenience for working women in India's time-strapped society, L'Oréal witnessed significant market share growth, underscoring the potency of culturally sensitive marketing strategies. The evolution of dry shampoo transcends merely targeted campaigns; Dry Shampoo manufacturers continuously innovate to amplify its user-friendliness. Compact travel-sized packaging enables on-the-go touch-ups, while aerosol and spray formats offer hassle-free application. Scented varieties not only refresh hair but also leave it delicately fragranced. Moreover, the advent of multifunctional formulas, providing volumizing, texturizing, or color-enhancing benefits, elevates the convenience quotient. This convenience narrative isn't confined to specific regions; it's a worldwide phenomenon. As societies worldwide grapple with escalating demands, the quest for time-saving solutions propels the global dry shampoo market into a new era, defining a paradigm shift in hair care practices across cultures. Market trends and challenges are analyzed and compiled in the report.Trends The Hair Health Awareness trend emerges as a pivotal driver, reshaping the dry shampoo market landscape. This trend transcends the traditional pursuit of convenience, aligning with a burgeoning consciousness surrounding hair well-being. Consumers increasingly comprehend the adverse effects of excessive washing and harsh hair care, seeking gentler alternatives that preserve hair health. Dry shampoo stands out as a hero, facilitating extended washing intervals by absorbing excess oil and sweat, thereby safeguarding the natural sebum essential for healthy, hydrated hair. Moreover, its avoidance of harsh chemicals commonly found in traditional shampoos supports scalp health, potentially mitigating concerns like dandruff. This driver resonates notably with health-conscious individuals valuing natural, nourishing formulations and those with delicate hair types seeking gentle care. Additionally, the alignment with eco-friendly values through reduced water usage further amplifies its appeal. As manufacturers continue to innovate with nourishing blends and scalp-soothing botanicals, this global movement toward hair health-oriented choices promises significant Dry Shampoo Market growth, particularly for brands prioritizing gentle and natural formulations. Navigating Dry Shampoo Markets Future: Balancing Challenges and Innovations Despite the popularity of dry shampoos, ingredient worries persist among consumers. To assuage these concerns, manufacturers need transparency and emphasis on natural or sustainable alternatives. By providing comprehensive ingredient information, aligning with the surging demand for healthier and transparent products. The use of aerosol cans in dry shampoo sparks environmental worries. Manufacturers face the task of reducing their carbon footprint while meeting consumer needs. Introducing refillable options and exploring eco-friendly packaging aligns with consumer eco-consciousness, addressing the product's environmental impact. Dry Shampoo Market opportunities in the dynamic dry shampoo sector encompass diversified demographics, eco-friendly formulations, optimized online presence, tailored hair-type formulations, sustainability focus, educational initiatives, customizable options, influencer partnerships, global expansion, and multifunctional benefits. Developing economies offer vast opportunities, but market entry necessitates cultural adaptability. Understanding diverse preferences and local hair care habits is crucial. Tailoring products to suit these specific needs drive substantial growth in these regions. Future market growth hinge on technological advancements. Smart applicators ensuring precise usage and AI-driven personalized recommendations revolutionize the user experience, fostering market expansion. Leveraging these innovations will be pivotal in driving the dry shampoo market forward, aligning with evolving consumer needs and global Dry Shampoo Market demands.

Hair Health Revolutionizing Dry Shampoo Market

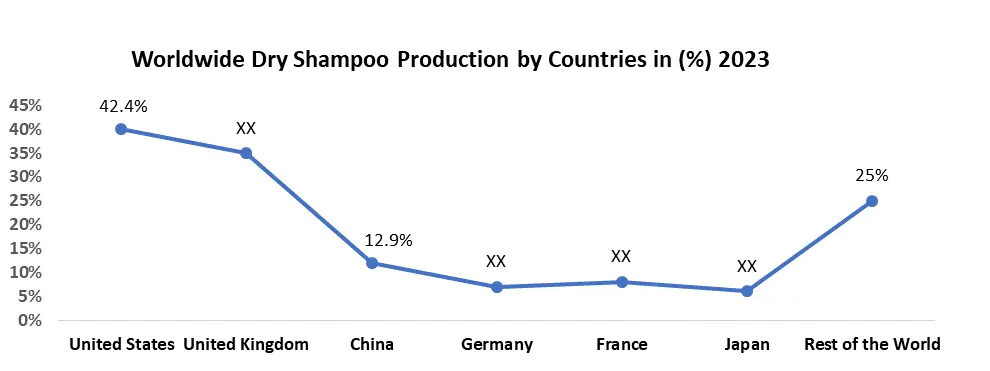

Country Market Share Range Key Factors Driving Consumption United States 42.4% Large population, busy lifestyles, strong brand presence United Kingdom xx% High disposable income, focus on hair care China 12.9% Rapidly growing market, rising disposable incomes Germany xx% Focus on quality and salon-grade hair care France xx% Emphasis on beauty and personal care Japan xx% High urbanization, convenience culture Rest of the World 25% Varied consumption patterns across other regions

Dry Shampoo Market Segment Analysis:

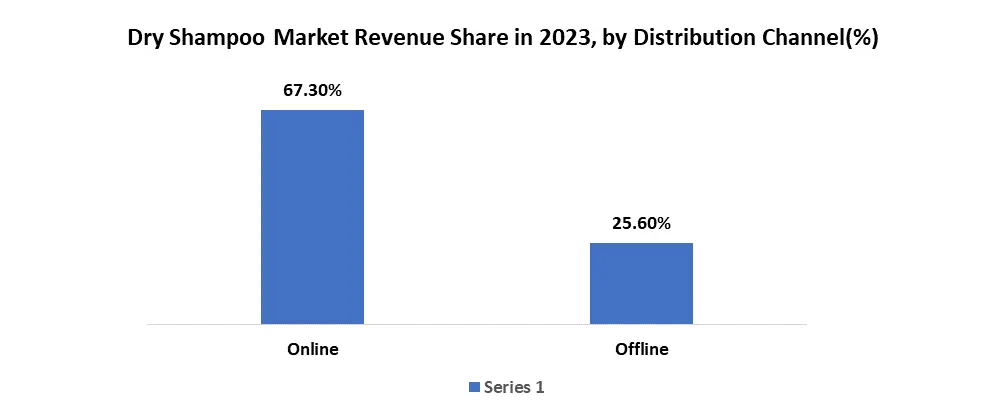

By Form, the Spray segment dominated the Dry Shampoo Market with a 63.7% share in 2023. The ability to apply the product to the root of the hair is the major factor driving the segment growth. Also helps add content and volume to the hair and removes hair and scalp residues. Increasing demand for waterless products along with natural ingredients such as charcoal is driving the segment demand. These factors are driving the segment growth through the forecast period. The powder segment is expected to grow at a CAGR of 6.7% through the forecast period. This is used by consumers who are more concerned about the reaction of chemicals to their hair. The powder mixes well with the hair and scalp and provides nutrients more evenly to all parts of the head than other shapes such as sprays and foams. These factors are expected to drive the growth of the segment in the market through the forecast period. By End User, the Women segment dominated the Dry Shampoo Market with a 60.6% share in 2023. This product is pursued as a celebrity and upper-class hair care product. Spread of shampoos that increase the durability of dyes and black-haired women prefer these products because they still have the property of resisting white hair. The growing population of working women who need additional grooming for long hair in a limited amount of time. These factors are driving the growth of the segment in the market. The men segment is expected to grow at a CAGR of 7.3% through the forecast period. Growth in trendy lifestyles and rising trends in the men's fashion and hair care industry. Shiny hair care products are gradually gaining acceptance in men. Increasing acceptance of ready-made products among the corporate population and acceptance of products in the men's grooming category to save hair styling time. These factors are expected to drive the demand for the product through the forecast period. By Distribution Channel, In Dry Shampoo Market is segmented into Online and Offline the Offline segment dominated the market with 67.3% share in 2023. Growing consumer preference to physically access and check quality of products prior to purchase. Finding a variety of products across stores that have access to real-time negotiation of transactions. Simple price comparisons of different categories and brands drive this segment. The emergence of trendy products in specialty stores, department stores, etc. These factors are driving the market growth of the segment in the market. An increasing number of e-commerce websites such as Myntra, Amazon, and Flipkart offer a wide range of products to consumers. The growing number of offers, deals, discount items, and leading online retailers in the industry through the online channel. These factors are expected to drive the growth of the segment through the forecast period

Rank Company Production Strategy Consumption Strategy 1 Church & Dwight Co. (Batiste) Focuses on affordability, wide product range, and diverse formulas. Utilizes economies of scale in production. Targets broad consumer base through mass-market distribution and targeted marketing campaigns. 2 Procter & Gamble (Drybar) Emphasizes premium branding, salon-quality results, and innovative formulas. Employs strategic partnerships with hairstylists and influencers. Focuses on high-end retailers and professional hair salons. Targets beauty-conscious consumers willing to pay more for premium quality. 3 Unilever (Elnett Satin Dry Shampoo) Leverages existing brand recognition and hair expertise. Offers fragrant options and diverse formulas for specific hair types. Utilizes established distribution channels and brand loyalty. Employs targeted marketing campaigns for different product lines. 4 Henkel AG & Co. KGaA (Schwarzkopf) Positions itself as a specialist in hair care solutions. Develops advanced formulas with emphasis on hair health and volume. Primarily focuses on European markets. Utilizes strong brand reputation and collaborations with hairdressers. 5 L'Oréal S.A. (Elnett Satin, Kerastase) Offers both mass-market and premium dry shampoos, catering to diverse consumer segments. Invests in research and development of new technologies. Employs multi-brand strategy, leveraging Elnett Satin's popularity and Kerastase's luxury positioning. Utilizes social media and influencer marketing. 6 Klorane Known for its natural and plant-based formulas. Targets consumers seeking gentle and eco-friendly options. Focuses on pharmacies and natural beauty stores. Emphasizes transparency in ingredient sourcing and sustainability practices. 7 Shiseido Company Limited Offers high-quality dry shampoos formulated with advanced technologies. Targets consumers seeking premium hair care solutions. Primarily focused on Asian markets. Utilizes strong brand loyalty and partnerships with beauty salons. 8 Coty Inc. (Wella Professionals) Primarily caters to professional hairdressers and salons. Offers high-performance dry shampoos for specific hair needs. Focuses on B2B sales and technical training for hairstylists. Develops partnerships with hair shows and professional associations. 9 Revlon Offers affordable dry shampoos with diverse fragrances and formulations. Targets cost-conscious consumers. Uses mass-market retail channels and promotional campaigns. Focuses on value for money proposition. 10 Kristin Ess Positions itself as a celebrity hairstylist-backed brand with salon-quality formulas. Targets millennials and Gen Z consumers. Utilizes online sales and social media marketing. Emphasizes trendy packaging and product collaborations with influencers. Regional Insights:

North America dominated the Dry Shampoo Market with a 54.23% share in 2023. Demand for products is increasing due to the growth of application fields such as hair care products as the population ages. Increasing demand for anti-aging products for trendy hairstyles, increase in the workforce, and disposable income. These factors are driving the demand for the product in the market. Asia Pacific region is expected to grow during the forecast period. Increased demand for beauty and natural care products in the region. Increasing consumer awareness of the beauty and personal well-being. The increasing young population, rising disposable income, etc. these factors are expected to drive the growth of the market through the forecast period in this region. The objective of the report is to present a comprehensive analysis of the Dry Shampoo market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Dry Shampoo market dynamics, structure by analysing the market segments and projecting the Dry Shampoo market Share. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Dry Shampoo market make the report an investor’s guide.Dry Shampoo Market Competitive Analysis

In the Competitive landscape of dry shampoo, innovation sparks a robust competition akin to the revitalizing effect of a skillful dry shampoo application. Key market contenders Unilever, Church & Dwight, Procter & Gamble (P&G), L'Oréal, and Henkel these companies are the largest manufacturers of drt Shampoo. Unilever leads the charge with a formidable presence driven by widely acclaimed brands such as TRESemmé and Batiste, securing the largest global market share. Church & Dwight, renowned for the iconic pink Batiste bottle, emerges as a robust rival to Unilever, a Manufacturer in European and American markets, emphasizing affordability and trend-centric fragrances. P&G steps into the arena with Herbal Essences Dry Shampoo, leveraging its brand recognition and deep-rooted expertise in hair care to offer specialized formulations addressing specific hair concerns such as volume and color protection. L'Oréal's Kerastase Dry Shampoo targets luxury-seeking consumers, spotlighting premium ingredients and professional-grade outcomes, while Henkel's Schwarzkopf Dry Shampoo adeptly meets diverse European hair needs, emphasizing sustainability initiatives that strike a chord with eco-conscious consumers. Price analysis of dry Shampoo Market reveals a broad spectrum, with dry shampoo prices varying widely based on brand, quality, and target audience. Brands like Batiste present budget-friendly options as low as $5, while luxury offerings such as Kerastase reach higher price points surpassing $30. This wide-ranging pricing strategy ensures accessibility for both budget-conscious consumers and those seeking premium products, catering to diverse preferences. Market penetration stands most pronounced in North America, boasting a saturation rate of approximately 40%. Unilever and Church & Dwight dominate this region, with Batiste holding a robust market position. Following closely behind, Europe showcases a penetration rate of around 35%, where L'Oréal and Henkel wield considerable influence, aligning product offerings with diverse European consumer needs. the Asia-Pacific region emerges as a hotspot for rapid growth, projecting a staggering CAGR of over 9%. This dynamic region welcomes a mix of local and established brands, adapting products to unique hair requirements and cultural preferences, signifying immense market potential. Unilever secures the largest market share globally, closely followed by Church & Dwight, their widespread distribution networks, diverse product portfolios, and effective marketing strategies have solidified their positions as industry leaders, defining the competitive landscape of the thriving dry shampoo market.Dry Shampoo Market Scope: Inquire before buying

Global Dry Shampoo Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.35 Bn. Forecast Period 2024 to 2030 CAGR: 8% Market Size in 2030: US $ 9.18Bn. Segments Covered: By Form Spray Powder Others By End User Men Women Children By Distribution Channel Offline Online Dry Shampoo Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Dry Shampoo Market Key Players:

Europe 1. Unilever (United Kingdom/Netherlands) 2. Pierre Fabre (France) 3. L’Oreal SA (France) 4. Henkel AG & Company KGaA (Germany) Asia Pacific 1. Shiseido Company Ltd. (Japan) 2. Kao Corporation (Japan) 3. BBLUNT (India) North America 1. Procter & Gamble Company (United States) 2. Revlon Inc. (United States) 3. Church & Dwight Co, Inc. (United States) 4. New Avon LLC (United States) 5. The Estee Lauder Companies Inc. (United States) 6. Coty Inc. (United States) 7. MacAndrews & Forbes Incorporated (United States) 8. PHILOSOPHY INC. (United States)Frequently Asked Questions:

1] What segments are covered in the Dry Shampoo Market report? Ans. The segments covered in the Dry Shampoo Market report are based on Form, End User, and Distribution Channel. 2] Which region is expected to hold the highest share in the Dry Shampoo Market? Ans. Asia Pacific Region is expected to hold the highest share in the Dry Shampoo Market. 3] What is the market size of the Dry Shampoo Market by 2030? Ans. The market size of the Dry Shampoo Market by 2030 is US $ 9.18 Bn. 4] Who are the top key players in the Dry Shampoo Market? Ans. Unilever, Shiseido Company Ltd., Procter & Gamble Company, Pierre Fabre, Revlon Inc., Church & Dwight Co, Inc., New Avon LLC, The Estee Lauder Companies Inc., L’Oreal SA, Henkel AG & Company, KGaA, Kao Corporation, 5] What was the market size of the Dry Shampoo Market in 2023? Ans. The market size of the Dry Shampoo Market in 2023 was US $ 5.35 Bn. 6] How does dry shampoo work, and why has it gained popularity? Ans : Dry shampoo is a waterless hair cleansing product available in powder or aerosol form. It works by absorbing excess oil, sweat, and product residue from the scalp and hair, offering a quick refresh without traditional washing. Its popularity stems from its convenience, time-saving benefits, and ability to add volume, making it an ideal solution for busy lifestyles and on-the-go touch-ups. 7] What factors are driving the growth of the global dry shampoo market? Ans: The growth of the dry shampoo market is propelled by various factors, including heightened awareness about hair health and appearance. Consumers seek quick and convenient hair care solutions, especially with busy schedules. Increased marketing efforts, innovative formulations like tinted options, rising disposable incomes, and the trend toward natural-looking hairstyles contribute significantly to the market's expansion. 8] Which companies are dominant players in the dry shampoo market? Ans: Several companies hold significant Dry Shampoo Market share in the dry shampoo sector. Unilever, through its Batiste brand, stands as a major player known for its diverse product range and effective formulations. Other notable companies include Procter & Gamble, Revlon, and Church & Dwight, each offering competitive dry shampoo products catering to different consumer preferences and needs.

1. Dry Shampoo Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Dry Shampoo Market: Dynamics 2.1. Dry Shampoo Market Trends by Region 2.1.1. Global Dry Shampoo Market Trends 2.1.2. North America Dry Shampoo Market Trends 2.1.3. Europe Dry Shampoo Market Trends 2.1.4. Asia Pacific Dry Shampoo Market Trends 2.1.5. Middle East and Africa Dry Shampoo Market Trends 2.1.6. South America Dry Shampoo Market Trends 2.2. Dry Shampoo Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Dry Shampoo Market Drivers 2.2.1.2. North America Dry Shampoo Market Restraints 2.2.1.3. North America Dry Shampoo Market Opportunities 2.2.1.4. North America Dry Shampoo Market Challenges 2.2.2. Europe 2.2.2.1. Europe Dry Shampoo Market Drivers 2.2.2.2. Europe Dry Shampoo Market Restraints 2.2.2.3. Europe Dry Shampoo Market Opportunities 2.2.2.4. Europe Dry Shampoo Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Dry Shampoo Market Drivers 2.2.3.2. Asia Pacific Dry Shampoo Market Restraints 2.2.3.3. Asia Pacific Dry Shampoo Market Opportunities 2.2.3.4. Asia Pacific Dry Shampoo Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Dry Shampoo Market Drivers 2.2.4.2. Middle East and Africa Dry Shampoo Market Restraints 2.2.4.3. Middle East and Africa Dry Shampoo Market Opportunities 2.2.4.4. Middle East and Africa Dry Shampoo Market Challenges 2.2.5. South America 2.2.5.1. South America Dry Shampoo Market Drivers 2.2.5.2. South America Dry Shampoo Market Restraints 2.2.5.3. South America Dry Shampoo Market Opportunities 2.2.5.4. South America Dry Shampoo Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. Global 2.6.2. North America 2.6.3. Europe 2.6.4. Asia Pacific 2.6.5. Middle East and Africa 2.6.6. South America 2.7. Dry Shampoo Clinical Trial Analysis for Dry Shampoo 2.8. Key Opinion Leader Analysis for Dry Shampoo Industry 2.9. Analysis of Government Schemes and Initiatives for Dry Shampoo Industry 2.10. The Global Pandemic Impact on Dry Shampoo Market 2.11. Dry Shampoo Price Trend Analysis (2021-22) 3. Dry Shampoo Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 3.1. Dry Shampoo Market Size and Forecast, by Form (2023-2030) 3.1.1. Spray 3.1.2. Powder 3.1.3. Others 3.2. Dry Shampoo Market Size and Forecast, by End User (2023-2030) 3.2.1. Men 3.2.2. Women 3.2.3. Children 3.3. Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 3.3.1. Offline 3.3.2. Online 3.4. Dry Shampoo Market Size and Forecast, by region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Dry Shampoo Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Dry Shampoo Market Size and Forecast, by Form (2023-2030) 4.1.1. Spray 4.1.2. Powder 4.1.3. Others 4.2. North America Dry Shampoo Market Size and Forecast, by End User (2023-2030) 4.2.1. Men 4.2.2. Women 4.2.3. Children 4.3. North America Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.1. Offline 4.3.2. Online 4.4. North America Dry Shampoo Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Dry Shampoo Market Size and Forecast, by Form (2023-2030) 4.4.1.1.1. Spray 4.4.1.1.2. Powder 4.4.1.1.3. Others 4.4.1.2. United States Dry Shampoo Market Size and Forecast, by End User (2023-2030) 4.4.1.2.1. Men 4.4.1.2.2. Women 4.4.1.2.3. Children 4.4.1.3. United States Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.1.3.1. Offline 4.4.1.3.2. Online 4.4.2. Canada 4.4.2.1. Canada Dry Shampoo Market Size and Forecast, by Form (2023-2030) 4.4.2.1.1. Spray 4.4.2.1.2. Powder 4.4.2.1.3. Others 4.4.2.2. Canada Dry Shampoo Market Size and Forecast, by End User (2023-2030) 4.4.2.2.1. Men 4.4.2.2.2. Women 4.4.2.2.3. Children 4.4.2.3. Canada Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.2.3.1. Offline 4.4.2.3.2. Online 4.4.3. Mexico 4.4.3.1. Mexico Dry Shampoo Market Size and Forecast, by Form (2023-2030) 4.4.3.1.1. Spray 4.4.3.1.2. Powder 4.4.3.1.3. Others 4.4.3.2. Mexico Dry Shampoo Market Size and Forecast, by End User (2023-2030) 4.4.3.2.1. Men 4.4.3.2.2. Women 4.4.3.2.3. Children 4.4.3.3. Mexico Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.3.3.1. Offline 4.4.3.3.2. Online 5. Europe Dry Shampoo Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe Dry Shampoo Market Size and Forecast, by Form (2023-2030) 5.2. Europe Dry Shampoo Market Size and Forecast, by End User (2023-2030) 5.3. Europe Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 5.4. Europe Dry Shampoo Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Dry Shampoo Market Size and Forecast, by Form (2023-2030) 5.4.1.2. United Kingdom Dry Shampoo Market Size and Forecast, by End User (2023-2030) 5.4.1.3. United Kingdom Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.2. France 5.4.2.1. France Dry Shampoo Market Size and Forecast, by Form (2023-2030) 5.4.2.2. France Dry Shampoo Market Size and Forecast, by End User (2023-2030) 5.4.2.3. France Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Dry Shampoo Market Size and Forecast, by Form (2023-2030) 5.4.3.2. Germany Dry Shampoo Market Size and Forecast, by End User (2023-2030) 5.4.3.3. Germany Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Dry Shampoo Market Size and Forecast, by Form (2023-2030) 5.4.4.2. Italy Dry Shampoo Market Size and Forecast, by End User (2023-2030) 5.4.4.3. Italy Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Dry Shampoo Market Size and Forecast, by Form (2023-2030) 5.4.5.2. Spain Dry Shampoo Market Size and Forecast, by End User (2023-2030) 5.4.5.3. Spain Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Dry Shampoo Market Size and Forecast, by Form (2023-2030) 5.4.6.2. Sweden Dry Shampoo Market Size and Forecast, by End User (2023-2030) 5.4.6.3. Sweden Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Dry Shampoo Market Size and Forecast, by Form (2023-2030) 5.4.7.2. Austria Dry Shampoo Market Size and Forecast, by End User (2023-2030) 5.4.7.3. Austria Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Dry Shampoo Market Size and Forecast, by Form (2023-2030) 5.4.8.2. Rest of Europe Dry Shampoo Market Size and Forecast, by End User (2023-2030) 5.4.8.3. Rest of Europe Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Dry Shampoo Market Size and Forecast by Segmentation for (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Dry Shampoo Market Size and Forecast, by Form (2023-2030) 6.2. Asia Pacific Dry Shampoo Market Size and Forecast, by End User (2023-2030) 6.3. Asia Pacific Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 6.4. Asia Pacific Dry Shampoo Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Dry Shampoo Market Size and Forecast, by Form (2023-2030) 6.4.1.2. China Dry Shampoo Market Size and Forecast, by End User (2023-2030) 6.4.1.3. China Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Dry Shampoo Market Size and Forecast, by Form (2023-2030) 6.4.2.2. S Korea Dry Shampoo Market Size and Forecast, by End User (2023-2030) 6.4.2.3. S Korea Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Dry Shampoo Market Size and Forecast, by Form (2023-2030) 6.4.3.2. Japan Dry Shampoo Market Size and Forecast, by End User (2023-2030) 6.4.3.3. Japan Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.4. India 6.4.4.1. India Dry Shampoo Market Size and Forecast, by Form (2023-2030) 6.4.4.2. India Dry Shampoo Market Size and Forecast, by End User (2023-2030) 6.4.4.3. India Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Dry Shampoo Market Size and Forecast, by Form (2023-2030) 6.4.5.2. Australia Dry Shampoo Market Size and Forecast, by End User (2023-2030) 6.4.5.3. Australia Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Dry Shampoo Market Size and Forecast, by Form (2023-2030) 6.4.6.2. Indonesia Dry Shampoo Market Size and Forecast, by End User (2023-2030) 6.4.6.3. Indonesia Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Dry Shampoo Market Size and Forecast, by Form (2023-2030) 6.4.7.2. Malaysia Dry Shampoo Market Size and Forecast, by End User (2023-2030) 6.4.7.3. Malaysia Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Dry Shampoo Market Size and Forecast, by Form (2023-2030) 6.4.8.2. Vietnam Dry Shampoo Market Size and Forecast, by End User (2023-2030) 6.4.8.3. Vietnam Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Dry Shampoo Market Size and Forecast, by Form (2023-2030) 6.4.9.2. Taiwan Dry Shampoo Market Size and Forecast, by End User (2023-2030) 6.4.9.3. Taiwan Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Dry Shampoo Market Size and Forecast, by Form (2023-2030) 6.4.10.2. Rest of Asia Pacific Dry Shampoo Market Size and Forecast, by End User (2023-2030) 6.4.10.3. Rest of Asia Pacific Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Dry Shampoo Market Size and Forecast by Segmentation for (by Value in USD Million) (2023-2030 7.1. Middle East and Africa Dry Shampoo Market Size and Forecast, by Form (2023-2030) 7.2. Middle East and Africa Dry Shampoo Market Size and Forecast, by End User (2023-2030) 7.3. Middle East and Africa Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 7.4. Middle East and Africa Dry Shampoo Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Dry Shampoo Market Size and Forecast, by Form (2023-2030) 7.4.1.2. South Africa Dry Shampoo Market Size and Forecast, by End User (2023-2030) 7.4.1.3. South Africa Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Dry Shampoo Market Size and Forecast, by Form (2023-2030) 7.4.2.2. GCC Dry Shampoo Market Size and Forecast, by End User (2023-2030) 7.4.2.3. GCC Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Dry Shampoo Market Size and Forecast, by Form (2023-2030) 7.4.3.2. Nigeria Dry Shampoo Market Size and Forecast, by End User (2023-2030) 7.4.3.3. Nigeria Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Dry Shampoo Market Size and Forecast, by Form (2023-2030) 7.4.4.2. Rest of ME&A Dry Shampoo Market Size and Forecast, by End User (2023-2030) 7.4.4.3. Rest of ME&A Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Dry Shampoo Market Size and Forecast by Segmentation for (by Value in USD Million) (2023-2030 8.1. South America Dry Shampoo Market Size and Forecast, by Form (2023-2030) 8.2. South America Dry Shampoo Market Size and Forecast, by End User (2023-2030) 8.3. South America Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 8.4. South America Dry Shampoo Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Dry Shampoo Market Size and Forecast, by Form (2023-2030) 8.4.1.2. Brazil Dry Shampoo Market Size and Forecast, by End User (2023-2030) 8.4.1.3. Brazil Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Dry Shampoo Market Size and Forecast, by Form (2023-2030) 8.4.2.2. Argentina Dry Shampoo Market Size and Forecast, by End User (2023-2030) 8.4.2.3. Argentina Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Dry Shampoo Market Size and Forecast, by Form (2023-2030) 8.4.3.2. Rest Of South America Dry Shampoo Market Size and Forecast, by End User (2023-2030) 8.4.3.3. Rest Of South America Dry Shampoo Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Dry Shampoo Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Dry Shampoo Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Unilever (United Kingdom) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Unilever (United Kingdom/Netherlands) 10.3. Shiseido Company Ltd. (Japan) 10.4. Procter & Gamble Company (United States) 10.5. Pierre Fabre (France) 10.6. Revlon Inc. (United States) 10.7. Church & Dwight Co, Inc. (United States) 10.8. New Avon LLC (United States) 10.9. The Estee Lauder Companies Inc. (United States) 10.10. L’Oreal SA (France) 10.11. Henkel AG & Company KGaA (Germany) 10.12. Kao Corporation (Japan) 10.13. Coty Inc. (United States) 10.14. BBLUNT (India) 10.15. MacAndrews & Forbes Incorporated (United States) 10.16. PHILOSOPHY INC. (United States) 11. Key Findings 12. Industry Recommendations 13. Dry Shampoo Market: Research Methodology 14. Terms and Glossary