The CRISPR Technology Market was valued at USD 4.93 Bn in 2024, and the total revenue of the CRISPR Technology Market is expected to grow at a CAGR of 16.02% from 2025 to 2032, reaching nearly USD 16.18 Bn by 2032.CRISPR Technology Market Overview:

CRISPR, which stands for "Clustered Regularly Interspaced Short Palindromic Repeats," is a revolutionary gene-editing technology that allows scientists to precisely modify DNA within living organisms. CRISPR technology utilizes RNA molecules and a protein called Cas9 to target and edit specific genes. It has gained immense popularity for its efficiency, precision, and versatility in various applications, ranging from biomedical research and gene therapy to agriculture and functional genomics. The CRISPR technology market has witnessed remarkable growth, fuelled by advancements in genome editing, increasing investments in biotechnology, and a rising demand for precise gene-editing tools across diverse industries.To know about the Research Methodology :- Request Free Sample Report The CRISPR Technology market is driven by rapid advancements in genome editing techniques, increasing investments in biotechnology and healthcare, a rising incidence of genetic disorders, increasing applications in agriculture, and the potential for personalized medicine. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global CRISPR Technology Market.

CRISPR Technology Market Dynamics

Rapid Advancements in Genome Editing and Increasing Investments in Biotechnology and Healthcare Driving CRISPR Technology Market Penetration The CRISPR technology market has experienced significant growth due to continuous advancements in genome editing. Ongoing research has led to the refinement of CRISPR techniques, making them increasingly precise and versatile. This progress has not only spurred adoption across diverse applications but has also fuelled the growth of the CRISPR Technology Market as a whole. A notable driver for the CRISPR technology market has been the substantial increase in investments from both the private and public sectors in biotechnology and healthcare. These financial inflows have provided crucial support for the research, development, and commercialization of products and therapies based on CRISPR technology, further propelling its market penetration. The growing prevalence of genetic disorders has emerged as a key driver for the adoption of CRISPR technology, particularly in the field of medicine. As the incidence of genetic diseases rises, there is an escalating demand for precise and efficient gene-editing tools, highlighting the significant market potential for CRISPR-based interventions in addressing genetic disorders. CRISPR technology's impact on agriculture has been a driving force behind its CRISPR Technology market growth. The technology is being harnessed for crop improvement, enhancing disease resistance, and addressing various agricultural challenges. These applications have not only contributed significantly to the increased adoption of CRISPR technology within the agricultural sector but have also expanded its market share in agriculture-related applications. The prospect of personalized medicine has driven the adoption of CRISPR technology. Its ability to enable targeted and highly personalized therapies has positioned it as a promising tool for developing individualized treatment options. This potential for precision medicine has not only garnered considerable interest but has also driven market innovation in the healthcare industry. Ethical Concerns Impacting Market Fluctuation with Off-Target Effects and Pricing Analysis Restraining CRISPR Technology Market Growth One of the prominent restraints affecting the CRISPR technology market is the ethical concerns associated with gene editing. Particularly in the context of human germline editing, the ethical implications have raised significant societal concerns. This has led to potential regulatory hurdles and challenges in gaining public acceptance, impacting the pace at which CRISPR-based technologies deployed and causing fluctuations in the market. Despite its precision, CRISPR technology result in unintended edits, known as off-target effects. These off-target effects pose risks to the integrity of the genome and compromise the safety of gene therapies, prompting a comprehensive pricing analysis for CRISPR-based treatments that accounts for potential risks and uncertainties. The evolving regulatory landscape for gene editing technologies poses a significant restraint on the CRISPR technology market. Uncertainties in regulations hinder the commercialization and widespread adoption of CRISPR-based products. However, navigating these challenges presents an opportunity for the market to evolve and align with regulatory requirements, thereby fostering further growth. Legal battles over patents and intellectual property rights have introduced uncertainties into the CRISPR technology market. Disputes among research institutions and companies regarding ownership of key CRISPR-related patents have the potential to hinder research and development efforts, influencing market share dynamics among industry players. Despite its revolutionary capabilities, CRISPR technology faces technical challenges that act as restraints. Issues such as optimizing delivery methods, improving editing efficiency, and developing effective delivery vehicles to reach specific tissues present ongoing hurdles for researchers and developers. Overcoming these challenges likely shape emerging trends in the CRISPR technology market.CRISPR Technology Market Segment Analysis

Based on Application, the Biomedical segment dominated the CRISPR Technology Market due to its extensive applications in therapeutics, particularly in gene therapy and rare disease treatment. Pharmaceutical companies heavily invested in CRISPR research, driving adoption. Additionally, regulatory approvals and clinical trials for CRISPR-based therapies created a robust market demand. The increasing prevalence of genetic disorders and the focus on precision medicine further reinforced the segment’s dominance. Agricultural and industrial applications, while growing, remained secondary due to regulatory challenges and slower commercialisation timelines. Based on End User, Pharmaceutical and biopharmaceutical companies led the CRISPR Technology Market in 2024, holding the largest share. Their dominance was fueled by the need for advanced gene-editing therapeutics, increasing R&D budgets, and the high commercial potential of CRISPR-based products. Biotechnology firms and academic institutions contributed to the growth, but their adoption was primarily research-focused. CROs, although essential for outsourced services, captured a smaller share due to their supporting role rather than direct product development.CRISPR Technology Market Regional Analysis

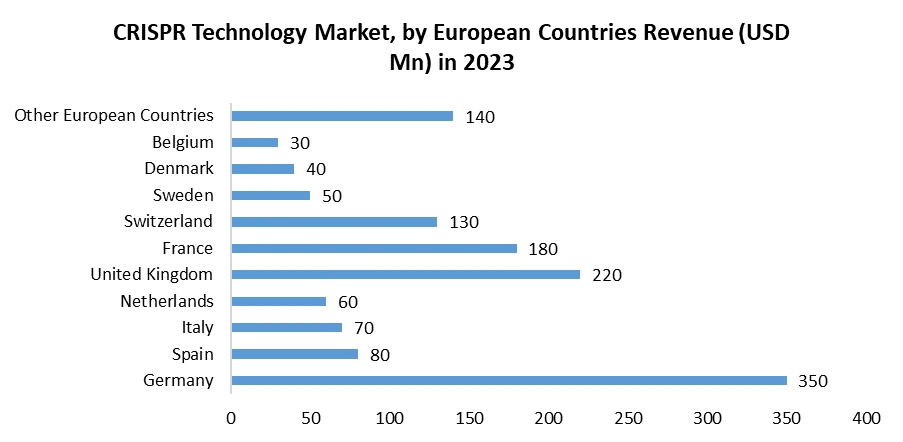

North America, particularly the United States, holds a dominant force in the CRISPR Technology Market. This dominance is attributed to a robust research infrastructure, substantial investments in biotechnology, and a high level of awareness and acceptance of gene-editing technologies. The regional growth in the US significantly influences North America's position as a market leader in CRISPR technology. Boasting a substantial market share, North America, encompassing the US, Canada, and Mexico, is a central hub for CRISPR advancements. Key players and research institutions actively contribute to the evolution of CRISPR technology, with the US serving as a primary contributor. The significant presence of major pharmaceutical and biotech companies further solidifies the region's market share, emphasizing its influential role in shaping the global CRISPR landscape. Experiencing a booming segment, particularly in biomedical applications and pharmaceutical research, the CRISPR market in North America is at the forefront of precision medicine and personalized therapies. The regional growth in the US, driven by a focus on cutting-edge drug development, propels the overall growth of CRISPR technology in these domains. Biotechnology companies in North America, especially those in the US, play a major role in driving CRISPR innovations. Collaborations between these companies and academic institutions contribute significantly, establishing North America, and particularly the US, as a major segment in the global CRISPR landscape. The Asia Pacific region, including countries like China and South Korea, showcases immense market potential for CRISPR technology. This potential is marked by increasing investments in biotechnology, rising awareness, and a growing emphasis on genetic research. The regional growth factors position Asia Pacific as a key player in the future of CRISPR applications. While still evolving, the Asia Pacific region commands a notable market share in the CRISPR Technology Market. Countries like China and Japan lead initiatives in genetic research, agriculture, and healthcare. The market share in China, in particular, has a significant impact on the overall influence of the Asia Pacific region in the global CRISPR landscape. Witnessing a booming segment in agricultural applications, the Asia Pacific region, especially China, addresses critical issues related to enhancing crop yield, improving food security, and meeting the demands of a growing population. CRISPR's role in agriculture is a significant driver of growth in this dynamic region. Academic and research institutes in the Asia Pacific region, with a focus on countries like China and South Korea, emerge as major segments contributing to CRISPR advancements. Supported by government initiatives and collaborations with global research networks, the region's research capabilities are shaping its major role in the CRISPR landscape. Europe, with key players in countries like Germany and France, holds a prominent position in the CRISPR Technology Market. This dominance is characterized by a strong emphasis on ethical gene editing practices, a well-established regulatory framework, and a robust biotechnology sector. The regional growth in Germany and France contributes significantly to Europe's dominance. Maintaining a significant market share, Europe's collaborative approach among research institutions, biotech companies, and pharmaceutical giants, particularly in Germany and France, contributes to shaping the global landscape of CRISPR technology. Europe is recognized as a key player in advancing the applications and ethical considerations of CRISPR. Experiencing a booming segment in biomedical applications, Europe focuses on developing innovative gene therapies and precision medicine approaches. The regional growth in Germany and France, among other European countries, contributes to the overall booming segment status. Biopharmaceutical companies in Europe, especially in Germany and France, play a major role in contributing to the development and commercialization of CRISPR-based therapeutics. The region's dedication to cutting-edge research positions it as a major segment and a leader in the global CRISPR Technology market. The Middle East and Africa region show increasing market potential for CRISPR technology market, with a growing interest in genetic research, agricultural advancements, and a nascent but increasing biotechnology sector. The regional growth in this sector holds promise for future contributions to the global CRISPR landscape. While currently representing a smaller market share compared to other regions, the Middle East and Africa are making strides in CRISPR applications. The market share in Brazil and other regions is actively contributing to the broader market, addressing agricultural challenges.

CRISPR Technology Industry Ecosystem:

CRISPR Technology Market Competitive Landscape May 2021, ERS Genomics Ltd. and GenScript Biotech Corporation signed a non-exclusive license agreement, through which GenScript have access to ERS Genomics’ CRISPR/Cas9 patent portfolio. March 2021, researchers from Nanyang Technological University, Singapore developed a CRISPR-based COVID-19 test that delivers results in 30 minutes. This test detects the virus even after the mutation. This would encourage other players to leverage this opportunity in the CRISPR technology market. May 2020, Mammoth Biosciences and GlaxoSmithKline Plc teamed up to develop an easy-to-use, accurate, rapid, and fully disposable test for COVID-19 detection by using Mammoth Biosciences CRISPR-based DETECTR platform. October 2020, Mammoth Biosciences signed agreement with MilliporeSigma and Hamilton Company for the commercialization of CRISPR-based SARS CoV-2 test in the CRISPR technology Market. In May 2023, Thermo Fisher Scientific opens cell therapy facility at UCSF to accelerate development of breakthrough therapies. Thermo Fisher Scientific Inc. and the University of California, San Francisco accelerated advanced cell therapies for difficult to treat conditions, including cancer, rare diseases, and other illnesses, from a newly opened cGMP manufacturing facility adjacent to UCSF Medical Center’s Mission Bay campus. In April 2022, Thermo Fisher Scientific Inc. launched the new GMP-manufactured Gibco CTS TrueCut Cas9 Protein to support genome editing for research and manufacturing applications, including CAR T-cell therapy research. In November 2021, GenScript publicised that it has launched the GenWand DoubleStranded DNA (dsDNA) Service for the manufacture of CRISPR knock-in homology- directed repair (HDR) templates in T cell engineering. In October 2020, Merck publicised that it signed agreements licensing its CRISPR technology to two companies PanCELLa, a cell therapy firm based in Toronto, Canada and Takara Bio USA, Inc., a biotechnology company based in Mountain View, California, USA.

CRISPR Technology Market Scope: Inquire before buying

Global CRISPR Technology Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 4.93 Bn. Forecast Period 2025 to 2032 CAGR: 16.02% Market Size in 2032: USD 16.18 Bn. Segments Covered: by Offering Products Kits Enzyme Libraries Services gRNA Synthesis Cell Line Development Screening Validation by Application Biomedical Applications Agricultural Applications Industrial Applications Biological Research by End User Pharmaceutical and Biopharmaceutical Companies Biotechnology Companies Academic and Research Institutes Contract Research Organizations Global CRISPR Technology Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)CRISPR Technology Market Key Players:

Major Global Key Players: 1. Integrated DNA Technologies (IDT) (United States, but global presence) 2. Oxford Genetics (United Kingdom, but global operations) 3. Caribou Biosciences, Inc. (United States, but global operations) 4. Synthego Corporation (United States, but global operations) 5. Inscripta, Inc. (United States, but global operations) 6. Synthetic Genomics, Inc. (United States, but global operations) Leading Key Players in North America: 1. Editas Medicine, Inc. (United States) 2. CRISPR Therapeutics (Switzerland, but major operations in the United States) 3. Intellia Therapeutics (United States) 4. Beam Therapeutics (United States) 5. Mammoth Biosciences (United States) Market Follower key Players in Europe: 1. Cellectis (France) 2. Merck KGaA (Germany) 3. Horizon Discovery Group plc (United Kingdom) 4. CRISPR-Cas9 Therapeutics AG (Switzerland) 5. Novartis International AG (Switzerland) Prominent Key player Asia Pacific: 1. GenScript Biotech Corporation (China) 2. ToolGen, Inc. (South Korea) 3. Thermo Fisher Scientific Inc. (United States, but significant operations in Asia-Pacific) 4. BGI Group (China) Market Leader Key Players in Middle East and Africa: 1. Bioline Global (South Africa) Dominant key Player in South America: 2. ChileGenomica (Chile) 3. Bioscript (Brazil) FAQ’s: 1. What is CRISPR technology? Ans: CRISPR technology is a revolutionary gene-editing tool that enables precise modification of DNA. It has diverse applications across medicine, agriculture, and research. 2. What are the key drivers of the CRISPR Technology Market? Ans: Rapid advancements in genome editing, increased investments in biotechnology and healthcare, rising genetic disorder incidences, growing agricultural applications, and the potential for personalised medicine are key drivers. 3. What are the main restraints for the CRISPR Technology Market? Ans: Ethical concerns, off-target effects, regulatory challenges, intellectual property disputes, and technical challenges are significant restraints in the CRISPR Technology Market. 4. Which regions dominate the CRISPR Technology Market? Ans: North America, particularly the United States, holds market dominance, followed by Europe and the Asia-Pacific region, which show significant growth potential. 5. What are the primary applications of CRISPR technology? Ans: CRISPR technology finds applications in biomedical (gene therapy), agriculture (crop improvement), industrial (bio-manufacturing), and biological research (functional genomics).

1. CRISPR Technology Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global CRISPR Technology Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading CRISPR Technology Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. CRISPR Technology Market: Dynamics 3.1. CRISPR Technology Market Trends by Region 3.1.1. North America CRISPR Technology Market Trends 3.1.2. Europe CRISPR Technology Market Trends 3.1.3. Asia Pacific CRISPR Technology Market Trends 3.1.4. Middle East and Africa CRISPR Technology Market Trends 3.1.5. South America CRISPR Technology Market Trends 3.2. CRISPR Technology Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America CRISPR Technology Market Drivers 3.2.1.2. North America CRISPR Technology Market Restraints 3.2.1.3. North America CRISPR Technology Market Opportunities 3.2.1.4. North America CRISPR Technology Market Challenges 3.2.2. Europe 3.2.2.1. Europe CRISPR Technology Market Drivers 3.2.2.2. Europe CRISPR Technology Market Restraints 3.2.2.3. Europe CRISPR Technology Market Opportunities 3.2.2.4. Europe CRISPR Technology Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific CRISPR Technology Market Drivers 3.2.3.2. Asia Pacific CRISPR Technology Market Restraints 3.2.3.3. Asia Pacific CRISPR Technology Market Opportunities 3.2.3.4. Asia Pacific CRISPR Technology Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa CRISPR Technology Market Drivers 3.2.4.2. Middle East and Africa CRISPR Technology Market Restraints 3.2.4.3. Middle East and Africa CRISPR Technology Market Opportunities 3.2.4.4. Middle East and Africa CRISPR Technology Market Challenges 3.2.5. South America 3.2.5.1. South America CRISPR Technology Market Drivers 3.2.5.2. South America CRISPR Technology Market Restraints 3.2.5.3. South America CRISPR Technology Market Opportunities 3.2.5.4. South America CRISPR Technology Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For CRISPR Technology Industry 3.8. Analysis of Government Schemes and Initiatives For CRISPR Technology Industry 3.9. CRISPR Technology Market Trade Analysis 3.10. The Global Pandemic Impact on CRISPR Technology Market 4. CRISPR Technology Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 4.1.1. Products 4.1.2. Services 4.2. CRISPR Technology Market Size and Forecast, by Application (2024-2032) 4.2.1. Biomedical 4.2.2. Agricultural 4.2.3. Industrial 4.2.4. Biological Research 4.3. CRISPR Technology Market Size and Forecast, by End User (2024-2032) 4.3.1. Pharmaceutical and Biopharmaceutical Companies 4.3.2. Biotechnology Companies 4.3.3. Academic and Research Institutes 4.3.4. Contract Research Organizations 4.4. CRISPR Technology Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America CRISPR Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 5.1.1. Products 5.1.2. Services 5.2. North America CRISPR Technology Market Size and Forecast, by Application (2024-2032) 5.2.1. Biomedical 5.2.2. Agricultural 5.2.3. Industrial 5.2.4. Biological Research 5.3. North America CRISPR Technology Market Size and Forecast, by End User (2024-2032) 5.3.1. Pharmaceutical and Biopharmaceutical Companies 5.3.2. Biotechnology Companies 5.3.3. Academic and Research Institutes 5.3.4. Contract Research Organizations 5.4. North America CRISPR Technology Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 5.4.1.1.1. Products 5.4.1.1.2. Services 5.4.1.2. United States CRISPR Technology Market Size and Forecast, by Application (2024-2032) 5.4.1.2.1. Biomedical 5.4.1.2.2. Agricultural 5.4.1.2.3. Industrial 5.4.1.2.4. Biological Research 5.4.1.3. United States CRISPR Technology Market Size and Forecast, by End User (2024-2032) 5.4.1.3.1. Pharmaceutical and Biopharmaceutical Companies 5.4.1.3.2. Biotechnology Companies 5.4.1.3.3. Academic and Research Institutes 5.4.1.3.4. Contract Research Organizations 5.4.2. Canada 5.4.2.1. Canada CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 5.4.2.1.1. Products 5.4.2.1.2. Services 5.4.2.2. Canada CRISPR Technology Market Size and Forecast, by Application (2024-2032) 5.4.2.2.1. Biomedical 5.4.2.2.2. Agricultural 5.4.2.2.3. Industrial 5.4.2.2.4. Biological Research 5.4.2.3. Canada CRISPR Technology Market Size and Forecast, by End User (2024-2032) 5.4.2.3.1. Pharmaceutical and Biopharmaceutical Companies 5.4.2.3.2. Biotechnology Companies 5.4.2.3.3. Academic and Research Institutes 5.4.2.3.4. Contract Research Organizations 5.4.3. Mexico 5.4.3.1. Mexico CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 5.4.3.1.1. Products 5.4.3.1.2. Services 5.4.3.2. Mexico CRISPR Technology Market Size and Forecast, by Application (2024-2032) 5.4.3.2.1. Biomedical 5.4.3.2.2. Agricultural 5.4.3.2.3. Industrial 5.4.3.2.4. Biological Research 5.4.3.3. Mexico CRISPR Technology Market Size and Forecast, by End User (2024-2032) 5.4.3.3.1. Pharmaceutical and Biopharmaceutical Companies 5.4.3.3.2. Biotechnology Companies 5.4.3.3.3. Academic and Research Institutes 5.4.3.3.4. Contract Research Organizations 6. Europe CRISPR Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 6.2. Europe CRISPR Technology Market Size and Forecast, by Application (2024-2032) 6.3. Europe CRISPR Technology Market Size and Forecast, by End User (2024-2032) 6.4. Europe CRISPR Technology Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 6.4.1.2. United Kingdom CRISPR Technology Market Size and Forecast, by Application (2024-2032) 6.4.1.3. United Kingdom CRISPR Technology Market Size and Forecast, by End User (2024-2032) 6.4.2. France 6.4.2.1. France CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 6.4.2.2. France CRISPR Technology Market Size and Forecast, by Application (2024-2032) 6.4.2.3. France CRISPR Technology Market Size and Forecast, by End User (2024-2032) 6.4.3. Germany 6.4.3.1. Germany CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 6.4.3.2. Germany CRISPR Technology Market Size and Forecast, by Application (2024-2032) 6.4.3.3. Germany CRISPR Technology Market Size and Forecast, by End User (2024-2032) 6.4.4. Italy 6.4.4.1. Italy CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 6.4.4.2. Italy CRISPR Technology Market Size and Forecast, by Application (2024-2032) 6.4.4.3. Italy CRISPR Technology Market Size and Forecast, by End User (2024-2032) 6.4.5. Spain 6.4.5.1. Spain CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 6.4.5.2. Spain CRISPR Technology Market Size and Forecast, by Application (2024-2032) 6.4.5.3. Spain CRISPR Technology Market Size and Forecast, by End User (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 6.4.6.2. Sweden CRISPR Technology Market Size and Forecast, by Application (2024-2032) 6.4.6.3. Sweden CRISPR Technology Market Size and Forecast, by End User (2024-2032) 6.4.7. Austria 6.4.7.1. Austria CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 6.4.7.2. Austria CRISPR Technology Market Size and Forecast, by Application (2024-2032) 6.4.7.3. Austria CRISPR Technology Market Size and Forecast, by End User (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 6.4.8.2. Rest of Europe CRISPR Technology Market Size and Forecast, by Application (2024-2032) 6.4.8.3. Rest of Europe CRISPR Technology Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific CRISPR Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 7.2. Asia Pacific CRISPR Technology Market Size and Forecast, by Application (2024-2032) 7.3. Asia Pacific CRISPR Technology Market Size and Forecast, by End User (2024-2032) 7.4. Asia Pacific CRISPR Technology Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 7.4.1.2. China CRISPR Technology Market Size and Forecast, by Application (2024-2032) 7.4.1.3. China CRISPR Technology Market Size and Forecast, by End User (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 7.4.2.2. S Korea CRISPR Technology Market Size and Forecast, by Application (2024-2032) 7.4.2.3. S Korea CRISPR Technology Market Size and Forecast, by End User (2024-2032) 7.4.3. Japan 7.4.3.1. Japan CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 7.4.3.2. Japan CRISPR Technology Market Size and Forecast, by Application (2024-2032) 7.4.3.3. Japan CRISPR Technology Market Size and Forecast, by End User (2024-2032) 7.4.4. India 7.4.4.1. India CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 7.4.4.2. India CRISPR Technology Market Size and Forecast, by Application (2024-2032) 7.4.4.3. India CRISPR Technology Market Size and Forecast, by End User (2024-2032) 7.4.5. Australia 7.4.5.1. Australia CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 7.4.5.2. Australia CRISPR Technology Market Size and Forecast, by Application (2024-2032) 7.4.5.3. Australia CRISPR Technology Market Size and Forecast, by End User (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 7.4.6.2. Indonesia CRISPR Technology Market Size and Forecast, by Application (2024-2032) 7.4.6.3. Indonesia CRISPR Technology Market Size and Forecast, by End User (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 7.4.7.2. Malaysia CRISPR Technology Market Size and Forecast, by Application (2024-2032) 7.4.7.3. Malaysia CRISPR Technology Market Size and Forecast, by End User (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 7.4.8.2. Vietnam CRISPR Technology Market Size and Forecast, by Application (2024-2032) 7.4.8.3. Vietnam CRISPR Technology Market Size and Forecast, by End User (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 7.4.9.2. Taiwan CRISPR Technology Market Size and Forecast, by Application (2024-2032) 7.4.9.3. Taiwan CRISPR Technology Market Size and Forecast, by End User (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 7.4.10.2. Rest of Asia Pacific CRISPR Technology Market Size and Forecast, by Application (2024-2032) 7.4.10.3. Rest of Asia Pacific CRISPR Technology Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa CRISPR Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 8.2. Middle East and Africa CRISPR Technology Market Size and Forecast, by Application (2024-2032) 8.3. Middle East and Africa CRISPR Technology Market Size and Forecast, by End User (2024-2032) 8.4. Middle East and Africa CRISPR Technology Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 8.4.1.2. South Africa CRISPR Technology Market Size and Forecast, by Application (2024-2032) 8.4.1.3. South Africa CRISPR Technology Market Size and Forecast, by End User (2024-2032) 8.4.2. GCC 8.4.2.1. GCC CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 8.4.2.2. GCC CRISPR Technology Market Size and Forecast, by Application (2024-2032) 8.4.2.3. GCC CRISPR Technology Market Size and Forecast, by End User (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 8.4.3.2. Nigeria CRISPR Technology Market Size and Forecast, by Application (2024-2032) 8.4.3.3. Nigeria CRISPR Technology Market Size and Forecast, by End User (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 8.4.4.2. Rest of ME&A CRISPR Technology Market Size and Forecast, by Application (2024-2032) 8.4.4.3. Rest of ME&A CRISPR Technology Market Size and Forecast, by End User (2024-2032) 9. South America CRISPR Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 9.2. South America CRISPR Technology Market Size and Forecast, by Application (2024-2032) 9.3. South America CRISPR Technology Market Size and Forecast, by End User(2024-2032) 9.4. South America CRISPR Technology Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 9.4.1.2. Brazil CRISPR Technology Market Size and Forecast, by Application (2024-2032) 9.4.1.3. Brazil CRISPR Technology Market Size and Forecast, by End User (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 9.4.2.2. Argentina CRISPR Technology Market Size and Forecast, by Application (2024-2032) 9.4.2.3. Argentina CRISPR Technology Market Size and Forecast, by End User (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America CRISPR Technology Market Size and Forecast, by Offering (2024-2032) 9.4.3.2. Rest Of South America CRISPR Technology Market Size and Forecast, by Application (2024-2032) 9.4.3.3. Rest Of South America CRISPR Technology Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. Integrated DNA Technologies (IDT) (United States, but global presence) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Oxford Genetics (United Kingdom, but global operations) 10.3. Caribou Biosciences, Inc. (United States, but global operations) 10.4. Synthego Corporation (United States, but global operations) 10.5. Inscripta, Inc. (United States, but global operations) 10.6. Synthetic Genomics, Inc. (United States, but global operations) 10.7. Editas Medicine, Inc. (United States) 10.8. CRISPR Therapeutics (Switzerland, but major operations in the United States) 10.9. Intellia Therapeutics (United States) 10.10. Beam Therapeutics (United States) 10.11. Mammoth Biosciences (United States) 10.12. Cellectis (France) 10.13. Merck KGaA (Germany) 10.14. Horizon Discovery Group plc (United Kingdom) 10.15. CRISPR-Cas9 Therapeutics AG (Switzerland) 10.16. Novartis International AG (Switzerland) 10.17. GenScript Biotech Corporation (China) 10.18. ToolGen, Inc. (South Korea) 10.19. Thermo Fisher Scientific Inc. (United States, but significant operations in Asia-Pacific) 10.20. BGI Group (China) 10.21. Bioline Global (South Africa) 10.22. ChileGenomica (Chile) 10.23. Bioscript (Brazil) 11. Key Findings 12. Industry Recommendations 13. CRISPR Technology Market: Research Methodology 14. Terms and Glossary