Business Process Management Market was valued at US$ 10.74 Bn. in 2022 and is expected to reach at US$ 21.60 Bn by 2029 at a CAGR of 10.5% over the forecast period 2023-2029.Market Definition:

Business process management (BPM) is an organisational discipline in which a business takes a step back and looks fully and independently at all of these procedures. It includes activities such as automation, design, modelling, control, execution, measurement, process optimization, and others to support initiative goals.To know about the Research Methodology :- Request Free Sample Report

COVID-19 impact on market:

COVID-19 has the potential to have three major effects on the global economy: directly impacting production and demand, causing supply chain and market disruption, and having a financial impact on businesses and financial markets. Our analysts, who are monitoring the situation throughout the world, believe that the market would provide producers with lucrative opportunities following the COVID-19 dilemma. The BPM programme centralises the resources distributed geographically and enhances an organization's operational efficiency. The incremental transition from linear management to holistic management and control is a major technological advancement in the BPM market. For instance, manufacturing and supply chain processes have only been integrated as a linear process in the last decade. Major factors expected to drive the growth of the BPM market are the convergence of Artificial Intelligence (AI) and Machine Learning (ML) technologies with BPM applications, the need for an automated business process to minimise manual errors, and improved IT systems to meet the diverse requirements of customers.Global Business Process Management Market segment Analysis:

The report covers the segments in the business process management market such as organization size, application, industry vertical, and deployment. By organization size, small and medium enterprises segment of BPM is expected to grow at the highest CAGR of xx% and is expected to reach a value of US$ xx Bn. by 2029. This growth is attributed to the easy implementation and rise in the scale of an undertaking for the realignment of the entire business process. Among the industry vertical, banking financial services and insurance segment dominated the market, with a market size of US$ xx Bn in 2021 thanks to rising economic and financial crises. Financial entities rely on technological tools to aid them optimize their processes and resources. For instance, Societe Generale Serbia has agreed to deploy IBM Business Process Manager and IBM Application Link Enterprise to better serve its customers.

Global Business Process Management Market Regional Analysis:

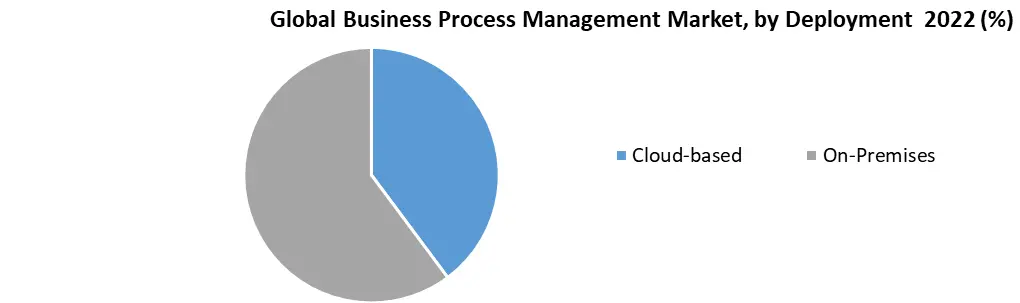

Globally, the cloud-based segment is estimated to grow at the highest rate, by deployment. This growth is attributed to the rising demand for low-cost storage and scalability offered by cloud technologies. By geography, North America is expected to hold the largest xx% share in the BPM market owing to the presence of major IT and Large Enterprises market players in this region. The U.S. Business Process Management (BPM) market is projected at US$ xx Bn. in the year 2021. Additionally, APAC also plays important roles in the BPM market, with a market size of US$ xx Bn in 2022 and will be US$ xx Bn in 2029, with a CAGR of xx%. Major countries like China and Japan have occurred as undisputed leaders in the BPM market. Report covers in-depth analysis of key development, marketing strategies, supply-side and demand side indicators and company profiles of market leaders, potential players, and new entrants. Key players operating in this market are adopting various organic and inorganic growth strategies such as merger & acquisitions, joint ventures, collaborations, expansion, new product launches and patents to increase their regional presence and business operations. The objective of the report is to present a comprehensive analysis of the Business Process Management Market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analysed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding global market dynamics, structure by analyzing the market segments and project global market Clear representation of competitive analysis of key players by price, financial position, Product portfolio, growth strategies, and regional presence in the global market the report investor’s guide.Global Business Process Management Market Scope: Inquire before buying

Global Business Process Management Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 10.74 Bn. Forecast Period 2023 to 2029 CAGR: 10.5% Market Size in 2029: US $ 21.60 Bn. Segments Covered: by Organization Size Small and Medium Enterprises Large Enterprises by Application Process Automation Content & Document Management Case Management Monitoring & Optimization Others by Industry Vertical Banking Financial Industry Services and Insurance Healthcare and Life Sciences IT and Telecommunication Energy and Utilities Manufacturing Transportation Retail Education Government & Defence Others by Deployment Cloud-based On-Premises Global Business Process Management Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Global Business Process Management Market, Key Players are

1. Aura Portal 2. Pegasystems 3. Appian 4. SAP SE 5. IBM Corporation 6. Oracle 7. Software AG 8. OpenText 9. Newgen Software 10. FUJITSU 11. Genpact 12. TIBCO Software 13. Bizagi 14. ProcessMaker 15. Creatio 16. AgilePoint 17. BP Logix 18. Bonitasoft 19. Kissflow 20. Microsoft Corp. 21. webMethodsI 22. Nintex 23. K2 24. Kofax Frequently Asked Questions: 1. Which region has the largest share in Global Business Process Management Market? Ans: North America region holds the highest share in 2022. 2. What is the growth rate of Global Business Process Management Market? Ans: The Global market is growing at a CAGR of 10.5% during forecasting period 2023-2029. 3. What segments are covered in Global Business Process Management market? Ans: Business Process Management Market is segmented into organization size, application, industry vertical, deployment and region. 4. Who are the key players in Global Business Process Management market? Ans: The important key players in the Business Process Management Market are – AuraPortal, Pegasystems, Appian, SAP SE, IBM Corporation, Oracle, Software AG, OpenText, Newgen Software, FUJITSU, Genpact, TIBCO Software, Bizagi, ProcessMaker, Creatio, AgilePoint, BP Logix, Bonitasoft, Kissflow, Microsoft Corp., webMethodsI, Nintex, K2, Kofax 5. What is the study period of this market? Ans: The global market is studied from 2022 to 2029.

Global Business Process Management Market 1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Business Process Management Market Size, by Market Value (US$ Mn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. Global Business Process Management Market Analysis and Forecast 7. Global Business Process Management Market Analysis and Forecast, by Organization Size 7.1. Introduction and Definition 7.2. Key Findings 7.3. Global Business Process Management Market Value Share Analysis, by Organization Size 7.4. Global Business Process Management Market Size (US$ Mn) Forecast, by Organization Size 7.5. Global Business Process Management Market Analysis, by Organization Size 7.6. Global Business Process Management Market Attractiveness Analysis, by Organization Size 8. Global Business Process Management Market Analysis and Forecast, by Application 8.1. Introduction and Definition 8.2. Key Findings 8.3. Global Business Process Management Market Value Share Analysis, by Application 8.4. Global Business Process Management Market Size (US$ Mn) Forecast, by Application 8.5. Global Business Process Management Market Analysis, by Application 8.6. Global Business Process Management Market Attractiveness Analysis, by Application 9. Global Business Process Management Market Analysis and Forecast, by Industry Vertical 9.1. Introduction and Definition 9.2. Key Findings 9.3. Global Business Process Management Market Value Share Analysis, by Industry Vertical 9.4. Global Business Process Management Market Size (US$ Mn) Forecast, by Industry Vertical 9.5. Global Business Process Management Market Analysis, by Industry Vertical 9.6. Global Business Process Management Market Attractiveness Analysis, by Industry Vertical 10. Global Business Process Management Market Analysis and Forecast, by Deployment 10.1. Introduction and Definition 10.2. Key Findings 10.3. Global Business Process Management Market Value Share Analysis, by Deployment 10.4. Global Business Process Management Market Size (US$ Mn) Forecast, by Deployment 10.5. Global Business Process Management Market Analysis, by Deployment 10.6. Global Business Process Management Market Attractiveness Analysis, by Deployment 11. Global Business Process Management Market Analysis and Forecast, by Region 11.1. Introduction and Definition 11.2. Key Findings 11.3. Global Business Process Management Market Value Share Analysis, by Region 11.4. Global Business Process Management Market Size (US$ Mn) Forecast, by Region 11.5. Global Business Process Management Market Analysis, by Region 12. Global Business Process Management Market Analysis 12.1. Key Findings 12.2. Global Business Process Management Market Overview 12.3. Global Business Process Management Market Forecast, by Organization Size 12.3.1. Small and Medium Enterprises 12.3.2. Large Enterprises 12.4. Global Business Process Management Market Forecast, by Application 12.4.1. Process Automation 12.4.2. Content & Document Management 12.4.3. Case Management 12.4.4. Monitoring & Optimization 12.4.5. Others 12.5. Global Business Process Management Market Forecast, by Industry Vertical 12.5.1. Banking Financial Industry Services and Insurance 12.5.2. Healthcare and Life Sciences 12.5.3. IT and Telecommunication 12.5.4. Energy and Utilities 12.5.5. Manufacturing 12.5.6. Transportation 12.5.7. Retail 12.5.8. Education 12.5.9. Government & Defence 12.5.10. Others 13. Global Business Process Management Market Forecast, by Deployment 13.1.1. Cloud-based 13.1.2. On-Premises 14. Global Business Process Management Market Forecast, by Region 14.1.1. North America 14.1.2. Europe 14.1.3. Asia-Pacific 14.1.4. ME & Africa 14.1.5. Latin America 14.2. PEST Analysis 14.3. Key Trends 14.4. Key Developments 15. North America Business Process Management Market Analysis 15.1. Key Findings 15.2. North America Business Process Management Market Forecast, by Organization Size 15.2.1. Small and Medium Enterprises 15.2.2. Large Enterprises 15.3. North America Business Process Management Market Forecast, by Application 15.3.1. Process Automation 15.3.2. Content & Document Management 15.3.3. Case Management 15.3.4. Monitoring & Optimization 15.3.5. Others 15.4. North America Business Process Management Market Forecast, by Industry Vertical 15.4.1. Banking Financial Industry Services and Insurance 15.4.2. Healthcare and Life Sciences 15.4.3. IT and Telecommunication 15.4.4. Energy and Utilities 15.4.5. Manufacturing 15.4.6. Transportation 15.4.7. Retail 15.4.8. Education 15.4.9. Government & Defence 15.4.10. Others 15.5. North America Business Process Management Market Forecast, by Deployment 15.5.1. Cloud-based 15.5.2. On-Premises 15.6. North America Business Process Management Market Forecast, by Country 15.6.1. US 15.6.2. Canada 15.7. US Business Process Management Market Forecast, by Organization Size 15.7.1. Small and Medium Enterprises 15.7.2. Large Enterprises 15.8. US Business Process Management Market Forecast, by Application 15.8.1. Process Automation 15.8.2. Content & Document Management 15.8.3. Case Management 15.8.4. Monitoring & Optimization 15.8.5. Others 15.9. US Business Process Management Market Forecast, by Industry Vertical 15.9.1. Banking Financial Industry Services and Insurance 15.9.2. Healthcare and Life Sciences 15.9.3. IT and Telecommunication 15.9.4. Energy and Utilities 15.9.5. Manufacturing 15.9.6. Transportation 15.9.7. Retail 15.9.8. Education 15.9.9. Government & Defence 15.9.10. Others 15.10. US Business Process Management Market Forecast, by Deployment 15.10.1. Cloud-based 15.10.2. On-Premises 15.11. Canada Business Process Management Market Forecast, by Organization Size 15.11.1. Small and Medium Enterprises 15.11.2. Large Enterprises 15.12. Canada Business Process Management Market Forecast, by Application 15.12.1. Process Automation 15.12.2. Content & Document Management 15.12.3. Case Management 15.12.4. Monitoring & Optimization 15.12.5. Others 15.13. Canada Business Process Management Market Forecast, by Industry Vertical 15.13.1. Banking Financial Industry Services and Insurance 15.13.2. Healthcare and Life Sciences 15.13.3. IT and Telecommunication 15.13.4. Energy and Utilities 15.13.5. Manufacturing 15.13.6. Transportation 15.13.7. Retail 15.13.8. Education 15.13.9. Government & Defence 15.13.10. Others 15.14. Canada Business Process Management Market Forecast, by Deployment 15.14.1. Cloud-based 15.14.2. On-Premises 15.15. PEST Analysis 15.16. Key Trends 15.17. Key Developments 16. Europe Business Process Management Market Analysis 16.1. Key Findings 16.2. Europe Business Process Management Market Overview 16.3. Europe Business Process Management Market Forecast, by Organization Size 16.3.1. Small and Medium Enterprises 16.3.2. Large Enterprises 16.4. Europe Business Process Management Market Forecast, by Application 16.4.1. Process Automation 16.4.2. Content & Document Management 16.4.3. Case Management 16.4.4. Monitoring & Optimization 16.4.5. Others 16.5. Europe Business Process Management Market Forecast, by Industry Vertical 16.5.1. Banking Financial Industry Services and Insurance 16.5.2. Healthcare and Life Sciences 16.5.3. IT and Telecommunication 16.5.4. Energy and Utilities 16.5.5. Manufacturing 16.5.6. Transportation 16.5.7. Retail 16.5.8. Education 16.5.9. Government & Defence 16.5.10. Others 16.6. Europe Business Process Management Market Forecast, by Deployment 16.6.1. Cloud-based 16.6.2. On-Premises 16.7. Europe Business Process Management Market Forecast, by Country 16.7.1. UK 16.7.2. France 16.7.3. Germany 16.7.4. Russia 16.7.5. Italy 16.7.6. Rest of Europe 16.8. UK Business Process Management Market Forecast, by Organization Size 16.8.1. Small and Medium Enterprises 16.8.2. Large Enterprises 16.9. UK Business Process Management Market Forecast, by Application 16.9.1. Process Automation 16.9.2. Content & Document Management 16.9.3. Case Management 16.9.4. Monitoring & Optimization 16.9.5. Others 16.10. UK Business Process Management Market Forecast, by Industry Vertical 16.10.1. Banking Financial Industry Services and Insurance 16.10.2. Healthcare and Life Sciences 16.10.3. IT and Telecommunication 16.10.4. Energy and Utilities 16.10.5. Manufacturing 16.10.6. Transportation 16.10.7. Retail 16.10.8. Education 16.10.9. Government & Defence 16.10.10. Others 16.11. UK Business Process Management Market Forecast, by Deployment 16.11.1. Cloud-based 16.11.2. On-Premises 16.12. France Business Process Management Market Forecast, by Organization Size 16.12.1. Small and Medium Enterprises 16.12.2. Large Enterprises 16.13. France Business Process Management Market Forecast, by Application 16.13.1. Process Automation 16.13.2. Content & Document Management 16.13.3. Case Management 16.13.4. Monitoring & Optimization 16.13.5. Others 16.14. France Business Process Management Market Forecast, by Industry Vertical 16.14.1. Banking Financial Industry Services and Insurance 16.14.2. Healthcare and Life Sciences 16.14.3. IT and Telecommunication 16.14.4. Energy and Utilities 16.14.5. Manufacturing 16.14.6. Transportation 16.14.7. Retail 16.14.8. Education 16.14.9. Government & Defence 16.14.10. Others 16.15. France Business Process Management Market Forecast, by Deployment 16.15.1. Cloud-based 16.15.2. On-Premises 16.16. Germany Business Process Management Market Forecast, by Organization Size 16.16.1. Small and Medium Enterprises 16.16.2. Large Enterprises 16.17. Germany Business Process Management Market Forecast, by Application 16.17.1. Process Automation 16.17.2. Content & Document Management 16.17.3. Case Management 16.17.4. Monitoring & Optimization 16.17.5. Others 16.18. Germany Business Process Management Market Forecast, by Industry Vertical 16.18.1. Banking Financial Industry Services and Insurance 16.18.2. Healthcare and Life Sciences 16.18.3. IT and Telecommunication 16.18.4. Energy and Utilities 16.18.5. Manufacturing 16.18.6. Transportation 16.18.7. Retail 16.18.8. Education 16.18.9. Government & Defence 16.18.10. Others 16.19. Germany Business Process Management Market Forecast, by Deployment 16.19.1. Cloud-based 16.19.2. On-Premises 16.20. Russia Business Process Management Market Forecast, by Organization Size 16.20.1. Small and Medium Enterprises 16.20.2. Large Enterprises 16.21. Russia Business Process Management Market Forecast, by Application 16.21.1. Process Automation 16.21.2. Content & Document Management 16.21.3. Case Management 16.21.4. Monitoring & Optimization 16.21.5. Others 16.22. Russia Business Process Management Market Forecast, by Industry Vertical 16.22.1. Banking Financial Industry Services and Insurance 16.22.2. Healthcare and Life Sciences 16.22.3. IT and Telecommunication 16.22.4. Energy and Utilities 16.22.5. Manufacturing 16.22.6. Transportation 16.22.7. Retail 16.22.8. Education 16.22.9. Government & Defence 16.22.10. Others 16.23. Russia Business Process Management Market Forecast, by Deployment 16.23.1. Cloud-based 16.23.2. On-Premises 16.24. Italy Business Process Management Market Forecast, by Organization Size 16.24.1. Small and Medium Enterprises 16.24.2. Large Enterprises 16.25. Italy Business Process Management Market Forecast, by Application 16.25.1. Process Automation 16.25.2. Content & Document Management 16.25.3. Case Management 16.25.4. Monitoring & Optimization 16.25.5. Others 16.26. Italy Business Process Management Market Forecast, by Industry Vertical 16.26.1. Banking Financial Industry Services and Insurance 16.26.2. Healthcare and Life Sciences 16.26.3. IT and Telecommunication 16.26.4. Energy and Utilities 16.26.5. Manufacturing 16.26.6. Transportation 16.26.7. Retail 16.26.8. Education 16.26.9. Government & Defence 16.26.10. Others 16.27. Italy Business Process Management Market Forecast, by Deployment 16.27.1. Cloud-based 16.27.2. On-Premises 16.28. Rest of Europe Business Process Management Market Forecast, by Organization Size 16.28.1. Small and Medium Enterprises 16.28.2. Large Enterprises 16.29. Rest of Europe Business Process Management Market Forecast, by Application 16.29.1. Process Automation 16.29.2. Content & Document Management 16.29.3. Case Management 16.29.4. Monitoring & Optimization 16.29.5. Others 16.30. Rest of Europe Business Process Management Market Forecast, by Industry Vertical 16.30.1. Banking Financial Industry Services and Insurance 16.30.2. Healthcare and Life Sciences 16.30.3. IT and Telecommunication 16.30.4. Energy and Utilities 16.30.5. Manufacturing 16.30.6. Transportation 16.30.7. Retail 16.30.8. Education 16.30.9. Government & Defence 16.30.10. Others 16.31. Rest of Europe Business Process Management Market Forecast, by Deployment 16.31.1. Cloud-based 16.31.2. On-Premises 16.32. PEST Analysis 16.33. Key Trends 16.34. Key Developments 17. Asia Pacific Business Process Management Market Analysis 17.1. Key Findings 17.2. Asia Pacific Business Process Management Market Overview 17.3. Asia Pacific Business Process Management Market Forecast, by Organization Size 17.3.1. Small and Medium Enterprises 17.3.2. Large Enterprises 17.4. Asia Pacific Business Process Management Market Forecast, by Application 17.4.1. Process Automation 17.4.2. Content & Document Management 17.4.3. Case Management 17.4.4. Monitoring & Optimization 17.4.5. Others 17.5. Asia Pacific Business Process Management Market Forecast, by Industry Vertical 17.5.1. Banking Financial Industry Services and Insurance 17.5.2. Healthcare and Life Sciences 17.5.3. IT and Telecommunication 17.5.4. Energy and Utilities 17.5.5. Manufacturing 17.5.6. Transportation 17.5.7. Retail 17.5.8. Education 17.5.9. Government & Defence 17.5.10. Others 17.6. Asia Pacific Business Process Management Market Forecast, by Deployment 17.6.1. Cloud-based 17.6.2. On-Premises 17.7. Asia Pacific Business Process Management Market Forecast, by Country 17.7.1. China 17.7.2. India 17.7.3. Japan 17.7.4. Malaysia 17.7.5. Indonesia 17.7.6. Rest of Asia-Pacific 17.8. China Business Process Management Market Forecast, by Organization Size 17.8.1. Small and Medium Enterprises 17.8.2. Large Enterprises 17.9. China Business Process Management Market Forecast, by Application 17.9.1. Process Automation 17.9.2. Content & Document Management 17.9.3. Case Management 17.9.4. Monitoring & Optimization 17.9.5. Others 17.10. China Business Process Management Market Forecast, by Industry Vertical 17.10.1. Banking Financial Industry Services and Insurance 17.10.2. Healthcare and Life Sciences 17.10.3. IT and Telecommunication 17.10.4. Energy and Utilities 17.10.5. Manufacturing 17.10.6. Transportation 17.10.7. Retail 17.10.8. Education 17.10.9. Government & Defence 17.10.10. Others 17.11. China Business Process Management Market Forecast, by Deployment 17.11.1. Cloud-based 17.11.2. On-Premises 17.12. India Business Process Management Market Forecast, by Organization Size 17.12.1. Small and Medium Enterprises 17.12.2. Large Enterprises 17.13. India Business Process Management Market Forecast, by Application 17.13.1. Process Automation 17.13.2. Content & Document Management 17.13.3. Case Management 17.13.4. Monitoring & Optimization 17.13.5. Others 17.14. India Business Process Management Market Forecast, by Industry Vertical 17.14.1. Banking Financial Industry Services and Insurance 17.14.2. Healthcare and Life Sciences 17.14.3. IT and Telecommunication 17.14.4. Energy and Utilities 17.14.5. Manufacturing 17.14.6. Transportation 17.14.7. Retail 17.14.8. Education 17.14.9. Government & Defence 17.14.10. Others 17.15. India Business Process Management Market Forecast, by Deployment 17.15.1. Cloud-based 17.15.2. On-Premises 17.16. Japan Business Process Management Market Forecast, by Organization Size 17.16.1. Small and Medium Enterprises 17.16.2. Large Enterprises 17.17. Japan Business Process Management Market Forecast, by Application 17.17.1. Process Automation 17.17.2. Content & Document Management 17.17.3. Case Management 17.17.4. Monitoring & Optimization 17.17.5. Others 17.18. Japan Business Process Management Market Forecast, by Industry Vertical 17.18.1. Banking Financial Industry Services and Insurance 17.18.2. Healthcare and Life Sciences 17.18.3. IT and Telecommunication 17.18.4. Energy and Utilities 17.18.5. Manufacturing 17.18.6. Transportation 17.18.7. Retail 17.18.8. Education 17.18.9. Government & Defence 17.18.10. Others 17.19. Japan Business Process Management Market Forecast, by Deployment 17.19.1. Cloud-based 17.19.2. On-Premises 17.20. Indonesia Business Process Management Market Forecast, by Organization Size 17.20.1. Small and Medium Enterprises 17.20.2. Large Enterprises 17.21. Indonesia Business Process Management Market Forecast, by Application 17.21.1. Process Automation 17.21.2. Content & Document Management 17.21.3. Case Management 17.21.4. Monitoring & Optimization 17.21.5. Others 17.22. Indonesia Business Process Management Market Forecast, by Industry Vertical 17.22.1. Banking Financial Industry Services and Insurance 17.22.2. Healthcare and Life Sciences 17.22.3. IT and Telecommunication 17.22.4. Energy and Utilities 17.22.5. Manufacturing 17.22.6. Transportation 17.22.7. Retail 17.22.8. Education 17.22.9. Government & Defence 17.22.10. Others 17.23. Indonesia Business Process Management Market Forecast, by Deployment 17.23.1. Cloud-based 17.23.2. On-Premises 17.24. Malaysia Business Process Management Market Forecast, by Organization Size 17.24.1. Small and Medium Enterprises 17.24.2. Large Enterprises 17.25. Malaysia Business Process Management Market Forecast, by Application 17.25.1. Process Automation 17.25.2. Content & Document Management 17.25.3. Case Management 17.25.4. Monitoring & Optimization 17.25.5. Others 17.26. Malaysia Business Process Management Market Forecast, by Industry Vertical 17.26.1. Banking Financial Industry Services and Insurance 17.26.2. Healthcare and Life Sciences 17.26.3. IT and Telecommunication 17.26.4. Energy and Utilities 17.26.5. Manufacturing 17.26.6. Transportation 17.26.7. Retail 17.26.8. Education 17.26.9. Government & Defence 17.26.10. Others 17.27. Malaysia Business Process Management Market Forecast, by Deployment 17.27.1. Cloud-based 17.27.2. On-Premises 17.28. Rest of Asia Pacific Business Process Management Market Forecast, by Organization Size 17.28.1. Small and Medium Enterprises 17.28.2. Large Enterprises 17.29. Rest of Asia Pacific Business Process Management Market Forecast, by Application 17.29.1. Process Automation 17.29.2. Content & Document Management 17.29.3. Case Management 17.29.4. Monitoring & Optimization 17.29.5. Others 17.30. Rest of Asia Pacific Business Process Management Market Forecast, by Industry Vertical 17.30.1. Banking Financial Industry Services and Insurance 17.30.2. Healthcare and Life Sciences 17.30.3. IT and Telecommunication 17.30.4. Energy and Utilities 17.30.5. Manufacturing 17.30.6. Transportation 17.30.7. Retail 17.30.8. Education 17.30.9. Government & Defence 17.30.10. Others 17.31. Rest of Asia Pacific Business Process Management Market Forecast, by Deployment 17.31.1. Cloud-based 17.31.2. On-Premises 17.32. Others PEST Analysis 17.33. Key Trends 17.34. Key Developments 18. ME & Africa Business Process Management Market Analysis 18.1. Key Findings 18.2. ME & Africa Business Process Management Market Overview 18.3. ME & Africa Business Process Management Market Forecast, by Organization Size 18.3.1. Small and Medium Enterprises 18.3.2. Large Enterprises 18.4. ME & Africa Business Process Management Market Forecast, by Application 18.4.1. Process Automation 18.4.2. Content & Document Management 18.4.3. Case Management 18.4.4. Monitoring & Optimization 18.4.5. Others 18.5. ME & Africa Business Process Management Market Forecast, by Industry Vertical 18.5.1. Banking Financial Industry Services and Insurance 18.5.2. Healthcare and Life Sciences 18.5.3. IT and Telecommunication 18.5.4. Energy and Utilities 18.5.5. Manufacturing 18.5.6. Transportation 18.5.7. Retail 18.5.8. Education 18.5.9. Government & Defence 18.5.10. Others 18.6. ME & Africa Business Process Management Market Forecast, by Deployment 18.6.1. Cloud-based 18.6.2. On-Premises 18.7. ME &Africa Business Process Management Market Forecast, by Country 18.7.1. GCC 18.7.2. South Africa 18.7.3. Rest of ME & Africa 18.8. GCC Business Process Management Market Forecast, by Organization Size 18.8.1. Small and Medium Enterprises 18.8.2. Large Enterprises 18.9. GCC Business Process Management Market Forecast, by Application 18.9.1. Process Automation 18.9.2. Content & Document Management 18.9.3. Case Management 18.9.4. Monitoring & Optimization 18.9.5. Others 18.10. GCC Business Process Management Market Forecast, by Industry Vertical 18.10.1. Banking Financial Industry Services and Insurance 18.10.2. Healthcare and Life Sciences 18.10.3. IT and Telecommunication 18.10.4. Energy and Utilities 18.10.5. Manufacturing 18.10.6. Transportation 18.10.7. Retail 18.10.8. Education 18.10.9. Government & Defence 18.10.10. Others 18.11. GCC Business Process Management Market Forecast, by Deployment 18.11.1. Cloud-based 18.11.2. On-Premises 18.12. South Africa Business Process Management Market Forecast, by Organization Size 18.12.1. Small and Medium Enterprises 18.12.2. Large Enterprises 18.13. South Africa Business Process Management Market Forecast, by Application 18.13.1. Process Automation 18.13.2. Content & Document Management 18.13.3. Case Management 18.13.4. Monitoring & Optimization 18.13.5. Others 18.14. South Africa Business Process Management Market Forecast, by Industry Vertical 18.14.1. Banking Financial Industry Services and Insurance 18.14.2. Healthcare and Life Sciences 18.14.3. IT and Telecommunication 18.14.4. Energy and Utilities 18.14.5. Manufacturing 18.14.6. Transportation 18.14.7. Retail 18.14.8. Education 18.14.9. Government & Defence 18.14.10. Others 18.15. South Africa Business Process Management Market Forecast, by Deployment 18.15.1. Cloud-based 18.15.2. On-Premises 18.16. Rest of ME &Africa Business Process Management Market Forecast, by Organization Size 18.16.1. Small and Medium Enterprises 18.16.2. Large Enterprises 18.17. Rest of ME &Africa Business Process Management Market Forecast, by Application 18.17.1. Process Automation 18.17.2. Content & Document Management 18.17.3. Case Management 18.17.4. Monitoring & Optimization 18.17.5. Others 18.18. Rest of ME &Africa Business Process Management Market Forecast, by Industry Vertical 18.18.1. Banking Financial Industry Services and Insurance 18.18.2. Healthcare and Life Sciences 18.18.3. IT and Telecommunication 18.18.4. Energy and Utilities 18.18.5. Manufacturing 18.18.6. Transportation 18.18.7. Retail 18.18.8. Education 18.18.9. Government & Defence 18.18.10. Others 18.19. Rest of ME &Africa Business Process Management Market Forecast, by Deployment 18.19.1. Cloud-based 18.19.2. On-Premises 18.20. PEST Analysis 18.21. Key Trends 18.22. Key Developments 19. Latin America Business Process Management Market Analysis 19.1. Key Findings 19.2. Latin America Business Process Management Market Overview 19.3. Latin America Business Process Management Market Forecast, by Organization Size 19.3.1. Small and Medium Enterprises 19.3.2. Large Enterprises 19.4. Latin America Business Process Management Market Forecast, by Application 19.4.1. Process Automation 19.4.2. Content & Document Management 19.4.3. Case Management 19.4.4. Monitoring & Optimization 19.4.5. Others 19.5. Latin America Business Process Management Market Forecast, by Industry Vertical 19.5.1. Banking Financial Industry Services and Insurance 19.5.2. Healthcare and Life Sciences 19.5.3. IT and Telecommunication 19.5.4. Energy and Utilities 19.5.5. Manufacturing 19.5.6. Transportation 19.5.7. Retail 19.5.8. Education 19.5.9. Government & Defence 19.5.10. Others 19.6. Latin America Business Process Management Market Forecast, by Deployment 19.6.1. Cloud-based 19.6.2. On-Premises 19.7. Latin America Business Process Management Market Forecast, by Country 19.7.1. Mexico 19.7.2. Brazil 19.7.3. Rest of Latin America 19.8. Mexico Business Process Management Market Forecast, by Organization Size 19.8.1. Small and Medium Enterprises 19.8.2. Large Enterprises 19.9. Mexico Business Process Management Market Forecast, by Application 19.9.1. Process Automation 19.9.2. Content & Document Management 19.9.3. Case Management 19.9.4. Monitoring & Optimization 19.9.5. Others 19.10. Mexico Business Process Management Market Forecast, by Industry Vertical 19.10.1. Banking Financial Industry Services and Insurance 19.10.2. Healthcare and Life Sciences 19.10.3. IT and Telecommunication 19.10.4. Energy and Utilities 19.10.5. Manufacturing 19.10.6. Transportation 19.10.7. Retail 19.10.8. Education 19.10.9. Government & Defence 19.10.10. Others 19.11. Mexico Business Process Management Market Forecast, by Deployment 19.11.1. Cloud-based 19.11.2. On-Premises 19.12. Brazil Business Process Management Market Forecast, by Organization Size 19.12.1. Small and Medium Enterprises 19.12.2. Large Enterprises 19.13. Brazil Business Process Management Market Forecast, by Application 19.13.1. Process Automation 19.13.2. Content & Document Management 19.13.3. Case Management 19.13.4. Monitoring & Optimization 19.13.5. Others 19.14. Brazil Business Process Management Market Forecast, by Industry Vertical 19.14.1. Banking Financial Industry Services and Insurance 19.14.2. Healthcare and Life Sciences 19.14.3. IT and Telecommunication 19.14.4. Energy and Utilities 19.14.5. Manufacturing 19.14.6. Transportation 19.14.7. Retail 19.14.8. Education 19.14.9. Government & Defence 19.14.10. Others 19.15. Brazil Business Process Management Market Forecast, by Deployment 19.15.1. Cloud-based 19.15.2. On-Premises 19.16. Rest of Latin America Business Process Management Market Forecast, by Organization Size 19.16.1. Small and Medium Enterprises 19.16.2. Large Enterprises 19.17. Rest of Latin America Business Process Management Market Forecast, by Application 19.17.1. Process Automation 19.17.2. Content & Document Management 19.17.3. Case Management 19.17.4. Monitoring & Optimization 19.17.5. Others 19.18. Rest of Latin America Business Process Management Market Forecast, by Industry Vertical 19.18.1. Banking Financial Industry Services and Insurance 19.18.2. Healthcare and Life Sciences 19.18.3. IT and Telecommunication 19.18.4. Energy and Utilities 19.18.5. Manufacturing 19.18.6. Transportation 19.18.7. Retail 19.18.8. Education 19.18.9. Government & Defence 19.18.10. Others 19.19. Rest of Latin America Business Process Management Market Forecast, by Deployment 19.19.1. Cloud-based 19.19.2. On-Premises 19.20. PEST Analysis 19.21. Key Trends 19.22. Key Developments 20. Company Profiles 20.1. Market Share Analysis, by Company 20.2. Competition Matrix 20.2.1. Competitive Benchmarking of key players by price, presence, market share, Raw material and R&D investment 20.2.2. New Raw material Launches and Raw material Enhancements 20.2.2.1. Market Consolidation 20.2.2.2. M&A by Regions, Investment 20.2.2.3. M&A Key Players, Forward Integration and Backward Integration 20.3. Company Profiles: Key Players 20.3.1. AuraPortal 20.3.1.1. Company Overview 20.3.1.2. Financial Overview 20.3.1.3. Product Portfolio 20.3.1.4. Business Strategy 20.3.1.5. Recent Developments 20.3.1.6. Development Footprint 20.3.2. Pegasystems 20.3.3. Appian 20.3.4. SAP SE 20.3.5. IBM Corporation 20.3.6. Oracle 20.3.7. Software AG 20.3.8. OpenText 20.3.9. Newgen Software 20.3.10. FUJITSU 20.3.11. Genpact 20.3.12. TIBCO Software 20.3.13. Bizagi 20.3.14. ProcessMaker 20.3.15. Creatio 20.3.16. AgilePoint 20.3.17. BP Logix 20.3.18. Bonitasoft 20.3.19. Kissflow 20.3.20. Microsoft Corp. 20.3.21. webMethodsI 20.3.22. Nintex 20.3.23. K2 20.3.24. Kofax 21. Primary Key Insights.