The Collaborative Robotics Market size was valued at USD 1.03 Billion in 2023 and the total Collaborative Robotics Market revenue is expected to grow at a CAGR of 28.9% from 2024 to 2030, reaching nearly USD 6.09 Billion by 2030.Collaborative Robotics Market Overview:

Collaborative robots are a form of robotic automation built to work safely alongside human workers in a shared, collaborative workspace. In most applications, a collaborative robot is responsible for repetitive, menial tasks while a human worker completes more complex and thought-intensive tasks. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Collaborative Robotics Market.To know about the Research Methodology:-Request Free Sample Report Collaborative Robotics Market Dynamics Increased Demand for Automation and Human-Centric Design Bolstering the Collaborative Robotics Market The Collaborative Robotics Market is experiencing robust growth, driven by a heightened demand for automation within expanding industries. Businesses, seeking solutions to augment efficiency and productivity, are increasingly adopting collaborative robots as a versatile and adaptable automation choice. This trend significantly contributes to the Collaborative Robotics Industry's potential for growth. Collaborative robots are strategically engineered to operate seamlessly alongside humans, fostering collaboration in various tasks. This human-centric tactic not only guarantees safer working surroundings but also reinforces acceptance and implementation across diverse industries, fortifying the Collaborative Robotics Market penetration. The emerging trends in the industry reflect a growing emphasis on human-centric design. Affordability relative to traditional industrial counterparts stands out as a significant driver, amplifying the Collaborative Robotics Market's potential for further expansion. Lesser application costs make collaborative robots an attractive opportunity for businesses seeking cost-effective automation solutions without compromising performance. This innovation in the industry is marked by cost-effective robotic solutions. Continuous innovations in robotics technology play a pivotal role in shaping the Collaborative Robotics Market. Improved sensors, artificial intelligence (AI), and machine learning contribute to the heightened capabilities of collaborative robots, ensuring superior overall performance. This technological progress reinforces the market's competitive edge and augments its market share, reflecting ongoing innovation in the Collaborative Robotics Industry. The heightened safety factor increases their appeal across a diverse range of applications, further solidifying their market share. Safety features represent an ongoing trend in the Collaborative Robotics Industry. Small and Medium Enterprises (SMEs) Adoption and Cross-Industry Applications emerging opportunities in Collaborative Robotics Market Collaborative robots present a substantial opportunity for SMEs seeking entry into automation. Their cost-effectiveness and flexibility make them an ideal choice for smaller businesses looking to embrace automation solutions and enhance their operations. This opportunity has the potential to drive Collaborative Robotics Market growth among SMEs, reflecting an opportunity for SME adoption trends in the industry. Beyond manufacturing, collaborative robots find applications in diverse industries such as healthcare, logistics, and agriculture. Exploring these varied sectors offers significant opportunities for market expansion, catering to a broad range of applications and enhancing Collaborative Robotics Market share across industries. This cross-industry application trend contributes to the industry's evolving landscape. The global market for collaborative robotics is experiencing substantial growth as businesses recognize the advantages of automation. Opportunities abound in catering to the international demand for collaborative robotic solutions, contributing to the market's expansion on a global scale and unlocking its full growth potential. International market growth remains a notable trend in the Collaborative Robotics Industry. The ability to tailor collaborative robotics for specific industry needs opens new avenues. Offering specialized solutions that address unique challenges in different sectors provides a strategic opportunity for companies in the Collaborative Robotics Market. This customization potential enhances their market penetration and solidifies their position in specific industry segments, reflecting a trend towards customization and specialization in the Collaborative Robotics Industry.

Collaborative Robotics Market Segment Analysis

Payload Capacity: Within the Payload Capacity segment majorly showcase growth in forecast period, Collaborative Robotics Market segment analysis, robots equipped with a payload capacity of up to 5kg are meticulously engineered for precision-oriented tasks. These lightweight robots find application in industries such as electronics and assembly, leveraging their versatility and agility for intricate operations. Their substantial share in this segment underscores their exceptional accuracy and efficiency in processes requiring precision. In the segment of up to 10 kg payload capacity, collaborative robots address a wider array of applications, including tasks like gathering and machine tending. Industries, including automotive and metal & machining, advantage from the discriminating payload capacity, facilitating the handling of heavier components. The segment analysis reveals a harmonious balance between strength and versatility, contributing to its noteworthy market share. Collaborative robots designed with a payload capacity exceeding 10 kg are tailored for heavy-duty tasks, particularly in sectors such as automotive, metal & machining, and palletizing. The segment analysis highlights their robust strength and capability, making them indispensable for more substantial manufacturing processes. Their significant market share reflects their pivotal role in ensuring operational efficiency when handling heavier components. Vertical: In the vertical segment analysis of the Collaborative Robotics Market, the automotive sector emerges as a key player, employing collaborative robotics for tasks like assembly and machine tending. The flexibility of these robots enhances operational efficiency in the production of automotive components, contributing to streamlined manufacturing processes and reflecting notable growth within this market segment. Within the electronics sector, collaborative robots with precision and speed play an instrumental role in assembly and pick & place applications. The accuracy of these robots is vital for delicately handling electronic components, ensuring efficient and error-free manufacturing processes. The segment analysis highlights their substantial market share and innovation within the industry. Collaborative robots contribute significantly to industries involved in metalworking and machining, undertaking tasks such as pick & place and quality testing. The segment analysis underscores the combination of strength and precision in these robots, optimizing operational processes and reflecting their noteworthy market share within the metal & machining sector. The Collaborative Robotics Market segment analysis reveals diverse applications in the plastics and polymer industries, spanning assembly, quality testing, and packaging. The versatility of collaborative robots addresses the varied needs of plastic manufacturing, ensuring flexibility and efficiency in production processes. Their substantial market share reflects their impactful presence within the plastics & polymer vertical. Within the food and agriculture sector, collaborative robots excel in tasks such as pick & place, packaging, and palletizing. Their ability to handle different shapes and sizes of products contributes to enhanced efficiency in food processing and agricultural operations. The segment analysis highlights their significant market share and emerging trends within the food & agriculture vertical. Application: In Application segment, Collaborative robots make a significant contribution to assembly processes across various industries, providing precision and efficiency in the production of complex products. Their ability to collaborate seamlessly with human operators ensures a harmonious and streamlined assembly line, reflecting a considerable market segment share in assembly applications. The pick & place application involves robots picking items from one location and placing them in another. Widely used in industries such as electronics, e-commerce, and logistics, this application enhances efficiency in material handling and distribution processes. The segment analysis emphasizes the substantial market share and ongoing innovation within pick & place applications. Collaborative robots play a pivotal role in machine tending by loading and unloading materials. This application is prominent in manufacturing settings, where these robots contribute to increased automation and reduced human intervention in machine-related tasks. The segment analysis underscores their growing market share and influence in machine tending applications.

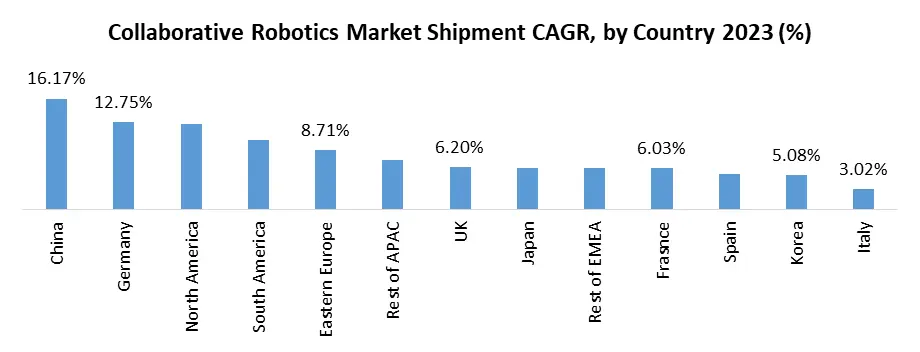

Collaborative Robotics Market Regional Analysis

The Collaborative Robotics Market in North America, especially the US, demonstrates robust growth and innovation, fuelled by regional growth factors such as a technologically advanced infrastructure and a high level of automation awareness. The US holds a significant Collaborative Robotics Market share, reflecting its position as a key adopter of collaborative robotic solutions. Industries, including automotive, electronics, and manufacturing, leverage collaborative robots for tasks like assembly, machine tending, and quality testing, contributing to the region's operational efficiency. Notable key players in the North American market further drive regional growth, emphasizing safety features, technological advancements, and seamless integration into existing workflows. In Europe, the Collaborative Robotics Market experiences extensive growth, driven by a robust manufacturing base and the emphasis on Industry 4.0 initiatives. European countries, particularly Germany, France, and the UK, are actively adopting collaborative robots in key industries like automotive and electronics. The regulatory environment supports collaborative robot integration, ensuring safety and compliance. Europe's Collaborative Robotics Market potential is evident in the proactive approach to automation, sustainability, and the demand for flexible manufacturing solutions. Key players in the region contribute to regional growth factors, with innovation in artificial intelligence and machine learning playing a pivotal role in expanding market reach. The Asia Pacific region emerges as a major growth center for the Collaborative Robotics Market, with notable contributions from countries such as China, Japan, and South Korea. The rapid industrialization and a surge in automation adoption across diverse industries fuel the market's growth. Collaborative Robotics Market regional growth in the Asia Pacific is driven by the emphasis on cost-effective solutions, meeting the increasing demand for automation. A diverse set of applications, including pick & place, machine tending, and packaging, shapes the Collaborative Robotics Market segment analysis in the region. The adoption of collaborative robots by small and medium enterprises (SMEs) is a significant trend, contributing to the market's expansion. Asia Pacific's role as a growth leader underscores its pivotal position in shaping the global Collaborative Robotics Market landscape. Collaborative Robotics Market Competitive Landscape In a groundbreaking collaboration, ABB the prominent key player in Collaborative Robotics Market, ABB Robotics and Porsche Consulting, both recognized as major market share holders and global market players, have entered into a joint venture to revolutionize the construction industry, particularly in modular housing manufacturing. This strategic partnership aims to integrate automation, advanced planning, and design for large-scale factories to address the rising demand for affordable and sustainable buildings. The collaboration comes in response to an 85% forecast increase in construction sector automation by 2030, driven by the need for improved housing amidst labor shortages. By leveraging ABB's robotic solutions and Porsche Consulting's expertise in factory planning, the collaboration seeks to transform the construction sector, providing high-quality, cost-effective, and environmentally friendly housing solutions. ABB, a global market player in the field of technology and innovation, has signed a significant contract with Polara, positioning itself as a major market share holder in the EV infrastructure domain. This collaboration is aimed at contributing to emissions reduction through the provision of e-mobility technology for vehicle fleets in Canada and the United States. The partnership involves ABB supplying Compact Secondary Substation (CSS) skid-mounted power distribution units for Polara's CHRGPK, an optimized modular design unit for charging electric vehicles. The collaboration aligns with the Canadian government's USD 11 billion investment in clean public transport, emphasizing ABB's commitment to being a key company providing safe, reliable, and sustainable solutions for accelerating the adoption of electric vehicles. KUKA, recognized as a global market player and major market share holder in industrial robotics, showcased its commitment to education and human/machine collaboration through two notable events. At the Wisconsin Manufacturing & Technology Show (WIMTS) 2023, KUKA highlighted its versatile robotic solutions, including educational and augmented reality components. The company showcased mobile, all-in-one training cells, such as the Edu_ArcWelding and Edu_Additive, designed for teaching robotic programming and complex manufacturing processes. Additionally, during the ATX West show, KUKA demonstrated cutting-edge technologies, including the LBR iisy cobot and the KMP 600-S diffDrive mobile platform. The LBR iisy represents a future-ready automation solution, while the KMP 600-S diffDrive addresses safe automation in manufacturing processes where humans interact with robots regularly.Collaborative Robotics Market Scope: Inquire before buying

Collaborative Robotics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.03 Bn. Forecast Period 2024 to 2030 CAGR: 28.9% Market Size in 2030: US $ 6.09 Bn. Segments Covered: by Payload capacity Up to 5kg Up to 10 kg Above 10 kg by Vertical Automotive Electronics Metal & machining Plastics & polymer Food & agriculture by Application Assembly Pick & place Machine tending Quality testing Packaging & Palletizing Collaborative Robotics Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Collaborative Robotics Market Key Players:

Global (Operating Across Regions): Universal Robots: Odense, Denmark Techman Robot for Quanta Storage: Taipei City, Taiwan AUBO Robotics Inc.: Santa Clara, California, USA Locus Robotics: Wilmington, Massachusetts, USA Robotiq: Lévis, Quebec, Canada Omron: Kyoto, Japan Rethink Robotics: Boston, Massachusetts, USA Aethon: Pittsburgh, Pennsylvania, USA Boston Dynamics: Waltham, Massachusetts, USA North America: ABB Inc.: Zurich, Switzerland Rethink Robotics: Boston, Massachusetts, USA Precise Automation: Fremont, California, USA Energrid Technology Corporation: Toronto, Ontario, Canada AUBO Robotics Inc.: Santa Clara, California, USA Locus Robotics: Wilmington, Massachusetts, USA Boston Dynamics: Waltham, Massachusetts, USA Kinova Robotics: Boisbriand, Quebec, Canada Teradyne Inc.: North Reading, Massachusetts, USA Europe: KUKA AG: Augsburg, Germany Robert Bosch GmbH: Gerlingen, Germany MRK-System GmbH: Augsburg, Germany F&P Robotics AG: Glattbrugg, Switzerland MABI AG: Baar, Switzerland Franka: Munich, Germany Comau S.P.A: Grugliasco, Italy Aethon: Pittsburgh, Pennsylvania, USA BlueBotics: St. Sulpice, Switzerland Stäubli International AG: Pfäffikon, Switzerland Asia Pacific: FANUC Corporation: Oshino, Japan Universal Robots: Odense, Denmark Techman Robot for Quanta Storage: Taipei City, Taiwan Emika GmbH: Munich, Germany KAWADA Robotics Corp.: Nagoya, Japan YASKAWA Electric Corporation: Kitakyushu, Japan Epson Robots: Suwa, Japan Cyberdyne Inc.: Tsukuba, Japan Siasun Robot & Automation Co., Ltd.: Shenyang, China Hiwin Corporation: Taichung, Taiwan Middle East: Omron: Kyoto, Japan PAL Robotics: Barcelona, Spain Mitsubishi Electric Corporation: Tokyo, Japan Aethon: Pittsburgh, Pennsylvania, USA FAQs: 1. What is the Collaborative Robotics Market? Ans: The Collaborative Robotics Market refers to the industry focused on the development, production, and deployment of robots designed to work alongside humans in various applications, fostering human-robot collaboration. 2. What are the key segments in the Collaborative Robotics Market? Ans: The market is segmented based on payload capacity (Up to 5kg, Up to 10 kg, Above 10 kg), verticals (Automotive, Electronics, Metal & Machining, Plastics & Polymer, Food & Agriculture), and applications (Assembly, Pick & Place, Machine Tending, Quality Testing, Packaging & Palletizing). 3. What drives the growth of the Collaborative Robotics Market? Ans: The market growth is propelled by factors such as evolving edge computing capabilities, ease of programming, and the demand for industrial automation to enhance safety and efficiency. 4. How does the Collaborative Robotics Market address labor shortages in industries? Ans: Collaborative robots contribute to overcoming labor shortages by automating tasks, improving productivity, and enabling more efficient and flexible manufacturing processes. 5. Which regions are significant in the Collaborative Robotics Market? Ans: Key regions include North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, with each region contributing to the market's global growth.

1. Collaborative Robotics Market: Research Methodology 2. Collaborative Robotics Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Collaborative Robotics Market: Dynamics 3.1. Collaborative Robotics Market Trends by Region 3.1.1. North America Collaborative Robotics Market Trends 3.1.2. Europe Collaborative Robotics Market Trends 3.1.3. Asia Pacific Collaborative Robotics Market Trends 3.1.4. Middle East and Africa Collaborative Robotics Market Trends 3.1.5. South America Collaborative Robotics Market Trends 3.2. Collaborative Robotics Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Collaborative Robotics Market Drivers 3.2.1.2. North America Collaborative Robotics Market Restraints 3.2.1.3. North America Collaborative Robotics Market Opportunities 3.2.1.4. North America Collaborative Robotics Market Challenges 3.2.2. Europe 3.2.2.1. Europe Collaborative Robotics Market Drivers 3.2.2.2. Europe Collaborative Robotics Market Restraints 3.2.2.3. Europe Collaborative Robotics Market Opportunities 3.2.2.4. Europe Collaborative Robotics Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Collaborative Robotics Market Drivers 3.2.3.2. Asia Pacific Collaborative Robotics Market Restraints 3.2.3.3. Asia Pacific Collaborative Robotics Market Opportunities 3.2.3.4. Asia Pacific Collaborative Robotics Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Collaborative Robotics Market Drivers 3.2.4.2. Middle East and Africa Collaborative Robotics Market Restraints 3.2.4.3. Middle East and Africa Collaborative Robotics Market Opportunities 3.2.4.4. Middle East and Africa Collaborative Robotics Market Challenges 3.2.5. South America 3.2.5.1. South America Collaborative Robotics Market Drivers 3.2.5.2. South America Collaborative Robotics Market Restraints 3.2.5.3. South America Collaborative Robotics Market Opportunities 3.2.5.4. South America Collaborative Robotics Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Collaborative Robotics Market 3.8. Analysis of Government Schemes and Initiatives For Collaborative Robotics Market 3.9. The Global Pandemic Impact on Collaborative Robotics Market 4. Collaborative Robotics Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2030-2030) 4.1. Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 4.1.1. Up to 5kg 4.1.2. Up to 10 kg 4.1.3. Above 10 kg 4.2. Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 4.2.1. Automotive 4.2.2. Electronics 4.2.3. Metal & machining 4.2.4. Plastics & polymer 4.2.5. Food & agriculture 4.3. Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 4.3.1. Assembly 4.3.2. Pick & place 4.3.3. Machine tending 4.3.4. Quality testing 4.3.5. Packaging & Palletizing 4.4. Collaborative Robotics Market Size and Forecast, by Region (2030-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Collaborative Robotics Market Size and Forecast by Segmentation (by Value in USD Million) (2030-2030) 5.1. North America Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 5.1.1. Up to 5kg 5.1.2. Up to 10 kg 5.1.3. Above 10 kg 5.2. North America Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 5.2.1. Automotive 5.2.2. Electronics 5.2.3. Metal & machining 5.2.4. Plastics & polymer 5.2.5. Food & agriculture 5.3. North America Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 5.3.1. Assembly 5.3.2. Pick & place 5.3.3. Machine tending 5.3.4. Quality testing 5.3.5. Packaging & Palletizing 5.4. North America Collaborative Robotics Market Size and Forecast, by Country (2030-2030) 5.4.1. United States 5.4.1.1. United States Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 5.4.1.1.1. Up to 5kg 5.4.1.1.2. Up to 10 kg 5.4.1.1.3. Above 10 kg 5.4.1.2. United States Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 5.4.1.2.1. Automotive 5.4.1.2.2. Electronics 5.4.1.2.3. Metal & machining 5.4.1.2.4. Plastics & polymer 5.4.1.2.5. Food & agriculture 5.4.1.3. United States Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 5.4.1.3.1. Assembly 5.4.1.3.2. Pick & place 5.4.1.3.3. Machine tending 5.4.1.3.4. Quality testing 5.4.1.3.5. Packaging & Palletizing 5.4.2. Canada 5.4.2.1. Canada Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 5.4.2.1.1. Up to 5kg 5.4.2.1.2. Up to 10 kg 5.4.2.1.3. Above 10 kg 5.4.2.2. Canada Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 5.4.2.2.1. Automotive 5.4.2.2.2. Electronics 5.4.2.2.3. Metal & machining 5.4.2.2.4. Plastics & polymer 5.4.2.2.5. Food & agriculture 5.4.2.3. Canada Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 5.4.2.3.1. Assembly 5.4.2.3.2. Pick & place 5.4.2.3.3. Machine tending 5.4.2.3.4. Quality testing 5.4.2.3.5. Packaging & Palletizing 5.4.3. Mexico 5.4.3.1. Mexico Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 5.4.3.1.1. Up to 5kg 5.4.3.1.2. Up to 10 kg 5.4.3.1.3. Above 10 kg 5.4.3.2. Mexico Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 5.4.3.2.1. Automotive 5.4.3.2.2. Electronics 5.4.3.2.3. Metal & machining 5.4.3.2.4. Plastics & polymer 5.4.3.2.5. Food & agriculture 5.4.3.3. Mexico Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 5.4.3.3.1. Assembly 5.4.3.3.2. Pick & place 5.4.3.3.3. Machine tending 5.4.3.3.4. Quality testing 5.4.3.3.5. Packaging & Palletizing 6. Europe Collaborative Robotics Market Size and Forecast by Segmentation (by Value in USD Million) (2030-2030) 6.1. Europe Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 6.2. Europe Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 6.3. Europe Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 6.4. Europe Collaborative Robotics Market Size and Forecast, by Country (2030-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 6.4.1.2. United Kingdom Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 6.4.1.3. United Kingdom Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 6.4.2. France 6.4.2.1. France Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 6.4.2.2. France Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 6.4.2.3. France Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 6.4.3. Germany 6.4.3.1. Germany Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 6.4.3.2. Germany Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 6.4.3.3. Germany Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 6.4.4. Italy 6.4.4.1. Italy Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 6.4.4.2. Italy Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 6.4.4.3. Italy Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 6.4.5. Spain 6.4.5.1. Spain Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 6.4.5.2. Spain Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 6.4.5.3. Spain Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 6.4.6. Sweden 6.4.6.1. Sweden Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 6.4.6.2. Sweden Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 6.4.6.3. Sweden Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 6.4.7. Austria 6.4.7.1. Austria Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 6.4.7.2. Austria Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 6.4.7.3. Austria Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 6.4.8.2. Rest of Europe Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 6.4.8.3. Rest of Europe Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 7. Asia Pacific Collaborative Robotics Market Size and Forecast by Segmentation (by Value in USD Million) (2030-2030) 7.1. Asia Pacific Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 7.2. Asia Pacific Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 7.3. Asia Pacific Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 7.4. Asia Pacific Collaborative Robotics Market Size and Forecast, by Country (2030-2030) 7.4.1. China 7.4.1.1. China Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 7.4.1.2. China Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 7.4.1.3. China Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 7.4.2. S Korea 7.4.2.1. S Korea Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 7.4.2.2. S Korea Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 7.4.2.3. S Korea Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 7.4.3. Japan 7.4.3.1. Japan Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 7.4.3.2. Japan Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 7.4.3.3. Japan Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 7.4.4. India 7.4.4.1. India Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 7.4.4.2. India Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 7.4.4.3. India Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 7.4.5. Australia 7.4.5.1. Australia Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 7.4.5.2. Australia Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 7.4.5.3. Australia Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 7.4.6.2. Indonesia Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 7.4.6.3. Indonesia Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 7.4.7.2. Malaysia Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 7.4.7.3. Malaysia Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 7.4.8.2. Vietnam Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 7.4.8.3. Vietnam Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 7.4.9.2. Taiwan Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 7.4.9.3. Taiwan Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 7.4.10.2. Rest of Asia Pacific Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 7.4.10.3. Rest of Asia Pacific Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 8. Middle East and Africa Collaborative Robotics Market Size and Forecast by Segmentation (by Value in USD Million) (2030-2030 8.1. Middle East and Africa Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 8.2. Middle East and Africa Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 8.3. Middle East and Africa Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 8.4. Middle East and Africa Collaborative Robotics Market Size and Forecast, by Country (2030-2030) 8.4.1. South Africa 8.4.1.1. South Africa Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 8.4.1.2. South Africa Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 8.4.1.3. South Africa Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 8.4.2. GCC 8.4.2.1. GCC Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 8.4.2.2. GCC Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 8.4.2.3. GCC Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 8.4.3.2. Nigeria Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 8.4.3.3. Nigeria Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 8.4.4.2. Rest of ME&A Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 8.4.4.3. Rest of ME&A Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 9. South America Collaborative Robotics Market Size and Forecast by Segmentation (by Value in USD Million) (2030-2030 9.1. South America Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 9.2. South America Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 9.3. South America Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 9.4. South America Collaborative Robotics Market Size and Forecast, by Country (2030-2030) 9.4.1. Brazil 9.4.1.1. Brazil Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 9.4.1.2. Brazil Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 9.4.1.3. Brazil Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 9.4.2. Argentina 9.4.2.1. Argentina Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 9.4.2.2. Argentina Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 9.4.2.3. Argentina Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Collaborative Robotics Market Size and Forecast, by Payload capacity (2030-2030) 9.4.3.2. Rest Of South America Collaborative Robotics Market Size and Forecast, by Vertical (2030-2030) 9.4.3.3. Rest Of South America Collaborative Robotics Market Size and Forecast, by Application (2030-2030) 10. Global Collaborative Robotics Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Collaborative Robotics Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. ABB Inc. 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Rethink Robotics 11.3. Precise Automation 11.4. Energrid Technology Corporation 11.5. AUBO Robotics Inc. 11.6. YASKAWA Electric Corporation 11.7. Locus Robotics 11.8. Boston Dynamics 11.9. Kinova Robotics 11.10. Teradyne Inc. 11.11. KUKA AG 11.12. Robert Bosch GmbH 11.13. MRK-System GmbH 11.14. F&P Robotics AG 11.15. MABI AG 11.16. Franka 11.17. Comau S.P.A 11.18. Aethon 11.19. BlueBotics 11.20. Stäubli International AG 11.21. FANUC Corporation 11.22. Universal Robots 11.23. Techman Robot for Quanta Storage 11.24. Emika GmbH 11.25. KAWADA Robotics Corp. 11.26. Epson Robots 11.27. Cyberdyne Inc. 11.28. Siasun Robot & Automation Co., Ltd. 11.29. Hiwin Corporation 11.30. Omron 11.31. PAL Robotics 11.32. Mitsubishi Electric Corporation 11.33. Aethon 12. Key Findings 13. Industry Recommendations