District Cooling Market size was valued at USD 28.19 Billion in 2023 and the District Cooling Market revenue is expected to reach USD 44.46 Billion by 2030, at a CAGR of 6.72 % over the forecast period.District Cooling Market Overview

District cooling is a centralized system for cooling multiple buildings or facilities within a district or urban area. It involves the production and distribution of chilled water from a central plant to serve the cooling needs of various buildings, such as commercial complexes, residential buildings, hospitals, and industrial facilities, within a predefined geographical area. District cooling systems are often more energy-efficient compared to individual cooling systems installed in each building. Centralized chiller plants leverage economies of scale and employ advanced technologies for efficient cooling production.To know about the Research Methodology :- Request Free Sample Report The district cooling market is witnessing significant growth globally, driven by factors such as urbanization, increasing demand for energy-efficient cooling solutions, sustainability initiatives, and the rise of smart cities. District cooling systems offer centralized cooling solutions that serve multiple buildings or facilities within a specific area, providing various benefits in terms of energy efficiency, environmental sustainability, and cost-effectiveness. Increasing awareness of energy efficiency and sustainability is encouraging the adoption of district cooling as an environmentally friendly alternative to traditional cooling systems. District cooling systems leverage economies of scale and advanced technologies to reduce energy consumption and greenhouse gas emissions.

District Cooling Market Dynamics

Urbanization and Infrastructure Development to boost District Cooling Market growth The world is experiencing unprecedented levels of urbanization, with millions of people moving to cities every year. Urbanization leads to increased energy demand, particularly for cooling in commercial, residential, and industrial buildings. District cooling systems are well-suited to meet the growing cooling needs of densely populated urban areas. Governments and city planners are investing in infrastructure development projects to accommodate urban growth and improve the quality of life for residents, which is expected to boost the District Cooling Market growth. District cooling is considered an essential component of modern urban infrastructure, providing efficient and reliable cooling solutions for large-scale developments, commercial districts, and urban communities. Energy efficiency has become a top priority for governments, businesses, and consumers worldwide. District cooling systems offer significant energy savings compared to decentralized cooling solutions, thanks to centralized production, distribution, and optimization of cooling resources. These systems leverage economies of scale and advanced technologies to reduce energy consumption and greenhouse gas emissions. Technological innovations in chillers, thermal storage, distribution networks, and control systems are enhancing the performance and efficiency of district cooling systems. High-efficiency chillers, thermal energy storage systems, and smart meters enable optimized cooling production, demand response, and load management, leading to greater energy savings and operational efficiency, which boosts the District Cooling Market growth. The integration of Internet of Things (IoT) technology into district cooling infrastructure is revolutionizing system monitoring, control, and maintenance. IoT-enabled sensors, data analytics, and predictive algorithms provide real-time insights into cooling operations, allowing operators to optimize system performance, detect anomalies, and pre-emptively address issues, thus improving reliability and reducing downtime. While the upfront investment in district cooling infrastructure is significant, the long-term cost savings associated with reduced energy consumption, maintenance costs, and operational efficiency make district cooling a financially viable option for developers, building owners, and end-users. High Initial Investment to boost the District Cooling Market growth Developing district cooling infrastructure, including central chiller plants, distribution networks, and cooling systems in buildings, requires substantial upfront investment. The high capital costs associated with planning, designing, and constructing district cooling systems deter potential investors, developers, and utilities from adopting these solutions. Despite the long-term cost savings and operational efficiencies offered by district cooling systems, the payback period for initial investments relatively long, which significantly restraints the District Cooling Market growth. This pose a financial challenge for stakeholders seeking shorter-term returns on investment, especially in regions with limited access to financing or where energy prices are low. Designing, implementing, and operating district cooling systems is complex and technically challenging. It requires expertise in engineering, construction, project management, and coordination among multiple stakeholders, including developers, utilities, regulators, and building owners. Integrating district cooling infrastructure with existing buildings, utility networks, and urban infrastructure is difficult, particularly in densely developed urban areas. Retrofitting buildings to accommodate district cooling systems require costly modifications and disruptions to occupants. District cooling systems require significant amounts of water for cooling purposes, particularly in regions with limited freshwater resources. The extraction, treatment, and disposal of water used in district cooling operations raise environmental concerns related to water scarcity, quality, and ecosystem impacts.District Cooling Market Segment Analysis

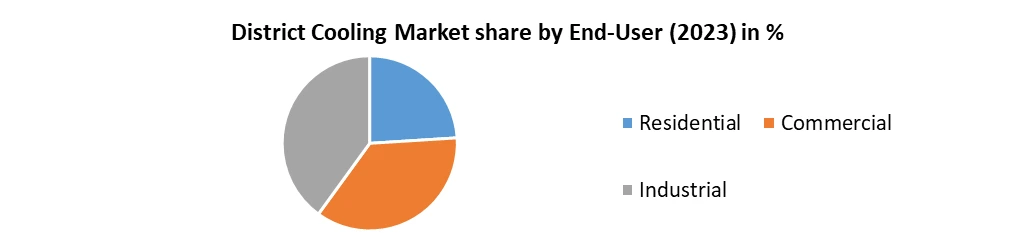

Based on Production, the market is segmented into free cooling, Absorption cooling, and Electric Chillers. The Electric Chillers segment dominated the market in 2023 and is expected to hold the largest District Cooling Market share over the forecast period. The electric chillers segment in the district cooling industry is a category of cooling equipment used in centralized chiller plants to generate chilled water for distribution to multiple buildings within a district cooling system. Electric chillers play a crucial role in the cooling process by absorbing heat from the water and lowering its temperature before it is circulated through the distribution network to cool buildings' air conditioning systems. Electric chillers are designed to operate efficiently, providing cooling capacity while minimizing energy consumption. Modern electric chillers incorporate advanced technologies such as variable-speed compressors, energy-efficient components, and intelligent controls to optimize performance and reduce operating costs. District Cooling manufacturers are developing electric chillers with higher efficiency ratings and lower energy consumption to meet stringent energy efficiency standards and regulations.Based on End-User, the market is segmented into Residential, Commercial, and Industrial. The commercial segment dominated the market in 2023 and is expected to hold the largest District Cooling Market share over the forecast period. Commercial buildings have significant cooling requirements due to factors such as occupancy density, internal heat gains from equipment and lighting, and varying cooling loads throughout the day. The commercial segment encompasses a wide range of building types, including office buildings, retail centers, hotels, shopping malls, and mixed-use developments. Each building type has unique cooling requirements based on factors such as occupancy patterns, operating hours, and internal heat loads. District cooling systems provide a consistent and reliable cooling supply, ensuring optimal indoor comfort levels for building occupants, visitors, and tenants, which is expected to boost the District Cooling Market growth. Comfortable indoor environments contribute to increased productivity, satisfaction, and retention rates in commercial spaces.

District Cooling Market Regional Insight

Climate Conditions and Cooling Demand to boost the Middle East and Africa District Cooling Market growth Middle East and Africa dominated the market in 2023 and is expected to hold the largest District Cooling Market share over the forecast period. The hot and arid climate prevalent in many countries in the Middle East and parts of Africa drives the need for cooling solutions throughout the year. High ambient temperatures and humidity levels increase the demand for air conditioning and cooling, making district cooling systems an attractive option for meeting the region's cooling needs efficiently. Governments in the Middle East and Africa are prioritizing sustainability and environmental conservation as part of their long-term development strategies, which is expected to boost the Middle East and Africa District Cooling Market growth. Initiatives such as Vision 2030 in Saudi Arabia, the UAE Vision 2021, and national development plans across the region emphasize the importance of sustainable urban development, energy efficiency, and climate action. District cooling aligns with these goals by offering energy-efficient and environmentally friendly cooling solutions. The Middle East, particularly countries such as the United Arab Emirates (UAE), Qatar, and Saudi Arabia, has been witnessing significant investments in real estate and infrastructure projects. These include mega-projects, urban developments, hospitality and tourism destinations, and industrial zones, all of which require reliable and scalable cooling solutions. District cooling systems are well-suited to meet the cooling demands of large-scale development and urban communities, which boosts the District Cooling Market growth. The UAE, particularly Dubai and Abu Dhabi, is a major hub for district cooling in the Middle East. Government-led initiatives such as Dubai's District Cooling Regulations and Abu Dhabi's Estidama Pearl Rating System promote the adoption of district cooling in new developments. Dubai's Mohammed bin Rashid Al Maktoum Solar Park is also integrating district cooling with renewable energy sources to enhance sustainability. For example, Qatar, host to the FIFA World Cup 2022, is investing in district cooling systems to meet the cooling requirements of stadiums, hotels, and infrastructure for the event. The country's National Vision 2030 focuses on sustainable development and environmental conservation, creating opportunities for district cooling providers.District Cooling Market Scope: Inquire before buying

Global District Cooling Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 28.19 Bn. Forecast Period 2024 to 2030 CAGR: 6.72% Market Size in 2030: US $ 44.46 Bn. Segments Covered: by Production Free cooling Absorption cooling Electric Chillers by End User Residential Commercial Industrial District Cooling Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading District Cooling Manufacturers include:

North America: 1. Enwave Energy Corporation: Toronto, Canada 2. Veolia North America: Boston, Massachusetts, USA 3. Trane Technologies: Davidson, North Carolina, USA 4. Engie North America: Houston, Texas, USA 5. NRG Energy: Princeton, New Jersey, USA Europe: 6. Fortum Corporation: Espoo, Finland 7. Logstor: Løgstør, Denmark 8. Ramboll Group: Copenhagen, Denmark 9. Goteborg Energi AB: Gothenburg, Sweden Asia-Pacific: 10. Singapore District Cooling: Singapore 11. Shinryo Corporation: Tokyo, Japan 12. Keppel DHCS Pte Ltd: Singapore 13. SNC-Lavalin Group (Atkins): Montreal, Canada (Also operates in Asia-Pacific) 14. Shanghai Kaite (Thermal Engineering Co., Ltd.): Shanghai, China Middle East & Africa: 15. Empower (Emirates Central Cooling Systems Corporation): Dubai, UAE 16. Tabreed (National Central Cooling Company PJSC): Abu Dhabi, UAE 17. Qatar District Cooling Company (Qatar Cool): Doha, Qatar 18. Emirates District Cooling (Emicool): Dubai, UAE 19. Marafeq Qatar: Doha, Qatar South America: 20. Clima Rio: Rio de Janeiro, Brazil 21. Rusklimat Group: Moscow, Russia 22. Engie Brasil: Rio de Janeiro, Brazil 23. DCB Brasil : São Paulo, Brazil 24. EKMAN Engenharia: Belo Horizonte, Brazil Frequently asked Questions: 1. What is district cooling, and how does it work? Ans: District cooling is a centralized system for cooling multiple buildings within a district or urban area. Chilled water is produced in a central plant and distributed through underground pipes to buildings, where it is used for air conditioning and cooling purposes. 2. What factors are driving the growth of the district cooling market? Ans: Factors driving the growth of the district cooling market include urbanization, increasing demand for energy-efficient cooling solutions, sustainability initiatives, and the rise of smart cities. District cooling systems provide centralized cooling solutions for large-scale developments and urban communities. 3. Which regions are leading in the adoption of district cooling? Ans: The Middle East and Africa region are leading in the adoption of district cooling due to their hot climate conditions, high cooling demand, and government initiatives promoting sustainability and urban development. Countries like the UAE, Qatar, and Saudi Arabia are investing in district cooling infrastructure for large-scale projects. 4. What are the key segments in the district cooling market? Ans: Key segments in the district cooling market include production methods (such as free cooling, absorption cooling, and electric chillers) and end-users (residential, commercial, and industrial). Electric chillers and the commercial segment are currently dominating the market. 5. How do district cooling systems contribute to sustainability? Ans: District cooling systems contribute to sustainability by reducing energy consumption, greenhouse gas emissions, and water usage compared to decentralized cooling systems. They promote energy efficiency, environmental conservation, and compliance with regulatory standards.

1. District Cooling Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. District Cooling Market: Dynamics 2.1. District Cooling Market Trends by Region 2.1.1. North America District Cooling Market Trends 2.1.2. Europe District Cooling Market Trends 2.1.3. Asia Pacific District Cooling Market Trends 2.1.4. Middle East and Africa District Cooling Market Trends 2.1.5. South America District Cooling Market Trends 2.2. District Cooling Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America District Cooling Market Drivers 2.2.1.2. North America District Cooling Market Restraints 2.2.1.3. North America District Cooling Market Opportunities 2.2.1.4. North America District Cooling Market Challenges 2.2.2. Europe 2.2.2.1. Europe District Cooling Market Drivers 2.2.2.2. Europe District Cooling Market Restraints 2.2.2.3. Europe District Cooling Market Opportunities 2.2.2.4. Europe District Cooling Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific District Cooling Market Drivers 2.2.3.2. Asia Pacific District Cooling Market Restraints 2.2.3.3. Asia Pacific District Cooling Market Opportunities 2.2.3.4. Asia Pacific District Cooling Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa District Cooling Market Drivers 2.2.4.2. Middle East and Africa District Cooling Market Restraints 2.2.4.3. Middle East and Africa District Cooling Market Opportunities 2.2.4.4. Middle East and Africa District Cooling Market Challenges 2.2.5. South America 2.2.5.1. South America District Cooling Market Drivers 2.2.5.2. South America District Cooling Market Restraints 2.2.5.3. South America District Cooling Market Opportunities 2.2.5.4. South America District Cooling Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For District Cooling Industry 2.8. Analysis of Government Schemes and Initiatives For District Cooling Industry 2.9. District Cooling Market Trade Analysis 2.10. The Global Pandemic Impact on District Cooling Market 3. District Cooling Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. District Cooling Market Size and Forecast, by Production (2023-2030) 3.1.1. Free cooling 3.1.2. Absorption cooling 3.1.3. Electric Chillers 3.2. District Cooling Market Size and Forecast, by End User (2023-2030) 3.2.1. Residential 3.2.2. Commercial 3.2.3. Industrial 3.3. District Cooling Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America District Cooling Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America District Cooling Market Size and Forecast, by Production (2023-2030) 4.1.1. Free cooling 4.1.2. Absorption cooling 4.1.3. Electric Chillers 4.2. North America District Cooling Market Size and Forecast, by End User (2023-2030) 4.2.1. Residential 4.2.2. Commercial 4.2.3. Industrial 4.3. North America District Cooling Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States District Cooling Market Size and Forecast, by Production (2023-2030) 4.3.1.1.1. Free cooling 4.3.1.1.2. Absorption cooling 4.3.1.1.3. Electric Chillers 4.3.1.2. United States District Cooling Market Size and Forecast, by End User (2023-2030) 4.3.1.2.1. Residential 4.3.1.2.2. Commercial 4.3.1.2.3. Industrial 4.3.2. Canada 4.3.2.1. Canada District Cooling Market Size and Forecast, by Production (2023-2030) 4.3.2.1.1. Free cooling 4.3.2.1.2. Absorption cooling 4.3.2.1.3. Electric Chillers 4.3.2.2. Canada District Cooling Market Size and Forecast, by End User (2023-2030) 4.3.2.2.1. Residential 4.3.2.2.2. Commercial 4.3.2.2.3. Industrial 4.3.3. Mexico 4.3.3.1. Mexico District Cooling Market Size and Forecast, by Production (2023-2030) 4.3.3.1.1. Free cooling 4.3.3.1.2. Absorption cooling 4.3.3.1.3. Electric Chillers 4.3.3.2. Mexico District Cooling Market Size and Forecast, by End User (2023-2030) 4.3.3.2.1. Residential 4.3.3.2.2. Commercial 4.3.3.2.3. Industrial 5. Europe District Cooling Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe District Cooling Market Size and Forecast, by Production (2023-2030) 5.2. Europe District Cooling Market Size and Forecast, by End User (2023-2030) 5.3. Europe District Cooling Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom District Cooling Market Size and Forecast, by Production (2023-2030) 5.3.1.2. United Kingdom District Cooling Market Size and Forecast, by End User (2023-2030) 5.3.2. France 5.3.2.1. France District Cooling Market Size and Forecast, by Production (2023-2030) 5.3.2.2. France District Cooling Market Size and Forecast, by End User (2023-2030) 5.3.3. Germany 5.3.3.1. Germany District Cooling Market Size and Forecast, by Production (2023-2030) 5.3.3.2. Germany District Cooling Market Size and Forecast, by End User (2023-2030) 5.3.4. Italy 5.3.4.1. Italy District Cooling Market Size and Forecast, by Production (2023-2030) 5.3.4.2. Italy District Cooling Market Size and Forecast, by End User (2023-2030) 5.3.5. Spain 5.3.5.1. Spain District Cooling Market Size and Forecast, by Production (2023-2030) 5.3.5.2. Spain District Cooling Market Size and Forecast, by End User (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden District Cooling Market Size and Forecast, by Production (2023-2030) 5.3.6.2. Sweden District Cooling Market Size and Forecast, by End User (2023-2030) 5.3.7. Austria 5.3.7.1. Austria District Cooling Market Size and Forecast, by Production (2023-2030) 5.3.7.2. Austria District Cooling Market Size and Forecast, by End User (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe District Cooling Market Size and Forecast, by Production (2023-2030) 5.3.8.2. Rest of Europe District Cooling Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific District Cooling Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific District Cooling Market Size and Forecast, by Production (2023-2030) 6.2. Asia Pacific District Cooling Market Size and Forecast, by End User (2023-2030) 6.3. Asia Pacific District Cooling Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China District Cooling Market Size and Forecast, by Production (2023-2030) 6.3.1.2. China District Cooling Market Size and Forecast, by End User (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea District Cooling Market Size and Forecast, by Production (2023-2030) 6.3.2.2. S Korea District Cooling Market Size and Forecast, by End User (2023-2030) 6.3.3. Japan 6.3.3.1. Japan District Cooling Market Size and Forecast, by Production (2023-2030) 6.3.3.2. Japan District Cooling Market Size and Forecast, by End User (2023-2030) 6.3.4. India 6.3.4.1. India District Cooling Market Size and Forecast, by Production (2023-2030) 6.3.4.2. India District Cooling Market Size and Forecast, by End User (2023-2030) 6.3.5. Australia 6.3.5.1. Australia District Cooling Market Size and Forecast, by Production (2023-2030) 6.3.5.2. Australia District Cooling Market Size and Forecast, by End User (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia District Cooling Market Size and Forecast, by Production (2023-2030) 6.3.6.2. Indonesia District Cooling Market Size and Forecast, by End User (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia District Cooling Market Size and Forecast, by Production (2023-2030) 6.3.7.2. Malaysia District Cooling Market Size and Forecast, by End User (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam District Cooling Market Size and Forecast, by Production (2023-2030) 6.3.8.2. Vietnam District Cooling Market Size and Forecast, by End User (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan District Cooling Market Size and Forecast, by Production (2023-2030) 6.3.9.2. Taiwan District Cooling Market Size and Forecast, by End User (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific District Cooling Market Size and Forecast, by Production (2023-2030) 6.3.10.2. Rest of Asia Pacific District Cooling Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa District Cooling Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa District Cooling Market Size and Forecast, by Production (2023-2030) 7.2. Middle East and Africa District Cooling Market Size and Forecast, by End User (2023-2030) 7.3. Middle East and Africa District Cooling Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa District Cooling Market Size and Forecast, by Production (2023-2030) 7.3.1.2. South Africa District Cooling Market Size and Forecast, by End User (2023-2030) 7.3.2. GCC 7.3.2.1. GCC District Cooling Market Size and Forecast, by Production (2023-2030) 7.3.2.2. GCC District Cooling Market Size and Forecast, by End User (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria District Cooling Market Size and Forecast, by Production (2023-2030) 7.3.3.2. Nigeria District Cooling Market Size and Forecast, by End User (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A District Cooling Market Size and Forecast, by Production (2023-2030) 7.3.4.2. Rest of ME&A District Cooling Market Size and Forecast, by End User (2023-2030) 8. South America District Cooling Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America District Cooling Market Size and Forecast, by Production (2023-2030) 8.2. South America District Cooling Market Size and Forecast, by End User (2023-2030) 8.3. South America District Cooling Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil District Cooling Market Size and Forecast, by Production (2023-2030) 8.3.1.2. Brazil District Cooling Market Size and Forecast, by End User (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina District Cooling Market Size and Forecast, by Production (2023-2030) 8.3.2.2. Argentina District Cooling Market Size and Forecast, by End User (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America District Cooling Market Size and Forecast, by Production (2023-2030) 8.3.3.2. Rest Of South America District Cooling Market Size and Forecast, by End User (2023-2030) 9. Global District Cooling Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading District Cooling Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Enwave Energy Corporation: Toronto, Canada 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Veolia North America: Boston, Massachusetts, USA 10.3. Trane Technologies: Davidson, North Carolina, USA 10.4. Engie North America: Houston, Texas, USA 10.5. NRG Energy: Princeton, New Jersey, USA 10.6. Fortum Corporation: Espoo, Finland 10.7. Logstor: Løgstør, Denmark 10.8. Ramboll Group: Copenhagen, Denmark 10.9. Goteborg Energi AB: Gothenburg, Sweden 10.10. Singapore District Cooling: Singapore 10.11. Shinryo Corporation: Tokyo, Japan 10.12. Keppel DHCS Pte Ltd: Singapore 10.13. SNC-Lavalin Group (Atkins): Montreal, Canada (Also operates in Asia-Pacific) 10.14. Shanghai Kaite (Thermal Engineering Co., Ltd.): Shanghai, China 10.15. Empower (Emirates Central Cooling Systems Corporation): Dubai, UAE 10.16. Tabreed (National Central Cooling Company PJSC): Abu Dhabi, UAE 10.17. Qatar District Cooling Company (Qatar Cool): Doha, Qatar 10.18. Emirates District Cooling (Emicool): Dubai, UAE 10.19. Marafeq Qatar: Doha, Qatar 10.20. Clima Rio: Rio de Janeiro, Brazil 10.21. Rusklimat Group: Moscow, Russia 10.22. Engie Brasil: Rio de Janeiro, Brazil 10.23. DCB Brasil : São Paulo, Brazil 10.24. EKMAN Engenharia: Belo Horizonte, Brazil 11. Key Findings 12. Industry Recommendations 13. District Cooling Market: Research Methodology 14. Terms and Glossary