The Cell Analysis Market size was valued at USD 21.4 Billion in 2023 and the total Cell Analysis Market revenue is expected to grow at a CAGR of 9.8% from 2023 to 2030, reaching nearly USD 41.17 Billion in 2030. Cell Analysis means the study of genomics, Transcriptomics, proteomics, metabolomics, and single cell analysis. It refers to an analysis of an individual cell in a bulk population of cells. Cell Analysis is useful in the study of cell-to-cell variation within a cell population, which is significant for understanding diseases, the development of drugs, cancer cell differentiation, Physiological functioning in embryos as well as the immune response of humans.To know about the Research Methodology :- Request Free Sample Report 1. According to MMR, In the United States, 2 million people are diagnosed with cancer, and an estimated 297790 women are diagnosed with breast cancer. So cancer is the second leading cause of death in the United States thus, the rising prevalence of cancer is the continuous progress in research and development in the field, is expected to be a cell analysis market growth. The cell analysis market is growing because research in drug discovery relies on cell analysis for drug screening, identification of biomarkers, and efficacy testing, which boosts the cell analysis market. The increasing occurrence of chronic diseases like neurological disorders, Cancer, and autoimmune diseases is increasing the demand for advanced diagnostics in cell analysis. The key players in the global cell analysis market include Thermo Fisher Scientific, Danaher, Becton, Dickinson and Company, Agilent Technologies, Merck KGaA, and many more. Asia-Pacific is the fastest-growing region with a market share of over 13.6 % in 2023. The region is expected to grow at a CAGR of 9.8 % during the forecast period and maintain its dominance by 2030. Widely increasing economic developments, as well as the government, provide the funding for the initiative to support the cell analysis market. The fastest development of Hospitals and Clinical testing Laboratories, pathology centers, and diagnostic centers contributed to the growth of cell analysis. The cell Analysis Market is estimated to grow in the future driving factors by continued technological advancements and rising demands for Cell Analysis techniques.

Cell Analysis Market Dynamics:

The rising Prevalence of Chronic Diseases and demand for personalized medicines. The prevalence of chronic diseases like cancer, neurological disorders, cardiovascular diseases, and diabetes is increasing globally owing to factors including unhealthy lifestyles, the number of aging populations. Cell analysis techniques flow cytometry is used for early detection of abnormal cells associated with multiple chronic diseases like Cancer, and Alzheimer’s disease. The development is in advanced cancer therapies, and the rising prevalence of chronic diseases is growing in technological advancement in the cell Analysis Market. In personalized medicine, healthcare advisors approach patient treatment on special genetic makeup. Cell Analysis is an essential role in developing personalized treatment medicines. Disease Management programs are used to improve the health of people with chronic conditions and reduce costs by providing healthcare interventions. It includes Health electronic records and clinical decision support. The drug development process involves preclinical research on cell-based and animal models, and also clinical trials on humans, and obtaining regulatory approval to market the drug. The FDA approval is necessary for new drug development.Regulatory Hurdles for New Technologies and Diagnostics The development of new drugs involves a combination of computational, experimental, translational, and clinical models. The researcher identifies a drug compound, conducting experiments and mechanism of action, dosage, toxicity, and effects. The regulatory hurdles for personalized pluripotent stem cells are great, particularly in gene therapy.

Cell Analysis Market Segment Analysis:

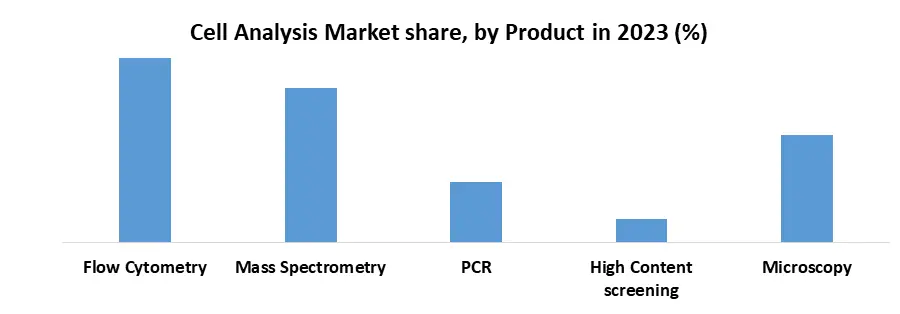

Based on Type, the Reagents and consumables held the largest market share of about 21.7 % in the Cell Analysis Market in 2023. According to the MMR analysis, the segment is expected to grow at a CAGR of 9.8% during the forecast period and maintain its dominance till 2030. Reagents and consumables are increasing in demand for research and diagnostic purposes. It includes items like reagents, plasticware, glassware, kits, and tubes. In advancement in reagents giving accurate results reagents and Consumables account for the largest global laboratory consumables market share in 2023. The services segment is projected to be the fastest-growing segment during the forecast period.Based on Techniques the Flow Cytometry segment held the largest market share of about 18.2% in the Cell Analysis Market in 2023 and is expected to maintain its dominance till 2030. Rising use of automated instruments and software as well as reducing operator errors. It is useful in data comparability and data reproducibility by using standardization in protocol in reagents. Flow cytometry technology for cell analysis in various research and diagnostic laboratories.so growing the cell analysis market.

Regional Analysis of Cell Analysis Market:

North America region dominates the Cell Analysis Market with the largest market share accounting for 42.5 % in 2023, the region is expected to grow during the forecast period and maintain its dominance by 2030. In the North American region well-developed healthcare infrastructure with rising demands for personalized medicines. Increasing acceptance of advanced technologies. Consumer awareness of costs as well as an aging population leads to the rising incidence of targeted diseases. The government initiates the funding for research and development in pharmaceutical and biotechnological industries like Stem cell research, and cancer vaccine research. So the Government contributing to the growth of the region.Europe, the fastest-growing region in the cell analysis Market held a market share of 33.4% and is significantly growing during its forecast period. There is strong research and development in Biotechnology and Pharmaceutical Companies. In Latin America developing markets have small market shares but major growth because of healthcare investments in and biotechnology support. Competitive Landscape for Cell Analysis Market The competitive landscape of the Cell Analysis market is constantly evolving, with new players emerging and established players adapting their strategies. A key component of their strategy is their constant commitment to research and development (R&D) to maintain a leading position in technological development. 1) In 2023, Becton, Dickinson, and the company launched a Spectral cell sorter pair with high-speed cell imaging. The product combines real-time imaging technology with spectral flow cytometry. 2) In 2022, Mission Bio, Inc. launched a single-cell Multi-omics MRD (scMRD) analyse which is capable of determining measurable residual disease (MRD) in cancer down to the level of individual cells and preventing revert in patients with acute myeloid leukemia and other cancers. However, these assays are limited to one type of measurement at a time, such as flow cytometry for immunophenotyping or bulk sequencing for mutation detection. 3) In 2022, Lifebit, a big data company based in the United Kingdom, announced a partnership with Boehringer Ingelheim. The collaboration will use Lifebit's Cloud OS, the first federated genomics platform, to build a data analytics infrastructure for Boehringer. This infrastructure will collect disease insights from biobanks in order to develop medicines. 4) In 2021, ELI Tech Group launched the ELITe BeGenius, a CE-IVD stand-alone, compact, total automated direct sample to provide results in real-time PCR (polymer chain reaction) solution. 5) In 2021, SeqWell Inc. announced the release of the plexWell Single Cell Rapid Kit. The kit can be used for single-cell RNA sequencing as well as simplified NGS library preparation.

Cell Analysis Market Scope: Inquire before buying

Global Cell Analysis Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 21.4 Bn. Forecast Period 2024 to 2030 CAGR: 9.8% Market Size in 2030: US $ 41.17 Bn. Segments Covered: by Product & Service Reagents & Consumables Instruments Accessories Software Service by Technique Flow Cytometry PCR Cell Microarrays Microscopy Spectrophotometry High Content Screening by Process Cell Identification Cell Viability Cell Signalling Pathways/ Signal Transduction Cell Proliferation Cell Counting and Quality Control Cell Interaction Cell Structure Study Target identification and Validation Single-cell Analysis by End-User Pharmaceutical and biotechnology companies Hospitals and clinical testing Laboratories Academic and Research Institutes Cell Analysis Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Cell Analysis Market Key Players:

1) Agilent Technologies, Inc. 2) Sartorius AG 3) Biomerieux SA 4) Qiagen N.V. 5) Standard BioTools Inc., 6) Thermo Fisher Scientific, Inc. 7) Danaher (Beckman Coulter) 8) Becton Dickinson (BD) 9) Agilent Technologies 10) PerkinElmer 11) Illumina, Inc., 12) Miltenyi Biotec 13) Bio-Rad Laboratories, Inc. 14) Fluidigm Corporation 15) 10x Genomics 16) Illumina, Inc. 17) Fluidigm Corporation 18) 10x Genomics 19) Illumina, Inc. 20) Novogene Corporation 21) Terumo BCT 22) Promega Corporation 23) BGI Frequently Asked Questions : 1)What are the key players in the cell analysis market? Ans. Some key players operating in the cell analysis market include Illumina, Inc., Thermo Fisher Scientific, Inc., Qiagen N.V., Bio-Rad Laboratories, Inc., Merck Millipore GmbH, Fluidigm, 10x Genomics, Inc., BGI, and Novogene Corporation. 2) Which product dominates the cell analysis market? Ans. The consumables segment accounted for the largest share of the global cell analysis market in 2023. The growth of this segment is attributed to the increase in launches of affordable and cutting-edge consumables. 3) Which end-user segment of the global cell analysis market is expected to witness the highest growth? Ans. The academic and research laboratories accounted for the highest revenue share of over 70.4% in 2022 owing to the wide use of single-cell analysis technology in research settings. 4) What is the market size of the Cell Analysis Market? Ans. The total Cell Analysis Market was valued at USD 21.4 Billion in 2023 and is expected to reach USD 41.17 Billion by 2030 at a CAGR of 9.8% during the forecast period. 5) Which region is expected to hold the highest share of the Global Gourmet Salt Market? Ans. The North American region is expected to hold the highest share of the Market.

1. Cell Analysis Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Cell Analysis Market: Dynamics 2.1. Cell Analysis Market Trends by Region 2.1.1. North America Cell Analysis Market Trends 2.1.2. Europe Cell Analysis Market Trends 2.1.3. Asia Pacific Cell Analysis Market Trends 2.1.4. Middle East and Africa Cell Analysis Market Trends 2.1.5. South America Cell Analysis Market Trends 2.2. Cell Analysis Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Cell Analysis Market Drivers 2.2.1.2. North America Cell Analysis Market Restraints 2.2.1.3. North America Cell Analysis Market Opportunities 2.2.1.4. North America Cell Analysis Market Challenges 2.2.2. Europe 2.2.2.1. Europe Cell Analysis Market Drivers 2.2.2.2. Europe Cell Analysis Market Restraints 2.2.2.3. Europe Cell Analysis Market Opportunities 2.2.2.4. Europe Cell Analysis Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Cell Analysis Market Drivers 2.2.3.2. Asia Pacific Cell Analysis Market Restraints 2.2.3.3. Asia Pacific Cell Analysis Market Opportunities 2.2.3.4. Asia Pacific Cell Analysis Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Cell Analysis Market Drivers 2.2.4.2. Middle East and Africa Cell Analysis Market Restraints 2.2.4.3. Middle East and Africa Cell Analysis Market Opportunities 2.2.4.4. Middle East and Africa Cell Analysis Market Challenges 2.2.5. South America 2.2.5.1. South America Cell Analysis Market Drivers 2.2.5.2. South America Cell Analysis Market Restraints 2.2.5.3. South America Cell Analysis Market Opportunities 2.2.5.4. South America Cell Analysis Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Cell Analysis Industry 2.8. Analysis of Government Schemes and Initiatives For Cell Analysis Industry 2.9. Cell Analysis Market Trade Analysis 2.10. The Global Pandemic Impact on Cell Analysis Market 3. Cell Analysis Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 3.1.1. Reagents & Consumables 3.1.2. Instruments 3.1.3. Accessories 3.1.4. Software 3.1.5. Service 3.2. Cell Analysis Market Size and Forecast, by Technique (2023-2030) 3.2.1. Flow Cytometry 3.2.2. PCR 3.2.3. Cell Microarrays 3.2.4. Microscopy 3.2.5. Spectrophotometry 3.2.6. High Content Screening 3.3. Cell Analysis Market Size and Forecast, by Process (2023-2030) 3.3.1. Cell Identification 3.3.2. Cell Viability 3.3.3. Cell Signalling Pathways/ Signal Transduction 3.3.4. Cell Proliferation 3.3.5. Cell Counting and Quality Control 3.3.6. Cell Interaction 3.3.7. Cell Structure Study 3.3.8. Target identification and Validation 3.3.9. Single-cell Analysis 3.4. Cell Analysis Market Size and Forecast, by End User (2023-2030) 3.4.1. Pharmaceutical and biotechnology companies 3.4.2. Hospitals and clinical testing Laboratories 3.4.3. Academic and Research Institutes 3.5. Cell Analysis Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Cell Analysis Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 4.1.1. Reagents & Consumables 4.1.2. Instruments 4.1.3. Accessories 4.1.4. Software 4.1.5. Service 4.2. North America Cell Analysis Market Size and Forecast, by Technique (2023-2030) 4.2.1. Flow Cytometry 4.2.2. PCR 4.2.3. Cell Microarrays 4.2.4. Microscopy 4.2.5. Spectrophotometry 4.2.6. High Content Screening 4.3. North America Cell Analysis Market Size and Forecast, by Process (2023-2030) 4.3.1. Cell Identification 4.3.2. Cell Viability 4.3.3. Cell Signalling Pathways/ Signal Transduction 4.3.4. Cell Proliferation 4.3.5. Cell Counting and Quality Control 4.3.6. Cell Interaction 4.3.7. Cell Structure Study 4.3.8. Target identification and Validation 4.3.9. Single-cell Analysis 4.4. North America Cell Analysis Market Size and Forecast, by End User (2023-2030) 4.4.1. Pharmaceutical and biotechnology companies 4.4.2. Hospitals and clinical testing Laboratories 4.4.3. Academic and Research Institutes 4.5. North America Cell Analysis Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 4.5.1.1.1. Reagents & Consumables 4.5.1.1.2. Instruments 4.5.1.1.3. Accessories 4.5.1.1.4. Software 4.5.1.1.5. Service 4.5.1.2. United States Cell Analysis Market Size and Forecast, by Technique (2023-2030) 4.5.1.2.1. Flow Cytometry 4.5.1.2.2. PCR 4.5.1.2.3. Cell Microarrays 4.5.1.2.4. Microscopy 4.5.1.2.5. Spectrophotometry 4.5.1.2.6. High Content Screening 4.5.1.3. United States Cell Analysis Market Size and Forecast, by Process (2023-2030) 4.5.1.3.1. Cell Identification 4.5.1.3.2. Cell Viability 4.5.1.3.3. Cell Signalling Pathways/ Signal Transduction 4.5.1.3.4. Cell Proliferation 4.5.1.3.5. Cell Counting and Quality Control 4.5.1.3.6. Cell Interaction 4.5.1.3.7. Cell Structure Study 4.5.1.3.8. Target identification and Validation 4.5.1.3.9. Single-cell Analysis 4.5.1.4. United States Cell Analysis Market Size and Forecast, by End User (2023-2030) 4.5.1.4.1. Pharmaceutical and biotechnology companies 4.5.1.4.2. Hospitals and clinical testing Laboratories 4.5.1.4.3. Academic and Research Institutes 4.5.2. Canada 4.5.2.1. Canada Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 4.5.2.1.1. Reagents & Consumables 4.5.2.1.2. Instruments 4.5.2.1.3. Accessories 4.5.2.1.4. Software 4.5.2.1.5. Service 4.5.2.2. Canada Cell Analysis Market Size and Forecast, by Technique (2023-2030) 4.5.2.2.1. Flow Cytometry 4.5.2.2.2. PCR 4.5.2.2.3. Cell Microarrays 4.5.2.2.4. Microscopy 4.5.2.2.5. Spectrophotometry 4.5.2.2.6. High Content Screening 4.5.2.3. Canada Cell Analysis Market Size and Forecast, by Process (2023-2030) 4.5.2.3.1. Cell Identification 4.5.2.3.2. Cell Viability 4.5.2.3.3. Cell Signalling Pathways/ Signal Transduction 4.5.2.3.4. Cell Proliferation 4.5.2.3.5. Cell Counting and Quality Control 4.5.2.3.6. Cell Interaction 4.5.2.3.7. Cell Structure Study 4.5.2.3.8. Target identification and Validation 4.5.2.3.9. Single-cell Analysis 4.5.2.4. Canada Cell Analysis Market Size and Forecast, by End User (2023-2030) 4.5.2.4.1. Pharmaceutical and biotechnology companies 4.5.2.4.2. Hospitals and clinical testing Laboratories 4.5.2.4.3. Academic and Research Institutes 4.5.3. Mexico 4.5.3.1. Mexico Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 4.5.3.1.1. Reagents & Consumables 4.5.3.1.2. Instruments 4.5.3.1.3. Accessories 4.5.3.1.4. Software 4.5.3.1.5. Service 4.5.3.2. Mexico Cell Analysis Market Size and Forecast, by Technique (2023-2030) 4.5.3.2.1. Flow Cytometry 4.5.3.2.2. PCR 4.5.3.2.3. Cell Microarrays 4.5.3.2.4. Microscopy 4.5.3.2.5. Spectrophotometry 4.5.3.2.6. High Content Screening 4.5.3.3. Mexico Cell Analysis Market Size and Forecast, by Process (2023-2030) 4.5.3.3.1. Cell Identification 4.5.3.3.2. Cell Viability 4.5.3.3.3. Cell Signalling Pathways/ Signal Transduction 4.5.3.3.4. Cell Proliferation 4.5.3.3.5. Cell Counting and Quality Control 4.5.3.3.6. Cell Interaction 4.5.3.3.7. Cell Structure Study 4.5.3.3.8. Target identification and Validation 4.5.3.3.9. Single-cell Analysis 4.5.3.4. Mexico Cell Analysis Market Size and Forecast, by End User (2023-2030) 4.5.3.4.1. Pharmaceutical and biotechnology companies 4.5.3.4.2. Hospitals and clinical testing Laboratories 4.5.3.4.3. Academic and Research Institutes 5. Europe Cell Analysis Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 5.2. Europe Cell Analysis Market Size and Forecast, by Technique (2023-2030) 5.3. Europe Cell Analysis Market Size and Forecast, by Process (2023-2030) 5.4. Europe Cell Analysis Market Size and Forecast, by End User (2023-2030) 5.5. Europe Cell Analysis Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 5.5.1.2. United Kingdom Cell Analysis Market Size and Forecast, by Technique (2023-2030) 5.5.1.3. United Kingdom Cell Analysis Market Size and Forecast, by Process (2023-2030) 5.5.1.4. United Kingdom Cell Analysis Market Size and Forecast, by End User (2023-2030) 5.5.2. France 5.5.2.1. France Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 5.5.2.2. France Cell Analysis Market Size and Forecast, by Technique (2023-2030) 5.5.2.3. France Cell Analysis Market Size and Forecast, by Process (2023-2030) 5.5.2.4. France Cell Analysis Market Size and Forecast, by End User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 5.5.3.2. Germany Cell Analysis Market Size and Forecast, by Technique (2023-2030) 5.5.3.3. Germany Cell Analysis Market Size and Forecast, by Process (2023-2030) 5.5.3.4. Germany Cell Analysis Market Size and Forecast, by End User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 5.5.4.2. Italy Cell Analysis Market Size and Forecast, by Technique (2023-2030) 5.5.4.3. Italy Cell Analysis Market Size and Forecast, by Process (2023-2030) 5.5.4.4. Italy Cell Analysis Market Size and Forecast, by End User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 5.5.5.2. Spain Cell Analysis Market Size and Forecast, by Technique (2023-2030) 5.5.5.3. Spain Cell Analysis Market Size and Forecast, by Process (2023-2030) 5.5.5.4. Spain Cell Analysis Market Size and Forecast, by End User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 5.5.6.2. Sweden Cell Analysis Market Size and Forecast, by Technique (2023-2030) 5.5.6.3. Sweden Cell Analysis Market Size and Forecast, by Process (2023-2030) 5.5.6.4. Sweden Cell Analysis Market Size and Forecast, by End User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 5.5.7.2. Austria Cell Analysis Market Size and Forecast, by Technique (2023-2030) 5.5.7.3. Austria Cell Analysis Market Size and Forecast, by Process (2023-2030) 5.5.7.4. Austria Cell Analysis Market Size and Forecast, by End User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 5.5.8.2. Rest of Europe Cell Analysis Market Size and Forecast, by Technique (2023-2030) 5.5.8.3. Rest of Europe Cell Analysis Market Size and Forecast, by Process (2023-2030) 5.5.8.4. Rest of Europe Cell Analysis Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Cell Analysis Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 6.2. Asia Pacific Cell Analysis Market Size and Forecast, by Technique (2023-2030) 6.3. Asia Pacific Cell Analysis Market Size and Forecast, by Process (2023-2030) 6.4. Asia Pacific Cell Analysis Market Size and Forecast, by End User (2023-2030) 6.5. Asia Pacific Cell Analysis Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 6.5.1.2. China Cell Analysis Market Size and Forecast, by Technique (2023-2030) 6.5.1.3. China Cell Analysis Market Size and Forecast, by Process (2023-2030) 6.5.1.4. China Cell Analysis Market Size and Forecast, by End User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 6.5.2.2. S Korea Cell Analysis Market Size and Forecast, by Technique (2023-2030) 6.5.2.3. S Korea Cell Analysis Market Size and Forecast, by Process (2023-2030) 6.5.2.4. S Korea Cell Analysis Market Size and Forecast, by End User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 6.5.3.2. Japan Cell Analysis Market Size and Forecast, by Technique (2023-2030) 6.5.3.3. Japan Cell Analysis Market Size and Forecast, by Process (2023-2030) 6.5.3.4. Japan Cell Analysis Market Size and Forecast, by End User (2023-2030) 6.5.4. India 6.5.4.1. India Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 6.5.4.2. India Cell Analysis Market Size and Forecast, by Technique (2023-2030) 6.5.4.3. India Cell Analysis Market Size and Forecast, by Process (2023-2030) 6.5.4.4. India Cell Analysis Market Size and Forecast, by End User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 6.5.5.2. Australia Cell Analysis Market Size and Forecast, by Technique (2023-2030) 6.5.5.3. Australia Cell Analysis Market Size and Forecast, by Process (2023-2030) 6.5.5.4. Australia Cell Analysis Market Size and Forecast, by End User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 6.5.6.2. Indonesia Cell Analysis Market Size and Forecast, by Technique (2023-2030) 6.5.6.3. Indonesia Cell Analysis Market Size and Forecast, by Process (2023-2030) 6.5.6.4. Indonesia Cell Analysis Market Size and Forecast, by End User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 6.5.7.2. Malaysia Cell Analysis Market Size and Forecast, by Technique (2023-2030) 6.5.7.3. Malaysia Cell Analysis Market Size and Forecast, by Process (2023-2030) 6.5.7.4. Malaysia Cell Analysis Market Size and Forecast, by End User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 6.5.8.2. Vietnam Cell Analysis Market Size and Forecast, by Technique (2023-2030) 6.5.8.3. Vietnam Cell Analysis Market Size and Forecast, by Process (2023-2030) 6.5.8.4. Vietnam Cell Analysis Market Size and Forecast, by End User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 6.5.9.2. Taiwan Cell Analysis Market Size and Forecast, by Technique (2023-2030) 6.5.9.3. Taiwan Cell Analysis Market Size and Forecast, by Process (2023-2030) 6.5.9.4. Taiwan Cell Analysis Market Size and Forecast, by End User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 6.5.10.2. Rest of Asia Pacific Cell Analysis Market Size and Forecast, by Technique (2023-2030) 6.5.10.3. Rest of Asia Pacific Cell Analysis Market Size and Forecast, by Process (2023-2030) 6.5.10.4. Rest of Asia Pacific Cell Analysis Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Cell Analysis Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 7.2. Middle East and Africa Cell Analysis Market Size and Forecast, by Technique (2023-2030) 7.3. Middle East and Africa Cell Analysis Market Size and Forecast, by Process (2023-2030) 7.4. Middle East and Africa Cell Analysis Market Size and Forecast, by End User (2023-2030) 7.5. Middle East and Africa Cell Analysis Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 7.5.1.2. South Africa Cell Analysis Market Size and Forecast, by Technique (2023-2030) 7.5.1.3. South Africa Cell Analysis Market Size and Forecast, by Process (2023-2030) 7.5.1.4. South Africa Cell Analysis Market Size and Forecast, by End User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 7.5.2.2. GCC Cell Analysis Market Size and Forecast, by Technique (2023-2030) 7.5.2.3. GCC Cell Analysis Market Size and Forecast, by Process (2023-2030) 7.5.2.4. GCC Cell Analysis Market Size and Forecast, by End User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 7.5.3.2. Nigeria Cell Analysis Market Size and Forecast, by Technique (2023-2030) 7.5.3.3. Nigeria Cell Analysis Market Size and Forecast, by Process (2023-2030) 7.5.3.4. Nigeria Cell Analysis Market Size and Forecast, by End User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 7.5.4.2. Rest of ME&A Cell Analysis Market Size and Forecast, by Technique (2023-2030) 7.5.4.3. Rest of ME&A Cell Analysis Market Size and Forecast, by Process (2023-2030) 7.5.4.4. Rest of ME&A Cell Analysis Market Size and Forecast, by End User (2023-2030) 8. South America Cell Analysis Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 8.2. South America Cell Analysis Market Size and Forecast, by Technique (2023-2030) 8.3. South America Cell Analysis Market Size and Forecast, by Process(2023-2030) 8.4. South America Cell Analysis Market Size and Forecast, by End User (2023-2030) 8.5. South America Cell Analysis Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 8.5.1.2. Brazil Cell Analysis Market Size and Forecast, by Technique (2023-2030) 8.5.1.3. Brazil Cell Analysis Market Size and Forecast, by Process (2023-2030) 8.5.1.4. Brazil Cell Analysis Market Size and Forecast, by End User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 8.5.2.2. Argentina Cell Analysis Market Size and Forecast, by Technique (2023-2030) 8.5.2.3. Argentina Cell Analysis Market Size and Forecast, by Process (2023-2030) 8.5.2.4. Argentina Cell Analysis Market Size and Forecast, by End User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Cell Analysis Market Size and Forecast, by Product & Service (2023-2030) 8.5.3.2. Rest Of South America Cell Analysis Market Size and Forecast, by Technique (2023-2030) 8.5.3.3. Rest Of South America Cell Analysis Market Size and Forecast, by Process (2023-2030) 8.5.3.4. Rest Of South America Cell Analysis Market Size and Forecast, by End User (2023-2030) 9. Global Cell Analysis Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Cell Analysis Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Agilent Technologies, Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Sartorius AG 10.3. Biomerieux SA 10.4. Qiagen N.V. 10.5. Standard BioTools Inc., 10.6. Thermo Fisher Scientific, Inc. 10.7. Danaher (Beckman Coulter) 10.8. Becton Dickinson (BD) 10.9. Agilent Technologies 10.10. PerkinElmer 10.11. Illumina, Inc., 10.12. Miltenyi Biotec 10.13. Bio-Rad Laboratories, Inc. 10.14. Fluidigm Corporation 10.15. 10x Genomics 10.16. Illumina, Inc. 10.17. Fluidigm Corporation 10.18. 10x Genomics 10.19. Illumina, Inc. 10.20. Novogene Corporation 10.21. Terumo BCT 10.22. Promega Corporation 10.23. BGI 11. Key Findings 12. Industry Recommendations 13. Cell Analysis Market: Research Methodology 14. Terms and Glossary