Global Calcium Propionate Market size was valued at USD 377.61 Mn in 2023 and is expected to reach USD 590.68 Mn by 2030, at a CAGR of 6.6 %.Calcium Propionate Market Overview

Calcium propionate is the calcium salt of propionic acid. It is also known as E282. It is a preservative typically utilized in baked goods, cheeses, jams and puddings where it extends its shelf life by prohibiting spoilage microorganisms and ropy bacteria growth. It accommodates low acute toxicity and is recognized as safe for consumption by many people. Calcium propionate supports to preserve food by interfering with the ability of microorganisms including molds and bacteria, to reproduce. The growth of the food industry, technological advancements in food preservation and increased focus on food waste reduction are the driving factors of the Market growth. The market report focuses on the drivers, challenges and major restraints of the Calcium Propionate industry. The report includes historical data, present and future trends, competitive environment of the Calcium Propionate industry. The bottom-up approach was used to estimate the market size. For a deeper knowledge of Calcium Propionate market penetration, competitive structure, pricing and demand analysis are included in the report. The qualitative and quantitative methods are included in the report for the analysis of the data of the Calcium Propionate market.To know about the Research Methodology :- Request Free Sample Report

Calcium Propionate Market Dynamics

Drivers Increasing Demand for Food Preservation to Drive the Calcium Propionate Market Growth Calcium propionate is a more useful preservative that inhibits molds and bacteria growth in food products. It extends the shelf life of several food items by preventing decay and spoilage such as bakery products, dairy products and others. Consumers, retailers and food manufacturers are all advantageous from longer shelf life as it minimizes food waste and allows for better inventory management. The modern lifestyle of consumers is characterized by a preference for convenience and ready-to-eat food products. As people's lives become more working, they seek foods that have been staying fresh for longer periods and calcium propionate supports to achieve this demand. The need to maintain food quality and safety in response to these changing consumer habits drives Calcium Propionate Market growth. In the global food supply chain, perishable food items have been required to travel long distances from producers to consumers. During storage and transportation, the risk of spoilage and contamination rises. Calcium propionate serves as a safeguard against microbial growth, assuring that the food products reach consumers in a consumable and safe state. This enhances supply chain efficiency and minimizes losses during transit. Rapid urbanization, convenience-driven consumer preferences and a rise in dual-income households drive the processed food industry has experienced significant growth over the years. Processed foods require preservatives to maintain their quality. With the increasing expansion of the processed food industry, there is an increase in the demand for calcium propionate, which drives Market growth. As Per Maximize Market Research, with the increase in the growth of the Convenience Foods Market, there is an increase in the Calcium Propionate industry. For Instance, consider the Convenience Foods Market in China.Convenience Foods Market Size in China from 2018-2022( in Billion yuan)

Growing health concerns of consumers to boost the Calcium Propionate Market growth Consumers are becoming more conscious of the consumption of the ingredients which are present in the food. The clean labels are free from artificial preservatives, synthetic additives and chemicals and thus there is a preference for them. Calcium propionate is treated as a natural preservative as it occurs naturally in some foods and its utilization aligns with the clean label trend. Manufacturers prefer calcium propionate to meet consumer demands for more transparent and natural food products. Generally, Calcium propionate is recognized as safe (GRAS) by regulatory authorities when utilized within prescribed limits. Compared with other synthetic preservatives, calcium propionate is perceived as a safer privilege and this perception have been fuelling its adoption in the food industry. A significant part of the consumer base is becoming more health-conscious, searching for food products that promote well-being and nutrition. As awareness of the impact of preservatives on health increases, consumers have been preferring products preserved with calcium propionate, recognizing it as a more adaptable option in terms of potential health effects. The demand for functional foods, which provide health benefits beyond basic nutrition, is on the increase. Calcium propionate's appearance as a preservative allows manufacturers to produce functional food items without compromising their health claims. For instance, bread with added nutrients has been still having an extended shelf life when preserved with calcium propionate. Some consumers have sensitivities to certain preservatives. Calcium propionate is preferable for those with sulfite allergies, as it does not contain sulfites, which have prompted adverse reactions in susceptible individuals. This allergen-friendly aspect of calcium propionate have been attract consumers with specific dietary restrictions. Calcium Propionate Market Trend Increasing Demand for Animal Feed Preservatives Population growth, rising income levels, and changing dietary preferences drive the continuously increasing demand for meat, dairy and poultry products is continuously increasing. As a result, there is a growing requirement for animal feed to help the expansion of poultry production and livestock. To prevent the growth of mold and bacteria in animal feed, Calcium Propionate is utilized as a feed preservative, ensuring the feed's quality and safety for consumption. Animal feed has been inclined to spoilage and contamination, particularly in humid and warm climates. Calcium Propionate serves as an efficient preservative that supports and extends the shelf life of animal feed by inhibiting the growth of molds and bacteria. This contributes to precise feed quality and minimizes potential health risks for the animals consuming the feed, which helps to drive Calcium Propionate Market growth. The quality of animal feed directly impacts the health and performance of livestock and poultry. The contaminated feed has led to reduced feed intake, lower weight gain, and overall health issues for animals. By using Calcium Propionate as a preservative, farmers, as well as producers, have been ensuring that the feed maintains its nutritional value and remains free from harmful microorganisms, helping optimal animal health and overall performance. Calcium Propionate Market Restraint Environmental concerns to hamper the Calcium Propionate Market growth The growing focus on sustainability and eco-friendly practices in several industries such food industry, has resulted in to an increase in interest in environmentally friendly preservatives. As a synthetic preservative, Calcium Propionate has faced competition from alternatives derived from natural sources which create low environmental impacts. The manufacturing process of Calcium Propionate includes certain environmental impacts, such as energy consumption, emissions and waste generation. While the overall environmental footprint of Calcium Propionate has been relatively small compared to other chemical substances, there is growing awareness about the environmental impacts of industrial processes. Concerns about these impacts have resulted to accept more sustainable production practices. The release of Calcium Propionate into water bodies has been increasing concerns regarding water pollution. As a result, increasing Environmental concerns hamper the Calcium Propionate Market growth.

Calcium Propionate Market Regional Insights

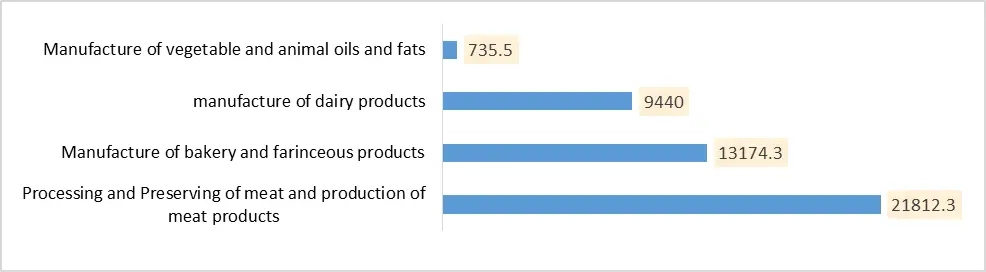

Europe dominated the Calcium Propionate Market in 2023 and is expected to have the highest CAGR during the forecast period. Europe has a well-established food processing industry. There has been a distinct midrange of food products such as bakery items, dairy products, and others. Calcium Propionate is widely utilized as a preservative in these food items to extend their shelf life and maintain product quality during storage. The demand for convenience and processed foods has been steadily increasing in the region due to busy schedules, changing consumer lifestyles and urbanization. This results that, there is a growing need for effective preservatives such as Calcium Propionate to ensure the safety of processed food products. Europe has certain of the strictest food safety regulations in the world. Calcium Propionate is recognized for use as a food preservative by the European Food Safety Authority (EFSA) and the European Commission. Its utilization has complied with specific regulations and optimum permitted levels. The constancy of these regulations fuels the demand for Calcium Propionate as a safe and approved preservative in the regional Calcium Propionate market. Consumers in Europe value food products with a longer shelf life, as it minimizes food waste and allows for efficient inventory management. Calcium Propionate supports achieving this goal by inhibiting the growth of molds and bacteria, making it a needful ingredient for many European food manufacturers.Production Value of the Food Manufacturing Industry in the United Kingdom (UK) In 2018, By Sector (in Million Euros)

Calcium Propionate Market Segment Analysis

Based on Form, the market is segmented into the Dry and Liquid form. Dry calcium propionate dominated the Calcium Propionate Market in 2023 and is expected to have the highest CAGR during the forecast period. Dry calcium propionate is accessible in the form of granules or white crystalline powder that are easy to handle and store. They are less prone to degradation and have a longer shelf life and compared to the liquid form. It is more cost-effective compared with liquid form. The manufacturing process for dry calcium propionate has been easier and less expensive, which contributes to its competitive pricing. The dry form of calcium propionate tends to have efficient stability during transportation and storage. It is less vulnerable to changes in temperature and environmental conditions, minimizing the risk of degradation. Dry calcium propionate adequately inhibits the growth of mold and other microorganisms in food and feed products, with extending their shelf life. It is considered a reliable preservative, particularly for bakery products and other dry formulations. Consumers and manufacturers are recognizable with the dry form of calcium propionate, as it has been utilized in the food and feed industries for many years. Familiarity generally drives the inclination for the dry form over the liquid form. The dry form of calcium propionate has benefits in meeting regulatory needs for certain food and feed applications. It has been easier to comply with food safety standards and regulations when using dry calcium propionate which fuels the Calcium Propionate Market growth. Based on Application, the market is categorized into Food and Beverages, Feed, Pharmaceuticals and Others. Food and Beverages held the largest Calcium Propionate Market share in 2023. Calcium Propionate is a useful preservative in the food and beverages industry, which is help to inhibit mold and microorganism growth. As consumers demand fresher and longer-lasting food options, the requirements for effective preservatives including calcium propionate have increased. The bakery industry is a substantial consumer of calcium propionate. Bread, rolls and other bakery products are staple foods consumed globally. Calcium propionate supports to prevent mold growth in these products, assuring they remain fresh for a more extended period. The large consumption of bakery products helps to dominate the position of the Food and Beverages application. With the increase in urbanization and busy lifestyles, the demand for convenience and processed foods has increased. Processed foods have an extended shelf life to make them more substantial to spoilage. Calcium propionate utilized as a preservative in several processed food items including convenience meals, snacks and packaged goods is instrumental in meeting this demand. In recent years, consumers give more preference for food safety, quality, and freshness. Calcium propionate helps to meet these expectations by preventing spoilage and maintaining product integrity. As consumers become more conscious regarding the ingredients in their food, the demand for reliable and safe preservatives such as calcium propionate increases and this boosts the Calcium Propionate Market growth.Calcium Propionate Market Competitive Landscape

The Competitive Landscape of the Calcium Propionate market covers the number of key companies, company size, their strengths, weaknesses, barriers and threats. It also focuses on potential, new market entrants, customers, suppliers and substitute services that boost the profitability of Calcium Propionate companies. The global Calcium Propionate markets include several market players at the country, regional and global levels. Some of the key companies are ADDCON (Germany), Kemin Industries (US), Macco Organiques (Canada), Bell Chem (US), Krishna Chemicals (India), AM Food Chemicals (China), Fine Organics (UK), Real S. A. S. (Columbia), Dr. Paul Lohmann GmbH & Co. KGaA (Germany) and others. Mergers and acquisitions are conducted by many companies to increase their leading position. For Instance, In 2021 The Niacet Company has been acquired by the Kerry group and has a value of €853m ($1,015m). The acquisition has been emphasized to create the world-leading global food protection and preservation platform. In addition, many companies conducted research and development activities to increase their product portfolio and meet consumer demand. For Instance, At IBIE 2022, Kemin Launches New Clean Label Bakery Solution. The Company adds SHIELD Pure clean label mold inhibitor to its portfolio of solutions that support bakers extend shelf life and improve the performance of bread, baked goods and other products. This new advanced product increases the demand for Calcium Propionate, which drives the Calcium Propionate industry growth.Calcium Propionate Market Scope: Inquire Before Buying

Global Calcium Propionate Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 377.61 Mn. Forecast Period 2024 to 2030 CAGR: 6.6% Market Size in 2030: US $ 590.68 Mn. Segments Covered: by Form Dry Liquid by Source Natural Synthetic by Application Food and Beverages Bakery Products Dairy and Frozen Desserts Meat Seafood Products Feed Livestock Feed Pet Feed Pharmaceuticals Others Calcium Propionate Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina, Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Calcium Propionate Key Player

1. Niacet (US) 2. Impextraco (Belgium) 3. ADDCON (Germany) 4. Kemin Industries (US) 5. Macco Organiques(Canada) 6. Bell Chem(US) 7. Krishna Chemicals(India) 8. AM Food Chemicals(China) 9. Fine Organics(UK) 10. Real S. A. S.(Columbia) 11. Dr. Paul Lohmann GmbH & Co. KGaA (Germany) 12. Environmental Working Group. (U.S.) 13. MAGNESIA GmbH (Germany) 14. Titan Biotech. (India) 15. Kemira (Finland) 16. Perstorp (Sweden) 17. Eastman Chemical Company(US) 18. BASF SE(Germany) 19. Kemira Oyj(Finland) 20. Dow Chemical Company(US) 21. A. B. Enterprises(India) 22. Alfa Aesar, Thermo Fisher Scientific(US) Frequently Asked Questions: 1] What is the growth rate of the Global Calcium Propionate Market? Ans. The Global Calcium Propionate Market is growing at a significant rate of 6.6 % during the forecast period. 2] Which region is expected to dominate the Global Calcium Propionate Market? Ans. Europe is expected to dominate the Calcium Propionate Market during the forecast period. 3] What is the expected Global Calcium Propionate Market size by 2030? Ans. The Calcium Propionate Market size is expected to reach USD 590.68 Mn by 2030. 4] Which are the top players in the Global Calcium Propionate Market? Ans. The top players in the Global Calcium Propionate Market are ADDCON (Germany), Kemin Industries (US), Macco Organiques (Canada), Bell Chem (US), Krishna Chemicals (India), AM Food Chemicals (China), Fine Organics (UK), Real S. A. S. (Columbia), Dr. Paul Lohmann GmbH & Co. KGaA (Germany), Environmental Working Group. (U.S.) and others. 5] What are the factors driving the Global Calcium Propionate Market growth? Ans. Increasing Demand for Food Preservation and growing health concerns of consumers are expected to drive market growth during the forecast period.

1. Calcium Propionate Market: Research Methodology 2. Calcium Propionate Market: Executive Summary 3. Calcium Propionate Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Calcium Propionate Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Calcium Propionate Market Size and Forecast by Segments (by Value USD and Volume Units ) 5.1. Calcium Propionate Market Size and Forecast, by Form (2023-2030) 5.1.1. Dry 5.1.2. Liquid 5.2. Calcium Propionate Market Size and Forecast, by Source (2023-2030) 5.2.1. Natural 5.2.2. Synthetic 5.3. Calcium Propionate Market Size and Forecast, by Application (2023-2030) 5.3.1. Food and Beverages 5.3.2. Feed 5.3.3. Pharmaceuticals 5.3.4. Others 5.4. Calcium Propionate Market Size and Forecast, by Region (2023-2030) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Calcium Propionate Market Size and Forecast by Segments (by Value USD and Volume Units ) 6.1. North America Calcium Propionate Market Size and Forecast, by Form (2023-2030) 6.1.1. Dry 6.1.2. Liquid 6.2. North America Calcium Propionate Market Size and Forecast, by Source (2023-2030) 6.2.1. Natural 6.2.2. Synthetic 6.3. North America Calcium Propionate Market Size and Forecast, by Application (2023-2030) 6.3.1. Food and Beverages 6.3.2. Feed 6.3.3. Pharmaceuticals 6.3.4. Others 6.4. North America Calcium Propionate Market Size and Forecast, by Country (2023-2030) 6.4.1. United States 6.4.2. Canada 6.4.3. Mexico 7. Europe Calcium Propionate Market Size and Forecast by Segments (by Value USD and Volume Units ) 7.1. Europe Calcium Propionate Market Size and Forecast, by Form (2023-2030) 7.1.1. Dry 7.1.2. Liquid 7.2. Europe Calcium Propionate Market Size and Forecast, by Source (2023-2030) 7.2.1. Natural 7.2.2. Synthetic 7.3. Europe Calcium Propionate Market Size and Forecast, by Application (2023-2030) 7.3.1. Food and Beverages 7.3.2. Feed 7.3.3. Pharmaceuticals 7.3.4. Others 7.4. Europe Calcium Propionate Market Size and Forecast, by Country (2023-2030) 7.4.1. UK 7.4.2. France 7.4.3. Germany 7.4.4. Italy 7.4.5. Spain 7.4.6. Sweden 7.4.7. Austria 7.4.8. Rest of Europe 8. Asia Pacific Calcium Propionate Market Size and Forecast by Segments (by Value USD and Volume Units ) 8.1. Asia Pacific Calcium Propionate Market Size and Forecast, by Form (2023-2030) 8.1.1. Dry 8.1.2. Liquid 8.2. Asia Pacific Calcium Propionate Market Size and Forecast, by Source (2023-2030) 8.2.1. Natural 8.2.2. Synthetic 8.3. Asia Pacific Calcium Propionate Market Size and Forecast, by Application (2023-2030) 8.3.1. Food and Beverages 8.3.2. Feed 8.3.3. Pharmaceuticals 8.3.4. Others 8.4. Asia Pacific Calcium Propionate Market Size and Forecast, by Country (2023-2030) 8.4.1. China 8.4.2. S Korea 8.4.3. Japan 8.4.4. India 8.4.5. Australia 8.4.6. Indonesia 8.4.7. Malaysia 8.4.8. Vietnam 8.4.9. Taiwan 8.4.10. Bangladesh 8.4.11. Pakistan 8.4.12. Rest of Asia Pacific 9. Middle East and Africa Calcium Propionate Market Size and Forecast by Segments (by Value USD and Volume Units ) 9.1. Middle East and Africa Calcium Propionate Market Size and Forecast, by Form (2023-2030) 9.1.1. Dry 9.1.2. Liquid 9.2. Middle East and Africa Calcium Propionate Market Size and Forecast, by Source (2023-2030) 9.2.1. Natural 9.2.2. Synthetic 9.3. Middle East and Africa Calcium Propionate Market Size and Forecast, by Application (2023-2030) 9.3.1. Food and Beverages 9.3.2. Feed 9.3.3. Pharmaceuticals 9.3.4. Others 9.4. Middle East and Africa Calcium Propionate Market Size and Forecast, by Country (2023-2030) 9.4.1. South Africa 9.4.2. GCC 9.4.3. Egypt 9.4.4. Nigeria 9.4.5. Rest of ME&A 10. South America Calcium Propionate Market Size and Forecast by Segments (by Value USD and Volume Units ) 10.1. South America Calcium Propionate Market Size and Forecast, by Form (2023-2030) 10.1.1. Dry 10.1.2. Liquid 10.2. South America Calcium Propionate Market Size and Forecast, by Source (2023-2030) 10.2.1. Natural 10.2.2. Synthetic 10.3. South America Calcium Propionate Market Size and Forecast, by Application (2023-2030) 10.3.1. Food and Beverages 10.3.2. Feed 10.3.3. Pharmaceuticals 10.3.4. Others 10.4. South America Calcium Propionate Market Size and Forecast, by Country (2023-2030) 10.4.1. Brazil 10.4.2. Argentina 10.4.3. Rest of South America 11. Company Profile: Key players 11.1. Av Concepts, Inc(US) 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Niacet (US) 11.3. Impextraco (Belgium) 11.4. ADDCON (Germany) 11.5. Kemin Industries (US) 11.6. Macco Organiques(Canada) 11.7. Bell Chem(US) 11.8. Krishna Chemicals(India) 11.9. AM Food Chemicals(China) 11.10. Fine Organics(UK) 11.11. Real S. A. S.(Columbia) 11.12. Dr. Paul Lohmann GmbH & Co. KGaA (Germany) 11.13. Environmental Working Group. (U.S.) 11.14. MAGNESIA GmbH (Germany) 11.15. Titan Biotech. (India) 11.16. Kemira (Finland) 11.17. Perstorp (Sweden) 11.18. Eastman Chemical Company(US) 11.19. BASF SE(Germany) 11.20. Kemira Oyj(Finland) 11.21. Dow Chemical Company(US) 11.22. A. B. Enterprises(India) 11.23. Alfa Aesar, Thermo Fisher Scientific(US) 12. Key Findings 13. Industry Recommendation