Bonded Magnet Market size was valued at USD 2.59 Billion in 2023 and the Bonded Magnet Market revenue is expected to reach USD 4.15 Billion by 2030, at a CAGR of 4.90% over the forecast period.Bonded Magnet Market Overview

Bonded magnets are made using compression or injection molding. Injection-molded magnets are flexible, but compression-bonded magnets have a higher magnetic output. Bonded magnets have many benefits, including Higher electrical resistivity than sintered magnets, Excellent geometric tolerances, Multipole magnetization, the ability to attract objects up to 640 times their own weight, and High dimensional accuracy. Bonded Magnet is not limited to a specific geographical region. The Bonded Magnet Market has a global presence, with consumers across different continents interested in these supplements. This Bonded Magnet Market Report offers a specific and detailed market overview with statistical as well as pre-sized trendy data. This Bonded Magnet Market report showcases the Bonded Magnet market situation with Dynamics, Bonded Magnet Market Segment, Regional Analysis, and Top Competitor's Market Position.To know about the Research Methodology :- Request Free Sample Report

Bonded Magnet Market Dynamics

The growing use of bonded magnets in the automotive industry due to its lightweight features is likely to fuel the Bonded Magnet Market's expansion throughout the forecast period. Furthermore, rare-earth high-performance magnets, which are employed in the manufacturing of electric vehicles, wind turbines, electronics, and other similar items, are driving market growth. As a result, as bonded magnets are extensively employed in electronic equipment including as microphones, headphones, speakers, cell phones, printers, and hard drives, the global Bonded Magnet Market is expected to grow. Furthermore, due to their low cost and greater performance over alternatives such as sintered magnets, the market for bonded magnets is predicted to grow. According to International Magnetics Association (IMA), bonded magnets devised of 65% share in HDD and SSD manufacturing in 2022 despite the lockdown restraints owing to availability of the magnets in APAC. Manufacturers in the bonded magnet market are seeing increased opportunities as the consumer electronics sector grows. Miniaturization, great performance, and intricate designs are all on the horizon for these little magnets. To improve magnetic performance, companies in the bonded magnet market are boosting their efforts to create neodymium iron boron-based permanent magnets utilizing sintering and hot deformation processes. Sintering and heat deformation for complicated-shaped magnets, on the other hand, would increase the manufacturing cost. As a result, manufacturers are adopting the bonding approach to create neodymium iron boron-based permanent magnets with more shape diversity. Bonded magnets have made tremendous progress in a wide range of industries over the last few decades due to their versatility and cost-effective production technique in Bonded Magnet Market. Besides, they serve a critical role in computer hardware, particularly data storage devices. The use of bonded magnets is not only important, but it is also growing, particularly in the field of data storage. This can include enterprises and other industry verticals recording and storing secret data on computers. Magnetic data storage, such as hard disc drives (HDDs), is a popular digital storage option. According to recent studies, computer drivers consume roughly 4000 T neodymium (NdFeB) bonded magnets per year. When compared to traditional solid state drives (SSD), storage devices with bonded magnets provide more benefits, such as increased storage capacity, faster file copy speeds, and improved performance. Researchers from all around the world are focusing on various breakthroughs that enable data storage on magnetic media utilizing laser-activated heat, which is faster and allows for the acquisition of enormous amounts of data - HAMR (Heat Assisted Magnetic Recording). Computers are becoming more common in practically every area since the dawn of the information era. According to recent estimates, over 912 exabytes of SSD/HDD storage shipped in 2022, including over 800 exabytes of HDD, 89 percent of which contained magnetic spinning platters. The emergence of stronger alternatives, such as the sintered magnet, on the other hand, is one of the reasons most likely to hamper the bonded magnet market's growth in the next years.Bonded Magnet Market Segment Analysis

Product Type, Ferrite Magnets remain a stalwart in the Bonded Magnet Market, owing to their cost-effectiveness and stable magnetic properties. However, Rare Earth Magnets, particularly NdFeB and SmCo variants, are witnessing significant demand due to their superior magnetic strength, making them indispensable in applications where high performance is critical. Other variants like Alnico, SmFeN, and Hybrid magnets cater to niche requirements, offering specialized properties for specific applications.By Applications, Bonded magnets find extensive usage. In sensors, they provide the necessary magnetic field for detection mechanisms in the Bonded Magnet Market. Level gauges rely on bonded magnets for precise measurement and control. Motors, an essential component across industries, leverage bonded magnets for efficient operation and power generation. Instrument panels, fuel filters, HDDs, and copier rotors all benefit from the magnetic properties of bonded magnets, contributing to their functionality and performance. On the basis of Process, Various manufacturing techniques are employed to produce bonded magnets. Calendaring, injection molding, extrusion, and compression processes each offer distinct advantages, catering to diverse application requirements and production scales in the Bonded Magnet Market. Calendaring bonded magnets provide flexibility in shaping, while injection-molded variants offer intricate designs and precise control over magnet properties. Extrusion and compression processes provide cost-effective solutions for bulk production with consistent quality.

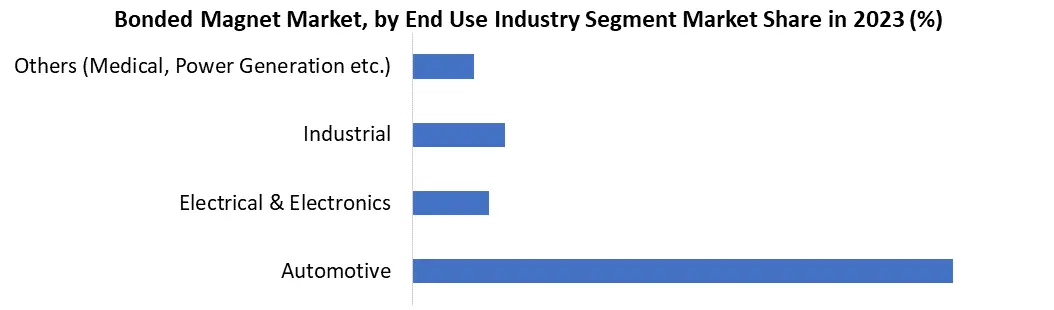

by End-use, Industries diversify the applications of bonded magnets. Medical devices utilize bonded magnets for diagnostic imaging and therapeutic equipment. Cameras integrate them for autofocus mechanisms and image stabilization. Consumer electronic appliances rely on bonded magnets for compact design and enhanced performance. Automotive applications encompass a wide range, from power steering systems to sensors and actuators. HVAC equipment benefits from the efficiency and reliability of bonded magnets in various components in the Bonded Magnet Market.

Bonded Magnet Market Regional Analysis

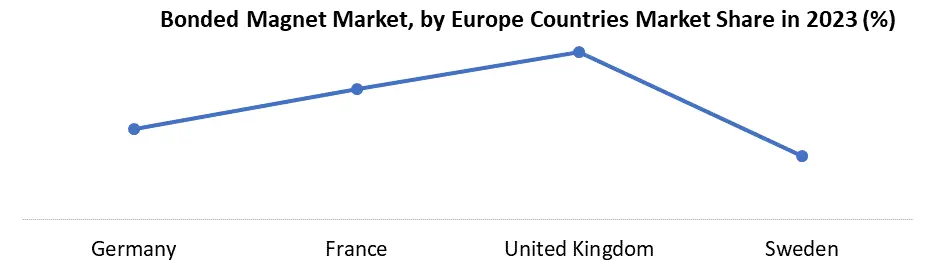

In North America, the Bonded Magnet Market is driven by robust technological innovation and strong demand across various industries. The region boasts a thriving automotive sector, where bonded magnets find extensive usage in electric vehicle components, sensors, and actuators. Additionally, the presence of leading medical device manufacturers propels the demand for bonded magnets in diagnostic imaging and therapeutic equipment. Moreover, North America's consumer electronics industry drives the adoption of bonded magnets in appliances, smartphones, and wearable devices. The region's emphasis on sustainability and energy efficiency further fuels the demand for bonded magnets in renewable energy applications. In Asia Pacific, the bonded magnet market experiences exponential growth fueled by rapid industrialization, urbanization, and technological advancement. China, in particular, emerges as a dominant player in the global market, owing to its vast manufacturing capabilities and robust supply chain infrastructure. The region's burgeoning automotive industry, coupled with the increasing adoption of electric vehicles, drives substantial demand for bonded magnets. Moreover, Asia Pacific leads in consumer electronics production, with countries like South Korea, Japan, and Taiwan playing pivotal roles, thereby augmenting the demand for bonded magnets in electronic devices and appliances. Additionally, the region's focus on infrastructure development and renewable energy initiatives further propels market growth. In Europe, the bonded magnet market benefits from a strong industrial base, stringent quality standards, and a focus on innovation. The automotive sector remains a key driver, with bonded magnets used in electric powertrains, advanced driver assistance systems (ADAS), and interior components. Furthermore, Europe's emphasis on environmental sustainability fosters the adoption of bonded magnets in wind turbines, electric motors, and other renewable energy applications. The region's well-established healthcare industry also contributes to market growth, with bonded magnets being integral to medical imaging equipment and diagnostic devices. Additionally, Europe's commitment to research and development ensures continuous advancements in bonded magnet technology, driving further market expansion.

Bonded Magnet Market Competitive Landscape

In March 2023, Arnold Magnetic Technologies acquired Ramco Electric Motors, Inc., a manufacturer of stators, rotors, and full electric motors. The acquisition expands Arnold’s capabilities and offerings in the e-mobility market. In February 2023, Alliance LLC announced the launch of its new website, which showcases its products and services in bonded magnets, rare earth magnets, and magnetic assemblies. In January 2023, Dexter Magnetic Technologies introduced its new line of bonded neodymium magnets optimized for high-temperature and high-corrosion applications. The magnets are suitable for automotive, aerospace, industrial, and medical markets. In December 2023, the TDK Corporation developed a new technology that enables the production of thin and flexible bonded magnets with high magnetic energy products. The technology uses a printing process to create complex shapes and patterns of bonded magnets on various substrates.Bonded Magnet Market Scope: Inquiry Before Buying

Bonded Magnet Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.59 Bn. Forecast Period 2024 to 2030 CAGR: 4.9% Market Size in 2030: US $ 4.15 Bn. Segments Covered: by Product Type Ferrite Magnets Rare Earth Magnets Others (Alnico, SmFeN, Hybrids) by Application Sensors Motors HDD (Hard Disk Drives) Level Gauges Instrument Panels Copier Rotors Fuel Filters Magnetic Couplings by Process Calendaring Injection Molding Extrusion Compression by End Use Industry Automotive Electrical & Electronics Industrial Others (Medical, Power Generation etc.) Bonded Magnet Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Russia and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, and Rest of APAC) Middle East and Africa (South Africa, GCC, and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Bonded Magnet Key Players Include

1. Arnold Magnetic Technologies 2. Alliance LLC 3. Dexter Magnetic Technologies 4. TDK Corporation 5. Adams Magnetic Products 6. SDM Magnetics Co., Ltd. 7. Ningbo Yunsheng Co. Ltd. 8. Advanced Technology Materials Co. Ltd. 9. MMC Magnetics Corp 10. Dura Magnetics, Inc. 11. National Imports, LLC 12. Super Magnet Co., Ltd. 13. MP Material 14. VACUUMSCHMELZE GmbH & Co. KG 15. Neo Magnequench 16. Stanford Magnets 17. Hitachi, Ltd. 18. Magnequench International, LLC 19. Viona Magnetics. 20. DEXTER MAGNETIC TECHNOLOGIES. 21. Evitron. 22. MS-Schramberg GmbH & Co. KG 23. RHEINMAGNET Horst Baermann GmbH. 24. Stanford MagnetsFrequently Asked Questions

1. What is the estimated value of the global Bonded Magnet Market? Ans: The global market for Bonded Magnet was estimated to be valued at USD 2.59 Bn in 2023. 2. Which Product Type Segment Dominates the Bonded Magnet Market? Ans: The ferrite magnets segment dominates the industry. 3. Who are the Top Three Bonded Magnet Providers? Ans: The top 3 bonded magnet providers are Arnold Magnetic Technologies, Alliance LLC, and TDK Corporation. 4. based on region, how is the global Bonded Magnet Market segmented? Ans: Based on region, the global Bonded Magnet Market is segmented into North America, Europe, Asia Pacific, Middle East & Africa and Latin America. 5. What is Driving the Demand for Bonded Magnets? Ans: The growing automotive and electronics industries drive the demand for bonded magnets.

1. Bonded Magnet Market: Market Introduction 1.1. Executive Summary 1.2. Market Size (2023) & Forecast (2024-2030) 1.3. Market Size (Value and Volume) - By Segments, Regions and Country 2. Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Product Segment 2.2.3. End-User Segment 2.2.4. Revenue Details 2.2.5. Headquarter 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Market Dynamics 3.1. Bonded Magnet Market Trends 3.2. Bonded Magnet Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Value Chain Analysis 3.7. Regulatory Landscape by Region 3.7.1. North America 3.7.2. Europe 3.7.3. Asia Pacific 3.7.4. Middle East and Africa 3.7.5. South America 3.8. Key Opinion Leader Analysis For the Global Industry 3.9. Analysis of Government Schemes and Initiatives for the Industry 3.10. Price Trend Analysis by Product Type (2019-2023) 3.11. Material and Production Process Analysis 3.11.1. Types of Materials Used (e.g., NdFeB, Ferrite) 3.11.2. Details of Production Processes Involved (e.g., Injection Molding, Compression Bonding, Extrusion) 3.11.3. Comparison of Different Materials and Processes 3.12. Application Analysis 3.12.1. Performance Requirements and Standards By End Use Industries 3.12.2. Efficiency and Performance Metrics By End Use Industries 3.12.3. Emerging Applications and Potential Market Segments 3.13. Supply Chain Analysis 3.13.1. Raw Material Suppliers 3.13.1.1. Availability and Cost of Raw Materials 3.13.1.2. Key Suppliers and Supply Agreements 3.13.2. Manufacturing Process and Technologies 3.13.3. Distribution Channels and Partnerships 3.13.4. End User Segments and Demand Analysis 3.13.5. Cost Reduction and Efficiency Improvement Measures 3.14. Regulatory Framework 3.14.1. ISO and IEC Standards for Bonded Magnets 3.14.2. Regional Regulatory Standards and Compliances 3.14.3. International Trade Regulations and Compliances 3.14.4. Impact of Regulations on Market Growth 3.15. Technological Advancements 3.15.1. Material Innovations 3.15.2. Innovations in Coatings and Surface Treatments 3.15.3. 3D Printing, Additive Manufacturing and Thermal Management Solutions 4. Bonded Magnet Market: Global Market Size and Forecast by Segmentation (by Value in USD and Volume in Units) (2023-2030) 4.1. Global Market Size and Forecast, by Product Type 4.1.1. Rare Earth Magnets 4.1.1.1. NdFeB (Neodymium-Iron-Boron) 4.1.1.2. SmCo (Samarium Cobalt) 4.1.2. Ferrite Magnets 4.1.3. Others (Alnico, SmFeN, Hybrids) 4.2. Global Market Size and Forecast, by Process 4.2.1. Calendaring 4.2.2. Injection Molding 4.2.3. Extrusion 4.2.4. Compression 4.3. Global Market Size and Forecast, by Application 4.3.1. Sensors 4.3.2. Motors 4.3.3. HDD (Hard Disk Drives) 4.3.4. Level Gauges 4.3.5. Instrument Panels 4.3.6. Copier Rotors 4.3.7. Fuel Filters 4.3.8. Magnetic Couplings 4.3.9. Others 4.4. Global Market Size and Forecast, by End Use Industry 4.4.1. Automotive 4.4.2. Electrical & Electronics 4.4.3. Industrial 4.4.4. Others (Medical, Power Generation, etc.) 4.5. Global Market Size and Forecast, by Region 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Market Size and Forecast by Segmentation (by Value in USD and Volume in Units) (2023-2030) 5.1. North America Market Size and Forecast, by Product Type 5.2. North America Market Size and Forecast, by Process 5.3. North America Market Size and Forecast, by Application 5.4. North America Market Size and Forecast, by End Use Industry 5.5. North America Market Size and Forecast, by Country 5.5.1. United States 5.5.1.1. United States Market Size and Forecast, by Product Type 5.5.1.2. United States Market Size and Forecast, by Process 5.5.1.3. United States Market Size and Forecast, by Application 5.5.1.4. United States Market Size and Forecast, by End Use Industry 5.5.2. Canada 5.5.3. Mexico 6. Europe Market Size and Forecast by Segmentation (by Value in USD and Volume in Units) (2023-2030) 6.1. Europe Market Size and Forecast, by Product Type 6.2. Europe Market Size and Forecast, by Process 6.3. Europe Market Size and Forecast, by Application 6.4. Europe Market Size and Forecast, by End Use Industry 6.5. Europe Market Size and Forecast, by Country 6.5.1. United Kingdom 6.5.1.1. United Kingdom Market Size and Forecast, by Product Type 6.5.1.2. United Kingdom Market Size and Forecast, by Process 6.5.1.3. United Kingdom Market Size and Forecast, by Application 6.5.1.4. United Kingdom Market Size and Forecast, by End Use Industry 6.5.2. France 6.5.3. Germany 6.5.4. Italy 6.5.5. Spain 6.5.6. Sweden 6.5.7. Russia 6.5.8. Rest of Europe 7. Asia Pacific Market Size and Forecast by Segmentation (by Value in USD and Volume in Units) (2023-2030) 7.1. Asia Pacific Market Size and Forecast, by Product Type 7.2. Asia Pacific Market Size and Forecast, by Process 7.3. Asia Pacific Market Size and Forecast, by Application 7.4. Asia Pacific Market Size and Forecast, by End Use Industry 7.5. Asia Pacific Market Size and Forecast, by Country 7.5.1. China 7.5.1.1. China Market Size and Forecast, by Product Type 7.5.1.2. China Market Size and Forecast, by Process 7.5.1.3. China Market Size and Forecast, by Application 7.5.1.4. China Market Size and Forecast, by End Use Industry 7.5.2. S Korea 7.5.3. Japan 7.5.4. India 7.5.5. Australia 7.5.6. Indonesia 7.5.7. Malaysia 7.5.8. Philippines 7.5.9. Thailand 7.5.10. Vietnam 7.5.11. Rest of Asia Pacific 8. Middle East and Africa Market Size and Forecast by Segmentation (by Value in USD and Volume in Units) (2023-2030) 8.1. Middle East and Africa Market Size and Forecast, by Product Type 8.2. Middle East and Africa Market Size and Forecast, by Process 8.3. Middle East and Africa Market Size and Forecast, by Application 8.4. Middle East and Africa Market Size and Forecast, by End Use Industry 8.5. Middle East and Africa Market Size and Forecast, by Country 8.5.1. South Africa 8.5.1.1. South Africa Market Size and Forecast, by Product Type 8.5.1.2. South Africa Market Size and Forecast, by Process 8.5.1.3. South Africa Market Size and Forecast, by Application 8.5.1.4. South Africa Market Size and Forecast, by End Use Industry 8.5.2. GCC 8.5.3. Egypt 8.5.4. Nigeria 8.5.5. Rest of ME&A 9. South America Market Size and Forecast by Segmentation (by Value in USD and Volume in Units) (2023-2030) 9.1. South America Market Size and Forecast, by Product Type 9.2. South America Market Size and Forecast, by Process 9.3. South America Market Size and Forecast, by Application 9.4. South America Market Size and Forecast, by End Use Industry 9.5. South America Market Size and Forecast, by Country 9.5.1. Brazil 9.5.1.1. Brazil Market Size and Forecast, by Product Type 9.5.1.2. Brazil Market Size and Forecast, by Process 9.5.1.3. Brazil Market Size and Forecast, by Application 9.5.1.4. Brazil Market Size and Forecast, by End Use Industry 9.5.2. Argentina 9.5.3. Colombia 9.5.4. Chile 9.5.5. Rest Of South America 10. Company Profile: Key Players 10.1. Arnold Magnetic Technologies 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Alliance LLC 10.3. Dexter Magnetic Technologies 10.4. TDK Corporation 10.5. Adams Magnetic Products 10.6. SDM Magnetics Co., Ltd. 10.7. Ningbo Yunsheng Co. Ltd. 10.8. Advanced Technology & Materials Co., Ltd. 10.9. MMC Magnetics Corp 10.10. Dura Magnetics, Inc. 10.11. National Imports, LLC 10.12. Super Magnet Co., Ltd. 10.13. MP Material 10.14. VACUUMSCHMELZE GmbH & Co. KG 10.15. Stanford Magnets 10.16. Magnequench International, LLC 10.17. Viona Magnetics 10.18. Evitron 10.19. MS-Schramberg GmbH & Co. KG 10.20. RHEINMAGNET Horst Baermann GmbH 10.21. Other Key Players 11. Key Findings 12. Analyst Recommendations 13. Bonded Magnet Market: Research Methodology