The Global Biorational Market size was valued at USD 950.3 Mn in 2022 and is expected to reach USD 1765.27 Mn by 2029, at a CAGR of 9.25 %.Overview of the Biorational Market

Biorational are substances or products with minimal environmental impact that are primarily derived from biological sources. In cases where Biorational is artificially synthesized, they possess a similar chemical structure and exhibit comparable functionality to naturally occurring materials. The category of Biorationals encompasses both biopesticides and non-pesticidal products, which serve various purposes such as managing crop stress, promoting advantageous plant physiology, regulating root growth, and facilitating postharvest activities. The graphical representation and structural exclusive information showed dominating region of the Biorational Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Biorational Market.Biorational Market Snapshot

To know about the Research Methodology :- Request Free Sample Report

Biorational Market Dynamics

Growing concerns about food safety and stringent regulations on conventional agrochemicals are the major drivers of the Biorational Market The major categories of bio-rational pesticides include botanicals, microbial, minerals, and synthetic materials. Botanicals are plant-derived materials such as rotenone, pyrethrum, sabadilla, ryania, etc. Nicotine products, although natural, are not considered bio-rational due to their high mammalian toxicity. Pesticides vary in their toxicity and in their potential to cause undesirable ecological impacts. Pest control materials that are relatively non-toxic with few ecological side-effects are sometimes called ‘bio-rational' pesticides. Consumers are increasingly demanding food that is produced using safe and sustainable methods. Biorational pesticides are seen as a way to meet this demand, as they are less toxic to humans and the environment than traditional chemical pesticides in the Biorational Market. Governments over the globe are implementing stricter regulations on the use of unnatural artificial pesticides and fertilizers due to their significant unnatural effects on human health and the environment. Biorational products, which are often exempt from certain regulatory requirements or have more favorable safety profiles, offer a viable solution for farmers and growers to comply with these regulations. Pest and disease resistance to conventional pesticides has become a significant challenge for farmers. Biorational products offer an alternative approach by utilizing different modes of action, making them effective against resistant pests and diseases. This drives the adoption of Biorational solutions to manage pests and diseases effectively. Integrated Pest Management emphasizes the use of multiple pest control strategies, including biological controls, cultural practices, and Biorational products, to minimize reliance on chemical pesticides. Biorational products are an integral part of IPM programs as they provide effective pest control while reducing environmental impacts and preserving beneficial organisms.Biorational Pesticides Market Value Worldwide in 2017 and 2022

Increasing Demand for Sustainable Agriculture is the biggest opportunity in the Biorational Market The global demand for sustainable agricultural practices that reduce reliance on conventional chemical pesticides is on the rise. Biorational products provide an environmentally friendly alternative that aligns with the preferences of consumers and regulatory bodies. Biorational products are often tailored to target specific pests or diseases, resulting in enhanced crop quality and yield. This offers a compelling value proposition for farmers, directly impacting their profitability and competitive edge. Consumers are becoming more aware of the environmental and health impacts associated with conventional pesticides. Biorational products, being less toxic and leaving fewer residues, resonate well with consumers who seek safer and healthier food options in the Biorational market.

Biorational Market Consumption by types of Biopesticides in 2022 (%)

Effectiveness and Consistency are the major challenges in the Biorational industry Biorational products may not consistently provide the same level of efficacy as their chemical counterparts. Achieving optimal results often requires adopting an integrated pest management approach and combining Biorational products with other control methods. Many farmers still lack familiarity with Biorational products or hold misconceptions regarding their effectiveness. Building awareness and providing education on the benefits and proper usage of these products are crucial steps to increase their adoption. The Biorational market is characterized by fragmentation, with numerous small and medium-sized companies offering products of varying quality and efficacy. This fragmentation complicates farmers' navigation of the market and the selection of the most suitable products for their specific needs.

Biorational Market Segment Analysis

Application: Crop Protection: Biopesticides are certain types of pesticides derived from such natural materials as animals, plants, bacteria, and certain minerals. For instance, canola oil and baking soda have pesticidal applications and are considered biopesticides. Growers use biological to complement chemical products in an integrated pest management (IPM) program, or as a stand-alone method, for protecting plants from disease, insect pests, and competition from weeds. Soil Management: Enhancing soil health by increasing soil organic matter is a crucial goal in agriculture. Soil organic matter plays a vital role in storing and releasing energy and nutrients that become accessible for plant uptake. Besides nutrient availability, soil organic matter contributes to improved soil texture, structure, and chemical equilibrium, while creating a favorable habitat for diverse soil flora and fauna. Adopting soil management techniques that prioritize the augmentation of soil organic matter can result in systems that possess sufficient nutrient reservoirs and storage capacity. Biorational products are used for improving soil health, fertility, and nutrient management in the Biorational Market. Post-Harvest Management: In the field of post-harvest management, Biorational products play a significant role in controlling diseases caused by fungi and bacteria. Microbial-based biopesticides and bio fungicides are examples of Biorational products that offer an environmentally friendly substitute for traditional chemical treatments in managing post-harvest diseases. Farmers can effectively combat diseases by utilizing these products while minimizing the ecological impact. Additionally, Biorational strategies encompass the use of beneficial insects, mites, or nematodes to control post-harvest pests. These naturally occurring predators specifically target pests that tend to infest stored crops. By harnessing the power of these natural enemies, the reliance on chemical insecticides can be reduced, further enhancing the environmental sustainability of post-harvest pest control practices.Biorational Market, by Post Harvest Loss in (%) 2022

Biorational Market Regional Analysis North America boasts a well-established Biorational market, driven by robust regulatory support for sustainable agricultural practices. The United States and Canada play pivotal roles as key contributors to the Biorational market in the region. Increasing awareness of environmental sustainability and consumer preferences for pesticide-free food is driving the demand for Biorational products in North America. Europe exhibits a mature Biorational market, backed by stringent regulations favoring sustainable agricultural practices. Major players in the European Biorational market include Germany, France, and Spain. The adoption of Biorational products is facilitated by the emphasis on organic farming practices and efforts to reduce chemical pesticide usage. The Asia Pacific region is witnessing significant growth in the Biorational market due to the rising demand for safe and sustainable agricultural practices. China, India, and Japan hold leading markets in the region, these countries are driven by the expansion of the organic farming sector and the need for eco-friendly crop protection solutions. These factors are supporting the rapid population growth, increasing incomes, and changing consumer preferences for pesticide-free food products are fueling the demand for Biorational products in the Asia Pacific. Latin America represents an emerging market for Biorational products, fueled by the region's robust agricultural sector and growing awareness of environmental sustainability. Brazil, Mexico, and Argentina are key markets in Latin America, with a strong focus on sustainable farming practices and organic certifications. The adoption of Biorational products in the region is also motivated by export requirements, as many countries demand residue-free agricultural produce.

Biorational Market, by Pestisides Consumption 2022 in (%)

Biorational Market Competitive Landscape Bayer Extends Partnership with Peking University to Foster Pharmaceutical Innovation in China. Bayer and Peking University (PKU) will collaborate to foster the translation of basic pharmaceutical research into drug discovery and development while accelerating scientific research on cutting-edge technologies across the pharmaceutical value chain. This new agreement builds on a strategic academic partnership between Bayer and PKU under which a joint research center at Peking University has been founded to advance the translation of drug discovery and research. Syngenta acquisition of Macspred Australia to boost focus in global forestry and landscape markets. The acquisition marks Syngenta’s entry through its Professional Solutions business into the forestry products and vegetation markets. It also secures Syngenta’s ability to service both large-scale commercial plantation customers, as well as a growing farm forestry clientele focused on improving financial sustainability and environmental biodiversity on the farm. Syngenta and Biotalys enter into strategic partnerships in biological innovation to advance solutions for sustainable agriculture. Syngenta Crop Protection and Biotalys (Euronext – BTLS) announced a collaboration to research, develop and commercialize new biocontrol solutions to manage key pests in a broad variety of crops. Marrone Bio Innovations, Inc. (NASDAQ: MBII) is a growth-oriented agricultural company leading the movement to environmentally sustainable farming practices through the discovery, development, and sale of innovative biological products for crop protection, crop health, and crop nutrition. In 2022, Marrone Bio Innovations, Inc. Shareholders Approve Merger Agreement with Bioceres Crop Solutions Corp. March 2022, Marrone Bio Expands Biological Seed Treatment Collaboration for Row Crops. Marrone Bio Innovations, Inc. signed an agreement with Corteva Agriscience (NYSE: CTVA) that expands the opportunity for MBI technologies to be used on seeds sold by Corteva for row crops globally. Marrone Bio currently provides seed treatment solutions to Corteva for use throughout Europe.

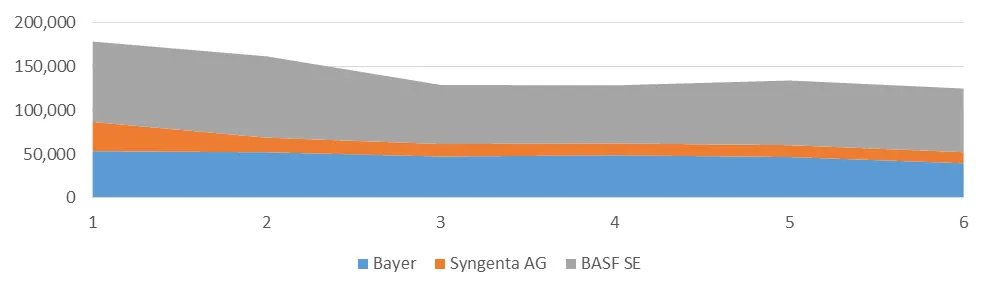

Biorationals Market Key Players, by Revenue from 2017 to 2022 in (Million USD)

Biorational Market Scope: Inquire Before Buying

Global Biorational Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 950.3 Mn. Forecast Period 2023 to 2029 CAGR: 9.25% Market Size in 2029: US $ 1765.27 Mn. Segments Covered: by Application Crop Protection Soil Management Post-Harvest Management by Types Microbial-Based Product Plant Extracts & Botanicals Semi-chemicals Minerals & Bio-minerals by Category Bio-pesticides Bio-fungicides Bio-herbicides Bio-stimulants by End-User Agriculture Horticulture Forestry Turf & Ornamentals Biorational Market, by Regions

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Biorational Market, Key Players are

1. Bayer CropScience 2. Syngenta AG 3. BASF SE 4. Marrone Bio Innovations Inc. 5. Valent BioSciences Corporation 6. Certis USA LLC 7. Koppert Biological Systems 8. Isagro S.p.A. 9. Bioworks Inc. 10. Novozymes A/S 11. Dow AgroSciences LLC 12. FMC Corporation 13. Gowan Company LLC 14. Russell IPM Ltd. 15. Sipcam-Oxon Group 16. Andermatt Biocontrol AGFrequently Asked Questions and Answers

1. What are Biorational products? Ans: Biorational products, also known as biopesticides or biocontrol agents, are derived from naturally occurring substances and are designed to control pests and diseases in agriculture while minimizing environmental impact. 2. What are the advantages of using Biorational products? Ans: Some advantages of using Biorational products include reduced environmental impact, improved sustainability, minimal harm to non-target organisms, reduced pesticide residues on food, and compatibility with integrated pest management (IPM) practices. 3. What applications are Biorational products used for? Ans: Biorational products are used in various applications, including crop protection, soil management, post-harvest management, and pest control in horticulture, forestry, and turf management. 4. What are some examples of Biorational products? Ans: Examples of Biorational products include microbial-based biopesticides, botanical extracts, bio fungicides, bio-herbicides, semiochemicals, and bio-stimulants. Each category serves different purposes in managing pests, and diseases, and enhancing plant health. 5. How can farmers benefit from using Biorational products? Ans: Farmers can benefit from using Biorational products by reducing their reliance on conventional chemical pesticides, minimizing environmental impact, improving crop quality and yield, complying with regulations, and meeting consumer demand for safer and healthier food options.

1. Biorational Market: Research Methodology 2. Biorational Market: Executive Summary 3. Biorational Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Biorational Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Biorational Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Biorational Market Size and Forecast, by Application (2022-2029) 5.1.1. Crop Protection 5.1.2. Soil Management 5.1.3. Post-Harvest Management 5.2. Biorational Market Size and Forecast, by Types (2022-2029) 5.2.1. Microbial-Based Product 5.2.2. Plant Extracts & Botanicals 5.2.3. Semi-chemicals 5.2.4. Minerals & Bio-minerals 5.3. Biorational Market Size and Forecast, by Category (2022-2029) 5.3.1. Bio-pesticides 5.3.2. Bio-fungicides 5.3.3. Bio-herbicides 5.3.4. Bio-stimulants 5.4. Biorational Market Size and Forecast, by End-User (2022-2029) 5.4.1. Agriculture 5.4.2. Horticulture 5.4.3. Forestry 5.4.4. Turf & Ornamentals 5.5. Biorational Market Size and Forecast, by Region (2022-2029) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Biorational Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Biorational Market Size and Forecast, by Application (2022-2029) 6.1.1. Crop Protection 6.1.2. Soil Management 6.1.3. Post-Harvest Management 6.2. North America Biorational Market Size and Forecast, by Types (2022-2029) 6.2.1. Microbial-Based Product 6.2.2. Plant Extracts & Botanicals 6.2.3. Semi-chemicals 6.2.4. Minerals & Bio-minerals 6.3. North America Biorational Market Size and Forecast, by Category (2022-2029) 6.3.1. Bio-pesticides 6.3.2. Bio-fungicides 6.3.3. Bio-herbicides 6.3.4. Bio-stimulants 6.4. North America Biorational Market Size and Forecast, by End-User (2022-2029) 6.4.1. Agriculture 6.4.2. Horticulture 6.4.3. Forestry 6.4.4. Turf & Ornamentals 6.5. North America Biorational Market Size and Forecast, by Country (2022-2029) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Biorational Market Size and Forecast (by Value USD and Volume Units) 7.1. Europe Biorational Market Size and Forecast, by Application (2022-2029) 7.1.1. Crop Protection 7.1.2. Soil Management 7.1.3. Post-Harvest Management 7.2. Europe Biorational Market Size and Forecast, by Types (2022-2029) 7.2.1. Microbial-Based Product 7.2.2. Plant Extracts & Botanicals 7.2.3. Semi-chemicals 7.2.4. Minerals & Bio-minerals 7.3. Europe Biorational Market Size and Forecast, by Category (2022-2029) 7.3.1. Bio-pesticides 7.3.2. Bio-fungicides 7.3.3. Bio-herbicides 7.3.4. Bio-stimulants 7.4. Europe Biorational Market Size and Forecast, by End-User (2022-2029) 7.4.1. Agriculture 7.4.2. Horticulture 7.4.3. Forestry 7.4.4. Turf & Ornamentals 7.5. Europe Biorational Market Size and Forecast, by Country (2022-2029) 7.5.1. UK 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Sweden 7.5.7. Austria 7.5.8. Rest of Europe 8. Asia Pacific Biorational Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Biorational Market Size and Forecast, by Application (2022-2029) 8.1.1. Crop Protection 8.1.2. Soil Management 8.1.3. Post-Harvest Management 8.2. Asia Pacific Biorational Market Size and Forecast, by Types (2022-2029) 8.2.1. Microbial-Based Product 8.2.2. Plant Extracts & Botanicals 8.2.3. Semi-chemicals 8.2.4. Minerals & Bio-minerals 8.3. Asia Pacific Biorational Market Size and Forecast, by Category (2022-2029) 8.3.1. Bio-pesticides 8.3.2. Bio-fungicides 8.3.3. Bio-herbicides 8.3.4. Bio-stimulants 8.4. Asia Pacific Biorational Market Size and Forecast, by End-User (2022-2029) 8.4.1. Agriculture 8.4.2. Horticulture 8.4.3. Forestry 8.4.4. Turf & Ornamentals 8.5. Asia Pacific Biorational Market Size and Forecast, by Country (2022-2029) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Indonesia 8.5.7. Malaysia 8.5.8. Vietnam 8.5.9. Taiwan 8.5.10. Bangladesh 8.5.11. Pakistan 8.5.12. Rest of Asia Pacific 9. Middle East and Africa Biorational Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Biorational Market Size and Forecast, by Application (2022-2029) 9.1.1. Crop Protection 9.1.2. Soil Management 9.1.3. Post-Harvest Management 9.2. Middle East and Africa Biorational Market Size and Forecast, by Types (2022-2029) 9.2.1. Microbial-Based Product 9.2.2. Plant Extracts & Botanicals 9.2.3. Semi-chemicals 9.2.4. Minerals & Bio-minerals 9.3. Middle East and Africa Biorational Market Size and Forecast, by Category (2022-2029) 9.3.1. Bio-pesticides 9.3.2. Bio-fungicides 9.3.3. Bio-herbicides 9.3.4. Bio-stimulants 9.4. Middle East and Africa Biorational Market Size and Forecast, by End-User (2022-2029) 9.4.1. Agriculture 9.4.2. Horticulture 9.4.3. Forestry 9.4.4. Turf & Ornamentals 9.5. Middle East and Africa Biorational Market Size and Forecast, by Country (2022-2029) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Egypt 9.5.4. Nigeria 9.5.5. Rest of ME&A 10. South America Biorational Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Biorational Market Size and Forecast, by Application (2022-2029) 10.1.1. Crop Protection 10.1.2. Soil Management 10.1.3. Post-Harvest Management 10.2. South America Biorational Market Size and Forecast, by Types (2022-2029) 10.2.1. Microbial-Based Product 10.2.2. Plant Extracts & Botanicals 10.2.3. Semi-chemicals 10.2.4. Minerals & Bio-minerals 10.3. South America Biorational Market Size and Forecast, by Category (2022-2029) 10.3.1. Bio-pesticides 10.3.2. Bio-fungicides 10.3.3. Bio-herbicides 10.3.4. Bio-stimulants 10.4. South America Biorational Market Size and Forecast, by End-User (2022-2029) 10.4.1. Agriculture 10.4.2. Horticulture 10.4.3. Forestry 10.4.4. Turf & Ornamentals 10.5. South America Biorational Market Size and Forecast, by Country (2022-2029) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. Bayer CropScience 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Syngenta AG 11.3. BASF SE 11.4. Marrone Bio Innovations Inc. 11.5. Valent BioSciences Corporation 11.6. Certis USA LLC 11.7. Koppert Biological Systems 11.8. Isagro S.p.A. 11.9. Bioworks Inc. 11.10. Novozymes A/S 11.11. Dow AgroSciences LLC 11.12. FMC Corporation 11.13. Gowan Company LLC 11.14. Russell IPM Ltd. 11.15. Sipcam-Oxon Group 11.16. Andermatt Biocontrol AG 12. Key Findings 13. Industry Recommendation