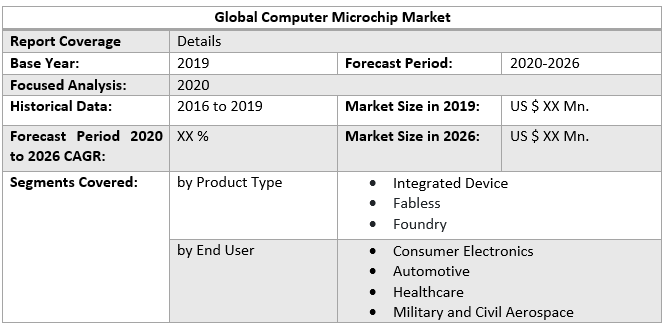

CAGR of the Global Computer Microchip market is expected to be 10.3% during the forecast period and the market size is expected to reach nearly US$ 32.8 billion by 2026.Global Computer Microchip Market Introduction

Computer chip, also called a chip, integrated circuit, or small wafer of semiconductor material embedded with integrated circuitry. Chips comprise the processing and memory units of the modern digital computer. As transistor components have shrunk, the number per chip has doubled about every 18 months, from a few thousand in 1971 (Intel Corp.’s first chip) to more than one billion in 2006. Nanotechnology is expected to make transistors even smaller and chips correspondingly more powerful as technology advances.Global Computer Microchip Market Dynamics

The market growth may be attributed to factors including increasing demand and continuous product innovations. Growth of IT industry, macro-economic scale, and continued high growth (average annual growth of global semiconductor industry is 16% per year in recent decades). The increasing demand for computers and smartphones is one of the major factors anticipated to gain traction in the computer microchips market. Further, the advent of IoT and automation process requires high-performance and smaller microchips, which in turn, is expected to drive the demand for Computer Microchip during the coming years. However, the high capital investment to build a state of art fabrication facility is expected to deter the growth of the Computer Microchip market. The industry is moving towards an integrated model since only a few companies can compete owning to rapidly changing technology and high capital investments. Key players in microchip designing and manufacturing are Samsung, Intel, Broadcom, Qualcomm, AMD, and TSMC.Global Computer Microchip Market Segment Analysis

A semiconductor foundry (commonly called a fab; also known as a semiconductor fabrication plant) is a factory where devices such as Integrated Circuits (IC) are manufactured. Taiwan Semiconductor Manufacturing Company, Limited (TSMC) has been the leader of the market for many years now. The world’s most valuable semiconductor company, TSMC is one of the biggest companies in Taiwan and the world’s largest dedicated independent semiconductor foundry. With a global capacity of about 13 million 300mm equivalent wafers per year, the Taiwanese company makes chips for customers with process nodes from 2 microns to 5 nanometers. Some of the biggest customers of TSMC include Apple and Huawei. The European Union is considering building an advanced semiconductor factory in Europe to avoid relying on the U.S. and Asia for technology at the heart of some of its major industries.To know about the Research Methodology :- Request Free Sample Report

Global Computer Microchip Market Regional Insights

The Asia Pacific showed the fastest growth rate during the forecast period due to the emerging economies. China represents huge potential for microchips with the low cost of raw materials and huge production facilities in the country. APAC comprising economies like China, India, South Korea, Australia and other rising economies showcased significant market growth followed by North America and Europe in 2019. The U.S is expected to exhibit high market growth over the forecast period owing to its early technological advancement and high capital expenditure.Global Computer Microchip Market Report Scope: Inquire before buying

Global Computer Microchip Market, by Region

• North America • Europe • South America • MEA • Asia PacificGlobal Computer Microchip Market Key Players

• Intel Corp • Taiwan Semiconductor Manufacturing Co. Ltd • Qualcomm Inc • Broadcom Inc • Micron Technology Inc • Texas Instruments Inc • ASE Technology Holding Co Ltd • NVIDIA Corp • ST Microelectronics NV • NXP Semiconductors NV • Advanced Micro Devices INC • Celera • GCT Semiconductor • AMD • Global Foundries • NUVIA • Infineon Recent Developments • In 2020, Intel expanded the 11th generation of its “Core” processor chip architecture from last year’s chips for thin laptops by adding new chips for more powerful (and bulkier) gaming laptops and desktops. New Core S-series chips for desktops are 14% faster than Intel’s prior best gaming chips. • Qualcomm, the leading maker of mobile chips for smartphones revealed its latest processor designs. An updated under-glass fingerprint sensor that can unlock a phone when the user simply presses a finger on the display. The second-generation 3D Sonic Sensor is 50% faster at unlocking than Qualcomm’s original technology from 2019. • Best known for its innovations in the area of safety, Volvo aims to use Nvidia’s Orin to propel itself to forefront of the self-driving technology by launching third generation XC90. Effectively a type of central nervous system for cars, Nvidia’s proprietary Orin chip combines 17 billion transistors across various processing cores. It was designed to crunch vast amounts of data generated by autonomous vehicles, which navigate by constantly probing their surroundings. The next generation of Volvo’s XC90 flagship crossover will come equipped with Orin starting in 2022. • In 2020, Nvidia unwrapped its Nvidia A100 artificial intelligence chip, the ultimate instrument for advancing AI. The chip has a monstrous 54 billion transistors (the on-off switches that are the building blocks of all things electronic), and it can execute 5 petaflops of performance, or about 20 times more than the previous-generation chip Volta.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Computer Microchip Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2019 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Computer Microchip Market 3.4. Geographical Snapshot of the Computer Microchip Market, By Manufacturer share 4. Global Computer Microchip Market Overview, 2019-2026 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Computer Microchip Market 5. Supply Side and Demand Side Indicators 6. Global Computer Microchip Market Analysis and Forecast, 2019-2026 6.1. Global Computer Microchip Market Size & Y-o-Y Growth Analysis. 7. Global Computer Microchip Market Analysis and Forecasts, 2019-2026 7.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 7.1.1. Integrated Device 7.1.2. Fabless 7.1.3. Foundry 7.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 7.2.1. Consumer Electronics 7.2.2. Automotive 7.2.3. Healthcare 7.2.4. Military and Civil Aerospace 8. Global Computer Microchip Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2019-2026 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Computer Microchip Market Analysis and Forecasts, 2019-2026 9.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 9.1.1. Integrated Device 9.1.2. Fabless 9.1.3. Foundry 9.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 9.2.1. Consumer Electronics 9.2.2. Automotive 9.2.3. Healthcare 9.2.4. Military and Civil Aerospace 10. North America Computer Microchip Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Computer Microchip Market Analysis and Forecasts, 2019-2026 11.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 11.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 12. Canada Computer Microchip Market Analysis and Forecasts, 2019-2026 12.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 12.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 13. Mexico Computer Microchip Market Analysis and Forecasts, 2019-2026 13.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 13.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 14. Europe Computer Microchip Market Analysis and Forecasts, 2019-2026 14.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 14.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 15. Europe Computer Microchip Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Computer Microchip Market Analysis and Forecasts, 2019-2026 16.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 16.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 17. France Computer Microchip Market Analysis and Forecasts, 2019-2026 17.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 17.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 18. Germany Computer Microchip Market Analysis and Forecasts, 2019-2026 18.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 18.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 19. Italy Computer Microchip Market Analysis and Forecasts, 2019-2026 19.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 19.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 20. Spain Computer Microchip Market Analysis and Forecasts, 2019-2026 20.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 20.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 21. Sweden Computer Microchip Market Analysis and Forecasts, 2019-2026 21.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 21.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 22. CIS Countries Computer Microchip Market Analysis and Forecasts, 2019-2026 22.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 22.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 23. Rest of Europe Computer Microchip Market Analysis and Forecasts, 2019-2026 23.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 23.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 24. Asia Pacific Computer Microchip Market Analysis and Forecasts, 2019-2026 24.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 24.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 25. Asia Pacific Computer Microchip Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Computer Microchip Market Analysis and Forecasts, 2019-2026 26.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 26.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 27. India Computer Microchip Market Analysis and Forecasts, 2019-2026 27.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 27.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 28. Japan Computer Microchip Market Analysis and Forecasts, 2019-2026 28.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 28.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 29. South Korea Computer Microchip Market Analysis and Forecasts, 2019-2026 29.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 29.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 30. Australia Computer Microchip Market Analysis and Forecasts, 2019-2026 30.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 30.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 31. ASEAN Computer Microchip Market Analysis and Forecasts, 2019-2026 31.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 31.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 32. Rest of Asia Pacific Computer Microchip Market Analysis and Forecasts, 2019-2026 32.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 32.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 33. Middle East Africa Computer Microchip Market Analysis and Forecasts, 2019-2026 33.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 33.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 34. Middle East Africa Computer Microchip Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2019-2026 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Computer Microchip Market Analysis and Forecasts, 2019-2026 35.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 35.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 36. GCC Countries Computer Microchip Market Analysis and Forecasts, 2019-2026 36.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 36.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 37. Egypt Computer Microchip Market Analysis and Forecasts, 2019-2026 37.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 37.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 38. Nigeria Computer Microchip Market Analysis and Forecasts, 2019-2026 38.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 38.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 39. Rest of ME&A Computer Microchip Market Analysis and Forecasts, 2019-2026 39.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 39.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 40. South America Computer Microchip Market Analysis and Forecasts, 2019-2026 40.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 40.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 41. South America Computer Microchip Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2019-2026 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Computer Microchip Market Analysis and Forecasts, 2019-2026 42.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 42.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 43. Argentina Computer Microchip Market Analysis and Forecasts, 2019-2026 43.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 43.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 44. Rest of South America Computer Microchip Market Analysis and Forecasts, 2019-2026 44.1. Market Size (Value) Estimates & Forecast By Product Type, 2019-2026 44.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global Computer Microchip Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Applications and R&D Investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 45.3. Company Profile: Key Players 45.3.1. Intel Corp 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.3.2. Taiwan Semiconductor Manufacturing Co. Ltd 45.3.3. Qualcomm Inc 45.3.4. Broadcom Inc 45.3.5. Micron Technology Inc 45.3.6. Texas Instruments Inc 45.3.7. ASE Technology Holding Co Ltd 45.3.8. NVIDIA Corp 45.3.9. ST Microelectronics NV 45.3.10. NXP Semiconductors NV 45.3.11. Advanced Micro Devices INC 45.3.12. Celera 45.3.13. GCT Semiconductor 45.3.14. AMD 45.3.15. Global Foundries 45.3.16. NUVIA 45.3.17. Infineon 45.3.18. Other Key Players 46. Primary Key Insights