Contact Center Software Market size was valued at US$ 36.27 Bn. in 2023 and the total revenue is expected to grow at 21% of CAGR through 2024 to 2030, reaching nearly US$ 137.75 Bn.Contact Center Software Market Overview:

Contact Center Software Market was valued at US$ 36.27 Bn. in 2023.It is a telephone system that allows businesses and customers to speak with one another. A contact centre software enables businesses to create and strengthen relationships with their customers and prospects by enabling them to communicate effectively across several channels such as audio, video, online, chat, mobile applications, and social media. By streamlining inbound and outbound operations, contact centre software assists enterprises in increasing overall productivity. It also provides enterprises with a variety of functions, such as call monitoring, analysis, and reporting from a centralized platform.To know about the Research Methodology :- Request Free Sample Report

Contact Center Software Market Dynamics:

ccording to an MMR study, 84% of customers place an equal value on a company's experience & its products and services. Businesses have also come to understand how enhanced customer service may contribute to increased profitability. As a result, companies are quickly implementing contact centre solutions as part of their initiatives to enhance customer service, hence fostering market expansion. The advantages of cloud-based computing and management solutions have been recognised by businesses. As a result, many companies worldwide are concentrating on making the transfer to cloud-based contact centres. $125 million is invested in Observe AI's intelligent call centre software The intelligent contact centre software provider Z21 Labs Inc., which does business as Observe.ai, said on 12th April 2022 that it has raised $125 Mn in a new round of funding. Zoom Video Communications Inc. joined the Series C round, which was led by SoftBank Vision Fund & included current investors Menlo Ventures, Scale Venture Partners, and Nexus Venture Partners, bringing the company's total funding to date to $231 million. An intelligent call centre platform developed by Observe.ai assists human operators with duties including customer support. The conversations that operators conduct with consumers are analysed using natural language processing algorithms that are based on artificial intelligence. In order to try to determine the caller's level of happiness, the software can also transcribe each call and do sentiment analysis. Additionally, it seeks to establish links between the caller's enjoyment and the operator's words and deeds. Business Appears Stronger than the Market Suggestions for Cloud Technology: Cloud technology is being embraced by administrators & managers of contact centres for a number of reasons, including increased security & productivity. To enhance customer experience, organisations are increasingly implementing other omni channel solutions, such as video chat support and Chatbots, based on cutting-edge technology like Artificial Intelligence (AI). Utilizing AI, a number of firms have already begun automating certain business tasks. The following generation of this technology, prescriptive AI, offers a wide range of new features, from better case routing to effective question resolution and scheduling management. Prescriptive AI is also expected to increase customer interactions from discovery & on boarding to post-purchase assistance, adding a new dimension to how organisations can expect the changing demands of customers. Additionally, internal uses for prescriptive AI include optimising field resource utilisation & replenishing inventories based on demand. The expansion of the market during the forecast period may be constrained, however, by Interactive Voice Response (IVR) fraud or fraudulent actions taking place within the IVR systems. As contact centres continue to embrace IVR systems, web chats, and self-service channels as part of the efforts to handle the rising amounts of calls being received by the agents, they are increasingly exposed to the danger of fraud attacks and the ensuing losses. Because they keep vast amounts of sensitive client data, contact centres are continuously at risk of cyber-attacks. Therefore, it is expected that the increasing number of cyber-attacks on contact centre corporate activities will hinder Contact Center Software market growth. Observe's Series B Investment from Menlo. The goal of AI is to enhance the contact centre The emphasis at Menlo is on making investments in businesses that employ technology to streamline laborious human procedures. Because of this, they are thrilled to share that they have made a Series B lead investment in Observe.AI, a top Contact Center AI platform that streamlines call analysis, quality assurance, and coaching workflows for major brands while accurately transcribing each call. Their cumbersome and inefficient procedure is revolutionised by AI by giving them complete visibility into each customer call. Observe. AI's patented technology provides transcription accuracy that leads the industry while maintaining the tone of every encounter. After managers have increased their expertise, the technology enables them to take action by conducting tailored coaching sessions to help agents develop and imitate great performers. Covid Pandemic Positive Impact on Contact Center Market The use of contact centre software is expected to be accelerated by the trend set by COVID-19 pandemic. In order to provide flawless customer support amidst the sharp increase in call traffic following the pandemic epidemic, contact centres deployed AI-based virtual agents. While creating a conversational experience, offering automated support, & managing the same intents as human agents, virtual agents enable quick, on-demand service. AI human assistance may be able to shift phone calls to chat & give users access to digital specialists while enhancing their ability to respond to customer concerns. What steps the development of contact centre technology and customer experience will take next positive step Contact centres have seen the emergence of omnichannel, virtual assistants, & even the beginnings of the metaverse over the last ten years. Customers who are modern and digital native and eager to solve problems with the fewest number of interactions are raising their expectations as a result of the growing adoption of new technologies and the advent of disruptors driven by CX. Because so many agents have switched to remote work over the past two years, cloud platforms are now more important than ever. As a result, many businesses now benefit from simpler technological connections, which makes it simpler to incorporate innovations into the contact centre ecosystem. It is exciting to think about what will happen next in the development of contact centre technology and the future of CX as these new realities merge. 1. Self-Service by Default: Self-service won't be limited to straightforward transactional requests anymore. Instead, it will take the place of a significant number of incoming calls as the standard technique for query resolution. Customers who still choose to contact centres will probably have more complicated issues that require human assistance, which will demand for a culture change as contact centres learn to handle difficult calls on a regular basis. 2. Conversational intelligence and conversational AI: Chatbots and voicebots that are powered by AI are referred to as conversational AI. Particularly for frequent problems and FAQs, these solutions automate a large chunk of the inquiry resolution process. Conversational AI, like self-service options, can assist users in finishing straightforward tasks like order cancellation through a simple chat flow. While this is happening, conversational intelligence analyses text and audio conversations using sophisticated analytics techniques to reveal hidden data. The developments in data processing will benefit both contact centre technologies. 3. The Increase in Personalization: Real-time customer data and AI are combined in hyper-personalization to produce insights. Businesses can use systems or human involvement to leverage these data for strategic individualization, creating distinctive and individualized customer journeys. For instance, the contact centre can send a consumer a discount offer when they are upset and their business is at risk by tracking the sentiment of a person in real-time. Alternatively, for a more personalized touch, the contact centre can put that consumer to an outbound dialing list so a person proactively makes adjustments.Contact Center Software Market Segment Overview:

Solution Segment: With a revenue share of more than 22.0%, the IVR sector dominated the Contact Center Software market in 2023. Compared to traditional speech recognition software, interactive voice response solutions can interpret tones & accents with more accuracy. Businesses can use interactive voice response systems to help assign callers to the appropriate departments or agents as needed. Additionally, IVR services can assist customers in addressing product-related issues independently rather than relying on customer service representatives. IVR solutions are frequently used by contact centres with high call volumes to handle numerous calls at once without alerting the callers' callers that there are other callers on the line. During the forecast period, it is expected that the customer collaboration solution category will grow at the fastest rate. Solutions for customer collaboration help firms communicate more effectively with both current and potential customers. These tools assist organisations in acquiring and using customer feedback to enhance their product & service offerings as well as tracking, receiving, and resolving customer care concerns swiftly. During the forecast period, the segment's growth is expected to be driven by the strong emphasis on boosting collaboration by using images and videos to interact with clients. Service Segment: With a revenue share of more than 42.0%, the integration & deployment segment commanded the majority of the market in the year 2023. During the forecast period, Contact Center Software market is expected to rise as cloud-based contact centre software solutions become more widely used. Businesses all over the world are making significant investments to include various apps and technologies, like Customer Relationship Management (CRM), into their business operations, which is fueling the expansion of this market. The rapid implementation of cloud-based solutions & the increasing demand for business agility are both positive factors for the growth of the integration and deployment segment. The managed services segment is expected to develop at the fastest rate during the forecast period. By delegating the company's IT-related activities to managed service providers, managed services enable enterprises to concentrate on their core goods and services. By utilizing configuration management, provisioning, common change management, and patch management solutions, managed services assist enterprises in maintaining their programmes for end users. Additionally, a variety of value-added services are included in these services to assist businesses in getting the most out of contact centre solutions in terms of performance and dependability while limiting operational expenses. The expansion of cloud solutions is encouraging for the managed services market. Deployment Segment: With a revenue share of more than 58.0%, the on-premise segment led the market in the year 2023. The idea behind on-premise deployment is to set up all the hardware and software needed to run and maintain a contact centre on the client's premises. Integrability, dependability, customizability, and to some extent scalability are all features that on-premise systems offer. However occasionally they can be highly expensive and difficult to implement. Only when organisations make significant investments in professional services can they appreciate the benefits of on-premise systems' customizability. Due to their flexibility to scale services, businesses all over the world are choosing cloud-based contact centre systems over on-premise alternatives. Agents can access centralized contact centre applications through cloud solutions, which also provide a secure intranet for staff collaboration and communication. Executives using on-premise solutions would not be able to track detailed information about the agents and clients that cloud-based systems are capable of providing. The average speed of answer (ASA) can be decreased by as much as 50% while enhancing customer call answer rates by about 5%, according to a study by RingCentral, Inc.Contact Center Software Market Regional Overview:

North America dominated the global Contact Center Software market with a revenue share of more than 36.0% in the year 2023. Some of the major market players are based in North America. Additionally, businesses in North American nations are making significant investments in cutting-edge technology like big data, analytics, and cloud platforms. Both major and small & medium firms in the area have increased their focus on optimizing outgoing and inbound processes to increase efficiency. The quickly expanding e-commerce sector, in conjunction with the more popular omnichannel approach to sales, is further expected to fuel regional Contact Center Software market growth. The presence of numerous Information Technology-enabled Services (ITES) & IT companies in the region is likely to make Asia Pacific the region with the quickest growth during the forecast period. The regional market is expected to increase as a result of the increasing usage of contact centre solutions by both small and large businesses. The positive efforts made by local governments to promote the use of cloud-based systems and the automation of business operations are also expected to play a significant part in propelling the expansion of the regional market. The fact that several businesses continue to be interested in investing in the APAC regional market is encouraging for the development of the local market.Competitive Scenario in the Global Contact Center Software Market

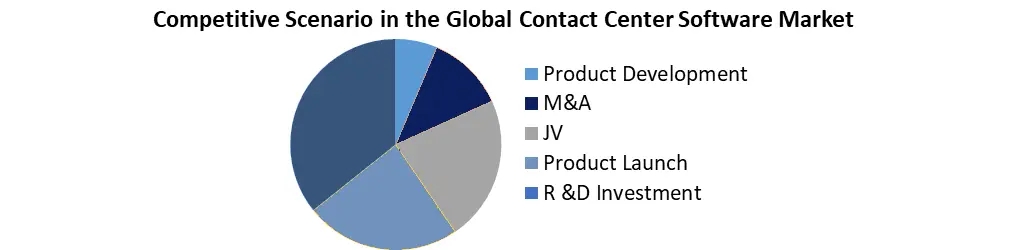

Acquisition, business expansions & technological advancements are common strategies followed by major market players.

Contact Center Software Market Scope: Inquiry Before Buying

Contact Center Software Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 36.27 Bn. Forecast Period 2024 to 2030 CAGR: 21% Market Size in 2030: US $ 137.75 Bn. Segments Covered: by Solution Automatic Call Distribution (ACD) Call Recording Computer Telephony Integration (CTI) Customer Collaboration Dialer Interactive Voice Responses (IVR) Reporting & Analytics Workforce Optimization Others by Service Integration & Deployment Support & Maintenance Training & Consulting Managed Services by Deployment Hosted On-premise by Enterprise Size Large Enterprise Small & Medium Enterprise by End user BFSI Consumer Goods & Retail Government Healthcare IT & Telecom Travel & Hospitality Others Contact Center Software Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Contact Center Software Market, Key Players are

1. 8X8, Inc.(US) 2. Altivon(US) 3. Amazon Web Services, Inc.(US) 4. Amtelco(US) 5. Aspect Software(US) 6. Avaya Inc.(US) 7. Avoxi(US) 8. Cisco Systems, Inc.(US) 9. Enghouse Interactive Inc.((US) 10. Five9, Inc.(US) 11. Genesys(US) 12. Microsoft Corporation(US) 13. Spok, Inc.(US) 14. Talkdesk, Inc.(US) 15. Twilio Inc.(US) 16. UiPath(US) 17. Unify Inc.(US) 18. Exotel Techcom Pvt. Ltd.(India) 19. Ameyo (India) 20. ALE International (France) 21. NEC Corporation (Japan) 22. SAP SE (Germany) Frequently Asked Questions: 1] What segments are covered in the Global Contact Center Software Market report? Ans. The segments covered in the Contact Center Software Market report are based on Solution and Service, Deployment, Enterprise Size. 2] Which region is expected to hold the highest share in the Global Contact Center Software Market? Ans. The Asia pacific region is expected to hold the highest share in the Contact Center Software Market. 3] What is the market size of the Global Contact Center Software Market by 2030? Ans. The market size of the Contact Center Software Market by 2030 is expected to reach US$ 137.26 Bn. 4] What is the forecast period for the Global Contact Center Software Market? Ans. The forecast period for the Contact Center Software Market is 2023-2030. 5] What was the market size of the Global Contact Center Software Market in 2023? Ans. The market size of the Contact Center Software Market in 2023 was valued at US$ 36.27 Bn.

1. Global Contact Center Software Market: Research Methodology 2. Global Contact Center Software Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Contact Center Software Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Contact Center Software Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Contact Center Software Market Segmentation 4.1 Global Contact Center Software Market, Solution (2023-2030) • Automatic Call Distribution (ACD) • Call Recording • Computer Telephony Integration (CTI) • Customer Collaboration • Dialer • Interactive Voice Responses (IVR) • Reporting & Analytics • Workforce Optimization • Others 4.2 Global Contact Center Software Market, Service (2023-2030) • Integration & Deployment • Support & Maintenance • Training & Consulting • Managed Services 4.3 Global Contact Center Software Market, Deployment (2023-2030) • Hosted • On-premise 4.4 Global Contact Center Software Market, Enterprise Size (2023-2030) • Large Enterprise • Small & Medium Enterprise 4.5 Global Contact Center Software Market, End user (2023-2030) • BFSI • Consumer Goods & Retail • Government • Healthcare • IT & Telecom • Travel & Hospitality • Others 5. North America Contact Center Software Market (2023-2030) 5.1 North America Contact Center Software Market, Solution (2023-2030) • Automatic Call Distribution (ACD) • Call Recording • Computer Telephony Integration (CTI) • Customer Collaboration • Dialer • Interactive Voice Responses (IVR) • Reporting & Analytics • Workforce Optimization • Others 5.2 North America Contact Center Software Market, Service (2023-2030) • Integration & Deployment • Support & Maintenance • Training & Consulting • Managed Services 5.3 North America Contact Center Software Market, Deployment (2023-2030) • Hosted • On-premise 5.4 North America Contact Center Software Market, Enterprise Size (2023-2030) • Large Enterprise • Small & Medium Enterprise 5.5 North America Contact Center Software Market, End user (2023-2030) • BFSI • Consumer Goods & Retail • Government • Healthcare • IT & Telecom • Travel & Hospitality • Others 5.6 North America Contact Center Software Market, by Country (2023-2030) • United States • Canada • Mexico 6. Europe Contact Center Software Market (2023-2030) 6.1. European Contact Center Software Market, by Solution (2023-2030) 6.2. European Contact Center Software Market, Service (2023-2030) 6.3. European Contact Center Software Market, by Deployment (2023-2030) 6.4. European Contact Center Software Market, Enterprise Size (2023-2030) 6.5. European Contact Center Software Market, End user (2023-2030) 6.6. European Contact Center Software Market, by Country (2023-2030) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Contact Center Software Market (2023-2030) 7.1. Asia Pacific Contact Center Software Market, by Solution (2023-2030) 7.2. Asia Pacific Contact Center Software Market, Service (2023-2030) 7.3. Asia Pacific Contact Center Software Market, by Deployment (2023-2030) 7.4. Asia Pacific Contact Center Software Market, Enterprise Size (2023-2030) 7.5. Asia Pacific Contact Center Software Market, End user (2023-2030) 7.6. Asia Pacific Contact Center Software Market, by Country (2023-2030) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Contact Center Software Market (2023-2030) 8.1 Middle East and Africa Contact Center Software Market, by Solution (2023-2030) 8.2. Middle East and Africa Contact Center Software Market, Service (2023-2030) 8.3. Middle East and Africa Contact Center Software Market, by Deployment (2023-2030) 8.4. Middle East and Africa Contact Center Software Market, Enterprise Size (2023-2030) 8.5. Middle East and Africa Contact Center Software Market, End user (2023-2030) 8.6. Middle East and Africa Contact Center Software Market, by Country (2023-2030) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Contact Center Software Market (2023-2030) 9.1. South America Contact Center Software Market, by Solution (2023-2030) 9.2. South America Contact Center Software Market, Service (2023-2030) 9.3. South America Contact Center Software Market, by Deployment (2023-2030) 9.4. South America Contact Center Software Market, Enterprise Size (2023-2030) 9.5. South America Contact Center Software Market, End user (2023-2030) 9.6 South America Contact Center Software Market, by Country (2023-2030) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 8X8, Inc. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 ALE International 10.3 Altivon 10.4 Amazon Web Services, Inc. 10.5 Ameyo 10.6 Amtelco 10.7 Aspect Software 10.8 Avaya Inc. 10.9 Avoxi 10.10 Cisco Systems, Inc. 10.11 Enghouse Interactive Inc. 10.12 Exotel Techcom Pvt. Ltd. 10.13 Five9, Inc. 10.14 Genesys 10.15 Microsoft Corporation 10.16 NEC Corporation 10.17 SAP SE 10.18 Spok, Inc. 10.19 Talkdesk, Inc. 10.20 Twilio Inc. 10.21 UiPath 10.22 Unify Inc. 10.23 VCC Live.