Carbon Fiber Market was valued at US$ 4.88 Bn. in 2023. Global Carbon Fiber Market size is estimated to grow at a CAGR of 8.8% over the forecast period.Carbon Fiber Market Overview:

Carbon fibers are combined with other materials to form composites, they are bonded together in crystals having several advantages, high stiffness, high tensile strength to weight ratio and low thermal expansion, these properties have made carbon fiber very popular in the field of civil engineering,military,aerospace,motorsports and other competition sports. The need for ready supply of precursor and carbon fibers the nature of the process technology and U.S export control has led to an industry growth with significant integration globally.To know about the Research Methodology :- Request Free Sample Report The report explores the Carbon Fiber Market's segments (Raw Material Type, Application, End-User, and Region). Data has been provided by market participants, and regions (North America, Asia Pacific, Europe, Middle East & Africa, and South America). The report also investigates the Carbon Fiber Market's drivers, limitations, prospects, and barriers. This MMR report includes investor recommendations based on a thorough examination of the Carbon Fiber Market's contemporary competitive scenario. Maximize Market Research assembles data from primary research interviews with different Antimicrobial Additives producers dispersed across the domestic and international market, suppliers, and dealers/distributors to obtain insights into value-chains and the demand-supply scenario and evaluate the market situation. To verify the facts, a thorough examination of the company's annual reports and secondary sources, such as a thorough search on reliable paid databases, including our internal database, is conducted. To give a meaningful and understandable image of the relevant market, all the material that has been gathered has been evaluated, assessed, and presented in chronological sequence. 2023 is considered as a base year to forecast the market from 2024 to 2030. 2023 market size is estimated on real numbers and outputs of the key players and major players across the globe. The past five years' trends are considered while forecasting the market through 2030. 2023 is a year of exception and analysis, especially with the impact of lockdown by region.

Carbon Fiber Market Dynamics:

The carbon fiber demand projection is more optimistic than the past estimations, including the previously most aggressive estimation by MMR report. Total demand is estimated to reach 1, 60,300 tones and 2, 25,300 tons by 2024-2030 respectively. Automotive and pressure vessel applications of Carbon fiber are forecasted to have a significant share of carbon fiber demand which is projected to be around 20% combined driving the carbon fiber market. The Aerospace projects have been the primary drivers of the carbon fiber industry for most of their history. Some of the first uses of the carbon fiber in aerospace structural application emerged from the US defense Department of Defense and the National Aeronautics and Space administration where the materials extraordinary mechanical properties were valuable enough for their significant use of the carbon fiber composites. The 3D printing process includes stacking thin materials to create an object in three dimensions from a digital model. This is an advanced technology with numerous applications that doesn't need a lot of setup time for huge equipment. Multiple things may be printed quickly with this technology. The utilization of continuous carbon fibers in 3D printing suggests that they are more robust and stronger than other metallic materials. The optimization method is made simpler by the adjustable nature of the carbon fiber's composition and orientation. Carbon fiber 3D printing also enables the production of Raw Material Types with great accuracy for a variety of end-use industries, including the aerospace, automotive, and dental sectors. This technique will revolutionize the production of carbon fiber and present the market with enormous prospects. The strict performance requirements of the carbon fiber in various application led the certification barriers and tighter manufacturing tolerances associated with the carbon fiber. Wind Energy carbon fiber uses a group of parallel filaments. It accounts for about 20%of total demand and is projected to grow from about 8000 tonnes/year to 30000 tonnes year by 2023.Europe has major share total worldwide wind energy carbon fiber demand. A key raw ingredient used to produce carbon fiber, polyacrylonitrile, has seen demand surge as a result of an increase in propylene output. Regional product growth is probably being driven by R&D activity in important locations.Carbon Fiber Market Segment Analysis:

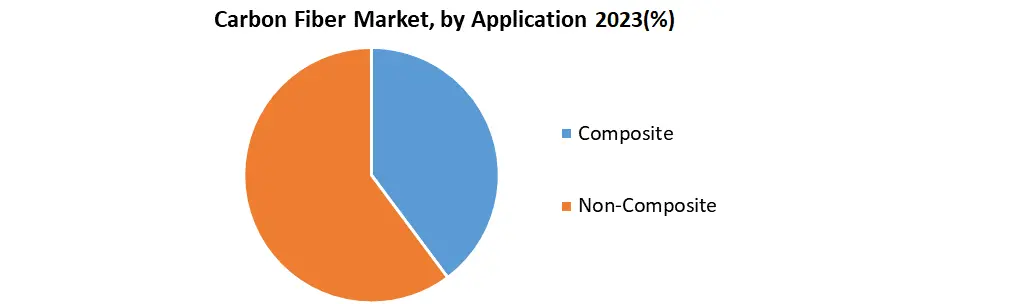

Based on raw material, Pitch or polyacrylonitrile (PAN) are the main basic ingredients used in the production of carbon fibre. PAN is anticipated to be more widely accepted in a variety of applications due to its better characteristics. By 2030, there will be a demand for more than 225 kilotons of PAN thanks to a CGAR of 13.1% predicted for the worldwide PAN market. As there is a growing need for carbon fibre with a higher strength to weight ratio, PAN precursor is frequently used because of its superior material qualities. The segment growth is also anticipated to be supported by PAN's lower cost when compared to pitch-based carbon fibre. Based on Application, by application, the composite segment is anticipated to dominate the carbon fibre market. This development can be attributed to the widespread adoption of carbon fibre in composite form by sectors including aerospace & military, automotive, and wind energy. Based on End-User, The aerospace industry uses small tow fiber,so as a market driver .The use of this small tow production for aerospace production capacity is centred in Asia, production in major supply chains .Application of carbon fiber in the commercial aerospace market is soon followed with the introduction of the carbon fiber composite rubber by Airbus for the A300 and A310 .This sort of innovation has continued to this day with the use of high composite content of the carbon fiber in the market. The automotive industry has slowly expanded its use of CF and CFRP and continued growth at compound annual growth rate of25% and is expected to reach higher in next several years.

Regional Insights:

North America leads the world in the current and projected production of the carbon fiber-based products. The end market occurs primarily in Asia-Pacific and Latin America countries where natural gas vehicle use is concentrated. According to MMR report North America, Europe, Japan is where the Carbon fiber industry began and remain concentrated in terms of both supply and demand till date. Europe was the leading region in terms of Carbon fiber in 2015.The latest forecast has indicated that Asia and Europe are having the higher share-33% to 34% respectively of total worldwide demand compared to 32% in North America by 2030. As Airbus has dominated the market for aerospace CF composite the demand of the aerospace came from Europe and North America, and is expected to increase rapidly by the year 2030.Europe has accounted for 50% of the aerospace carbon fiber demand compared to 40% for North America. Most of the small tow capacity exists in Asia which is consistent with the latest projected 52% share of total worldwide small Carbon fiber production capacity of 113500 tonnes in 2030. The objective of the report is to present a comprehensive analysis of the global Carbon Fiber Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Carbon Fiber Market dynamic, and structure by analyzing the market segments and projecting the Carbon Fiber Market size. Clear representation of competitive analysis of key players by Design, price, financial position, Instrumentation Technology portfolio, growth strategies, and regional presence in the Carbon Fiber Market make the report investor’s guide.Carbon Fiber Market Scope: Inquire before buying

Global Carbon Fiber Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US$ 4.88 Bn. Forecast Period 2024 to 2030 CAGR: 8.8% Market Size in 2030: US$ 8.81 Bn. Segments Covered: by Raw Material Type PAN–based carbon fiber Pitch–based carbon fiber Rayon–based carbon fiber by Application Composite Non-Composite by End-User Aerospace & defense Automotive Wind Energy Electrical & electronics Civil Engineering Marine Carbon Fiber Market by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest)Key Players:

1. Toray Industries Inc. (Japan) 2. SGL Group (Germany) 3. Hexcel Corporation (U.S.) 4. Mitsubishi Rayon Co. Ltd. (Japan) 5. Teijin Limited (Japan) 6. Plastics Corporation (Taiwan) 7. Solvay (Belgium) 8. Jiangsu Hengshen Co. Ltd. (China) 9. Hyosung (South Korea), 10. DowAksa (Turkey). 11. BASF SE 12. SGL Group 13. Teijin Limited 14. Mitsubishi Rayon Co., Ltd. 15. Hexcel Corporation Frequently Asked Questions: 1. What is the study period of the market? Ans. The Global Carbon Fiber Market is studied from 2023-2030. 2. What is the growth rate of Carbon Fiber Market? Ans. The Global Carbon Fiber Market is growing at a CAGR of 8.8% over forecast period. 3. What is the market size of the Carbon Fiber Market by 2030? Ans. The market size of the Carbon Fiber Market by 2030 is expected to reach at US$ 8.81 Bn. 4. What is the forecast period for the Carbon Fiber Market? Ans. The forecast period for the Carbon Fiber Market is 2024-2030 5. What was the market size of the Carbon Fiber Market in 2023? Ans. The market size of the Carbon Fiber Market in 2023 was valued at US$ 4.88 Bn.

1. Carbon Fiber Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Carbon Fiber Market: Dynamics 2.1. Carbon Fiber Market Trends by Region 2.1.1. North America Carbon Fiber Market Trends 2.1.2. Europe Carbon Fiber Market Trends 2.1.3. Asia Pacific Carbon Fiber Market Trends 2.1.4. Middle East and Africa Carbon Fiber Market Trends 2.1.5. South America Carbon Fiber Market Trends 2.2. Carbon Fiber Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Carbon Fiber Market Drivers 2.2.1.2. North America Carbon Fiber Market Restraints 2.2.1.3. North America Carbon Fiber Market Opportunities 2.2.1.4. North America Carbon Fiber Market Challenges 2.2.2. Europe 2.2.2.1. Europe Carbon Fiber Market Drivers 2.2.2.2. Europe Carbon Fiber Market Restraints 2.2.2.3. Europe Carbon Fiber Market Opportunities 2.2.2.4. Europe Carbon Fiber Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Carbon Fiber Market Drivers 2.2.3.2. Asia Pacific Carbon Fiber Market Restraints 2.2.3.3. Asia Pacific Carbon Fiber Market Opportunities 2.2.3.4. Asia Pacific Carbon Fiber Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Carbon Fiber Market Drivers 2.2.4.2. Middle East and Africa Carbon Fiber Market Restraints 2.2.4.3. Middle East and Africa Carbon Fiber Market Opportunities 2.2.4.4. Middle East and Africa Carbon Fiber Market Challenges 2.2.5. South America 2.2.5.1. South America Carbon Fiber Market Drivers 2.2.5.2. South America Carbon Fiber Market Restraints 2.2.5.3. South America Carbon Fiber Market Opportunities 2.2.5.4. South America Carbon Fiber Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Carbon Fiber Industry 2.8. Analysis of Government Schemes and Initiatives For Carbon Fiber Industry 2.9. Carbon Fiber Market Trade Analysis 2.10. The Global Pandemic Impact on Carbon Fiber Market 3. Carbon Fiber Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 3.1.1. PAN–based carbon fiber 3.1.2. Pitch–based carbon fiber 3.1.3. Rayon–based carbon fiber 3.2. Carbon Fiber Market Size and Forecast, by Application (2023-2030) 3.2.1. Composite 3.2.2. Non-Composite 3.3. Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 3.3.1. Aerospace & defense 3.3.2. Automotive 3.3.3. Wind Energy 3.3.4. Electrical & electronics 3.3.5. Civil Engineering 3.3.6. Marine 3.4. Carbon Fiber Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Carbon Fiber Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 4.1.1. PAN–based carbon fiber 4.1.2. Pitch–based carbon fiber 4.1.3. Rayon–based carbon fiber 4.2. North America Carbon Fiber Market Size and Forecast, by Application (2023-2030) 4.2.1. Composite 4.2.2. Non-Composite 4.3. North America Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 4.3.1. Aerospace & defense 4.3.2. Automotive 4.3.3. Wind Energy 4.3.4. Electrical & electronics 4.3.5. Civil Engineering 4.3.6. Marine 4.4. North America Carbon Fiber Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 4.4.1.1.1. PAN–based carbon fiber 4.4.1.1.2. Pitch–based carbon fiber 4.4.1.1.3. Rayon–based carbon fiber 4.4.1.2. United States Carbon Fiber Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Composite 4.4.1.2.2. Non-Composite 4.4.1.3. United States Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 4.4.1.3.1. Aerospace & defense 4.4.1.3.2. Automotive 4.4.1.3.3. Wind Energy 4.4.1.3.4. Electrical & electronics 4.4.1.3.5. Civil Engineering 4.4.1.3.6. Marine 4.4.2. Canada 4.4.2.1. Canada Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 4.4.2.1.1. PAN–based carbon fiber 4.4.2.1.2. Pitch–based carbon fiber 4.4.2.1.3. Rayon–based carbon fiber 4.4.2.2. Canada Carbon Fiber Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Composite 4.4.2.2.2. Non-Composite 4.4.2.3. Canada Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 4.4.2.3.1. Aerospace & defense 4.4.2.3.2. Automotive 4.4.2.3.3. Wind Energy 4.4.2.3.4. Electrical & electronics 4.4.2.3.5. Civil Engineering 4.4.2.3.6. Marine 4.4.3. Mexico 4.4.3.1. Mexico Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 4.4.3.1.1. PAN–based carbon fiber 4.4.3.1.2. Pitch–based carbon fiber 4.4.3.1.3. Rayon–based carbon fiber 4.4.3.2. Mexico Carbon Fiber Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Composite 4.4.3.2.2. Non-Composite 4.4.3.3. Mexico Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 4.4.3.3.1. Aerospace & defense 4.4.3.3.2. Automotive 4.4.3.3.3. Wind Energy 4.4.3.3.4. Electrical & electronics 4.4.3.3.5. Civil Engineering 4.4.3.3.6. Marine 5. Europe Carbon Fiber Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 5.2. Europe Carbon Fiber Market Size and Forecast, by Application (2023-2030) 5.3. Europe Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 5.4. Europe Carbon Fiber Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 5.4.1.2. United Kingdom Carbon Fiber Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Carbon Fiber Market Size and Forecast, by End-User(2023-2030) 5.4.2. France 5.4.2.1. France Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 5.4.2.2. France Carbon Fiber Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Carbon Fiber Market Size and Forecast, by End-User(2023-2030) 5.4.3. Germany 5.4.3.1. Germany Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 5.4.3.2. Germany Carbon Fiber Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 5.4.4.2. Italy Carbon Fiber Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Carbon Fiber Market Size and Forecast, by End-User(2023-2030) 5.4.5. Spain 5.4.5.1. Spain Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 5.4.5.2. Spain Carbon Fiber Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 5.4.6.2. Sweden Carbon Fiber Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 5.4.7.2. Austria Carbon Fiber Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 5.4.8.2. Rest of Europe Carbon Fiber Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 6. Asia Pacific Carbon Fiber Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 6.2. Asia Pacific Carbon Fiber Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 6.4. Asia Pacific Carbon Fiber Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 6.4.1.2. China Carbon Fiber Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 6.4.2.2. S Korea Carbon Fiber Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 6.4.3.2. Japan Carbon Fiber Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 6.4.4. India 6.4.4.1. India Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 6.4.4.2. India Carbon Fiber Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 6.4.5.2. Australia Carbon Fiber Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 6.4.6.2. Indonesia Carbon Fiber Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 6.4.7.2. Malaysia Carbon Fiber Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 6.4.8.2. Vietnam Carbon Fiber Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Carbon Fiber Market Size and Forecast, by End-User(2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 6.4.9.2. Taiwan Carbon Fiber Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Carbon Fiber Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 7. Middle East and Africa Carbon Fiber Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 7.2. Middle East and Africa Carbon Fiber Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 7.4. Middle East and Africa Carbon Fiber Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 7.4.1.2. South Africa Carbon Fiber Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 7.4.2.2. GCC Carbon Fiber Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 7.4.3.2. Nigeria Carbon Fiber Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 7.4.4.2. Rest of ME&A Carbon Fiber Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 8. South America Carbon Fiber Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 8.2. South America Carbon Fiber Market Size and Forecast, by Application (2023-2030) 8.3. South America Carbon Fiber Market Size and Forecast, by End-User(2023-2030) 8.4. South America Carbon Fiber Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 8.4.1.2. Brazil Carbon Fiber Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 8.4.2.2. Argentina Carbon Fiber Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Carbon Fiber Market Size and Forecast, by Raw Material Type (2023-2030) 8.4.3.2. Rest Of South America Carbon Fiber Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Carbon Fiber Market Size and Forecast, by End-User (2023-2030) 9. Global Carbon Fiber Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Carbon Fiber Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Toray Industries Inc. (Japan) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. SGL Group (Germany) 10.3. Hexcel Corporation (U.S.) 10.4. Mitsubishi Rayon Co. Ltd. (Japan) 10.5. Teijin Limited (Japan) 10.6. Plastics Corporation (Taiwan) 10.7. Solvay (Belgium) 10.8. Jiangsu Hengshen Co. Ltd. (China) 10.9. Hyosung (South Korea), 10.10. DowAksa (Turkey). 10.11. BASF SE 10.12. SGL Group 10.13. Teijin Limited 10.14. Mitsubishi Rayon Co., Ltd. 10.15. Hexcel Corporation 11. Key Findings 12. Industry Recommendations 13. Carbon Fiber Market: Research Methodology 14. Terms and Glossary