CT Scanner Market size was valued at USD 6.87 Billion in 2023 and the total CT Scanner revenue is expected to grow at a CAGR of 5.8% from 2024 to 2030, reaching nearly USD 10.19 Billion by 2030 Computed Tomography (CT) scanning is a diagnostic imaging procedure that utilizes a series of narrow beams emitted through the human body as it moves in an arc. The X-ray machines that emit a single radiation beam, and CT scans produce highly detailed cross-sectional images, providing insights into tissues within solid organs. The CT scanner's X-ray detector captures hundreds of density levels, which are transmitted to a computer to construct 3-D images displayed on a screen. Contrast dyes, such as barium used to enhance visualization of specific structures. For example, a barium meal highlights the digestive system, while a barium enema targets the rectum. Alternatively, contrast agents injected into veins facilitate imaging of blood vessels. Spiral CT technology enhances accuracy and speed by capturing continuous data without image gaps. Despite its diagnostic utility, CT scans emit ionizing radiation and pose a potential cancer risk, prompting the National Cancer Institute to recommend patients discuss the risks and benefits with their doctors before undergoing a CT scan.To know about the Research Methodology :- Request Free Sample Report Canon Medical Systems introduced two innovative scanners at RSNA. One, the Aquilion One Insight Edition, boasts 640 slices and 8 cm coverage, scanning the heart or brain in one rotation, twice as fast as previous models. The Aquilion Serve SP, with 160 slices and 4 cm coverage, emphasizes high throughput. Both utilize extensive AI integration to enhance workflows, and image quality, and automate processes, facilitating improved patient interaction. Canon revamped its Aquilion platform, incorporating newer hardware and AI technology for low-dose image reconstruction and workflow support, including automated iso-centering, pending FDA 510(k) clearance which boost CT Scanner Market growth. Fujifilm launched the FCT iStream, a compact 128-slice CT system leveraging iterative reconstruction to achieve up to 83% radiation dose reduction compared to earlier systems, although not yet FDA-cleared. United Imaging from China showcased various CT systems at RSNA, aiming to penetrate the U.S. market with competitively priced offerings featuring integrated AI, demonstrating a commitment to innovation and accessibility for CT Scanner Market.

Market Dynamics:

Revolutionizing CT Workflow and Patient Care through AI Integration The integration of artificial intelligence (AI) into CT technology has emerged as a pivotal trend in the CT scanner market, revolutionizing workflows and enhancing patient care. With AI-powered solutions permeating various aspects of CT imaging, from smart protocoling to image post-processing, the industry is witnessing a transformative shift. AI-enabled features such as iso-centering assistance, offered by major vendors' CT systems, automate the process of centering patients on the table, reducing the need for manual intervention by technologists. Moreover, deep learning-based iterative reconstruction techniques, coupled with advanced digital detectors, have enabled significant reductions in radiation doses, achieving levels as low as reasonably achievable (ALARA). For instance, GE Healthcare's TrueFidelity deep-learning image reconstruction technology on the Revolution Ascend system has enabled healthcare facilities like Duly Health and Care in the Chicago suburbs to routinely achieve CT exam doses below 2 milliSieverts, substantially lowering radiation exposure for patients. This dose reduction is particularly critical for oncology and pediatric patients undergoing frequent imaging studies, where minimizing radiation exposure is paramount for the CT Scanner Market growth. The implementation of AI-driven smart protocols has standardized the quality of scans, irrespective of the technologist's experience level, leading to improved patient outcomes. Automated settings and protocol adjustments streamline the CT imaging process, enhancing efficiency and reducing scan times. This not only addresses the current backlog in healthcare facilities but also alleviates the pressures faced by healthcare providers. The emphasis on enhancing the patient experience through AI-driven innovations aligns with vendors' goals of optimizing workflows and enabling technologists to focus more on patient care rather than technical intricacies in the CT Scanner Market. The impact of AI on reducing scan times and improving workflow efficiency has been significant, contributing to better patient experiences and outcomes for the CT Scanner Market. 1. Philips' CT collaborative remote access technology, introduced at RSNA 2023, further underscores the industry's commitment to innovation and efficiency. This technology allows technologists and radiologists to remotely access CT system control rooms for troubleshooting, even if they are not physically present at the imaging center. Such remote access capabilities enhance operational efficiency and facilitate timely interventions, ensuring seamless CT imaging processes and minimizing downtimes. Photon-counting CT is poised to become the next major innovation in CT imaging technology. Offering significant technical advantages, photon-counting CT scanners are anticipated to dominate the market in the coming decade. These systems boast approximately twice the resolution of conventional CT scanners and seamlessly integrate spectral CT data into every scan. Leading manufacturers such as Siemens and Samsung have already launched commercial photon-counting systems, while GE and Philips are actively developing their own versions of this technology. Photon counting garnered significant attention at RSNA sessions, indicating its growing importance in the field of medical imaging. Siemens was an early pioneer in photon-counting CT, having introduced the Naeotom Alpha system several years ago. Facilities equipped with these systems are actively conducting research across a range of medical specialties, with a particular emphasis on the benefits of photon-counting CT in cardiac imaging. The growing body of evidence supporting its utility in diverse clinical applications further solidifies photon-counting CT's position as a transformative technology in medical imaging. 1. Siemens unveiled the Somatom Pro.Pulse, a spectral CT scanner designed for both cardiac and general imaging applications. This innovative system integrates dual-source technology at a competitive price, making advanced imaging capabilities more accessible to a wider range of healthcare facilities. Additionally, the incorporation of an air-cooling system helps to lower the overall cost of ownership. The Somatom Pro.Pulse offers versatile applications, including cardiac care, brain, lung, musculoskeletal (MSK), and thoracic imaging. The impressive temporal resolution of 83 milliseconds enables the freezing of cardiac motion, even in patients with elevated heart rates.Advancements in CT Imaging Technology the SPCCT Project Perspective Boost the CT Scanner Market EU-funded SPCCT Project Initiatives like the SPCCT project demonstrate ongoing research efforts to enhance CT imaging for the early detection and characterization of various diseases. Collaborations between academia, healthcare institutions, and industry partners create opportunities for further innovation and development in CT technology. The implementation of photon-counting CT technology in healthcare facilities like the Acute Multidisciplinary Imaging and Interventional Centre (AMIIC) opens doors for market expansion. This technology's adoption in hybrid catheterization laboratories demonstrates its versatility and potential for diverse clinical applications. Enhanced imaging capabilities, such as better spatial resolution and reduced radiation exposure, contribute to improved patient outcomes. The ability to detect lesions more accurately and early enables timely interventions, ultimately benefiting patient care. The integration of AI and the development of contrast agents tailored for specific clinical needs pave the way for personalized medicine in CT imaging. This aligns with the growing demand for precision medicine solutions in healthcare, driving the adoption of advanced CT scanners market. Portable CT scanning offers both clinical and economic advantages. It helps physicians mitigate risks associated with intrahospital transport, such as compromising monitoring equipment, intravenous lines, or intubation tubes. These scanners facilitate rapid deployment to hospitals and radiology units, particularly benefiting head injury treatments by reducing patient transportation risks and treatment delays. By enabling clinicians to optimize stationary CT equipment availability, they improve workflow efficiency, leading to faster imaging for both ICU and non-ICU patients. This reduced need for extra transport not only yields economic benefits but also enhances equipment utilization and overall patient care quality. Neurologica, a Samsung Electronics Co., Ltd. subsidiary, developed the Bodytom Elite, the world's first mobile full-body 32-slice CT scanner. Battery-powered with an internal drive system, it seamlessly moves between rooms and accommodates patients of all sizes.

CT Scanner Market Segment Analysis:

Based on Application, the market is segmented into Oncology, Neurology, Cardiology, Musculoskeletal Imaging and Others. Oncology is expected to dominate the Computed Tomography Market over the forecast period. The domain of Computed Tomography (CT) finds its paramount importance in oncology, a field where it serves as the linchpin for diagnosis, treatment and continual management of cancer. With its unparalleled capability to render intricate cross-sectional images of the body's internal structures, CT imaging holds an essential position in oncology. CT scans prove instrumental in detecting metastases, offering crucial insights into cancer spread and significantly aiding in treatment planning. Beyond diagnosis, CT scans are indispensable for treatment planning in oncology. These imaging modalities offer detailed images enabling oncologists to precisely delineate tumor boundaries and adjacent vital structures, facilitating highly targeted and effective therapies. This precision empowers radiation oncologists in planning and administering radiation therapy with utmost accuracy, minimizing damage to healthy tissues while effectively targeting cancerous cells. CT scans assist surgeons by mapping precise surgical approaches, enabling minimally invasive procedures and enhancing surgical precision. CT imaging continues essential in monitoring cancer treatment responses. It enables oncologists to track changes in tumor size and appearance over time, providing crucial insights into the efficacy of treatments like chemotherapy or radiation therapy. This real-time evaluation aids in modifying treatment strategies, ensuring optimal therapeutic outcomes for patients.CT Scanner Market Regional Insight:

North America dominated the CT Scanner Market in 2023 and is expected to continue its dominance over the forecast period. North America stands as the dominant force in the Computed Tomography (CT) market due to a confluence of factors that underscore its leading position in the adoption, development, and utilization of this diagnostic imaging technology. The region boasts a robust healthcare infrastructure coupled with a high level of awareness and acceptance of advanced medical technologies, propelling the widespread integration of CT scanners across various medical specialties and healthcare facilities. The prevalence of chronic diseases, coupled with an aging population, has heightened the demand for precise diagnostic tools, thus bolstering the usage of CT imaging systems. North America's steadfast focus on research and development has spurred continuous innovation in CT technology, resulting in the introduction of state-of-the-art scanners with improved imaging resolution, faster scan times, and reduced radiation doses, aligning with patient safety and comfort. In the region, prominent manufacturers and technological innovators have spurred the swift uptake of advanced CT models. Collaborative efforts among academia, research institutions, and healthcare providers have propelled CT utilization across various specialized fields like oncology, cardiology, and neurology, augmenting its significance and impact within these focused domains. The Strong regulatory environment and favorable reimbursement policies have also played a key role, providing impetus for healthcare facilities to invest in and expand their CT capabilities. The convergence of an advanced healthcare ecosystem, persistent technological innovation, heightened demand for precise diagnostics, and supportive regulatory frameworks solidify North America's pre-eminence in the CT Scanner Market, positioning the region at the forefront of CT technology innovation and utilization.

Global CT Scanner Market: scope Inquire before buying

Global CT Scanner Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 6.87 Bn. Forecast Period 2024 to 2030 CAGR: 5.8% Market Size in 2030: US $ 10.19 Bn. Segments Covered: by Type Low Slice Medium Slice High Slice by Application Oncology Neurology Cardiovascular Musculoskeletal Others by End User Hospitals Diagnostic Centres Other CT Scanner Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)CT Scanner Market Key Players:

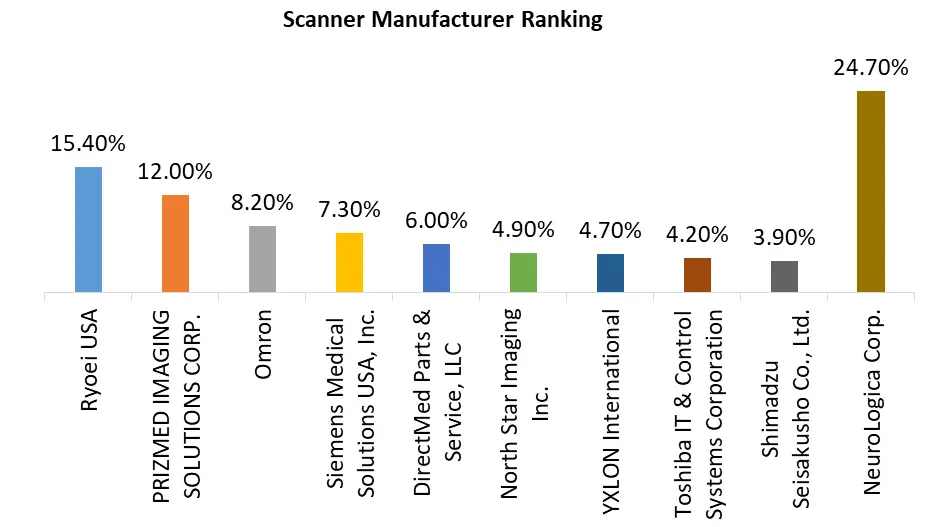

Major Contributors in the CT Scanner Market in North America: 1. NeuroLogica Corp. (Danvers, Massachusetts, USA) 2. Ryoei USA (Hollywood, Florida, USA) 3. PRIZMED IMAGING SOLUTIONS CORP. (Long Island City, New York, USA) 4. General Electric Company (Boston, Massachusetts, USA) 5. Siemens Medical Solutions USA, Inc. (Pennsylvania, USA) 6. DirectMed Parts & Service, LLC (Placentia, California, USA) 7. North Star Imaging Inc. (Rogers, Minnesota, USA) Major Leading Player in the CT Scanner Market in Europe: 1. YXLON International (Hamburg, Germany) Major Leading Player in the CT Scanner Market in Asia Pacific: 1. Canon Medical Systems Corporation (Otawara, Tochigi, Japan) 2. FUJIFILM Corporation (Tokyo, Japan) 3. Neusoft Corporation (Shenyang, Liaoning, China) 4. Omron (Kyoto, Japan) 5. Toshiba IT & Control Systems Corporation (Tokyo, Japan) 6. Shimadzu Seisakusho Co., Ltd. (Kyoto, Japan) FAQ: 1] What segments are covered in the CT Scanner Market report? Ans. The segments covered in the CT Scanner Market report are based on Type, Application, End User, and Region. 2] Which region is expected to hold the highest share in the Global CT Scanner Market? Ans. North America region is expected to hold the highest market share in the CT Scanner market. 3] What is the market size of the Global CT Scanner Market by 2030? Ans. The market size of the CT Scanner Market by 2030 is expected to reach USD 10.19 Billion. 4] What is the forecast period for the Global CT Scanner Market? Ans. The forecast period for the CT Scanner Market is 2024-2030. 5] What was the market size of the Global CT Scanner Market in 2023? Ans. The market size of the CT Scanner Market in 2023 was valued at USD 6.87 Billion.

1. CT Scanner Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. CT Scanner Market: Dynamics 2.1. CT Scanner Market Trends by Region 2.1.1. North America CT Scanner Market Trends 2.1.2. Europe CT Scanner Market Trends 2.1.3. Asia Pacific CT Scanner Market Trends 2.1.4. Middle East and Africa CT Scanner Market Trends 2.1.5. South America CT Scanner Market Trends 2.2. CT Scanner Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America CT Scanner Market Drivers 2.2.1.2. North America CT Scanner Market Restraints 2.2.1.3. North America CT Scanner Market Opportunities 2.2.1.4. North America CT Scanner Market Challenges 2.2.2. Europe 2.2.2.1. Europe CT Scanner Market Drivers 2.2.2.2. Europe CT Scanner Market Restraints 2.2.2.3. Europe CT Scanner Market Opportunities 2.2.2.4. Europe CT Scanner Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific CT Scanner Market Drivers 2.2.3.2. Asia Pacific CT Scanner Market Restraints 2.2.3.3. Asia Pacific CT Scanner Market Opportunities 2.2.3.4. Asia Pacific CT Scanner Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa CT Scanner Market Drivers 2.2.4.2. Middle East and Africa CT Scanner Market Restraints 2.2.4.3. Middle East and Africa CT Scanner Market Opportunities 2.2.4.4. Middle East and Africa CT Scanner Market Challenges 2.2.5. South America 2.2.5.1. South America CT Scanner Market Drivers 2.2.5.2. South America CT Scanner Market Restraints 2.2.5.3. South America CT Scanner Market Opportunities 2.2.5.4. South America CT Scanner Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For CT Scanner Industry 2.8. Analysis of Government Schemes and Initiatives For CT Scanner Industry 2.9. CT Scanner Market Trade Analysis 2.10. The Global Pandemic Impact on CT Scanner Market 3. CT Scanner Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. CT Scanner Market Size and Forecast, by Type (2023-2030) 3.1.1. Low Slice 3.1.2. Medium Slice 3.1.3. High Slice 3.2. CT Scanner Market Size and Forecast, by Application (2023-2030) 3.2.1. Oncology 3.2.2. Neurology 3.2.3. Cardiovascular 3.2.4. Musculoskeletal 3.2.5. Others 3.3. CT Scanner Market Size and Forecast, by End User (2023-2030) 3.3.1. Hospitals 3.3.2. Diagnostic Centres 3.3.3. Other 3.4. CT Scanner Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America CT Scanner Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America CT Scanner Market Size and Forecast, by Type (2023-2030) 4.1.1. Low Slice 4.1.2. Medium Slice 4.1.3. High Slice 4.2. North America CT Scanner Market Size and Forecast, by Application (2023-2030) 4.2.1. Oncology 4.2.2. Neurology 4.2.3. Cardiovascular 4.2.4. Musculoskeletal 4.2.5. Others 4.3. North America CT Scanner Market Size and Forecast, by End User (2023-2030) 4.3.1. Hospitals 4.3.2. Diagnostic Centres 4.3.3. Other 4.4. North America CT Scanner Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States CT Scanner Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Low Slice 4.4.1.1.2. Medium Slice 4.4.1.1.3. High Slice 4.4.1.2. United States CT Scanner Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Oncology 4.4.1.2.2. Neurology 4.4.1.2.3. Cardiovascular 4.4.1.2.4. Musculoskeletal 4.4.1.2.5. Others 4.4.1.3. United States CT Scanner Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Hospitals 4.4.1.3.2. Diagnostic Centres 4.4.1.3.3. Other 4.4.2. Canada 4.4.2.1. Canada CT Scanner Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Low Slice 4.4.2.1.2. Medium Slice 4.4.2.1.3. High Slice 4.4.2.2. Canada CT Scanner Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Oncology 4.4.2.2.2. Neurology 4.4.2.2.3. Cardiovascular 4.4.2.2.4. Musculoskeletal 4.4.2.2.5. Others 4.4.2.3. Canada CT Scanner Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Hospitals 4.4.2.3.2. Diagnostic Centres 4.4.2.3.3. Other 4.4.3. Mexico 4.4.3.1. Mexico CT Scanner Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Low Slice 4.4.3.1.2. Medium Slice 4.4.3.1.3. High Slice 4.4.3.2. Mexico CT Scanner Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Oncology 4.4.3.2.2. Neurology 4.4.3.2.3. Cardiovascular 4.4.3.2.4. Musculoskeletal 4.4.3.2.5. Others 4.4.3.3. Mexico CT Scanner Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Hospitals 4.4.3.3.2. Diagnostic Centres 4.4.3.3.3. Other 5. Europe CT Scanner Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe CT Scanner Market Size and Forecast, by Type (2023-2030) 5.2. Europe CT Scanner Market Size and Forecast, by Application (2023-2030) 5.3. Europe CT Scanner Market Size and Forecast, by End User (2023-2030) 5.4. Europe CT Scanner Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom CT Scanner Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom CT Scanner Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom CT Scanner Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France CT Scanner Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France CT Scanner Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France CT Scanner Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany CT Scanner Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany CT Scanner Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany CT Scanner Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy CT Scanner Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy CT Scanner Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy CT Scanner Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain CT Scanner Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain CT Scanner Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain CT Scanner Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden CT Scanner Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden CT Scanner Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden CT Scanner Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria CT Scanner Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria CT Scanner Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria CT Scanner Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe CT Scanner Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe CT Scanner Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe CT Scanner Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific CT Scanner Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific CT Scanner Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific CT Scanner Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific CT Scanner Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific CT Scanner Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China CT Scanner Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China CT Scanner Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China CT Scanner Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea CT Scanner Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea CT Scanner Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea CT Scanner Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan CT Scanner Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan CT Scanner Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan CT Scanner Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India CT Scanner Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India CT Scanner Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India CT Scanner Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia CT Scanner Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia CT Scanner Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia CT Scanner Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia CT Scanner Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia CT Scanner Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia CT Scanner Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia CT Scanner Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia CT Scanner Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia CT Scanner Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam CT Scanner Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam CT Scanner Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam CT Scanner Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan CT Scanner Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan CT Scanner Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan CT Scanner Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific CT Scanner Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific CT Scanner Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific CT Scanner Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa CT Scanner Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa CT Scanner Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa CT Scanner Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa CT Scanner Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa CT Scanner Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa CT Scanner Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa CT Scanner Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa CT Scanner Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC CT Scanner Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC CT Scanner Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC CT Scanner Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria CT Scanner Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria CT Scanner Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria CT Scanner Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A CT Scanner Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A CT Scanner Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A CT Scanner Market Size and Forecast, by End User (2023-2030) 8. South America CT Scanner Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America CT Scanner Market Size and Forecast, by Type (2023-2030) 8.2. South America CT Scanner Market Size and Forecast, by Application (2023-2030) 8.3. South America CT Scanner Market Size and Forecast, by End User(2023-2030) 8.4. South America CT Scanner Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil CT Scanner Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil CT Scanner Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil CT Scanner Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina CT Scanner Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina CT Scanner Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina CT Scanner Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America CT Scanner Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America CT Scanner Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America CT Scanner Market Size and Forecast, by End User (2023-2030) 9. Global CT Scanner Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading CT Scanner Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. NeuroLogica Corp. (Danvers, Massachusetts, USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Ryoei USA (Hollywood, Florida, USA) 10.3. PRIZMED IMAGING SOLUTIONS CORP. (Long Island City, New York, USA) 10.4. General Electric Company (Boston, Massachusetts, USA) 10.5. Siemens Medical Solutions USA, Inc. (Pennsylvania, USA) 10.6. DirectMed Parts & Service, LLC (Placentia, California, USA) 10.7. North Star Imaging Inc. (Rogers, Minnesota, USA) 10.8. YXLON International (Hamburg, Germany) 10.9. Canon Medical Systems Corporation (Otawara, Tochigi, Japan) 10.10. FUJIFILM Corporation (Tokyo, Japan) 10.11. Neusoft Corporation (Shenyang, Liaoning, China) 10.12. Omron (Kyoto, Japan) 10.13. Toshiba IT & Control Systems Corporation (Tokyo, Japan) 10.14. Shimadzu Seisakusho Co., Ltd. (Kyoto, Japan) 11. Key Findings 12. Industry Recommendations 13. CT Scanner Market: Research Methodology 14. Terms and Glossary