The Dental Equipment and Consumables Market size was valued at USD 48.24 billion in 2023 and the total Dental Equipment and Consumables Market revenue is expected to grow at a CAGR of 6.78 % from 2024 to 2030, reaching nearly USD 76.35 billion. Dental equipment and consumables encompass a wide array of tools, instruments, devices, and materials used in dental practices for diagnostic, therapeutic, and preventive purposes. Dental equipment includes machines, instruments, and appliances like dental chairs, handpieces, imaging systems, lasers, and CAD/CAM systems, while consumables consist of disposable items like gloves, masks, syringes, dental materials, and medicaments. The global dental equipment and consumables market has been witnessing significant growth, driven by factors such as the increasing prevalence of dental disorders, rising demand for cosmetic dentistry, technological advancements, and growing awareness of oral health. The dental equipment and consumables market is characterized by robust growth, fueled by rising incidences of dental disorders, increasing demand for cosmetic dentistry, and advancements in dental technologies. Factors such as the aging population, growing awareness of oral hygiene, and growing dental tourism further contribute to market growth. Technological advancements, particularly in digital dentistry, are revolutionizing dental practices and driving the adoption of advanced equipment and consumables.To know about the Research Methodology :- Request Free Sample Report Several growth factors are shaping the dental equipment and consumables market, including the increasing adoption of preventive dental care, growing demand for aesthetic dentistry, and rising investments in healthcare infrastructure, particularly in emerging markets. Technological trends such as the integration of artificial intelligence (AI) and the Internet of Things (IoT) in dental equipment, along with the development of innovative materials and techniques, are driving market growth. Opportunities abound in emerging economies due to increasing disposable incomes, growing dental insurance coverage, and the establishment of dental care facilities. Recent developments by key players include strategic collaborations, mergers, and acquisitions to enhance product portfolios and geographical reach. Advancements in 3D printing technology for dental prosthetics and the introduction of minimally invasive surgical techniques represent significant developments in the dental equipment and consumables market. As the market continues to evolve, collaboration between industry players, research institutions, and regulatory bodies will be crucial in driving innovation and addressing emerging challenges in dental care delivery and accessibility.

Market Dynamics:

3D Printing Revolutionizes Dental Equipment Manufacturing: Innovations like 3D printing in dental equipment manufacturing improve precision and efficiency, driving dental equipment and consumables market growth. For example, companies like Sirona Dental Systems offer 3D printing solutions for dental prosthetics, reducing production time and costs. Increasing globalization and the affordability of dental treatments in countries like India and Mexico boost demand for equipment and consumables. For instance, clinics in countries with lower labor costs attract patients from developed nations, increasing the need for dental supplies. Growing the elderly population globally necessitates more dental care, leading to higher demand for equipment and consumables. As people age, they require more dental treatments and procedures, driving the market for dental products. For example, the aging population in Japan has contributed to increased demand for dental implants and prosthetics. The rising incidence of dental diseases like cavities and periodontal diseases increases the need for dental treatments and consequently, equipment and consumables. For instance, the prevalence of dental caries among children and adults drives the demand for restorative materials and equipment such as dental drills and filling materials. Widening insurance coverage for dental procedures encourages more people to seek dental care, driving the dental equipment and consumables market growth. For example, in countries like the United States, the Affordable Care Act has expanded dental coverage for many individuals, leading to increased utilization of dental services. Growing desire for aesthetic dental procedures like teeth whitening and veneers fuels the demand for specialized equipment and consumables. For instance, advancements in tooth-whitening technologies have led to an increase in demand for whitening agents and laser equipment. Increased awareness about oral health through campaigns and initiatives prompts more individuals to seek dental services, boosting market growth. For example, public health campaigns promoting regular dental check-ups and preventative care contribute to higher demand for dental products. Rapid economic development in emerging markets creates opportunities for the growth of dental services, driving demand for equipment and consumables. For instance, countries in Asia-Pacific, such as China and India, witness increasing investments in healthcare infrastructure, leading to higher demand for dental products. The adoption of artificial intelligence and the Internet of Things (IoT) in dental equipment enhances diagnostics and treatment, stimulating dental equipment and consumables market growth. For example, AI-powered imaging systems improve accuracy in detecting dental conditions, while IoT-enabled devices streamline workflow in dental practices. Government initiatives promoting oral healthcare, such as subsidized dental programs, stimulate demand for dental equipment and consumables. For instance, government-funded school dental programs provide preventative care to children, leading to increased demand for dental supplies like fluoride varnishes and sealants. Rising Demand for Aesthetic Dental Procedures Drives Equipment Sales: Increasing desire for aesthetic dental procedures drives demand for specialized equipment and consumables. For example, the growing popularity of teeth whitening treatments boosts sales of whitening agents and laser equipment, presenting growth prospects for manufacturers. Growing globalization and the affordability of dental treatments in emerging markets attract patients, stimulating demand for equipment and consumables. Countries like Thailand and Mexico offer cost-effective dental procedures, driving the need for supplies in dental tourism hubs. The increasing elderly population worldwide fuels demand for dental care, creating opportunities for equipment and consumables. For instance, the rising prevalence of age-related dental issues necessitates more dental treatments, leading to higher sales of dental products. Rapid economic growth in emerging dental equipment and consumables market like China and India drives the expansion of dental services, boosting demand for equipment and consumables. Increasing investments in healthcare infrastructure and rising disposable incomes contribute to market growth. The adoption of artificial intelligence and the Internet of Things in dental equipment enhances diagnostics and treatment, presenting growth opportunities. For example, AI-powered imaging systems improve diagnosis accuracy, while IoT-enabled devices streamline workflow in dental practices, driving dental equipment and consumables market growth. Supportive government policies promoting oral healthcare stimulate demand for dental equipment and consumables. For instance, initiatives offering subsidies for dental programs encourage the utilization of dental services, creating growth prospects for suppliers. Heightened awareness about oral health through educational campaigns encourages individuals to seek dental services, fostering market growth. For example, public health initiatives promoting regular dental check-ups and preventative care drive demand for dental products. Widening coverage for dental procedures increases affordability and accessibility to dental care, driving dental equipment and consumables market growth. For instance, the implementation of dental coverage in healthcare policies encourages more people to seek dental treatments, boosting the demand for equipment and consumables. Growing emphasis on preventive dental care leads to higher demand for related equipment and consumables. For example, the rising popularity of dental sealants and fluoride treatments in preventing dental caries creates opportunities for manufacturers of preventive dental products.High initial investment deters adoption of advanced dental equipment: The substantial investment required for advanced dental equipment limits adoption, especially for small dental practices. For instance, the cost of purchasing digital imaging systems or laser technology deters dentists from upgrading their equipment. Inadequate reimbursement coverage for certain dental procedures reduces the affordability of treatments, impacting the demand for equipment and consumables. For example, limited insurance coverage for cosmetic dentistry procedures like teeth whitening restricts dental equipment and consumables market growth for related products. Stringent regulations and compliance requirements in the dental industry pose barriers to market entry and product innovation. For instance, obtaining regulatory approval for new dental devices involves lengthy processes, delaying product launches and market penetration. The complexity of operating and maintaining advanced dental equipment hinders adoption rates among dental practitioners. For example, the intricate setup and calibration process of certain equipment like CAD/CAM systems requires specialized training, leading to slower adoption rates. Some dental professionals resist transitioning from traditional to digital practices due to familiarity and comfort with conventional methods. For instance, experienced dentists hesitate to adopt digital impression systems over traditional alginate impressions, slowing the dental equipment and consumables market growth for digital equipment. The presence of numerous small-scale dental equipment manufacturers and suppliers leads to market fragmentation, intensifying competition, and price pressures. For example, the influx of low-cost dental products from emerging dental equipment and consumables market challenges established players, affecting market profitability. Lack of awareness of advanced dental technologies and treatments in developing regions impedes market growth. For example, rural areas with limited access to dental education and training are not fully embracing modern dental practices, slowing the adoption of equipment and consumables. Inadequate healthcare infrastructure and facilities in certain regions hinder the utilization of dental equipment and consumables. For example, remote areas with insufficient power supply or internet connectivity struggle to implement digital dental technologies effectively, limiting market growth. Economic fluctuations and financial instability lead to reduced spending on non-essential healthcare services, including dental treatments and equipment. For instance, during economic downturns, individuals postpone elective dental procedures, impacting the demand for related products. Some dental professionals is hesitant to embrace automation and digitalization in dental practices due to concerns about job displacement and loss of autonomy. For example, reluctance to use robotic-assisted dental surgery systems impedes the adoption of such technologies, limiting dental equipment and consumables market growth.

Dental Equipment and Consumables Market Segment Analysis:

Based on End-Use, dental clinics currently dominate the market and are expected to dominate in the forecast period, due to their widespread presence and high patient footfall. Dental clinics serve as primary centers for routine dental check-ups, treatments, and procedures, driving consistent demand for equipment and consumables. Additionally, the increasing trend toward preventive dental care further amplifies the importance of dental clinics in the dental equipment and consumables market landscape. However, hospitals and ambulatory surgical centers are also significant contributors, particularly for complex dental surgeries and procedures requiring specialized facilities and expertise. Hospitals, equipped with advanced infrastructure and resources, cater to a wide range of dental services, including oral surgery and emergency dental care. Ambulatory surgical centers offer a balance between the comprehensive capabilities of hospitals and the convenience of outpatient services, making them increasingly popular for various dental treatments. Looking ahead, while dental clinics are expected to maintain their dominance, the adoption of dental equipment and consumables in hospitals and ambulatory surgical centers is projected to grow rapidly. This growth will be driven by the increasing focus on comprehensive dental care, technological advancements, and the integration of dental services into broader healthcare systems. Furthermore, as the global population ages and oral healthcare awareness increases, all segments are poised to witness sustained application and adoption of dental equipment and consumables, with dental clinics remaining the cornerstone of the dental equipment and consumables market while hospitals and ambulatory surgical centers continue to expand their roles in providing specialized dental care services.Dental Equipment and Consumables Market Regional Insights:

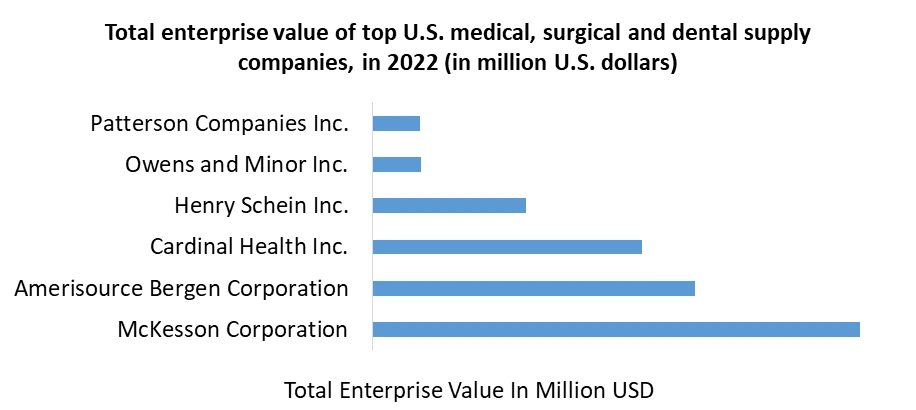

North America holds a dominant position in the Dental Equipment and Consumables Market, driven by factors such as a well-established healthcare infrastructure, high dental care expenditure, and technological advancements. The region benefits from many dental clinics and hospitals equipped with advanced dental equipment, contributing significantly to dental equipment and consumables market revenue. For example, in the United States, the presence of leading dental equipment manufacturers like Dentsply Sirona and Henry Schein underscores the market's maturity and dominance in North America. The Asia-Pacific region is emerging as a rapidly growing market for dental equipment and consumables. Factors such as increasing healthcare expenditure, rising disposable incomes, and growing awareness about oral health drive dental equipment and consumables market growth in countries like China, India, and Japan. For instance, China has witnessed a surge in dental tourism, supported by the availability of high-quality yet cost-effective dental treatments, which in turn fuels demand for dental equipment and consumables. Furthermore, governmental initiatives aimed at improving oral healthcare infrastructure and increasing access to dental services, such as India's National Oral Health Program, are expected to accelerate market growth in the Asia-Pacific region. Latin America and the Middle East & Africa regions are experiencing steady growth in the dental equipment and consumables market. In Latin America, countries like Brazil and Mexico are witnessing increased investments in dental care facilities and a growing demand for aesthetic dental procedures, contributing to market growth. Meanwhile, in the Middle East & Africa region, improving healthcare infrastructure and rising healthcare expenditures are driving the adoption of dental equipment and consumables. For example, the United Arab Emirates has emerged as a hub for dental tourism, attracting patients from across the globe for advanced dental treatments, thus bolstering demand for dental equipment in the region. The Dental Equipment and Consumables Market's regional landscape reflects a blend of established markets and emerging economies, each presenting unique opportunities and challenges for dental equipment and consumables market players. Competitive Landscape The competitive landscape of the Dental Equipment and Consumables Market is characterized by the presence of several key players vying for market share and striving for innovation. Leading companies such as 3M, Dentsply Sirona, Henry Schein, and Straumann dominate the dental equipment and consumables market. These companies have a strong global presence and offer a wide range of dental equipment and consumables, including dental implants, prosthetics, imaging systems, and restorative materials. They focus on research and development to introduce advanced products and technologies, enhancing their competitive edge. Recent developments in the dental equipment and consumables market include strategic partnerships, mergers, and acquisitions aimed at expanding product portfolios and geographical reach. For example, in recent years, Dentsply Sirona has undertaken acquisitions to strengthen its position in the market and broaden its product offerings. Companies are increasingly investing in digitalization and automation to improve efficiency and meet the growing demand for advanced dental solutions. The competitive landscape is expected to remain intense, with companies focusing on innovation, strategic collaborations, and geographical growth to maintain their competitive positions in the dental equipment and consumables market.Dental Equipment & Consumables Market Scope : Inquire before buying

Global Dental Equipment & Consumables Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 41.4 Bn. Forecast Period 2024 to 2030 CAGR: 6.79% Market Size in 2030: US $ 72.02 Bn. Segments Covered: by Products Equipmento Dental radiology equipment Dental Lasers Systems & Parts Laboratory Machines Hygiene Maintenance Devices Other Equipment’s

ConsumablesDental implants Crowns and bridges Orthodontics Periodontics Dental biomaterials

by End-Use Hospitals Ambulatory Surgical Centers Dental Clinics Others by Treatment Orthodontic Endodontic Peridontic Prosthodontic Dental Equipment and Consumables Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Dental Equipment and Consumables Market Key Players:

North America: 1. Danaher Corporation (Washington, USA) 2. Dentsply Sirona (North Carolina, USA) 3. Henry Schein (New York, USA) 4. Patterson Companies Inc.(Minnesota, USA) 5. Ultradent Products, Inc.(Utah, USA) Europe: 6. 3M Company(Minnesota, USA) 7. A-Dec Inc.(Oregon, USA) 8. Carestream Health(New York, USA) 9. GC Corporation (Tokyo, Japan) 10. Planmeca (Helsinki, Finland) Asia Pacific: 11. Carestream Health(New York, USA) 12. GC Corporation(Tokyo, Japan) 13. Ivoclar Vivadent Aktiengesellschaft (Liechtenstein) 14. Planmeca (Finland) 15. Straumann (Basel, Switzerland) FAQs: 1. What are the growth drivers for the Dental Equipment and Consumables Market? Ans. 3D Printing Revolutionizes Dental Equipment Manufacturing and is expected to be the major driver for the Dental Equipment and Consumables Market. 2. What is the major Opportunity for the Dental Equipment and Consumables Market growth? Ans. Rising Demand for Aesthetic Dental Procedures Drives Equipment Sales is expected to be the major Opportunity in the Dental Equipment and Consumables Market. 3. Which country is expected to lead the global Dental Equipment and Consumables Market during the forecast period? Ans. North America is expected to lead the Dental Equipment and Consumables Market during the forecast period. 4. What is the projected market size and growth rate of the Dental Equipment and Consumables Market? Ans. The Dental Equipment and Consumables Market size was valued at USD 48.24 billion in 2023 and the total Dental Equipment and Consumables Market revenue is expected to grow at a CAGR of 6.78 % from 2024 to 2030, reaching nearly USD 76.35 billion. 5. What segments are covered in the Dental Equipment and Consumables Market report? Ans. The segments covered in the Dental Equipment and Consumables Market report are by Products, End-Use, Treatment, and Region.

1. Dental Equipment and Consumables Market: Research Methodology 2. Dental Equipment and Consumables Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Dental Equipment and Consumables Market: Dynamics 3.1 Dental Equipment and Consumables Market Trends by Region 3.1.1 North America Dental Equipment and Consumables Market Trends 3.1.2 Europe Dental Equipment and Consumables Market Trends 3.1.3 Asia Pacific Dental Equipment and Consumables Market Trends 3.1.4 Middle East and Africa Dental Equipment and Consumables Market Trends 3.1.5 South America Dental Equipment and Consumables Market Trends 3.2 Dental Equipment and Consumables Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Dental Equipment and Consumables Market Drivers 3.2.1.2 North America Dental Equipment and Consumables Market Restraints 3.2.1.3 North America Dental Equipment and Consumables Market Opportunities 3.2.1.4 North America Dental Equipment and Consumables Market Challenges 3.2.2 Europe 3.2.2.1 Europe Dental Equipment and Consumables Market Drivers 3.2.2.2 Europe Dental Equipment and Consumables Market Restraints 3.2.2.3 Europe Dental Equipment and Consumables Market Opportunities 3.2.2.4 Europe Dental Equipment and Consumables Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Dental Equipment and Consumables Market Drivers 3.2.3.2 Asia Pacific Dental Equipment and Consumables Market Restraints 3.2.3.3 Asia Pacific Dental Equipment and Consumables Market Opportunities 3.2.3.4 Asia Pacific Dental Equipment and Consumables Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Dental Equipment and Consumables Market Drivers 3.2.4.2 Middle East and Africa Dental Equipment and Consumables Market Restraints 3.2.4.3 Middle East and Africa Dental Equipment and Consumables Market Opportunities 3.2.4.4 Middle East and Africa Dental Equipment and Consumables Market Challenges 3.2.5 South America 3.2.5.1 South America Dental Equipment and Consumables Market Drivers 3.2.5.2 South America Dental Equipment and Consumables Market Restraints 3.2.5.3 South America Dental Equipment and Consumables Market Opportunities 3.2.5.4 South America Dental Equipment and Consumables Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power of Suppliers 3.3.2 Bargaining Power of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives for the Dental Equipment and Consumables Industry 3.8 The Global Pandemic and Redefining of The Dental Equipment and Consumables Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 4. Global Dental Equipment and Consumables Market: Global Market Size and Forecast by Segmentation (Value) (2023-2030) 4.1 Global Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 4.1.1 Equipmento Dental radiology equipment 4.1.1.1 Dental Lasers 4.1.1.2 Systems & Parts 4.1.1.3 Laboratory Machines 4.1.1.4 Hygiene Maintenance Devices 4.1.1.5 Other Equipment’s 4.1.2 Consumables 4.1.2.1 Dental implants 4.1.2.2 Crowns and bridges 4.1.2.3 Orthodontics 4.1.2.4 Periodontics 4.1.2.5 Dental biomaterials 4.2 Global Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 4.2.1 Hospitals 4.2.2 Ambulatory Surgical Centers 4.2.3 Dental Clinics 4.2.4 Others 4.3 Global Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 4.3.1 Orthodontic 4.3.2 Endodontic 4.3.3 Peridontic 4.3.4 Prosthodontic 4.4 Global Dental Equipment and Consumables Market Size and Forecast, by Region (2023-2030) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Dental Equipment and Consumables Market Size and Forecast by Segmentation (Value) (2023-2030) 5.1 North America Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 5.1.1 Equipmento Dental radiology equipment 5.1.1.1 Dental Lasers 5.1.1.2 Systems & Parts 5.1.1.3 Laboratory Machines 5.1.1.4 Hygiene Maintenance Devices 5.1.1.5 Other Equipment’s 5.1.2 Consumables 5.1.2.1 Dental implants 5.1.2.2 Crowns and bridges 5.1.2.3 Orthodontics 5.1.2.4 Periodontics 5.1.2.5 Dental biomaterials 5.2 North America Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 5.2.1 Hospitals 5.2.2 Ambulatory Surgical Centers 5.2.3 Dental Clinics 5.2.4 Others 5.3 North America Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 5.3.1 Orthodontic 5.3.2 Endodontic 5.3.3 Peridontic 5.3.4 Prosthodontic 5.4 North America Dental Equipment and Consumables Market Size and Forecast, by Country (2023-2030) 5.4.1 United States 5.4.1.1 United States Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 5.4.1.1.1 Equipmento Dental radiology equipment 5.4.1.1.1.1 Dental Lasers 5.4.1.1.1.2 Systems & Parts 5.4.1.1.1.3 Laboratory Machines 5.4.1.1.1.4 Hygiene Maintenance Devices 5.4.1.1.1.5 Other Equipment’s 5.4.1.1.2 Consumables 5.4.1.1.2.1 Dental implants 5.4.1.1.2.2 Crowns and bridges 5.4.1.1.2.3 Orthodontics 5.4.1.1.2.4 Periodontics 5.4.1.1.2.5 Dental biomaterials 5.4.1.2 United States Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 5.4.1.2.1 Hospitals 5.4.1.2.2 Ambulatory Surgical Centers 5.4.1.2.3 Dental Clinics 5.4.1.2.4 Others 5.4.1.3 United States Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 5.4.1.3.1 Orthodontic 5.4.1.3.2 Endodontic 5.4.1.3.3 Peridontic 5.4.1.3.4 Prosthodontic 5.4.2 Canada 5.4.2.1 Canada Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 5.4.2.1.1 Equipmento Dental radiology equipment 5.4.2.1.1.1 Dental Lasers 5.4.2.1.1.2 Systems & Parts 5.4.2.1.1.3 Laboratory Machines 5.4.2.1.1.4 Hygiene Maintenance Devices 5.4.2.1.1.5 Other Equipment’s 5.4.2.1.2 Consumables 5.4.2.1.2.1 Dental implants 5.4.2.1.2.2 Crowns and bridges 5.4.2.1.2.3 Orthodontics 5.4.2.1.2.4 Periodontics 5.4.2.1.2.5 Dental biomaterials 5.4.2.2 Canada Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 5.4.2.2.1 Hospitals 5.4.2.2.2 Ambulatory Surgical Centers 5.4.2.2.3 Dental Clinics 5.4.2.2.4 Others 5.4.2.3 Canada Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 5.4.2.3.1 Orthodontic 5.4.2.3.2 Endodontic 5.4.2.3.3 Peridontic 5.4.2.3.4 Prosthodontic 5.4.3 Mexico 5.4.3.1 Mexico Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 5.4.3.1.1 Equipmento Dental radiology equipment 5.4.3.1.1.1 Dental Lasers 5.4.3.1.1.2 Systems & Parts 5.4.3.1.1.3 Laboratory Machines 5.4.3.1.1.4 Hygiene Maintenance Devices 5.4.3.1.1.5 Other Equipment’s 5.4.3.1.2 Consumables 5.4.3.1.2.1 Dental implants 5.4.3.1.2.2 Crowns and bridges 5.4.3.1.2.3 Orthodontics 5.4.3.1.2.4 Periodontics 5.4.3.1.2.5 Dental biomaterials 5.4.3.2 Mexico Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 5.4.3.2.1 Hospitals 5.4.3.2.2 Ambulatory Surgical Centers 5.4.3.2.3 Dental Clinics 5.4.3.2.4 Others 5.4.3.3 Mexico Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 5.4.3.3.1 Orthodontic 5.4.3.3.2 Endodontic 5.4.3.3.3 Peridontic 5.4.3.3.4 Prosthodontic 6. Europe Dental Equipment and Consumables Market Size and Forecast by Segmentation (Value) (2023-2030) 6.1 Europe Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 6.2 Europe Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 6.3 Europe Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 6.4 Europe Dental Equipment and Consumables Market Size and Forecast, by Country (2023-2030) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 6.4.1.2 United Kingdom Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 6.4.1.3 United Kingdom Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 6.4.2 France 6.4.2.1 France Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 6.4.2.2 France Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 6.4.2.3 France Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 6.4.3 Germany 6.4.3.1 Germany Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 6.4.3.2 Germany Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 6.4.3.3 Germany Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 6.4.4 Italy 6.4.4.1 Italy Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 6.4.4.2 Italy Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 6.4.4.3 Italy Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 6.4.5 Spain 6.4.5.1 Spain Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 6.4.5.2 Spain Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 6.4.5.3 Spain Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 6.4.6 Sweden 6.4.6.1 Sweden Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 6.4.6.2 Sweden Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 6.4.6.3 Sweden Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 6.4.7 Austria 6.4.7.1 Austria Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 6.4.7.2 Austria Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 6.4.7.3 Austria Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 6.4.8.2 Rest of Europe Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030). 6.4.8.3 Rest of Europe Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 7. Asia Pacific Dental Equipment and Consumables Market Size and Forecast by Segmentation (Value) (2023-2030) 7.1 Asia Pacific Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 7.2 Asia Pacific Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 7.3 Asia Pacific Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 7.4 Asia Pacific Dental Equipment and Consumables Market Size and Forecast, by Country (2023-2030) 7.4.1 China 7.4.1.1 China Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 7.4.1.2 China Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 7.4.1.3 China Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 7.4.2 South Korea 7.4.2.1 S Korea Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 7.4.2.2 S Korea Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 7.4.2.3 S Korea Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 7.4.3 Japan 7.4.3.1 Japan Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 7.4.3.2 Japan Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 7.4.3.3 Japan Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 7.4.4 India 7.4.4.1 India Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 7.4.4.2 India Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 7.4.4.3 India Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 7.4.5 Australia 7.4.5.1 Australia Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 7.4.5.2 Australia Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 7.4.5.3 Australia Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 7.4.6 Indonesia 7.4.6.1 Indonesia Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 7.4.6.2 Indonesia Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 7.4.6.3 Indonesia Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 7.4.7 Malaysia 7.4.7.1 Malaysia Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 7.4.7.2 Malaysia Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 7.4.7.3 Malaysia Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 7.4.8 Vietnam 7.4.8.1 Vietnam Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 7.4.8.2 Vietnam Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 7.4.8.3 Vietnam Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 7.4.9 Taiwan 7.4.9.1 Taiwan Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 7.4.9.2 Taiwan Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 7.4.9.3 Taiwan Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 7.4.10.2 Bangladesh Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 7.4.10.3 Bangladesh Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 7.4.11 Pakistan 7.4.11.1 Pakistan Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 7.4.11.2 Pakistan Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 7.4.11.3 Pakistan Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 7.4.12.2 Rest of Asia Pacific Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 7.4.12.3 Rest of Asia Pacific Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 8. Middle East and Africa Dental Equipment and Consumables Market Size and Forecast by Segmentation (Value) (2023-2030) 8.1 Middle East and Africa Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 8.2 Middle East and Africa Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 8.3 Middle East and Africa Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 8.4 Middle East and Africa Dental Equipment and Consumables Market Size and Forecast, by Country (2023-2030) 8.4.1 South Africa 8.4.1.1 South Africa Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 8.4.1.2 South Africa Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 8.4.1.3 South Africa Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 8.4.2 GCC 8.4.2.1 GCC Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 8.4.2.2 GCC Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 8.4.2.3 GCC Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 8.4.3 Egypt 8.4.3.1 Egypt Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 8.4.3.2 Egypt Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 8.4.3.3 Egypt Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 8.4.4 Nigeria 8.4.4.1 Nigeria Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 8.4.4.2 Nigeria Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 8.4.4.3 Nigeria Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 8.4.5.2 Rest of ME&A Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 8.4.5.3 Rest of ME&A Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 9. South America Dental Equipment and Consumables Market Size and Forecast by Segmentation (Value) (2023-2030) 9.1 South America Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 9.2 South America Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 9.3 South America Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 9.4 South America Dental Equipment and Consumables Market Size and Forecast, by Country (2023-2030) 9.4.1 Brazil 9.4.1.1 Brazil Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 9.4.1.2 Brazil Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 9.4.1.3 Brazil Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 9.4.2 Argentina 9.4.2.1 Argentina Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 9.4.2.2 Argentina Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 9.4.2.3 Argentina Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Dental Equipment and Consumables Market Size and Forecast, By Products (2023-2030) 9.4.3.2 Rest Of South America Dental Equipment and Consumables Market Size and Forecast, By End-Use (2023-2030) 9.4.3.3 Rest Of South America Dental Equipment and Consumables Market Size and Forecast, By Treatment (2023-2030) 10. Global Dental Equipment and Consumables Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Dental Equipment and Consumables Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Danaher Corporation (Washington, USA) 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Dentsply Sirona (North Carolina, USA) 11.3 Henry Schein (New York, USA) 11.4 Patterson Companies Inc.(Minnesota, USA) 11.5 Ultradent Products, Inc.(Utah, USA) 11.6 3M Company(Minnesota, USA) 11.7 A-Dec Inc.(Oregon, USA) 11.8 Carestream Health(New York, USA) 11.9 GC Corporation (Tokyo, Japan) 11.10 Planmeca (Helsinki, Finland) 11.11 Carestream Health(New York, USA) 11.12 GC Corporation(Tokyo, Japan) 11.13 Ivoclar Vivadent Aktiengesellschaft (Liechtenstein) 11.14 Planmeca (Finland) 11.15 Straumann (Basel, Switzerland) 12. Key Findings and Analyst Recommendations 13. Terms and Glossary