Bleeding Disorders Treatment Market size was valued at US$ 16.81 Bn. in 2022 and the total Bleeding Disorders Treatment Market revenue is expected to grow at 8.5% from 2023 to 2029, reaching nearly US$ 29.76 Bn.Bleeding Disorders Treatment Market Overview:

When the body's natural blood clotting process is disrupted, it is said to have a bleeding disorder. This condition can have serious consequences in the situation of accidents due to prolonged bleeding. There is also the possibility of the bleeding to begin spontaneously through parts of body. The majority of bleeding disorders are inherited, although some can also be acquired because of liver conditions, drug interactions, low red blood cell counts, vitamin K deficiencies, and some other factors that are discussed in detail in report by regional tendencies of decease. Due to the growth in the number of people with liver diseases, anemia, and other blood coagulation problems, the market for treating bleeding disorders is expected to grow at high rate and different growth factors are analyzed with dynamics in the report. The market for treating bleeding disorders is growing as a result of an increase in the number of patients who have been diagnosed with the condition, increased research and development efforts, investments by major market players, increased public awareness of bleeding disorders, particularly hemophilia, and successful government initiatives in developed nations to create a vast network of diagnosis and treatment facilities. The high cost of medications and the lack of qualified medical personnel, however, prevent many people from receiving the right care, which has been restricting the market's growth. Growth restraints for treatment are basically in developing and underdeveloped countries however market is picking up in theses countries tooReport Scope:

The bleeding disorders treatment market report provides an in-depth analysis of the market's growth prospects, challenges, and projections. Research on Porter's five forces shows how networks of suppliers and customers can be formed in order to make lucrative decisions. The present Bleeding Disorders Treatment Market potential ascertained through in-depth analysis, market size, and segmentation. The analysis, which also contains the elements anticipated to have a positive or negative impact on the company, will provide investors with a full picture of the prospects in different demographics. The report is investor's guide and offers total market opportunity, accessible market with key competitors and their strategies with historical and contemporary scenarios for the Bleeding disorders treatment market. Every facet of the market is covered in the report's comprehensive study of significant rivals, including market leaders, followers, and new entrants. The study includes strategic profiles of the leading industry players, a thorough analysis of their core strengths, and information on their company-specific plans for the launch of new products, growth, partnerships, joint ventures, and acquisitions. The research serves as a source for investors with its clear depiction of competitive analysis of key companies by product, pricing, financial condition, product portfolio, growth strategies, and geographical presence in both the domestic and local market.To know about the Research Methodology :- Request Free Sample Report

Bleeding Disorders Treatment Market Dynamics:

Increase in blood-related diseases The need for treating bleeding disorders is expected to increase in forecast period as the rising incidence of liver illnesses, anemia, and other blood coagulation problems. Development activities and Growing awareness and more research Growing consumer awareness of the value of treating different forms of bleeding disorders is also opening up promising new revenue channels. Growing R&D projects for the treatment of diverse blood disorders is also expected to increase growth potential. The growth in the number of patients with bleeding disorders who have been diagnosed, and their awareness is increasing the growth of the market. However, in some regions the lack of access to appropriate care brought on by high prescription costs and a shortage of qualified medical staff are expected to restrain the growth. Well trained medical representatives are key growth drivers for the treatment. Asia-Pacific region is expected to offer good potential for market growth as the infrastructure for treatment and public awareness is increasing fast. The market for the treatment of bleeding disorders is expected to grow owing to generic products The market for treating bleeding disorders is driven by a sizable customer base, growing public awareness of bleeding disorders and their treatments, and attractive remuneration practices. Additionally, the patent expirations of current brands provide generic medication producers access to the lucrative market for therapies for bleeding disorders. Owing to the high cost of branded medications, the market for the treatment of bleeding disorders is mostly concentrated in North America and Europe. Low-cost medications are expected to aid in market penetration in poor and underdeveloped nations where patients cannot afford expensive medical care. Therefore, the availability of affordable generic medications is expected to spur market growth. The report has detailed analysis on the share of generic medicine and branded medicines. Market Restraints: Adverse Reimbursement Conditions and a Clinician Shortage A significant barrier to the market for treating bleeding disorders is the high cost of care. Hospitalization, lab tests, and routine outpatient checkups are all too expensive. The development of the market for therapies for acquired bleeding disorders is expected to be hampered by other factors, such as a lack of awareness in some developing countries. The market for treating bleeding disorders would face substantial obstacles owing to the lack of trained professionals and specialists with the necessary skills. Lack of access to effective therapy owing to high prescription fees restricts the market's development rate. The absence of attractive reimbursement policies further constrains market growth.Bleeding Disorders Treatment Market Segment Analysis:

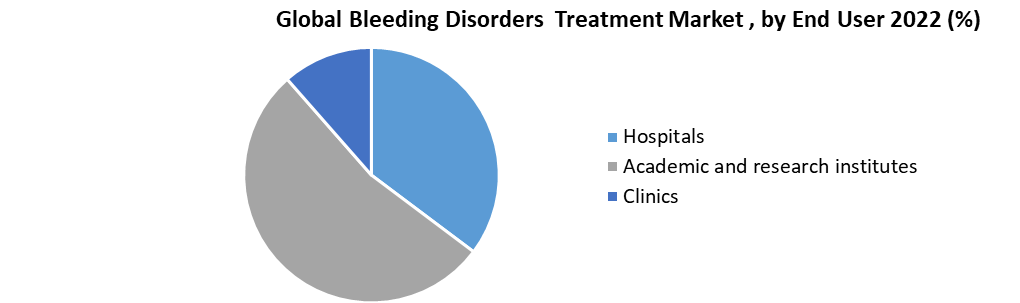

Based on Dosage Form, The Plasma-derived coagulation factor concentrates segment is expected to grow at the highest CAGR during the forecast period. Used to treat bleeds and stop surgical bleeding in those with von Willebrand disease. Additionally, recombinant coagulation factor concentrates segment is expected to grow significantly. Recombinant products provide a safer alternative to plasma-derived products because they prevent the potential spread of infectious illnesses through blood.Based on Disease Type, The Hemophilia A segment is expected to grow at the highest CAGR during the forecast period. The classification is based on the patient's individual lack of coagulation factor. Hemophilia type A is the most common kind and is four times more common than hemophilia type B, according to statistics. The frequency of type A varies with different countries, with a range of 5.4-14.5 cases per 100,000 males, according to figures published in WebMD LLC in 2019. Additionally, 50 to 60 % of individuals had severe hemophilia A, which is linked to severe bleeding symptoms. Additionally, the majority of products on the market are used to treat type A hemophilia. Based on End Users, The Hospitals segment is expected to grow at the highest CAGR during the forecast period. The hospitals market accounted for USD 3,390 million in 2022, which can be attributed, among other things, to the availability of professional haematologists who are board certified, the significance of providing quality treatment plans, and their increased efficiency. These medical facilities offer reasonably priced medical procedures that benefit both patients and insurance companies equally. The popularity of treating bleeding disorders in hospitals is increasing owing to the simple accessibility of novel remedies. Additionally, it is expected that the thorough care plans and ongoing monitoring provided in hospitals will improve patient choice for these healthcare institutions. The demand for cutting-edge treatments and the growing number of hospital admissions for hereditary bleeding disorders are thus expected to drive the uptake of the product in these settings.

Bleeding Disorders Treatment Market Regional Insights:

North America is having a sizable market share and is expected to continue during the forecast period. Owing to the increased prevalence of various blood disorders and growing patient awareness in this area, North America is expected to hold a significant market position in the blood disorder therapeutics market. The World Federation of Hemophilia estimates that about 11,000 Americans have von Willebrand disease and about 18,000 Americans have hemophilia. Additionally, 400 newborns are diagnosed with hemophilia A each year, affecting 1 in 5,000 male births. The presence of strong healthcare infrastructure and growing investments in research & development to create treatments for blood disorders are two other factors that are substantially boosting regional market growth.Bleeding Disorders Treatment Market Scope: Inquire before buying

Global Bleeding Disorders Treatment Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 16.81 Bn. Forecast Period 2023 to 2029 CAGR: 8.5% Market Size in 2029: US $ 29.76 Bn. Segments Covered: by Drug Type 1. Plasma-derived coagulation factor concentrates 2. Recombinant coagulation factor concentrates 3. Desmopressin 4. Antifibrinolytics 5. Fibrin sealants 6. Others by Disease Type 1. Hemophilia A 2. Hemophilia B 3. Von willebrand disease 4. Liver disease 5. Others by End User 1. Hospitals 2. Academic and research institutes 3. Clinics Bleeding Disorders Treatment Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Bleeding Disorders Treatment Market Key Players are:

1. Biogen Inc. (US) 2. CSL Behring (US) 3. Pfizer Inc. (US) 4. Baxter International Inc. (US) 5. Alnylam Pharmaceuticals, Inc. (US) 6. Xenetic Biosciences, Inc. (US) 7. Bristol-Myers Squibb Company (US) 8. Amgen, Inc. (US) 9. Janssen Global Services, LLC (US) 10. BDI Pharma (US) 11. Akorn Operating Company LLC (US) 12. Johnson & Johnson Services, Inc. (US) 13. AbbVie Inc. (US) 14. Prestige Consumer Healthcare Inc. (US) 15. OASIS Medical (US) 16. Sun Pharmaceutical Industries Ltd. (India) 17. Wellona Pharma (India) 18. Zydus Group (India) 19. Amneal Pharmaceuticals LLC (India) 20. Santen Pharmaceutical Co., Ltd. (Japan) 21. Ferring Pharmaceuticals (Switzerland) 22. Alcon (Switzerland) 23. Octapharma AG (Switzerland) 24. Novartis AG (Switzerland) 25. Bayer AG (Germany) 26. Grifols International SA (Spain) 27. Novo Nordisk A/S (Denmark) 28. Bausch & Lomb Incorporated (Canada) 29. Théa Laboratories (France) 30. Sanofi (France) Frequently Asked Questions: 1] What segments are covered in the Global Bleeding Disorders Treatment Market report? Ans. The segments covered in the Bleeding Disorders Treatment Market report are based on Drug Type, Disease Type, End-User, and Region. 2] Which region is expected to hold the highest share in the Global Bleeding Disorders Treatment Market? Ans. The North America region is expected to hold the highest share in the Bleeding Disorders Treatment Market. 3] What is the market size of the Global Bleeding Disorders Treatment Market by 2029? Ans. The market size of the Bleeding Disorders Treatment Market by 2029 is expected to reach US$ 29.76 Bn. 4] What is the forecast period for the Global Bleeding Disorders Treatment Market? Ans. The forecast period for the Bleeding Disorders Treatment Market is 2023-2029. 5] What was the market size of the Global Bleeding Disorders Treatment Market in 2022? Ans. The market size of the Bleeding Disorders Treatment Market in 2022 was valued at US$ 16.81 Bn.

1. Global Bleeding Disorders Treatment Market Size: Research Methodology 2. Global Bleeding Disorders Treatment Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Bleeding Disorders Treatment Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Bleeding Disorders Treatment Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Bleeding Disorders Treatment Market Size Segmentation 4.1. Global Bleeding Disorders Treatment Market Size, by Drug Type (2023-2029) • Plasma-derived coagulation factor concentrates • Recombinant coagulation factor concentrates • Desmopressin • Antifibrinolytics • Fibrin sealants • Others 4.2. Global Bleeding Disorders Treatment Market Size, by Disease Type (2023-2029) • Hemophilia A • Hemophilia B • Von willebrand disease • Liver disease • Others 4.3. Global Bleeding Disorders Treatment Market Size, by End User (2023-2029) • Hospitals • Academic and research institutes • Clinics 5. North America Bleeding Disorders Treatment Market (2023-2029) 5.1. North America Bleeding Disorders Treatment Market Size, by Drug Type (2023-2029) • Plasma-derived coagulation factor concentrates • Recombinant coagulation factor concentrates • Desmopressin • Antifibrinolytics • Fibrin sealants • Others 5.2. North America Bleeding Disorders Treatment Market Size, by Disease Type (2023-2029) • Hemophilia A • Hemophilia B • Von willebrand disease • Liver disease • Others 5.3. North America Bleeding Disorders Treatment Market Size, by End User (2023-2029) • Hospitals • Academic and research institutes • Clinics 5.4. North America Semiconductor Memory Market, by Country (2023-2029) • United States • Canada • Mexico 6. European Bleeding Disorders Treatment Market (2023-2029) 6.1. European Bleeding Disorders Treatment Market, by Drug Type (2023-2029) 6.2. European Bleeding Disorders Treatment Market, by Disease Type (2023-2029) 6.3. European Bleeding Disorders Treatment Market, by End User (2023-2029) 6.4. European Bleeding Disorders Treatment Market, by Country (2023-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Bleeding Disorders Treatment Market (2023-2029) 7.1. Asia Pacific Bleeding Disorders Treatment Market, by Drug Type (2023-2029) 7.2. Asia Pacific Bleeding Disorders Treatment Market, by Disease Type (2023-2029) 7.3. Asia Pacific Bleeding Disorders Treatment Market, by End User (2023-2029) 7.4. Asia Pacific Bleeding Disorders Treatment Market, by Country (2023-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Bleeding Disorders Treatment Market (2023-2029) 8.1. Middle East and Africa Bleeding Disorders Treatment Market, by Drug Type (2023-2029) 8.2. Middle East and Africa Bleeding Disorders Treatment Market, by Disease Type (2023-2029) 8.3. Middle East and Africa Bleeding Disorders Treatment Market, by End User (2023-2029) 8.4. Middle East and Africa Bleeding Disorders Treatment Market, by Country (2023-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Bleeding Disorders Treatment Market (2023-2029) 9.1. South America Bleeding Disorders Treatment Market, by Drug Type (2023-2029) 9.2. South America Bleeding Disorders Treatment Market, by Disease Type (2023-2029) 9.3. South America Bleeding Disorders Treatment Market, by End User (2023-2029) 9.4. South America Bleeding Disorders Treatment Market, by Country (2023-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Biogen Inc. (US) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 CSL Behring (US) 10.3 Pfizer Inc. (US) 10.4 Baxter International Inc. (US) 10.5 Alnylam Pharmaceuticals, Inc. (US) 10.6 Xenetic Biosciences, Inc. (US) 10.7 Bristol-Myers Squibb Company (US) 10.8 Amgen, Inc. (US) 10.9 Janssen Global Services, LLC (US) 10.10 BDI Pharma (US) 10.11 Akorn Operating Company LLC (US) 10.12 Johnson & Johnson Services, Inc. (US) 10.13 AbbVie Inc. (US) 10.14 Prestige Consumer Healthcare Inc. (US) 10.15 OASIS Medical (US) 10.16 Sun Pharmaceutical Industries Ltd. (India) 10.17 Wellona Pharma (India) 10.18 Zydus Group (India) 10.19 Amneal Pharmaceuticals LLC (India) 10.20 Santen Pharmaceutical Co., Ltd. (Japan) 10.21 Ferring Pharmaceuticals (Switzerland) 10.22 Alcon (Switzerland) 10.23 Octapharma AG (Switzerland) 10.24 Novartis AG (Switzerland) 10.25 Bayer AG (Germany) 10.26 Grifols International SA (Spain) 10.27 Novo Nordisk A/S (Denmark) 10.28 Bausch & Lomb Incorporated (Canada) 10.29 Théa Laboratories (France) 10.30 Sanofi (France)