Boiler Water Treatment Chemicals Market size was valued at USD 4.37 Billion in 2023 and Boiler Water Treatment Chemicals Revenue is expected to grow at a CAGR of 10.8 % from 2024 to 2030, reaching nearly USD 8.96 Billion in 2030.Boiler Water Treatment Chemicals Market Overview:

Boiler water treatment is the conditioning and treatment of boiler feed water for three main purposes that are continuous heat exchange, quality steam protection, and corrosion protection. Boilers are meant to heat fluids, which are subsequently evaporated or heated and utilized for heating purposes and other industrial activities such as sanitation and cooking.To know about the Research Methodology :- Request Free Sample Report The suitability factor of the boiler treatment program is the regulatory requirements. In plants that are governed by the U.S. Food and Drug Administration (FDA) or the U.S. Department of Agriculture (USDA) and in which the steam contacts food or surfaces that contact food, the boiler water treatment chemicals must be formulated using only ingredients that are listed in 21 CFR § 173.310. It is the responsibility of plant personnel to ensure that the boiler water chemicals used in their facility are approved for the application. Usually accomplished by obtaining a letter from the water treatment company that certifies that the chemical products in use in their boiler system meet the approval. According to the International Energy Agency's (IEA) monthly figures, total electricity production in Europe in February 2023 was 284.756 TWh, while total electricity production in the first two months of 2023 was more than 602 TWh. Boiler water treatment systems and chemicals are in higher demand as a result of rising demand and market growth in the manufacturing, power, and industrial sectors. Along with solar and wind power facilities.

Boiler Water Treatment Chemicals Market Dynamics:

Industrialization’s Impact on the Boiler Water Treatment Chemicals Market The increasing industrialization is expected to propel the growth of the boiler water treatment chemicals market. Industrialization involves the establishment and development of various industries, such as manufacturing, power generation, and chemical processing. Increasing requirements for steam and pure water from numerous end-use industries also raise the boiler water treatment market through the forecast period. Boiler water treatment involves three main factors namely corrosion protection, a continuous exchange of heat, and high-quality steam production. The chemicals are added to enhance the reliability, safety, and efficiency of the system. Rising demand for power generation increases the need for boiler technology, which pushes the demand growth of the boiler water treatment chemicals market.Technological Advancements in Boiler Water Treatment Chemicals Technological advancement is a key trend in the boiler water treatment chemical market. Technologically advanced chemicals were created scientifically to preventatively handle issues with water users, scale buildup, metallic corrosion, boiler water carryover, and sludge deposition. Some industrial and utility boilers use No. 6 oil as the alternate fuel. No. 6 is a heavy residual oil that must be heated to approximately 150oF to be easily pumped. If No. 6 oil were fed to a boiler that was set up to burn No. 2, the burner would not burn the fuel efficiently, and the unit’s combustion efficiency would decrease. No. 6 oil is not a good “fit” for a boiler set up to burn no. 2. The shifting focus on the usage of green chemicals and development in chemical technology likely provide a major growth opportunity for the market studied through the forecast period. Navigating Challenges and Opportunities The growth of the boiler water treatment chemical market is hampered through the forecast period by scale deposition factors in boiler water treatment chemicals. Additionally, strict environmental regulations that are imposed by various governments for the use of boilers limit market growth for boiler water treatment. On the other hand, through the forecast period, key players benefit financially from technological advancements that improve the properties of chemicals used to treat boiler water, such as scale inhibitors, corrosion inhibitors, and heat effectiveness.

Boiler Water Treatment Chemicals Market Segmentation:

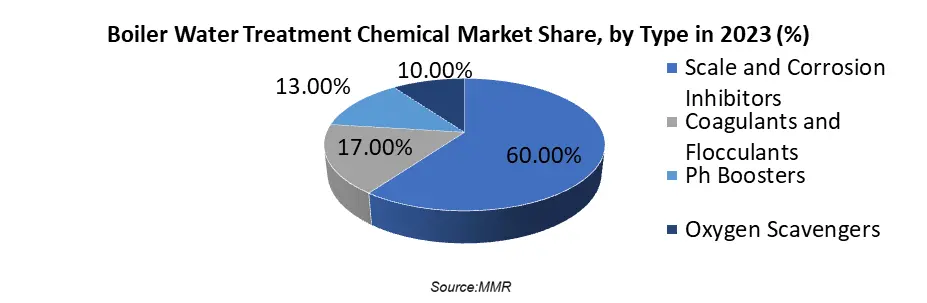

By Type, the Scale & Corrosion Inhibitor type dominated the market with the highest market share of 60 % in 2023. Boiler water treatment chemicals are necessary to prevent scale and corrosion problems. Chemicals called scale inhibitors are used in boilers to stop the growth of scale deposits. Corrosion inhibitors are chemicals that shield metals found in the boiler system, oxygen, moisture, and other elements from corroding boiler components. The market for boiler water treatment chemicals’ scale and corrosion inhibitors is driven by the need to increase boiler efficiency, lower energy costs, and reduce equipment downtime. Equipment and parts of water systems have a lower quality of life and a shorter overall life expectancy due to scale (the accumulation of mineral deposits) and corrosion (the deterioration of metal). Scale and corrosion quickly wreak havoc if the proper preventative measures are not implemented, leading to problems like leaks and equipment failure. Necessitate shutdown and expensive repairs. Additionally, scale is brought on by the buildup of complex salts in the boiler system. In contrast, corrosion brought on by the water's acidity throws the pH of the boiler water out of balance. Chemical treatments called corrosion inhibitors are used to delay or halt corrosive damage.

Boiler Water Treatment Chemicals Market Regional Insight:

Asia Pacific dominates the boiler water treatment chemicals market with a share of more than 50%, followed by North America and Europe. Scale inhibitors are currently dominating the Asia-Pacific boiler water treatment chemicals market. Through boiler water operation at industrial plants, the pipelines accumulate scale on their walls. The scales if untreated can cause overheating, reduced efficiency in heat transfer, tube failures, and restricted circulation, which in turn reduce the reliability of the boiler water system. China accounts for the major share of the Asia-Pacific boiler water treatment chemicals market. The major industries in the country with extensive usage of boiler water, where the treatment of the water is necessary, are the power industry, the food processing industry, the industrial equipment manufacturing industry, the pharmaceutical industry, and the processed metals industry. China has one of the largest pharmaceutical industries in the world. Generics, therapeutic drugs, active pharmaceutical ingredients, and traditional Chinese medicine are all produced nationwide. More than 90% of the nation's legally registered medications are generic. It is projected that China's pharmaceutical industry grow to 3 trillion CNY through the forecast period. The world's largest producer of chemicals is China. Additionally, over 35% of the region's total chemical sales were made in China. The market under study is expected to increase through the forecast period owing to the country's burgeoning chemical and pharmaceutical industries. The food processing sector is maturing and expanding at a moderate rate. In India, the food and beverage industry is experiencing rapid expansion, driven by factors such as increasing consumer demand, urbanization, and a rise in disposable income. This remarkable growth has led to a surge in the demand for BWTCs. West India, comprising states like Maharashtra and Gujrat, is renowned for its industrial prowess. The states boast a multitude of thriving sectors, including power, oil & gas, and manufacturing, all of which heavily rely on boilers and, consequently, BWTCs.Boiler Water Treatment Chemicals Market Competitive Landscape: 1. 22 May 2023: BASF’s Coatings division has launched a crowdsourcing digital tool to streamline and enhance color formula search for customers of its two paint brands, NORBIN and Shancai. 2. 22 March 2023: BASF introduced a new Ultramid Deep Gloss grade, optimized for highly glossy automotive interior parts, and applied for the first time to the garnish of Toyota ‘s new Prius 3. In January 2023, Kemira, a chemical solutions provider for water-intensive industries, completed the full acquisition of SimAnalytics. This strategic move enhances Kemira's ability to provide data-driven predictive services and machine-learning solutions to support its customers' businesses effectively. Through this acquisition, Kemira strengthens its portfolio and reinforces its commitment to delivering advanced and tailored solutions to meet evolving industry needs. 4. In March 2023, WABAG was recognized by Water Digest, and WABAG has been conferred with the “Best Water Treatment Solution Provider” at the Water Digest Water Awards 2022 – 23. WABAG has been a preferred partner for various governments and industries across the globe for providing innovative and advanced water treatment solutions and thereby ensuring safe and clean drinking water and sustainable sanitation for millions of people.

Boiler Water Treatment Chemicals Market Scope: Inquire before buying

Boiler Water Treatment Chemicals Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 4.37 Bn. Forecast Period 2024 to 2030 CAGR: 10.8% Market Size in 2030: US $ 8.96 Bn. Segments Covered: by Type Scale and Corrosion Inhibitors Coagulants and Flocculants Ph Boosters Oxygen Scavengers by Application Basic Chemicals Blended/Specialty Chemicals by End-user Power Generation Steel and Metal Industry Oil Refinery Chemical and Petrochemical Textile and Dye Industry Sugar Mill Pulp and Paper Food and Beverage Institutional Pharmaceutical Boiler Water Treatment Chemicals Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Boiler Water Treatment Chemicals Market Key Players:

1. Veolia Water Technologies - France 2. Suez Water Technologies & Solutions - France 3. Ecolab Inc. - United States 4. Kurita Water Industries Ltd. - Japan 5. ChemTreat, Inc. (a subsidiary of Danaher Corporation) - United States 6. Nalco Water (an Ecolab Company) - United States 7. GE Water & Process Technologies (now part of SUEZ) - United States 8. Solenis LLC - United States 9. AkzoNobel N.V. - Netherlands 10. BASF SE - Germany 11. Dow Chemical Company - United States 12. Solenis LLC - United States 13. Accepta - United Kingdom 14. Kemira Oyj - Finland 15. SNF Group - France 16. Aries Chemical, Inc. - United States 17. Hydrite Chemical Co. - United States 18. Buckman Laboratories International, Inc. - United States 19. Kemira Oyj - Finland 20. Lonza Group Ltd. - Switzerland Frequently Asked Questions: 1] What segments are covered in the Boiler Water Treatment Market report? Ans. The segments covered in the Boiler Water Treatment Market report are based on, Type, Application, and End Users. 2] Which region is expected to hold the highest share in the Boiler Water Treatment Market? Ans. The Asia Pacific region is expected to hold the highest share of the Boiler Water Treatment Market. 3] What is the market size of the Boiler Water Treatment Market by 2030? Ans. The market size of the Boiler Water Treatment Market by 2030 will be USD 8.96 Billion. 4] What is the forecast period for the Boiler Water Treatment Market? Ans. The Forecast period for the Boiler Water Treatment Market is 2024- 2030.

1. Boiler Water Treatment Chemicals Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Boiler Water Treatment Chemicals Market: Dynamics 2.1. Boiler Water Treatment Chemicals Market Trends by Region 2.1.1. North America Boiler Water Treatment Chemicals Market Trends 2.1.2. Europe Boiler Water Treatment Chemicals Market Trends 2.1.3. Asia Pacific Boiler Water Treatment Chemicals Market Trends 2.1.4. Middle East and Africa Boiler Water Treatment Chemicals Market Trends 2.1.5. South America Boiler Water Treatment Chemicals Market Trends 2.2. Boiler Water Treatment Chemicals Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Boiler Water Treatment Chemicals Market Drivers 2.2.1.2. North America Boiler Water Treatment Chemicals Market Restraints 2.2.1.3. North America Boiler Water Treatment Chemicals Market Opportunities 2.2.1.4. North America Boiler Water Treatment Chemicals Market Challenges 2.2.2. Europe 2.2.2.1. Europe Boiler Water Treatment Chemicals Market Drivers 2.2.2.2. Europe Boiler Water Treatment Chemicals Market Restraints 2.2.2.3. Europe Boiler Water Treatment Chemicals Market Opportunities 2.2.2.4. Europe Boiler Water Treatment Chemicals Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Boiler Water Treatment Chemicals Market Drivers 2.2.3.2. Asia Pacific Boiler Water Treatment Chemicals Market Restraints 2.2.3.3. Asia Pacific Boiler Water Treatment Chemicals Market Opportunities 2.2.3.4. Asia Pacific Boiler Water Treatment Chemicals Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Boiler Water Treatment Chemicals Market Drivers 2.2.4.2. Middle East and Africa Boiler Water Treatment Chemicals Market Restraints 2.2.4.3. Middle East and Africa Boiler Water Treatment Chemicals Market Opportunities 2.2.4.4. Middle East and Africa Boiler Water Treatment Chemicals Market Challenges 2.2.5. South America 2.2.5.1. South America Boiler Water Treatment Chemicals Market Drivers 2.2.5.2. South America Boiler Water Treatment Chemicals Market Restraints 2.2.5.3. South America Boiler Water Treatment Chemicals Market Opportunities 2.2.5.4. South America Boiler Water Treatment Chemicals Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Boiler Water Treatment Chemicals Industry 2.8. Analysis of Government Schemes and Initiatives For Boiler Water Treatment Chemicals Industry 2.9. Boiler Water Treatment Chemicals Market Trade Analysis 2.10. The Global Pandemic Impact on Boiler Water Treatment Chemicals Market 3. Boiler Water Treatment Chemicals Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 3.1.1. Scale and Corrosion Inhibitors 3.1.2. Coagulants and Flocculants 3.1.3. Ph Boosters 3.1.4. Oxygen Scavengers 3.2. Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 3.2.1. Basic Chemicals 3.2.2. Blended/Specialty Chemicals 3.2.3. 3.3. Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 3.3.1. Power Generation 3.3.2. Steel and Metal Industry 3.3.3. Oil Refinery 3.3.4. Chemical and Petrochemical 3.3.5. Textile and Dye Industry 3.3.6. Sugar Mill 3.3.7. Pulp and Paper 3.3.8. Food and Beverage 3.3.9. Institutional 3.3.10. Pharmaceutical 3.4. Boiler Water Treatment Chemicals Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Boiler Water Treatment Chemicals Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 4.1.1. Scale and Corrosion Inhibitors 4.1.2. Coagulants and Flocculants 4.1.3. Ph Boosters 4.1.4. Oxygen Scavengers 4.2. North America Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 4.2.1. Basic Chemicals 4.2.2. Blended/Specialty Chemicals 4.2.3. 4.3. North America Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 4.3.1. Power Generation 4.3.2. Steel and Metal Industry 4.3.3. Oil Refinery 4.3.4. Chemical and Petrochemical 4.3.5. Textile and Dye Industry 4.3.6. Sugar Mill 4.3.7. Pulp and Paper 4.3.8. Food and Beverage 4.3.9. Institutional 4.3.10. Pharmaceutical 4.4. North America Boiler Water Treatment Chemicals Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Scale and Corrosion Inhibitors 4.4.1.1.2. Coagulants and Flocculants 4.4.1.1.3. Ph Boosters 4.4.1.1.4. Oxygen Scavengers 4.4.1.2. United States Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Basic Chemicals 4.4.1.2.2. Blended/Specialty Chemicals 4.4.1.2.3. 4.4.1.3. United States Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Power Generation 4.4.1.3.2. Steel and Metal Industry 4.4.1.3.3. Oil Refinery 4.4.1.3.4. Chemical and Petrochemical 4.4.1.3.5. Textile and Dye Industry 4.4.1.3.6. Sugar Mill 4.4.1.3.7. Pulp and Paper 4.4.1.3.8. Food and Beverage 4.4.1.3.9. Institutional 4.4.1.3.10. Pharmaceutical 4.4.2. Canada 4.4.2.1. Canada Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Scale and Corrosion Inhibitors 4.4.2.1.2. Coagulants and Flocculants 4.4.2.1.3. Ph Boosters 4.4.2.1.4. Oxygen Scavengers 4.4.2.2. Canada Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Basic Chemicals 4.4.2.2.2. Blended/Specialty Chemicals 4.4.2.2.3. 4.4.2.3. Canada Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Power Generation 4.4.2.3.2. Steel and Metal Industry 4.4.2.3.3. Oil Refinery 4.4.2.3.4. Chemical and Petrochemical 4.4.2.3.5. Textile and Dye Industry 4.4.2.3.6. Sugar Mill 4.4.2.3.7. Pulp and Paper 4.4.2.3.8. Food and Beverage 4.4.2.3.9. Institutional 4.4.2.3.10. Pharmaceutical 4.4.3. Mexico 4.4.3.1. Mexico Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Scale and Corrosion Inhibitors 4.4.3.1.2. Coagulants and Flocculants 4.4.3.1.3. Ph Boosters 4.4.3.1.4. Oxygen Scavengers 4.4.3.2. Mexico Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Basic Chemicals 4.4.3.2.2. Blended/Specialty Chemicals 4.4.3.2.3. 4.4.3.3. Mexico Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Power Generation 4.4.3.3.2. Steel and Metal Industry 4.4.3.3.3. Oil Refinery 4.4.3.3.4. Chemical and Petrochemical 4.4.3.3.5. Textile and Dye Industry 4.4.3.3.6. Sugar Mill 4.4.3.3.7. Pulp and Paper 4.4.3.3.8. Food and Beverage 4.4.3.3.9. Institutional 4.4.3.3.10. Pharmaceutical 5. Europe Boiler Water Treatment Chemicals Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 5.2. Europe Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 5.3. Europe Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 5.4. Europe Boiler Water Treatment Chemicals Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Boiler Water Treatment Chemicals Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Boiler Water Treatment Chemicals Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Boiler Water Treatment Chemicals Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Boiler Water Treatment Chemicals Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 8. South America Boiler Water Treatment Chemicals Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 8.2. South America Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 8.3. South America Boiler Water Treatment Chemicals Market Size and Forecast, by End User(2023-2030) 8.4. South America Boiler Water Treatment Chemicals Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Boiler Water Treatment Chemicals Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Boiler Water Treatment Chemicals Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Boiler Water Treatment Chemicals Market Size and Forecast, by End User (2023-2030) 9. Global Boiler Water Treatment Chemicals Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Boiler Water Treatment Chemicals Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Veolia Water Technologies - France 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Suez Water Technologies & Solutions - France 10.3. Ecolab Inc. - United States 10.4. Kurita Water Industries Ltd. - Japan 10.5. ChemTreat, Inc. (a subsidiary of Danaher Corporation) - United States 10.6. Nalco Water (an Ecolab Company) - United States 10.7. GE Water & Process Technologies (now part of SUEZ) - United States 10.8. Solenis LLC - United States 10.9. AkzoNobel N.V. - Netherlands 10.10. BASF SE - Germany 10.11. Dow Chemical Company - United States 10.12. Solenis LLC - United States 10.13. Accepta - United Kingdom 10.14. Kemira Oyj - Finland 10.15. SNF Group - France 10.16. Aries Chemical, Inc. - United States 10.17. Hydrite Chemical Co. - United States 10.18. Buckman Laboratories International, Inc. - United States 10.19. Kemira Oyj - Finland 10.20. Lonza Group Ltd. - Switzerland 11. Key Findings 12. Industry Recommendations 13. Boiler Water Treatment Chemicals Market: Research Methodology 14. Terms and Glossary