The Global Diesel Exhaust Fluid Market size was valued at USD 37.82 Billion in 2023 and the total Diesel Exhaust Fluid Market’s revenue is expected to grow at a CAGR of 7.9% from 2024 to 2030, reaching nearly USD 64.41 Billion.Global Diesel Exhaust Fluid Overview

Diesel exhaust fluid (DEF), also known as AdBlue, is a consumable fluid used in selective catalytic reduction (SCR) systems to control nitrogen oxide (NOx) emissions from diesel engines. DEF is a solution of urea and deionized water, typically 32.5% urea by weight. When injected into the exhaust stream, the urea reacts with NOx to form nitrogen and water, which are harmless by products. The use of SCR and DEF, it has been found that engine improvements actually made it possible to get more power from the engine. The addition of DEF fluid for fleet management market not only gives extra power but will also add mileage to fleet operations. As a fleet operator today, with the use of DEF assured of the increased life expectancy of vehicles. Now, since the engines run extra efficiently so that consumers stop worrying about any wear and tear on the engine components which is likely and expectedly to reduce the chance of frequent repairs and maintenance. This will in turn reduce overall fleet maintenance costs and will help manage fleet with more control effectively. The efficiency of an SCR engine that uses DEF allows to worry less about engine maintenance now and in the future. This advantages have led to increase the adoption of Diesel exhaust fluid market in the forecasted period.To know about the Research Methodology:- Request Free Sample Report Back in 2010, the Environment Protection Agency (EPA) mandated the use of Selective Catalytic Reduction (SCR) in all diesel vehicles. However, SCR is not a new invention, in fact it has been around for nearly half a century! And in India with the advent of Bharat Stage VI (BSVI) norms, diesel engines will have to reduce their HC+NOx (hydro carbon + nitrogen oxides) by 43%, their NOx levels by 68% and particulate matter levels by 82%. This is where the role of Diesel Exhaust Fluid (DEF) comes into play as DEF is going to work as a catalyst with Selective Catalytic Reduction (SCR) towards improving the overall health of the environment and making diesel vehicle a responsible choice and a more viable option for the future, which leads to growth of the market.

Diesel Exhaust Fluid Market Dynamics:

Stringent Emission Standards Drive Growth in Diesel Exhaust Fluid Market As the environmental concerns are growing every day, the need for fuel that is sustainable, provides optimum clean energy and delivers maximum efficiency is needed and this is where Diesel Exhaust Fluid market comes in. Diesel Exhaust Fluid Industry is an important element of Selective Catalytic Reduction systems responsible for decreasing NOx emissions caused by diesel engines. The demand for Diesel Exhaust Fluid Market is likely to grow in the coming years as most governments are introducing stringent emission standards aimed at improving air quality and protecting public health, this demand drives the Diesel Exhaust Fluid market. Selective Catalytic Reduction systems are being widely adopted especially in heavy-duty vehicles like trucks and buses as they curb the noxious gases which are harmful to the environment, which lead to use of stringent emission standards in the vehicles to be equipped with SCR system that leads to increase in diesel exhaust fluid markets usage. The demand for Diesel Exhaust Fluid market is increasing as a result of stringent emission standards that many diesel vehicles are now having SCR systems. In the next few years, there will be a tremendous increase in the demand for DEF as most diesel powered cars become installed with SCR systems. The stringent emission standards compel the use of SCR systems in diesel engines to help minimize the toxic NOx. The demand for DEF is projected to rise at a CAGR of XX percent from 2024– 2030. Technological improvements are driven by requirements that vehicles must comply with strict emission standards. These advancements include, Formulation research aimed at improved performance and longer-life DEF for new formulations, Enhanced design and manufacturing of new efficient SCR catalysts, New SCR system designs are less bulky and lighter in weight. This is contributing greatly to the development of more efficient and affordable SCR systems, encouraging their utilization in diesel vehicles which ultimately grows the diesel exhaust fluid market in the forecasted period. The increasing network of diesel exhaust fluid market availability is making it more convenient for both consumers and businesses to acquire this product, which leads to expansion of the infrastructure for diesel exhaust fluid market availability at rapid rates. A large number of diesel exhaust fluid market dispensing stations are currently being set up in retail fuel stations, truck stops, as well as in rest areas with the ease of availability consumers and businesses are getting access to diesel exhaust fluid, which makes the market to grow. This product can be bought by the commercial vehicle fleet as bulk quantities are now available, thereby reducing fuel costs. Governments are giving incentives and supports to promote the use of diesel exhaust fluid market and SCR systems by offering incentives as well as assistance towards the installation of diesel exhaust fluid market technology. Some of these incentives includes tax discounts where the American government provided a tax credit of $4,800 for purchasing new SCR-equipped diesel based motor vehicles, various subsides, and also funds researches and the formulation of new diesel exhaust fluid market and SCR system designs. As these technologies are becoming cheaper due to various government support the diesel exhaust fluid market is expected to grow in forecasted period.Global Trends that are Shaping Diesel Exhaust Fluid Market

Impact of Exhaust Emission Standards and Norms, No Fixed Prices for Diesel Exhaust Fluid Market According to the engine range, the most recent Tier 4 emission laws in the US have replaced the Tier 4 transitional, Tier 3, and Tier 2 requirements. Diesel engines must now adhere to the restrictions set out in the EPA Nonroad Compression Ignition Exhaust Emission Standards for numerous upstream oil and gas activities. Compared to Tier 3 and Tier 2, the reduction of nitrous oxides (NOx) and particulate matter (PM) has been the primary emphasis of current Tier 4 emission limits. The U.S. EPA has decided to limit the sulphur content of the diesel fuel used by these engines to 15 parts per million (ppm) with the most current Tier 4 emission requirements, a 97% reduction from the original requirement of 500 ppm. Diesel Exhaust Fluid Market with these restrictions, the European Commission, like the EPA, decided to concentrate on lowering emissions of carbon monoxide (CO), hydrocarbons (HC), nitrogen oxides (NOx), and particulate matter. The most recent and stringent stage of these restrictions is Stage V. The key points of Stage V emissions in relation to upstream oil and gas applications and more detail of each country-wise regulation and their effect on the market are covered in the report. Since urea and de-ionized water make up DEF, the price of urea has some influence on the price of DEF. Agriculture is the main use that affects the price of urea on a worldwide scale. The agriculture sector has an impact on urea pricing. Since it is depending on supply and demand from the agricultural sector, the price of urea is far more unpredictable than the price of diesel. Crops are sown at the start of the year in several northern hemisphere nations. As a result, urea is expensive. Prices for urea decrease after the crops are prepared for winter harvest. According to the graph below, urea prices rise at the start of every year as a result of planters' increased demand from the agricultural sector. The price of urea was at its lowest in 2020 more than ten years ago, according to Yara International (Norway). Since urea is the primary component of DEF, changes in urea prices have an impact on DEF costs and hence present a challenge for the global market for diesel exhaust fluid.

Rising Adoption of SCR Systems SCR is now being used more often in diesel vehicles, especially in heavy-duty trucks and buses as it has proven successful in controlling NOx emissions. The increasing utilization of SCR systems leads to increased demand for Diesel Exhaust Fluid Market. Technological Advancements in Diesel Exhaust Fluid Production The advances in the production technologies for Diesel Exhaust Fluid have been resulting in more efficient Diesel Exhaust Fluid with enhanced performance and extended shelf life. This is increasing the implementation of Diesel Exhaust Fluid and is helping in market growth. Expanding Infrastructure for Diesel Exhaust Fluid Availability The infrastructure for Diesel Exhaust Fluid supply is developing fast with the addition of more Diesel Exhaust Fluid dispensing stations in retail fuel stations, truck stops, and rest areas. The increased availability of Diesel Exhaust Fluid is now making it easy for consumers and businesses to obtain it. Growing Use of Diesel Exhaust Fluid in Non-Road Applications The use of Diesel Exhaust Fluid for both non-road applications (including construction equipment, agriculture machinery, and marine engines) is increasing. Such emission regulations apply to these applications as much as they apply to diesel vehicles, and subsequently, there will be an increased demand for Diesel Exhaust Fluid. Research into Alternative Diesel Exhaust Fluid Sources The main raw material in Diesel Exhaust Fluid production is urea and researchers are examining alternatives. This may also aid in the reduction of fossil fuel usage while enhancing the sustainability of the Diesel Exhaust Fluid industry. Diesel Exhaust Fluid Market Segment Analysis:

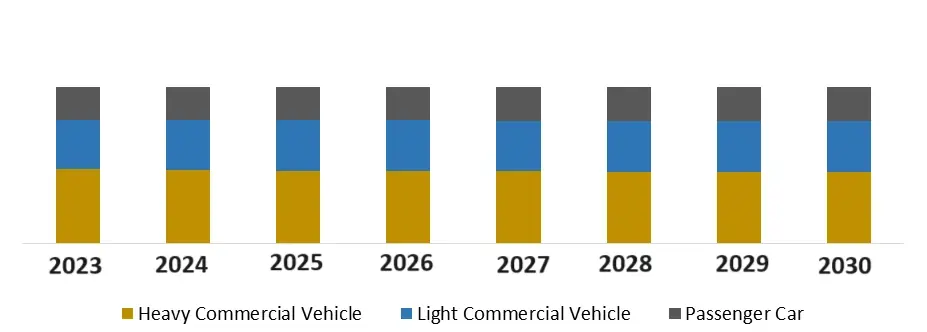

Based on Vehicle Type, the diesel exhaust fluid market (DEF) is segmented into Passenger Car, HCVs, and LCVs. Heavy commercial vehicle (HCV) dominates the diesel exhaust fluid market accounting for over 60% of the global diesel exhaust fluid market in 2023. This market is growing due to higher fuel consumption than light commercial vehicles (LCVs) and passenger cars, which means they consume more diesel exhaust fluid, as diesel exhaust fluid is used to reduce nitrogen oxide (NOx) emissions from diesel engines. As HCVs emit more pollution than LCVs and passenger cars, including NOx that contribute to air pollution and health problem so HCVs have stringent emission standards. Selective catalytic reduction (SCR) systems are the most effective technology for reducing NOx emissions from diesel engines. SCR systems require DEF to function properly. HCVs are more likely to have SCR systems installed than LCVs and passenger cars. Globally, demand for the HCV vehicle segment has grown in industrialized and developing countries thanks to improved product offerings or higher economic activity. Businesses must abide by the laws and standards of the country in which they conduct business. Regulation compliance result in a rise in demand for DEF products. More than 500,000 diesel vehicles in Europe are currently using this technology, and the fleet is expanding by roughly 25,000 trucks each month.Global Diesel Exhaust Fluid Market Share (%), By Vehicle Type, 2024-2030

The manufacturers of passenger cars and light trucks supplying in United States, including Audi, BMW, Hyundai, Jeep, Kia, Mini Cooper, and Volkswagen, are using Diesel Exhaust Fluid and Selective Catalytic Reduction technology. In the latter part of 2020, Mercedes-Benz release three new SCR-equipped diesel SUVs in the United States. Freightliner, Kenworth, Mack, Peterbilt, and Volvo are among the manufacturers who are using SCR in the commercial transportation sector. Detroit Diesel and Cummins are two of the top engine manufacturers that uses SCR and the Diesel Exhaust Fluid Market (DEF). More details are covered in the report.Diesel Exhaust Fluid Market Regional Insights:

The North American region dominated the market with a 45 % share in 2023. The North American region is expected to witness significant growth from 2024 to 2030 at forecast period. Both the US and Canada have a huge number of automobiles on the road and strict emission regulations, such as the US Clean Air Act (CAA) that is driving the diesel exhaust fluid market of North America. The high demand for diesel-intensive cars and equipment is a result of Mexico's growing economic activity and better business climate, demand for DEF in the country has been driven by respect to emission rules. Canada has comparable demand and regulatory patterns to the US, therefore it is expected to have similar DEF demand trends. The Europe diesel exhaust fluid market is expected to grow steadily from 2024 to 2030, driven by the implementation of stricter emission standards for diesel vehicles. The European Union Euro6 has implemented standards, which requires the use of SCR systems in new diesel vehicles this is driving the demand for DEF in the Europe region. Germany diesel exhaust fluid market held the largest market share, and the Australia diesel exhaust fluid market has been the fastest growing market in the region. The Austrian government has announced that they have invested 100 million in DEF infrastructure for next five years. This investment includes the installation of new diesel exhaust fluid dispensing stations at fuel stations, as well as the development of national DEF logistics network. This news is expected to boost the demand for DEF in Austria and help to ensure that there is a sufficient supply of DEF to meet the needs of the growing market. Competitive Landscape Key Players of the Diesel Exhaust Fluid Market profiled in the report are Shell PLC, Gilbarco, PotashCorp, CF Industries, Old World Industries, LLC, Yara International, KOST USA, Inc, and STOCKMEIER Group. This provides huge opportunities to serve many End-users and customers and expand the Diesel Exhaust Fluid Market. Yara International, one of the world's largest producers of DEF, has announced that it will build a new DEF production plant in Austria. The new plant is expected to be operational in 2025 and will have a production capacity of 200,000 tons of DEF per year. This will significantly increase the supply of DEF in Austria and help to meet the growing demand for the product. CF Industries, another major producer of DEF, is planning to build a new DEF production plant in Europe. The new plant is expected to be operational in 2026 and will have a production capacity of 200,000 tons of DEF per year. BASF, another major producer of DEF, has announced that it will introduce a new DEF product specifically designed for use in heavy-duty trucks. The new product is expected to be more efficient and effective than existing DEF products, and it is also expected to have a longer shelf life. This new product is expected to help to reduce emissions from heavy-duty trucks and improve air quality in Austria.Diesel Exhaust Fluid Market (DEF) Scope: Inquire before buying

Diesel Exhaust Fluid Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 37.82 Bn. Forecast Period 2024 to 2030 CAGR: 7.9% Market Size in 2030: US $ 64.41 Bn. Segments Covered: by Vehicle Type Passenger Cars LCVs HCVs by Component SCR Catalysts DEF Tank DEF Injectors DEF Supply Modules DEF Sensors by Application Construction Agricultural Diesel Exhaust Fluid Market (DEF) by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Diesel Exhaust Fluid Market, Key Players:

The report highlights leading global companies in the Diesel Exhaust Fluid industry that prioritize expansion, innovation, and product development. Key strategies driving market growth include mergers and acquisitions, investments in research and development, and strategic partnerships. These companies focus on enhancing product efficiency and performance by integrating advanced technologies and adhering to stringent regulatory standards. Additionally, the financial performance of key players in the Diesel Exhaust Fluid industry reflects their successful strategies, showcasing strong revenue growth and profitability in a competitive landscape. 1. Shell PLC 2. Gilbarco 3. PotashCorp 4. CF Industries 5. Old World Industries 6. LLC 7. Yara International 8. KOST USA, Inc 9. STOCKMEIER Group 10. Dyno Nobel 11. Blue Sky Diesel Exhaust Fluid 12. Certified DEF 13. TotalEnergies 14. BASF SE 15. Brenntag AG 16. China Petrochemical Corporation 17. Agrium Inc 18. Mitsui Chemicals Inc 19. BP p.l.c 20. Co.za 21. Engen Petroleum Ltd 22. Borealis AG 23. Nissan Chemical Corporation 24. GreenChem 25. NOVAX Material & Technology Inc 26. Adeco doo FAQs: 1]What segments are covered in the Global Market report? Ans. The segments covered in the Market report are based on Product Type and End User. 2] Which region is expected to hold the highest share in the Global Market? Ans. The North America region is expected to hold the highest share in the Market . 3] What is the market size of the Global Market by 2030? Ans. The market size of the Diesel Exhaust Fluid Market (DEF) by 2030 is expected to reach US$ 64.41 Bn. 4] What is the forecast period for the Global Diesel Exhaust Fluid Market (DEF)? Ans. The forecast period for the Diesel Exhaust Fluid Market (DEF) is 2024-2030. 5] What was the market size of the Global Market in 2023? Ans. The market size of the Diesel Exhaust Fluid Market (DEF) in 2023 was valued at US$ 37.82 Bn.

1. Diesel Exhaust Fluid Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Diesel Exhaust Fluid Market: Dynamics 2.1. Diesel Exhaust Fluid Market Trends by Region 2.1.1. North America Diesel Exhaust Fluid Market Trends 2.1.2. Europe Diesel Exhaust Fluid Market Trends 2.1.3. Asia Pacific Diesel Exhaust Fluid Market Trends 2.1.4. Middle East and Africa Diesel Exhaust Fluid Market Trends 2.1.5. South America Diesel Exhaust Fluid Market Trends 2.2. Diesel Exhaust Fluid Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Diesel Exhaust Fluid Market Drivers 2.2.1.2. North America Diesel Exhaust Fluid Market Restraints 2.2.1.3. North America Diesel Exhaust Fluid Market Opportunities 2.2.1.4. North America Diesel Exhaust Fluid Market Challenges 2.2.2. Europe 2.2.2.1. Europe Diesel Exhaust Fluid Market Drivers 2.2.2.2. Europe Diesel Exhaust Fluid Market Restraints 2.2.2.3. Europe Diesel Exhaust Fluid Market Opportunities 2.2.2.4. Europe Diesel Exhaust Fluid Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Diesel Exhaust Fluid Market Drivers 2.2.3.2. Asia Pacific Diesel Exhaust Fluid Market Restraints 2.2.3.3. Asia Pacific Diesel Exhaust Fluid Market Opportunities 2.2.3.4. Asia Pacific Diesel Exhaust Fluid Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Diesel Exhaust Fluid Market Drivers 2.2.4.2. Middle East and Africa Diesel Exhaust Fluid Market Restraints 2.2.4.3. Middle East and Africa Diesel Exhaust Fluid Market Opportunities 2.2.4.4. Middle East and Africa Diesel Exhaust Fluid Market Challenges 2.2.5. South America 2.2.5.1. South America Diesel Exhaust Fluid Market Drivers 2.2.5.2. South America Diesel Exhaust Fluid Market Restraints 2.2.5.3. South America Diesel Exhaust Fluid Market Opportunities 2.2.5.4. South America Diesel Exhaust Fluid Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. Global 2.6.2. North America 2.6.3. Europe 2.6.4. Asia Pacific 2.6.5. Middle East and Africa 2.6.6. South America 2.7. Key Opinion Leader Analysis For Diesel Exhaust Fluid Industry 2.8. Analysis of Government Schemes and Initiatives For Diesel Exhaust Fluid Industry 2.9. The Global Pandemic Impact on Diesel Exhaust Fluid Market 3. Diesel Exhaust Fluid Market: Global Market Size and Forecast by Segmentation (2023-2030) 3.1. Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 3.1.1. PASSENGER CARS 3.1.2. LCVS 3.1.3. HCVs 3.2. Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 3.2.1. SCR Catalysts 3.2.2. DEF Tank 3.2.3. DEF Injectors 3.2.4. DEF Supply Modules 3.2.5. DEF Sensors 3.3. Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 3.3.1. Construction 3.3.2. Agricultural 3.4. Diesel Exhaust Fluid Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Diesel Exhaust Fluid Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 4.1.1. PASSENGER CARS 4.1.2. LCVS 4.1.3. HCVs 4.2. North America Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 4.2.1. SCR Catalysts 4.2.2. DEF Tank 4.2.3. DEF Injectors 4.2.4. DEF Supply Modules 4.2.5. DEF Sensors 4.3. North America Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 4.3.1. Construction 4.3.2. Agricultural 4.4. North America Diesel Exhaust Fluid Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 4.4.1.1.1. PASSENGER CARS 4.4.1.1.2. LCVS 4.4.1.1.3. HCVs 4.4.1.2. United States Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 4.4.1.2.1. SCR Catalysts 4.4.1.2.2. DEF Tank 4.4.1.2.3. DEF Injectors 4.4.1.2.4. DEF Supply Modules 4.4.1.2.5. DEF Sensors 4.4.1.3. United States Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Construction 4.4.1.3.2. Agricultural 4.4.2. Canada 4.4.2.1. Canada Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 4.4.2.1.1. PASSENGER CARS 4.4.2.1.2. LCVS 4.4.2.1.3. HCVs 4.4.2.2. Canada Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 4.4.2.2.1. SCR Catalysts 4.4.2.2.2. DEF Tank 4.4.2.2.3. DEF Injectors 4.4.2.2.4. DEF Supply Modules 4.4.2.2.5. DEF Sensors 4.4.2.3. Canada Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Construction 4.4.2.3.2. Agricultural 4.4.3. Mexico 4.4.3.1. Mexico Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 4.4.3.1.1. PASSENGER CARS 4.4.3.1.2. LCVS 4.4.3.1.3. HCVs 4.4.3.2. Mexico Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 4.4.3.2.1. SCR Catalysts 4.4.3.2.2. DEF Tank 4.4.3.2.3. DEF Injectors 4.4.3.2.4. DEF Supply Modules 4.4.3.2.5. DEF Sensors 4.4.3.3. Mexico Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. Construction 4.4.3.3.2. Agricultural 5. Europe Diesel Exhaust Fluid Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 5.2. Europe Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 5.3. Europe Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 5.4. Europe Diesel Exhaust Fluid Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.1.2. United Kingdom Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 5.4.1.3. United Kingdom Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 5.4.2. France 5.4.2.1. France Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.2.2. France Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 5.4.2.3. France Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.3.2. Germany Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 5.4.3.3. Germany Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.4.2. Italy Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 5.4.4.3. Italy Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.5.2. Spain Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 5.4.5.3. Spain Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.6.2. Sweden Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 5.4.6.3. Sweden Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.7.2. Austria Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 5.4.7.3. Austria Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.8.2. Rest of Europe Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 5.4.8.3. Rest of Europe Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Diesel Exhaust Fluid Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 6.2. Asia Pacific Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 6.3. Asia Pacific Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Diesel Exhaust Fluid Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.1.2. China Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 6.4.1.3. China Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.2.2. S Korea Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 6.4.2.3. S Korea Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.3.2. Japan Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 6.4.3.3. Japan Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.4.2. India Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 6.4.4.3. India Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.5.2. Australia Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 6.4.5.3. Australia Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.6.2. Indonesia Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 6.4.6.3. Indonesia Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.7.2. Malaysia Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 6.4.7.3. Malaysia Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.8.2. Vietnam Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 6.4.8.3. Vietnam Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.9.2. Taiwan Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 6.4.9.3. Taiwan Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 6.4.10.3. Rest of Asia Pacific Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Diesel Exhaust Fluid Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 7.1. Middle East and Africa Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 7.2. Middle East and Africa Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 7.3. Middle East and Africa Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Diesel Exhaust Fluid Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.1.2. South Africa Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 7.4.1.3. South Africa Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.2.2. GCC Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 7.4.2.3. GCC Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.3.2. Nigeria Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 7.4.3.3. Nigeria Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.4.2. Rest of ME&A Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 7.4.4.3. Rest of ME&A Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 8. South America Diesel Exhaust Fluid Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 8.1. South America Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 8.2. South America Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 8.3. South America Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 8.4. South America Diesel Exhaust Fluid Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 8.4.1.2. Brazil Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 8.4.1.3. Brazil Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 8.4.2.2. Argentina Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 8.4.2.3. Argentina Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Diesel Exhaust Fluid Market Size and Forecast, by Vehicle Type (2023-2030) 8.4.3.2. Rest Of South America Diesel Exhaust Fluid Market Size and Forecast, by Component (2023-2030) 8.4.3.3. Rest Of South America Diesel Exhaust Fluid Market Size and Forecast, by Application (2023-2030) 9. Global Diesel Exhaust Fluid Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue () 9.3.5. Company Locations 9.3.6. SKU Details 9.3.7. No. of Stores 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Diesel Exhaust Fluid Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Shell PLC 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Gilbarco 10.3. PotashCorp 10.4. CF Industries 10.5. Old World Industries 10.6. LLC 10.7. Yara International 10.8. KOST USA, Inc 10.9. STOCKMEIER Group 10.10. Dyno Nobel 10.11. Blue Sky Diesel Exhaust Fluid 10.12. Certified DEF 10.13. TotalEnergies 11. Key Findings 12. Industry Recommendations 13. Diesel Exhaust Fluid Market: Research Methodology