C4ISR Market size was valued at USD 113.4 Billion in 2023 and C4ISR Revenue is expected to grow at a CAGR of 4.1 % from 2024 to 2030, reaching nearly USD 150.63 Billion in 2030.C4ISR Market Overview:

C4ISR stands for Command, Control, Communications, Computers (C4) Intelligence, Surveillance and Reconnaissance (ISR). Advanced C4ISR capabilities provide an advantage through situational awareness, knowledge of the adversary and environment, and shortening the time between sensing and response. The proliferation of autonomous aircraft and land vehicles has spurred significant demand for participants in the C4ISR market. Radiofrequency (RF) communications, electro-optical (EO) components, and satellite positioning sensors have been critical to the operation and development of autonomous systems and software. New initiatives from the Department of Defence have aimed to increase the U.S. military’s autonomous systems across multiple domains, subsequently driving consolidation activity in the C4ISR sector. The DOD’s Replicator initiative, announced in September 2023, plans to mass-produce thousands of smaller and less expensive autonomous drones. The program’s ambitious goal to build the drone swarms at scale within the next 18 to 24 months is expected to provide new contracting opportunities for sector players. Communication market businesses with command-and-control solutions that provide integration for unmanned systems are poised to garner increased revenue opportunities and buyer appetite in the long term.To know about the Research Methodology :- Request Free Sample Report 1. The Aerospace sub-sector was particularly buoyant, recording the highest value of M&A deals within ADS, more than $24.2bn since 1 January, followed by the C4ISR sector, with $8.7bn. Within the C4ISR sub-sector, Hensoldt’s acquisition of Elektroniksystem-und Logistik-GmbH (ESG) for $732.6m stands out as being the largest deal of 2023, allowing Hensoldt to add ESG’s knowledge of Concept of Operations for the digitization of the battlefield and the integration of network solutions.

C4ISR Market Dynamics:

Embracing CREW Systems, Satellite Innovations, and Asymmetric Warfare One of the key factors driving the C4ISR market growth is the growing acceptance of CREW systems. Demand for situational awareness systems is high in the military sector. The sector provides a lot of demand for a market the size of C4ISR. Advanced systems have additional features such as sensor capability, flight data processing, storage, and display. The high demands of precision technologies enable the effectiveness of the c4ISR mission. Growing demand for asymmetric warfare increases the growth opportunities of the market. Multiple sectors have been affected by the growing importance of satellites in military and commercial contexts. Investments in space-based C4 systems are driven by the development of small satellites, which offer the same performance as conventional satellites while contributing to cost savings.Harnessing AI, Cybersecurity, and Land Systems for Modern Warfare The emergence of cutting-edge technologies like artificial intelligence, machine learning, and big data analytics has made it possible to build more complex C4ISR systems manage massive volumes of data, and offer real-time insights. Military organizations are now better able to make decisions based on the information gathered owing to AI-enabled C4ISR systems analyze and interpret data more rapidly and precisely. C4ISR systems are now more protected from potential cyber assaults owing to developments in cybersecurity technology including intrusion detection and encryption. C4 is crucial in modern warfare, but countries' defense budgets must bear the high costs of developing and implementing these systems. Air defense, communication, computer, command and control, intelligence, surveillance, and reconnaissance systems are all components of what is known as "C4", or a multi-domain platform that enables all of these systems to work together. Transitioning Markets also present opportunities in Land C4ISR systems; military vehicles are being turned into a small situational awareness hub with multi-role functionality. Most wheeled/armored fighting or C2 vehicles that have recently been contracted by MoDs in countries such as Brazil, Turkey, India, South Africa, and Saudi Arabia have computing systems on board an advanced open Vehicle Electronic Architecture (VEA). This enables the integration of all elements of total situational awareness (communications, surveillance, navigation, detection, force tracking (blue/red), fire control, and survivability/protection systems (i.e., Counter-IED)) into a common display to provide comprehensive force protection on the frontline. Challenges and Opportunities in the Evolving C4ISR Industry The C4ISR industry is evolving rapidly to address emerging challenges such as asymmetric warfare and network-centric battle management. Barriers to adopting new technology and equipment are one of the key challenges hindering the C4ISR (command, control, communications, computer, intelligence, surveillance, and reconnaissance) market growth. companies in this market must comply with strict regulatory standards in various countries. Many private companies and third-party technology providers are working with government agencies and ministries of defense in various countries. The challenges associated with the introduction of new technologies are high costs, technical risks caused by certification requirements, and superior technical expertise.

C4ISR Market Segment Analysis:

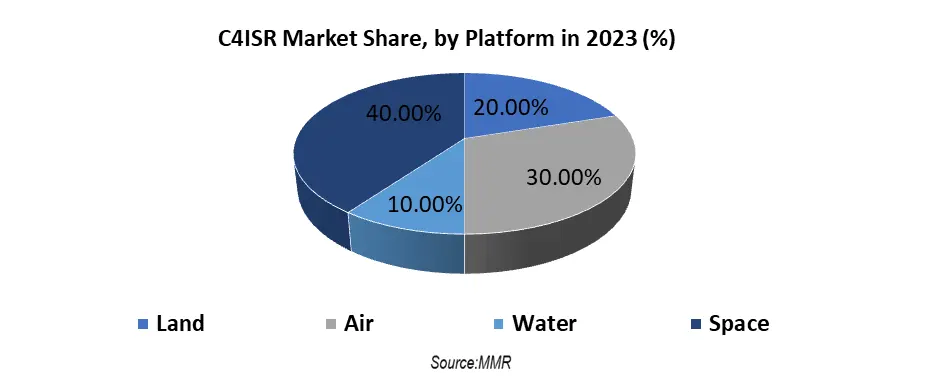

By Platform, Space-based C4 systems hold the largest share of 40 % in 2023. Intelligence, surveillance, and reconnaissance (ISR) capabilities within the space-based C4ISR market represent the eyes and ears of modern defense strategies. ISR technologies in space encompass advanced satellite systems, remote sensing, and data analytics, enabling precise and timely intelligence gathering, strategic surveillance, and reconnaissance, crucial for informed decision-making in national security. Application of Space-based weather forecasting, secure communications, intelligence gathering, round-the-clock surveillance, in-depth reconnaissance, accurate positioning, precise navigation, targeting, and missile warning duly integrated with cyberspace and Artificial Intelligence (AI) constitute the power of converting every soldier into a formidable system in war. The demand for space-based C4 systems is driven by the emergence of tiny satellites that deliver traditional satellite capability at a lower cost. The agency is particularly interested in lightweight laser communication terminals for the feet of LEO safelights that the Pentagons’ Space Development Agency intends to launch through the forecast period. A space-based satellite or a collection of tiny satellites specifically created to transport massive amounts of data around the planet with the slightest delay and data loss are used for most jobs in the C4 segment. An experimental satellite bus known as EAGLE and a covert communications satellite known as the Continuous Broadband Augmented SATCOM (CBAS) spacecraft were both parts of the Air Force's dual-payload mission.

C4ISR Market Regional Analysis:

North America is capturing the largest share of 35 % in C4ISR systems, owing to technological advancements along with increasing government spending in the U.S. The growth in terrorism, threats from adversaries, and increasing global territorial tensions are some of the major factors that generate the demand for advanced systems to carry out intelligence, surveillance, and reconnaissance missions across land and sea borders of the United States. The US Air Force plans to enhance their C4ISR capabilities to obtain a decisive advantage over their adversaries amidst the ongoing race for technological superiority. The country is investing huge amounts into the development of advanced C4ISR solutions, which has become one of the key priorities of the warfare strategy of the United States. For the FY2023 budget, the Department of Defense has requested about USD 12.8 billion for C4I systems. The funding is for several programs such as tactical network transport (TNT), handheld manpack small form fit (HMS) radio, joint regional security stacks (JRSS), information systems security program (ISSP), crypto devices, key management infrastructure, and nuclear command and control equipping the cyber mission forces, the Air Force National Airborne Operations Center (NAOC) recapitalization program, the Navy’s Consolidated Afloat Networks and Enterprise Services (CANES), and the Integrated Personnel and Pay System-Army (IPPS-A). Building on the momentum of the Space Race, the U.S. has shifted its focus to investing in C4ISR (Command, Control, Computer, Communications, Intelligence, Surveillance, and Reconnaissance). The US is investing significantly in creating space-based security systems to counter the rising dangers of nations like Russia and China. Asia-Pacific is expected to grow through the forecast period. Countries like China, India, and Japan, among others, are expected to increase their demand for electronic warfare, driving growth in the C4ISR market. China is the highest military spender in the Asia-Pacific region and the country has allocated significant resources to improve space-related R&D and launch infrastructure. There has been a significant advancement in China's C4ISR-related space development programs, like the Beidou-2 satellite series. China has also modernized and prolonged its space launch infrastructure to facilitate space C4ISR programs. Such developments are expected to propel the market growth of the country through the forecast period.C4ISR Market Competitive Landscape: 1. Hermes 650 Spark Unveiled: Elbit Systems Launches a New State-of-the-Art UAS February 21, 2024, Elbit Systems, a global leader in defense technology, unveiled its latest addition to its market-leading Hermes family. The Next Generation Unmanned Aerial System (UAS) boasts outstanding endurance, versatility, and cost-effective performance across land, air, and sea operations. 2. November 2023: Northrop Grumman Corporation received a contract from the US Navy (USN) to develop the cockpit and computer architecture of the new generation of the advanced Hawkeye (E-2D) aircraft (Delta System Software Configuration (DSSC) 6) for use by the US Marine Corps (USMC) and the US Air Force (U.S. Air Force) until 2028. 3. October 2023: The Curtiss-wright corporation announced that it was awarded a USD 34 million, five-year contract by the Naval Surface Warfare Center (NSWC) for modular open systems approach (MOSA)-based airborne data recorder technology to be deployed on US and Australian maritime aircraft.

C4ISR Market Scope: Inquire before buying

Global C4ISR Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 113.4 Bn. Forecast Period 2024 to 2030 CAGR: 4.1% Market Size in 2030: US $ 150.23 Bn. Segments Covered: by Platform Land Air Water Space by Applications Intelligence Surveillance and Reconnaissance Communication Command and Control Computers Electronic Warfare by End User Defense & Space Homeland Security Commercial C4ISR Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (razil, Argentina Rest of South America)C4ISR Market Key Players:

1. Lockheed Martin Corporation - Bethesda, Maryland, USA 2. Raytheon Technologies Corporation - Waltham, Massachusetts, USA 3. Northrop Grumman Corporation - Falls Church, Virginia, USA 4. General Dynamics Corporation - Reston, Virginia, USA 5. BAE Systems plc - London, United Kingdom 6. Thales Group - Paris, France 7. L3Harris Technologies, Inc. - Melbourne, Florida, USA 8. Boeing Company - Chicago, Illinois, USA 9. SAIC (Science Applications International Corporation) - Reston, Virginia, USA 10. Leidos Holdings, Inc. - Reston, Virginia, USA 11. Harris Corporation - Melbourne, Florida, USA 12. Elbit Systems Ltd. - Haifa, Israel 13. CACI International Inc. - Arlington, Virginia, USA 14. Honeywell International Inc. - Charlotte, North Carolina, USA 15. Kratos Defense & Security Solutions, Inc. - San Diego, California, USA 16. Rockwell Collins, Inc. - Cedar Rapids, Iowa, USA 17. General Atomics - San Diego, California, USA 18. Airbus Group - Leiden, Netherlands 19. Leonardo S.p.A. - Rome, Italy 20. Rheinmetall AG - Düsseldorf, Germany Frequently Asked Questions: 1] What segments are covered in the C4ISR Market report? Ans. The segments covered in the C4ISR Market report are based on, Platform, Application, and End Users. 2] Which region is expected to hold the highest share in the C4ISR Market? Ans. The North American region is expected to hold the highest share of the C4ISR Market. 3] What is the market size of the C4ISR Market by 2030? Ans. The market size of the C4ISR Market by 2030 will be USD 150.23 Billion. 4] What is the forecast period for the C4ISR Market? Ans. The Forecast period for the C4ISR Market is 2024- 2030.

1. C4ISR Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. C4ISR Market: Dynamics 2.1. C4ISR Market Trends by Region 2.1.1. North America C4ISR Market Trends 2.1.2. Europe C4ISR Market Trends 2.1.3. Asia Pacific C4ISR Market Trends 2.1.4. Middle East and Africa C4ISR Market Trends 2.1.5. South America C4ISR Market Trends 2.2. C4ISR Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America C4ISR Market Drivers 2.2.1.2. North America C4ISR Market Restraints 2.2.1.3. North America C4ISR Market Opportunities 2.2.1.4. North America C4ISR Market Challenges 2.2.2. Europe 2.2.2.1. Europe C4ISR Market Drivers 2.2.2.2. Europe C4ISR Market Restraints 2.2.2.3. Europe C4ISR Market Opportunities 2.2.2.4. Europe C4ISR Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific C4ISR Market Drivers 2.2.3.2. Asia Pacific C4ISR Market Restraints 2.2.3.3. Asia Pacific C4ISR Market Opportunities 2.2.3.4. Asia Pacific C4ISR Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa C4ISR Market Drivers 2.2.4.2. Middle East and Africa C4ISR Market Restraints 2.2.4.3. Middle East and Africa C4ISR Market Opportunities 2.2.4.4. Middle East and Africa C4ISR Market Challenges 2.2.5. South America 2.2.5.1. South America C4ISR Market Drivers 2.2.5.2. South America C4ISR Market Restraints 2.2.5.3. South America C4ISR Market Opportunities 2.2.5.4. South America C4ISR Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For C4ISR Industry 2.8. Analysis of Government Schemes and Initiatives For C4ISR Industry 2.9. C4ISR Market Trade Analysis 2.10. The Global Pandemic Impact on C4ISR Market 3. C4ISR Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. C4ISR Market Size and Forecast, by Platform (2023-2030) 3.1.1. Land 3.1.2. Air 3.1.3. Water 3.1.4. Space 3.2. C4ISR Market Size and Forecast, by Application (2023-2030) 3.2.1. Intelligence Surveillance and Reconnaissance 3.2.2. Communication 3.2.3. Command and Control 3.2.4. Computers 3.2.5. Electronic Warfare 3.3. C4ISR Market Size and Forecast, by End User (2023-2030) 3.3.1. Defense & Space 3.3.2. Homeland Security 3.3.3. Commercial 3.4. C4ISR Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America C4ISR Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America C4ISR Market Size and Forecast, by Platform (2023-2030) 4.1.1. Land 4.1.2. Air 4.1.3. Water 4.1.4. Space 4.2. North America C4ISR Market Size and Forecast, by Application (2023-2030) 4.2.1. Intelligence Surveillance and Reconnaissance 4.2.2. Communication 4.2.3. Command and Control 4.2.4. Computers 4.2.5. Electronic Warfare 4.3. North America C4ISR Market Size and Forecast, by End User (2023-2030) 4.3.1. Defense & Space 4.3.2. Homeland Security 4.3.3. Commercial 4.4. North America C4ISR Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States C4ISR Market Size and Forecast, by Platform (2023-2030) 4.4.1.1.1. Land 4.4.1.1.2. Air 4.4.1.1.3. Water 4.4.1.1.4. Space 4.4.1.2. United States C4ISR Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Intelligence Surveillance and Reconnaissance 4.4.1.2.2. Communication 4.4.1.2.3. Command and Control 4.4.1.2.4. Computers 4.4.1.2.5. Electronic Warfare 4.4.1.3. United States C4ISR Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Defense & Space 4.4.1.3.2. Homeland Security 4.4.1.3.3. Commercial 4.4.2. Canada 4.4.2.1. Canada C4ISR Market Size and Forecast, by Platform (2023-2030) 4.4.2.1.1. Land 4.4.2.1.2. Air 4.4.2.1.3. Water 4.4.2.1.4. Space 4.4.2.2. Canada C4ISR Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Intelligence Surveillance and Reconnaissance 4.4.2.2.2. Communication 4.4.2.2.3. Command and Control 4.4.2.2.4. Computers 4.4.2.2.5. Electronic Warfare 4.4.2.3. Canada C4ISR Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Defense & Space 4.4.2.3.2. Homeland Security 4.4.2.3.3. Commercial 4.4.3. Mexico 4.4.3.1. Mexico C4ISR Market Size and Forecast, by Platform (2023-2030) 4.4.3.1.1. Land 4.4.3.1.2. Air 4.4.3.1.3. Water 4.4.3.1.4. Space 4.4.3.2. Mexico C4ISR Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Intelligence Surveillance and Reconnaissance 4.4.3.2.2. Communication 4.4.3.2.3. Command and Control 4.4.3.2.4. Computers 4.4.3.2.5. Electronic Warfare 4.4.3.3. Mexico C4ISR Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Defense & Space 4.4.3.3.2. Homeland Security 4.4.3.3.3. Commercial 5. Europe C4ISR Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe C4ISR Market Size and Forecast, by Platform (2023-2030) 5.2. Europe C4ISR Market Size and Forecast, by Application (2023-2030) 5.3. Europe C4ISR Market Size and Forecast, by End User (2023-2030) 5.4. Europe C4ISR Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom C4ISR Market Size and Forecast, by Platform (2023-2030) 5.4.1.2. United Kingdom C4ISR Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom C4ISR Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France C4ISR Market Size and Forecast, by Platform (2023-2030) 5.4.2.2. France C4ISR Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France C4ISR Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany C4ISR Market Size and Forecast, by Platform (2023-2030) 5.4.3.2. Germany C4ISR Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany C4ISR Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy C4ISR Market Size and Forecast, by Platform (2023-2030) 5.4.4.2. Italy C4ISR Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy C4ISR Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain C4ISR Market Size and Forecast, by Platform (2023-2030) 5.4.5.2. Spain C4ISR Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain C4ISR Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden C4ISR Market Size and Forecast, by Platform (2023-2030) 5.4.6.2. Sweden C4ISR Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden C4ISR Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria C4ISR Market Size and Forecast, by Platform (2023-2030) 5.4.7.2. Austria C4ISR Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria C4ISR Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe C4ISR Market Size and Forecast, by Platform (2023-2030) 5.4.8.2. Rest of Europe C4ISR Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe C4ISR Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific C4ISR Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific C4ISR Market Size and Forecast, by Platform (2023-2030) 6.2. Asia Pacific C4ISR Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific C4ISR Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific C4ISR Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China C4ISR Market Size and Forecast, by Platform (2023-2030) 6.4.1.2. China C4ISR Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China C4ISR Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea C4ISR Market Size and Forecast, by Platform (2023-2030) 6.4.2.2. S Korea C4ISR Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea C4ISR Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan C4ISR Market Size and Forecast, by Platform (2023-2030) 6.4.3.2. Japan C4ISR Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan C4ISR Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India C4ISR Market Size and Forecast, by Platform (2023-2030) 6.4.4.2. India C4ISR Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India C4ISR Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia C4ISR Market Size and Forecast, by Platform (2023-2030) 6.4.5.2. Australia C4ISR Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia C4ISR Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia C4ISR Market Size and Forecast, by Platform (2023-2030) 6.4.6.2. Indonesia C4ISR Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia C4ISR Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia C4ISR Market Size and Forecast, by Platform (2023-2030) 6.4.7.2. Malaysia C4ISR Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia C4ISR Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam C4ISR Market Size and Forecast, by Platform (2023-2030) 6.4.8.2. Vietnam C4ISR Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam C4ISR Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan C4ISR Market Size and Forecast, by Platform (2023-2030) 6.4.9.2. Taiwan C4ISR Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan C4ISR Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific C4ISR Market Size and Forecast, by Platform (2023-2030) 6.4.10.2. Rest of Asia Pacific C4ISR Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific C4ISR Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa C4ISR Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa C4ISR Market Size and Forecast, by Platform (2023-2030) 7.2. Middle East and Africa C4ISR Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa C4ISR Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa C4ISR Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa C4ISR Market Size and Forecast, by Platform (2023-2030) 7.4.1.2. South Africa C4ISR Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa C4ISR Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC C4ISR Market Size and Forecast, by Platform (2023-2030) 7.4.2.2. GCC C4ISR Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC C4ISR Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria C4ISR Market Size and Forecast, by Platform (2023-2030) 7.4.3.2. Nigeria C4ISR Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria C4ISR Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A C4ISR Market Size and Forecast, by Platform (2023-2030) 7.4.4.2. Rest of ME&A C4ISR Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A C4ISR Market Size and Forecast, by End User (2023-2030) 8. South America C4ISR Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America C4ISR Market Size and Forecast, by Platform (2023-2030) 8.2. South America C4ISR Market Size and Forecast, by Application (2023-2030) 8.3. South America C4ISR Market Size and Forecast, by End User(2023-2030) 8.4. South America C4ISR Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil C4ISR Market Size and Forecast, by Platform (2023-2030) 8.4.1.2. Brazil C4ISR Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil C4ISR Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina C4ISR Market Size and Forecast, by Platform (2023-2030) 8.4.2.2. Argentina C4ISR Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina C4ISR Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America C4ISR Market Size and Forecast, by Platform (2023-2030) 8.4.3.2. Rest Of South America C4ISR Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America C4ISR Market Size and Forecast, by End User (2023-2030) 9. Global C4ISR Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading C4ISR Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Lockheed Martin Corporation - Bethesda, Maryland, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Raytheon Technologies Corporation - Waltham, Massachusetts, USA 10.3. Northrop Grumman Corporation - Falls Church, Virginia, USA 10.4. General Dynamics Corporation - Reston, Virginia, USA 10.5. BAE Systems plc - London, United Kingdom 10.6. Thales Group - Paris, France 10.7. L3Harris Technologies, Inc. - Melbourne, Florida, USA 10.8. Boeing Company - Chicago, Illinois, USA 10.9. SAIC (Science Applications International Corporation) - Reston, Virginia, USA 10.10. Leidos Holdings, Inc. - Reston, Virginia, USA 10.11. Harris Corporation - Melbourne, Florida, USA 10.12. Elbit Systems Ltd. - Haifa, Israel 10.13. CACI International Inc. - Arlington, Virginia, USA 10.14. Honeywell International Inc. - Charlotte, North Carolina, USA 10.15. Kratos Defense & Security Solutions, Inc. - San Diego, California, USA 10.16. Rockwell Collins, Inc. - Cedar Rapids, Iowa, USA 10.17. General Atomics - San Diego, California, USA 10.18. Airbus Group - Leiden, Netherlands 10.19. Leonardo S.p.A. - Rome, Italy 10.20. Rheinmetall AG - Düsseldorf, Germany 11. Key Findings 12. Industry Recommendations 13. C4ISR Market: Research Methodology 14. Terms and Glossary