Copper Mining Market size was valued at US$ 76.17 Bn. in 2022 and the total revenue is expected to grow at a CAGR of 0.81% through 2023 to 2029, reaching nearly US$ 80.60 Bn.Market Overview:

Copper is widely utilized in the construction of various buildings, solar energy transmission, and high-speed data transmission lines due to its high electrical and thermal conductivity. It is commonly utilised to build cables and pipelines due to its malleable and soft physical properties in soft state. Building & Construction Industry, Equipment Manufacturers, Transportation, and Infrastructure Industry are the end-users of the copper mining. Underground Mining, and Open pit Mining are the methods of the copper mining.To know about the Research Methodology :- Request Free Sample Report

Global Copper Mining Market Dynamics:

Copper's strong thermal and electrical conductivity has made it a very important metal. Approximately half of the world's copper production is now used for electrical purposes. Copper's popularity stems from the fact that it can be recycled endlessly without losing any chemical or physical qualities. Copper that has been recycled, or secondary copper, is virtually indistinguishable from primary copper, and the manufacturing process uses far less energy. Copper for mining is widely distributed throughout broader geographic regions, where it is mixed and manifested with other substances and rocks. It is mined and extracted in the form of copper oxide ore and copper sulphides ore, which are both compound ore. Copper grade refers to the proportion of copper in various copper ores that ranges from 1% to 1.8%. To extract pure copper, copper ores go through a number of procedures and stages, including crushing the ore into smaller pieces. Following the crushing of the ores, the concentration is split based on the kind of ores, with oxide ores going to leach tanks and sulfites going to concentrating stages. Increasing development and construction initiatives in emerging and developing economies are expected to drive the global copper mining market during the forecast period 2023-2029. Copper is widely utilizing in wood preservatives, bacteriostatic agents, and fungicides, are the other key benefits that are expected to boost the growth of the global market. Government mining regulations, as well as the copper mining industry's high operational costs, are some of the major restraining factors that are expected to restrains the growth of the global copper mining market during the forecast period 2023-2029.Global Copper Mining Market Segment Analysis:

Based on the Method, the market is segmented into Underground mining, and Open pit mining. Open pit mining segment is expected to hold the largest market share of xx% by 2029. This is due to its flexible operating procedure, increased levels of production, and cost-effectiveness, open-pit mining is the best method for extraction. Open pit mining offers plenty of benefits such as large volumes of rock can be moved with the use of powerful trucks and shovels, lower mining costs imply that lower-grade ore is more economically mined, production is faster, and other benefits. These are the key benefits that are expected to boost the growth of this segment in the global market during the forecast period 2023-2029.Based on the End-Users, the market is segmented into Building & Construction Industry, Equipment Manufacturers, Transportation, and Infrastructure Industry. Building & Construction Industry is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. This is due to the growing building & construction activities in various countries increases the demand for copper mining as it provides various benefits.

Global Copper Mining Market Regional Insights:

Asia Pacific dominates the Global Copper Mining market during the forecast period 2023-2029. Asia Pacific is expected hold the largest market share of xx% by 2029. China is responsible for roughly half of global copper consumption, whereas Chile is responsible for one-fifth of global copper supplies. Copper consumption per capita varies from 10 to 20 kg in industrialised countries to 1 to 2 kg or less in developing countries. The extensive demand for copper in many areas is the key driver of the copper mining industry. These are the major factors that drive the growth of this region in the Global market during the forecast period 2023-2029.The objective of the report is to present a comprehensive analysis of the Global Copper Mining Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Copper Mining Market dynamic, structure by analyzing the market segments and project the Global Copper Mining Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Global Copper Mining Market make the report investor’s guide.

Global Copper Mining Market Scope: Inquiry Before Buying

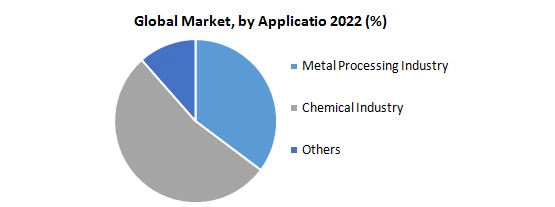

Global Copper Mining Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 76.17 Bn. Forecast Period 2023 to 2029 CAGR: 0.81% Market Size in 2029: US $ 80.60 Bn. Segments Covered: by Method Underground Mining Open pit Mining by End-Users Building & Construction Industry Equipment Manufacturers Transportation Infrastructure Industry by Application Metal Processing Industry Chemical Industry Others Global Copper Mining Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players

1. Freeport-McMoRan Inc. 2. Sumitomo Metal Mining 3. Grupo Mexico 4. Glencore International AG 5. Southern Copper Corp 6. Amerigo Resources Ltd. 7. Glencore International 8. BHP Billiton Ltd. 9. Rio Tinto 10.Codelco 11.Xstrata 12.Bougainville Copper Limited 13.Hindalco Industries 14.Hindustan Copper 15.Others Frequently Asked Questions: 1] What segments are covered in Global Market report? Ans. The segments covered in Global Copper Mining Market report are based on Method, and End-Users. 2] Which region is expected to hold the highest share in the Global Copper Mining Market? Ans. Asia Pacific is expected to hold the highest share in the Global Copper Mining Market. 3] Who are the top key players in the Global Copper Mining Market? Ans. Freeport-McMoRan Inc., Sumitomo Metal Mining, Grupo Mexico, Glencore International AG, and Southern Copper Corpare the top key players in the Global Copper Mining Market. 4] Which segment holds the largest market share in the Global market by 2029? Ans. Open pit mining method segment hold the largest market share in the Global Copper Mining market by 2029. 5] What is the market size of the Global Copper Mining market by 2029? Ans. The market size of the Global Copper Mining market is US $ 80.60 Bn. by 2029. 6] What was the market size of the Global Copper Mining market in 2022? Ans. The market size of the Global Copper Mining market was worth US $ 76.17 Bn. in 2022.

1. Global Copper Mining Market: Research Methodology 2. Global Copper Mining Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Copper Mining Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Copper Mining Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Copper Mining Market Segmentation 4.1 Global Copper Mining Market, by Method (2023-2029) • Underground Mining • Open pit Mining 4.2 Global Copper Mining Market, by End-Users (2023-2029) • Building & Construction Industry • Equipment Manufacturers • Transportation • Infrastructure Industry 4.3 Global Copper Mining Market, by Application (2023-2029) • Metal Processing Industry • Chemical Industry • Others 5. North America Copper Mining Market(2023-2029) 5.1 North America Copper Mining Market, by Method (2023-2029) • Underground Mining • Open pit Mining 5.2 North America Copper Mining Market, by End-Users (2023-2029) • Building & Construction Industry • Equipment Manufacturers • Transportation • Infrastructure Industry 5.3 North America Copper Mining Market, by Application (2023-2029) • Metal Processing Industry • Chemical Industry • Others 5.4 North America Copper Mining Market, by Country (2023-2029) • United States • Canada • Mexico 6. Europe Copper Mining Market (2023-2029) 6.1. European Copper Mining Market, by Method (2023-2029) 6.2. European Copper Mining Market, by End-Users (2023-2029) 6.3. European Copper Mining Market, by Application (2023-2029) 6.4. European Copper Mining Market, by Country (2023-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Copper Mining Market (2023-2029) 7.1. Asia Pacific Copper Mining Market, by Method (2023-2029) 7.2. Asia Pacific Copper Mining Market, by End-Users (2023-2029) 7.3. Asia Pacific Copper Mining Market, by Application (2023-2029) 7.4. Asia Pacific Copper Mining Market, by Country (2023-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Copper Mining Market (2023-2029) 8.1 Middle East and Africa Copper Mining Market, by Method (2023-2029) 8.2. Middle East and Africa Copper Mining Market, by End-Users (2023-2029) 8.3. Middle East and Africa Copper Mining Market, by Application (2023-2029) 8.4. Middle East and Africa Copper Mining Market, by Country (2023-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Copper Mining Market (2023-2029) 9.1. South America Copper Mining Market, by Method (2023-2029) 9.2. South America Copper Mining Market, by End-Users (2023-2029) 9.3. South America Copper Mining Market, by Application (2023-2029) 9.4 South America Copper Mining Market, by Country (2023-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Freeport-McMoRan Inc. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Sumitomo Metal Mining 10.3 Grupo Mexico 10.4 Glencore International AG 10.5 Southern Copper Corp 10.6 Amerigo Resources Ltd. 10.7 Glencore International 10.8 BHP Billiton Ltd. 10.9 Rio Tinto 10.10 Codelco 10.11 Xstrata 10.12 Bougainville Copper Limited 10.13 Hindalco Industries 10.14 Hindustan Copper 10.15 Others